Beruflich Dokumente

Kultur Dokumente

Steel March 220313

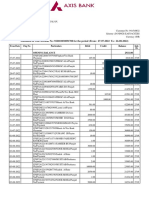

Hochgeladen von

mahmood750Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Steel March 220313

Hochgeladen von

mahmood750Copyright:

Verfügbare Formate

Steel

MARCH

2013

For updated information, please visit www.ibef.org

Steel

MARCH

2013

Contents

Advantage India

Market overview and trends

Growth drivers

Success stories: TATA Steel, JSW Steel

Opportunities

Useful information

For updated information, please visit www.ibef.org

Steel

MARCH

2013

Advantage India

Increasing investments

Robust demand

Demand to be supported by growth

in the domestic market

Infrastructure, oil & gas, and

automotives will drive the growth

of the industry

Intended steel capacity build-up

in India is set to result in

investments in the range of

USD104.2 billion to USD208.3

billion by 2020

301 MoUs have been signed with

various states for planned

capacity of about 488.6 MT

2014E

Market value:

USD83 billion

Advantage

India

Competitive advantages

2009

Market value:

USD33 billion

India is the worlds fourth largest

producer of crude steel (up from

eighth in 2003); the country is

expected to become the second

largest producer by 2015

Easy availability of low cost

manpower and presence of abundant

reserves make India competitive in

the global setup

Policy support

100 per cent FDI through automatic

route is allowed in the sector

Large infrastructure projects in

Public-Private Partnership (PPP)

mode are being formed

National Steel Policy (NSP) to

encourage industry in reaching

global benchmarks

Notes: FDI - Foreign Direct Investment, MT - Million Tonnes, MoUs - Memorandum of Understanding,

2014E - estimated figure for the year 2014; these estimates are from Data monitor

For updated information, please visit www.ibef.org

ADVANTAGE INDIA

Steel

MARCH

2013

Contents

Advantage India

Market overview and trends

Growth drivers

Success stories: TATA Steel, JSW Steel

Opportunities

Useful information

For updated information, please visit www.ibef.org

Steel

MARCH

2013

Evolution of the Indian steel sector

1993-2012

1973-1992

1954-1964

1923-1948

1907-1918

Production of

steel started in

India (TISCO

was setup in

1907)

IISC was set up

in 1918 to

compete with

TISCO

Hindustan Steel

Ltd and Bokaro

Steel Ltd were

setup in 1954 and

Mysore Iron and

1964 respectively

Steel Company

was set up in 1923 In early 1990s, the

public sector

According to the

dominated the

new Industrial

steel production

Policy Statement

Private players

(1948) new

were in

ventures were

downstream

undertaken only

production, mainly

by the central

producing finished

government

steel using crude

steel products

For updated information, please visit www.ibef.org

SAIL was created in

1973 as a holding

company to oversee

most of India's iron &

steel production

In 1989 SAIL acquired

Vivesvata Iron and

Steel Ltd

In 1993, the

government set plans

in motion to partially

privatise SAIL

Foreign players started

entering the Indian

steel market

No license

requirement for

capacity creation

Export duty has been

imposed on iron ore,

thereby giving more

impetus on catering to

growing domestic

demand

Decontrol of domestic

steel prices

Launch of Scheme for

promotion of Research

and Development in

Iron & Steel sector

Notes: TISCO - Tata Iron and Steel Company,

IISC - Indian Iron & Steel Company, SAIL - Steel Authority of India Ltd

MARKET OVERVIEW AND TRENDS

Steel

MARCH

2013

Structure of the steel sector

Steel

Form

Liquid steel

Ingots

Semis

End use

Composition

Crude steel

Alloy

Finished steel

Structural

steel

Stainless

Low carbon

steel

Construction

steel

Silicon

electrical

Medium

carbon steel

Rail steel

High speed

High carbon

steel

Flat

Non flat

Non-alloy

steel

Source: Report on Indian steel industry by Competition Commission of India, Aranca Research

For updated information, please visit www.ibef.org

MARKET OVERVIEW AND TRENDS

Steel

MARCH

2013

Steel production in India has been

growing at a fast pace

Total crude steel production grew at a CAGR of 6.6 per cent over FY08-11 to 69.6 MT; production in the first nine

months of FY12 is a little more than three-fourth of FY11 levels and is estimated to touch 128.1 MT by FY17

Finished steel production stood at 66.0 MT in FY11, recording a CAGR of 4.2 per cent over the above-mentioned

period; analysts expect production figures to shoot up in the next five years with the Ministry of Steel forecasting

production levels at 115.3 MT by FY17

Total crude steel production (million tonnes)

80

Total finished steel production (million tonnes)

70

60

49.1

36.8

42.1

52.9

56

52.6

41.1

47.6

42.6

44.5

13.5

12.7

13.0

13.1

FY08

FY09

FY10

FY11*

43.4

42

40

28

20

17.1

16.4

16.7

17.0

0

FY08

FY09

Public sector

FY10

FY11*

14

12.3

FY12* (April

- Dec)

Private sector

Public sector

8.6

FY12* (April

- Dec)

Private sector

Source: Ministry of Steel, Aranca Research,

Notes: FY - Indian Financial Year (April - March), MT - Million Tonnes, * - Provisional, CAGR - Compound Annual Growth Rate

For updated information, please visit www.ibef.org

MARKET OVERVIEW AND TRENDS

Steel

MARCH

2013

Shares in production: SAIL and Tata

lead the way

SAIL is the leading player in the steel sector in India; it accounted for 18.7 per cent of crude steel production in

the country in the first nine months of FY12 and had a 13.5 per cent share in finished steel production in that

period

TATA Steel, another household name in the country, leads private sector activity in the steel sector; during April December 2011, the firm accounted for 9.9 per cent of crude steel production and 7.8 per cent of finished steel

production

India crude steel market share by production - FY12* (Apr-Dec)

India finished steel market share by production - FY12* (Apr-Dec)

7.8%

9.9%

13.5%

18.7%

TATA Steel

SAIL

4.0%

RINL

67.1%

4.3%

TATA steel

SAIL

RINL

Other

Other

74.7%

Source: Ministry of Steel, Aranca Research,

Notes: RINL - Rashtriya Ispat Nigam Limited, *Provisional

For updated information, please visit www.ibef.org

MARKET OVERVIEW AND TRENDS

Steel

MARCH

2013

Growth in market value of the Indian

steel sector has also been strong

In 2011, the total market value of the steel sector in

India was estimated to be USD55.1 billion

The sector has benefitted from rise in prices

and production, especially since the beginning

of the millennium

Market value of the Indian steel sector (USD billion)

60

55.1

50

46.8

38.6

40

32.9

Over 2006-11, market value of the sector is estimated

to have posted a strong CAGR of 19.3 per cent

30

22.8

25.5

2006

2007

20

10

0

2008

2009

2010

2011E

Source: Datamonitor, Aranca Research

Note: E - Estimates

For updated information, please visit www.ibef.org

MARKET OVERVIEW AND TRENDS

Steel

MARCH

2013

Demand has outpaced supply over the

last five years

Total consumption of steel exceeded production and

grew to 70.9 MT in FY12 as against 66.4 MT in FY11;

over FY07-12, consumption has expanded at a CAGR

of 8.7 per cent

In the most likely economic growth scenario (9 per

cent GDP growth as envisaged by the Draft Approach

Paper of the 12th Five Year Plan), demand for steel is

set to rise to 113.3 MT by FY17

Consumption of steel (in million tonnes)

66.4

70.9

59.3

46.8

FY07

52.1

51.9

FY08

FY09

FY10

FY11

FY12*

Source: Ministry of Steel, Indian Steel Markets Conference,

Aranca Research

Notes: FY12* - Data for FY12 is provisional, MT - Million Tonnes

For updated information, please visit www.ibef.org

MARKET OVERVIEW AND TRENDS

10

Steel

MARCH

2013

A consequence of demand outpacing

supply has been rising imports

With demand growth for steel outpacing growth in

domestic production over the last few years, import

dependency has increased

Steel exports and imports (in MT)

8.0

Imports have increased at a CAGR of 6.8 per

cent over FY07-12

Total imports in FY12 stood at about 6.8 MT

6.8

6.8

5.8

6.0

5.0

7.4

7.0

7.0

4.9

5.2

5.1

4.4

3.5

4.0

4.0

3.3

3.0

2.0

1.0

FY07

FY08

FY09

Imports

FY10

FY11

FY12*

Exports

Source: Ministry of Steel, Aranca Research

Notes: FY - Indian Financial Year (April - March)

*Data for FY12 is provisional

For updated information, please visit www.ibef.org

MARKET OVERVIEW AND TRENDS

11

Steel

MARCH

2013

Construction and infrastructure: Key

consumers of steel in India

Construction & infrastructure is the largest

consumer of steel in India, accounting for 61 per cent

of total consumption in 2010

This is not surprising given the heavy use of

steel in this sector and soaring construction

and infrastructure activity in the country over

the past decade

Capital goods is the next largest consumer, with 11

per cent of total consumption

Sector-wise steel consumption shares (2010)

Construction &

Infrastructure

12%

Capital goods

3%

5%

Autos

8%

61%

11%

Packaging

Consumer

durables

Others

Source: Crisil, Aranca Research

For updated information, please visit www.ibef.org

MARKET OVERVIEW AND TRENDS

12

Steel

MARCH

2013

Key players in the industry

Company

Products

Tata Steel Ltd

Finished steel (non-alloy steel)

SAIL

Finished steel (non-alloy steel)

J S W Steel Ltd

Hot rolled coils, strips, sheets

Jindal Steel & Power Ltd

Iron and steel

Ispat Industries Ltd

Hot rolled coils, strips, sheets

Welspun-Gujarat Stahl Rohren Ltd

Tubes and pipes

Bhushan Steel Ltd

Cold rolled coils, strips, sheets

For updated information, please visit www.ibef.org

MARKET OVERVIEW AND TRENDS

13

Steel

MARCH

2013

Notable trends in the Indian steel

industry

SAIL has undertaken modernisation and expansion of its integrated steel plants

in Bhilai, Bokaro, Rourkela, Durgapur, Burnpur and Salem

Growing investments

It is in the process of expanding its crude steel production capacity to 21.4 MTPA

Completed mega expansion of Rashtriya Ispat Nigam Limited (RINL) to more

than double capacity of plant (from 2.9 MT to 6.3 MT)

International Coal Ventures Pvt. Ltd., comprising of SAIL, RINL, CIL, NTPC, and

NMDC, has been set up for acquisition of coal mines overseas

The consortium of SAIL and National Fertilizer Limited (NFL) has been

Strategic alliances

nominated for revival of Sindri Unit of Fertilizer Corporation of India Limited

RINL, Vishakhapatnam Steel Plant and Power Grid Corporation of India Ltd.

(POWERGRID) signed an MoU to set up a joint venture company for

manufacturing of Transmission Line Towers and Tower Parts including R&D of

new high-end products

Attracted by the growth potential of the Indian steel industry, several global

steel players have been planning to enter the market

Entry of international

companies

National Mineral Development Corporation (NMDC) has signed an MoU with

Russias third-largest steelmaker, Severstal for a greenfield steel plant in

Karnataka

Posco Steel to invest USD12 billion for setting up 12 MT project in India

Source: Ministry of Railways, Aranca Research

Notes: MOUs - Memorandum of Understanding, MT - Million Tonnes

For updated information, please visit www.ibef.org

MARKET OVERVIEW AND TRENDS

14

Steel

MARCH

2013

Key steel plants in India

Steel integrated plants

under SAIL (Bhilai,

Rourkela, Bokaro,

Durgapur and Burnpur)

Biggest steel plant of Tata

Steel in Jamshedpur

Alloy and special steel

plants under SAIL

(Bhadrawati and Salem)

RINL steel plant in

Vishakhapatnam

Source: Company websites, Aranca Research

For updated information, please visit www.ibef.org

MARKET OVERVIEW AND TRENDS

15

Steel

MARCH

2013

Contents

Advantage India

Market overview and trends

Growth drivers

Success stories: TATA Steel, JSW Steel

Opportunities

Useful information

For updated information, please visit www.ibef.org

16

Steel

MARCH

2013

Strong demand and policy support

driving investments

Growing demand

Policy support

Growing demand

in the construction

industry

Increasing investments

100 per cent FDI in

steel sector

Resulting

in

Inviting

Growing demand

in the automotives

sector

Rising investments

from domestic and

foreign players

Government is

encouraging R&D

activities in the

sector

Increase in number

of MoUs signed to

boost investment in

steel

Reduced custom

duty and other

favourable

measures

Foreign investment

of nearly USD40

billion committed in

the steel sector

Notes: FDI - Foreign Direct Investment

For updated information, please visit www.ibef.org

GROWTH DRIVERS

17

Steel

MARCH

2013

Construction & infrastructure and

automotives driving steel growth

Investment in infrastructure is expected to expand at

a CAGR of 14.5 per cent over FY12-17 by the Planning

Commission

The Planning Commission expects total investment in

infrastructure to be USD1 trillion in the 12th Five-Year

Plan (2012-17), as compared to USD428 billion in the

11th Plan

This increase in investment in infrastructure is set to

raise steel demand by roughly 40 MTPA from FY13 to

FY17

Projected values of investment in infrastructure (USD billion)

250

216.6

191.3

200

168.7

148.5

150

110.1

129.0

100

50

0

FY12

FY13

FY14

FY15

FY16

FY17

Source: Planning Commission, Aranca Research

Notes: MTPA - Million Tonnes per annum

For updated information, please visit www.ibef.org

GROWTH DRIVERS

18

Steel

MARCH

2013

Automotives leading sector in driving

steel growth

Automotives production expanded at a CAGR of 22.2

per cent over FY09-12

Total production of automobiles in India (million units)

Commercial vehicles are the fastest growing segment

with a CAGR of 29.8 per cent over the same period

30

35

25

20

15

10

5

0

FY09

FY10

Passenger vehicles

FY11

FY12

FY16E

FY21E

Commercial vehicles

Three wheelers & two wheelers

Source: SIAM, Aranca Research

Notes: E - estimate; FY - Indian Financial Year (April - March)

For updated information, please visit www.ibef.org

GROWTH DRIVERS

19

Steel

MARCH

2013

Policy support aiding growth in the steel

sector

In view of the changed dynamics of the sector both globally as well as

National Steel Policy

2012

domestically, Ministry of Steel has initiated the process of drafting the new

National Steel Policy in place of the existing National Steel Policy in 2005

The government has set up a committee headed by the Steel Secretary for

monitoring the progress on formulation of the new National Steel Policy

Four task forces have been constituted to study, analyse, consult and formulate

draft policy documents on different aspects of the policy

A new scheme named The scheme for the promotion of R&D in the iron and

R&D and innovation

steel sector has been approved with budgetary provision of USD24.6 million to

initiate and implement the provisions of the scheme as per the 11th Five Year

Plan

A total amount of USD8.5 million has been spent under the scheme upto

December 2011

Steel Innovation Council for promotion of innovative ideas in the steel sector has

been set up by the Ministry of Steel

Increased export duty on

iron ore

Foreign direct

investment

The government hiked the export duty on iron ore to 30 per cent ad-valorem on

all varieties of iron ore* (except pellets)

100 per cent FDI through the automatic route is allowed in the Indian steel sector

Source: Ministry of Steel, Aranca Research

Notes: *w.e.f. 30th December 2011

For updated information, please visit www.ibef.org

GROWTH DRIVERS

20

Steel

MARCH

2013

Major initiatives taken by the Ministry

of Steel during the year

Export duty on iron ore has been increased to 30

per cent ad-valorem on all varieties of iron ore

(except pellets), in order to preserve iron ore

resources for domestic use

As per the Government decision, 51 per cent

shareholding of Government of India in Eastern

Investments Company Limited (EIL) under Bird

Group of Companies was transferred to RINL

New Research and Development policy for Steel

Sector has been finalised/adopted for

implementation

New techno-economic benchmarks have been

evolved on international pattern for improvement in

performance of steel PSUs and its implementation is

being monitored closely

The Joint Plant Committee (JPC) under the

Ministry studied 300 districts, 1500 villages, 4500

manufactures and 8000 retailers spread over all

the 35 states and union territories of the company

to assess the steel demand in the rural areas and

examine the potential of increasing the level of

steel consumption

Steel Innovation Council for promotion of

innovative ideas in the steel sector has been set

up by the Ministry of Steel

New National Steel Policy for the forthcoming

years is under finalisation

Source: Ministry of Steel, Aranca Research

Notes: w.e.f - with effect from 30th December, 2011

For updated information, please visit www.ibef.org

GROWTH DRIVERS

21

Steel

MARCH

2013

Steel SEZs in India

Developer

Location

Product

Viraj Profiles Ltd

Thane, Maharashtra

Stainless steel engineering products

Jindal Steel Ltd

Kalinganagar

Stainless steel

SAIL Salem SEZ Pvt Ltd

Salem, Tamil Nadu

Steel

Orissa Industrial Infrastructure

Development Corporation

Jajpur, Orissa

Metallurgical-based engineering and

ancillary/downstream industry

Source: Formal approvals granted in the Board of Approvals after the SEZ rules coming into force, Special Economic Zones in India website,

www.sezindia.nic.in

For updated information, please visit www.ibef.org

GROWTH DRIVERS

22

Steel

MARCH

2013

The sector witnessed rising investments

in the last decade

M&A scenario - details

Period: 1 January 2011 to 13 June 2012

Deal type

No of deals

Largest deal (USD million)

Inbound

Outbound

1.01

Domestic

474.4

Cumulative FDI inflows

Period: April 2000 to September 2012

Sector

Metallurgical industries

Per cent of total FDI inflow

USD6.7 billion

4.0

Source: Thompson ONE Banker, Fact Sheet On Foreign Direct Investment (FDI), Department of Industrial

Policy and Promotion; JSW - JFE Partnership Press Meet Presentation, Press releases; and Ministry of Steel,

Government of India, Annual Report 2009-10

For updated information, please visit www.ibef.org

GROWTH DRIVERS

23

Steel

MARCH

2013

Planned capacity additions in different

states

State

MoUs signed

Capacity addition (MTPA)

Orissa

63

81.2

Jharkhand

49

105.1

Chhattisgarh

76

60.0

West Bengal

16

39.4

Karnataka

57

173.0

Andhra Pradesh

18

11.8

Other states

22

18.2*

Total

301

488.6

Capacity addition plans

Company

Plans

SAIL

SAIL is planning to invest USD27.3 billion to increase capacity from 21.4MTPA to 45MTPA. In

its recent expansion plan, it has undertaken modernisation and expansion of its integrated

steel plants at Bhilai, Bokaro, Rourkela, Durgapur, Burnpur and a special plant at Salem

NMDC

It is setting up a greenfield integrated steel plant of 3MTPA capacity in Nagarnar,

Chhattisgarh at an estimated cost of about USD3.2 billion

Source: Ministry of Steel, Annual report 2011-12,

Note: MTPA - Million Tonnes Per Annum, * - Estimated figures

For updated information, please visit www.ibef.org

GROWTH DRIVERS

24

Steel

MARCH

2013

Contents

Advantage India

Market overview and trends

Growth drivers

Success stories: TATA Steel, JSW Steel

Opportunities

Useful information

For updated information, please visit www.ibef.org

25

Steel

MARCH

2013

TATA Steel: A compelling growth story

(1/3)

TATA Steel Limited

Projected crude steel capacity in the 12th Plan (million tonnes)

Established in 1907, by the visionary-founder JN Tata, Tata Steel

is among the top ten global steel companies with an annual

crude steel capacity of over 28 million tonnes per annum

(MTPA)

25

Caters to - Automotive, Construction, Consumer goods,

Engineering, Packaging, Energy & Power, Ship Building, Rail,

and Defence and Security

15

20.0

20

17.5

15.1

11.0

9.2

10

6.8

Milestones

2009 - Tata Ryerson and HMPCL merge with Tata

Steel in 2009

2007 - Integration of Tata Steel and Corus was

accomplished at USD12 billion, making Tata Steel

one among the top ten steel producers globally

FY11

7.6

FY12

FY13

FY14

FY15

FY16

FY17

Source: Company website (www.tatasteel.com),

Planning Commission, Aranca Research

For updated information, please visit www.ibef.org

SUCCESS STORIES: TATA STEEL, JSW STEEL

26

Steel

MARCH

2013

TATA Steel: A compelling growth story

(2/3)

Production and sales of steel division (million tonnes)

8

6.4 6.2

7

6

5

4.9 4.8

6.7

6.4

7.0

6.6

5.4 5.2

Financial growth (USD billion)

8

5.8

5.7

6

4.7

4.2

7.4

6.8

3

2

1

FY08

FY09

FY10

Production

FY11

FY12

Sales

0.9

1.0

1.1

1.1

1.4

1.4

FY07

FY08

FY09

NPAT

FY10

FY11

FY12

Gross revenue

Source: Company website (www.tatasteel.com), Aranca Research

Notes: NPAT - Net Profit After Tax

For updated information, please visit www.ibef.org

SUCCESS STORIES: TATA STEEL, JSW STEEL

27

Steel

MARCH

2013

TATA Steel: A compelling growth story

(3/3)

Developed

Developed products

products

Technological

upgradation

Iron making and

Iron making and

castings

castings

Capacity

expansion

(3 MT)

Diversification

(Coal injection

unit)

Alloy steel

Alloy steel

Wheel, tyre and

Wheel,

and

axle

plant tyre

(railways)

axle plant (railways)

FY12

USD7,445

million

turnover

Organic growth in

Steel

Pig iron and

1912

Production

capacity (1.6

Lakh tonnes)

steel ingots

M&A

(Tata-Corus)

FY06

USD3,625

million

turnover

Blast furnace

1994

1995

1996

1997

For updated information, please visit www.ibef.org

1998

1999

2000

2002

2004

2006

2008

2010

2011

2012

SUCCESS STORIES: TATA STEEL, JSW STEEL

28

Steel

MARCH

2013

JSW Steel: Surging ahead on cost

competitiveness (1/3)

JSW Steel

Projected crude steel capacity in the 12th Plan (million tonnes)

20

Established in 1994, JSW Steel Ltd manufactures iron and steel

products in India and abroad

Products - Hot rolled coils, plates, and sheets; cold rolled coils

and sheets; galvanised sheets and coils; pre-painted galvanised

coils, sheets, and galvanised corrugated sheets

Achievements

2011 - National Sustainability Award by Indian

Institute of Metals

2009 - Gold Award in Metal and Mining Sector

2008 - National Energy Management Award

instituted by CII

16

13.23

12

14.3

14.3

14.3

FY13

FY14

FY15

17.6

18.4

FY16

FY17

11.1

8

4

0

FY11

FY12

Source: Company website (www.jsw.in),

Planning Commission, Aranca Research

For updated information, please visit www.ibef.org

SUCCESS STORIES: TATA STEEL, JSW STEEL

29

Steel

MARCH

2013

JSW Steel: Surging ahead on cost

competitiveness (2/3)

Product group-wise sales (in million tonnes)

4.5

4.0

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0.0

4.3

Financial growth (in USD million)

8,000

3.1

7221

6,000

1.6 1.7

1.5

5228

4,053

4,000

2,631

1.1

2,000

0.3 0.4

1,937

269

Semis

Rolled Flats

FY11

Rolled Longs

Value Added

Flat

FY12

3,162

360

96

421

419

339

0

FY07

FY08

FY09

Gross revenue

FY10

FY11

FY12

NPAT

Source: Company website (www.jsw.in)

For updated information, please visit www.ibef.org

SUCCESS STORIES: TATA STEEL, JSW STEEL

30

Steel

MARCH

2013

JSW Steel: Surging ahead on cost

competitiveness (3/3)

Hot rolled

Capacity addition

7.8 MT

rolledand

IronCold

making

castings

JV formed to

explore, develop

& mine iron ore

with MML

Wire rods

Alloy steel

FY 12

USD7,221

million

turnover

1994

ISO Accreditations

TMT rebars

Wheel,

tyre and

axle plant (railways)

Organic Growth

& Integration

Galvanised

1994

Production

capacity

(1.25 MTPA)

product

FY06

USD1,417

million

turnover

Special steel bars

1994

1995

1996

1997

1998

1999

2000

2002

2004

2006

2008

2010

2011

2012

Notes: JV - Joint Venture TMT - Thermo Mechanically Treated, MML - Mysore Minerals Limited MTPA - Million Tonnes Per Annum

For updated information, please visit www.ibef.org

SUCCESS STORIES: TATA STEEL, JSW STEEL

31

Steel

MARCH

2013

Contents

Advantage India

Market overview and trends

Growth drivers

Success stories: TATA Steel, JSW Steel

Opportunities

Useful information

For updated information, please visit www.ibef.org

32

Steel

MARCH

2013

Opportunities (1/2)

Automotive

The size of the

automotives industry

is forecasted to grow

between USD122

billion and USD159

billion by 2016

With increasing

capacity addition by

the automotives

industry, demand for

steel from the sector

is expected to be

robust

Capital goods

Capital goods

accounts for 11 per

cent of steel

consumption, and has

the potential to

increase in tonnage

and market share

Corporate Indias

capex is expected to

grow and generate

greater demand for

steel

Infrastructure

The government aims

to increase

infrastructure

spending from 8.4

per cent of GDP in

FY11 to 10.7 per cent

of GDP by FY17

Due to such a huge

investment in

infrastructure the

demand for long

products of steel will

be increasing in years

ahead

Airports

More and more

modern and private

airports expected to

be set up

Development of Tier-II

city airports will

sustain consumption

growth

The estimated steel

consumption in

airport building is

likely to grow more

than 20 per cent over

next few years

Notes: Capex - Capital Expenditure

For updated information, please visit www.ibef.org

OPPORTUNITIES

33

Steel

MARCH

2013

Opportunities (2/2)

Railways

Dedicated Rail Freight

Corridor (DRFC)

network expansion

will be enhanced in

future

Gauge conversion,

setting up of new

lines, and

electrification will

drive steel demand in

the near future

Oil and gas

Power

Pipeline network for

liquid fuel

transportation is

likely to grow from

the present 16,800 km

to 22,000 km in 2014

The government is

aiming to add 71,0001,07,500 MW of

capacity during the

12th Five Year Plan

Both generation and

This would lead to an

increase in demand

of steel tubes and

pipes and hence

provides a lucrative

opportunity to the

steel industry

transmission

capacities will be

enhanced, thereby

raising steel demand

from the sector

Source: Planning Commission, Aranca research

For updated information, please visit www.ibef.org

OPPORTUNITIES

34

Steel

MARCH

2013

Contents

Advantage India

Market overview and trends

Growth drivers

Success stories: TATA Steel, JSW Steel

Opportunities

Useful information

For updated information, please visit www.ibef.org

35

Steel

MARCH

2013

Industry associations

Indian Stainless Steel Development Association

L-22/4, DLF Phase - II

Gurgaon, Haryana - 122 002

Phone: 91-124-4375501

Fax: 91-124-4375509

E-mail: nissda@gmail.com

For updated information, please visit www.ibef.org

USEFUL INFORMATION

36

Steel

MARCH

2013

Glossary

CAGR: Compound Annual Growth Rate

FDI: Foreign Direct Investment

FY: Indian Financial Year (April to March)

So FY10 implies April 2009 to March 2010

JV: Joint Venture

MoU: Memorandum of Understanding

MT: Million tonnes

MTPA: Million tonnes per annum

NPAT: Net Profit After Tax

SEZ: Special Economic Zone

TMT: Thermo Mechanically Treated

USD: US Dollar

Conversion rate used: USD1= INR48

Wherever applicable, numbers have been rounded off to the nearest whole number

For updated information, please visit www.ibef.org

USEFUL INFORMATION

37

Steel

MARCH

2013

Disclaimer

India Brand Equity Foundation (IBEF) engaged Aranca to

prepare this presentation and the same has been

prepared by Aranca in consultation with IBEF.

All rights reserved. All copyright in this presentation and

related works is solely and exclusively owned by IBEF.

The same may not be reproduced, wholly or in part in

any material form (including photocopying or storing it in

any medium by electronic means and whether or not

transiently or incidentally to some other use of this

presentation), modified or in any manner communicated

to any third party except with the written approval of

IBEF.

This presentation is for information purposes only. While

due care has been taken during the compilation of this

For updated information, please visit www.ibef.org

presentation to ensure that the information is accurate to

the best of Aranca and IBEFs knowledge and belief, the

content is not to be construed in any manner whatsoever

as a substitute for professional advice.

Aranca and IBEF neither recommend nor endorse any

specific products or services that may have been

mentioned in this presentation and nor do they assume

any liability or responsibility for the outcome of decisions

taken as a result of any reliance placed on this

presentation.

Neither Aranca nor IBEF shall be liable for any direct or

indirect damages that may arise due to any act or

omission on the part of the user due to any reliance

placed or guidance taken from any portion of this

presentation.

DISCLAIMER

38

Das könnte Ihnen auch gefallen

- EPC Projects BasicsDokument2 SeitenEPC Projects Basicsmahmood75080% (5)

- ACList 20180808Dokument3 SeitenACList 20180808mahmood750Noch keine Bewertungen

- Bank Statement (Various Formats)Dokument48 SeitenBank Statement (Various Formats)Araman AmruNoch keine Bewertungen

- Steel IndustryDokument28 SeitenSteel Industryrohitmahato10Noch keine Bewertungen

- Acct Statement XX1708 26082022Dokument4 SeitenAcct Statement XX1708 26082022Firoz KhanNoch keine Bewertungen

- Technical Data Sheet 15cdv6Dokument2 SeitenTechnical Data Sheet 15cdv6mahmood750Noch keine Bewertungen

- Steel Industry in IndiaDokument8 SeitenSteel Industry in IndiaakashNoch keine Bewertungen

- Structured Note ProductsDokument10 SeitenStructured Note Productschandkhand2Noch keine Bewertungen

- Steelplant SeminarDokument28 SeitenSteelplant SeminarBharat L. YeduNoch keine Bewertungen

- Strategy Review - Tata SteelDokument20 SeitenStrategy Review - Tata SteelKen SekharNoch keine Bewertungen

- Iron and Steel IndustryDokument14 SeitenIron and Steel IndustryMeethu Rajan100% (1)

- The Nadcap Approval in NDTDokument3 SeitenThe Nadcap Approval in NDTmahmood750Noch keine Bewertungen

- Project KamleshDokument103 SeitenProject Kamleshdeep1aroraNoch keine Bewertungen

- Strategy Management Project Report On Tata SteelDokument34 SeitenStrategy Management Project Report On Tata SteelAndreea CriclevitNoch keine Bewertungen

- Project Report On Performance Apprasial of HDFC Bank Shipli Uttam Inst.Dokument92 SeitenProject Report On Performance Apprasial of HDFC Bank Shipli Uttam Inst.Ayush Tiwari0% (2)

- SDG Primer Companion Textbook PDFDokument68 SeitenSDG Primer Companion Textbook PDFAaron BareNoch keine Bewertungen

- Quantitative Strategic Planning Matrix (QSPM) For AirasiaDokument4 SeitenQuantitative Strategic Planning Matrix (QSPM) For AirasiamaliklduNoch keine Bewertungen

- Steel Industry in India: Project FinanceDokument32 SeitenSteel Industry in India: Project FinanceSharvil Vikram Singh100% (1)

- Iron & Steel IndustryDokument10 SeitenIron & Steel IndustryRishav KhaitanNoch keine Bewertungen

- Project Report On Comparative Analysis of Public and Private Sector Steel Companies in IndiaDokument48 SeitenProject Report On Comparative Analysis of Public and Private Sector Steel Companies in IndiaHillary RobinsonNoch keine Bewertungen

- Project Report On Vizag Steel Plant Distribution ChannelDokument94 SeitenProject Report On Vizag Steel Plant Distribution ChannelOm Prakash78% (9)

- PMBOK (Project Management Body of Knowledge)Dokument8 SeitenPMBOK (Project Management Body of Knowledge)Hari Purwadi0% (1)

- Infrastructural Challenges in Steel Industry - Best Paper Published in 4th International Steel Logistics Conference in AntwerpDokument38 SeitenInfrastructural Challenges in Steel Industry - Best Paper Published in 4th International Steel Logistics Conference in Antwerpsubrat_sahoo19690% (1)

- Modern Warehouses The Purposes of Warehouses, and Basic RequirementsDokument6 SeitenModern Warehouses The Purposes of Warehouses, and Basic Requirementsmahmood750Noch keine Bewertungen

- Nezone FinalDokument61 SeitenNezone Finalvictor saikiaNoch keine Bewertungen

- A Study of Electronic Data Storage Steel Factory in Mumbai11Dokument71 SeitenA Study of Electronic Data Storage Steel Factory in Mumbai11Thirupal Nk100% (3)

- IBEF Presentation Steel5012012Dokument36 SeitenIBEF Presentation Steel5012012Prasoon YadavNoch keine Bewertungen

- Internship ReportDokument41 SeitenInternship ReportPankaj KumarNoch keine Bewertungen

- Market Structure-Indian Steel SectorDokument6 SeitenMarket Structure-Indian Steel SectorRakesh RanjanNoch keine Bewertungen

- Steel Has An Oligopoly Market IDokument6 SeitenSteel Has An Oligopoly Market Iarchana783Noch keine Bewertungen

- Sub: Strategic Management: Steel IndustryDokument13 SeitenSub: Strategic Management: Steel IndustryRohit GhaiNoch keine Bewertungen

- Market Structure AnalaysisDokument17 SeitenMarket Structure AnalaysisAnil Ak0% (1)

- Production and Consumption Trends in The Total Finished Steel Market (In Million Tonnes)Dokument6 SeitenProduction and Consumption Trends in The Total Finished Steel Market (In Million Tonnes)Monish RcNoch keine Bewertungen

- Steel Industry in India AbstractDokument8 SeitenSteel Industry in India AbstractPawan Kumar VulluriNoch keine Bewertungen

- CCI Iron and Steel Industry in IndiaDokument16 SeitenCCI Iron and Steel Industry in IndiaShubham KhattriNoch keine Bewertungen

- Iron and Steel Industry in IndiaDokument16 SeitenIron and Steel Industry in IndiaAnonymous gQyrTUHX38100% (1)

- CH 2 CP - 1Dokument11 SeitenCH 2 CP - 1PearlNoch keine Bewertungen

- Precision Steel TubesDokument9 SeitenPrecision Steel TubesRam KumarNoch keine Bewertungen

- An Overview of Steel SectorDokument3 SeitenAn Overview of Steel SectorAnand SagarNoch keine Bewertungen

- A Study of Electronic Data Storage Steel Factory in Mumbai11 150218034403 Conversion Gate02Dokument51 SeitenA Study of Electronic Data Storage Steel Factory in Mumbai11 150218034403 Conversion Gate02NIKHIL CHAUHANNoch keine Bewertungen

- ProjectDokument5 SeitenProjectNittin MittalNoch keine Bewertungen

- An Overview of The Steel Industry: Group Number: 6Dokument9 SeitenAn Overview of The Steel Industry: Group Number: 6MohitNoch keine Bewertungen

- National Steel Policy 2017Dokument4 SeitenNational Steel Policy 2017Rakesh PrasadNoch keine Bewertungen

- Industry Profile: Steel Industry Is Becoming More and More Competitive With Every Passing Day. During TheDokument19 SeitenIndustry Profile: Steel Industry Is Becoming More and More Competitive With Every Passing Day. During Thevinay8464Noch keine Bewertungen

- Jaya BlackBook Final1Dokument75 SeitenJaya BlackBook Final1SauravNoch keine Bewertungen

- Iron and Steel Industry: Economics AssignmentDokument10 SeitenIron and Steel Industry: Economics Assignmentsamikshya choudhuryNoch keine Bewertungen

- Executive Summary The Indian Steel Industry: Worldwide Crude Steel Production in 2009Dokument6 SeitenExecutive Summary The Indian Steel Industry: Worldwide Crude Steel Production in 2009Prateek Singh SidhuNoch keine Bewertungen

- Report On Steel IndustryDokument15 SeitenReport On Steel Industrysiddhesh4788Noch keine Bewertungen

- Feb 2014 PDFDokument72 SeitenFeb 2014 PDFsatish_trivediNoch keine Bewertungen

- Steel Scenario: Kushagra JadhavDokument12 SeitenSteel Scenario: Kushagra JadhavKushagra JadhavNoch keine Bewertungen

- Tata SteelDokument27 SeitenTata SteelJAYKISHAN JOSHI50% (4)

- FinMod Final AssignmentDokument17 SeitenFinMod Final Assignmentvirat kohliNoch keine Bewertungen

- Steel Industry in IndiaDokument23 SeitenSteel Industry in IndiaAnna KruglovaNoch keine Bewertungen

- Indian Steel Industry EconomyDokument18 SeitenIndian Steel Industry Economydj gangster0% (2)

- Tata CorusDokument14 SeitenTata CorusSameer SunnyNoch keine Bewertungen

- Tata SteelDokument13 SeitenTata SteelDeep Nainwani100% (1)

- Tata SteelDokument16 SeitenTata SteelDeep NainwaniNoch keine Bewertungen

- ChapterDokument91 SeitenChaptersuryadtp suryadtpNoch keine Bewertungen

- A Study On Analysis of Profitability Position of Jindal Steel LimitedDokument59 SeitenA Study On Analysis of Profitability Position of Jindal Steel LimitedsathiyaNoch keine Bewertungen

- Final PPT Steel IndustryDokument26 SeitenFinal PPT Steel IndustryHimalaya GuptaNoch keine Bewertungen

- Cluster IronDokument31 SeitenCluster IronPraneeth Kumar V RNoch keine Bewertungen

- AStudyon Performanceand Prospectof Indian Steel Industryfrom National Perspective Under GlobalizationDokument9 SeitenAStudyon Performanceand Prospectof Indian Steel Industryfrom National Perspective Under GlobalizationNiketa Govind KhalkhoNoch keine Bewertungen

- Created By: Sakshi Gupta Jatinder Singh Hari Om Gupta Tarun Narang Kanika AgarwalDokument12 SeitenCreated By: Sakshi Gupta Jatinder Singh Hari Om Gupta Tarun Narang Kanika AgarwalSakshi GuptaNoch keine Bewertungen

- Combined Research PaperDokument11 SeitenCombined Research PaperSibikshaNoch keine Bewertungen

- Sec-F Grp-3 CF-II Project - Tata SteelDokument20 SeitenSec-F Grp-3 CF-II Project - Tata SteelPranav BajajNoch keine Bewertungen

- Comparative Analysis of Indian Private and Public Sectors With Special Reference To TATA Steel and SAILDokument53 SeitenComparative Analysis of Indian Private and Public Sectors With Special Reference To TATA Steel and SAILManu GCNoch keine Bewertungen

- Report On: BY:-Archana Tiwari Section C (Ibf) ROLL NO:103Dokument10 SeitenReport On: BY:-Archana Tiwari Section C (Ibf) ROLL NO:103archana0001Noch keine Bewertungen

- Cast Iron Soil Pipe & Fittings & Special Fittings, Gray Iron World Summary: Market Sector Values & Financials by CountryVon EverandCast Iron Soil Pipe & Fittings & Special Fittings, Gray Iron World Summary: Market Sector Values & Financials by CountryNoch keine Bewertungen

- Machine Tools, Metal Cutting Types World Summary: Market Values & Financials by CountryVon EverandMachine Tools, Metal Cutting Types World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Iron & Steel Scrap Wholesale, Processors & Dealers Revenues World Summary: Market Values & Financials by CountryVon EverandIron & Steel Scrap Wholesale, Processors & Dealers Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- High Speed Steel End Mills & Milling Cutters World Summary: Market Sector Values & Financials by CountryVon EverandHigh Speed Steel End Mills & Milling Cutters World Summary: Market Sector Values & Financials by CountryNoch keine Bewertungen

- Faq Nitwaa V.0Dokument20 SeitenFaq Nitwaa V.0mahmood750Noch keine Bewertungen

- BilletHeating PDFDokument2 SeitenBilletHeating PDFmahmood750Noch keine Bewertungen

- HTDokument17 SeitenHTmahmood750Noch keine Bewertungen

- AC Checklists Posted On JAQG WebDokument3 SeitenAC Checklists Posted On JAQG Webmahmood750Noch keine Bewertungen

- AC Checklists Posted On JAQG WebDokument3 SeitenAC Checklists Posted On JAQG Webmahmood750Noch keine Bewertungen

- Steel Making Prof. Deepak Mazumdar Prof. S. C. Koria Department of Materials Science and Engineering Indian Institute of Technology, KanpurDokument27 SeitenSteel Making Prof. Deepak Mazumdar Prof. S. C. Koria Department of Materials Science and Engineering Indian Institute of Technology, Kanpurmahmood750Noch keine Bewertungen

- 03MukeshKumar 29sept2012Dokument15 Seiten03MukeshKumar 29sept2012mahmood750Noch keine Bewertungen

- Rental AgreementDokument4 SeitenRental Agreementmahmood750Noch keine Bewertungen

- Steam SurbinesDokument12 SeitenSteam Surbinesmahmood750Noch keine Bewertungen

- Tck-In Day 9Dokument3 SeitenTck-In Day 9Julieth RiañoNoch keine Bewertungen

- BUS 1102-1 Unit 1 Written AssignmentDokument3 SeitenBUS 1102-1 Unit 1 Written AssignmentKG Yu WaiNoch keine Bewertungen

- Fund Card Sample PDFDokument4 SeitenFund Card Sample PDFSandeep SoniNoch keine Bewertungen

- PAYE-GEN-01-G02 - Guide For Employers in Respect of Fringe Benefits - External GuideDokument25 SeitenPAYE-GEN-01-G02 - Guide For Employers in Respect of Fringe Benefits - External Guidelixocan100% (1)

- Vietnam Tax Legal HandbookDokument52 SeitenVietnam Tax Legal HandbookaNoch keine Bewertungen

- Value Added TaxDokument46 SeitenValue Added TaxBoss NikNoch keine Bewertungen

- Global Study On Interactions Between Social Processes and Participatory Guarantee SystemsDokument90 SeitenGlobal Study On Interactions Between Social Processes and Participatory Guarantee SystemsedgoitesNoch keine Bewertungen

- Retirement QuestionDokument2 SeitenRetirement QuestionshubhamsundraniNoch keine Bewertungen

- E. Sharath Babu, Founder & CEO, Food King: Entrepreneurs Non-Tech EntrepreneursDokument3 SeitenE. Sharath Babu, Founder & CEO, Food King: Entrepreneurs Non-Tech Entrepreneurssundar666Noch keine Bewertungen

- Sandeep Kumar Shivhare: ObjectiveDokument4 SeitenSandeep Kumar Shivhare: ObjectiveSai Swaroop MandalNoch keine Bewertungen

- SUSTAINABLE TOURISM PrefinalsDokument4 SeitenSUSTAINABLE TOURISM PrefinalsNicole SarmientoNoch keine Bewertungen

- Glosario de SAP en InglésDokument129 SeitenGlosario de SAP en InglésTester_10Noch keine Bewertungen

- Introduction To DerivativesDokument6 SeitenIntroduction To DerivativesXiaoxi NiNoch keine Bewertungen

- L4DB - Y12 - UBO Assignment - Sep - 2020 PDFDokument4 SeitenL4DB - Y12 - UBO Assignment - Sep - 2020 PDFsnapNoch keine Bewertungen

- Money & Banking - MGT411 Handouts PDFDokument149 SeitenMoney & Banking - MGT411 Handouts PDFnesa100% (1)

- Solutions For GST Question BankDokument73 SeitenSolutions For GST Question BankSuprajaNoch keine Bewertungen

- A Critic Le Analysis of AppleDokument14 SeitenA Critic Le Analysis of Applesabishi2312Noch keine Bewertungen

- MIT 1050: Week 2: Overview of Media IndustriesDokument3 SeitenMIT 1050: Week 2: Overview of Media IndustriesMar JoNoch keine Bewertungen

- Dea Aul - QuizDokument5 SeitenDea Aul - QuizDea Aulia AmanahNoch keine Bewertungen

- Definitions of Globalization - A Comprehensive Overview and A Proposed DefinitionDokument21 SeitenDefinitions of Globalization - A Comprehensive Overview and A Proposed Definitionnagendrar_2Noch keine Bewertungen

- Architect / Contract Administrator's Instruction: Estimated Revised Contract PriceDokument6 SeitenArchitect / Contract Administrator's Instruction: Estimated Revised Contract PriceAfiya PatersonNoch keine Bewertungen

- AgentsDokument11 SeitenAgentschinchumoleNoch keine Bewertungen

- 2 Annual Secretarial Compliance Report - NSE Clearing Limited - SignedDokument3 Seiten2 Annual Secretarial Compliance Report - NSE Clearing Limited - SignedAmit KumarNoch keine Bewertungen