Beruflich Dokumente

Kultur Dokumente

Ubl

Hochgeladen von

Jessica Miller0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

20 Ansichten1 Seitereview

Originaltitel

ubl

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenreview

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

20 Ansichten1 SeiteUbl

Hochgeladen von

Jessica Millerreview

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

UNITED BANK LIMITED

UBL is one of the most profitable banks of

Pakistan and has been ranked as number 3

on the basis of its size. UBLs balance sheet

has crossed the 1 trillion mark recently at

the 2013 year end and showed a growth of

13% over the year 2012, which makes it a

Large bank as per KPMGs classification of

big banks 2013.

UBL has the 2nd largest branch network in

Pakistan with 1,281 branches.

PAST PERFORMANCE:

The profit after tax has been continuously

increasing for UBL and in just the last year

i.e. 2013, it showed a growth of 4% which

was directly reflected in its increased share

price also.

The net interest income has been over a

period of 5 years, first showed an increasing

trend but later, during the past two years

since the interest rates have been declining

and almost declined by 500bps i.e. 5% so

therefore in 2013 and 2014 the net interest

income has been declining. But this

negative impact can be offset by looking at

the strong CASA ratio that stood at 83%.

However the non-interest income has

constantly been on the rise for UBL, among

which a major growth was seen in the fee

and commission income received. UBL has

faced a severe spread compression and

thats primarily due to increased

competitiveness in the banking sector and

the declining interest rates. But still as per

KPMG, UBL stands at no. 3 in terms of its

spread, as it has been effective enough to

cope up by increasing its non-interest

income.

A worth mentioning fact is that the NPLs

have considerably declined in 2012, and

further improves UBLs liquidity position.

Thus we can say that UBL has lowered the

credibility risk it was exposed to previously.

In terms of its liquidity, it cannot be said

that the bank is facing high liquidity risk just

because its cash on hand to total assets is

low. The bank has seen increase in its

current and saving deposits over the years

and also is trying to increase its deposit

base. So these deposits increases can be

used to meet the short term obligations

along with the most liquid investments i.e.

heavy investment by UBL in Government

securities. Also The CAR was maintained at

13.3% which was above the SBP

requirements and thus makes it a safe bank.

The advances to deposit ratio, though still

above than 50% has been declining, which

indicates the inefficiency of management in

converting deposits into high earning

advances, and that too can be attributed to

the increased deposit base but coupled with

a comparatively low growth in advances,

and most importantly the increasing NPLs

over 2008-11.

FUTURE OUTLOOK:

Primarily a banks earning depends upon

the net interest income therefore much of

UBLs profitability like any other bank will

rely on what the future holds for the

interest rates.

Since the banking sector is becoming highly

competitive with passage of time therefore,

one needs to take a little risk to earn more.

So UBL if shift from heavy investment in the

government instruments towards private

sector, that will decide its profitability in

future and its spread improvement if any in

future.

Das könnte Ihnen auch gefallen

- AEL - Annual - Report - 2013, 2012,2011Dokument84 SeitenAEL - Annual - Report - 2013, 2012,2011Jessica MillerNoch keine Bewertungen

- Telenor CaseDokument26 SeitenTelenor CaseJessica MillerNoch keine Bewertungen

- What Makes a Quality ProductDokument4 SeitenWhat Makes a Quality ProductJessica MillerNoch keine Bewertungen

- Share Price of Top 10 BanksDokument82 SeitenShare Price of Top 10 BanksJessica MillerNoch keine Bewertungen

- Kse 100 3rd FebDokument1 SeiteKse 100 3rd FebJessica MillerNoch keine Bewertungen

- 3rd March 2Dokument1 Seite3rd March 2Jessica MillerNoch keine Bewertungen

- Pakistan's electricity crisis explained: Causes, impacts and solutionsDokument4 SeitenPakistan's electricity crisis explained: Causes, impacts and solutionsJessica MillerNoch keine Bewertungen

- ITC eChoupal Supply ChainDokument13 SeitenITC eChoupal Supply ChainJessica MillerNoch keine Bewertungen

- TELENOR: From Cellular Networks To Financial Services: Team InfinityDokument8 SeitenTELENOR: From Cellular Networks To Financial Services: Team InfinityJessica MillerNoch keine Bewertungen

- Krisitins Cookie SolutionDokument1 SeiteKrisitins Cookie SolutionSrivastav GauravNoch keine Bewertungen

- Compare operations of McDonald's vs Burger KingDokument4 SeitenCompare operations of McDonald's vs Burger KingJessica Miller0% (1)

- Docs RequiredDokument1 SeiteDocs RequiredJessica MillerNoch keine Bewertungen

- Ali Ahmed Case StudyDokument3 SeitenAli Ahmed Case StudyJessica MillerNoch keine Bewertungen

- BP TexasDokument6 SeitenBP TexasJessica Miller100% (1)

- Taxation Concepts and DefinitionsDokument2 SeitenTaxation Concepts and DefinitionsJessica MillerNoch keine Bewertungen

- Asset management, HUF, modaraba definitionsDokument2 SeitenAsset management, HUF, modaraba definitionsJessica MillerNoch keine Bewertungen

- Varioline Intercool Pakistan (PVT) Limited: Company ProfileDokument1 SeiteVarioline Intercool Pakistan (PVT) Limited: Company ProfileJessica MillerNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Compliance Officers (Brokers) Module Curriculum 1.Dokument2 SeitenCompliance Officers (Brokers) Module Curriculum 1.ambreenkhanamNoch keine Bewertungen

- Investor Account - Zakat Declaration FormDokument2 SeitenInvestor Account - Zakat Declaration FormMuhammad WasimNoch keine Bewertungen

- Wage Account November 2020M HN-1Dokument12 SeitenWage Account November 2020M HN-1Pavel ViktorNoch keine Bewertungen

- Answer Key: Chapter 06 Audit Planning, Understanding The Client, Assessing Risks, and RespondingDokument25 SeitenAnswer Key: Chapter 06 Audit Planning, Understanding The Client, Assessing Risks, and RespondingRalph Santos100% (2)

- Uganda Management Institute Cash Deposit SlipDokument3 SeitenUganda Management Institute Cash Deposit SlipNyeko Francis100% (3)

- Fundamental Analysis of Indian Banking SectorDokument17 SeitenFundamental Analysis of Indian Banking SectorDipesh AprajNoch keine Bewertungen

- Introduction to Banking Types and HistoryDokument164 SeitenIntroduction to Banking Types and HistoryAiny Rajpoot RajpootNoch keine Bewertungen

- MR - Yogesh Daulat Chhaproo: Page 1 of 2 M-864489Dokument2 SeitenMR - Yogesh Daulat Chhaproo: Page 1 of 2 M-864489Yogesh ChhaprooNoch keine Bewertungen

- Project On SebiDokument15 SeitenProject On SebiVrushti Parmar86% (14)

- Lord BlackheathDokument16 SeitenLord BlackheathrealtimetruthNoch keine Bewertungen

- Chapter 17 - Control AccountsDokument17 SeitenChapter 17 - Control Accountsshemida75% (4)

- Bill of Lading - Short Form - Not NegotiableDokument1 SeiteBill of Lading - Short Form - Not NegotiableYashraj PanchmatiaNoch keine Bewertungen

- Quantitative ToolsDokument14 SeitenQuantitative Tools9439223514pNoch keine Bewertungen

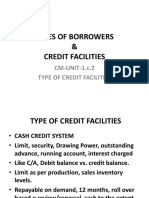

- CM Unit 1.c.2 TYPES of Credit FacilitiesDokument8 SeitenCM Unit 1.c.2 TYPES of Credit Facilitiesabdullahi shafiuNoch keine Bewertungen

- Prudential Financial Inc BondDokument2 SeitenPrudential Financial Inc BonddroidNoch keine Bewertungen

- Regulation of Cryptocurrency and Combating Terrorist FinancingDokument26 SeitenRegulation of Cryptocurrency and Combating Terrorist FinancingsafaafNoch keine Bewertungen

- Organized Group Activity in Insurance Fraud PublicDokument11 SeitenOrganized Group Activity in Insurance Fraud PublicMinnesota Public RadioNoch keine Bewertungen

- SMEFinancingDokument60 SeitenSMEFinancingKhan Jewel100% (4)

- Marketing Plan Report ItradeDokument8 SeitenMarketing Plan Report ItradeVkNoch keine Bewertungen

- Sip Project FDokument55 SeitenSip Project Fravi kangneNoch keine Bewertungen

- Commercial Law ReviewDokument27 SeitenCommercial Law ReviewimianmoralesNoch keine Bewertungen

- Bank Copy: Position Code For Assistant Is 301 Position Code For Stenotypist Is 302Dokument1 SeiteBank Copy: Position Code For Assistant Is 301 Position Code For Stenotypist Is 302i am lateNoch keine Bewertungen

- VRL Marketing Project ReportDokument85 SeitenVRL Marketing Project Reportkaustubh383Noch keine Bewertungen

- Wells Fargo Way2Save Checking: Important Account InformationDokument5 SeitenWells Fargo Way2Save Checking: Important Account InformationBernadette B. Reyes0% (1)

- Credit SYLLABUS PrintableDokument9 SeitenCredit SYLLABUS PrintableCarme Ann S. RollonNoch keine Bewertungen

- An Insider's Guide To SFTR For The Buy-SideDokument12 SeitenAn Insider's Guide To SFTR For The Buy-SideMalika DwarkaNoch keine Bewertungen

- Promotion March2016 Final Updated Upto 24-02-2016Dokument147 SeitenPromotion March2016 Final Updated Upto 24-02-2016pankaj gargNoch keine Bewertungen

- H Theory of Money SupplyDokument3 SeitenH Theory of Money SupplyShofi R Krishna100% (17)

- Statement of Account - 171017 To 151117Dokument2 SeitenStatement of Account - 171017 To 151117Anonymous 44AH37TUNoch keine Bewertungen

- NAFSCOB Formulates HR Policy for PACSDokument97 SeitenNAFSCOB Formulates HR Policy for PACSK Srinivasa MurthyNoch keine Bewertungen