Beruflich Dokumente

Kultur Dokumente

Beta Calculation

Hochgeladen von

anuradhaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Beta Calculation

Hochgeladen von

anuradhaCopyright:

Verfügbare Formate

Beta Calculation

There are two methods of calculating intercept (alpha, a) and beta (b) of the

characteristic line for a firm’s equity share. The direct method is to calculate

covariance and variances. The Excel has a function, “Covariance”, under its

Data Analysis that can be used to get the covariance matrix. The alternative

method of estimating beta and intercept is the regression method. The Excel’s

“Regression” function under its Data Analysis can be used.

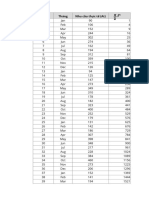

The next sheet gives closing share prices for Company J and Sensex.

We calculted log rate of return for one period. Calculate the market and

company returns for the remaining periods and calculate beta using

"Regression". Go to Tools>Data Analysis>Regression. When the dilogue box

opens, fill in company returns range in 'Input Y range" and Sensex returns

range in "Input X range'. Click Newsheet in the output box.

Note: To get Data Analysis function: Go to Tools>Add-Ins>Tick Analysis ToolPak

Co. J Sensex

Period Cl. Price Cl. Price

Dec-00 536.95 3972.12 RJ RM

Jan-01 648.35 4326.72 0.189 0.086

Feb-01 622.65 4247.04

Mar-01 368.7 3604.38

Apr-01 377.15 3519.16

May-01 392.8 3631.91

Jun-01 293.15 3456.78

Jul-01 247.05 3329.28

Aug-01 222.45 3244.95

Sep-01 129.85 2811.6

Oct-01 164.3 2989.35

Nov-01 231.45 3287.56

Dec-01 274.3 3262.33

Jan-02 245.35 3311.03

Feb-02 261.4 3562.31

Mar-02 253.65 3469.35

Apr-02 242.65 3338.16

May-02 221.65 3125.73

Jun-02 224 3244.7

Jul-02 187.7 2987.65

Aug-02 203.55 3181.23

Sep-02 208.7 2991.36

Oct-02 163.15 2949.32

Nov-02 191.25 3228.82

Dec-02 186.6 3377.28

Jan-03 162.3 3250.38

Feb-03 175.3 3283.66

Mar-03 151.55 3048.72

Apr-03 135.15 2959.79

May-03 123.4 3180.75

Jun-03 154.55 3607.13

Jul-03 162.45 3792.61

Aug-03 183.65 4244.73

Sep-03 172.1 4453.24

Oct-03 216.5 4906.87

Nov-03 269.5 5044.82

Dec-03 306.4 5838.96

Jan-04 304.3 5695.67

Feb-04 291.95 5667.51

Mar-04 247.85 5590.6

Apr-04 275.1 5655.09

Average 247.3475

Das könnte Ihnen auch gefallen

- Bank of Baroda (Bob) : Beta CalculationDokument3 SeitenBank of Baroda (Bob) : Beta CalculationrathneshkumarNoch keine Bewertungen

- Modeloff 2018 - Round 1 - Section 1: FormatsDokument62 SeitenModeloff 2018 - Round 1 - Section 1: FormatsGaurav NaulakhaNoch keine Bewertungen

- QT Trial FourDokument138 SeitenQT Trial FourKHUSHI SHANBHAGNoch keine Bewertungen

- Christie and Chang AnalysisDokument10 SeitenChristie and Chang AnalysisJaved IqbalNoch keine Bewertungen

- UK House Price IndexDokument10 SeitenUK House Price IndexArrow NagNoch keine Bewertungen

- Sample IAS 29 COS ComputationDokument29 SeitenSample IAS 29 COS ComputationShingirai CynthiaNoch keine Bewertungen

- EMBI Banco CentralDokument25 SeitenEMBI Banco CentralMario ObrequeNoch keine Bewertungen

- Lab Poa WinterDokument12 SeitenLab Poa WinterHanif Cesario AbdullahNoch keine Bewertungen

- Declared+Variables+ +Practice+Workbook+ +answersDokument9 SeitenDeclared+Variables+ +Practice+Workbook+ +answersParag ShegokarNoch keine Bewertungen

- Dự Báo Định Lượng - Tuần 3 - Ví DụDokument8 SeitenDự Báo Định Lượng - Tuần 3 - Ví Dụlephuongthao19042004Noch keine Bewertungen

- Yes Bank 2Dokument1 SeiteYes Bank 2MuskaanNoch keine Bewertungen

- Estimates of United States Total Monthly Retail and Food Services SalesDokument37 SeitenEstimates of United States Total Monthly Retail and Food Services SalesrakeshNoch keine Bewertungen

- New Microsoft Excel WorksheetDokument6 SeitenNew Microsoft Excel WorksheetselvaNoch keine Bewertungen

- Basic Financial Management DA-2 Objective: Month Sensex Returns (X) Ecil Returns (Y) X 2 XYDokument4 SeitenBasic Financial Management DA-2 Objective: Month Sensex Returns (X) Ecil Returns (Y) X 2 XYpapu kuttyNoch keine Bewertungen

- Instructions:: This Is An Online, Closed Book ExaminationDokument18 SeitenInstructions:: This Is An Online, Closed Book ExaminationChandan SahNoch keine Bewertungen

- Amortization Table: Year Month Principal Paid Interest Paidloan BalanceDokument2 SeitenAmortization Table: Year Month Principal Paid Interest Paidloan BalanceAshok Kumar ReddyNoch keine Bewertungen

- Sales ReportDokument31 SeitenSales Reportvinodh kumarNoch keine Bewertungen

- SBI Technical AnalysisDokument88 SeitenSBI Technical AnalysisrahulNoch keine Bewertungen

- Industry AnalysisDokument19 SeitenIndustry AnalysisNadirNoch keine Bewertungen

- Clearing TransactionsDokument7 SeitenClearing TransactionsabdyNoch keine Bewertungen

- Beta For IOCL and HPCLDokument3 SeitenBeta For IOCL and HPCLUtkarsh PandeyNoch keine Bewertungen

- TxnsDokument12 SeitenTxnsedward mpangileNoch keine Bewertungen

- ChartsDokument11 SeitenChartsRadhika SarawagiNoch keine Bewertungen

- Cat Turnover 050224Dokument4 SeitenCat Turnover 050224anilkhubchandani9744Noch keine Bewertungen

- Book 12Dokument8 SeitenBook 12Manan GuptaNoch keine Bewertungen

- Interest: Credit Amount: Monthly PaymentDokument4 SeitenInterest: Credit Amount: Monthly Paymentpepepepe12345Noch keine Bewertungen

- Conditional Formulas PracticeDokument3 SeitenConditional Formulas PracticeParag ShegokarNoch keine Bewertungen

- TLKM. Olah Data BaruDokument5 SeitenTLKM. Olah Data Barusyahrul oikosNoch keine Bewertungen

- Home Loan CalcDokument16 SeitenHome Loan CalcViplawNoch keine Bewertungen

- Dự Báo Định Lượng - Tuần 2 - Ví DụDokument18 SeitenDự Báo Định Lượng - Tuần 2 - Ví Dụphanngocduy2004.2019Noch keine Bewertungen

- Dự Báo Định Lượng - Tuần 2 - Ví Dụ - Đáp ÁnDokument18 SeitenDự Báo Định Lượng - Tuần 2 - Ví Dụ - Đáp Ánlephuongthao19042004Noch keine Bewertungen

- The Black Litterman Model: Inputs: SheetDokument30 SeitenThe Black Litterman Model: Inputs: SheetRadhika SarawagiNoch keine Bewertungen

- Forecasting: (Untitled)Dokument4 SeitenForecasting: (Untitled)Roeder IgnacioNoch keine Bewertungen

- NUST Business School: Course Title: Fundamentals of Econometrics Assignment#1Dokument12 SeitenNUST Business School: Course Title: Fundamentals of Econometrics Assignment#1Isbah INoch keine Bewertungen

- Declared+Variables+ +Practice+WorkbookDokument2 SeitenDeclared+Variables+ +Practice+WorkbookParag ShegokarNoch keine Bewertungen

- OSCM Assessment AnalysisDokument8 SeitenOSCM Assessment AnalysisShanmathi ArumugamNoch keine Bewertungen

- Czech ForDokument8 SeitenCzech ForRoeder IgnacioNoch keine Bewertungen

- Czech ForDokument8 SeitenCzech ForRoeder IgnacioNoch keine Bewertungen

- Akhir Periode Uang Kartal Uang Giral Jumlah (M1) Uang Kuasi Surat Berharga Selain Saham Jumlah (M2)Dokument4 SeitenAkhir Periode Uang Kartal Uang Giral Jumlah (M1) Uang Kuasi Surat Berharga Selain Saham Jumlah (M2)Gagan HermawanNoch keine Bewertungen

- Evapotranspirasi Penman-1Dokument6 SeitenEvapotranspirasi Penman-1Samuel HarisNoch keine Bewertungen

- HVAC Invoice Details 2Dokument12 SeitenHVAC Invoice Details 2padmasunilNoch keine Bewertungen

- Sensex & NiftyDokument3 SeitenSensex & NiftyNitin CognescentiNoch keine Bewertungen

- Fish Catch Data (1101)Dokument35 SeitenFish Catch Data (1101)Gautam BindlishNoch keine Bewertungen

- Ayush CFDokument69 SeitenAyush CFShraddha TiwariNoch keine Bewertungen

- Management Thesis: Sbi Mutual Fund Is Better Investment PlanDokument19 SeitenManagement Thesis: Sbi Mutual Fund Is Better Investment Plansukra vaniNoch keine Bewertungen

- PF CalDokument5 SeitenPF Calda MNoch keine Bewertungen

- DecomDokument10 SeitenDecomManan GuptaNoch keine Bewertungen

- NEeng Test Part1Dokument81 SeitenNEeng Test Part1KWITONDA AngeNoch keine Bewertungen

- Caudal RamisDokument148 SeitenCaudal RamisZorayda YasmiraNoch keine Bewertungen

- Statistics in Real LifeDokument19 SeitenStatistics in Real LifeArnold AnthonyNoch keine Bewertungen

- International Financial StatisticsDokument18 SeitenInternational Financial StatisticsKhurram Sadiq (Father Name:Muhammad Sadiq)Noch keine Bewertungen

- Descri TivaDokument6 SeitenDescri TivaAriani FotNoch keine Bewertungen

- Flood Hydrology FrequencyDokument3 SeitenFlood Hydrology FrequencydsanandaNoch keine Bewertungen

- Statistical Tables and FormulaeDokument8 SeitenStatistical Tables and FormulaeAnjali SrivastavaNoch keine Bewertungen

- Huda Khalid Portfolio ManagementDokument7 SeitenHuda Khalid Portfolio ManagementSimraNoch keine Bewertungen

- Pia EaDokument7 SeitenPia EaAlejandro SánchezNoch keine Bewertungen

- Stock Market Vertality of Two IndustryDokument41 SeitenStock Market Vertality of Two IndustryAli NadafNoch keine Bewertungen

- CFin I CAPM AutomobilesDokument8 SeitenCFin I CAPM Automobilessumeet kumarNoch keine Bewertungen

- Month Open Pricehigh Price Low Price Close Priceno - of Sharno. of Tra Total Turnover (RS.) Spread HiDokument2 SeitenMonth Open Pricehigh Price Low Price Close Priceno - of Sharno. of Tra Total Turnover (RS.) Spread HipandeyshivpatiNoch keine Bewertungen

- Financial Ratio Analysis TemplateDokument6 SeitenFinancial Ratio Analysis Template✬ SHANZA MALIK ✬Noch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Consumer BehaviourDokument10 SeitenConsumer BehaviouramolgadgikarNoch keine Bewertungen

- Equity Analysis of A Project: Capital Budgeting WorksheetDokument8 SeitenEquity Analysis of A Project: Capital Budgeting WorksheetanuradhaNoch keine Bewertungen

- Strategic Analysis of Investment Banking in IndiaDokument19 SeitenStrategic Analysis of Investment Banking in Indiaanuradha100% (7)

- To Study The Market Feasibility of 5 Star HotelsDokument20 SeitenTo Study The Market Feasibility of 5 Star Hotelsanuradha0% (1)

- BAIN Capital Global PE Report 2010 PRDokument76 SeitenBAIN Capital Global PE Report 2010 PRvkiriakNoch keine Bewertungen

- Involvement Theory: Other NamesDokument13 SeitenInvolvement Theory: Other Namesanuradha67% (9)

- Buyer Behaviour oDokument27 SeitenBuyer Behaviour oanuradhaNoch keine Bewertungen

- Communication Program To Develop Brands and Build Customer LoyaltyDokument21 SeitenCommunication Program To Develop Brands and Build Customer LoyaltyanuradhaNoch keine Bewertungen

- Learning TheoryDokument13 SeitenLearning TheoryanuradhaNoch keine Bewertungen

- Flow of Information - StepsDokument23 SeitenFlow of Information - StepsanuradhaNoch keine Bewertungen

- Consumer Decision MakingDokument23 SeitenConsumer Decision MakinganuradhaNoch keine Bewertungen

- Objectives of Good Store DesignDokument19 SeitenObjectives of Good Store DesignanuradhaNoch keine Bewertungen

- 1BDokument24 Seiten1BanuradhaNoch keine Bewertungen

- Importance of Merchandize PlanningDokument22 SeitenImportance of Merchandize PlanninganuradhaNoch keine Bewertungen

- Objectives of Good Store DesignDokument19 SeitenObjectives of Good Store DesignanuradhaNoch keine Bewertungen

- Retail Strategy Is The Overall Plan or Framework of Action That Guides A Retailer Process of Strategic PlanningDokument15 SeitenRetail Strategy Is The Overall Plan or Framework of Action That Guides A Retailer Process of Strategic PlanninganuradhaNoch keine Bewertungen

- Financial Inclusion in INDIADokument6 SeitenFinancial Inclusion in INDIAanuradha100% (1)

- Objectives of Good Store DesignDokument19 SeitenObjectives of Good Store DesignanuradhaNoch keine Bewertungen

- Improved Return On InvestmentsDokument15 SeitenImproved Return On InvestmentsanuradhaNoch keine Bewertungen

- Retail ManagementDokument23 SeitenRetail ManagementanuradhaNoch keine Bewertungen

- The Retail Scenario in IndiaDokument5 SeitenThe Retail Scenario in IndiaanuradhaNoch keine Bewertungen

- Financial Inclusion in INDIADokument6 SeitenFinancial Inclusion in INDIAanuradha100% (1)

- World Trade CentreDokument4 SeitenWorld Trade CentreanuradhaNoch keine Bewertungen

- Intro of AccountingDokument13 SeitenIntro of AccountinganuradhaNoch keine Bewertungen

- Derivative MarketDokument71 SeitenDerivative Marketanuradha100% (1)

- Mutual FundDokument69 SeitenMutual Fundanuradha100% (3)

- Trade Barriers: Pgdib - IDokument16 SeitenTrade Barriers: Pgdib - IanuradhaNoch keine Bewertungen

- Statistics SlidesDokument59 SeitenStatistics SlidesanuradhaNoch keine Bewertungen

- CATIA V5-6R2015 Basics - Part I : Getting Started and Sketcher WorkbenchVon EverandCATIA V5-6R2015 Basics - Part I : Getting Started and Sketcher WorkbenchBewertung: 4 von 5 Sternen4/5 (10)

- SketchUp Success for Woodworkers: Four Simple Rules to Create 3D Drawings Quickly and AccuratelyVon EverandSketchUp Success for Woodworkers: Four Simple Rules to Create 3D Drawings Quickly and AccuratelyBewertung: 1.5 von 5 Sternen1.5/5 (2)

- Beginning AutoCAD® 2020 Exercise WorkbookVon EverandBeginning AutoCAD® 2020 Exercise WorkbookBewertung: 2.5 von 5 Sternen2.5/5 (3)

- Autodesk Inventor 2020: A Power Guide for Beginners and Intermediate UsersVon EverandAutodesk Inventor 2020: A Power Guide for Beginners and Intermediate UsersNoch keine Bewertungen

- Certified Solidworks Professional Advanced Weldments Exam PreparationVon EverandCertified Solidworks Professional Advanced Weldments Exam PreparationBewertung: 5 von 5 Sternen5/5 (1)

- Autodesk Fusion 360: A Power Guide for Beginners and Intermediate Users (3rd Edition)Von EverandAutodesk Fusion 360: A Power Guide for Beginners and Intermediate Users (3rd Edition)Bewertung: 5 von 5 Sternen5/5 (2)

- FreeCAD | Step by Step: Learn how to easily create 3D objects, assemblies, and technical drawingsVon EverandFreeCAD | Step by Step: Learn how to easily create 3D objects, assemblies, and technical drawingsBewertung: 5 von 5 Sternen5/5 (1)

- Beginning AutoCAD® 2022 Exercise Workbook: For Windows®Von EverandBeginning AutoCAD® 2022 Exercise Workbook: For Windows®Noch keine Bewertungen

- Up and Running with AutoCAD 2020: 2D Drafting and DesignVon EverandUp and Running with AutoCAD 2020: 2D Drafting and DesignNoch keine Bewertungen