Beruflich Dokumente

Kultur Dokumente

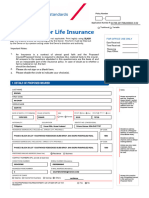

Personal Account Application Form

Hochgeladen von

JohnJacksonCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Personal Account Application Form

Hochgeladen von

JohnJacksonCopyright:

Verfügbare Formate

Personal Account Application Form

Sole Personal Current Account

PLEASE COMPLETE IN BLOCK CAPITALS

For Bank Use Only

NSC

A/c No.

Purpose of A/c (Mandatory: Box must show an understanding of purpose and likely operation of account.)

Current Account:

Source of Funds

Source of Wealth

SECTION A: YOUR PERSONAL DETAILS

Title Mr

Mrs

Ms

Miss

Other

First Name

Surname

Address

Date of Birth

Email

Tel (Home)

Tel (Mobile)

Tel (Work)

Afternoon

Best time to contact Morning

Evening

Employment Details

Employee

Employer

Self Employed

Homemaker

Student

Retired

Occupation

Net Monthly Pay

Employers Name

Annual Gross Income

Other

Residential Details

Home Owner

With Parents

Year moved to address

Tenant

Monthly Rent/Mortgage

Other

Previous Address

if tenant

Marital Status

Married

Single

Widowed

Divorced

Separated

Civil Partner

SECTION B: YOUR RELATIONSHIP WITH US

Existing Bank of Ireland Customer

Yes

If Existing Bank of Ireland Customer - N.S.C

No

Sole A/C number

Will your salary be mandated to this account?

Yes

No

Are you switching your bank account from another financial institution?

(If yes please complete Switching your personal bank accounts made easy brochure Ref 37-769RU)

Yes

No

For the purpose of the Foreign Account Tax Compliance Act (FATCA), we are required to establish whether you are a US citizen and/

or resident in the US for tax purposes.

Are you a US citizen?

Yes

No

Are you resident in the US for tax purposes? Yes

No

If yes was answered to either question:

US TIN

(not mandatory)

Current legislation requires us to verify the true name and address of all new customers. You will therefore be requested to submit

formal identification documents with this application e.g. current passport or driving licence and current utility bill. If you do not have

any of these forms of identification please contact us and we can discuss alternative documentation. Ask for our leaflet Your account

and the implications of legislation (37-831RU).

Page 1 of 6

4-791R.22(07/14)

SECTION C: YOUR PERSONAL CHOICES

ATM/Debit Card

Card Type

Customer Name

(to appear on Card)

(Max 22 characters)

Registration for 365

Use Bank of Ireland 365 online to make payments, check your account or view transactions. Whats more, by using 365 online you

can benefit from a whole range of other convenient features including our Mobile App.

Phone and Online Banking

A 365 PIN will be posted to your address provided above, on receipt of this PIN please contact Banking 365 on 0818 365 365 to

activate and avail of our service.

AUTHORISATION, CONSENTS AND APPLICATION FOR ACCOUNT(S)

NOTE: YOU SHOULD ONLY SIGN BELOW WHEN YOU HAVE READ THIS SECTION AND THE CONSENTS AT APPENDIX 1

CAREFULLY AND AGREE TO BE BOUND BY THESE TERMS

To: The Governor and Company of the Bank of Ireland (the Bank, which term includes and shall be construed to include Bank

branches, its subsidiaries, agents and third parties appointed by the Bank)

I, the undersigned, authorise you to open one or more accounts in the name of

I authorise you to accept and to honour all withdrawal forms and orders drawn on the account and to act on all instructions relating to

the account.

I have received and read the following documents and, in consideration of your providing me from time to time with any of the products

and/or services requested under this Mandate Application Form, agree to be bound by their terms:

the Terms and Conditions and Terms of Business that apply to the relevant account;

the Schedule of Fees and Charges for Personal Customers;

the details of debit interest outlined in the table of Personal Overdraft Interest Rates sheet at Appendix 2 of this Authorisation

and Application Form;

where applicable, the Terms and Conditions relating to ATM / Debit cards.

I confirm that I have read each authorisation required by the Bank as set out in Appendix 1 to this Authorisation and Application Form

(a copy of which I have been furnished with and will retain) to hold, use, disclose, copy and process information and I understand

that by signing this application form I am giving my consent for the use of information provided by us for the purposes of (1) the Data

Protection Acts, 1988 and 2003; and (2) the Criminal Justice (Money Laundering and Terrorist Financing) Act 2010 and/or the Taxes

Consolidation Act, 1997, as any such legislation may be amended, varied or substituted from time to time.

Optional Data Marketing Consent

I consent to the details that I am being asked to supply being used to provide me with information about other products and services,

either from the Bank of Ireland Group or which the Bank of Ireland Group has arranged for us with a third party. I understand that at

any time I can ask you to stop or change the methods by which the bank may send me marketing materials. This can be done free of

charge by writing to my branch of the Bank.

Please tick this box if you would not like to receive this information.

By signing below I further agree that this Authorisation will remain in full force and effect until an amending Authorisation shall be

communicated to the Bank.

Customer Signature:

DATE:

WITNESS:

Page 2 of 6

4-791R.22(07/14)

SECTION D: BANK USE ONLY

Yes

Is person to be identified an existing Bank of Ireland Group Customer?

IF YES:

Name of Branch/Group Entity

Method used to check (Servicelink, etc.)

EXISTING CUSTOMER AS AT 2/5/95 Yes

9 0

NSC

No

A/c No.

Date Opened

Has AML Documentation Screen been completed for above account?

EXISTING CUSTOMER AFTER 2/5/95 Yes

9 0

NSC

Yes

A/c No.

Date Opened

Is AML ID&V documentation held and in order and has AML Documentation Screen been fully completed? Yes

No

If Yes and full AML ID&V is in order and AML screen has been fully completed then with the persons consent, as detailed in

the application form, you can request the Branch/Group entity who has established his/her identity to update the AML

Documentation Screen OR provide copies of the ID&V documentation for your records.

If No i.e. full AML ID&V documentation is not in order OR AML Documentation Screen is not fully completed the ID&V

documentation for the customer must be perfected in line with procedures and/or the AML Documentation Screen must be

created/corrected.

Has AML Documentation Screen been created for new account being opened?

Yes

NOTE: Whether customer is existing pre or post 95 a new AML Documentation Screen must be created for the new deposit

account being opened. If we are relying on AML ID&V documents held for another account that account must be referenced

on the AML Documentation Screen.

IF NO:

Name and current permanent address of person named overleaf must be verified in line with procedures.

Has there been face to face contact with the person being identified?

Yes

No

Was the account requested on a non face to face basis?

Yes

No

Is the customer resident in a high/very high risk country?

Yes

No

Is it evident from purpose of account that the customer intends transacting with a high/very high risk country?

Yes

No

If NO, specify method of contact

(Two separate forms of Address Verification must be obtained)

Methods used for the two separate forms of address verification

Has AML Documentation Screen been completed for new account?

Visa Debit Card Type:

Contactless

Yes

Contact

BRANCH CHECKLIST

Purpose of Account

Source of Funds

Source of Wealth

*If Yes to any of the above questions, relationship should be of higher risk. All higher risk rated accounts must be referred to Network

Governance and Control for sign off prior to account opening.

Overall Risk Rating*

Standard

High

Signed (Staff Member)

Date

Staff Number

2 0

The Governor and Company of the Bank of Ireland, incorporated by charter in Ireland with limited liability. A tied agent of

New Ireland Assurance Company plc. trading as Bank of Ireland Life. Bank of Ireland is regulated by the Central Bank of Ireland.

Registered No. C-1. Head Office, 40 Mespil Road, Dublin 4, Ireland.

Page 3 of 6

4-791R.22(07/14)

APPENDIX 1: CUSTOMER CONSENTS. Please give to the Customer to retain

A: DATA PROTECTION CONSENTS

1. Where this application is an application for facilities, I confirm that I am not less than 18 years of age. 2. I certify the accuracy

of the information given above together with the continued accuracy of such information in the event of any future applications by

me (whether oral or written) for a facility, unless I expressly advise you to the contrary at the time of any such future application. 3. I

understand that you reserve the right to decline this or any future application without being required to state any reason and that no

correspondence will be entered into it in such circumstances. 4. By signing this form I consent to the Bank of Ireland Group and its

contracted agents storing, using and processing my personal details: (a) to manage and administer my accounts, policies or other

financial products; (b) to process my applications for credit or financial services and any requests for payment services made by me;

(c) to carry out business and market research and compile statistics; (d) to help detect and prevent fraud and dishonesty including

through the use of information technology; (e) to form a single view of my entire relationship with the Bank of Ireland Group (whether

as a consumer or in connection with my trade, business or profession) to enable it manage and develop the relationship; (f) to enable

business units in the Bank of Ireland Group share or access my personal details for the purposes set out in this consent (but not for

the purposes of direct marketing where I have indicated to the Bank of Ireland Group I do not want it); (g) to contact me by post,

telephone, text message, electronic mail, facsimile or other means but not in a way contrary to my instructions to the Bank of Ireland

Group or contrary to law or regulation; (h) (where I apply for or avail of a credit facility) to carry out credit reviews including automated

credit decision processes and to obtain details of my credit history from the Irish Credit Bureau (ICB) or other credit rating agency;

(i) (where I have not indicated otherwise to the Bank of Ireland Group) to directly market the products and services of the Bank of

Ireland Group or of suppliers selected by the Bank of Ireland Group using a form of communication permitted by me under paragraph

(g) above; and (j) to establish and/or report my identity, residence and tax details to the extent necessary order to comply with law

and regulation concerning taxation, return of payments and the prevention of money laundering or terrorist financing. I consent to the

Bank of Ireland Group disclosing my personal details: 1) (where I apply for or avail of a credit facility) to the ICB or other credit rating

agency and I also consent to the ICB or other credit rating agency disclosing details of my credit history (and using those details for

credit scoring purposes) to the Bank of Ireland Group or other institutions to which I apply for credit facilities; 2) to facilitate a potential

or actual transfer of any loan or product provided to me or in connection with a securitisation; 3) to its contracted agents and to

recipients abroad but only for purposes indicated in this consent and only where the Bank of Ireland Group complies with Irish data

protection law in doing so. This consent does not limit any other consent I have given (or may give) to the Bank of Ireland Group to

process or disclose my personal details. In this consent: Bank of Ireland Group means the Bank of Ireland and its present and future

subsidiaries. contracted agents means entities which have contracted with the Bank of Ireland Group to assist it in the conduct of its

business or in providing services to me. I, me, my is a reference to each of us where more than one of us have signed this form.

personal details means information concerning me which Bank of Ireland Group has including information given by me or others

verbally or in writing, information contained in application forms and records of my transactions with the Bank of Ireland Group. 5. In

the event of a facility being approved I authorise you to make the facility available and to put the appropriate repayment schedule into

effect. 6. I agree that the facility (and any other facilities as may be granted by you at your discretion) shall be subject to the terms and

conditions and specific provisions detailed in your Facility Letter or Credit Agreement, once issued. 7. I understand that in opening the

account(s) that I may be automatically registered for Bank of Ireland 365 services as outlined in the terms and conditions attached. 8.

In consideration of my application for an account, I agree to the Terms and Conditions and Schedule of Fees and Charges for

Personal Customers Brochure (where applicable).

B: IDENTIFICATION CONSENTS

I hereby agree that any information and/or original documents and/or any copy documents supplied by me or on my behalf to the

Bank are accurate so as to enable the Bank to comply with any and all of the obligations of the Bank under law and regulations

concerning the prevention of money laundering and terrorist financing and to comply with taxation requirements. Such information or

documentation may at any time be disclosed by the Bank to, transferred to, or copies thereof sent by the Bank to any Bank branch,

any other member of the Bank of Ireland Group, or any other designated body (as defined in The Criminal Justice (Money Laundering

and Terrorist Financing) Act 2010 as may be amended, varied or substituted from time to time (the 2010 Act)) which may at any

time provide or be requested to provide any services to me. I hereby further agree that any information and/or any original documents

and/or any copy documents that have been supplied by or for me to any Bank of Ireland Group member to enable such Bank of

Ireland Group member and/or Bank of Ireland Group to comply with any and all obligations under or pursuant to the 2010 Act and/

or Part 38, Chapter 3A of the Taxes Consolidation Act, 1997 as amended, varied or substituted from time to time (the 1997 Act)

may at any time, by such Bank of Ireland Group member, be disclosed to any other Bank of Ireland Group member, or be transferred

to, or copies thereof sent to any other Bank of Ireland Group member, so as to enable such other Bank of Ireland Group member to

comply with the 2010 Act and /or the 1997 Act, and for the benefit of any Bank of Ireland Group member to which I have supplied

any such information, documents and/or copy documents aforesaid, I hereby confirm that such Bank of Ireland Group member may

act on this authorisation and consent as if it was specifically addressed to such Bank of Ireland Group member .i hereby confirm that

each authorisation contained herein to hold, use, disclose, copy and process information constitutes a consent for the purpose of

the Data Protection Acts 1988 and 2003 and any amending or extending legislation or any related European Communities regulation

or directive. For the purposes of this consent the terms Bank of Ireland Group and Bank of Ireland Group member each mean

and shall be construed to mean any and all of the following: the Bank; ICS Building Society; any branch of the Bank or ICS Building

Society; the separate legal entities that constitute the Bank of Ireland Group; any respective successors, assigns and transferees of the

Bank, ICS Building Society or entities aforesaid.

Page 4 of 6

4-791R.22(07/14)

Please give this rate sheet to the customer to retain.

TABLE OF PERSONAL OVERDRAFT INTEREST RATES SHEET

CURRENT RATE TABLE

Standard Overdraft Rate

FLAT RATE

APR WITHOUT FACILITY FEE

APR WITH 30 FACILITY FEE

13.25%

13.9%

16.2%*

The current variable standard overdraft interest rate (including the overdraft facility fee) is 16.2% APR. The Annual

Percentage rate quoted above is correct as at 25 August 2011 and is subject to change. The rate quoted is based on a

representative example of 1,500 over a 12 month period. Total cost of credit is 208.85.

Graduate Overdraft Rate

9.40%

9.7%

N/A

The current variable overdraft interest rate for Graduate Current Account is 9.7% APR. The Annual Percentage Rate

quoted above is correct as at 24 February 2010 and is subject to change. The rate quoted is based on a representative

example of 1,500 over a 12 month period. Total cost of credit is 146.05.

PENDING RATES

FLAT RATE

APR WITHOUT FACILITY FEE

APR WITH FACILITY FEE

Standard Overdraft Rate

None

None

None

Graduate Overdraft Rate

None

None

None

PENDING RATES EFFECTIVE ON

2 0

Notification to Bank of Ireland Personal Current Account

Customers Personal ATM/Debit Cards

Important Notice

This is an important notice and should be read.

Change to Visa Debit Card Terms and Conditions - Clause 2.6 as of 1st September 2014.

Current Version Clause 2.6

When you receive your Visa Debit Card you, you must activate it at one of our ATMs. The activation of your card is acceptance

of these Card terms and conditions.

Amended Version - Clause 2.6

When you receive your Visa Debit Card you, you must activate it at one of our ATMs. If activation does not take place within 60

days of the issue of the Card, in the interest of card security, the card will be cancelled an a new card will have to be applied for.

The activation of your card is acceptance of these Card terms and conditions.

If you do not accept the above change to the Terms and Conditions of your Card, you may end your Card contract with us.

To do this you must first pay us Government Duty (if any) that you owe concerning your Card. If you do not ask us to end your

Card contract, you will be deemed to have accepted the change on this effective date: 1st September 2014.

New terms and conditions are available at www.bankofireland.com from the 1st September 2014.

Bank of Ireland is regulated by the Central Bank of Ireland.

Page 5 of 6

4-791R.22(07/14)

Payroll Letter

PLEASE COMPLETE IN BLOCK CAPITALS

To: The Accounts/Payroll Department

Company name:

(your home address)

Company Address:

Date:

Request to credit my salary to my new bank account

My staff/employee number:

Dear Sir/Madam,

Please note from (date) D

Bank:

Y I wish to have my salary paid directly into the account detailed below:

Branch name:

Name of account:

BIC: (Bank Identifier Code)

IBAN (International Bank Account No.)

Branch NSC:

Account number:

Thank you for your help.

Yours faithfully

(your signature)

(your name printed)

Page 6 of 6

4-791R.22(07/14)

Das könnte Ihnen auch gefallen

- RA 9048 Change of NameDokument2 SeitenRA 9048 Change of Nameeva100% (1)

- Very Cheap Car InsuranceDokument1 SeiteVery Cheap Car Insurancepapi7000Noch keine Bewertungen

- Return Instructions: Upload/Secure MessageDokument9 SeitenReturn Instructions: Upload/Secure MessageRemyNoch keine Bewertungen

- Dispute Resolution FormDokument3 SeitenDispute Resolution Formmerlin masterchiefNoch keine Bewertungen

- USPS Change of AddressDokument20 SeitenUSPS Change of AddressmegcorNoch keine Bewertungen

- Unit Trust Account Opening Form 13.12.2019 1Dokument4 SeitenUnit Trust Account Opening Form 13.12.2019 1henrykibe01Noch keine Bewertungen

- Credit Default SwapsDokument4 SeitenCredit Default SwapsAbhijeit BhosaleNoch keine Bewertungen

- VW Audi Credit AppDokument1 SeiteVW Audi Credit AppSaaNoch keine Bewertungen

- Montenegro Investment OpportunitiesDokument41 SeitenMontenegro Investment Opportunitiesassassin011Noch keine Bewertungen

- Canceled Debts, Foreclosures, Repossessions, and AbandonmentsDokument17 SeitenCanceled Debts, Foreclosures, Repossessions, and AbandonmentsPeter MouldenNoch keine Bewertungen

- Jury Duty Excuse Letter Template for Breastfeeding MothersDokument1 SeiteJury Duty Excuse Letter Template for Breastfeeding Motherssarge18Noch keine Bewertungen

- Break The Slavery of Debt Forever12Dokument25 SeitenBreak The Slavery of Debt Forever12Jennifer DicangNoch keine Bewertungen

- Depositories Act 1996Dokument25 SeitenDepositories Act 1996siddharthdileepkamatNoch keine Bewertungen

- Sterling Trust Corporation LTD - BrochureDokument11 SeitenSterling Trust Corporation LTD - BrochurehyenadogNoch keine Bewertungen

- Mailbox Rental Instructions - For Package Forwarding ServiceDokument5 SeitenMailbox Rental Instructions - For Package Forwarding Servicesafe wayNoch keine Bewertungen

- Advantages of Trade CreditDokument22 SeitenAdvantages of Trade CredityadavgunwalNoch keine Bewertungen

- Chapter 16 - Credit NotesDokument3 SeitenChapter 16 - Credit NotesEthan WongNoch keine Bewertungen

- E ApplicationDokument17 SeitenE Applicationisaiahdesmondbrown1Noch keine Bewertungen

- Hilton Credit Card Authorization Form TemplateDokument1 SeiteHilton Credit Card Authorization Form TemplateSam BojanglesNoch keine Bewertungen

- Determine Employee or Self-Employed StatusDokument11 SeitenDetermine Employee or Self-Employed StatusDavid DobbelsteynNoch keine Bewertungen

- Dispute Resolution Form - FRAUD TransactionDokument2 SeitenDispute Resolution Form - FRAUD TransactionJosé Eduardo Tijerina cuestaNoch keine Bewertungen

- New Personal FormDokument2 SeitenNew Personal Formcacious mwewaNoch keine Bewertungen

- Request IRS Tax Return Transcript OnlineDokument2 SeitenRequest IRS Tax Return Transcript OnlineBilboDBagginsNoch keine Bewertungen

- DEFINITION BIBLE by SkymoneyDokument22 SeitenDEFINITION BIBLE by Skymoneyemmastybrown1Noch keine Bewertungen

- Acting ChairpersonDokument33 SeitenActing ChairpersonNovie AmorNoch keine Bewertungen

- Off Shore CompaniesDokument9 SeitenOff Shore Companieskainat safdarNoch keine Bewertungen

- En 05 10064Dokument8 SeitenEn 05 10064api-309082881Noch keine Bewertungen

- Id Crises 9Dokument2 SeitenId Crises 9Flaviub23Noch keine Bewertungen

- Order 0801 Cogniz Law of CaseDokument2 SeitenOrder 0801 Cogniz Law of CasebblurkinNoch keine Bewertungen

- Technology Embarked The Issuance of New ICAO E-Passport: Case Study of Malaysia E-PassportDokument5 SeitenTechnology Embarked The Issuance of New ICAO E-Passport: Case Study of Malaysia E-Passportcallmeayu100% (2)

- US Internal Revenue Service: p1245Dokument35 SeitenUS Internal Revenue Service: p1245IRSNoch keine Bewertungen

- Talent6 5419 Hollywood Blvd. Suite C727 Hollywood, CA 90027Dokument9 SeitenTalent6 5419 Hollywood Blvd. Suite C727 Hollywood, CA 90027bambini84Noch keine Bewertungen

- TCF Equipment Finance Credit AppDokument1 SeiteTCF Equipment Finance Credit Appjasonparker80Noch keine Bewertungen

- Application Business Loan SHORT FORM PDFDokument2 SeitenApplication Business Loan SHORT FORM PDFGeorgiMoskeyMarinoNoch keine Bewertungen

- UNDERSTANDING MAIL FRAUD AND WIRE FRAUD: A Nonattorney's GuideVon EverandUNDERSTANDING MAIL FRAUD AND WIRE FRAUD: A Nonattorney's GuideNoch keine Bewertungen

- An Analysis of A Police Force Unfit For PurposeDokument59 SeitenAn Analysis of A Police Force Unfit For PurposePolitical WorldNoch keine Bewertungen

- Applicant Guidance NotesDokument29 SeitenApplicant Guidance NotesJervan KhouNoch keine Bewertungen

- Social Security Form OnlineDokument5 SeitenSocial Security Form OnlineDiego PinedoNoch keine Bewertungen

- Cara Magazine September 2013Dokument140 SeitenCara Magazine September 2013Cara Magazine100% (2)

- Coinmint vs. Ashton Soniat Fraud CaseDokument8 SeitenCoinmint vs. Ashton Soniat Fraud CaseDon HewlettNoch keine Bewertungen

- Treasury New-Agent-Welcome-BookletDokument10 SeitenTreasury New-Agent-Welcome-BookletOrlando David MachadoNoch keine Bewertungen

- Cashline Form - LatestDokument3 SeitenCashline Form - LatestAnonymous GxsqKv85GNoch keine Bewertungen

- Blocked Account Contract DetailsDokument13 SeitenBlocked Account Contract Detailsshahzeel khanNoch keine Bewertungen

- Police Verification VN PDFDokument2 SeitenPolice Verification VN PDFVivek50% (2)

- Jt08 Identity and Address Verification Guidelines For Individual PolicyholdersDokument2 SeitenJt08 Identity and Address Verification Guidelines For Individual Policyholderspedro araujoNoch keine Bewertungen

- Certification of AddressDokument1 SeiteCertification of AddressMadison SnyderNoch keine Bewertungen

- Paypal User AgreementDokument34 SeitenPaypal User Agreementspark4uNoch keine Bewertungen

- 5801 15 Rental LeaseDokument1 Seite5801 15 Rental LeaseEfra SageNoch keine Bewertungen

- Insight Global Informs Individuals of Data IncidentDokument3 SeitenInsight Global Informs Individuals of Data IncidentKristina KoppeserNoch keine Bewertungen

- DD Form 214 PDFDokument1 SeiteDD Form 214 PDFJ MillerNoch keine Bewertungen

- SCB Application Form Standing InstructionDokument2 SeitenSCB Application Form Standing InstructionNindy Ratri KNoch keine Bewertungen

- Company Credit Account ApprobationDokument1 SeiteCompany Credit Account ApprobationkiranrauniyarNoch keine Bewertungen

- What Is 'Forensic Accounting': TypesDokument5 SeitenWhat Is 'Forensic Accounting': TypesBhaven SinghNoch keine Bewertungen

- What Is Eon Bank Group Mol-Mymode Freedom Mastercard Unembossed Card?Dokument8 SeitenWhat Is Eon Bank Group Mol-Mymode Freedom Mastercard Unembossed Card?wan norizanNoch keine Bewertungen

- En US Funds Redemption FxddmaltaDokument1 SeiteEn US Funds Redemption Fxddmaltaariefato_341200971Noch keine Bewertungen

- InstructionsDokument2 SeitenInstructionsemmanuelhood642Noch keine Bewertungen

- Public Records Request 14871 PDFDokument29 SeitenPublic Records Request 14871 PDFRecordTrac - City of OaklandNoch keine Bewertungen

- Epayment Form - NewDokument3 SeitenEpayment Form - NewVirender SainiNoch keine Bewertungen

- Identity Theft in PennsylvaniaDokument2 SeitenIdentity Theft in PennsylvaniaJesse WhiteNoch keine Bewertungen

- Letter of Return RedactDokument3 SeitenLetter of Return RedactTauheedah S. Najee-Ullah El100% (1)

- Notes On Negotiable Instrument Act 1881Dokument6 SeitenNotes On Negotiable Instrument Act 1881Pranjal SrivastavaNoch keine Bewertungen

- Court Grants Habeas Corpus for Man Detained Due to Mistaken IdentityDokument554 SeitenCourt Grants Habeas Corpus for Man Detained Due to Mistaken IdentityGillian Elliot AlbayNoch keine Bewertungen

- Irish Public Spending CodeDokument184 SeitenIrish Public Spending CodeSeabanNoch keine Bewertungen

- Socialist Fight No 10Dokument32 SeitenSocialist Fight No 10Gerald J DowningNoch keine Bewertungen

- From Shouting To Counting: A New Frontier in Social DevelopmentDokument20 SeitenFrom Shouting To Counting: A New Frontier in Social DevelopmentAccountability Initiative IndiaNoch keine Bewertungen

- Cleaner Greener Production Programme (cgpp4&5) Business Case Studies 2008-2012Dokument36 SeitenCleaner Greener Production Programme (cgpp4&5) Business Case Studies 2008-2012api-286562658Noch keine Bewertungen

- Update Pestle Discussion 2022Dokument8 SeitenUpdate Pestle Discussion 2022lornaNoch keine Bewertungen

- Department of Finance FOI Log 2007 To 2010Dokument91 SeitenDepartment of Finance FOI Log 2007 To 2010thestorydotieNoch keine Bewertungen

- Active Retirement Ireland: Welcome To The New ARI NewsDokument8 SeitenActive Retirement Ireland: Welcome To The New ARI NewsWorldReachPR100% (2)

- Taoiseach Appointments Diary 2004Dokument147 SeitenTaoiseach Appointments Diary 2004thestorydotieNoch keine Bewertungen

- The Pursuit of Sovereignty and The Impact of Partition, 1912-1949 Past Exam QuestionsDokument5 SeitenThe Pursuit of Sovereignty and The Impact of Partition, 1912-1949 Past Exam QuestionsJo Meredith BurkeNoch keine Bewertungen

- Heritage Tourism and The Commodification of Contested Spaces: Ireland and The Battle of The Boyne SiteDokument20 SeitenHeritage Tourism and The Commodification of Contested Spaces: Ireland and The Battle of The Boyne SiteJosiane AlvesNoch keine Bewertungen

- Apuntes Literatura IrlandesaDokument16 SeitenApuntes Literatura IrlandesaLaura Gabardino SánchezNoch keine Bewertungen

- A Mother-NoteDokument22 SeitenA Mother-NoteAfra OysheeNoch keine Bewertungen

- Education Diary 2006Dokument138 SeitenEducation Diary 2006thestorydotieNoch keine Bewertungen

- Ecological Self and Nativism in Seamus Heaney's "Digging"Dokument4 SeitenEcological Self and Nativism in Seamus Heaney's "Digging"RISHIKA SINHANoch keine Bewertungen

- Enda Kenny Withdraws Claims That Bank Guarantee Documents Were ShreddedSeanie FitzDokument373 SeitenEnda Kenny Withdraws Claims That Bank Guarantee Documents Were ShreddedSeanie FitzRita CahillNoch keine Bewertungen

- Cork Chamber - Chamberlink (Nov 2013)Dokument24 SeitenCork Chamber - Chamberlink (Nov 2013)Imelda V. MulcahyNoch keine Bewertungen

- Stopping Election Fraud: Ireland's Example 6-9th June 2009Dokument263 SeitenStopping Election Fraud: Ireland's Example 6-9th June 2009James DwyerNoch keine Bewertungen

- IrelandDokument86 SeitenIrelandVivek GairaNoch keine Bewertungen

- CheeseDokument7 SeitenCheeselisa bonzomNoch keine Bewertungen

- DBS International Fees IrelandDokument2 SeitenDBS International Fees IrelandAryan KapoorNoch keine Bewertungen

- Research Evidence and Policy MakingDokument20 SeitenResearch Evidence and Policy Makingcmwangi2174Noch keine Bewertungen

- Rearranging Ireland's Public Dance Halls Act of 1935Dokument12 SeitenRearranging Ireland's Public Dance Halls Act of 1935Elaine ClaytonNoch keine Bewertungen

- Referendum 2011 - Oireachtas InquiriesDokument2 SeitenReferendum 2011 - Oireachtas InquiriesRita CahillNoch keine Bewertungen

- Fianna Fáil Ard Fheis Clar 2012Dokument108 SeitenFianna Fáil Ard Fheis Clar 2012Politics.ieNoch keine Bewertungen

- Access of Family Members of Blue Card Holders To Employment in EUDokument10 SeitenAccess of Family Members of Blue Card Holders To Employment in EUKledi SinaNoch keine Bewertungen

- 1 s2.0 S0264837714001331 MainDokument10 Seiten1 s2.0 S0264837714001331 Mainmariajose garciaNoch keine Bewertungen

- Natural Bodybuilding Federation of Ireland MembershipDokument1 SeiteNatural Bodybuilding Federation of Ireland MembershippatsyaherneNoch keine Bewertungen