Beruflich Dokumente

Kultur Dokumente

Tax Update - Charitable Extender's Bill Passes - Gevers Wealth Management LLC December 2014

Hochgeladen von

Gevers Wealth Management, LLCCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tax Update - Charitable Extender's Bill Passes - Gevers Wealth Management LLC December 2014

Hochgeladen von

Gevers Wealth Management, LLCCopyright:

Verfügbare Formate

Tax Update Charitable Extenders Bill Passes Tax-Free Gifts

from IRA accounts for 70+ IRA Owners

December 2014

Congress has been promising action on a number of tax provisions that expired at the end of 2013.

After much delay, on December 16th, the Senate passed HR 5771 which included a one year extension

of expired tax provisions retroactive to January 1, 2014. This reauthorizes the IRA charitable rollover

through December 31, 2014. Donors age 70 1/2 and older may transfer up to $100,000 from their

IRA to a qualified public charity. The transfer will be made free of federal income tax and the gift

qualifies for the donor's 2014 required minimum distribution (RMD).

IRA owners that are over age 70 and want to make a gift from their IRA accounts have a few days left

to take advantage of this provision. The bill that the Senate passed expires (again) on December 31st,

2014, and it is not clear what will happen in 2015.

Charitable gifts made directly from an IRA account may be used to satisfy Required Minimum

Distribution (RMD) requirements, can be an income tax planning tool, might reduce AGI, and are an

efficient way to make charitable gifts. Many of our clients have used this provision in the past to

generously support churches, community groups and other charities that are doing charitable work that

is important to them. You may want to consult with your CPA or a qualified advisor to see if this

might make sense in your personal situation.

To editorialize for a moment it is extremely frustrating that Congress waited until this late in the year

to pass this bill. Many families have been waiting and delaying decisions on their RMDs for 2014 in

hopes that this bill might pass. I give our legislators a C- grade for their lack of timeliness and for

creating what will certainly be a last minute stampede to take advantage of the charitable provision.

2All complaining aside we will do all we can to help our clients implement any charitable gifts they

might want to make from their IRA accounts before the year-end deadline. If we have not already

discussed this, and you are over 70, we would be happy to review this strategy with you.

And, undoubtedly, many charities are delighted that this provision has passed as it may lead to a surge

in last-minute giving. There are many great groups doing outstanding and vital work to make our

Tax Update Charitable Extenders Bill Passes

December 2014

Gevers Wealth Management, LLC

Page 2

communities better, and it is gratifying to see money go to many of these deserving causes. As

financial advisors, we feel privileged to play a small part in helping facilitate these important gifts.

(Pasted below is an informational flyer from World Vision with some more details on the charitable

extender provision.)

Merry Christmas to you and your families!

Warm regards,

William R. Gevers

Financial Advisor

PS: We have been repeatedly asked by clients if they could share these e-mail notes with their friends

or neighbors. Please feel free to forward this with the stipulation that it may only be forwarded if done

so in its entirety with no portions omitted. We would be delighted to share our comments and opinions

with your friends, and welcome your comments and feedback. If you received this and would like to be

included on our newsletter list, please email us at info@geverswealth.com

Copyright 2014 William R. Gevers. All rights reserved.

Gevers Wealth Management, LLC

5825 221st Place SE

Suite 102

Issaquah, WA98027

Office: 425.902.4840

Fax: 425.902.4841

Email: wgevers@geverswealth.com

The views are those of Gevers Wealth Management, LLC, and should not be construed as individual investment advice. All information is believed to be from reliable

sources; however, no representation is made as to its completeness or accuracy. All economic and performance information is historical and not indicative of future results.

Investors cannot invest directly in an index. Please consult your financial advisor for more information. Securities and advisory services offered through Cetera Advisor

Networks LLC Member FINRA/SIPC. Cetera is under separate ownership from an any other named entity.

planned giving

Give a gift

from your IRA

Oppo

r t uni

ty

exp

D ece ire s

mber

31

tax free

The IRA Rollover Provision allowing you to make tax-free charitable

gifts from your IRA has been extended for 2014. Right now, outright gifts

from your IRA totaling up to $100,000 per year may be given tax free to

qualified charities such as World Vision. But this opportunity expires on

December 31, 2014, so youll want to take action today!

Some important conditions

for a charitable IRA rollover:

Give up to $100,000 tax free

And do not forget to do

good and to share with

others, for with such

sacrifices God is pleased.

Hebrews 13:16 (NIV)

Qualifies as your minimum required distribution

May only be made from traditional IRAs and Roth IRAs

Donor must be age 70 or older

Must be an outright gift made directly to the qualified public charity

Gifts must be completed by December 31, 2014

If you receive any benefit from the gift, it does not qualify

This presents a significant opportunity if you:

Hold assets in your IRAs that you do not need, and you wish to

make a large lifetime gift

Wish to give more than the deductibility ceiling (50% of AGI)

Are subject to the 2% rule that reduces your itemized deductions

Do not itemize

Plan to leave part or all of your IRA to World Vision at death

To take advantage of this opportunity

call 1.800.426.5753 or email plannedgiving@worldvision.org

Planned Giving

P.O. Box 9716

Federal Way, WA 98063-9716

1.800.426.5753

plannedgiving@worldvision.org

worldvision.org/mylegacy

GP147539_1214 2014 World Vision, Inc.

This summary was prepared for educational purposes and is not intended as

professional legal or tax advice. Consult your own legal or tax professional(s)

regarding your particular situation.

Das könnte Ihnen auch gefallen

- Happy Labor Day 2016 - FirstsevenjobsDokument1 SeiteHappy Labor Day 2016 - FirstsevenjobsGevers Wealth Management, LLCNoch keine Bewertungen

- Dow 18,000 - What Should I Do About Risk?! - Gevers Wealth Management LLC - May 2015Dokument15 SeitenDow 18,000 - What Should I Do About Risk?! - Gevers Wealth Management LLC - May 2015Gevers Wealth Management, LLCNoch keine Bewertungen

- Will Angels Save The USA? - Going For Gold in Omaha. A Note From Willy/Gevers Wealth Management, LLC July 2012 CaDokument9 SeitenWill Angels Save The USA? - Going For Gold in Omaha. A Note From Willy/Gevers Wealth Management, LLC July 2012 CaGevers Wealth Management, LLC100% (1)

- Four Good and Four Bad - Presidents PIIGS and Printing Presses November 2011 CADokument14 SeitenFour Good and Four Bad - Presidents PIIGS and Printing Presses November 2011 CAGevers Wealth Management, LLCNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Libri SekretiDokument2 SeitenLibri SekretiRediNoch keine Bewertungen

- Integrated Tax Management System in KenyaDokument15 SeitenIntegrated Tax Management System in KenyaGeorge OtienoNoch keine Bewertungen

- 0619-E Jan 2018 Rev Final PDFDokument1 Seite0619-E Jan 2018 Rev Final PDFMebelyn NavarraNoch keine Bewertungen

- The Law On Persons and Family Relations RABUYA1Dokument2 SeitenThe Law On Persons and Family Relations RABUYA1Daniel Besina Jr.Noch keine Bewertungen

- p7-10 HelpDokument8 Seitenp7-10 HelpAJ SuttonNoch keine Bewertungen

- WS Retail Services Pvt. LTD.,: Grand TotalDokument1 SeiteWS Retail Services Pvt. LTD.,: Grand TotalAbhinav MehraNoch keine Bewertungen

- Commercial Invoice: Exporter/Shipper Importer/ConsigneeDokument1 SeiteCommercial Invoice: Exporter/Shipper Importer/ConsigneePrem ChanderNoch keine Bewertungen

- Coca Cola vs. CIRDokument1 SeiteCoca Cola vs. CIRmenlyn100% (4)

- Shareholder Value MaximizationDokument41 SeitenShareholder Value MaximizationPrashant Karpe100% (1)

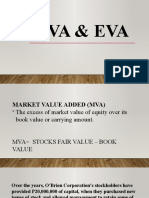

- Mva EvaDokument11 SeitenMva EvaRian ChiseiNoch keine Bewertungen

- DigestDokument2 SeitenDigestNivra Lyn EmpialesNoch keine Bewertungen

- 29AMBPG7773M000 The Odisha State Co-Operative Marketing Federation LimitedDokument1 Seite29AMBPG7773M000 The Odisha State Co-Operative Marketing Federation LimitedPRASHANT KUMAR SAHOONoch keine Bewertungen

- United States Court of Appeals, Second Circuit.: Docket Nos. 94-1161, 94-1192Dokument16 SeitenUnited States Court of Appeals, Second Circuit.: Docket Nos. 94-1161, 94-1192Scribd Government DocsNoch keine Bewertungen

- Section 29Dokument2 SeitenSection 29milleranNoch keine Bewertungen

- Unit 2: Master Budget: An Overall Plan The Fundamentals of BudgetingDokument11 SeitenUnit 2: Master Budget: An Overall Plan The Fundamentals of BudgetingbojaNoch keine Bewertungen

- BAC 4644 Assignment Sem 47Dokument5 SeitenBAC 4644 Assignment Sem 47Nur AmiraNoch keine Bewertungen

- Peligrino (Temp)Dokument6 SeitenPeligrino (Temp)JanJan Claros100% (1)

- New Microsoft PowerPoint Presentation TAXDokument10 SeitenNew Microsoft PowerPoint Presentation TAXramesh BNoch keine Bewertungen

- Corporate Partnership Estate and Gift Taxation 2013 7th Edition Pratt Test BankDokument26 SeitenCorporate Partnership Estate and Gift Taxation 2013 7th Edition Pratt Test Bankdanielwilkinsonkzemqgtxda100% (33)

- RIO HONDO DUPA FORM Revised 3Dokument110 SeitenRIO HONDO DUPA FORM Revised 3Bert EngNoch keine Bewertungen

- Test 1 C3Dokument8 SeitenTest 1 C3SaviusNoch keine Bewertungen

- 2014 Annual Report CytecDokument115 Seiten2014 Annual Report Cytecهیمن مNoch keine Bewertungen

- Ocde/gd (92) 81Dokument12 SeitenOcde/gd (92) 81Andhika Putra Sudarman 吴军Noch keine Bewertungen

- 5332740317Dokument301 Seiten5332740317sharkl123Noch keine Bewertungen

- Nitafan vs. Commissioner of Internal RevenueDokument1 SeiteNitafan vs. Commissioner of Internal RevenueRheinhart PahilaNoch keine Bewertungen

- Computation of Income of A FirmDokument6 SeitenComputation of Income of A FirmKhushbu GuptaNoch keine Bewertungen

- CCH Federal Taxation Comprehensive Topics 2014 1st Edition Harmelink Test Bank 1Dokument21 SeitenCCH Federal Taxation Comprehensive Topics 2014 1st Edition Harmelink Test Bank 1laurie100% (36)

- Baba2 Fin MidtermDokument8 SeitenBaba2 Fin MidtermYu BabylanNoch keine Bewertungen

- FM - Capital StructureDokument9 SeitenFM - Capital StructureTea Cher CelineNoch keine Bewertungen