Beruflich Dokumente

Kultur Dokumente

Sabric Card Fraud Booklet 2014

Hochgeladen von

eNCA.comCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Sabric Card Fraud Booklet 2014

Hochgeladen von

eNCA.comCopyright:

Verfügbare Formate

TABLE OF CONTENTS

Sabric Card Fraud Booklet 2014

Summary ...................................................................................................................................

Qualification of Information ...............................................................................................

National Overview of Card Fraud (2006-2014) .............................................................

Credit Card Fraud

...................................................................................................................

Where Does the Fraudulent Expenditure Occur? .......................................................................

Credit Card Fraud Loss in South Africa ......................................................................................

Geographical Distribution .........................................................................................................

5

7

9

10

Debit Card Fraud ...................................................................................................................

11

12

13

How Does RSA Compare Internationally?

.................................................................

14

Card Not Present Card (CNP) Fraud ...........................................................................................

What is Card Not Present Card (CNP) Fraud? ..............................................................................

Counterfeit Credit Card Fraud ...................................................................................................

What is Counterfeit Credit Card Fraud? ......................................................................................

Card Skimming ........................................................................................................................

What is Card Skimming ............................................................................................................

Card Skimming with Handheld Devices ...................................................................................

What does a Handheld Skimming Device Look Like? .................................................................

Card Skimming with ATM Mounted Devices ..............................................................................

What does an ATM Mounted Skimming Device look like? .........................................................

Lost and/or Stolen Card Fraud ...................................................................................................

What is Lost and/or Stolen Card Fraud? ......................................................................................

False Application Card Fraud ......................................................................................................

What is False Application Card Fraud? ........................................................................................

Account Takeover Card Fraud ....................................................................................................

What is Account Takeover Card Fraud? .......................................................................................

Not Received Issued (NRI) Card Fraud ........................................................................................

What is Not Received Issued (NRI) Card Fraud? ..........................................................................

15

16

17

18

19

19

19

21

22

23

24

25

26

27

27

28

28

29

Where Does the Fraudulent Expenditure Occur? ......................................................................

Geographical Distribution ........................................................................................................

Fraud Types

Important Tips to Avoid Becoming a Victim of Card Fraud

.................................

30

.................................................................

32

Protection of Client Data ..........................................................................................................

Improvement of Internal Systems and Processes ......................................................................

Sharing of Information and Combating of Card Crime ...............................................................

....................................................................................................................

Crime Awareness

32

32

32

32

Industry Measures to Prevent Card Fraud

SABRIC CARD FRAUD BOOKLET 2014

SUMMARY

The banking industrys gross fraud losses due to South African (SA) issued credit card fraud increased

by 23%, from R366.8m in 2013 to R453.9m in 2014.

A drastic increase (1143%, from R6.2m to R78.3m) in False Application fraud is a major contributor to

the overall increase in credit card fraud during 2014.

Card Not Present (CNP) card fraud contributed 42% of the total credit card gross fraud losses in 2014

and the losses increased by 7% from R178.7m in 2013 to R191.7m in 2014.

64% of all CNP credit card losses occurred outside of South Africa.

Counterfeit credit card fraud losses decreased by 14% in 2014 and contributed to 27% of the overall

credit card gross fraud loss.

60% of all Counterfeit credit card losses occurred outside of South Africa.

Whilst Lost and/or Stolen credit card fraud increased by 64% from R31.7m in 2013 to R52.2m in 2014,

the fraud losses account for 11% of the total gross fraud losses on credit cards.

Gauteng, the Western Cape and KwaZulu-Natal accounted for 88% of the credit card fraud losses in

South Africa.

Debit card gross fraud losses amounted to R123.5m in 2014 compared to the R117.7m in 2013,

recording a 5% increase.

The majority of debit card fraud losses relate to Counterfeit fraud (65%), followed by Lost and/or

Stolen fraud losses (33%).

The majority of the fraudulent debit card transactions for 2014 occurred in Gauteng (40%) followed by

KwaZulu-Natal (15%), Eastern and Western Cape, (both 9%)

PAGE 3 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

QUALIFICATION OF INFORMATION

Credit and debit card fraud information utilised in this report was provided by Barclays Africa Group, First

National Bank, Standard Bank of South Africa, Nedbank, Investec, Virgin, Amex, Diners Club, Capitec Bank,

Mercantile Bank, Bidvest, UBank, Bank of Athens, Albaraka Bank, Postbank and African Bank.

Credit card fraud figures include cheque card fraud.

Statistics used in the report are from 01 January to September 2014. For the comparative analysis the

abovementioned period will be compared to similar periods since 2006, with a focus on 2013 to 2014.

Information set used: All credit and debit card fraud losses as reported to SABRIC by 20 October 2014. All

calculations are based on the date of the fraudulent transaction.

All fraud losses mentioned in this booklet refer to gross fraud losses and do not relate to the actual losses

suffered by the banking industry. Figures pertaining to losses due to fraud have been rounded off to the

nearest R1 million, unless otherwise stated. Due to rounding off, the sum of the separate items may differ

from the totals shown.

PAGE 4 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

NATIONAL OVERVIEW OF CARD FRAUD (2006-2014)

CREDIT CARD FRAUD

The gross fraud losses due to fraud perpetrated with SA issued credit cards increased by 23%, from

R366.8m in 2013 to R453.9m in 2014. The graph below depicts the industrys total fraud losses on SA issued

credit cards, irrespective of the geographical location of the fraudulent transaction.

Card fraud losses on SA issued credit cards (all countries) (Jan - Sept 2006 to 2014)

2014

R453.9

2013

R366.8

2012

R300.6

2011

R367.4

2010

R186.9

2009

R291.7

2008

R367.9

2007

R278.4

2006

R0

R178.3

R100

R200

R300

R400

R500

MILLIONS

PAGE 5 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

Percentage distribution per fraud type on SA issued credit cards during 2014

Lost and/or

Stolen

NRI

11.4%

1.3%

CNP

42.4%

False

Application

17.4%

Counterfeit

27.4%

Account

Takeover

0.1%

SA issued credit card fraud per fraud type, all countries

FRAUD TYPE

2006

2007

2008

2009

2010

2011

2012

2013

2014

Lost and/or

Stolen

R66.2m

R117.5m

R117.5m

R65.7m

R25.8m

R18.3m

R15.6m

R31.7m

R52.2m

NRI (Not

Received Issued)

R4.2m

R5.1m

R10.4m

R8.8m

R1.7m

R1.3m

<R1m

<R1m

R3.8m

False Application

Fraud

R29.8m

R18.2m

R11.1m

R5.4m

R1.8m

R4m

R13.3m

R6.2m

R78.3m

Counterfeit

R53.5m

R94.7m

R157.1m

R145.7m

R92.7m

R207.7m

R113.9m

R144.5m

R123.1m

Account

Takeover

<R1m

<R1m

R1.6m

<R1m

<R1m

<R1m

R1m

R2.2m

<R1m

CNP (Card Not

Present)

R22.3m

R40.7m

R65.8m

R63.1m

R64.2m

R133.4m

R154.7m

R178.7m

R191.7m

All figures in R millions

PAGE 6 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

WHERE DOES THE FRAUDULENT EXPENDITURE OCCUR?

Card fraud losses on SA issued credit cards (Jan - Sept 2006 to 2014)

Transactions not in SA

Transactions in SA

2014

R222.9

R231.0

2013

R220.7

R145.9

2012

R135.8

R164.8

R123.5

2011

R243.9

2010

R72.8

R114.0

2009

R78.2

R213.4

2008

R95.5

R272.4

2007

R65.0

R213.4

2006

R48.1

R130.1

R0

R50

R100

R150

R200

R250

R300

MILLIONS

PAGE 7 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

For the year 2014, 49% of all credit card fraud losses occurred outside the borders of South Africa as

compared to 60% in 2013. Credit card fraud losses on SA issued credit cards used inside South Africa,

increased by 58% in 2014 (from R145.9m in 2013 to R231.0m in 2014).

A seven percent increase occurred on CNP credit card fraud losses. CNP fraud remains the biggest

contributor of fraudulent expenditure on SA issued credit cards (42%) for 2014. Of all CNP credit card fraud

losses, 64% occured outside South Africa.

Counterfeit credit card fraud losses outside South Africa decreased by 16% (R89.3m to R74.6m). Whilst 40%

of all counterfeit transactions occurred within South Africa, these losses decreased by 12%, from R55.1m to

R48.4m in 2014.

Fraudulent spend with Lost and/or Stolen credit cards increased by 64% with 79% of the transactions

occurring in South Africa.

Counterfeit SA issued credit cards are frequently being used by criminals in neighbouring countries such

as Zambia, Zimbabwe, Botswana, Namibia and Mozambique and these transactions are mostly related to

fraudulent cash withdrawals at ATMs.

The five countries with the highest recorded financial losses due to CNP and Counterfeit fraud on SA

issued credit cards during 2014 were:

CNP

Counterfeit

United States

United States

United Kingdom

India

France

Mexico

China

Brazil

Australia

Canada

PAGE 8 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

CREDIT CARD FRAUD LOSS IN SOUTH AFRICA

Credit card fraud losses on SA issued cards used in South Africa, increased by 58% from R145.9m in 2013 to

in R231.0m in 2014.

Lost and/or Stolen credit card fraud losses increased by 60% in 2014 and accounts for 18% of the total

credit card fraud losses in South Africa. Criminals have reverted to modus operandi such as shoulder

surfing and card jamming or swopping due to changes in business processes linked to Chip & PIN cards.

Inevitably this has led to a visible increase in Lost and/or Stolen card fraud, similar to the card fraud trends

noted in the UK. Lost and/or Stolen card fraud is currently at the highest level in five years.

Transactions associated with False Applications recorded the biggest increase (1516%), increasing from

R4.2m (2013) to R68.8m (2014). Out of all False Application transactions, 88% occurred in South Africa.

Criminals abuse online application channels and use false details to open multiple credit card accounts

and in doing so, receive a legitimate card and PIN.

Counterfeit credit card fraud losses inside South Africa, decreased by 12% (from R55.1m in 2013 to R48.4m

in 2014).

CNP fraud committed within South Africa increased by 21% from R56.7m in 2013 to R68.9m in 2014.

Credit card fraud in South Africa split by fraud type (year-on-year, Jan - Sept 2006 to 2014)

Account Takeover

Card Not Present

Counterfeit

Not Received Issued

Lost/Stolen

False Applications

R160

R140

R120

MILLIONS

R100

R80

R60

R40

R20

R0

2006

2007

2008

2009

2010

2011

2012

2013

2014

PAGE 9 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

GEOGRAPHICAL DISTRIBUTION

Gauteng, Western Cape and KwaZulu-Natal accounted for 88% of all credit card fraud losses in South

Africa. These provinces also recorded the highest number of skimming devices retrieved in the field.

The remaining provinces accounted for 12% of the fraud losses. With the exception of the North West

Province, all eight provinces recorded an increase. Gauteng accounts for 55% of the credit card fraud

losses, followed by the Western Cape with 22% and KwaZulu-Natal with 9%. The provinces with the

highest increase in credit card fraud losses were Gauteng with 49% (R63.5m to R94.7m) and the Western

Cape with 47% (R26.2m to R38.6m). Losses in the Northern Cape increased with 168% (R288 112 to R772

860), however the losses are miniscule when compared to the rest of the provinces.

Provincial Geographical Distribution

PROVINCE

2006

2007

2008

2009

2010

2011

2012

2013

2014

Eastern Cape

R1.9m

R4.8m

R4.9m

R2.1m

R1.3m

R1.9m

R3.6m

R4.4m

R5.2m

Free State

R1.6m

R3.3m

R4.3m

R2.3m

R1.1m

R1.1m

R1.3m

R1.7m

R2.0m

Gauteng

R67.8m

R91.9m

R117.5m

R85.9m

R49.4m

R73.6m

R73.9m

R63.5m

R94.7m

KwaZulu-Natal

R16.3m

R34.3m

R41.4m

R27.9m

R16.7m

R23.7m

R10.9m

R13.5m

R15.9m

Limpopo

R1.5m

R2.7m

R3.5m

R2.1m

R2.2m

R2.4m

R2.7m

R3.3m

R4.8m

Mpumalanga

R2.7m

R6.1m

R7.2m

R4.9m

R1.9m

R1.4m

R2.3m

R3.4m

R4.2m

North West

R1.4m

R4.3m

R5.2m

R2.6m

R1.4m

R1.8m

R2.1m

R3.3m

R3.2m

Northern Cape

<R1m

<R1m

<R1m

<R1m

<R1m

<R1m

<R1m

<R1m

<R1m

Western Cape

R11.3m

R26.4m

R29m

R27m

R12.8m

R29.3m

R39.1m

R26.2m

R38.6m

All figures in R millions

PAGE 10 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

DEBIT CARD FRAUD

An increase of five percent in debit card fraud gross losses was recorded, from R117.7m in 2013 to R123.5m

in 2014.

The majority of fraud on debit cards are related to Counterfeit, Lost and/or Stolen and CNP. The other

fraud types are so minuscule (0.2% of the total debit card fraud) that it will not be discussed in detail in this

document.

Counterfeit debit card fraud contributed 65% of overall debit card losses. Cash withdrawals at ATMs

contributed to a large percentage (85%) of all debit card fraud transactions.

Criminals need both the magnetic stripe information and the PIN of a debit card to succesfully transact.

The majority of Counterfeit debit card fraud can thus be directly linked to card skimming.

Card fraud losses on SA issued debit cards (all countries) (Jan - Sept 2011 to 2014)

2014

R123.5

2013

R117.7

2012

R204.0

2011

R0

R219.9

R50

R100

R150

R200

R250

MILLIONS

A 25% decrease on Counterfeit debit card fraud losses was recorded from R109.8m in 2013 to R82.2m in

2014. In the same time period Lost and/or Stolen debit card fraud increased by 420% which is similar to

the trend seen in credit card fraud (from R31.7m to R52.2m).

PAGE 11 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

WHERE DOES THE FRAUDULENT EXPENDITURE OCCUR?

The majority of the fraudulent transactions on SA issued debit cards occured within South Africa. When

used outside South Africa, neighbouring African countries are targeted and the bulk of these transactions

relates to cash withdrawals at ATMs.

The five African countries with the highest recorded financial losses due to Counterfeit fraud on SA issued

debit cards during 2014 were:

Lesotho

Namibia

Zimbabwe

Mozambique

Botswana

PAGE 12 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

GEOGRAPHICAL DISTRIBUTION

The distribution of debit card fraud within Gauteng, KwaZulu-Natal, Western and Eastern Cape is similar

to that of credit card fraud. In 2014 the majority of the fraudulent transactions occurred in Gauteng (41%)

followed by KwaZulu- Natal (15%), Western Cape (10%) and Eastern Cape (9%).

The other provinces collectively account for 26% of the fraud losses on debit cards. A decrease was seen in

the losses associated with fraudulent transactions, in all the provinces except the Northern Cape where an

increase from 0.4% to 1.2% was seen.

Percentage of debit card fraud losses per province (Jan - Sept 2011 to 2014)

PROVINCE

2011

2012

2013

2014

Gauteng

42%

43%

42%

41%

KwaZulu-Natal

18%

18%

16%

15%

Eastern Cape

17%

9%

8%

9%

Western Cape

7%

9%

8%

10%

Mpumalanga

4%

6%

6%

7%

Free State

3%

3%

4%

5%

North West

3%

5%

5%

6%

Limpopo

2%

3%

6%

7%

Northern Cape

0.4%

1%

PAGE 13 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

HOW DOES RSA COMPARE INTERNATIONALLY?

Card fraud losses on UK issued cards (Jan - June 2007 to 2014)

2014

247.6

2013

216.1

2012

185.0

2011

169.8

2010

186.8

2009

232.8

2008

304.2

2007

R0

263.6

R50

R100

R150

R200

R250

R300

R350

MILLIONS

According to Financial Fraud Action UK, fraud losses on UK issued cards increased by 14% from January

to June 2014, compared to the same period in 2013. These figures include the losses for debit and credit

card fraud.

CNP fraud accounted for 70% of the total losses and increased by 22% compared to 2013.

Lost and/or Stolen card fraud increased by three percent and was the second highest loss category, with

12% of all losses associated to Lost and/or Stolen cards.

Counterfeit fraud accounts for 10% of the total losses and increased by 3% compared to the same period

in 2013. It is noteworthy to mention that losses associated to cards issued but not received (NRI) increased

by 10%.

South Africa mirrors the UK trend with increases in CNP, NRI and Lost and/or Stolen card fraud. However,

in spite of the current decrease in Counterfeit credit card fraud it remains one of the major contributors to

card fraud in South Africa.

Source: (http://www.financialfraudaction.org.uk/news-article.asp?genre=media&Article=2780)

PAGE 14 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

FRAUD TYPES (RSA ISSUED CREDIT AND DEBIT

CARDS, USED WITHIN AND OUTSIDE

SOUTH AFRICA)

CARD NOT PRESENT CARD FRAUD (CNP)

CNP fraud losses increased by 7% from R178.7m in 2013 to R191.7m in 2014 and contributed 42% of the

total credit card fraud losses in 2014.

The increase in CNP fraud seen over the last few years is a clear indication that South African credit card

fraud trends are following similar trends as in other EMV compliant countries such as the UK.

Banks are starting to allow CNP transactions on their debit cards, and the fraud on these cards is expected

to increase. During 2014 the losses associated with CNP fraud on debit cards amounted to R1.2m, and

contributed 1.8% of the total loss on debit cards.

Card Not Present credit card fraud (Jan - Sept 2006 to 2014)

2014

R191.7

2013

R178.7

2012

R154.7

2011

R133.4

2010

R64.2

2009

R63.1

2008

2007

2006

R0

R65.8

R40.7

R22.3

R50

R100

R150

R200

MILLIONS

PAGE 15 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

PAGE 16 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

COUNTERFEIT CARD FRAUD

Counterfeit card fraud losses on SA issued credit cards (all countries) (Jan - Sept 2006 to 2014)

2014

R123.1

2013

R144.5

2012

R113.9

2011

R207.7

2010

R92.7

2009

R145.7

2008

R157.1

2007

2006

R0

R94.7

R53.5

R50

R100

R150

R200

R250

MILLIONS

Counterfeit card fraud decreased by 14% in 2014 and contributed 27% of the overall credit card gross fraud

losses. 60% of all Counterfeit credit card losses occurred outside South Africa and decreased by 16% (from

R89.3m in 2013 to R74.6m in 2014). Counterfeit credit card losses in South Africa decreased from R55.1m to

R48.4m (-12%) during 2014.

PAGE 17 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

Counterfeit debit card fraud decreased by 25% in 2014 and contributes 65% of the overall debit card gross

fraud losses. 60% of all Counterfeit debit card losses occurred inside South Africa with the remaining 40%

occurring outside South Africa.

Counterfeit card fraud losses on SA issued debit cards (all countries) (Jan - Sept 2011 to 2014)

2014

R82.2

2013

R109.8

2012

R183.9

2011

R0

R213.3

R50

R100

R150

R200

R250

MILLIONS

PAGE 18 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

CARD SKIMMING

CARD SKIMMING WITH HANDHELD DEVICES

Handheld skimming still remains a threat and is one of the major contributors to Counterfeit card fraud.

From 2005 to September 2014 a total of 1 377 handheld skimming devices were recovered by either SAPS

or bank investigators, with 74 of these seized between January to September 2014.

Retrieved handheld skimming devices (2005 to 2014)

2014

74

2013

151

2012

237

2011

194

2010

190

2009

206

2008

143

2007

2006

2005

90

48

44

50

100

150

200

250

PAGE 19 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

During 2014 the majority of handheld skimming devices were recovered in Gauteng (38), KwaZulu-Natal

(13) and the Western Cape (9). There was an increase in the number of devices recovered in KwaZulu-Natal

(13 compared to the 11 in 2013).

North West

Western

Cape

Eastern

Cape

Northern

Cape

Free

State

0

Mpumalanga

Limpopo

2

Gauteng

38

KwaZulu-Natal

13

Cards can be skimmed at ATMs or at points of sale and therefore bank clients are urged not to accept

assistance from anybody at ATMs and not to let their cards out of sight when transacting.

PAGE 20 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

WHAT DOES A HANDHELD SKIMMING DEVICE LOOK LIKE?

The images below are examples of handheld skimming devices. Although there are many models

available, handheld skimming devices are usually small black objects that fit into the palm of your hand

and easily hidden in a pocket. The public is urged to report any individuals importing or using these

devices to steal card data to the police.

PAGE 21 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

CARD SKIMMING WITH ATM MOUNTED DEVICES

Between 2007 to September 2014, 237 ATM mounted skimming devices were recovered by the banking

industry and law enforcement. During January to September 2014, a total of 49 devices were recovered.

Retrieved ATM mounted skimming devices (2007 to 2014)

2014

49

2013

44

2012

43

2011

53

2010

2009

2008

2007

36

10

20

30

40

50

60

ATM mounted skimming devices were retrieved in four provinces. Gauteng had the highest number

retrieved (32), followed by the Western Cape (13), Mpumalanga (3) and Free State (1).

ATM clients are encouraged to be on the lookout for foreign objects attached to ATMs and are urged to

always conceal their PIN when transacting.

PAGE 22 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

WHAT DOES AN ATM MOUNTED SKIMMING DEVICE LOOK LIKE?

This device is difficult to recognise as it is manufactured to match the look and feel of the ATM. Always

inspect the ATM machine and cover the PIN pad with your free hand when entering your PIN.

PAGE 23 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

LOST AND/OR STOLEN CARD FRAUD

Lost and/or Stolen credit card fraud (Jan - Sept 2006 to 2014)

2014

R52.2

2013

R31.7

2012

R15.6

2011

2010

R18.3

R25.8

2009

R65.7

2008

R117.5

2007

R117.5

2006

R0

R66.2

R20

R40

R60

R80

R100

R120

MILLIONS

Lost and/or Stolen credit card fraud increased by 64% from R31.7m in 2013 to R52.2m in 2014 and the

fraud losses accounted for 11% of the total gross fraud losses on credit cards. The majority (79%) of the

fraud losses occurred inside South Africa.

Lost and/or Stolen debit card fraud increased by 420% from R7.9m in 2013 to R41.2m in 2014 and the fraud

losses accounted for 33% of the total gross fraud losses on credit cards. Almost all (99%) of the fraud losses

occurred inside South Africa.

PAGE 24 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

Lost and/or Stolen debit card fraud (Jan - Sept 2011 to 2014)

2014

2013

R41.2

R7.9

2012

R6.7

2011

R7.1

R0

R5

R10

R15

R20

R25

R30

R35

R40

R45

MILLIONS

Changes in business processes to accommodate Chip & PIN cards, have resulted in criminals reverting to

older modus operandi such as shoulder surfing and card swopping. The increase in Lost and/or Stolen

card fraud in South Africa is similar to the card fraud trends seen in the UK. It is crucial for bank clients to

not be distracted when transacting at ATMs and under no circumstances must assistance be accepted

from anybody whilst using an ATM.

PAGE 25 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

FALSE APPLICATION CREDIT CARD FRAUD

False Application credit card fraud (Jan - Sept 2006 to 2014)

2014

R78.3

2013

R6.2

2012

R13.3

2011

R4.0

2010

R1.8

2009

R5.4

2008

2007

R11.1

R18.2

2006

R29.8

10

20

30

40

50

60

70

80

MILLIONS

Losses related to False Applications on credit card accounts, accounted for 17% of the overall credit card

fraud losses. During 2014, fraud losses associated with transactions following a False Application increased

with 1143%, from R6.2m to R78.3m.

Criminals will apply for credit card accounts online using false information and supplying fraudulent

supporting documentation. The fraudulent documentation is of such good quality that bank processes

are not always able to detect it. Once the account is approved and the card issued, the criminal will then

use the full credit facility available on the card account. Only once in arrears, will the bank realise that the

account was opened with fraudulent details.

Whilst the threat is relatively new, the banking industry has already implemented strategies for fraud

detection and prevention to mitigate the risk associated with False Application fraud.

PAGE 26 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

ACCOUNT TAKEOVER CREDIT CARD FRAUD

Account Takeover credit card fraud (Jan - Sept 2006 to 2014)

2014

R0.5

2013

R2.2

2012

R1.0

2011

2010

R0.7

R0.2

2009

R0.6

2008

R1.6

2007

2006

R0.4

R0.3

0.5

1.5

2.0

2.5

MILLIONS

Credit card fraud losses associated with Account Takeover fraud decreased by 75% (from R2.2m in 2013 to

R544 000 in 2014). Account Takeover fraud accounted for 0.1% of the overall credit card losses.

PAGE 27 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

NOT RECEIVED ISSUED CREDIT CARD FRAUD (NRI)

Not Received Issued credit card fraud (Jan - Sept 2006 to 2014)

2014

R3.8

2013

R0.7

2012

R0.5

2011

R1.3

2010

R1.7

2009

R8.8

2008

R10.4

2007

R5.1

2006

R4.2

10

12

MILLIONS

PAGE 28 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

Not Received Issued (NRI) card fraud losses increased by 427%, from R730 000 in 2013 to R3.8m in 2014.

Credit card fraud losses associated with NRI cards accounted for 1% of the overall credit card losses.

Although the percentage increase is high, the associated loss is still relatively low.

Banks are continuously improving processes in respect of card collections and PIN activation. Customers

are urged to respond quickly to calls to collect replacement cards. It is also very important that bank

customers alert the bank if replacement cards were not received within a reasonable time.

PAGE 29 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

IMPORTANT TIPS TO AVOID BECOMING A VICTIM

OF CARD FRAUD

DOS

If you think the ATM is faulty, cancel the transaction immediately and report the fault to your bank and

transact at another ATM.

Be cautious of strangers offering help as they could be trying to distract you in order to get your card

or PIN.

If you are disturbed or interfered with whilst transacting at the ATM, your card could be skimmed by

being removed and replaced back into the ATM without your knowledge. Cancel the transaction and

immediately report the incident using your Banks Stop Card Toll free number which is displayed on

the ATM or on the back of your bank card.

Choose familiar and well-lit ATMs where you are visible and safe to transact.

Know what your ATM looks like so that you are able to identify any foreign objects attached to it.

If your card is retained, do not leave the ATM before you have cancelled your card by calling your

banks call centre using your own mobile phone.

Shield the hand that is typing your PIN number so that nobody can see your PIN number.

Never let the card out of your sight when making payments and if possible insert the card into the

Point of Sale device yourself.

Always ensure that the card you receive out of the ATM is your own.

If you have debit, cheque and credit cards, dont choose the same PIN for all of them so that if you lose

one, the others will still be safe.

PAGE 30 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

Keep your transaction slips and check them against your statement to spot any suspicious

transactions which must be queried with your bank immediately.

Check the Rand value of the transaction on the screen before entering your PIN and authorizing the

transaction. Note the value must be reflected in Rands. If not, stop the transaction and contact your

bank immediately

If possible change your PIN as often as possible

DONTS

Do not ask anyone to assist you at the ATM, not even the security guard or a bank official. Rather go

inside the bank for help.

Never force your card into the slot as it might have been tampered with.

Do not insert your card if the screen layout is not familiar to you and looks like the ATM may have been

tampered with.

Never write your PIN on your card.

Never write your PIN on paper and store it in the same location as your card

PAGE 31 | Card Fraud 2014

SABRIC CARD FRAUD BOOKLET 2014

INDUSTRY MEASURES TO PREVENT CARD FRAUD

PROTECTION OF CLIENT DATA

South African banks subscribe to PCI DSS standards as set by MasterCard, Visa, as well as local legislation

to protect client information inclusive of card data. Banks also urge clients to become PCI aware as data

security is of utmost importance.

IMPROVEMENT OF INTERNAL SYSTEMS AND PROCESSES

SA banks are continuously investing in new technologies to assist with the detection, prevention and

reduction of bank card fraud.

Crime trends are followed closely and adjustments to monitoring systems are made to mitigate associated

risks.

SMS notifications for transactions on card accounts are an effective detection tool and banks encourage

customers to utilise this service.

SHARING OF INFORMATION AND COMBATING OF CARD CRIME

SABRIC provides the industry with an industry view of crime trends, threats and facilitates a collective

approach to the combating of card fraud in partnership with the SA Police Service and the National

Prosecuting Authority, as well as other stakeholders in the fight against crime. Dedicated police reaction

teams were established in provinces where card fraud is most prevalent. This contributed to numerous

arrests and successful prosecutions.

CRIME AWARENESS

SABRIC and the banking industry regularly partner with the media to alert bank clients and merchants to

new modus operandi and provide crime prevention tips to card users.

PAGE 32 | Card Fraud 2014

Switchboard: +27 11 847 3000

Email: info@sabric.co.za

Postal Address:

PO Box 3682

Halfway House

1685

Physical Address:

Sabric House, Hertford Office Park

90 Bekker Road cnr Allandale Road

Midrand

Das könnte Ihnen auch gefallen

- Media Statement - Dsac On The Passing of Aka 11 February 2023 - 230211 - 082746Dokument2 SeitenMedia Statement - Dsac On The Passing of Aka 11 February 2023 - 230211 - 082746eNCA.comNoch keine Bewertungen

- DCS To Terminate Concession Contract at Mangaung Correctional CentreDokument1 SeiteDCS To Terminate Concession Contract at Mangaung Correctional CentreeNCA.comNoch keine Bewertungen

- Cabinet Statement Final830Dokument18 SeitenCabinet Statement Final830eNCA.comNoch keine Bewertungen

- Gauteng Premier Saddened by Rising Death Toll Following The Boksburg Truck ExplosionDokument2 SeitenGauteng Premier Saddened by Rising Death Toll Following The Boksburg Truck ExplosioneNCA.comNoch keine Bewertungen

- Media Statement - Arrest of GuptasDokument1 SeiteMedia Statement - Arrest of GuptaseNCA.comNoch keine Bewertungen

- Government Gazette Staatskoerant: Republic of South Africa Republiek Van Suid AfrikaDokument4 SeitenGovernment Gazette Staatskoerant: Republic of South Africa Republiek Van Suid AfrikaeNCA.com100% (3)

- MFMA2020-21 Media-Release 15 June Final ApprovedDokument14 SeitenMFMA2020-21 Media-Release 15 June Final ApprovedeNCA.comNoch keine Bewertungen

- Media Statement - Fuel Prices Adjustment For October 2022Dokument3 SeitenMedia Statement - Fuel Prices Adjustment For October 2022eNCA.comNoch keine Bewertungen

- Order GP0522Dokument10 SeitenOrder GP0522eNCA.comNoch keine Bewertungen

- Power Alert 1 - 05 January 2023Dokument1 SeitePower Alert 1 - 05 January 2023eNCA.comNoch keine Bewertungen

- Gauteng Provincial Government Places Senior Health Officials On Precautionary Suspension As The Siu Begins An Investigation Into Procurement at Tembisa HospitalDokument2 SeitenGauteng Provincial Government Places Senior Health Officials On Precautionary Suspension As The Siu Begins An Investigation Into Procurement at Tembisa HospitaleNCA.comNoch keine Bewertungen

- Letter To DG TshanganaDokument1 SeiteLetter To DG TshanganaeNCA.comNoch keine Bewertungen

- Media Statement - Moretele Municipality Manager Arrest Welcome 18 July 2022Dokument3 SeitenMedia Statement - Moretele Municipality Manager Arrest Welcome 18 July 2022eNCA.comNoch keine Bewertungen

- 13-4 CoOperativeGovernanceDokument8 Seiten13-4 CoOperativeGovernanceeNCA.comNoch keine Bewertungen

- Temporary Closure of Tembisa Hospital After Fatal Incident 20220209Dokument1 SeiteTemporary Closure of Tembisa Hospital After Fatal Incident 20220209eNCA.comNoch keine Bewertungen

- Joint Statement-Extension of The Temporary Reduction in The General Fuel LevyDokument2 SeitenJoint Statement-Extension of The Temporary Reduction in The General Fuel LevyeNCA.comNoch keine Bewertungen

- Second Booster Dose For J&J VaccineDokument2 SeitenSecond Booster Dose For J&J VaccineeNCA.comNoch keine Bewertungen

- Media Statement 21 December 2021Dokument2 SeitenMedia Statement 21 December 2021eNCA.comNoch keine Bewertungen

- Pule Mlambo Progrmme (A)Dokument1 SeitePule Mlambo Progrmme (A)eNCA.comNoch keine Bewertungen

- Statement DLCA XtensionDokument9 SeitenStatement DLCA XtensioneNCA.comNoch keine Bewertungen

- CEF Press Release 25 Feb 2022Dokument4 SeitenCEF Press Release 25 Feb 2022eNCA.com100% (1)

- Fire Safety Observations Parliamentary Complex 2 January 2022Dokument22 SeitenFire Safety Observations Parliamentary Complex 2 January 2022eNCA.comNoch keine Bewertungen

- Zuma ParoleDokument34 SeitenZuma ParoleTimesLIVE100% (1)

- MEDIA RELEASE Janssen Vaccine BoosterDokument2 SeitenMEDIA RELEASE Janssen Vaccine BoostereNCA.comNoch keine Bewertungen

- Aspen Press Release 30 Nov 2021Dokument4 SeitenAspen Press Release 30 Nov 2021eNCA.comNoch keine Bewertungen

- PRASA's Group CEO Precautionary SuspensionDokument1 SeitePRASA's Group CEO Precautionary SuspensioneNCA.comNoch keine Bewertungen

- FDD-9623 Protest - 1Dokument1 SeiteFDD-9623 Protest - 1eNCA.comNoch keine Bewertungen

- 2021.11.17. NSFAS Media Statement On The 2023 Eligibility Criteria and Conditions For Finantial AidDokument2 Seiten2021.11.17. NSFAS Media Statement On The 2023 Eligibility Criteria and Conditions For Finantial AideNCA.comNoch keine Bewertungen

- Media Statement - Fuel Prices For December 2021Dokument3 SeitenMedia Statement - Fuel Prices For December 2021eNCA.comNoch keine Bewertungen

- Routine Maitenance Final2Dokument1 SeiteRoutine Maitenance Final2eNCA.comNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- CIF No. No. CIF: 2300351974 Statement Date Tarikh Penyata: 28/02/2022Dokument4 SeitenCIF No. No. CIF: 2300351974 Statement Date Tarikh Penyata: 28/02/2022ryedah musyairaNoch keine Bewertungen

- Amrapali Aadya TradingDokument7 SeitenAmrapali Aadya Tradingpiyanjan88Noch keine Bewertungen

- International Journal of Contemporary Applied Researches Vol. 4, No. 12, December 2017 (ISSN: 2308-1365)Dokument22 SeitenInternational Journal of Contemporary Applied Researches Vol. 4, No. 12, December 2017 (ISSN: 2308-1365)aleneNoch keine Bewertungen

- Knowledge Park: IT CBS & NONCBS: (Updated Upto 01.04.2023)Dokument20 SeitenKnowledge Park: IT CBS & NONCBS: (Updated Upto 01.04.2023)Surendra Kumar SethNoch keine Bewertungen

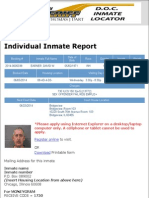

- Cook County Sheriff Inmate Locator Search ResultsDokument3 SeitenCook County Sheriff Inmate Locator Search Resultsapi-214091549Noch keine Bewertungen

- Credit Card Letter 121 PDFDokument1 SeiteCredit Card Letter 121 PDFsushant100% (1)

- Admission Is Strictly Limited To The Patients With Treatable, Chronic and Acute DiseasesDokument10 SeitenAdmission Is Strictly Limited To The Patients With Treatable, Chronic and Acute DiseasesVivek GuptaNoch keine Bewertungen

- EBL Annual - Report (2018 19) PDFDokument156 SeitenEBL Annual - Report (2018 19) PDFNiraj AdhikariNoch keine Bewertungen

- 5 6199529792761496319Dokument77 Seiten5 6199529792761496319Disha PaiNoch keine Bewertungen

- Membership Application FormDokument1 SeiteMembership Application Formseng kiong LeeNoch keine Bewertungen

- Mcommerce AssignDokument9 SeitenMcommerce AssignRose Rhodah Marsh100% (1)

- OOAD Midterm2020 QuestionsDokument12 SeitenOOAD Midterm2020 QuestionsNguyễn Tiến ĐứcNoch keine Bewertungen

- Third Division G.R. NO. 152609, June 29, 2005: Supreme Court of The PhilippinesDokument20 SeitenThird Division G.R. NO. 152609, June 29, 2005: Supreme Court of The PhilippinesMarian Dominique AuroraNoch keine Bewertungen

- Murthy ProfileDokument4 SeitenMurthy ProfileKathryn MayNoch keine Bewertungen

- Rabindra Bharati University: 56A, B.T. Road, Kolkata - 700050Dokument13 SeitenRabindra Bharati University: 56A, B.T. Road, Kolkata - 700050Salman NoorNoch keine Bewertungen

- Souvenir Shop BUSINESS OVERVIEWDokument15 SeitenSouvenir Shop BUSINESS OVERVIEWTirthankar MohantyNoch keine Bewertungen

- Microsoft Services AgreementDokument39 SeitenMicrosoft Services AgreementFrancisco Del PuertoNoch keine Bewertungen

- Electronic CrimeDokument139 SeitenElectronic CrimePa GarNoch keine Bewertungen

- Your Adv Plus Banking: Account SummaryDokument6 SeitenYour Adv Plus Banking: Account SummaryЮлия ПNoch keine Bewertungen

- Account Statement PDFDokument12 SeitenAccount Statement PDFShalini SinghNoch keine Bewertungen

- HDFC Bank Millennia Credit Card: Products Making Payments Apply Now Locate Us Ways To Bank Customer CareDokument1 SeiteHDFC Bank Millennia Credit Card: Products Making Payments Apply Now Locate Us Ways To Bank Customer CareAnonymous plfbbc9RNoch keine Bewertungen

- Haad FaqDokument5 SeitenHaad FaqMenGuitarNoch keine Bewertungen

- Financial Transactions and Fraud SchemesDokument40 SeitenFinancial Transactions and Fraud Schemesjit21senNoch keine Bewertungen

- ERP Sample Test 2016Dokument18 SeitenERP Sample Test 2016keyspNoch keine Bewertungen

- Child General Passport ApplicationDokument8 SeitenChild General Passport ApplicationbarreyloverNoch keine Bewertungen

- 1540395230512Gvsx636FlEg3pp89 PDFDokument3 Seiten1540395230512Gvsx636FlEg3pp89 PDFMathew RaiNoch keine Bewertungen

- Centinal CollgeDokument17 SeitenCentinal CollgeAdit KadakiaNoch keine Bewertungen

- Review of The Accounting Process Straight Problems Problem 1Dokument13 SeitenReview of The Accounting Process Straight Problems Problem 1angielynNoch keine Bewertungen

- Magento Enterprise Edition 1 10 User's GuideDokument69 SeitenMagento Enterprise Edition 1 10 User's GuidebrooklynheritageNoch keine Bewertungen

- The Procrastinators Guide To Progress - Shawn Blanc PDFDokument40 SeitenThe Procrastinators Guide To Progress - Shawn Blanc PDFjustorin100% (1)