Beruflich Dokumente

Kultur Dokumente

Candlestick Pattern Dictionary Guide

Hochgeladen von

Abhijit ModakOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Candlestick Pattern Dictionary Guide

Hochgeladen von

Abhijit ModakCopyright:

Verfügbare Formate

Candlestick Pattern Dictionary

Abandoned Baby

A rare reversal pattern characterized by a gap followed by a Doji, which is then followed by another gap in the

opposite direction. The shadows on the Doji must completely gap below or above the shadows of the first and

third day.

Dark Cloud Cover

A bearish reversal pattern that continues the uptrend with a long white body. The next day opens at a new high

then closes below the midpoint of the body of the first day.

Doji

Doji form when a security's open and close are virtually equal. The length of the upper and lower shadows can

vary and the resulting candlestick looks like a cross, inverted cross or plus sign. Doji convey a sense of indecision

or tug-of-war between buyers and sellers. Prices move above and below the opening level during the session, but

close at or near the opening level.

Downside Tasuki Gap

A continuation pattern with a long black body followed by another black body that has gapped below the first

one. The third day is white and opens within the body of the second day, then closes in the gap between the first

two days, but does not close the gap.

Dragonfly Doji

A Doji line where the open and close price are at the high of the day. Like other Doji days, this one normally

appears at market turning points.

Engulfing Pattern

A reversal pattern that can be bearish or bullish depending upon whether it appears at the end of an uptrend

(bearish engulfing pattern) or downtrend (bullish engulfing pattern). The first day is characterized by a small

body, followed by a day whose body completely engulfs the previous day's body.

Ham0612231

Evening Doji Star

A three day bearish reversal pattern similar to the Evening Star. The uptrend continues with a large white body.

The next day opens higher, trades in a small range, then closes at its open (Doji). The next day closes below the

midpoint of the body of the first day.

Evening Star

A bearish reversal pattern that continues an uptrend with a long white body day followed by a gapped up small

body day, then a down close with the close below the midpoint of the first day.

Falling Three Methods

A bearish continuation pattern. A long black body is followed by three small body days, each fully contained

within the range of the high and low of the first day. The fifth day closes at a new low.

Gravestone Doji

A doji line that develops when the Doji is at, or very near, the low of the day.

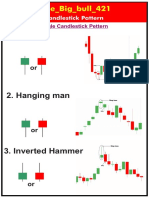

Hammer

Hammer candlesticks form when a security moves significantly lower after the open, but rallies to close well

above the intraday low. The resulting candlestick looks like a square lollipop with a long stick. If this candlestick

forms during an advance, then it is called a Hanging Man.

Hanging Man

Hanging Man candlesticks form when a security moves significantly lower after the open, but rallies to close well

above the intraday low. The resulting candlestick looks like a square lollipop with a long stick. If this candlestick

forms during a decline, then it is called a Hammer.

Harami

A two day pattern that has a small body day completely contained within the range of the previous body, and is

the opposite color.

Ham0612232

Harami Cross

A two day pattern similar to the Harami. The difference is that the last day is a Doji.

Inverted Hammer

A one day bullish reversal pattern. In a downtrend, the open is lower, then it trades higher, but closes near its

open, therefore looking like an inverted lollipop.

Long Day

A long day represents a large price move from open to close, where the length of the candle body is long.

Long-Legged Doji

This candlestick has long upper and lower shadows with the Doji in the middle of the day's trading range, clearly

reflecting the indecision of traders.

Long Shadows

Candlesticks with a long upper shadow and short lower shadow indicate that buyers dominated during the session

and bid prices higher. Conversely, candlesticks with long lower shadows and short upper shadows indicate that

sellers dominated during the session and drove prices lower.

Marubozo

A candlestick with no shadow extending from the body at either the open, the close or at both. The name means

close-cropped or close-cut in Japanese, though other interpretations refer to it as Bald or Shaven Head.

Morning Doji Star

A three day bullish reversal pattern that is very similar to the Morning Star. The first day is in a downtrend with a

long black body. The next day opens lower with a Doji that has a small trading range. The last day closes above

the midpoint of the first day.

Ham0612233

Morning Star

A three day bullish reversal pattern consisting of three candlesticks - a long-bodied black candle extending the

current downtrend, a short middle candle that gapped down on the open, and a long-bodied white candle that

gapped up on the open and closed above the midpoint of the body of the first day.

Piercing Line

A bullish two day reversal pattern. The first day, in a downtrend, is a long black day. The next day opens at a new

low, then closes above the midpoint of the body of the first day.

Rising Three Methods

A bullish continuation pattern. A long white body is followed by three small body days, each fully contained

within the range of the high and low of the first day. The fifth day closes at a new high.

Shooting Star

A single day pattern that can appear in an uptrend. It opens higher, trades much higher, then closes near its open.

It looks just like the Inverted Hammer except that it is bearish.

Short Day

A short day represents a small price move from open to close, where the length of the candle body is short.

Spinning Top

Candlestick lines that have small bodies with upper and lower shadows that exceed the length of the body.

Spinning tops signal indecision.

Stars

A candlestick that gaps away from the previous candlestick is said to be in star position. Depending on the

previous candlestick, the star position candlestick gaps up or down and appears isolated from previous price

action.

Ham0612234

Stick Sandwich

A bullish reversal pattern with two black bodies surrounding a white body. The closing prices of the two black

bodies must be equal. A support prices is apparent and the opportunity for prices to reverse is quite good.

Three Black Crows

A bearish reversal pattern consisting of three consecutive black bodies where each day closes near below the

previous low, and opens within the body of the previous day.

Three White Soldiers

A bullish reversal pattern consisting of three consecutive white bodies, each with a higher close. Each should

open within the previous body and the close should be near the high of the day.

Upside Gap Two Crows

A three day bearish pattern that only happens in an uptrend. The first day is a long white body, followed by a

gapped open with the small black body remaining gapped above the first day. The third day is also a black day

whose body is larger than the second day and engulfs it. The close of the last day is still above the first long white

day.

Upside Tasuki Gap

A continuation pattern with a long white body followed by another white body that has gapped above the first

one. The third day is black and opens within the body of the second day, then closes in the gap between the first

two days, but does not close the gap.

Ham0612235

Das könnte Ihnen auch gefallen

- Trading TricksDokument21 SeitenTrading TricksCompte1100% (11)

- Swing Trading Cheat Sheet Final PDFDokument6 SeitenSwing Trading Cheat Sheet Final PDFharjindersingh saini100% (2)

- 21 Easy Candlestick PatternsDokument24 Seiten21 Easy Candlestick Patternsharry1520100% (3)

- Candle Stick Pattern Group 2Dokument58 SeitenCandle Stick Pattern Group 2Rasika SawantNoch keine Bewertungen

- Candlestick Patterns For Day TradingDokument8 SeitenCandlestick Patterns For Day Tradinganzraina96% (24)

- Price Bars Chart Patterns PDFDokument15 SeitenPrice Bars Chart Patterns PDFsevsamra20% (15)

- The Major Candlestick Signals PDFDokument1 SeiteThe Major Candlestick Signals PDFSenyum Sentiasa TenangNoch keine Bewertungen

- Day Trading With Canlestick and Moving Averages - Stephen BigalowDokument3 SeitenDay Trading With Canlestick and Moving Averages - Stephen Bigalowarashiro100% (2)

- Candle Stick AnalysisDokument30 SeitenCandle Stick Analysisonur100% (1)

- Compilation of Chart Reversal PatternsDokument13 SeitenCompilation of Chart Reversal PatternsChartSniper75% (4)

- Top 20 Day Trading Rules For SuccessDokument4 SeitenTop 20 Day Trading Rules For Successbugbugbugbug100% (3)

- Candle Sticks Flash Cards 1Dokument41 SeitenCandle Sticks Flash Cards 1James Gorham50% (2)

- Top 10 Candlestick Patterns Cheat SheetDokument1 SeiteTop 10 Candlestick Patterns Cheat SheetAnthony Filpo100% (2)

- Support and Resistance SimplifiedDokument128 SeitenSupport and Resistance Simplifiedterrywisniewski100% (5)

- 11 Winning Candlestick Patterns Part 1 C PDFDokument6 Seiten11 Winning Candlestick Patterns Part 1 C PDFAnonymous sDnT9yu100% (1)

- Basic Japanese Candlestick PatternsDokument36 SeitenBasic Japanese Candlestick PatternsDevanshi ShahNoch keine Bewertungen

- Candlestick PatternDokument9 SeitenCandlestick PatternMuhamad ZaqquanNoch keine Bewertungen

- Candlestick 1Dokument6 SeitenCandlestick 1Hafizul Hisyam Maysih LuzifahNoch keine Bewertungen

- Candlestick 1Dokument6 SeitenCandlestick 1Hafizul Hisyam Maysih LuzifahNoch keine Bewertungen

- Japanese CandlestickDokument38 SeitenJapanese CandlestickmtcNoch keine Bewertungen

- Overview of Consumer Credit and V+Dokument30 SeitenOverview of Consumer Credit and V+subash_dot75% (4)

- Start Day Trading NowDokument44 SeitenStart Day Trading Nowfuraito100% (2)

- The Wedge PatternDokument56 SeitenThe Wedge PatternMohaNoch keine Bewertungen

- Daily Technical Analysis Report: Market WatchDokument16 SeitenDaily Technical Analysis Report: Market WatchSeven Star FX Limited100% (2)

- Cripto Trading CourseDokument47 SeitenCripto Trading CourseBruno Manfron100% (1)

- Stock Market TermsDokument11 SeitenStock Market TermsAbhijit ModakNoch keine Bewertungen

- Candle ChartDokument1 SeiteCandle ChartM Try Trader Kaltim100% (5)

- Share MarketDokument10 SeitenShare MarketAk Reviews100% (1)

- Deciphering Candlestick ChartsDokument15 SeitenDeciphering Candlestick Chartssumilang50% (2)

- Candlestick Quick Guide PDFDokument2 SeitenCandlestick Quick Guide PDFJavier Murphys93% (14)

- The 10 Best Momentum Chart PatternsDokument42 SeitenThe 10 Best Momentum Chart PatternsNicola Duke100% (8)

- BCA COBOL SYLLABUSDokument153 SeitenBCA COBOL SYLLABUSHarsha GortlaNoch keine Bewertungen

- StochasticDokument9 SeitenStochasticsivasundaram anushan50% (2)

- Free Candlestick E Book Error Revise 09192014 1Dokument35 SeitenFree Candlestick E Book Error Revise 09192014 1debaditya_hit326634100% (1)

- Lindencourt Daily Forex SystemDokument19 SeitenLindencourt Daily Forex Systemjodaw100% (1)

- Bearish & Bullish Candlestick Patterns GuideDokument5 SeitenBearish & Bullish Candlestick Patterns Guidesugeng widodoNoch keine Bewertungen

- Chart Patterns - Financial Trading SystemDokument10 SeitenChart Patterns - Financial Trading Systemrajendraa19810% (1)

- Price Action Cheatsheet PDFDokument19 SeitenPrice Action Cheatsheet PDFSir.ioNoch keine Bewertungen

- Volume Spikes & Index Reversals - The Technical Analyst, May 2004Dokument4 SeitenVolume Spikes & Index Reversals - The Technical Analyst, May 2004Steffen L. Norgren100% (1)

- Comprehensive Candlestick Patterns Trading GuideDokument17 SeitenComprehensive Candlestick Patterns Trading GuideaaryinfoNoch keine Bewertungen

- Palmistry SecretsDokument146 SeitenPalmistry Secretsshethharsh100% (36)

- Top 10 Candlestick Patterns - CandlestickgeniusDokument2 SeitenTop 10 Candlestick Patterns - CandlestickgeniusPrabhu MohanNoch keine Bewertungen

- Alphaex Capital Candlestick Pattern Cheat Sheet InfographDokument1 SeiteAlphaex Capital Candlestick Pattern Cheat Sheet InfographAlfian Amin100% (1)

- Gyertyák5 - Doji Long Legged - Candlestick Pattern DictionarDokument5 SeitenGyertyák5 - Doji Long Legged - Candlestick Pattern DictionarTSXfx01Noch keine Bewertungen

- Gyertyák5 - Doji Long Legged - Candlestick Pattern DictionarDokument5 SeitenGyertyák5 - Doji Long Legged - Candlestick Pattern DictionarTSXfx01Noch keine Bewertungen

- Crypto Trading Candlestick Chart PatternsDokument2 SeitenCrypto Trading Candlestick Chart Patternsshanthila100% (2)

- Candlestick Pattern Cheat SheetDokument1 SeiteCandlestick Pattern Cheat SheetBetro PemilioNoch keine Bewertungen

- Combined CandlesDokument11 SeitenCombined CandlesNicola Duke100% (2)

- Price Action - Japanese Candlestick Patterns SheetDokument4 SeitenPrice Action - Japanese Candlestick Patterns SheetVicaas VSNoch keine Bewertungen

- 3.30 MCX FormulaDokument41 Seiten3.30 MCX Formula1ganeshkumar40% (5)

- The Little Book of Currency Trading. by Kathy Lien.: Predicting Is Really Hard, Especially About The Future!Dokument14 SeitenThe Little Book of Currency Trading. by Kathy Lien.: Predicting Is Really Hard, Especially About The Future!RajaNoch keine Bewertungen

- Chart Pattern Masters SeriesDokument48 SeitenChart Pattern Masters SeriesMarje Adams100% (3)

- CandlestickCharting PDFDokument13 SeitenCandlestickCharting PDFPrasad Swaminathan100% (1)

- How to trade support and resistance levelsDokument41 SeitenHow to trade support and resistance levelsAbhinav Keshari100% (4)

- 1500 Palavras Mais Usadas em Inglês - GlobishDokument5 Seiten1500 Palavras Mais Usadas em Inglês - GlobishDinho SilvaNoch keine Bewertungen

- Candlestick Pattern Full PDFDokument25 SeitenCandlestick Pattern Full PDFM Try Trader Kaltim80% (5)

- Candlestick Patterns: Group - I Nikunj Nayak Salil Naravekar W.Umesh Nanda Vipul Shah Brijesh MouryaDokument44 SeitenCandlestick Patterns: Group - I Nikunj Nayak Salil Naravekar W.Umesh Nanda Vipul Shah Brijesh Mouryaumeshnanda2189% (9)

- Alphaex Capital Candlestick Pattern Cheat Sheet InfographDokument1 SeiteAlphaex Capital Candlestick Pattern Cheat Sheet InfographRyan Vassa PramudyaNoch keine Bewertungen

- Trading PlanDokument24 SeitenTrading PlanEdo Bhe-Dhaw 翁明慧100% (1)

- Daily Trade Journal - Summary SheetDokument7 SeitenDaily Trade Journal - Summary SheetBv Rao100% (1)

- Candlestick GeniusDokument60 SeitenCandlestick Geniuscorreiojm100% (3)

- Binary Option Trading: Introduction to Binary Option TradingVon EverandBinary Option Trading: Introduction to Binary Option TradingNoch keine Bewertungen

- Candlestick DescriptionsDokument14 SeitenCandlestick Descriptionsflakeman100% (3)

- The Encyclopedia Of Technical Market Indicators, Second EditionVon EverandThe Encyclopedia Of Technical Market Indicators, Second EditionBewertung: 3.5 von 5 Sternen3.5/5 (9)

- Script Candlestick Scanner Iqoption ComprimidoDokument2 SeitenScript Candlestick Scanner Iqoption ComprimidoIndigo GraficosNoch keine Bewertungen

- Basics of Candle Stick PatternsDokument5 SeitenBasics of Candle Stick PatternsRahul KatariyaNoch keine Bewertungen

- Elliott WaveDokument13 SeitenElliott WaveYoderIII100% (1)

- Candlestick CheatsheetDokument1 SeiteCandlestick CheatsheetArie PutrantoNoch keine Bewertungen

- Candlestick Patterns Every Trader Should KnowDokument65 SeitenCandlestick Patterns Every Trader Should KnowDxtr V Drn100% (1)

- Kamus Candle StickDokument89 SeitenKamus Candle Stickrudi eko prasetyoNoch keine Bewertungen

- 2 Candles Pattern PDFDokument3 Seiten2 Candles Pattern PDFdrsuresh260% (2)

- Candlestick Pattern Dictionary GuideDokument5 SeitenCandlestick Pattern Dictionary GuideAbhijit ModakNoch keine Bewertungen

- Ichimoku Admiral Markets Uk PDFDokument12 SeitenIchimoku Admiral Markets Uk PDFZeynep Emirhan Şenyüz100% (1)

- Candlestick Pattern DictionaryDokument5 SeitenCandlestick Pattern Dictionaryaica1234Noch keine Bewertungen

- Example of Supply and Demand in A TradeDokument5 SeitenExample of Supply and Demand in A TradeHank Allan80% (10)

- Philakone's Cryptocurrency Superstar Trading GuideDokument8 SeitenPhilakone's Cryptocurrency Superstar Trading GuideJhol AnthonyNoch keine Bewertungen

- Trading Crypto Technical and Fundamental AnalysisDokument4 SeitenTrading Crypto Technical and Fundamental AnalysisRupomir Sajberski50% (2)

- FAS 8.0 System FlowchartDokument6 SeitenFAS 8.0 System FlowchartAbhijit ModakNoch keine Bewertungen

- Selenium Automation set up with TestNG and EclipseDokument19 SeitenSelenium Automation set up with TestNG and EclipseNileshNoch keine Bewertungen

- Top 5 Most Consistent Candlestick Patterns - CandlestickgeniusDokument2 SeitenTop 5 Most Consistent Candlestick Patterns - CandlestickgeniusPrabhu MohanNoch keine Bewertungen

- Trading Ebook - Candlesticks - High Profit Candlestick Patterns and Conventional Technical AnalysisDokument4 SeitenTrading Ebook - Candlesticks - High Profit Candlestick Patterns and Conventional Technical AnalysisSudipta BoseNoch keine Bewertungen

- Bullish confirmation patterns and technical analysisDokument6 SeitenBullish confirmation patterns and technical analysisScott LuNoch keine Bewertungen

- GYERTYÁK8 - Inverted Hammer Candlestick Pattern DictionaryDokument5 SeitenGYERTYÁK8 - Inverted Hammer Candlestick Pattern DictionaryTSXfx01Noch keine Bewertungen

- Investing BasicsDokument37 SeitenInvesting BasicsAbhijit ModakNoch keine Bewertungen

- PlasticCards OperatiosDokument30 SeitenPlasticCards OperatiosAbhijit ModakNoch keine Bewertungen

- REXX400 Programmer's GuideDokument251 SeitenREXX400 Programmer's GuideAmol VermaNoch keine Bewertungen

- Stock Market TermsDokument20 SeitenStock Market TermsAbhijit ModakNoch keine Bewertungen

- Mercury QTP TutorialDokument111 SeitenMercury QTP TutorialDhiraj PatilNoch keine Bewertungen

- New Word ReaderDokument1 SeiteNew Word ReaderAbhijit ModakNoch keine Bewertungen

- Problemisolationguide 32Dokument138 SeitenProblemisolationguide 32Abhijit ModakNoch keine Bewertungen

- What Is UML?: Do I Need UML?Dokument8 SeitenWhat Is UML?: Do I Need UML?vinaymadireddyNoch keine Bewertungen

- 1900Dokument14 Seiten1900Abhijit ModakNoch keine Bewertungen

- Metastock FormulaDokument52 SeitenMetastock FormulaMr. YILDIZNoch keine Bewertungen

- GYERTYÁK8 - Inverted Hammer Candlestick Pattern DictionaryDokument5 SeitenGYERTYÁK8 - Inverted Hammer Candlestick Pattern DictionaryTSXfx01Noch keine Bewertungen

- Long Lower Shadow: All Rights ReservedDokument5 SeitenLong Lower Shadow: All Rights ReservedMr. YILDIZNoch keine Bewertungen

- ProfitX CandlesDokument27 SeitenProfitX CandlesDickson MakoriNoch keine Bewertungen

- 26086130294Dokument2 Seiten26086130294Whales CallNoch keine Bewertungen

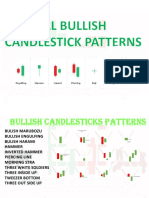

- All Bullish Candlestick Pattern by Optrading00 Telegram Optrading00Dokument25 SeitenAll Bullish Candlestick Pattern by Optrading00 Telegram Optrading00Samitm TamhankarNoch keine Bewertungen

- Candel Stick Pattern All SingleDokument26 SeitenCandel Stick Pattern All SinglergautomobilesstockNoch keine Bewertungen

- Duminda BookDokument48 SeitenDuminda BookThusitha HettiarachchiNoch keine Bewertungen

- FractalDokument55 SeitenFractalNarendra BholeNoch keine Bewertungen