Beruflich Dokumente

Kultur Dokumente

HDFC Bank LTD.: Profit and Loss A/C

Hochgeladen von

sureshkarnaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

HDFC Bank LTD.: Profit and Loss A/C

Hochgeladen von

sureshkarnaCopyright:

Verfügbare Formate

HDFC Bank Ltd.

Balance Sheet

Rs. Cr

Period & months 2009/03 2008/03 2007/03 2006/03 2005/03

CAPITAL & LIABILITIES

Owned Funds

Equity Share Capital 425.38 354.43 319.39 313.14 309.88

Share Application Money 400.92 0.00 0.00 0.07 0.43

Preferential Share Capital 0.00 0.00 0.00 0.00 0.00

Reserves & Surplus 14,226.43 11,142.80 6,113.76 4,986.39 4,209.97

Loan Funds

Deposits 142,811.58 100,768.60 68,297.94 55,796.82 36,354.25

Borrowings made by the bank 2,685.84 4,478.86 2,815.39 4,560.48 5,290.01

TOTAL 160,550.15 116,744.69 77,546.48 65,656.90 46,164.54

ASSETS

Cash & Balances with RBI 13,527.21 12,553.18 5,182.48 3,306.61 2,650.13

Money at call and Short Notice 3,979.41 2,225.16 3,971.40 3,612.39 1,823.87

Investments 58,817.55 49,393.54 30,564.80 28,393.96 19,349.81

Advances 98,883.05 63,426.90 46,944.78 35,061.26 25,566.30

Fixed Assets

Gross Block 3,956.63 2,386.99 1,917.56 1,589.47 1,290.51

Accumulated Depreciation 2,249.90 1,211.86 950.89 734.39 582.19

Less: Revaluation Reserve 0.00 0.00 0.00 0.00 0.00

Net Block 1,706.73 1,175.13 966.67 855.08 708.32

Capital Work-in-progress 0.00 0.00 0.00 0.00 0.00

Net Current Assets 6,356.83 4,402.69 3,605.48 2,277.09 1,330.57

Miscellaneous Expenses not written off 0.00 0.00 0.00 0.00 0.00

TOTAL 160,550.15 116,744.69 77,546.48 65,656.90 46,164.54

Number of Equity shares outstanding (Cr.) 42.54 35.44 31.94 31.31 30.99

Bonus component in Equity Capital 0.00 0.00 0.00 0.00 0.00

Notes:

Contingent liabilities 414,533.93 599,928.79 209,338.61 144,137.86 89,928.65

Book Value of Unquoted Investments 0.00 0.00 0.00 0.00 0.00

Market Value of Quoted Investments

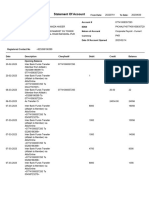

PROFIT AND LOSS A/C

HDFC Bank Ltd.

Half - yearly results

Rs. Cr

year 2009/09 2008/09 var 2009/03 2008/03 var 2009/03 2008/03 Var

period 1st Half 1st Half % 2nd Half 2nd Half % Full Year Full Year %

Sales Income 8,084.99 7,612.94 6.20 8,719.33 5,683.08 53.43 16,332.27 10,115.00 61.47

Other Income 2,051.05 1,236.53 65.87 2,054.08 1,228.23 67.24 3,290.61 2,283.15 44.13

Total Expenditure 4,003.70 3,366.59 18.92 4,045.93 3,041.13 33.04 7,412.52 5,230.40 41.72

Interest 4,273.65 4,023.02 6.23 4,888.08 2,603.40 87.76 8,911.10 4,887.12 82.34

Gross Profit 3,111.65 2,150.36 44.70 3,028.60 2,155.05 40.54 5,178.96 3,765.41 37.54

Depreciation 0.00 0.00 NA 0.00 0.00 NA 0.00 0.00 NA

Tax Charges 565.12 467.53 20.87 586.78 366.31 60.19 1,054.31 690.45 52.70

Extra Ordinary Items 0.00 0.00 NA 0.00 0.00 NA 0.00 0.00 NA

Reported PAT 1,293.57 992.33 30.36 1,252.62 900.47 39.11 2,244.95 1,590.18 41.18

Prior Year Adjustment 0.00 0.00 NA 0.00 0.00 NA 0.00 0.00 NA

Reswritten Back 0.00 0.00 NA 0.00 0.00 NA 0.00 0.00 NA

Equity Capital 427.36 425.03 0.55 425.38 354.43 20.02 425.38 354.43 20.02

Res & Surplus 0.00 0.00 NA 0.00 0.00 NA 14,220.95 1,142.80 1,144.40

QUARTERLY

HDFC Bank Ltd.

Rs. cr

Quarter ended Year ended

year 2009/09 2008/09 var % 2009/03 2008/03 var %

Sales Income 3,991.89 3,991.21 0.02 16,332.27 10,115.00 61.47

Other Income 1,007.40 643.11 56.65 3,290.61 2,283.15 44.13

Expenditure 1,964.30 1,732.74 13.36 7,412.52 5,230.40 41.72

Interest 2,036.13 2,124.76 -4.17 8,911.10 4,887.12 82.34

Gross Profit 1,593.00 1,122.85 41.87 5,178.96 3,765.41 37.54

Depreciation 0.00 0.00 0.00 0.00 0.00 0.00

Tax 311.40 248.84 25.14 1,054.31 690.45 52.70

PAT 687.46 527.98 30.21 2,244.95 1,590.18 41.18

Equity 427.36 425.03 0.55 425.38 354.43 20.02

OPM (%) 50.79 56.59 -5.80 54.61 48.29 6.32

GPM (%) -0.21 3.35 -3.56 0.05 -0.02 0.07

NPM (%) 17.22 13.22 4.00 13.74 15.72 -1.98

ANDHRA BANK

Andhra Bank

Balance Sheet

Rs. cr

Period & months 2009/03 2008/03 2007/03 2006/03 2005/03

CAPITAL & LIABILITIES

Owned Funds

Equity Share Capital 485.00 485.00 485.00 485.00 400.00

Share Application Money 0.00 0.00 0.00 0.00 0.00

Preferential Share Capital 0.00 0.00 0.00 0.00 0.00

Reserves & Surplus 3,161.99 2,764.29 2,671.28 2,408.94 1,437.00

Loan Funds

Deposits 59,390.02 49,436.55 41,454.02 33,922.41 27,550.71

Borrowings made by the bank 1,311.23 590.51 733.53 758.49 983.24

TOTAL 64,348.25 53,276.35 45,343.84 37,574.85 30,370.95

ASSETS

Cash & Balances with RBI 4,853.34 4,901.67 2,949.06 3,860.71 2,073.93

Money at call and Short Notice 434.16 792.65 1,075.12 1,278.69 1,449.36

Investments 16,911.11 14,898.24 14,300.72 11,444.15 10,646.28

Advances 44,139.26 34,238.38 27,889.07 22,100.43 17,516.84

Fixed Assets

Gross Block 778.32 600.73 545.65 504.85 450.85

Accumulated Depreciation 455.73 399.57 353.31 312.10 263.57

Less: Revaluation Reserve 0.00 0.00 0.00 0.00 0.00

Net Block 322.59 201.16 192.34 192.75 187.28

Capital Work-in-progress 12.71 18.30 0.00 0.00 0.00

Net Current Assets 1,796.04 1,541.99 1,134.69 1,792.61 854.99

Miscellaneous Expenses not written off 0.00 0.00 0.00 0.00 0.00

TOTAL 64,348.25 53,276.35 45,343.84 37,574.85 30,370.95

Number of Equity shares outstanding (Cr.) 48.50 48.50 48.50 48.50 40.00

Bonus component in Equity Capital 0.00 0.00 0.00 0.00 0.00

Notes:

Contingent liabilities 35,352.06 22,408.50 23,949.22 26,304.35 18,312.24

Book Value of Unquoted Investments 0.00 0.00 0.00 0.00 0.00

Market Value of Quoted Investments 0.00 0.00 0.00 0.00 0.00

Period & months 2009/03

CAPITAL & LIABILITIES

Owned Funds

Equity Share Capital 425.38

Share Application Money 400.92

Preferential Share Capital 0

Reserves & Surplus 14,226.43

Loan Funds

Deposits 142,811.58

Borrowings made by the bank 2,685.84

TOTAL 160,550.15

ASSETS

Cash & Balances with RBI 13,527.21

Money at call and Short Notice 3,979.41

Investments 58,817.55

Advances 98,883.05

Fixed Assets

Gross Block 3,956.63

Accumulated Depreciation 2,249.90

Less: Revaluation Reserve 0

Net Block 1,706.73

Capital Work-in-progress 0

Net Current Assets 6,356.83

Miscellaneous Expenses not

written off 0

TOTAL 160,550.15

Number of Equity shares

outstanding (Cr.) 42.54

Bonus component in Equity

Capital 0

Notes:

Contingent liabilities 414,533.93

Book Value of Unquoted

Investments 0

Das könnte Ihnen auch gefallen

- Finance Satyam AnalysisDokument12 SeitenFinance Satyam AnalysisNeha AgarwalNoch keine Bewertungen

- ITM MaricoDokument8 SeitenITM MaricoAdarsh ChaudharyNoch keine Bewertungen

- CV Assignment - Agneesh DuttaDokument9 SeitenCV Assignment - Agneesh DuttaAgneesh DuttaNoch keine Bewertungen

- ICICI Bank Is IndiaDokument6 SeitenICICI Bank Is IndiaHarinder PalNoch keine Bewertungen

- Balance Sheet - in Rs. Cr.Dokument72 SeitenBalance Sheet - in Rs. Cr.sukesh_sanghi100% (1)

- Balance Sheet of Allahabad BankDokument26 SeitenBalance Sheet of Allahabad BankMemoona RizviNoch keine Bewertungen

- Financial Modelling CIA 2Dokument45 SeitenFinancial Modelling CIA 2Saloni Jain 1820343Noch keine Bewertungen

- Ratio Analysis Tata MotorsDokument8 SeitenRatio Analysis Tata MotorsVivek SinghNoch keine Bewertungen

- Cash Flow of ICICI Bank - in Rs. Cr.Dokument12 SeitenCash Flow of ICICI Bank - in Rs. Cr.Neethu GesanNoch keine Bewertungen

- Indian Oil Corpn. LTD.: Balance Sheet Rs. Crore Mar-95 Mar-96 Mar-97 Mar-98 Mar-99 Assets Gross Fixed AssetsDokument15 SeitenIndian Oil Corpn. LTD.: Balance Sheet Rs. Crore Mar-95 Mar-96 Mar-97 Mar-98 Mar-99 Assets Gross Fixed AssetsrathneshkumarNoch keine Bewertungen

- Company Info - Print FinancialsDokument2 SeitenCompany Info - Print FinancialsDivya PandeyNoch keine Bewertungen

- Balance Sheet of DR Reddys Laboratories: - in Rs. Cr.Dokument14 SeitenBalance Sheet of DR Reddys Laboratories: - in Rs. Cr.Anand MalashettiNoch keine Bewertungen

- Data of BhartiDokument2 SeitenData of BhartiAnkur MehtaNoch keine Bewertungen

- CV Assignment - Agneesh DuttaDokument14 SeitenCV Assignment - Agneesh DuttaAgneesh DuttaNoch keine Bewertungen

- HTTP WWW - MoneycontrolDokument1 SeiteHTTP WWW - MoneycontrolPavan PoliNoch keine Bewertungen

- Balance Sheet of Reliance Communications: - in Rs. Cr.Dokument4 SeitenBalance Sheet of Reliance Communications: - in Rs. Cr.Nanvinder SinghNoch keine Bewertungen

- Company Info - Print FinancialsDokument2 SeitenCompany Info - Print FinancialsDhruv NarangNoch keine Bewertungen

- Balance Sheet of State Bank of IndiaDokument5 SeitenBalance Sheet of State Bank of Indiakanishtha1Noch keine Bewertungen

- Balance Sheet of TCSDokument8 SeitenBalance Sheet of TCSSurbhi LodhaNoch keine Bewertungen

- Balance Sheet of TCSDokument8 SeitenBalance Sheet of TCSAmit LalchandaniNoch keine Bewertungen

- CHAPTER - 4 Data Analysis and InterpretationDokument12 SeitenCHAPTER - 4 Data Analysis and InterpretationSarva ShivaNoch keine Bewertungen

- Term Paper Sandeep Anurag GautamDokument13 SeitenTerm Paper Sandeep Anurag GautamRohit JainNoch keine Bewertungen

- (XI) Bibliography and AppendixDokument5 Seiten(XI) Bibliography and AppendixSwami Yog BirendraNoch keine Bewertungen

- State Bank of India: Balance SheetDokument9 SeitenState Bank of India: Balance SheetKatta AshishNoch keine Bewertungen

- Surajit SahaDokument30 SeitenSurajit SahaAgneesh DuttaNoch keine Bewertungen

- Financial+Statements+ +Maruti+Suzuki+&+Tata+MotorsDokument5 SeitenFinancial+Statements+ +Maruti+Suzuki+&+Tata+MotorsApoorv GuptaNoch keine Bewertungen

- Consolidated Profit CanarabankDokument1 SeiteConsolidated Profit CanarabankMadhav LuthraNoch keine Bewertungen

- Ceat Balance SheetDokument2 SeitenCeat Balance Sheetkcr kc100% (2)

- ABB India: PrintDokument2 SeitenABB India: PrintAbhay Kumar SinghNoch keine Bewertungen

- Project On SbiDokument4 SeitenProject On Sbijini03Noch keine Bewertungen

- IciciDokument9 SeitenIciciChirdeep PareekNoch keine Bewertungen

- Balance Sheet of Essar Oil: - in Rs. Cr.Dokument7 SeitenBalance Sheet of Essar Oil: - in Rs. Cr.sonalmahidaNoch keine Bewertungen

- Finance Project On ITC (Statement Analysis)Dokument2 SeitenFinance Project On ITC (Statement Analysis)jigar jainNoch keine Bewertungen

- Analysis of Financial StatementsDokument7 SeitenAnalysis of Financial StatementsGlen ValereenNoch keine Bewertungen

- Profit Loss AccountDokument8 SeitenProfit Loss AccountAbhishek JenaNoch keine Bewertungen

- Financial Analysis (HAL) FinalDokument22 SeitenFinancial Analysis (HAL) FinalAbhishek SoniNoch keine Bewertungen

- Company Info - Print FinancialsDokument2 SeitenCompany Info - Print FinancialsPreethaNoch keine Bewertungen

- Balance Sheet of Gitanjali GemsDokument5 SeitenBalance Sheet of Gitanjali GemsHarold GeorgeNoch keine Bewertungen

- 11 - Eshaan Chhagotra - Maruti Suzuki Ltd.Dokument8 Seiten11 - Eshaan Chhagotra - Maruti Suzuki Ltd.rajat_singlaNoch keine Bewertungen

- Balance Sheet of Cipla 1Dokument6 SeitenBalance Sheet of Cipla 1anjalipawaskarNoch keine Bewertungen

- Group 1 Adani PortsDokument12 SeitenGroup 1 Adani PortsshreechaNoch keine Bewertungen

- Sbi Banlce SheetDokument1 SeiteSbi Banlce SheetANIKET VISHWANATH KURANENoch keine Bewertungen

- MKT Ca1Dokument96 SeitenMKT Ca1Nainpreet KaurNoch keine Bewertungen

- Print: Previous YearsDokument2 SeitenPrint: Previous YearsArun BineshNoch keine Bewertungen

- Balance SheetDokument2 SeitenBalance SheetSachin SinghNoch keine Bewertungen

- Axis Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of Axis Bank - BSE: 532215, NSE: AXISBANKDokument2 SeitenAxis Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of Axis Bank - BSE: 532215, NSE: AXISBANKr79qwkxcfjNoch keine Bewertungen

- Balance Sheet of Jet AirwaysDokument2 SeitenBalance Sheet of Jet Airwaysakhilesh718Noch keine Bewertungen

- Balance Sheet of Apollo Tyres2010Dokument2 SeitenBalance Sheet of Apollo Tyres2010shivamgupt18Noch keine Bewertungen

- Cipla Balance SheetDokument2 SeitenCipla Balance SheetNEHA LAL100% (1)

- Vodafone Idea Limited: PrintDokument2 SeitenVodafone Idea Limited: PrintPrakhar KapoorNoch keine Bewertungen

- Ashok Leyland Balane SheetDokument2 SeitenAshok Leyland Balane SheetNaresh Kumar NareshNoch keine Bewertungen

- Balance Sheet of State Bank of IndiaDokument9 SeitenBalance Sheet of State Bank of IndiaSnehal TanksaleNoch keine Bewertungen

- JSW Steel LimitedDokument35 SeitenJSW Steel LimitedNeha SinghNoch keine Bewertungen

- Wipro: Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05 Mar ' 04 Owner's FundDokument4 SeitenWipro: Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05 Mar ' 04 Owner's FundManikantha PatnaikNoch keine Bewertungen

- Consolidated Balance Sheet: Wipro TCS InfosysDokument4 SeitenConsolidated Balance Sheet: Wipro TCS Infosysvineel kumarNoch keine Bewertungen

- Dion Global Solutions Limited: SourceDokument1 SeiteDion Global Solutions Limited: SourceAnonymous aHLT8NNoch keine Bewertungen

- Hindustan Unilever LTD Industry:Personal Care - MultinationalDokument17 SeitenHindustan Unilever LTD Industry:Personal Care - MultinationalZia AhmadNoch keine Bewertungen

- Titan Balance-SheetDokument2 SeitenTitan Balance-SheetDt.vijaya ShethNoch keine Bewertungen

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionVon EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionBewertung: 5 von 5 Sternen5/5 (1)

- Report of Checks Issued 2023Dokument1 SeiteReport of Checks Issued 2023Jahzeel RubioNoch keine Bewertungen

- STD 11 Business Studies ModelDokument2 SeitenSTD 11 Business Studies ModelArs BokaroNoch keine Bewertungen

- Annexure A (Excel)Dokument108 SeitenAnnexure A (Excel)Sanjana JaiswalNoch keine Bewertungen

- Practice Set Quasi Reorganization - QUESTIONNAIREDokument2 SeitenPractice Set Quasi Reorganization - QUESTIONNAIREJERICO RAMOSNoch keine Bewertungen

- Application and Declaration For Account Opening Form: Borang Permohonan Dan Perakuan Membuka AkaunDokument6 SeitenApplication and Declaration For Account Opening Form: Borang Permohonan Dan Perakuan Membuka Akaunjin862100% (1)

- Assignment On International TradeDokument3 SeitenAssignment On International TradeMark James GarzonNoch keine Bewertungen

- ch15 MCDokument26 Seitench15 MCWed CornelNoch keine Bewertungen

- 001I7D7441643896296Dokument1 Seite001I7D7441643896296Shamantha ManiNoch keine Bewertungen

- Statement of AccountDokument7 SeitenStatement of AccountHamza CollectionNoch keine Bewertungen

- P2 07Dokument3 SeitenP2 07rietzhel22Noch keine Bewertungen

- IAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDokument3 SeitenIAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsMarc Eric RedondoNoch keine Bewertungen

- Engineering EconomyDokument19 SeitenEngineering EconomyGreg Calibo LidasanNoch keine Bewertungen

- Warm Fuzz Cards CaseDokument2 SeitenWarm Fuzz Cards CaseVeeranjaneyulu KacherlaNoch keine Bewertungen

- Cfas Millan 2020 Answer KeyDokument193 SeitenCfas Millan 2020 Answer KeyPEBIDA, DAVERLY N.Noch keine Bewertungen

- Lecture 5Dokument1 SeiteLecture 5JohnNoch keine Bewertungen

- Pre ClosestatementDokument2 SeitenPre Closestatementkhurafaat inNoch keine Bewertungen

- Neil Garfield - Expert or Bozo?Dokument44 SeitenNeil Garfield - Expert or Bozo?Bob Hurt50% (2)

- PA Sample MCQs 2Dokument15 SeitenPA Sample MCQs 2ANH PHẠM QUỲNHNoch keine Bewertungen

- SM1001904 Chapter-5 Caselets PDFDokument4 SeitenSM1001904 Chapter-5 Caselets PDFsai bhargavNoch keine Bewertungen

- Pamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoDokument5 SeitenPamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoLyca SorianoNoch keine Bewertungen

- Lecture Outline: Share-Based Compensation and Earnings Per ShareDokument3 SeitenLecture Outline: Share-Based Compensation and Earnings Per ShareFranz AppleNoch keine Bewertungen

- Borrowing Costs - Assignment - For PostingDokument1 SeiteBorrowing Costs - Assignment - For Postingemman neriNoch keine Bewertungen

- Manufacturing Account Worked Example Question 8Dokument7 SeitenManufacturing Account Worked Example Question 8Roshan RamkhalawonNoch keine Bewertungen

- BUS 330 Exam 1 - Fall 2012 (B) - SolutionDokument14 SeitenBUS 330 Exam 1 - Fall 2012 (B) - SolutionTao Chun LiuNoch keine Bewertungen

- Basic Property Cashflow SimulatorDokument2 SeitenBasic Property Cashflow SimulatorBen BieberNoch keine Bewertungen

- AmazonFile 0Dokument2 SeitenAmazonFile 0chawllarohitNoch keine Bewertungen

- Banker Customer Relationship - Exam2 PDFDokument3 SeitenBanker Customer Relationship - Exam2 PDFrahulpatel1202Noch keine Bewertungen

- ChatGPT 18Dokument2 SeitenChatGPT 18ashaykosare.007Noch keine Bewertungen

- Handbook Governmental Accounting - CompressedDokument552 SeitenHandbook Governmental Accounting - CompressedJuli Tri anantaNoch keine Bewertungen

- Rules Governing Acceptance of Fixed Deposit: Kerala Transport Development Finance Corporation LimitedDokument2 SeitenRules Governing Acceptance of Fixed Deposit: Kerala Transport Development Finance Corporation LimitedemilsonusamNoch keine Bewertungen