Beruflich Dokumente

Kultur Dokumente

PhilHealth Revised Employer Remittance Report-RF-1 PDF

Hochgeladen von

Yvan Jackson Marquez NacionalesOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

PhilHealth Revised Employer Remittance Report-RF-1 PDF

Hochgeladen von

Yvan Jackson Marquez NacionalesCopyright:

Verfügbare Formate

This form maybe reproduced and is NOT FOR SALE

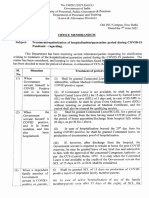

Republic of the Philippines

PHILIPPINE HEALTH INSURANCE CORPORATION

Healthline 441-7444 www.philhealth.gov.ph

THIS PORTION TO BE FILLED UP BY PHILHEALTH

EMPLOYERS REMITTANCE REPORT

Revised January 2012

By:

EMPLOYER TIN

2

Action Taken:

Date Received:

PHILHEALTH NO.

Signature Over Printed Name

3

COMPLETE EMPLOYER NAME

EMPLOYER TYPE

REPORT TYPE

PRIVATE

REGULAR RF-1

GOVERNMENT

ADDITION TO PREVIOUS RF-1

HOUSEHOLD

DEDUCTION TO PREVIOUS RF-1

APPLICABLE

PERIOD

COMPLETE MAILING ADDRESS

TELEPHONE NO.

EMAIL ADDRESS

EMPLOYEE/S INFORMATION

PHILHEALTH IDENTIFICATION NUMBER

(PIN)

LAST NAME

NAME

SUFFIX

FIRST NAME

Fill-out this portion only if

declared employee/s has not

yet been issued his/her PIN

MIDDLE NAME

DATE OF BIRTH

SEX

(mm-dd-yyyy)

(M/F)

MONTHLY

SALARY

BRACKET

(MSB)

10

NHIP PREMIUM

CONTRIBUTION

PS

ES

11 EMPLOYEE STATUS

S-Separated, NE-No Earnings,

NH-Newly Hired /

Effectivity Date

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

12

13

14

ACKNOWLEDGEMENT RECEIPT (PAR/POR/TRANSACTION REFERENCE NO.)

APPLICABLE PERIOD

REMITTED AMOUNT

ACKNOWLEDGEMENT

RECEIPT NO.

TRANSACTION DATE

NO. OF EMPLOYEES

Indicate Total Number of

employees per page

SUBTOTAL

15

(PS + ES)

(To be accomplished on every page)

GRAND TOTAL

PREPARED BY:

SIGNATURE OVER PRINTED NAME

(PS + ES)

OFFICIAL DESIGNATION

(To be accomplished on every page)

16

DATE

UNDER THE PENALTY OF THE LAW, I HEREBY ATTEST THAT THE ABOVE INFORMATIONS PROVIDED HEREIN ARE TRUE AND CORRECT.

Signature over printed name

Official Designation

Date

PLEASE READ INSTRUCTIONS ( FOR EACH NUMBERED BOX) AT THE BACK BEFORE ACCOMPLISHING THIS FORM

17

PAGE

OF

PAGES

INSTRUCTIONS

NHIP MONTHLY PREMIUM CONTRIBUTION SCHEDULE

MSB

BOX 1

Write the complete PHILHEALTH NUMBER and EMPLOYER TIN in corresponding boxes. If without PEN, the employer shall be required to attach duly

accomplished ER1 form and any of the following documents, Whichever is applicable to facilitate registration and PEN issuance:

P 4,999.99 and below

Salary Base

(SB)

Monthly Salary Range

P

1. Business License Permit for Single Proprietorship

5,000.00 to 5,999.99

4,000.00

5,000.00

2. SEC Registration for a partnership and Corporation

6,000.00 to 6,999.99

3. License to Operate for all employees

4

5

BOX 2

Write the COMPLETE Employer Name, Mailing Address , Telephone Number and Email Address ( DO NOT ABBREVIATE).

BOX 3

Check applicable box for the EMPLOYER TYPE.

BOX 4

Total Monthly

Contribution

P

100.00

Personal

Share (PS)

P

50.00

Employer

Share (ES)

P

50.00

125.00

62.50

62.50

6,000.00

150.00

75.00

75.00

7,000.00 to 7,999.99

7,000.00

175.00

87.50

87.50

8,000.00 to 8,999.99

8,000.00

200.00

100.00

100.00

9,000.00 to 9,999.99

9,000.00

225.00

112.50

112.50

10,000.00 to 10,999.99

10,000.00

250.00

125.00

125.00

Check the applicable box for the REPORT TYPE. For adjustment on remittance report on previous month, use a separate RF1 form and check the box

corresponding to Addition to Previous RF1 or Deduction to Previous RF1 as the case maybe. Write only the names of the employees with

erroneous contributions and the difference between the correct amount and the amount that was previously reported. If an underpayment results due to

correction, please remit the amount due to PhilHealth. Use separated/different sets of RF1 form for each month when reporting previous payments or

late payments made on previous month(s).

11,000.00 to 11,999.99

11,000.00

275.00

137.50

137.50

12,000.00 to 12,999.99

12,000.00

300.00

150.00

150.00

10

13,000.00 to 13,999.99

13,000.00

325.00

162.50

162.50

11

14,000.00 to 14,999.99

14,000.00

350.00

175.00

175.00

Always indicate the applicable month and year of premium contributions paid. The month and year coverage in the RF1 should correspond with the

month and year coverage indicated in the PAR/POR/Transaction Reference No.

12

15,000.00 to 15,999.99

15,000.00

375.00

187.50

187.50

13

14

16,000.00 to 16,999.99

16,000.00

400.00

200.00

200.00

17,000.00 to 17,999.99

17,000.00

425.00

212.50

212.50

15

18,000.00 to 18,999.99

18,000.00

450.00

225.00

225.00

16

19,000.00 to 19,999.99

19,000.00

475.00

237.50

237.50

17

20,000.00 to 20,999.99

20,000.00

500.00

250.00

250.00

18

21,000.00 to 21,999.99

21,000.00

525.00

262.50

262.50

19

22,000.00 to 22,999.99

22,000.00

550.00

275.00

275.00

20

23,000.00 to 23,999.99

23,000.00

575.00

287.50

287.50

In case that the employee/s listed in the submitted RF1 has not yet been issued his/her permanent PIN, indicate his/her DATE OF BIRTH and SEX in the

column provided to facilitate the immediate generation of PIN. Else, if he/she already has a PIN leave the column blank and indicate his/her PIN in box

no. 6.

21

24,000.00 to 24,999.99

24,000.00

600.00

300.00

300.00

22

25,000.00 to 25,999.99

25,000.00

625.00

312.50

312.50

23

26,000.00 to 26,999.99

26,000.00

650.00

325.00

325.00

Indicate your employees respective MONTHLY SALARY BRACKET (MSB) corresponding to the MONTHLY SALARY RANGE where the employees monthly

salary falls. Please refer to the NHIP MONTHLY PREMIUM CONTRIBUTION SCHEDULE for your reference. Corresponding MSB left accomplished shall

mean that the employees compensation for the particular period shall belong to the highest bracket.

24

27,000.00 to 27,999.99

27,000.00

675.00

337.50

337.50

25

28,000.00 to 28,999.99

28,000.00

700.00

350.00

350.00

26

29,000.00 to 29,999.99

29,000.00

725.00

362.50

362.50

BOX 10 Indicate the corresponding PERSONAL SHARE (PS) and EMPLOYER SHARE (ES) on the boxes provided for each remittance. The Total Premium

Contribution (PS + ES) for the month must fall within the prescribed bracket.

27

30,000.00 and up

30,000.00

750.00

375.00

375.00

BOX 5

BOX 6

BOX 7

BOX 8

BOX 9

Indicate the corresponding PHILHEALTH IDENTIFICATION NO. (PIN) opposite the respective names of your employees. For updating of member data

record and/or declaration of dependents, require the employee/s to submit the properly accomplished PhilHealth Member Registration Form (PMRF)

including the supporting document/s and the same shall to PhilHealth Regional/Branch Offices together with the ER2 duly signed by the employer.

Print names of Employees in alphabetical order; write Last Name; First Name and Middle Name as they pronounced. For instance, the names JULIAN

SALVADOR DELA CRUZ; LILIA BERNARDO DELOS SANTOS and MARIA LAGDAMEO DE GUIA should be written as DELA CRUZ, JULIAN SALVADOR; DELOS

SANTOS, LILIA BERNARDO and DE GUIA, MARIA LAGDAMEO; also, names with suffixes such as Jr., Sr., III, etc. should always be written after the last

name. do not skip lines when listing down their names. Write NOTHING FOLLOWS on the line immediately following the last listed employee.

BOX 11 In the EMPLOYEE STATUS column indicate the S if the employee is Separated, NE if with No Earnings and NH if employee is Newly Hired. As

such, supply the Date of effectivity in the column provided.

BOX 12 Indicate total number of employee/s listed in the submitted RF1. Ensure that the total number of employees listed in box no. 7 shall correspond to

the number of employees in box no. 12.

BOX 13 Supply needed information on the ACKNOWLEDGEMENT RECEIPT (PAR/POR/Transaction Reference No. ) boxes. Indicate in the corresponding box

the Applicable Period, Remitted Amount, Acknowledgement Receipt No., Transaction Date and Number of Employees (to be filledup on every pages).

BOX 14 Add all contribution in the PERSONAL SHARE (PS) column and EMPLOYER SHARE (ES) column, for each month and reflect the sum in the SUBTOTAL box

for each page. Consequently, add all subtotals/page totals and reflect the sum in the GRAND TOTAL box in the last sheet of the accomplished RF1 to

indicate total amount of contributions paid for the applicable month.

BOX 15 Affix signature over complete printed name of the authorized officer preparing the report, his/her official designation and date.

BOX 16 Affix signature over complete printed name of the authorized officer certifying the report, his/her designation and date.

BOX 17 Always indicate page number and total number of pages at each of the form.

COPY DISTRIBUTION

Form

RF1

PAR

3rd

4th

1st

2nd

PHIC

PAYOR

PAYOR

COLLECTING AGENTS

COPY

PHIC

PHIC

No. of Copies

DEADLINE OF SUBMISSION OF FORMS

Every 15th day after the applicable month

Submit Original Copy of this duly accomplished form with the corresponding copies of the validated PAR/POR/

Transaction Reference No. to the Collection Section of the respective NCRService Offices for payors within the

NCR or to Service Offices (SOs)/PhilHealth Regional Offices (PROs) for payors outside NCR. Deadline of payment

contributions shall be on the 10th day after the applicable month. The submission of Monthly Reports are due on

the 15th day after the applicable month. Employers who fail to comply with the above requirements shall be

subjected to the penalties provided under Article X, R.A.7875

Das könnte Ihnen auch gefallen

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsVon EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNoch keine Bewertungen

- Philhealth RF1-Employer RemittanceDokument2 SeitenPhilhealth RF1-Employer RemittanceAimee F100% (3)

- Business Financial Information Secrets: How a Business Produces and Utilizes Critical Financial InformationVon EverandBusiness Financial Information Secrets: How a Business Produces and Utilizes Critical Financial InformationNoch keine Bewertungen

- Philhealth rf1 PDFDokument2 SeitenPhilhealth rf1 PDFDimitri Irtimid100% (1)

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersVon EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNoch keine Bewertungen

- PhilHealth Revised Employer Remittance Report-RF-1Dokument2 SeitenPhilHealth Revised Employer Remittance Report-RF-1Grace GayonNoch keine Bewertungen

- Philhealth rf-1Dokument2 SeitenPhilhealth rf-1Suzette SubicoNoch keine Bewertungen

- 1040 Exam Prep: Module II - Basic Tax ConceptsVon Everand1040 Exam Prep: Module II - Basic Tax ConceptsBewertung: 1.5 von 5 Sternen1.5/5 (2)

- rf1 - PhilhealthDokument6 Seitenrf1 - PhilhealthAngelica Radoc SansanNoch keine Bewertungen

- PHILHEALTH FormDokument2 SeitenPHILHEALTH Formketty04Noch keine Bewertungen

- Bureau of Internal Revenue Form 1604e 2016Dokument2 SeitenBureau of Internal Revenue Form 1604e 2016Lynnard Philip PanesNoch keine Bewertungen

- Pag IbigDokument3 SeitenPag IbigSharon Rillo Ofalda100% (1)

- The Risk Premium Factor: A New Model for Understanding the Volatile Forces that Drive Stock PricesVon EverandThe Risk Premium Factor: A New Model for Understanding the Volatile Forces that Drive Stock PricesNoch keine Bewertungen

- FPF060 Member'sContributionRemittance V01Dokument3 SeitenFPF060 Member'sContributionRemittance V01christine_balanagNoch keine Bewertungen

- ACC 105 Lesson 4 Assignment 1 3-11bDokument4 SeitenACC 105 Lesson 4 Assignment 1 3-11bJennifer BaileyNoch keine Bewertungen

- Pag-IBIG Data FormDokument2 SeitenPag-IBIG Data Formnelia_villarete3070Noch keine Bewertungen

- Employer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsDokument4 SeitenEmployer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsrobbickelNoch keine Bewertungen

- BIR Form 1604EDokument2 SeitenBIR Form 1604Ecld_tiger100% (2)

- Annual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxDokument2 SeitenAnnual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxAngela ArleneNoch keine Bewertungen

- PFF053 MembersContributionRemittanceForm V02-FillableDokument2 SeitenPFF053 MembersContributionRemittanceForm V02-FillableCYvelle TorefielNoch keine Bewertungen

- 1604 e 99Dokument4 Seiten1604 e 99ILubo AkNoch keine Bewertungen

- R 1aDokument2 SeitenR 1aJaniene SecuyaNoch keine Bewertungen

- FPF060 Membership Contributions Remittance Form (MCRF)Dokument2 SeitenFPF060 Membership Contributions Remittance Form (MCRF)Shirly33% (6)

- R 1a Social Security SystemDokument2 SeitenR 1a Social Security SystemCaroline TurlaNoch keine Bewertungen

- PHILFAST R-5 - Fill PDFDokument2 SeitenPHILFAST R-5 - Fill PDFChristopher SantiagoNoch keine Bewertungen

- Filling Instructions 03Dokument1 SeiteFilling Instructions 03Abdurrehman ShaheenNoch keine Bewertungen

- SLF017 ShortTermLoanRemittanceForm V01Dokument2 SeitenSLF017 ShortTermLoanRemittanceForm V01Ray Nan100% (8)

- Hayward Form 1Dokument2 SeitenHayward Form 1Anonymous ZRsuuxNcCNoch keine Bewertungen

- Guidelines 1702-EX June 2013Dokument4 SeitenGuidelines 1702-EX June 2013Julio Gabriel AseronNoch keine Bewertungen

- Employer's QUARTERLY Federal Tax Return: Part 1: Answer These Questions For This QuarterDokument4 SeitenEmployer's QUARTERLY Federal Tax Return: Part 1: Answer These Questions For This QuarterFrancis Wolfgang UrbanNoch keine Bewertungen

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDokument4 SeitenEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterTony MillerNoch keine Bewertungen

- SSS R-5 Employer Payment ReturnDokument2 SeitenSSS R-5 Employer Payment ReturnJimzon Kristian JimenezNoch keine Bewertungen

- 941-SS For 2010:: Employer's QUARTERLY Federal Tax ReturnDokument4 Seiten941-SS For 2010:: Employer's QUARTERLY Federal Tax ReturnFrancis Wolfgang UrbanNoch keine Bewertungen

- Judgement Lein FormDokument4 SeitenJudgement Lein Formlizako100% (2)

- Cra (2) DddaDokument14 SeitenCra (2) DddadulmasterNoch keine Bewertungen

- SSS RS - 5Dokument1 SeiteSSS RS - 5Anid AzertsedNoch keine Bewertungen

- Explanatory Notes TF2011 2Dokument16 SeitenExplanatory Notes TF2011 2Ili AmirahNoch keine Bewertungen

- F 941 SsDokument4 SeitenF 941 SsBilboDBagginsNoch keine Bewertungen

- How To Fill-Out BIR Form 1905Dokument11 SeitenHow To Fill-Out BIR Form 1905Jhon Michael VillafloresNoch keine Bewertungen

- SSS R5 - AdmiralDokument6 SeitenSSS R5 - AdmiralKaye LadsNoch keine Bewertungen

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDokument4 SeitenEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterpdizypdizyNoch keine Bewertungen

- Periodic Employment Final FormDokument2 SeitenPeriodic Employment Final FormamirmaherNoch keine Bewertungen

- F Ss'Philippine Health Insurance Corporation) (@ "1" : Philhealth CircularDokument3 SeitenF Ss'Philippine Health Insurance Corporation) (@ "1" : Philhealth CircularJo Anne LayugNoch keine Bewertungen

- Contributions Payment Form-SSSDokument6 SeitenContributions Payment Form-SSSrhev63% (8)

- Period Covered Filing DeadlineDokument10 SeitenPeriod Covered Filing DeadlineHaftari HarmiNoch keine Bewertungen

- SSS Form Salary LoanDokument4 SeitenSSS Form Salary LoanMikoy Lacson100% (4)

- Pagibig - FormDokument2 SeitenPagibig - FormTiffany Malata100% (3)

- Form 1099Dokument6 SeitenForm 1099Joe LongNoch keine Bewertungen

- AC Energy Corporation June 30, 2021 Interim Consolidated FS SignedDokument138 SeitenAC Energy Corporation June 30, 2021 Interim Consolidated FS SignedRomnick Dela Cruz GasparNoch keine Bewertungen

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDokument4 SeitenEmployer's Annual Federal Unemployment (FUTA) Tax ReturnKaradi KuttiNoch keine Bewertungen

- DepEd Teachers Applicant CSC Form 212 Revised 2017Dokument6 SeitenDepEd Teachers Applicant CSC Form 212 Revised 2017Roy C. EstenzoNoch keine Bewertungen

- Online Filing of The Personal Income Tax Return by An Accredited PersonDokument2 SeitenOnline Filing of The Personal Income Tax Return by An Accredited PersondtoxidNoch keine Bewertungen

- Pag Ibig 1Dokument2 SeitenPag Ibig 1Fervi Louie Jalop Bongco0% (1)

- Inos Sss Contribution FormDokument6 SeitenInos Sss Contribution FormYeye TanNoch keine Bewertungen

- IRS Reporting Requirements Under The Affordable Care Act Is Your Business Ready?Dokument8 SeitenIRS Reporting Requirements Under The Affordable Care Act Is Your Business Ready?api-284589375Noch keine Bewertungen

- PFF053 Member'SContributionRemittanceForm V03Dokument12 SeitenPFF053 Member'SContributionRemittanceForm V03CA RosarioNoch keine Bewertungen

- F138 SecondaryDokument2 SeitenF138 SecondaryYvan Jackson Marquez NacionalesNoch keine Bewertungen

- PDA Dental ChartDokument4 SeitenPDA Dental ChartCyril Almario CunananNoch keine Bewertungen

- Bedarra Holdings, Inc.: Canlubang, LagunaDokument1 SeiteBedarra Holdings, Inc.: Canlubang, LagunaYvan Jackson Marquez NacionalesNoch keine Bewertungen

- F138-E Grade IV - VI DepEd BatangasDokument2 SeitenF138-E Grade IV - VI DepEd BatangasYvan Jackson Marquez Nacionales100% (1)

- KashmirDokument58 SeitenKashmirMahamnoorNoch keine Bewertungen

- Australia - Prison Police State - Thanks Anthony AlbaneseDokument40 SeitenAustralia - Prison Police State - Thanks Anthony AlbaneseLloyd T VanceNoch keine Bewertungen

- 2 PNOC v. Court of Appeals, 457 SCRA 32Dokument37 Seiten2 PNOC v. Court of Appeals, 457 SCRA 32Aivy Christine ManigosNoch keine Bewertungen

- 2023 Korean Honor Scholarship (KHS) GuidelinesDokument8 Seiten2023 Korean Honor Scholarship (KHS) GuidelinesBình NguyênNoch keine Bewertungen

- Hotel RwandaDokument1 SeiteHotel Rwandaapi-305331020Noch keine Bewertungen

- Credit MonitoringDokument20 SeitenCredit MonitoringMdramjanaliNoch keine Bewertungen

- Certified Patent Valuation Analyst - TrainingDokument8 SeitenCertified Patent Valuation Analyst - TrainingDavid WanetickNoch keine Bewertungen

- Tcode GTSDokument28 SeitenTcode GTSKishor BodaNoch keine Bewertungen

- Theme I-About EducationDokument4 SeitenTheme I-About EducationAlexandru VlăduțNoch keine Bewertungen

- Free Pattern Easy Animal CoasterDokument4 SeitenFree Pattern Easy Animal CoasterAdrielly Otto100% (2)

- Edimburgh TicDokument26 SeitenEdimburgh TicARIADNA2003Noch keine Bewertungen

- 06 - StreamUP & Umap User ManualDokument98 Seiten06 - StreamUP & Umap User ManualRené RuaultNoch keine Bewertungen

- Lecture No. 06 - Types of Business Ethics Academic ScriptDokument8 SeitenLecture No. 06 - Types of Business Ethics Academic ScriptShihab ChiyaNoch keine Bewertungen

- Language in India: Strength For Today and Bright Hope For TomorrowDokument24 SeitenLanguage in India: Strength For Today and Bright Hope For TomorrownglindaNoch keine Bewertungen

- Solicitor General Vs Metropolitan Manila Authority, 204 SCRA 837 (1991) - BernardoDokument1 SeiteSolicitor General Vs Metropolitan Manila Authority, 204 SCRA 837 (1991) - Bernardogeni_pearlc100% (1)

- Assignment - The Universal Declaration of Human RightsDokument5 SeitenAssignment - The Universal Declaration of Human RightsMarina PavlovaNoch keine Bewertungen

- Bangladesh Export Processing Zones AuthorityDokument16 SeitenBangladesh Export Processing Zones AuthoritySohel Rana SumonNoch keine Bewertungen

- Check2Dokument58 SeitenCheck2dreadpiratelynxNoch keine Bewertungen

- Week 13 - Local Government (Ra 7160) and DecentralizationDokument4 SeitenWeek 13 - Local Government (Ra 7160) and DecentralizationElaina JoyNoch keine Bewertungen

- Chapter 6 Financial AssetsDokument6 SeitenChapter 6 Financial AssetsAngelica Joy ManaoisNoch keine Bewertungen

- DoPT Guidelines On Treatment - Regularization of Hospitalization - Quarantine Period During COVID 19 PandemicDokument2 SeitenDoPT Guidelines On Treatment - Regularization of Hospitalization - Quarantine Period During COVID 19 PandemictapansNoch keine Bewertungen

- Brokenshire College: Form C. Informed Consent Assessment FormDokument2 SeitenBrokenshire College: Form C. Informed Consent Assessment Formgeng gengNoch keine Bewertungen

- Instructions & Commentary For: Standard Form of Contract For Architect's ServicesDokument65 SeitenInstructions & Commentary For: Standard Form of Contract For Architect's ServicesliamdrbrownNoch keine Bewertungen

- Samuel-659766347-Java Paragon Hotel and Residence-HOTEL - STANDALONEDokument3 SeitenSamuel-659766347-Java Paragon Hotel and Residence-HOTEL - STANDALONEsamuel chenNoch keine Bewertungen

- CH10 Finan Acc Long Term Liab LectDokument28 SeitenCH10 Finan Acc Long Term Liab LectAbdul KabeerNoch keine Bewertungen

- #Caracol Industrial Park Social and Gender Impacts of Year One of #Haiti's Newest IFI-funded Industrial ParkDokument46 Seiten#Caracol Industrial Park Social and Gender Impacts of Year One of #Haiti's Newest IFI-funded Industrial ParkLaurette M. BackerNoch keine Bewertungen

- EFPS Home - EFiling and Payment SystemDokument1 SeiteEFPS Home - EFiling and Payment SystemIra MejiaNoch keine Bewertungen

- Samaniego Vs AbenaDokument11 SeitenSamaniego Vs AbenaAlyssa Alee Angeles JacintoNoch keine Bewertungen

- HSE Policy Statement, SchlumbergerDokument1 SeiteHSE Policy Statement, SchlumbergerProf C.S.PurushothamanNoch keine Bewertungen

- Review - Phippine Arch Post WarDokument34 SeitenReview - Phippine Arch Post WariloilocityNoch keine Bewertungen