Beruflich Dokumente

Kultur Dokumente

Financial Performance of Banking Sector in Pakistan (A Study of Listed Banks On Karachi Stock Exchange)

Hochgeladen von

TI Journals PublishingOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Performance of Banking Sector in Pakistan (A Study of Listed Banks On Karachi Stock Exchange)

Hochgeladen von

TI Journals PublishingCopyright:

Verfügbare Formate

General Scientific Researches, Vol(2), No (1), December, 2014. pp.

1-12

TI Journals

ISSN:

General Scientific Researches

xxxx-xxxx

www.tijournals.com

Copyright 2014. All rights reserved for TI Journals.

Financial Performance of Banking Sector in Pakistan

(A Study of Listed Banks on Karachi Stock Exchange)

Muhammad Zamrad *

Student of MBA (3.5) Abdul Wali Khan University Mardan, Pakistan.

Muhammad Ilyas

Lecturer in Finance Abdul Wali Khan University Mardan, Pakistan.

*Corresponding author: zamrad.sagar@gmail.com

Keywords

Abstract

Banking Sector

Pakistan

Karachi Stock Exchange

In this study the researchers evaluate the financial performance of the commercial banks of Pakistan for the

period 2007-2012. Selected seven commercial banks, nature of data is secondary and used from financial

statements of listed banks. Different financial ratio used to check the financial performance of the

commercial banks such as Return on Assets, Return on Equity and other ratios for the assessment of

financial performance that is Return on advances. Return on deposits to assets, Return on investment to

assets, Return on operating fixed assets that how the banks using their asset for the performance. From the

result of analysis we conclude that the banks having more average assets, equity, advances, deposits, fixed

assets have better financial performance.

Introduction

As we know that finance is the life blood of every business, now-a-days banking sector act as the backbone of modern business in general and

specially in whole economy. Development of mot countries mainly depends upon the efficient banking system. In old days, European money

lenders or money changers used to display coins of different countries in big heaps means quantity on benches or tables for the purpose of

lending or exchanging, and other related services. It receives money from those who want to save in the form of deposits and it lends money to

those who need it.

After independence from British Raj in 1947, and the emergence of Pakistan as a country in the globe, the scope of banking in Pakistan has been

increasing and expanding continuously. In Pakistan the overall banking sectors are managed and controlled by State Bank of Pakistan which is

also called Central Bank of Pakistan. There are more than twenty five schedule banks and all of these are busy now-a-days to contribute their

share in development of the economy. In other word businessmen want to achieve their goal and promote their business activities and they are

easy to mange with help of banks. In Pakistan many types of banks are doing working. The banks normally earn profit from lending of money.

There are different parameters and skills to checks the financial performance of the banks. The financial performance of the banks can be

elevate through different ratio analysis such as like total assets, total shareholder equity by comparing with profit of the banks. The profitability

indicates the financial performance of the banks. The bank having high profit rate is performing well.

Problem Statement and Objectives of the Study

The banking sector play important role in economic development but most of the studies are available on other sectors of this economy thats

way we have selected this area for study. The objective of the study design is to examine the financial performance of banking sector in Pakistan.

Literature Review

[1] Minh (2002) in this research work the researcher used this article to reviews the factors that affecting the performance of foreign-owned

banks in New Zealand, where they control 99.2% of all banking system assets. On the basis of econometric analysis they used cross-sectional

data for both period of banks in which seven banks for the period of 10 years (1991-2000) and the other eight bank for the period of eight years

(1991to1998).they suggested that the length of time is important variables for the bank performance the foreign bank had been in New Zealand

and the parent banks return on assets.

[2] CHIRW (2003) in this research Chirwa investigate the relationship between market structure and profitability Of commercial banks in

Malawi by using a long time period from (1970-1994).It used the techniques of integration and error-correction mechanism to test the collusion

hypothesis and determine whether along-run relationship exists between profits of commercial banks and concentration in the banking industry.

The results conclude that in a long run positive relationship between the concentration and performance but short run analysis also shows a high

speed of adjustment in profitability.

[3] Tarawneh (2006) the aim of the study is to classify the commercial banks in Oman on the basis of their financial ratios. There are five Omani

commercial banks and more than 260 branches were financially analyzed, identified and simple regression model was used to eovalvat the

impact of asset management, operational efficiency, and bank size on the financial performance of these banks. The author study that the bank

with higher total capital, or total assets does not always mean that has better profitability performance

[4] Okpara (2010) overall focused of the author to identify the critical factors that influence the banking system of Nigeria. By using factor

analysis and techniques, the researcher fined that undue interference from board members. political crises, Under capitalization, and fraudulent

practices are considered the most critical factors that impact the performance of banking system in Nigeria Simply stated, that the current

bank performance literature describes the objective of financial organizations as that of earning acceptable returns and minimizing the risk taken

Muhammad Zamrad *, Muhammad Ilyas

General Scientific Researches Vol(2), No (1), December, 2014.

to earn this return on the other hand The researcher calls on the monetary authorities to put in place the financial super structure necessary for

making mandatory the establishment of banks in every community, if poverty will be aggressively against.

[5] Tamimi (2010) Determine some factors that show differences in UAEs Islamic and conventional national banks during the period 19962008.Useing of regression model in which ROE and ROA as dependent variables. The researcher determines that liquidity and concentration

were the most significant determinants of conventional national banks performance. On the other hand, cost and number of branches were the

most significant determinants of Islamic banks performance

[6] Salem (2011) in this research determines the major factors that affecting the performance of commercial banks in the Middle East region.

The author selected 23 variables and checks them according to factor analysis techniques. There are six different factors which must for the

banks performance well. The first factor (banks characteristics) is the most important factor of banks. The results showed that higher loan

concentrate banks face will lower profitability level. The contrary higher income from non-interest sources, and higher profit the performance

commercial banks are efficient.

[7] Ahmed (2011) the researcher examine the profitability of public and private commercial banks in Pakistan in the period of 2006-2009. The

author used some ratio for the profitability measurement like return on assets (ROA) and return on equity (ROE).The correlation and regression

analysis results are discus with the help of SPSS. Both models are (measured by ROA & ROE). The high credit risk and capitalization lead to

lower profitability measured by return on assets (ROA). The profitability level as measured by return on equity. The technological, time and

productivity are changing this is the anther extension study of banks. The aim of study is to providing empirical evidence and profitability in

case of Commercial Banks of Pakistan to cover the gap between demanding and literature.

[8] Abbas (2012) in this study eovalvat the financial performance of banking sectors in Pakistan by completing the period of five years from

2007 to 2011. The reasons for selecting this period is rapidly growth of the banking sector in Pakistan and in coming change in financial

performance of banks. There are more than twenty procedure banks in Pakistan and out of those he have selected top five scheduled banks. Their

network are consist of more than 4000 branches. The researchers used different financial ratio to eovalvat the financial performance of the

banks such like Return on assets (ROA), Return on Equity (ROE), Return on Capital (ROC) and by using some other operating and efficiency

ratios. But in this study, he used another ratios for assessment of financial performance that is Return on Operating Fixed Assets (ROFA).

Return on Fixed Assets shows that how the banks are using their Operating Fixed Assets and what is the parts of the Operating Fixed Assets in

the performance of the banks. This study indicates that banks having more Total Assets, Total equity and Total operating fixed assets have good

financial performance or not. It not means that the banks having higher total assets; higher total operating fixed assets and higher equity have

good performance.

[9] Raza (2012) the aim of the study to compare the financial performance of Pakistani public banks sector and rank them to the financial

indictor. Some variables such as total assets, advance, deposit, investment, profit before tax and return on assets has been selected for the

evaluating of the study. There are five sectors four public sectors were selected for the currently working in Pakistan. The period of four years

(2006-2010) author analyzed secondary data. The researcher concludes that the public sector differ as the financial measures or ratio differs the

aim of this study is academic.

[10] In their study Dhanabhakyam and Kavitha (2012) examined that in every country banks is important for the economic development. Banks

control over the supply of money in circulation. A bank is a financial intermediary that accepts deposits and channels those deposits into

lending activities. Banks are a fundamental part of the financial system, and like warier in financial markets. The achievement of

profitability is the financial performance of banks. The profitability of a bank can define the efficiency with which a bank optimize its net

profits. The author analyzed ratio, correlation and regression for the financial performance of public sector banks. For this purpose six Public

Sector Banks are selected in Indian which faces several different challenges. Public sector banks have performed well on the sources of growth

rate and financial efficiency during the study period. The old and new private sector banks play a vital role in marketing.

[11] RUI (2012) the banking system is important for modern economies to maintain the stability. And achieve their goal China's banking

industry has experienced a long-term reformed process. The aim of study is to cover some vital factors that influence the performance of

commercial banks in China. This study analyzed the variable on banks performance. Which are the real growth rate, inflation rate, exchange

rate, banks size, and equity ratio, The ROE is measured by the banks performance. The results show that the variables contribute 85.8% to

the commercial bank performance in China.

[12] Tabari (2013) financial system Banks, and financial institutions, are important for the society wealth. Therefore, the author checked the

performance of commercial banks and examines the effect of liquidity risk on the performance of commercial banks by using of panel data

which related to commercial banks of Iran for the period of seven years (2003-2010). Two variable used in this research model, bank-specific

variables and macroeconomic variables. The researcher show that the variables of bank's size, bank's asset, and inflation will improve the

performance of banks but credit risk and liquidity risk will not improve the performance of bank.

[13] Madishetti (2013)The purpose of this study to determine those factors which influence banks profitability they categorized in to two,

internal determinants and external determinants. Variables which were selected to represent internal factors were Liquidity risk, operating

efficiency, credit risk, business mix, bank assets and capital adequacy. The variables which were used in this research representing external

factor were annual Gross Domestic Product growth rate and annual inflation rate. The data are combined from the annual reports of banks for

the period of seven years (from 2006-2012).the author sued SPSS software and multiple regression model for checking the relationship

between banks profitability and internal determinants and external determinants. The internal determinants which influence banks

profitability are especially capital adequacy, operating efficiency, liquidity risk, and bank size And their relation with banks performance were

not statistically. This study show the additional information about Tanzanian commercial banking sector which will be used policy makers in

the future.

Research Methodology

For every research work methodology is essential part and every research has its own methodology, therefore we explained the methodology of

our research work in this section of research.

Population of this study is the commercial banks of Pakistan and due to time limitation we cannot include all banks. Data is secondary in nature

and source is state bank site, collected from the financial statement analysis. We used non-probability sampling in the non-probability sampling

we selected purposive sampling. The sample for this study was select top seven commercial banks including all branches in Pakistan. The

banking sector is one of the major service sectors in Pakistan there are different categories of banks in Pakistan but we have selected commercial

banks for this research. In this research we use different financial variables such like return on equity which show the overall performance of

banks. The formula for ROE is net profit after taxes divided by shareholders equity second variable is return on assets which show the

profitability of banks the formula is net profit after taxes divided by total assets. The variable is return on equity (ROC). The research is made for

Financial Performance of Banking Sector in Pakistan (A Study of Listed Banks on Karachi Stock Exchange)

General Scientific Researches Vol(2), No (1), December, 2014.

the same purpose. Therefore we selected top seven commercial banks from Pakistan which is more than twenty scheduled banks with wide

network of branches. Financial performance is the dependent variable which is measured by return on equity (ROE), return on assets (ROA),

Return on operating fixed assets (ROFA) Growth and Average of the assets and equity. Other variables Investment to total assets which were

used for financial performance of banks and ratio of advances to assets and ratio of capital to deposits are also used for the financial performance

of banks.

Source of Data

Secondary data was collected from the annual reports of banks by using the consolidated balance sheet and profit and loss accounts of the banks

for the period six years (2007-2012). Data are used from state bank of Pakistan web site (publications-Financial statement analysis of companies

(Non-financial) listed at Karachi Stock Exchange).

Variables

The variable used for the financial performance of banks are Return on Assets, It is a measure of profit per dollar of assets and also called

profitability ratio. Return on Equity measure earning power on shareholders equity. Return on Operating Fixed Assets indicates that how the

banks using their operating fixed assets and what are the contribution of the operating fixed assets in the performance of the banks. Ratio of

Advances to assets is the major resources with the help of which banks are able to increase their earnings. Ratio of Capital to Deposits with the

help of deposits banks are able to lend more and generate income and on the other hand pay interest on the deposits, Investment to total assets

ratio, The ratio is used to recognize the segment of total assets which is used for investment in various areas.

Results and Discussion

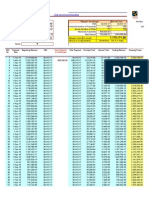

Table 1. Total Assets of the Banks and Their Growth (values in thousand)

Banks/years

2007

2008

2009

2010

2011

2012

Growth Rate

Average

MCB

762,193,593

817,758,326

946,253,269

1,038,018,467

ABL

320,109,723

320,109,723

320,109,723

320,109,723

1,153,480,100

770282541

7.453135578

914,664,383

320,109,723

320,109,723

97.52655436

320,109,723

HBL

655,838,856

717,282,010

863,924,793

UBL

530,283,956

620,707,389

640,421,911

924,699,403

1,139,554,205

1,610,308,572

145.5341823

985,267,973

726,422,551

807,204,788

960,210,415

81.07476271

714,208,502

NBP

762,193,593

817,758,326

946,253,269

1,038,018,467

1,153,480,100

1,316,160,457

72.68059835

1,005,644,035

BOP

234,974,195

185,909,120

185,909,120

229,131,774

280,889,692

332,110,474

41.3391262

241,487,396

BOK

29,739,717

31,338,989

38,810,570

50,794,303

68,424,466

82,177,638

176.3228648

50,214,281

Source: Financial Statements Analysis of Banks (2007-2012)

The growth of the banks is calculated by taking 2007 as a basis year and find that BOK is a leading bank in growth during these years, HBL is at

position two, ABL is at position three, UBL is at position four, NBP is at position five, BOP is at position six, MCB is at position seven. Now

on the basis of average total assets NBP is at position one, HBL is at position two, MCB is at position three, UBL is at position four, ABL is at

position five, BOP is at position six and BOK is at position seven.one of the important factors is that all the banks have positive growth rate but

the average assets of the banks and growth rate of the banks are different. In the above table the results have similarities with other research work

like Raza and Faisal Abbas have the same position NBP is at position one in average total assets.

Figure 1. Total Assets of the Banks and Their Growth

In the above figure NBP is leading bank in average total assets during these year, HBL is at position two, MCB is at position three, UBL is at

position four, ABL is at position five, BOP is at position six and BOK is at position seven.one of the important factors is that all the banks have

positive growth rate but the average assets of the banks and growth rate of the banks are different. In the above figure the results have similarities

with other research work like Raza and Faisal Abbas have the same position NBP is at position one in average total assets.

Muhammad Zamrad *, Muhammad Ilyas

General Scientific Researches Vol(2), No (1), December, 2014.

Table 2. Return on Total Assets (Values in thousand)

Banks/Years

2007

2008

2009

2010

2011

2012

Average

MCB

2.00284575

1.88009092

1.65551904

1.625599114

1.673412745

2.756811153

1.932379786

ABL

1.27336276

1.13355198

1.70896769

1.84098565

1.988059585

1.879224251

1.637358652

HBL

1.2261268

1.39428842

1.55114764

1.842153239

1.959803395

1.388289201

1.560301449

UBL

2.34399945

1.3605849

1.48151583

1.517150725

1.844279571

2.007870744

1.759233536

NBP

2.49723603

1.89036168

1.84401392

1.708871813

1.535281363

1.283054578

1.793136563

BOP

1.89196052

5.41097984

5.41097984

1.766037913

0.104996377

0.525293882

2.518374728

BOK

0.7378584

0.43826557

1.64177697

1.109348818

1.274848093

1.308386352

1.085080701

Source: Financial Statements Analysis of Banks (2007-2012)

The return on assets ratio are given for the period of six years (2007 to 2012) for the commercial banks of Pakistan which have already selected

on the basis of ratio BOP is leading bank in return on assets during these year with average ratio is 2.5183, MCB is at position two, NBP is at

position three, UBL is at position four, ABL is at position five, HBL is at position six and BOK is at position seven.

Figure 2. Return on Total Assets

In the above figure return on assets ratio are given for the period of six years (2007 to 2012) for the commercial banks of Pakistan which have

already selected on the basis of ratio BOP is leading bank in return on assets during these year with average ratio is 2.5183, MCB is at position

two, NBP is at position three, UBL is at position four, ABL is at position five, HBL is at position six and BOK is at position seven.

Table 3. Total Equity and Their Growth (Values in thousand)

Banks/years

2007

2008

2009

2010

2011

2012

Growth Rate

Average

MCB

45,414,156

52,244,865

63,120,371

71,225,105

81,034,402

90,630,601

99.56464896

67,278,250

ABL

18,408,391

20,805,117

25,857,515

31,191,174

37,761,572

43,275,849

135.0876239

29,549,936

HBL

50,741,564

61,290,814

75,133,715

86,842,059

100,147,132

119,025,317

134.5716364

82,196,767

UBL

34,009,411

45,076,576

55,914,736

63,919,969

73,945,411

82,772,301

143.3805778

59,273,067

NBP

69,270,631

81,367,002

95,855,355

105,687,665

112,671,683

119,434,799

72.41765706

97,381,189

BOP

15,110,453

5,056,520

5,056,520

7,111,043

6,976,480

6,267,811

-58.52003246

7,596,471

BOK

5,568,253

5,677,816

5,040,633

5,604,119

9,700,427

10,775,628

93.51900857

7,061,146

Source: Financial Statements Analysis of Banks (2007-2012)

In the above table the average equity of the banks is clear so NBP is a leading position with highest average of equity, HBL is at second position,

and MCB is at position three. UBL is at position four. ABL is at position five. BOP is at position six. And BOK is at position seven. On the

other hand growth rate are calculated on by taking 2007 as a basis year UBL is leading bank in growth, ABL is at position two. HBL is at

position three. MCB is at position four, BOK is at position five. NBP is at position six. And BOP is at position seven with negative growth. The

above table results have matching results with research result of Faisal Abbas.

Financial Performance of Banking Sector in Pakistan (A Study of Listed Banks on Karachi Stock Exchange)

General Scientific Researches Vol(2), No (1), December, 2014.

Figure 3. Total Equity and Their Growth

In the above figure the average equity of the banks is clear so NBP is a leading position with highest average of equity, HBL is at second

position, and MCB is at position three. UBL is at position four. ABL is at position five. BOP is at position six. And BOK is at position seven.

Table 4. Return on Equity (values in thousand)

Banks/Years

2007

2008

2009

2010

2011

2012

Average

MCB

33.6141048

29.4279639

24.8182999

23.69111144

23.82010914

23.43053534

26.46702076

ABL

22.1429347

19.9791522

27.6488673

26.55820842

27.16034438

27.45727068

25.15779628

HBL

15.847789

16.3172576

17.8358664

19.61535712

22.30021125

18.78234023

18.44980359

UBL

36.5482748

18.7353427

16.9686073

17.24175586

20.13257185

23.29255532

22.15318465

NBP

27.4774067

18.9985985

18.203513

16.78379875

15.71749399

14.13914298

18.55332565

BOP

29.4208188

198.941268

198.941268

56.90521067

4.227404078

27.83357699

86.04492439

BOK

3.94085901

2.41902873

12.6409322

10.0548543

8.992470125

9.97808202

8.004371063

Source: Financial Statements Analysis of Banks (2007-2012)

According to table number 4 the average ratio of equity is clear that the BOP is at position one with a highest ratio of equity, MCB is at position

two, ABL is position three, UBL is at position four, NBP is at position five, HBL is at position six, and BOK is at position seven. In the above

table UBL is at position four and NBP is at position five in average ratio of equity as like same in the Faisal Abbas paper UBL is at position four

and NBP is at position five.

Figure 4. Return on Equity

In the above figure average ratio of equity is clear that the BOP is at position one with a highest ratio of equity, MCB is at position two, ABL is

position three, UBL is at position four, NBP is at position five, HBL is at position six, and BOK is at position seven. In the above figure UBL is

at position four and NBP is at position five in average ratio of equity as like same in the Faisal Abbas paper UBL is at position four and NBP is

at position five.

Muhammad Zamrad *, Muhammad Ilyas

General Scientific Researches Vol(2), No (1), December, 2014.

Table 5. Total Fixed Assets and Their Growth (Values in thousand)

Banks/years

2007

2008

2009

2010

2011

2012

Growth Rate

Average

MCB

16,024,123

17,263,733

18,099,010

21,061,787

22,418,450

24,144,242

50.67434268

19,835,224

ABL

7,548,628

11,134,436

12,459,586

15,371,118

18,095,123

18,475,755

144.7564644

13,847,441

HBL

13,582,240

33,490,506

16,766,668

16,155,290

19,167,654

23,632,324

73.99430433

20,465,780

UBL

16,918,844

19,926,915

23,734,082

24,684,566

25,722,481

27,460,839

62.30919205

23,074,621

NBP

25,922,979

24,217,655

25,200,870

27,620,697

29,064,564

29,714,221

14.62502438

26,956,831

BOP

3,252,759

3,471,838

3,471,838

3,534,660

3,597,483

3,473,491

6.78599306

3,467,012

BOK

213,025

187,589

1,013,670

1,121,554

1,301,822

1,359,149

538.0232367

866,135

Source: Financial Statements Analysis of Banks (2007-2012)

In table 5 growth are calculated by taking 2007 as a basis year with comparison of 2012. By assigning the data of the banks on the basis of

average total fixed assets NBP is at position one, UBL is at position two, HBL is at position three, MCB is at position four, ABL is at position

five, BOP is at position six and BOK is at position seven. On the other hand all growth rates of banks are positive but different from each other.

On the basis growth BOK is at position one, ABL is at position two, HBL is at position three, UBL is at position four, MCB is at position five,

NBP is at position six and BOP is at position seven, in the above table and Faisal Abbas paper have some similarity in average total fixed assets

NBP, UBL and ABL have at same position.

Figure 5. Total Fixed Assets and Their Growth.

In figure 5 growth are calculated by taking 2007 as a basis year with comparison of 2012. By assigning the data of the banks on the basis of

average total fixed assets NBP is at position one, UBL is at position two, HBL is at position three, MCB is at position four, ABL is at position

five, BOP is at position six and BOK is at position seven. In the above figure and Faisal Abbas paper have some similarity in average total fixed

assets NBP, UBL and ABL have at same position.

Table 6. Return on Operating Fixed Assets

Banks/Years

2007

2008

2009

2010

2011

2012

Average

MCB

95.2661309

ABL

53.9986604

89.0572161

86.553922

80.11674888

86.10088119

87.95154969

87.50774147

37.3318056

57.3799964

53.89209165

56.6792113

64.31329599

53.93251023

HBL

59.2053741

UBL

73.4675076

29.8621347

79.924938

105.4414993

116.5141128

94.59814447

80.92436722

42.3811262

39.9760648

44.64702762

57.87588297

70.2082846

54.75931564

NBP

73.4243275

63.8319028

69.2398397

64.22142425

60.93043405

56.8315656

64.74658232

BOP

136.672253

289.745806

289.745806

114.4821284

8.198065147

50.22486023

148.1781531

BOK

103.009975

73.2175128

62.8590172

50.24153986

67.00670291

79.10839798

72.57385768

Source: Financial Statements Analysis of Banks (2007-2012)

In the above table show that return on operating fixed assets of the banks are different, on the basis of average ratio BOP is a leading bank, MCB

is at position two, HBL is at position three, BOK is at position four, NBP is at position five, UBL is at position six and ABL is at position seven.

In the above table and Faisal Abbas paper only MCB at same position in operating fixed assets.

Financial Performance of Banking Sector in Pakistan (A Study of Listed Banks on Karachi Stock Exchange)

General Scientific Researches Vol(2), No (1), December, 2014.

Figure 6. Return on Operating Fixed Assets

In the above figure show that return on operating fixed assets of the banks are different, on the basis of average ratio BOP is a leading bank,

MCB is at position two, HBL is at position three, BOK is at position four, NBP is at position five, UBL is at position six and ABL is at position

seven. In the above figure and Faisal Abbas paper only MCB at same position in operating fixed assets.

Table 7. Advances to Assets and Their Growth (Values in thousand)

Banks/years

2007

2008

2009

2010

2011

2012

Growth Rate

Average

MCB

ABL

229,732,772

178,524,257

272,847,325

223,639,777

269,721,034

249,925,187

274,157,806

268,532,972

249,907,060

262,143,554

262,597,534

288,920,715

14.30564813

61.83835175

259,827,255

245,281,077

HBL

380,751,226

460,244,672

490,010,583

502,445,637

503,453,704

545,788,112

43.34507015

480,448,989

UBL

294,725,035

397,736,446

390,493,953

376,480,024

382,115,775

430,694,442

46.13432551

378,707,613

NBP

375,090,202

457,828,029

531,103,507

540,130,378

595,630,955

734,349,374

95.77940722

539,022,074

BOP

BOK

136,530,003

12,174,026

153,226,251

14,925,119

153,226,251

14,820,746

150,117,159

21,272,033

153,430,862

25,284,711

175,880,046

29,708,787

28.82153529

144.0342004

153,735,095

19,697,570

Source: Financial Statements Analysis of Banks (2007-2012)

According to table number 7 the growth rate of the banks is calculated by taking 2007 as a basis year. BOK is leading bank in growth, NBP is at

position two, ABL is at position three, UBL is at position four, HBL is at position five, BOP is at position six, and MCB is at position seven.

Now on the basis of average advances to assets NBP is a leading bank, HBL is at position two, UBL is at position three, MCB is at position four,

ABL is position five, BOP is at position six, and BOK is at position seven. In the table and Raza paper has only NBP is a same position in

average advances to assets.

Figure 7. Advances to Assets and Their Growth

According to figure number 7 the growth rate of the banks is calculated by taking 2007 as a basis year. BOK is leading bank in growth, NBP is

at position two, ABL is at position three, UBL is at position four, HBL is at position five, BOP is at position six, and MCB is at position seven.

Now on the basis of average advances to assets NBP is a leading bank, HBL is at position two, UBL is at position three, MCB is at position four,

ABL is position five, BOP is at position six, and BOK is at position seven. In the above figure and Raza paper has only NBP is a same position

in average advances to assets.

Muhammad Zamrad *, Muhammad Ilyas

General Scientific Researches Vol(2), No (1), December, 2014.

Table 8. Advances to Assets Ratio (Values in thousand)

Banks/years

2007

2008

2009

2010

2011

2012

Average

MCB

30.1410001

33.3652763

28.5041059

26.41165015

21.66548517

34.09106659

29.02976405

ABL

55.7697078

60.9878425

59.7419989

59.67844871

50.81398347

45.69348972

55.4475785

HBL

58.0556066

64.1650934

56.719125

54.33610483

44.17988208

33.89338674

51.89153311

UBL

55.57872

64.07793

60.9744836

51.82658819

47.33814525

44.85417313

54.10834002

NBP

49.2119332

55.9857374

56.1269931

52.03475614

51.63773133

55.79482122

53.46532874

BOP

58.104254

82.4199754

82.4199754

65.51564472

54.62317286

52.95829544

66.0068863

BOK

40.9352449

47.6247622

38.1873959

41.87877723

36.95273413

36.15191155

40.28847099

Source: Financial Statements Analysis of Banks (2007-2012)

As above the advances to assets ratio are given for the period of six years (2007 to 2012) on the basis of average ratio all of the banks have

different ratio. BOP is leading bank in average ratio, ABL is at position two. UBL is at position three, NBP is at position four. HBL is at position

five. BOK is at position six and MCB is at position seven. In the above table and Raza paper BOP is at same position in Advances to assets ratio

the other ratio are different from each other.

Figure 8. Advances to Assets Ratio.

In the above figure advances to assets ratio are given for the period of six years (2007 to 2012) on the basis of average ratio all of the banks have

different ratio. BOP is leading bank in average ratio, ABL is at position two. UBL is at position three, NBP is at position four. HBL is at position

five. BOK is at position six and MCB is at position seven. In the above figure and Raza paper BOP is at same position in Advances to assets

ratio the other ratio are different from each other.

Table 9. Deposits and Their Growth (Values in thousand)

Bank/&years

2007

2008

2009

2010

2011

2012

Growth Rate

Average

MCB

292,098,066

330,181,624

367,581,075

431,295,499

491,146,798

544,988,091

86.57709668

409,548,526

ABL

263,972,382

297,475,321

328,872,559

371,280,948

399,560,790

514,702,444

94.9834449

362,644,074

HBL

508,986,541

572,399,187

682,750,079

747,374,799

933,631,525

1,214,963,700

138.70252

776,684,305

UBL

401,637,816

492,267,898

503,831,672

567,611,258

633,889,416

755,264,264

88.04610371

559,083,721

NBP

591,907,435

624,939,016

727,513,013

832,134,054

927,410,553

1,038,094,985

75.38130519

790,333,176

BOP

191,968,909

164,072,532

164,072,532

208,176,902

237,896,692

266,055,761

38.59315156

205,373,888

BOK

21,410,828

24,732,195

26,285,794

36,981,351

45,548,423

60,043,083

180.4332602

35,833,612

Source: Financial Statements Analysis of Banks (2007-2012)

In the above table the growth is calculated by taking 2007 as a basis year and at clearly shows that all of the banks have different growth rate. On

the basis of growth BOK is leading bank in these year, HBL is at position two, ABL is at position three. UBL is at position four, MCB is at

position five, NBP is at position six and BOP is at position seven. Now on the basis of average NBP is at position one, HBL is at position two,

UBL is at position three, MCB is at position four, ABL is at position five, BOP is at position six and BOK is at position seven. In the above table

and Raza paper only NBP is at same position in average Deposits.

Financial Performance of Banking Sector in Pakistan (A Study of Listed Banks on Karachi Stock Exchange)

General Scientific Researches Vol(2), No (1), December, 2014.

Figure 9. Deposits and Their Growth.

In the above figure the growth is calculated by taking 2007 as a basis year and at clearly shows that all of the banks have different growth rate.

On the basis of growth BOK is leading bank in these year, HBL is at position two, ABL is at position three. UBL is at position four, MCB is at

position five, NBP is at position six and BOP is at position seven. Now on the basis of average NBP is at position one, HBL is at position two,

UBL is at position three, MCB is at position four, ABL is at position five, BOP is at position six and BOK is at position seven. In the above

figure and Raza paper only NBP is at same position in average Deposits.

Table 10: Ratio of Capital to Deposits (Values in thousand)

Banks/Years

2007

2008

2009

2010

2011

2012

Average

MCB

15.5475716

15.8230686

17.1718228

16.51422404

16.49901869

16.62983146

16.36425622

ABL

6.97360491

6.99389681

7.86247265

8.400962712

9.450770182

8.407935401

8.014940445

HBL

9.96913669

10.7077046

11.0045707

11.61961296

10.7266228

9.796615076

10.63737713

UBL

8.46768149

9.15691967

11.0979002

11.26122291

11.66534874

10.95938269

10.43474261

NBP

11.70295

13.0199907

13.1757581

12.70079797

12.14906199

11.50518986

12.37562478

BOP

7.87130222

3.08188088

3.08188088

3.415865512

2.932567049

2.355826078

3.789887105

BOK

26.0067149

22.957186

19.176263

15.15390555

21.29695467

17.94649352

20.42291961

Source: Financial Statements Analysis of Banks (2007-2012)

According to table 10 the average ratio of capital to deposits is as under BOK is leading bank in these year, MCB is at position two, NBP is at

position three, HBL is at position four, UBL is at position five. ABL is at position six and BOP is at position seven so all of the banks have

different average ratio.

Figure 10. Ratio of Capital to Deposits

Muhammad Zamrad *, Muhammad Ilyas

10

General Scientific Researches Vol(2), No (1), December, 2014.

According to figure number 10 the average ratio of capital to deposits is as under BOK is leading bank in these year, MCB is at position two,

NBP is at position three, HBL is at position four, UBL is at position five. ABL is at position six and BOP is at position seven so all of the banks

have different average ratio.

Table 11. Investment and Their Growth (Values in thousand)

Bank/&years

2007

2008

2009

2010

2011

2012

Growth Rate

Average

MCB

113,089,261

96,631,874

169,484,647

215,747,844

319,005,983

405,601,313

258.6559054

219,926,820

ABL

83,958,463

82,646,595

94,673,100

121,158,730

195,789,638

267,682,679

218.8275124

140,984,868

HBL

171,932,281

127,786,754

216,467,532

254,909,116

418,604,147

267,682,679

55.69076234

242,897,085

UBL

115,585,646

115,057,090

137,734,578

231,717,214

301,106,877

381,245,903

229.8384498

213,741,218

NBP

210,787,868

170,822,491

217,596,037

301,078,498

319,527,254

342,964,635

62.70606001

260,462,797

BOP

73,461,695

22,711,980

22,711,980

56,359,404

92,492,813

129,552,044

76.35319196

66,214,986

BOK

8,945,856

8,985,441

17,925,911

19,852,730

36,684,689

45,671,700

410.5347101

23,011,055

Source: Financial Statements Analysis of Banks (2007-2012)

In the a bove table it is celearly show that the growth rate and average of the banks are diifferent. The growth rate are calculated by taking 2007

as abasis year on the basis of growth BOK is leading bank, MCB is at position two, UBL is at position three. ABL is at position four,BOP is at

position five,NBP is at position six and HBL is at position seven. On the basis of average investment NBP is at position one,HBL is at position

two, MCB is at position three, UBL is at position four, ABL is at position five, BOP is at position six and BOK is at position seven. In the above

table and Ali raza paper only NBP is at same poition in average investment.

Figure 11. Investment and Their Growth

In the a bove figure it is celearly show that the growth rate and average of the banks are diifferent. The growth rate are calculated by taking 2007

as abasis year on the basis of growth BOK is leading bank, MCB is at position two, UBL is at position three. ABL is at position four,BOP is at

position five,NBP is at position six and HBL is at position seven. On the basis of average investment NBP is at position one,HBL is at position

two, MCB is at position three, UBL is at position four, ABL is at position five, BOP is at position six and BOK is at position seven. In the above

figure and Raza paper only NBP is at same poition in average investment.

Table 12. Investment to Total Assets Ratio

Banks/Years

2007

2008

2009

2010

2011

2012

Average

MCB

15

12

18

21

28

53

24

ABL

26

23

23

27

38

42

30

HBL

26

18

25

28

37

17

25

UBL

22

19

22

32

37

40

28

NBP

28

21

23

29

28

26

26

BOP

31

12

12

25

33

39

25

BOK

30

29

46

39

54

56

42

Source: Financial Statements Analysis of Banks (2007-2012)

11

Financial Performance of Banking Sector in Pakistan (A Study of Listed Banks on Karachi Stock Exchange)

General Scientific Researches Vol(2), No (1), December, 2014.

As above the investment to total assets ratio are given for the period of six years (2007 to 2012) for each selected commerical bank of pakistan.

On the basis of average ratio BOK is a leading bank, ABL is at position two, UBL is at position three, NBP is at position four, HBL is at position

five, BOP is at position six and MCB is at position seven. In the above table and Raza paper only NBP is a same position four in investment to

total assets ratio the other ratio are different.

Figure 12. Investment to Total Assets Ratio

In the above figure investment to total assets ratio are given for the period of six years (2007 to 2012) for each selected commerical bank of

pakistan. On the basis of average ratio BOK is a leading bank, ABL is at position two, UBL is at position three, NBP is at position four, HBL is

at position five, BOP is at position six and MCB is at position seven. In the above figure and Raza paper only NBP is a same position four in

investment to total assets ratio the other ratio are different.

Table 13. Pakistani Commerical Banks Based on Fananical Perfomances

Banks/variable

MCB

ABL

HBL

UBL

NBP

BOP

BOK

Average Total Assets

ROA

Average Total equity

ROE

Average operating fixed assets

Return on fixed assets

Average Advances to assets

Return on Advances to assets

Average to deposits

Return on deposits

Average investment

Investment to total assets ratio

Conclusion

As cleaerly mentioned that the main purpose of this research work is to examined the financial performance of banking sector in Pakistan. For

such finding we used the total average assets, total average equity, total operatng fixed assets, average advances to assets, average to deposits, average to total

investment and ratios means Return on assets, Return on equity, Return on operating fixed asstes, Return on advances to assets ratio, Return on deposits ratio,

Investment to total assets ratio as proxies. This is concluded that on the basis of average total assets, total equity, total operating fixed assets, advances, deposits

and average total investment NBP is leading bank, HBL is second follower, MCB, UBL, ABL, BOP and BOK are their respective follower. On the basis of these

research and their finding it is concluded that the bank getting first position frequently are considered top performer like NBP is the top performer.

Muhammad Zamrad *, Muhammad Ilyas

12

General Scientific Researches Vol(2), No (1), December, 2014.

References

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

[12]

[13]

Minh, H. (2002): Factors influencing the performance of foreign- owned banks in New Zealand Journal of International Financial Markets, Institutions

and Money 341 357

Chirwa, E.W. (2003). Determinants of commercial banks in Malawi: a cointegration approach Applied Financial Economics, 13, 565-571

Tarawneh, M, (2006),A Comparison of Financial Performance in the Banking Sector: Some Evidence from Omani Commercial Banks, International

Research Journal of Finance and Economics, Issue.3.

Okpara (2010) MICROFINANCE BANKS AND POVERTY ALLEVIATION IN NIGERIA Journal of Sustainable Development in Africa (Volume

12, No.6)

Al-Tamimi, H (2010)Factors Influencing Performance of the UAE Islamic and Conventional National Banks, Global Journal of Business Research, vol.

4, no.2.

Salem R (2011) The Major Factors that Affect Banks Performance in Middle Eastern Countries Journal of Money, Investment and Banking ISSN 1450288X Issue 20

Ali, K., Akhtar, M.F., and Ahmed, H.Z. (2011). Bank-Specific and Macroeconomic indicators of Profitability Empirical Evidence from the

commercial Banks of Pakistan. International Journal of business and Social Science vol 2.no 6.

Abbas Faisal, Tahir M and Rahman (2012) A Comparison of Financial Performance in the Banking Sector: Some Evidence from Pakistani Commercial

Banks Journal of Business Administration and Education ISSN 2201-2958 Volume 1.

Raza Ali (2012) Financial Performance Assessment of Banks: A Case of Pakistani Public Sector Banks International Journal of Business and Social

Science Vol. 3 No. 14.

Kavitha.M and Dhanabhakyam (2012) Financial Performance of Selected Public Sector Banks in India International Journal of Multidisciplinary

Research Vol.2 Issue 1,

JI RUI (2012) Factors Influencing Commercial Bank Performance: A case study on commercial banks in china

Tabari1, Ahmadi and Ma'someh Emami (2013) The Effect of Liquidity Risk on the Performance of Commercial Banks International Research Journal

of Applied and Basic Sciences Vol, 4 (6): 1624-1631.

Madishetti and Rwechungura (2013) Determinants of Bank Profitability in a Developing Economy: Empirical Evidence from Tanzania Asian Journal of

Research in Banking and Finance Vol. 3, No. 11, pp. 46-65.

Das könnte Ihnen auch gefallen

- The Impact of El Nino and La Nina On The United Arab Emirates (UAE) RainfallDokument6 SeitenThe Impact of El Nino and La Nina On The United Arab Emirates (UAE) RainfallTI Journals PublishingNoch keine Bewertungen

- Factors Affecting Medication Compliance Behavior Among Hypertension Patients Based On Theory of Planned BehaviorDokument5 SeitenFactors Affecting Medication Compliance Behavior Among Hypertension Patients Based On Theory of Planned BehaviorTI Journals PublishingNoch keine Bewertungen

- Empirical Analysis of The Relationship Between Economic Growth and Energy Consumption in Nigeria: A Multivariate Cointegration ApproachDokument12 SeitenEmpirical Analysis of The Relationship Between Economic Growth and Energy Consumption in Nigeria: A Multivariate Cointegration ApproachTI Journals PublishingNoch keine Bewertungen

- Simulation of Control System in Environment of Mushroom Growing Rooms Using Fuzzy Logic ControlDokument5 SeitenSimulation of Control System in Environment of Mushroom Growing Rooms Using Fuzzy Logic ControlTI Journals PublishingNoch keine Bewertungen

- Effects of Priming Treatments On Germination and Seedling Growth of Anise (Pimpinella Anisum L.)Dokument5 SeitenEffects of Priming Treatments On Germination and Seedling Growth of Anise (Pimpinella Anisum L.)TI Journals PublishingNoch keine Bewertungen

- Novel Microwave Assisted Synthesis of Anionic Methyl Ester Sulfonate Based On Renewable SourceDokument5 SeitenNovel Microwave Assisted Synthesis of Anionic Methyl Ester Sulfonate Based On Renewable SourceTI Journals PublishingNoch keine Bewertungen

- Allelopathic Effects of Aqueous Extracts of Bermuda Grass (Cynodon Dactylon L.) On Germination Characteristics and Seedling Growth of Corn (Zea Maize L.)Dokument3 SeitenAllelopathic Effects of Aqueous Extracts of Bermuda Grass (Cynodon Dactylon L.) On Germination Characteristics and Seedling Growth of Corn (Zea Maize L.)TI Journals PublishingNoch keine Bewertungen

- Different Modalities in First Stage Enhancement of LaborDokument4 SeitenDifferent Modalities in First Stage Enhancement of LaborTI Journals PublishingNoch keine Bewertungen

- A Review of The Effects of Syrian Refugees Crisis On LebanonDokument11 SeitenA Review of The Effects of Syrian Refugees Crisis On LebanonTI Journals Publishing100% (1)

- Relationship Between Couples Communication Patterns and Marital SatisfactionDokument4 SeitenRelationship Between Couples Communication Patterns and Marital SatisfactionTI Journals PublishingNoch keine Bewertungen

- The Effects of Praying in Mental Health From Islam PerspectiveDokument7 SeitenThe Effects of Praying in Mental Health From Islam PerspectiveTI Journals PublishingNoch keine Bewertungen

- Composites From Rice Straw and High Density Polyethylene - Thermal and Mechanical PropertiesDokument8 SeitenComposites From Rice Straw and High Density Polyethylene - Thermal and Mechanical PropertiesTI Journals PublishingNoch keine Bewertungen

- Do Social Media Marketing Activities Increase Brand Equity?Dokument4 SeitenDo Social Media Marketing Activities Increase Brand Equity?TI Journals PublishingNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Vontobel Holding AG Annual Report 2011Dokument190 SeitenVontobel Holding AG Annual Report 2011pml1028Noch keine Bewertungen

- LLLKKDokument30 SeitenLLLKKSatha SivamNoch keine Bewertungen

- Deposition Hugh Burnaby Atkins PDFDokument81 SeitenDeposition Hugh Burnaby Atkins PDFHarry AnnNoch keine Bewertungen

- Capstone Project Finance QuestionsDokument4 SeitenCapstone Project Finance QuestionsMuskan BohraNoch keine Bewertungen

- Kuroiler - NPV Financial Plan - Chick SalesDokument14 SeitenKuroiler - NPV Financial Plan - Chick SalesYouth Environmental and Social Enterprises (YESE)0% (1)

- Trading With Time Time SampleDokument12 SeitenTrading With Time Time SampleRasmi Ranjan100% (1)

- Bond Market in PakistanDokument8 SeitenBond Market in PakistanManan KhanNoch keine Bewertungen

- Sbi Maxgain CalculatorDokument4 SeitenSbi Maxgain CalculatorAnkit ChawlaNoch keine Bewertungen

- Vol-2 - Issue-5 of International Journal of Research in Commerce & ManagementDokument146 SeitenVol-2 - Issue-5 of International Journal of Research in Commerce & ManagementPrerna Sharma100% (1)

- Compensating Errors - Definition, Explanation, Examples - Play Accounting PDFDokument8 SeitenCompensating Errors - Definition, Explanation, Examples - Play Accounting PDFRahmat WaliNoch keine Bewertungen

- The 10 Fastest Growing Economies of The Next 40 Years Mar 11Dokument5 SeitenThe 10 Fastest Growing Economies of The Next 40 Years Mar 11Genevieve Goveas LoboNoch keine Bewertungen

- The Secrets of Fibonacci RevealedDokument95 SeitenThe Secrets of Fibonacci Revealedpsoonek100% (14)

- Trading FX Like Jesse Livermore Traded StocksDokument5 SeitenTrading FX Like Jesse Livermore Traded StocksMishu Aqua0% (1)

- 7 Common Mistakes in Technical AnalysisDokument2 Seiten7 Common Mistakes in Technical AnalysisEdgar MuyiaNoch keine Bewertungen

- Forex Trading Complete Course Study: Forex: The Imperishable DineroDokument31 SeitenForex Trading Complete Course Study: Forex: The Imperishable Dinerodibino100% (1)

- Moving Average SimplifiedDokument136 SeitenMoving Average Simplifiedimmachoboy100% (13)

- PE Expansion PhaseDokument2 SeitenPE Expansion PhaseVikram SenNoch keine Bewertungen

- TopstepTrader Path Funded Trader EbookDokument26 SeitenTopstepTrader Path Funded Trader EbookfnopulseNoch keine Bewertungen

- Darson Securities PVT LTD Internship ReportDokument90 SeitenDarson Securities PVT LTD Internship Report333FaisalNoch keine Bewertungen

- CQF Brochure Jan18Dokument24 SeitenCQF Brochure Jan18leojohn171759Noch keine Bewertungen

- 1979 Graph Arbitrage 2330182Dokument21 Seiten1979 Graph Arbitrage 2330182therm000Noch keine Bewertungen

- Math ProbDokument2 SeitenMath Probadonis bibatNoch keine Bewertungen

- CAIA Level I Workbook March 2014Dokument86 SeitenCAIA Level I Workbook March 2014Silviu Trebuian100% (1)

- Chapter Four Part Three Foreign Exchange Market and Derivative MarketDokument45 SeitenChapter Four Part Three Foreign Exchange Market and Derivative MarketNatnael AsfawNoch keine Bewertungen

- Fibonacci Retracement LevelsDokument3 SeitenFibonacci Retracement LevelsAmeer HamzaNoch keine Bewertungen

- Banking Banana Skins 2012 ResultsDokument43 SeitenBanking Banana Skins 2012 Resultsankur4042007Noch keine Bewertungen

- Market Risk MGMTDokument7 SeitenMarket Risk MGMTPrathamesh LadNoch keine Bewertungen

- Flexi Cap FundsDokument7 SeitenFlexi Cap FundsArmstrong CapitalNoch keine Bewertungen

- Uae ExchangeDokument7 SeitenUae ExchangeJAKANNoch keine Bewertungen

- The University of DodomaDokument4 SeitenThe University of DodomaMesack SerekiNoch keine Bewertungen