Beruflich Dokumente

Kultur Dokumente

Auditors' Liability

Hochgeladen von

Nur Shuhada0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

135 Ansichten2 SeitenThe revised Hong Kong stock exchange code requires auditors to attend annual general meetings and answer shareholder questions about the audit. This raises the question of whether auditors' legal duties and liabilities could be extended to individual shareholders, not just the company. Currently, auditors generally only owe a duty of care to their client company. The leading case of Caparo Industries established that auditors do not owe a duty of care to individual shareholders or potential investors, to avoid unlimited liability. However, the code changes could increase opportunities for exceptional circumstances where a duty to shareholders arises. Auditors should be aware of the legal position and consider disclaiming additional liability when answering shareholder questions to minimize risks.

Originalbeschreibung:

auditors' liability and duty of care

Originaltitel

Auditors' liability

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe revised Hong Kong stock exchange code requires auditors to attend annual general meetings and answer shareholder questions about the audit. This raises the question of whether auditors' legal duties and liabilities could be extended to individual shareholders, not just the company. Currently, auditors generally only owe a duty of care to their client company. The leading case of Caparo Industries established that auditors do not owe a duty of care to individual shareholders or potential investors, to avoid unlimited liability. However, the code changes could increase opportunities for exceptional circumstances where a duty to shareholders arises. Auditors should be aware of the legal position and consider disclaiming additional liability when answering shareholder questions to minimize risks.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

135 Ansichten2 SeitenAuditors' Liability

Hochgeladen von

Nur ShuhadaThe revised Hong Kong stock exchange code requires auditors to attend annual general meetings and answer shareholder questions about the audit. This raises the question of whether auditors' legal duties and liabilities could be extended to individual shareholders, not just the company. Currently, auditors generally only owe a duty of care to their client company. The leading case of Caparo Industries established that auditors do not owe a duty of care to individual shareholders or potential investors, to avoid unlimited liability. However, the code changes could increase opportunities for exceptional circumstances where a duty to shareholders arises. Auditors should be aware of the legal position and consider disclaiming additional liability when answering shareholder questions to minimize risks.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Corporate governance

Auditors liability and duty of care

when responding to AGM questions

Nathan Dentice and Veronica To examine possible effects of

changes to the Code on Corporate Governance Practices,

which forms part of the stock exchange Listing Rules

n October 2011, the Hong Kong

stock exchange published various

changes to the Code on Corporate

Governance Practices, which forms

Appendix 14 of Listing Rules. The revised

code came into effect on 1 April. Among

other matters, the revised code requires

a listed issuer to ensure that the issuers

external auditors attend annual general

meetings to answer questions about the

conduct of the audit, the preparation and

content of the auditors report, accounting

policies and auditor independence. This

changes the previous position under section

141(7) of the Companies Ordinance, in which

auditors were entitled, but not required, to

attend AGMs.

The new requirement to attend and

answer questions at AGMs raises a question

as to whether the revised code might extend

an auditors legal duties and liabilities

for negligence and economic loss to the

companys shareholders as individuals,

in addition to the auditors existing duties

towards the company.

The current position under Hong Kong

law is that, generally, auditors only owe a

duty of care to their client, being the company

they are auditing. Nevertheless, a duty of

care to third parties, such as shareholders,

creditors and potential investors, may arise in

exceptional circumstances.

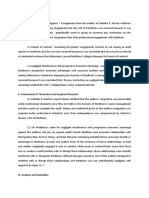

The leading case on the question of an

auditors duty of care to third parties is

Caparo Industries plc. v Dickman [1990]

2 AC 605. In that case, Caparo brought an

action against the auditors of an electronics

company, Fidelity, after an accomplished

takeover of Fidelity. Caparo began to buy

shares shortly before Fidelity published its

annual audited accounts to shareholders.

44

June 2012

Caparo then purchased more shares in

reliance on those accounts so as to take over

Fidelity. In its claim against the auditors of

Fidelity, Caparo asserted that the audited

accounts were incorrect and that it would not

have purchased the shares had it known of

Fidelitys true state of affairs.

The House of Lords determined that, in

general, auditors only owe a duty of care to

shareholders as a body and not to individual

shareholders. They reasoned that the

purpose of audited accounts is to enable the

companys management and shareholders

to make informed decisions in respect of

the company and not to assist potential

investors in deciding whether or not to

invest in the company. To impose a duty on

the auditors to all such investors would be to

expose them to (in the words of Lord Oliver

of Aylmerton) a liability wholly indefinite in

the area, duration and amount and would

open up a limitless vista of uninsurable risk

for the professional man.

As regards existing shareholders, the

House of Lords held that, while existing

shareholders are entitled to rely on the

audited accounts to protect their collective

interest in the proper management of the

company, they are not entitled to rely on

the auditors statutory report as a basis for

making their own investment decisions.

The House of Lords then adopted a

threefold test for the purpose of determining

whether the auditors nevertheless owed

a duty of care to Caparo in the particular

circumstances of the case. First, the

damage must be reasonably foreseeable

as a consequence of the auditors conduct.

Second, there must be a close relationship

of proximity between the parties such as

to justify the imposition of a duty of care.

Proximity for a duty of care would arise

where (i) advice is required for a purpose

and the auditor was fully aware of the nature

of the transaction that the advisee had in

contemplation; (ii) the auditor knew that

the advice would be communicated to the

advisee; (iii) the auditor knew that it was

very likely that the advisee would rely on that

advice in deciding whether to engage in the

transaction; and (iv) the advice was so acted

upon by the advisee to his detriment. Third,

the situation must be such that it is fair, just

and reasonable that the law should impose

a duty upon the auditor. After examining the

circumstances of the case, the House of Lords

determined that no duty of care was owed to

Caparo by the auditors of Fidelity.

The decision in Caparo Industries plc.v

Dickman represented a deliberate effort

by the House of Lords to restrict the extent

to which auditors might be liable to third

parties. Underpinning the decision were

important policy considerations, including

a recognition that, if auditors routinely

owed duties to all those parties who might

rely upon audited accounts, the potential

liabilities in respect of audit work would

be enormous and unquantifiable, placing a

heavy burden on auditors and potentially

resulting in significant increases in the costs

of audit services.

While the decision in Caparo Industries

plc. v Dickman represents the leading case

on the question of an auditors duty of care

to third parties, there exist two other legal

approaches that the courts might adopt for

the purposes of deciding whether to impose

a duty of care in a particular case. One is the

assumption of responsibility approach,

which arises from Hedley Byrne & Co. Ltd. v

Heller & Partners Ltd. [1964] AC 465. In this

A PLUS

case, the House of Lords ruled that a person

may be liable to another party in respect of

statements that they make or advice that they

give if they voluntarily assume responsibility

to that other party, and the other party relies

upon their judgment or skill. Lightman J.

in the case of Anthony v Wright [1995] BCC

768 summarized this in the context of audit

reports as follows:

The law is well established that auditors

do not in respect of their audits owe a duty

of care to anyone other than the company

itself save in exceptional circumstances

where a special duty has been treated

as assumed to a third party A special

relationship is required and in particular

intention (actual or inferred) on the part of

the auditors that the third party shall rely,

and reliance by the third party, on the audit,

before a claim in negligence against the

auditor can be maintained.

The other is the incremental approach

suggested by Brennan J. in his judgment in

the High Court of Australia in Sutherland Shire

Council v Heyman [1984] 157 CLR 424, being

that the law should develop new categories

of negligence incrementally and by analogy

with established categories. In the case

of James McNaughton Paper Group Ltd. v

Hicks Anderson & Co. [1991] 2 QB 113, the

court identified six factors to be considered

when deciding whether to impose a duty

of care in relation to statements or advice.

In particular, the court will consider (i) the

purpose for which the statement was made;

(ii) the purpose for which the statement

was communicated; (iii) the relationship

between the adviser, the advisee and any

relevant third party; (iv) the size of any class

to which the advisee belongs; (v) the state

of knowledge of the adviser; and (vi) the

reliance on the statement by the advisee.

Each of the three approaches discussed

above were reviewed in the context of

audit negligence in the case Bank of Credit

Commercial International (Overseas) Ltd. v

Price Waterhouse (No. 2) [1998] PNLR 564.

In that case, Sir Brian Neill concluded that the

court should apply all three tests, and if the

facts were properly analysed, it was likely

that they would all lead to the same result.

Against the background set out above,

it would appear that, to the extent the

revised code introduced by the stock

exchange requires auditors to attend

AGMs and answer questions, the revised

code will not (in and of itself) alter the

existing principle that, in general, auditors

will not owe a duty of care to individual

shareholders. Nevertheless, by putting

auditors in direct discussions with individual

shareholders, there is now greater scope

for circumstances to arise in which a duty

of care to individual shareholders might be

imposed in a particular case.

Auditors should therefore be cognizant of

the legal position when answering questions

and should avoid conduct that might bring

them within the exceptional circumstances

described by the approaches discussed.

An effective precaution that auditors

may take to minimize the risk of a duty

of care to individual shareholders arising

is for auditors to circulate or read a short

disclaimer prior to answering questions,

to the effect that, notwithstanding any

answers they give or statements they make

at the AGM, they shall not have any liability,

responsibility or duty of care towards

individual shareholders or third parties.

This is likely to be sufficient to put

the auditors outside the exceptional

circumstances described by the legal

approaches.

Nathan P.W. Dentice is a partner and Veronica Siwang

To is an associate solicitor in the Hong Kong office of Reed

Smith Richards Butler, an international law firm. This article

is intended for general information purposes and does not

constitute specific legal advice. Reed Smith Richards Butler

shall not have any legal liability in respect of the matters

discussed. Where auditors have questions in relation to their

legal duties, it is recommended they seek specific legal advice.

June 2012

45

Das könnte Ihnen auch gefallen

- Indemnity AgreementDokument17 SeitenIndemnity AgreementEunice Lim100% (1)

- Lecture Notes: Auditing Theory AT.0107-Understanding The Entity's Internal Control MAY 2020Dokument6 SeitenLecture Notes: Auditing Theory AT.0107-Understanding The Entity's Internal Control MAY 2020MaeNoch keine Bewertungen

- CBS Research Proposal - GuidelinesDokument3 SeitenCBS Research Proposal - GuidelinesSnishatNoch keine Bewertungen

- ShareholderDokument20 SeitenShareholderYHNoch keine Bewertungen

- Continuous Auditing Technology Adoption in Leading Internal Audit OrganizationsDokument10 SeitenContinuous Auditing Technology Adoption in Leading Internal Audit Organizationsthusain05061986Noch keine Bewertungen

- Fabm 1Dokument23 SeitenFabm 1BarbaraMaribbay, Trisha100% (2)

- Start-Up IndiaDokument5 SeitenStart-Up IndiaSanjay YadavNoch keine Bewertungen

- Week2 Auditor's LiabilityDokument28 SeitenWeek2 Auditor's LiabilityNasrulhaqim Nazri100% (1)

- Devops Full NotesDokument230 SeitenDevops Full Notesbandarukrishnakanth123100% (2)

- Chapter 08 Auditor's Legal LiabilityDokument20 SeitenChapter 08 Auditor's Legal LiabilityRichard de LeonNoch keine Bewertungen

- Rule of Caparo v. Dickman PDFDokument15 SeitenRule of Caparo v. Dickman PDFSaumya SinghNoch keine Bewertungen

- Afman 23-110, CD Basic Usaf Supply Manual 1 April 2009 Incorporating Through Interim Change 11, 1 APRIL 2012Dokument18 SeitenAfman 23-110, CD Basic Usaf Supply Manual 1 April 2009 Incorporating Through Interim Change 11, 1 APRIL 2012ruizar28Noch keine Bewertungen

- Auditor's LiabilityDokument6 SeitenAuditor's LiabilityHilda MuchunkuNoch keine Bewertungen

- The Auditor's Legal LiabilityDokument32 SeitenThe Auditor's Legal LiabilityLaiba KanwalNoch keine Bewertungen

- Legal LiabilityDokument33 SeitenLegal LiabilitysherlyneNoch keine Bewertungen

- Legal LiabilityDokument32 SeitenLegal Liabilitynurhoneyz100% (1)

- Solution Manual For Auditing and Assurance Services Arens Elder Beasley 15th EditionDokument15 SeitenSolution Manual For Auditing and Assurance Services Arens Elder Beasley 15th EditionMeredithFleminggztay100% (86)

- CONTRACTDokument8 SeitenCONTRACTbhumikabisht3175Noch keine Bewertungen

- Tutorial 3 Home WorkDokument6 SeitenTutorial 3 Home WorkchubstNoch keine Bewertungen

- Auditor Liability: Fair and Reasonable' Punishment?Dokument6 SeitenAuditor Liability: Fair and Reasonable' Punishment?kawsursharifNoch keine Bewertungen

- Chapter 4 - Overview of Auditor's Legal LiabilityDokument13 SeitenChapter 4 - Overview of Auditor's Legal LiabilityJima KromahNoch keine Bewertungen

- 4 JawapanDokument5 Seiten4 JawapanNad Adenan100% (1)

- Resume Buku Arens 5 & 6Dokument11 SeitenResume Buku Arens 5 & 6liamayangsNoch keine Bewertungen

- Overview of Legal Liability of CpaDokument15 SeitenOverview of Legal Liability of CpaPankaj KhannaNoch keine Bewertungen

- Auditing SP 2008 CH 5 SolutionsDokument13 SeitenAuditing SP 2008 CH 5 SolutionsManal ElkhoshkhanyNoch keine Bewertungen

- A Domestic Framework For Group InsolvencyDokument23 SeitenA Domestic Framework For Group InsolvencyPradhuymn MishraNoch keine Bewertungen

- Chapter 6 EBPA (ING)Dokument66 SeitenChapter 6 EBPA (ING)Yovie SantriaNoch keine Bewertungen

- Law and Ethics Case StudyDokument6 SeitenLaw and Ethics Case Studyiman.zawadiNoch keine Bewertungen

- AF304 Auditing Tutorial 4 AnswersDokument7 SeitenAF304 Auditing Tutorial 4 AnswersShivneel NaiduNoch keine Bewertungen

- Cac4203 The Auditor & Liability Under The LawDokument14 SeitenCac4203 The Auditor & Liability Under The Lawkelvin mkweshaNoch keine Bewertungen

- Review Questions: Chapter 04 - Legal Liability of CpasDokument14 SeitenReview Questions: Chapter 04 - Legal Liability of CpasJima KromahNoch keine Bewertungen

- Auditor's LiabilityDokument3 SeitenAuditor's Liabilitydavinci0317Noch keine Bewertungen

- Ch.4-5 PROFESSIONAL ETHICS & LEGAL ENVIRONMENT - SummaryDokument6 SeitenCh.4-5 PROFESSIONAL ETHICS & LEGAL ENVIRONMENT - SummaryAndi PriatamaNoch keine Bewertungen

- Liability of Auditors To Third Party in IndiaDokument4 SeitenLiability of Auditors To Third Party in IndiaVinamra AgrawalNoch keine Bewertungen

- Audit LiabilityDokument54 SeitenAudit LiabilityjessiecaNoch keine Bewertungen

- Legal LiabilityDokument9 SeitenLegal LiabilityviolettaNoch keine Bewertungen

- Wisconsin BJR - KBDDokument10 SeitenWisconsin BJR - KBDkbdavis2Noch keine Bewertungen

- Ch05.pdf Audit SolutionDokument14 SeitenCh05.pdf Audit SolutionChristianto TanerNoch keine Bewertungen

- Chapter 4 - Solution ManualDokument17 SeitenChapter 4 - Solution ManualjuanNoch keine Bewertungen

- Business Law 2Dokument7 SeitenBusiness Law 2Brian MachariaNoch keine Bewertungen

- TOPIC 2a 1 Auditor S Legal LiabilityDokument56 SeitenTOPIC 2a 1 Auditor S Legal LiabilityHanis ZahiraNoch keine Bewertungen

- Uber Lyft Case AnswerDokument8 SeitenUber Lyft Case AnswerJaskaranNoch keine Bewertungen

- End Term Corporate Insolvency LawDokument4 SeitenEnd Term Corporate Insolvency LawUsmaa HashmiNoch keine Bewertungen

- Citigroup 2009Dokument6 SeitenCitigroup 20093282672Noch keine Bewertungen

- Caremark 1996Dokument6 SeitenCaremark 19963282672Noch keine Bewertungen

- 2 Legal LiabilityDokument68 Seiten2 Legal Liabilitycamillediaz100% (1)

- HomeDokument15 SeitenHomeTweetyNoch keine Bewertungen

- Chapter 4Dokument4 SeitenChapter 4viechocNoch keine Bewertungen

- 4.1 MIA By-Law (On Professional Conducts and Ethics)Dokument84 Seiten4.1 MIA By-Law (On Professional Conducts and Ethics)Yaya-Nadia AhmadNoch keine Bewertungen

- RFBT 2 Module 1 Corporations Lesson 6Dokument10 SeitenRFBT 2 Module 1 Corporations Lesson 6JQ RandomNoch keine Bewertungen

- Ethics - Assignment UpdatedDokument10 SeitenEthics - Assignment UpdatedAkhtarMasoodNoch keine Bewertungen

- Case Study 2Dokument6 SeitenCase Study 2jhouvanNoch keine Bewertungen

- Fiduciary Relationship in A Commercial Context by CampbellDokument69 SeitenFiduciary Relationship in A Commercial Context by CampbellVerene TanNoch keine Bewertungen

- University of Jahangir Nagar Institute of Business AdministrationDokument6 SeitenUniversity of Jahangir Nagar Institute of Business Administrationtabassum tasnim SinthyNoch keine Bewertungen

- Djankov, S., LaPorta, R., Lopez-de-Silanes, F., and Shleifer, A. (2008), "The Law and Economics of Self-Dealing", Journal of Financial Economics 88, Pp. 430-465.Dokument8 SeitenDjankov, S., LaPorta, R., Lopez-de-Silanes, F., and Shleifer, A. (2008), "The Law and Economics of Self-Dealing", Journal of Financial Economics 88, Pp. 430-465.Nuria MartorellNoch keine Bewertungen

- Lecture Two - Legal Liability and Ethics, Independance, Corporate GovernanceDokument42 SeitenLecture Two - Legal Liability and Ethics, Independance, Corporate GovernancePranto KarmokarNoch keine Bewertungen

- Cases Liability To Third PartyDokument3 SeitenCases Liability To Third PartyNeha LalNoch keine Bewertungen

- Business Judgment Rule: Research Project OnDokument12 SeitenBusiness Judgment Rule: Research Project OnmaithNoch keine Bewertungen

- CH 4Dokument6 SeitenCH 4Mona Adila PardedeNoch keine Bewertungen

- Legal LiabilityDokument30 SeitenLegal LiabilityDiane PascualNoch keine Bewertungen

- Advanced Accounting 4th Edition Jeter Solutions Manual Full Chapter PDFDokument50 SeitenAdvanced Accounting 4th Edition Jeter Solutions Manual Full Chapter PDFanwalteru32x100% (15)

- 2 Legal LiabilityDokument68 Seiten2 Legal LiabilityEmilia Ahmad Zam ZamNoch keine Bewertungen

- Legal Concepts Related To Auditor's LiabilityDokument6 SeitenLegal Concepts Related To Auditor's LiabilityFerial FerniawanNoch keine Bewertungen

- ???? ??? ??Dokument19 Seiten???? ??? ??Anaya DonaldsonNoch keine Bewertungen

- Solution Manual For Walston Dunham Introduction To Law 7th Full DownloadDokument12 SeitenSolution Manual For Walston Dunham Introduction To Law 7th Full Downloadaliciamyersfgsdnqxwok100% (48)

- Avoiding and Managing Us Business Litigation Risks: A Comprehensive Guide for Business Owners and the Attorneys Who Advise ThemVon EverandAvoiding and Managing Us Business Litigation Risks: A Comprehensive Guide for Business Owners and the Attorneys Who Advise ThemNoch keine Bewertungen

- Glassix AI Customer Support Chatbots & Messaging SoftwareDokument7 SeitenGlassix AI Customer Support Chatbots & Messaging SoftwarechatbotsoftwarerNoch keine Bewertungen

- Service Flower of Insurance Sector - BMS - CoDokument4 SeitenService Flower of Insurance Sector - BMS - Co92Sgope100% (1)

- Project Records From A Delay Analysis Perspective: Haris KatostarasDokument2 SeitenProject Records From A Delay Analysis Perspective: Haris KatostarasMariana MoreiraNoch keine Bewertungen

- Bar Questions and Answers in Mercantile Law (Repaired)Dokument208 SeitenBar Questions and Answers in Mercantile Law (Repaired)Ken ArnozaNoch keine Bewertungen

- Corporate Finance Institute - Financial-Modeling-GuidelinesDokument95 SeitenCorporate Finance Institute - Financial-Modeling-GuidelinesTan Pheng SoonNoch keine Bewertungen

- What Is Marketing?: Sameer MathurDokument12 SeitenWhat Is Marketing?: Sameer MathurTadi SaiNoch keine Bewertungen

- Industrial Relations & Labour Laws: ObjectivesDokument40 SeitenIndustrial Relations & Labour Laws: ObjectivesAditya KulkarniNoch keine Bewertungen

- El Nido Plaza - 2960, 2982, 2990 E. Colorado BLVD, Pasadena - For LeaseDokument3 SeitenEl Nido Plaza - 2960, 2982, 2990 E. Colorado BLVD, Pasadena - For LeaseJohn AlleNoch keine Bewertungen

- BCom I Principles of MarketingDokument5 SeitenBCom I Principles of MarketingPooja RajputNoch keine Bewertungen

- C05 Revenue Recognition - Percentage Completion AccountingDokument16 SeitenC05 Revenue Recognition - Percentage Completion AccountingBrooke CarterNoch keine Bewertungen

- Nature and Scope of Investment ManagementDokument5 SeitenNature and Scope of Investment ManagementRavi GuptaNoch keine Bewertungen

- A 12 Wage and SalaryDokument28 SeitenA 12 Wage and SalaryNeeru SharmaNoch keine Bewertungen

- ICICI Prudential Life Insurance Vs LIC PriDokument53 SeitenICICI Prudential Life Insurance Vs LIC PriPriya Aggarwal100% (2)

- Ofir Eduardo de Jesús Guerra Matus: Profile DetailsDokument2 SeitenOfir Eduardo de Jesús Guerra Matus: Profile DetailsEdwin Rolando LaraNoch keine Bewertungen

- Cairo For Investment & Real Estate Development (CIRA) : Initiation of Coverage A Promising Decade AheadDokument14 SeitenCairo For Investment & Real Estate Development (CIRA) : Initiation of Coverage A Promising Decade AheadSobolNoch keine Bewertungen

- Management Leading and Collaborating in A Competitive World 12th Edition Bateman Snell Konopaske Solution ManualDokument76 SeitenManagement Leading and Collaborating in A Competitive World 12th Edition Bateman Snell Konopaske Solution Manualamanda100% (24)

- Learning's From TMG Simulation: Product FeaturesDokument6 SeitenLearning's From TMG Simulation: Product FeaturesPrabir AcharyaNoch keine Bewertungen

- Chennai Metro Rail Limited: Terms of Reference For Outsourcing of Internal AuditDokument15 SeitenChennai Metro Rail Limited: Terms of Reference For Outsourcing of Internal Auditpvraju1040Noch keine Bewertungen

- Outsourcing ofDokument19 SeitenOutsourcing ofsaranevesNoch keine Bewertungen

- LNTDokument202 SeitenLNTKumar AbhishekNoch keine Bewertungen

- Financial Modelling 2016 PDFDokument25 SeitenFinancial Modelling 2016 PDFĐỗ Đen Đổ Đỏ0% (1)

- Ushtrime Studente Tema 3, TezgjidhuraDokument25 SeitenUshtrime Studente Tema 3, TezgjidhuraAndi HoxhaNoch keine Bewertungen