Beruflich Dokumente

Kultur Dokumente

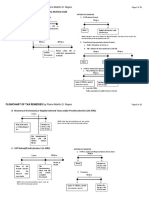

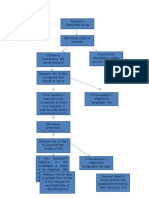

Tax Assessment Process

Hochgeladen von

Marie Morales0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

113 Ansichten1 SeitePrepared by Atty. Mijares

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenPrepared by Atty. Mijares

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

113 Ansichten1 SeiteTax Assessment Process

Hochgeladen von

Marie MoralesPrepared by Atty. Mijares

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

Administrative protest of assessment

under Rev. Regs. No. 12-99

as amended by Rev. Regs. No. 18-13

Taxpayer is found to be

liable for deficiency taxes

Taxpayer does not respond w/in 15 days from

receipt of PAN taxpayer considered in default

BIR issues preliminary

assessment notice (PAN)

Taxpayer responds w/in 15

days from receipt of PAN

BIR issues formal letter of demand/final assessment notice (FLD/FAN) w/in 15

days from lapse of period to respond to PAN or from filing of response

Taxpayer does not protest FLD/FAN

w/in 30 days from receipt

Taxpayer protest FLD/FAN w/in

30 days from receipt

Assessment becomes final,

executory, and demandable

Taxpayer files a Request for

Reinvestigation

Taxpayer files a Request for

Reconsideration

Taxpayer submits supporting

documents w/in 60 days from filing of

protest

Taxpayer fails to submit supporting

documents w/in 60 days from filing of

protest

180 days from filing of

Request for Reconsideration

has elapsed

180 days from filing of

Request for Reconsideration

has NOT yet elapsed

180 days from submission of

supporting documents (or

from filing of RFR if no

supporting docs submitted)

has NOT YET elapsed

Wait for Final Decision

on Disputed Assessment

(FDDA)

180 days from submission of

supporting documents

documents (or from filing of

RFR if no supporting docs

submitted) has elapsed

Wait for Final Decision

on Disputed Assessment

(FDDA)

BIR issues FDDA

Protest

denied by CIR

Protest denied by

CIRs representative

Taxpayer has 30 days to

elevate protest to CIR

Taxpayer has 30 days to appeal

to Court of Tax Appeals

Das könnte Ihnen auch gefallen

- Tax AssessmentDokument11 SeitenTax AssessmentRon VillanuevaNoch keine Bewertungen

- Taxpayer Tax Assessment Process BIR IssuesDokument3 SeitenTaxpayer Tax Assessment Process BIR IssuesPetrovich Tamag50% (4)

- Assessment Process FlowchartDokument4 SeitenAssessment Process FlowchartMaria Reylan GarciaNoch keine Bewertungen

- TAX 2 Tax Remedies 2020 PDFDokument5 SeitenTAX 2 Tax Remedies 2020 PDFAlex Buzarang SubradoNoch keine Bewertungen

- WON A Corp Is Entitled To Moral DamagesDokument6 SeitenWON A Corp Is Entitled To Moral DamagesShane Edrosolano100% (1)

- Flowchart of Tax Remedies I. Remedies Un PDFDokument12 SeitenFlowchart of Tax Remedies I. Remedies Un PDFJunivenReyUmadhayNoch keine Bewertungen

- Corpo ReviewerDokument62 SeitenCorpo ReviewerLorelie Sakiwat VargasNoch keine Bewertungen

- Tax Remedies Under The NircDokument119 SeitenTax Remedies Under The NircAnonymous a4JYe5d150% (2)

- Facie To Have Been Issued For A Valuable Consideration and Every Person WhoseDokument5 SeitenFacie To Have Been Issued For A Valuable Consideration and Every Person WhoseRina Lynne BaricuatroNoch keine Bewertungen

- MCQ 2011 Bar TaxationDokument37 SeitenMCQ 2011 Bar TaxationKara Clark100% (1)

- Tax RemediesDokument7 SeitenTax RemediesKyla Ellen CalelaoNoch keine Bewertungen

- Republic Act No 11232Dokument55 SeitenRepublic Act No 11232concern citizenNoch keine Bewertungen

- Philippine Accounting StandardsDokument4 SeitenPhilippine Accounting StandardsElyssa100% (1)

- Tax Remidies of The TaxpayerDokument6 SeitenTax Remidies of The TaxpayerJustin Robert RoqueNoch keine Bewertungen

- G - Crim - 27755-27756 - People Vs Macapugay, Et Al - 07 - 24 - 2019 PDFDokument21 SeitenG - Crim - 27755-27756 - People Vs Macapugay, Et Al - 07 - 24 - 2019 PDFVlynNoch keine Bewertungen

- Local Taxation RemediesDokument16 SeitenLocal Taxation RemediesJordan TumayanNoch keine Bewertungen

- 2019 Bar ExaminationsDokument62 Seiten2019 Bar ExaminationsAllana Erica CortesNoch keine Bewertungen

- 2012 Bar Exam in Mercantile LawDokument102 Seiten2012 Bar Exam in Mercantile Lawtere_aquinoluna828Noch keine Bewertungen

- 1.) Who Are Eligible To Register As Bmbes?: AnswerDokument6 Seiten1.) Who Are Eligible To Register As Bmbes?: AnswerHazel Seguerra BicadaNoch keine Bewertungen

- Tax2 Premid PDFDokument18 SeitenTax2 Premid PDFJoben CuencaNoch keine Bewertungen

- Flowchart Remedies of A TaxpayerDokument2 SeitenFlowchart Remedies of A TaxpayerRab Thomas BartolomeNoch keine Bewertungen

- Mary Florence D. Yap - Tax DigestsDokument16 SeitenMary Florence D. Yap - Tax Digestsowl2019Noch keine Bewertungen

- Flowchart of Tax Remedies I. Remedies UnDokument12 SeitenFlowchart of Tax Remedies I. Remedies UnKevin Ken Sison Ganchero100% (2)

- Oblicon NotesDokument48 SeitenOblicon NotesMaria Regina Luisa CambaNoch keine Bewertungen

- INCOME TAX HANDOUT FOR FINALS - SorianoDokument77 SeitenINCOME TAX HANDOUT FOR FINALS - SorianoPoPo MillanNoch keine Bewertungen

- Case Digests Taxation Law - Philippine Landmark CasesDokument2 SeitenCase Digests Taxation Law - Philippine Landmark CasesEmilee TerestaNoch keine Bewertungen

- BANDULA - COMPARE-Partnership vs. CorporationDokument2 SeitenBANDULA - COMPARE-Partnership vs. CorporationCharena BandulaNoch keine Bewertungen

- INSTRUCTIONS: Read Each Question Carefully Before Answering. Answer The Questions DirectlyDokument5 SeitenINSTRUCTIONS: Read Each Question Carefully Before Answering. Answer The Questions DirectlyMikes FloresNoch keine Bewertungen

- Partnership Agreement DisputeDokument10 SeitenPartnership Agreement DisputeboorijanNoch keine Bewertungen

- Mercantile Law Q&ADokument6 SeitenMercantile Law Q&ARay Anthony RilveriaNoch keine Bewertungen

- 2015 - 2019 - Remedial Law - Bar ExaminationsDokument35 Seiten2015 - 2019 - Remedial Law - Bar ExaminationsPLO Davao del SurNoch keine Bewertungen

- 2007-2013 Bar Questions On Corporation LawsDokument8 Seiten2007-2013 Bar Questions On Corporation LawsHazel Martinii Panganiban100% (1)

- Wasting Assets CorporationsDokument2 SeitenWasting Assets CorporationsVon VelascoNoch keine Bewertungen

- Law on Business Organizations ReviewerDokument12 SeitenLaw on Business Organizations Reviewererickson hernanNoch keine Bewertungen

- Sole Proprietorship Has No Separate Juridical PersonalityDokument30 SeitenSole Proprietorship Has No Separate Juridical PersonalityChristianneNoelleDeVeraNoch keine Bewertungen

- Taxation of income from illegal activitiesDokument15 SeitenTaxation of income from illegal activitiesjaine0305Noch keine Bewertungen

- Philippine IP Law Digest CasesDokument63 SeitenPhilippine IP Law Digest CasesTricia SibalNoch keine Bewertungen

- OM No. 2018-04-03Dokument2 SeitenOM No. 2018-04-03Christian Albert HerreraNoch keine Bewertungen

- US vs. BernardoDokument6 SeitenUS vs. BernardolictoledoNoch keine Bewertungen

- Province of Bataan V CasimiroDokument1 SeiteProvince of Bataan V CasimiroJinny Gin100% (1)

- LandBank of The Philippines v. CADokument4 SeitenLandBank of The Philippines v. CAbearzhugNoch keine Bewertungen

- Separate Juridical Personality and Doctrine of Piercing The Veil of Corporate FictionsDokument31 SeitenSeparate Juridical Personality and Doctrine of Piercing The Veil of Corporate FictionsRache Gutierrez100% (4)

- Flowchart of Tax Remedies 2019 Update TRDokument11 SeitenFlowchart of Tax Remedies 2019 Update TRBlackjack SharedNoch keine Bewertungen

- QUICKNOTES on Revised Corporation CodeDokument11 SeitenQUICKNOTES on Revised Corporation CodeMichaelangelo MacabeeNoch keine Bewertungen

- Tax Flowchart Remedies (Tokie)Dokument9 SeitenTax Flowchart Remedies (Tokie)Tokie TokiNoch keine Bewertungen

- Old and Revised Corporation Code of The Philippines - DeliberationsDokument44 SeitenOld and Revised Corporation Code of The Philippines - Deliberationsaudreyracela100% (1)

- Bir - Train Tot - Transfer TaxesDokument14 SeitenBir - Train Tot - Transfer TaxesGlo GanzonNoch keine Bewertungen

- VAT 101: Understanding Value Added TaxDokument13 SeitenVAT 101: Understanding Value Added TaxKara Clark100% (1)

- University of Perpetual Help System Dalta: Calamba Campus, Brgy. Paciano Rizal, Calamba City, Laguna, PhilippinesDokument19 SeitenUniversity of Perpetual Help System Dalta: Calamba Campus, Brgy. Paciano Rizal, Calamba City, Laguna, PhilippinesDerick Ocampo FulgencioNoch keine Bewertungen

- Local Government Tax PDFDokument9 SeitenLocal Government Tax PDFNikko ParNoch keine Bewertungen

- When, What and How of Insurance Contract (Perfection) When Is It Perfected?Dokument9 SeitenWhen, What and How of Insurance Contract (Perfection) When Is It Perfected?Jexelle Marteen Tumibay PestañoNoch keine Bewertungen

- Remedial Law Reviewer 2018 UpdatedDokument22 SeitenRemedial Law Reviewer 2018 UpdatedVenice Jamaila Dagcutan100% (1)

- RMC No. 77-2008Dokument3 SeitenRMC No. 77-2008James Susuki100% (1)

- eBTAC 100Dokument66 SeiteneBTAC 100Maria Christina Hiceta Maynes100% (1)

- Corporation Law ReviewerDokument41 SeitenCorporation Law ReviewerRik GarciaNoch keine Bewertungen

- Assessment Tax Flow ChartDokument3 SeitenAssessment Tax Flow ChartkawaiimiracleNoch keine Bewertungen

- Flowchart of Tax RemediesDokument3 SeitenFlowchart of Tax RemediesJunivenReyUmadhayNoch keine Bewertungen

- PENALTIES AND FINES FOR TAX NON-COMPLIANCEDokument8 SeitenPENALTIES AND FINES FOR TAX NON-COMPLIANCEDaryl Noel TejanoNoch keine Bewertungen

- Request For Reconsideration and ReinvestigationDokument2 SeitenRequest For Reconsideration and Reinvestigationalmira halasanNoch keine Bewertungen

- Procedural Steps for Tax Assessment and ProtestDokument2 SeitenProcedural Steps for Tax Assessment and ProtestErmawooNoch keine Bewertungen

- Fighting Anxiety and Fatigue - Doterra OilDokument1 SeiteFighting Anxiety and Fatigue - Doterra OilMarie MoralesNoch keine Bewertungen

- Peppermint - Doterra OilDokument1 SeitePeppermint - Doterra OilMarie MoralesNoch keine Bewertungen

- 7th Version (JDT)Dokument2 Seiten7th Version (JDT)Marie MoralesNoch keine Bewertungen

- AI Magazine Issue 3 2019 Jan19181Dokument1 SeiteAI Magazine Issue 3 2019 Jan19181Marie MoralesNoch keine Bewertungen

- 101 Uses for Lemon, Peppermint and Lavender Essential OilsDokument9 Seiten101 Uses for Lemon, Peppermint and Lavender Essential OilsMarie MoralesNoch keine Bewertungen

- 2nd Quarterly Seminar & Meeting On National Tourism Development Plan 2016 2022Dokument21 Seiten2nd Quarterly Seminar & Meeting On National Tourism Development Plan 2016 2022Marie MoralesNoch keine Bewertungen

- Justice Delayed Is Justice Denied: Ensuring Efficient and Speedy Criminal Trials in The PhilippinesDokument11 SeitenJustice Delayed Is Justice Denied: Ensuring Efficient and Speedy Criminal Trials in The PhilippinesNoznuagNoch keine Bewertungen

- On Guard - Doterra OilDokument1 SeiteOn Guard - Doterra OilMarie MoralesNoch keine Bewertungen

- Bangko Sentral NG Pilipinas Application For EmploymentDokument2 SeitenBangko Sentral NG Pilipinas Application For EmploymentMarie MoralesNoch keine Bewertungen

- Tokyo Global ConferenceDokument16 SeitenTokyo Global ConferenceMarie MoralesNoch keine Bewertungen

- Rules and Regulations To Implement The Provisions of RA 10667Dokument33 SeitenRules and Regulations To Implement The Provisions of RA 10667dyajeeNoch keine Bewertungen

- Key Prohibitions Under The PCA Explained Oed FinalDokument20 SeitenKey Prohibitions Under The PCA Explained Oed FinalMacy YbanezNoch keine Bewertungen

- Querubin V COMELECDokument41 SeitenQuerubin V COMELECTriccie Coleen MangueraNoch keine Bewertungen

- Revised PAO Operations Manual 20170406 v1 - 2Dokument70 SeitenRevised PAO Operations Manual 20170406 v1 - 2alwayskeepthefaith8Noch keine Bewertungen

- Revenue Memorandum Order No. 26-2016 (Digest)Dokument2 SeitenRevenue Memorandum Order No. 26-2016 (Digest)JV BMNoch keine Bewertungen

- Revenue Memorandum Order No. 26-2016 (Digest)Dokument2 SeitenRevenue Memorandum Order No. 26-2016 (Digest)JV BMNoch keine Bewertungen

- I Love YouDokument1 SeiteI Love YouMarie MoralesNoch keine Bewertungen

- COA Circular 89-296 Dtd. 1-27-89Dokument6 SeitenCOA Circular 89-296 Dtd. 1-27-89Andrew GarciaNoch keine Bewertungen

- One Hundred Services Inc. vs. CIRDokument12 SeitenOne Hundred Services Inc. vs. CIRMarie MoralesNoch keine Bewertungen

- Derek Ramsay vs. CIR (2015)Dokument24 SeitenDerek Ramsay vs. CIR (2015)Marie MoralesNoch keine Bewertungen

- HB 06926Dokument10 SeitenHB 06926Marie MoralesNoch keine Bewertungen

- Ra 9485Dokument6 SeitenRa 9485Junalee Cuansing SabugalNoch keine Bewertungen

- Civil Law ReviewDokument90 SeitenCivil Law ReviewMarie MoralesNoch keine Bewertungen

- RA 6713 - Code of Conduct and Ethical Standard For Public Officials and EmployeesDokument12 SeitenRA 6713 - Code of Conduct and Ethical Standard For Public Officials and EmployeesCrislene Cruz83% (12)

- Real Estate Class - Atty. Rex Cruz (2014)Dokument49 SeitenReal Estate Class - Atty. Rex Cruz (2014)Marie MoralesNoch keine Bewertungen

- Hanjin Heavy Industries and Construction Company Vs CA (2009)Dokument2 SeitenHanjin Heavy Industries and Construction Company Vs CA (2009)Marie Morales100% (1)

- Tax Treatment of Certain Real Property Transactions Under The NIRC of 1997 PDFDokument8 SeitenTax Treatment of Certain Real Property Transactions Under The NIRC of 1997 PDFMarie MoralesNoch keine Bewertungen

- Cabrador Vs PeopleDokument1 SeiteCabrador Vs PeopleMarie MoralesNoch keine Bewertungen

- Court Ruling on Demurrer to EvidenceDokument1 SeiteCourt Ruling on Demurrer to EvidenceMarie MoralesNoch keine Bewertungen