Beruflich Dokumente

Kultur Dokumente

Jan 2010 Monthly Operating Report

Hochgeladen von

Troy UhlmanCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Jan 2010 Monthly Operating Report

Hochgeladen von

Troy UhlmanCopyright:

Verfügbare Formate

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.

htm

8-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 14, 2010

LEHMAN BROTHERS HOLDINGS INC.

(Exact name of registrant as specified in its charter)

Delaware 1-9466 13-3216325

(State or other jurisdiction (Commission (IRS Employer

Of incorporation) File Number) Identification No.)

1271 Avenue of the Americas

New York, New York

10020

(Address of Principal Executive Offices)

(Zip Code)

Registrant’s telephone number, including area code:

(646) 285-9000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 7.01 Regulation FD Disclosure.

As previously disclosed, on September 15, 2008, Lehman Brothers Holdings Inc. (the “Registrant”) filed a voluntary petition for relief

under Chapter 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of

New York (the “Court”) in a jointly administered proceeding named In re Lehman Brothers Holdings Inc., et. al. under Case Number

08-13555 (the “Chapter 11 Proceeding”). As further disclosed previously, certain of the Registrant’s subsidiaries (collectively with

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.htm (1 of 9) [1/14/2010 8:10:53 PM]

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.htm

the Registrant, the “Debtors”) have also filed proceedings under Chapter 11 of the Bankruptcy Code. The Debtors’ Chapter 11 cases have

been consolidated for procedural purposes only and are being jointly administered pursuant to Rule 1015(b) of the Federal

Rules of Bankruptcy Procedure (the “Bankruptcy Rules”) and the Debtors continue to operate as debtors-in-possession pursuant to

sections 1107(a) and 1108 of the Bankruptcy Code.

On January 14, 2010, the Debtors filed with the Court a Monthly Operating Report (the “Monthly Operating Report”). A copy of the

Monthly Operating Report for the Debtors is attached hereto as Exhibit 99.1. This Current Report (including the Exhibits hereto) will not

be deemed an admission as to the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation FD.

Limitation on Incorporation by Reference

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01 shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except

as shall be expressly set forth by specific reference in such a filing.

Cautionary Statements Regarding Financial and Operating Data

The Registrant cautions investors and potential investors not to place undue reliance upon the information contained in the Monthly

Operating Report, as it was not prepared for the purpose of providing the basis for an investment decision relating to any of the securities

of any of the Debtors, or any other affiliate of the Registrant. The Monthly Operating Report is not prepared in accordance with U.S.

generally accepted accounting principles, was not audited or reviewed by independent accountants, will not be subject to audit or review by

the Registrant’s external auditors at any time in the future, is in a format consistent with applicable bankruptcy laws, and is subject to

future adjustment and reconciliation. There can be no assurances that, from the perspective of an investor or potential investor in

the Registrant’s securities, the Monthly Operating Report is accurate or complete. The Monthly Operating Report contains a

further description of limitations on the information contained therein. The Monthly Operating Report also contains information for

periods which are shorter or otherwise different from those required in the Registrant’s reports pursuant to the Exchange Act, and

such information might not be indicative of the Registrant’s financial condition or operating results for the period that would be reflected in

the Registrant’s financial statements or in its reports pursuant to the Exchange Act. Results set forth in the Monthly Operating Report

should not be viewed as indicative of future results.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K and Exhibit 99.1 hereto may contain forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995 with respect to the Registrant’s financial condition, results of operations, and business that

is not historical information. As a general matter, forward-looking statements are those focused upon future or

anticipated events or trends and expectations and beliefs relating to matters that are not historical in nature. The words “believe,”

“expect,” “plan,” “intend,” “estimate,” or “anticipate” and similar expressions, as well as future or conditional verbs such as “will,”

“should,” “would,” and “could,” often identify forward-looking statements. The Registrant believes there is a reasonable basis for

its expectations and beliefs, but they are inherently uncertain, and the Registrant may not realize its expectations and its beliefs may not

prove correct. The Registrant undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of

new information, future events, or otherwise. The Registrant’s actual results and future financial condition may differ materially from

those described or implied by any such forward-looking statements as a result of many factors that may be outside the Registrant’s

control. Such factors include, without limitation: (i) the ability of the Registrant to develop, prosecute, confirm, and consummate any plan

of reorganization or liquidation with respect to the Chapter 11 Proceeding; (ii) the Registrant’s ability to obtain Court approval with respect

to motions in the Chapter 11 Proceeding; (iii) risks associated with third parties seeking and obtaining court approval for the appointment of

a Chapter 11 trustee; and (iv) the potential adverse impact of the Chapter 11 Proceeding on the Registrant’s liquidity or results of

operations. This list is not intended to be exhaustive.

The Registrant’s informational filings with the Court, including this Monthly Operating Report, are available to the public at the office of

the Clerk of the Bankruptcy Court, Alexander Hamilton Custom House, One Bowling Green, New York, New York 10004-1408.

Such informational filings may be available electronically, for a fee, through the Court’s Internet world wide web site (www.nysb.

uscourts.gov), and/or free of cost, at a world wide web site maintained by the Registrant’s Court-approved noticing agent (www.

lehman-docket.com).

ITEM 9.01 Financial Statements and Exhibits.

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.htm (2 of 9) [1/14/2010 8:10:53 PM]

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.htm

(a) Exhibits

99.1 Lehman Brothers Holdings Inc. — Monthly Operating Report filed with the Bankruptcy Court on January 14,

2010

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

LEHMAN BROTHERS HOLDINGS INC.

Date: January 14, 2010 By: /s/ William J. Fox

Name: William J. Fox

Title: Chief Financial Officer and Executive Vice President

EXHIBIT INDEX

Exhibit No. Description

99.1 Lehman Brothers Holdings Inc. — Monthly Operating Report filed with the Bankruptcy Court on January 14, 2010

EX-99.1

Exhibit 99.1

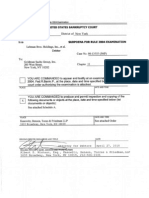

UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF NEW YORK

In re: Chapter 11 Case No.

Lehman Brothers Holdings Inc., et al., 08-13555

Debtors.

MONTHLY OPERATING REPORT

DECEMBER 2009

SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS

SCHEDULE OF PROFESSIONAL FEE AND EXPENSE DISBURSEMENTS

DEBTORS’ ADDRESS: LEHMAN BROTHERS HOLDINGS INC.

c/o WILLIAM J. FOX

1271 AVENUE OF THE AMERICAS

35th FLOOR

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.htm (3 of 9) [1/14/2010 8:10:53 PM]

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.htm

NEW YORK, NY 10020

DEBTORS’ ATTORNEYS: WEIL, GOTSHAL & MANGES LLP

c/o SHAI WAISMAN

767 FIFTH AVENUE

NEW YORK, NY 10153

REPORT PREPARER: LEHMAN BROTHERS HOLDINGS INC., A DEBTOR IN POSSESSION (IN THE SOUTHERN

DISTRICT OF NEW YORK)

THIS OPERATING STATEMENT MUST BE SIGNED BY A REPRESENTATIVE OF THE DEBTOR

The undersigned, having reviewed the attached report and being familiar with the Debtors’ financial affairs, verifies under penalty of

perjury, that the information contained therein is complete, accurate and truthful to the best of my knowledge.

Lehman Brothers Holdings Inc.

Date: January 14, 2010 By: /s/ William J. Fox

William J. Fox

Executive Vice President

Indicate if this is an amended statement by checking here: AMENDED STATEMENT o

TABLE OF CONTENTS

Schedule of Debtors 3

Lehman Brothers Holdings Inc. (“LBHI”) and Other Debtors and Other Controlled Subsidiaries

Basis of Presentation — Schedule of Cash Receipts and Disbursements 4

Schedule of Cash Receipts and Disbursements 5

LBHI

Basis of Presentation — Schedule of Professional Fee and Expense Disbursements 6

Schedule of Professional Fee and Expense Disbursements 7

LBHI

Quarterly Hedging Transactions Update 8

Schedule of Hedging Transactions as of December 31, 2009 9

SCHEDULE OF DEBTORS

The following entities have filed for bankruptcy in the Southern District of New York:

Case No. Date Filed

Lead Debtor:

Lehman Brothers Holdings Inc. (“LBHI”) 08-13555 9/15/2008

Related Debtors:

LB 745 LLC 08-13600 9/16/2008

PAMI Statler Arms LLC(1) 08-13664 9/23/2008

Lehman Brothers Commodity Services Inc. 08-13885 10/3/2008

Lehman Brothers Special Financing Inc. 08-13888 10/3/2008

Lehman Brothers OTC Derivatives Inc. 08-13893 10/3/2008

Lehman Brothers Derivative Products Inc. 08-13899 10/5/2008

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.htm (4 of 9) [1/14/2010 8:10:53 PM]

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.htm

Lehman Commercial Paper Inc. 08-13900 10/5/2008

Lehman Brothers Commercial Corporation 08-13901 10/5/2008

Lehman Brothers Financial Products Inc. 08-13902 10/5/2008

Lehman Scottish Finance L.P. 08-13904 10/5/2008

CES Aviation LLC 08-13905 10/5/2008

CES Aviation V LLC 08-13906 10/5/2008

CES Aviation IX LLC 08-13907 10/5/2008

East Dover Limited 08-13908 10/5/2008

Luxembourg Residential Properties Loan Finance S.a.r.l 09-10108 1/7/2009

BNC Mortgage LLC 09-10137 1/9/2009

LB Rose Ranch LLC 09-10560 2/9/2009

Structured Asset Securities Corporation 09-10558 2/9/2009

LB 2080 Kalakaua Owners LLC 09-12516 4/23/2009

Merit LLC 09-17331 12/14/2009

LB Somerset LLC 09-17503 12/22/2009

LB Preferred Somerset LLC 09-17505 12/22/2009

(1) On May 26, 2009, a motion was filed on behalf of Lehman Brothers Holdings Inc. seeking entry of an order pursuant to Section 1112

(b) of the Bankruptcy Code to dismiss the Chapter 11 Case of PAMI Statler Arms LLC, with a hearing to be held on June 24, 2009.

On June 19, 2009, the motion was adjourned without a date for a continuation hearing.

The Chapter 11 case of Fundo de Investimento Multimercado Credito Privado Navigator Investimento No Exterior (Case No: 08-13903)

has been dismissed.

The Chapter 11 case of Lehman Brothers Finance SA (Case No: 08-13887) has been dismissed.

LEHMAN BROTHERS HOLDINGS INC., (“LBHI”), AND OTHER DEBTORS AND OTHER CONTROLLED ENTITIES

BASIS OF PRESENTATION

SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS

DECEMBER 1, 2009 TO DECEMBER 31, 2009

The information and data included in this Report are derived from sources available to Lehman Brothers Holdings Inc. (“LBHI”) and

its Controlled Entities (collectively, the “Company”). The term “Controlled Entities” refers to those entities that are directly or

indirectly controlled by LBHI, and excludes, among other things, those entities that are under separate administrations in the United States

or abroad, including Lehman Brothers Inc., which is the subject of proceedings under the Securities Investor Protection Act. LBHI and

certain of its Controlled Entities have filed for protection under Chapter 11 of the Bankruptcy Code, and those entities are referred to herein

as the “Debtors”. The Debtors’ Chapter 11 cases have been consolidated for procedural purposes only and are being jointly

administered pursuant to Rule 1015(b) of the Federal Rules of Bankruptcy Procedure. The Debtors have prepared this presentation, as

required by the Office of the United States Trustee, based on the information available to the Debtors at this time, but note that

such information may be incomplete and may be materially deficient in certain respects. This Monthly Operating Report, (“MOR”), is

not meant to be relied upon as a complete description of the Debtors, their business, condition (financial or otherwise), results of

operations, prospects, assets or liabilities. The Debtors reserve all rights to revise this report.

1. This MOR is not prepared in accordance with U.S. generally accepted accounting principles (GAAP). This MOR should be read in

conjunction with the financial statements and accompanying notes in the Company’s annual and quarterly reports that were filed with the

United States Securities and Exchange Commission.

2. This MOR is not audited and will not be subject to audit or review by the Company’s external auditors at any time in the future.

3. The beginning and ending balances include cash in demand-deposit accounts (DDA), money-market funds (MMF), treasury bills, and

other investments.

4. The ending cash balances are based on preliminary closing numbers and are subject to adjustment.

5. Beginning and ending cash balances exclude cash that has been posted as collateral for derivatives hedging activity.

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.htm (5 of 9) [1/14/2010 8:10:53 PM]

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.htm

6. Beginning and ending cash balances exclude cash related to LBHI’s wholly-owned indirect subsidiaries Aurora Bank FSB (formerly

known as Lehman Brothers Bank FSB), Woodlands Commercial Bank (formerly known as Lehman Brothers Commercial Bank), Lehman

Brothers Trust Company N.A., and Lehman Brothers Trust Company of Delaware.

7. Intercompany transfers between Lehman entities are listed as disbursements for the paying entity and receipts for the receiving entity.

8. The following entities have filed for protection under Chapter 11 of the Bankruptcy Code during the month of December and are

included in the report herein:

a. Merit LLC – filed December 14, 2009.

b. LB Somerset LLC – filed December 22, 2009.

c. LB Preferred Somerset LLC – filed December 22, 2009.

LEHMAN BROTHERS HOLDINGS INC. and Other Debtors and Other Controlled Entities

Schedule of Cash Receipts and Disbursements

December 1, 2009 - December 31, 2009

Unaudited ($ in millions)

Beginning Cash & Ending Cash &

Filing Investments FX Investments

Legal Entity Date (12/1/09) (a) Receipts Transfers (b) Disbursements (c) Fluctuation (d) (12/31/09) (e)

Lehman Brothers Holdings Inc. 9/15/2008 $ 2,474 $ 1,435(f) $ 5 (939)(g) $ (10)$ 2,964

LB 745 LLC 9/16/2008 — — — — — —

PAMI Statler Arms LLC 9/23/2008 — — — — — —

Lehman Brothers Special Financing Inc.

(“LBSF”) 10/3/2008 5,118 571 — (278)(h) (10) 5,401

Lehman Brothers Commodity Services Inc.

(“LBCS”) 10/3/2008 1,176 44 — (21) (1) 1,198

Lehman Brothers OTC Derivatives Inc

(“LOTC”) 10/3/2008 167 1 — — — 167

Lehman Commercial Paper Inc. (“LCPI”) 10/5/2008 3,546 897(i) — (812)(i) (3) 3,628

Lehman Brothers Commercial Corporation

(“LBCC”) 10/5/2008 472 15 — — — 488

Lehman Brothers Derivative Products Inc.

(“LBDP”) 10/5/2008 387 — — — — 387

Lehman Brothers Financial Products Inc

(“LBFP”) 10/5/2008 426 1 — (2) — 425

CES Aviation LLC 10/5/2008 — — — — — —

CES Aviation V LLC 10/5/2008 — — — — — —

CES Aviation IX LLC 10/5/2008 — — — — — —

East Dover Limited 10/5/2008 — — — — — —

Lehman Scottish Finance L.P. 10/5/2008 2 — — — — 2

Luxembourg Residential Properties Loan

Finance 1/7/2009 — — — — — —

BNC Mortgage LLC 1/9/2009 — — — — — —

LB Rose Ranch LLC 2/9/2009 1 — — — — 1

Structured Asset Securities Corporation

(“SASCO”) 2/9/2009 — — — — — —

LB 2080 Kalakaua Owners LLC 4/23/2009 — — — — — —

Merit LLC 12/14/2009 — — — — — —

LB Somerset LLC 12/22/2009 — — — — — —

LB Preferred Somerset LLC 12/22/2009 — — — — — —

Debtor Cash and Investment Flows -

Domestically Managed (j) 13,769 $ 2,963 $ 5$ (2,051) $ (24) 14,661

Non-Debtor Cash and Investment Balances -

Domestically Managed (j) 1,987 1,920

Debtor and Non-Debtor Cash and Investment

Balances - Foreign Managed (k) 576 573

Total Cash and Investment Balances $ 16,332 $ 17,154

Notes:

(a) Beginning Cash & Investments balance has been restated from November 30, 2009 closing balance by ($2 million) for LBSF.

(b) Reflects transfers from bank accounts managed in other regions to the US.

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.htm (6 of 9) [1/14/2010 8:10:53 PM]

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.htm

(c) $264 million was disbursed from subsidiaries of LBHI to reimburse LBHI for estimated operating expenses and professional fees which had been paid by LBHI from

June 2009 to November 2009, and are subject to adjustment and true-up (LBSF $180 million, LCPI $41 million, LBCS 21 million, LBFP $1 million, and Non-Debtors $21

million).

(d) Reflects fluctuation in value in foreign currency bank accounts.

(e) Ending Cash and Investments balances include approximately $2.6 billion of cash associated with pledged assets, court order segregated accounts, funds administratively held

by banks, and other identified funds which may not belong to the Debtor or non-Debtor subsidiaries. These amounts are preliminarily estimated as follows: Debtors - LBHI

$215 million, LBSF $310 million, LBCS $33 million, LCPI $1.9 billion, LBCC $8 million, Lehman Scottish Finance $2 million; Non-Debtors $100 million; and International

$98 million, and are subject to adjustment. Ending cash balances also exlcude approximately $414 million in cash posted as collateral for derivatives hedging activity; broken

down as follows: LBSF $390 million, LBFP $15 million, and LBCS $10 million. Cash pledged on or prior to September 15, 2008 by the Company in connection with certain

documents executed by the Company and various financial institutions has been excluded from this report.

(f) Includes $837 million in receipts from Aurora Bank associated with repayment of court approved repo financing transactions. On 12/31/09, there was $0 outstanding on the

repo with Aurora Bank. Also includes $264 million in receipts from subsidiaries for estimated operating expenses and professional fees which had been paid by LBHI, and are

subject to adjustment and true-up.

(g) Reflects ordinary course outflows and other court approved disbursements, including court approved disbursements to Aurora Bank for repo financing transactions of $606

million.

(h) Reflects $180 million transferred to LBHI for cost allocation, $71 million returned to a counterparty for a wire transfer sent in error in April 2009, $21 million posted as

collateral for court approved hedging activity, and $6 million disbursements related to live trades.

(i) LCPI, in its capacity as loan agreement agent, receives and passes along principal and interest to loan syndicate participants.

(j) Represents bank accounts managed and reconciled by Lehman US operations, which may include cash associated with foreign entities. Foreign currency cash flows are

reflected in USD equivalents.

(k) Represents bank accounts managed and reconciled by Lehman foreign operations. Ending balance of $573 million includes Asia balance of $464 million, South America

balance of $26 million and Europe balance of $83 million.

LEHMAN BROTHERS HOLDINGS INC. (“LBHI”)

BASIS OF PRESENTATION

SCHEDULE OF PROFESSIONAL FEE AND EXPENSE DISBURSEMENTS

DATED FROM FILING DATE TO DECEMBER 31, 2009

The information and data included in this Report are derived from sources available to Lehman Brothers Holdings Inc. (“LBHI”) and

its Controlled Entities (collectively, the “Company”). The term “Controlled Entities” refers to those entities that are directly or

indirectly controlled by LBHI, and excludes, among other things, those entities that are under separate administrations in the United States

or abroad, including Lehman Brothers Inc., which is the subject of proceedings under the Securities Investor Protection Act. LBHI and

certain of its Controlled Entities have filed for protection under Chapter 11 of the Bankruptcy Code, and those entities are referred to herein

as the “Debtors”. The Debtors’ Chapter 11 cases have been consolidated for procedural purposes only and are being jointly

administered pursuant to Rule 101(b) of the Federal Rules of Bankruptcy Procedure. The Debtors have prepared this presentation, as

required by the Office of the United States Trustee, based on information from the Debtors internal systems, but note that such

information may be incomplete in certain respects and the Debtors reserve all rights to revise this report. This MOR is not meant to be

relied upon as a complete description of the Debtors, their business, condition (financial or otherwise), results of operations, prospects,

assets or liabilities.

1. This MOR is not prepared in accordance with U.S. generally accepted accounting principles (GAAP). This MOR should be read in

conjunction with the financial statements and accompanying notes in the Company’s annual and quarterly reports that were filed with the

United States Securities and Exchange Commission.

2. This MOR is not audited and will not be subject to audit or review by the Company’s external auditors at any time in the future.

3. The professional fee disbursements presented in this report reflect the date of actual cash payments to professional service providers.

The Debtors have incurred additional professional fee expenses during the reporting period that will be reflected in future MORs as cash

payments are made to providers.

LEHMAN BROTHERS HOLDINGS INC.

Schedule of Professional Fee and Expense Disbursements (a)

December 2009

Unaudited ($ in thousands)

Filing Date

Dec-09 Through Dec-09 (b)

Debtors - Section 363 Professionals

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.htm (7 of 9) [1/14/2010 8:10:53 PM]

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.htm

Alvarez & Marsal LLC Interim Management $ 15,877 $ 218,297

Kelly Matthew Wright Art Consultant and Auctioneer — 47

Natixis Capital Markets Inc. Derivatives Consultant 1,428 8,121

Debtors - Section 327 Professionals

Bingham McCutchen LLP Special Counsel - Tax 590 8,516

Bortstein Legal LLC Special Counsel - IT and Other Vendor Contracts 267 2,548

Curtis, Mallet-Prevost, Colt & Mosle LLP Special Counsel - Conflicts 1,250 13,032

Discover Ready LLC eDiscovery Services — 4,812

Ernst & Young LLP Audit and Tax Services 71 1,367

Hudson Global Resources Contract Attorneys — 1,928

Huron Consulting Tax Services 155 1,973

Jones Day Special Counsel - Asia and Domestic Litigation 1,952 14,292

Lazard Freres & Co. Investment Banking Advisor 3,219 17,118

McKenna Long & Aldridge LLP Special Counsel - Commercial Real Estate Lending 907 3,227

Pachulski Stang Ziehl & Jones Special Counsel - Real Estate 124 661

Reilly Pozner LLP Special Counsel - Mortgage Litigation and Claims 211 1,763

Special Counsel - SEC Reporting, Asset Sales, and

Simpson Thacher & Bartlett LLP Congressional Testimony 25 2,117

Weil Gotshal & Manges LLP Lead Counsel — 127,143

Windels Marx Lane & Mittendorf, LLP Special Counsel - Real Estate 153 750

Debtors - Claims and Noticing Agent

Epiq Bankruptcy Solutions LLC Claims Management and Noticing Agent 3,741 6,514

Creditors - Section 327 Professionals

FTI Consulting Inc. Financial Advisor 4,355 20,625

Houlihan Lokey Howard & Zukin Capital Inc. Investment Banking Advisor 487 5,683

Milbank Tweed Hadley & McCloy LLP Lead Counsel 5,933 42,360

Quinn Emanuel Urquhart Oliver & Hedges LLP Special Counsel - Conflicts 614 4,894

Richard Sheldon, Q.C. Special Counsel - UK — 74

Examiner - Section 327 Professionals

Duff & Phelps LLC Financial Advisor 5,016 26,411

Jenner & Block LLP Examiner 6,074 33,961

Fee Examiner

Feinberg Rozen LLP Fee Examiner 75 418

Brown Greer Plc Fee and Expense Analyst 87 87

Total Non-Ordinary Course Professionals 52,612 568,741

Debtors - Ordinary Course Professionals 2,280 19,134

US Trustee Quarterly Fees — 483

Total Professional Fees and UST Fees $ 54,892 $ 588,358

(a) All professional fees have been paid by LBHI; however, a portion has been charged back to debtor and non-debtor subsidiaries based on

the direct costs associated with each entity and an allocation methodology.

(b) The figures reflected in this table represent cash disbursements from LBHI’s filing date through the end of December 2009 and do not

include holdback amounts required by court order for Non-Ordinary Course Professionals. The figures do not include accruals.

LEHMAN BROTHERS HOLDINGS INC. (“LBHI”)

QUARTERLY HEDGING TRANSACTIONS UPDATE

AS OF DECEMBER 31, 2009

The information and data included in this report are derived from sources available to Lehman Brothers Holdings Inc. (“LBHI”) and

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.htm (8 of 9) [1/14/2010 8:10:53 PM]

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.htm

its Controlled Entities (collectively, the “Company”). The term “Controlled Entities” refers to those entities that are directly or

indirectly controlled by LBHI, and excludes, among other things, those entities that are under separate administrations in the United States

or abroad, including Lehman Brothers Inc., which is the subject of proceedings under the Securities Investor Protection Act. LBHI and

certain of its Controlled Entities have filed for protection under Chapter 11 of the Bankruptcy Code, and those entities are referred to herein

as the “Debtors”. The Debtors’ Chapter 11 cases have been consolidated for procedural purposes only and are being jointly

administered pursuant to Rule 1015(b) of the Federal Rules of Bankruptcy Procedure.

On March 11, 2009, the United States Court for the Southern District of New York overseeing the Debtors’ chapter 11 cases (the

“Court”) entered an “Order Pursuant to Sections 105 and 364 of the Bankruptcy Code Authorizing the Debtors to Grant First Priority Liens

in Cash Collateral Posted in Connection With the Hedging Transactions the Debtors Enter Into Through Certain Futures and Prime

Brokerage Account” [Docket No. 3047] (the “Derivatives Order”).

On July 16, 2009, the Court entered a separate “Order Pursuant to Sections 105 and 364 of the Bankruptcy Code Authorizing the Debtors

to Grant First Priority Liens in Collateral Posted in Connection With the Hedging Transactions” [Docket No. 4423] (the “Residential

Loan Order”).

Terms used and not otherwise defined herein shall have the meanings ascribed thereto in the Derivatives Order or the Residential Loan

Order, as the case may be.

The Debtors have prepared this Quarterly Hedging Transactions Update, as required by the Derivatives Order, based on the

information available to the Debtors at this time, but note that such presentation is partially based on market pricing which is subject to day-

to-day fluctuations. The Debtors reserve all rights to revise this report.

Derivatives Order. Between the entry of the Derivatives Order and December 31, 2009 (the “Report Date”), the Debtors have proposed

12 Hedging Transactions to the Hedging Transactions Committee. As of the Report Date, the Debtors had executed all 12

Hedging Transactions and posted an aggregate $414 million in cash collateral pursuant thereto. The Open Derivative Positions correspond

to 100 un-terminated derivative contracts with an estimated recovery value as of the Report Date equal to $812 million. The

expected recovery amounts are determined using various models, data sources, and certain assumptions regarding contract provisions.

The Company expects to adjust the amounts recorded for the Open Derivative Positions in the future; such adjustments (including write-

downs and write-offs) may be material. For further description regarding derivative recovery values, please refer to the

November 2009 Monthly Operating Report filed on December 14, 2009.

As of the Report Date, the Hedging Transactions were allocated to individual Debtors as set forth on the following page.

Residential Loan Order. Between the entry of the Residential Loan Order and the Report Date, there were no Residential

Hedging Transactions.

Lehman Brothers Holdings Inc.

As of December 31, 2009

Collateral Posted Estimated Recovery

For Hedging Value of Receivables

Debtor Transactions Being Hedged

Lehman Brothers Special Financing Inc. (LBSF) $ 390,238,000 $ 802,757,351

Lehman Brothers Financial Products (LBFP) 14,500,000 2,669,285

Lehman Brothers Commodity Services (LBCS) 9,500,000 6,931,010

$ 414,238,000 $ 812,357,646

file:///C|/Documents%20and%20Settings/Troy%20Uhlman/Desktop/filing_raw.php.htm (9 of 9) [1/14/2010 8:10:53 PM]

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Lbhi Bylaws 8 Nov 2007Dokument22 SeitenLbhi Bylaws 8 Nov 2007Troy UhlmanNoch keine Bewertungen

- 2010-04-29 Lehman Hearing TranscriptDokument283 Seiten2010-04-29 Lehman Hearing TranscriptTroy UhlmanNoch keine Bewertungen

- 31mar2010 HoldingsDokument10 Seiten31mar2010 HoldingsTroy UhlmanNoch keine Bewertungen

- 2010-04-26 Lehman Hearing Transcript AmendedDokument246 Seiten2010-04-26 Lehman Hearing Transcript AmendedTroy UhlmanNoch keine Bewertungen

- Statement Notice of Subpoena Issued Pursuan - StatementDokument16 SeitenStatement Notice of Subpoena Issued Pursuan - StatementTroy UhlmanNoch keine Bewertungen

- In Re:: Docket #2454 Date Filed: 3/3/2010Dokument6 SeitenIn Re:: Docket #2454 Date Filed: 3/3/2010Troy UhlmanNoch keine Bewertungen

- March 2010 Monthly Operating ReportDokument12 SeitenMarch 2010 Monthly Operating ReportTroy UhlmanNoch keine Bewertungen

- Application For FRBP 2004 ExaminationDokument50 SeitenApplication For FRBP 2004 ExaminationTroy UhlmanNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 91f52d6b-a48b-4b90-ad4d-02dd572827fdDokument22 Seiten91f52d6b-a48b-4b90-ad4d-02dd572827fdHeather Timmons100% (1)

- Bills of Exchange Act 22 of 2003Dokument32 SeitenBills of Exchange Act 22 of 2003André Le Roux100% (1)

- Latest A4VDokument10 SeitenLatest A4VStephen L. SmithNoch keine Bewertungen

- 25 50 Full Board Meeting 20230227Dokument11 Seiten25 50 Full Board Meeting 20230227Contra Value BetsNoch keine Bewertungen

- Kotak PMS Pharma Strategy May 2018Dokument50 SeitenKotak PMS Pharma Strategy May 2018rchawdhry123Noch keine Bewertungen

- To Financial Markets: Prof Anita C RamanDokument30 SeitenTo Financial Markets: Prof Anita C RamanSIDDHARTH GAUTAMNoch keine Bewertungen

- K OD-EmerEquitySchemeDokument76 SeitenK OD-EmerEquitySchemegrfgtftrgtNoch keine Bewertungen

- CIR Vs PAL - ConstructionDokument8 SeitenCIR Vs PAL - ConstructionEvan NervezaNoch keine Bewertungen

- ACCA 201 and ACCA 202 Own NotesDokument153 SeitenACCA 201 and ACCA 202 Own Notesgavin henning100% (1)

- Singapore Salary BankingDokument5 SeitenSingapore Salary BankingMartin JpNoch keine Bewertungen

- Solution Manual For Financial Reporting, Financial Statement Analysis and Valuation, 9th Edition, James M. Wahlen, Stephen P. Baginski Mark BradshawDokument42 SeitenSolution Manual For Financial Reporting, Financial Statement Analysis and Valuation, 9th Edition, James M. Wahlen, Stephen P. Baginski Mark Bradshawbrandonfowler12031998mgj100% (43)

- Company Meetings NavinDokument12 SeitenCompany Meetings NavinNavin SureshNoch keine Bewertungen

- NPSI Term SheetDokument5 SeitenNPSI Term SheetNegros Solar PHNoch keine Bewertungen

- Real Estate Weekly News Letter 13 October 2014 - 19 October 2014Dokument25 SeitenReal Estate Weekly News Letter 13 October 2014 - 19 October 2014Aayushi AroraNoch keine Bewertungen

- Detailed Study On Hedging, Arbitrage and SpeculationDokument247 SeitenDetailed Study On Hedging, Arbitrage and SpeculationSumit NamdevNoch keine Bewertungen

- QAU Bulletin: No. 1 Series of 2016Dokument34 SeitenQAU Bulletin: No. 1 Series of 2016Stephn GrayNoch keine Bewertungen

- Globtec Investment Group Announces $170 Million Investment in Public Infrastructure and Real Estate Projects in The Visegrád StatesDokument3 SeitenGlobtec Investment Group Announces $170 Million Investment in Public Infrastructure and Real Estate Projects in The Visegrád StatesPR.comNoch keine Bewertungen

- SARFAESI Act, Asset Reconstruction Company (ARC), Security Receipts (SR), QIB, DRT, Central Registry PrintDokument11 SeitenSARFAESI Act, Asset Reconstruction Company (ARC), Security Receipts (SR), QIB, DRT, Central Registry PrintAkalya ThangarajNoch keine Bewertungen

- StocksDokument15 SeitenStocksmayko-angeles-3102Noch keine Bewertungen

- HDFC - LIC Right MARKETING STRATEGIESDokument56 SeitenHDFC - LIC Right MARKETING STRATEGIESMANISHA GAUTAMNoch keine Bewertungen

- Business Finance - Horizontal AnalysisDokument2 SeitenBusiness Finance - Horizontal AnalysisAnon0% (1)

- Stock Exchange of IndiaDokument23 SeitenStock Exchange of IndiaAnirudh UbhanNoch keine Bewertungen

- Investment PropertyDokument28 SeitenInvestment PropertydedYno1100% (1)

- IASB Project ForSMEDokument27 SeitenIASB Project ForSMEAlexandre ValcazaraNoch keine Bewertungen

- ACCA Financial Management - Mock Exam 1 - 1000225 PDFDokument25 SeitenACCA Financial Management - Mock Exam 1 - 1000225 PDFrash D100% (1)

- LiquidityDokument26 SeitenLiquidityPallavi RanjanNoch keine Bewertungen

- Certificate in Insurance: Unit 1 - Insurance, Legal and RegulatoryDokument29 SeitenCertificate in Insurance: Unit 1 - Insurance, Legal and RegulatorytamzNoch keine Bewertungen

- 100 Women in Hedge Funds - Fireside Chat With Saba Capital's Boaz WeinsteinDokument2 Seiten100 Women in Hedge Funds - Fireside Chat With Saba Capital's Boaz WeinsteingneymanNoch keine Bewertungen

- Chapter 14Dokument20 SeitenChapter 14runawayyyNoch keine Bewertungen

- RR 1-99Dokument7 SeitenRR 1-99matinikkiNoch keine Bewertungen