Beruflich Dokumente

Kultur Dokumente

The Anatomy of Medical Research

Hochgeladen von

AdvaMedLCIOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Anatomy of Medical Research

Hochgeladen von

AdvaMedLCICopyright:

Verfügbare Formate

Clinical Review & Education

Special Communication | SCIENTIFIC DISCOVERY AND THE FUTURE OF MEDICINE

The Anatomy of Medical Research

US and International Comparisons

Hamilton Moses III, MD; David H. M. Matheson, JD, MBA; Sarah Cairns-Smith, PhD; Benjamin P. George, MD, MPH;

Chase Palisch, MPhil; E. Ray Dorsey, MD, MBA

Editorials pages 143 and 145

IMPORTANCE Medical research is a prerequisite of clinical advances, while health service

research supports improved delivery, access, and cost. Few previous analyses have compared

the United States with other developed countries.

Supplemental content at

jama.com

OBJECTIVES To quantify total public and private investment and personnel (economic inputs)

and to evaluate resulting patents, publications, drug and device approvals, and value created

(economic outputs).

EVIDENCE REVIEW Publicly available data from 1994 to 2012 were compiled showing trends

in US and international research funding, productivity, and disease burden by source and

industry type. Patents and publications (1981-2011) were evaluated using citation rates and

impact factors.

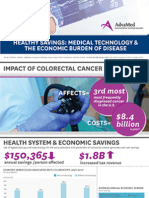

FINDINGS (1) Reduced science investment: Total US funding increased 6% per year

(1994-2004), but rate of growth declined to 0.8% per year (2004-2012), reaching $117 billion

(4.5%) of total health care expenditures. Private sources increased from 46% (1994) to 58%

(2012). Industry reduced early-stage research, favoring medical devices, bioengineered

drugs, and late-stage clinical trials, particularly for cancer and rare diseases. National Insitutes

of Health allocations correlate imperfectly with disease burden, with cancer and HIV/AIDS

receiving disproportionate support. (2) Underfunding of service innovation: Health services

research receives $5.0 billion (0.3% of total health care expenditures) or only 1/20th of

science funding. Private insurers ranked last (0.04% of revenue) and health systems 19th

(0.1% of revenue) among 22 industries in their investment in innovation. An increment of

$8 billion to $15 billion yearly would occur if service firms were to reach median research

and development funding. (3) Globalization: US government research funding declined from

57% (2004) to 50% (2012) of the global total, as did that of US companies (50% to 41%),

with the total US (public plus private) share of global research funding declining from 57% to

44%. Asia, particularly China, tripled investment from $2.6 billion (2004) to $9.7 billion

(2012) preferentially for education and personnel. The US share of life science patents

declined from 57% (1981) to 51% (2011), as did those considered most valuable, from 73%

(1981) to 59% (2011).

CONCLUSIONS AND RELEVANCE New investment is required if the clinical value of past

scientific discoveries and opportunities to improve care are to be fully realized. Sources could

include repatriation of foreign capital, new innovation bonds, administrative savings, patent

pools, and public-private risk sharing collaborations. Given international trends, the United

States will relinquish its historical international lead in the next decade unless such measures

are undertaken.

JAMA. 2015;313(2):174-189. doi:10.1001/jama.2014.15939

174

Author Affiliations: The Alerion

Institute and Alerion Advisors LLC,

North Garden, Virginia (Moses);

Johns Hopkins School of Medicine,

Baltimore, Maryland (Moses); Boston

Consulting Group, Boston,

Massachusetts (Matheson, CairnsSmith, Palisch); University of

Rochester School of Medicine,

Rochester, New York (George,

Dorsey); Stanford University School

of Medicine, Stanford, California

(Palisch).

Corresponding Author: Hamilton

Moses III, MD, Alerion, PO Box 150,

North Garden, VA 22959

(hm@alerion.us).

(Reprinted) jama.com

Copyright 2014 American Medical Association. All rights reserved.

Downloaded From: http://jama.jamanetwork.com/ on 01/15/2015

The Anatomy of Medical Research

Special Communication Clinical Review & Education

he promise of new drugs, vaccines, medical procedures, and

devices captures the imaginations of the public, scientists, and physicians alike. For the last century, medical research, including public health advances, has been the primary source

of and an essential contributor to improvement in the health and longevity of individuals and populations in developed countries. The

United States has historically been where research has found the

greatest support and has generated more than half the worlds funding for many decades. Although US-based companies, foundations, and public agencies have sponsored most research, that research is conducted by an array of autonomous university

laboratories, study groups, and coalitions of researchers. This organization contrasts with that found in most other countries, where

government laboratories are predominant and where health systems and insurers conduct and finance service innovations directly.

Expectations for medical research vary sharply, depending on

the observers perspective. For a patient affected by disease, it is a

source of hope. For a parent of a child with a serious condition, it

evokes both expectation and frustration over the pace of progress.

Where a physician may seek a route to better care, an economist sees

an engine of growth and a politician sees high-skill jobs and improved national competitiveness. Hospital executives expect research to spawn new services, whereas pharmaceutical CEOs must

have new products. An insurance executive doubts instinctively that

the value of research will outweigh its incremental cost. A regulator aims for the appropriate amount of risk while still getting innovations that matter to the market. For philanthropists and public

health campaigners, research represents the best hope for alleviating the worlds most immediate health-related problems. To a scientist, research deepens critical knowledge and the way intelligence and organized effort can improve health. All of these

constituents play a role in how research is funded and brought from

bench to bedside. Meeting their collective needs produces a complex set of hurdles.

This Special Communication examines developments over the

past 2 decades in the pattern of who conducts and who supports

medical research, as well as resulting patents, publications, and new

drug and device approvals. We place the United States in an international context to understand the key forces of change and sug-

gest remedies for the various stakeholders to explore as they seek

greater benefit for their investment.

Key Questions

We address 3 major trends:

1. Diminished funding in the United States from both public and private sponsors at a time when scientific opportunity has never

been greater but when support for sustained, long-term investments is limited and short-term performance is rewarded disproportionately

2. Establishing strong incentives for investment in health service and

delivery innovations and better ways to deliver care

3. The implications of globalization

Better understanding of these factors is required if the full promise of the cumulative investment in biomedical science and opportunity for improved services are to be realized.

Information in 8 areas has been assembled to inform the discussion (Figure 1). Two areas involve the current and historical landscape in the United States of investment and employment in medical research, placing the United States in an international context.

Two areas examine funding on biomedical and health services research separately. Four areas quantify the value of that investment

as judged by resulting patents, publications, drug and device approvals, and public market performance of life science and health

service companies.

Methods

To describe and document the current anatomy and historical trends

of medical research, we assembled an array of information from various data sources. We relied on publicly available data, recalculated

those data for display when necessary, reconciled inconsistent

sources, and included years for which data are complete (in general, from 1994 to 2012). The Box contains a list of the included and

supplementary figures and tables.

Methods were similar to those we have used previously.1-3 Additionally, in this study, the 40 largest developed nations were ex-

Figure 1. The Anatomy of Medical Research: US and International Comparisons

Medical Research Funding

Sources of funding

Government, industry,

foundations, charities,

and universities

Historical trends

International comparisons

Science and Technology

Workforce

Workforce size

Historical trends

International comparisons

Medical Research Activities

Biomedical research

Historical funding trends

Funding by phase of

research

Funding by therapeutic area

Health services research

Historical funding trends

Industrial sector comparisons

jama.com

Medical Research Output

Patents

International comparison

of patenting activity

Publications

International comparison

of publication activity

New drugs and devices

New drug and device

approvals by FDA and EMA

Market performance

Health care sector

performance compared

with market average

EMA indicates European Medicines

Agency; FDA, US Food and Drug

Administration.

(Reprinted) JAMA January 13, 2015 Volume 313, Number 2

Copyright 2014 American Medical Association. All rights reserved.

Downloaded From: http://jama.jamanetwork.com/ on 01/15/2015

175

The Anatomy of Medical Research

Special Communication Clinical Review & Education

slowed (medical device, 6.6% to 6.2% in 1994-2004 vs 20042012; biotechnology, 14.1% to 4.6% in 1994-2004 vs 20042012), or declined (pharmaceutical firms, 6.8% to 0.6% in 19942004 vs 2004-2012).

Figure 2. US Funding for Medical Research by Source, 1994-2012

Funding source

Foundations, charities, and other private funds

Medical device firms

State and local government

Biotechnology firmsc

Research Funding

Other federalb

Pharmaceutical firms

Biomedical Research

National Institutes of Healthb

jama.com

Compound annual growth

rate, 6.3% d

Compound annual growth

rate, 0.8% d

140

Medical Research Funding, $, in Billions a

The distribution of investments across the types of medical research changed from 2004 to 2011. Pharmaceutical companies

shifted funding to late-phase clinical trials and away from discovery activity such as target identification and validation. The share

of pharmaceutical industry funding (including that by US companies outside of the United States) spent on phase 3 trials increased

by 36% (5%/year growth rate) from 2004 to 2011 (Figure 4), and

the share of investment in prehuman/preclinical activities decreased by 4% (2%/year average decline). This shift toward clinical

research and development reflects the increasing costs, complexity, and length of clinical trials but may also reflect a deemphasis of

early discovery efforts by the US pharmaceutical industry. While industry has shifted funding to clinical trials, the share of NIH contributions dedicated to basic science and clinical research was unchanged (eTable 2 in the Supplement), with the majority of funds

still focused on basic research. These data may not accurately reflect the true division of NIH investment for basic science vs diseasefocused research, as a growing proportion of NIH expenditures is

for projects having potential clinical application in many diseases or

organ systems.7

In real terms, venture capital investment in biotechnology companies steadily increased from $1.5 billion in 1995 to a peak of $7.0

billion in 2007 (eFigure 3 in the Supplement). During that period,

investment in biotechnology companies as a share of total venture

capital investment increased from 10% to 18%, and the number of

investments increased from 176 to 538. Investment levels and the

number of transactions of biotechnology decreased following the

financial crisis in 2008-2009, declining to a low of $4.3 billion in

2009. Venture capital investment still has not recovered to its pre2008 levels, with only $4.5 billion invested in 2013. Size of investment per transaction (median, $11 million, inflation adjusted) has remained unchanged for 2 decades.

Public funding of medical research by condition was only marginally associated with disease burden in the United States in 2010

(eFigure 4 in the Supplement). A set of 27 diseases that account

for 84% of US mortality, 52% of years of life lived with disability,

84% of years of life lost, and 70% of disability-adjusted life-years

receive 48% of NIH funding (R2 = 0.26) (eTable 3 in the Supplement). Several factors other than disease burden may influence

funding, including the quality of research, scientific opportunity,

portfolio diversification, or building of infrastructure, and the combination of these factors complicates the relationship of funding to

particular conditions.8,9 Cancer and HIV/AIDS were funded well

above the predicted levels based on US disability alone (eFigure 4

in the Supplement), with cancer accounting for 16% ($5.6 billion)

of total NIH funding and 25% of all medicines currently in clinical

trials (Figure 5).

Rare diseases have emerged for industry as a preferential area

of therapeutic development, with nearly as many compounds in

trials as analgesics and antidiabetic drugs (Figure 5). Industry

favors rare diseases because they are commercially attractive due

120

100

80

60

40

20

0

1994

1996

1998

2000

2002

2004

Year

2006

2008

2010

2012

Includes

ARRA Fundingb

Data were calculated according to methods outlined in eTable 1 in the

Supplement. ARRA indicates American Recovery and Reinvestment Act.

a

Data were adjusted to 2012 dollars using the Biomedical Research and

Development Price Index.4

The National Institutes of Health and other federal sources include stimulus

provided by ARRA in 2009 and 2010.

Data from 1994-2002 and 2011-2012 were estimated based on linear

regression analysis of industry market share.

Compound annual growth rate (CAGR) supposing that year A is x and year B is

y, CAGR = (y/x){1/(BA)}1. The CAGR was calculated separately for 2 different

periods with a single overlapping year: 1994-2004 and 2004-2012. The cut

point was chosen at 2004 given the changes seen in funding from the

National Institutes of Health in that year.

to provisions of the Orphan Drug Act and relative ease of clinical

trials. Investment can be expected to increase as diseases are

defined by biomarkers that allow the development of targeted

therapies.12

Support from private foundations, public charities, and other

entities comes from only a few organizations. In 2011, 42% of total

not-for-profit funding was by the top 10 public medical charities and

top 10 private foundations (eTable 4 in the Supplement). The Howard Hughes Medical Institute (which supports domestic research primarily) and the Bill and Melinda Gates Foundation (which supports

international research primarily) account for 87% of biomedical research funding by private foundations (eTable 4, panel B). United

Statesbased medical charities direct most monies in the United

States, though the amount spent on research (as opposed to education, disease screening, and other activities) cannot be quantified using public data.

Health Services Research Funding

Health services research, which examines access to care, the quality and cost of care, and the health and well-being of individuals,

communities, and populations, accounted for between 0.2% and

(Reprinted) JAMA January 13, 2015 Volume 313, Number 2

Copyright 2014 American Medical Association. All rights reserved.

Downloaded From: http://jama.jamanetwork.com/ on 01/15/2015

177

The Anatomy of Medical Research

Special Communication Clinical Review & Education

slowed (medical device, 6.6% to 6.2% in 1994-2004 vs 20042012; biotechnology, 14.1% to 4.6% in 1994-2004 vs 20042012), or declined (pharmaceutical firms, 6.8% to 0.6% in 19942004 vs 2004-2012).

Figure 2. US Funding for Medical Research by Source, 1994-2012

Funding source

Foundations, charities, and other private funds

Medical device firms

State and local government

Biotechnology firmsc

Research Funding

Other federalb

Pharmaceutical firms

Biomedical Research

National Institutes of Healthb

jama.com

Compound annual growth

rate, 6.3% d

Compound annual growth

rate, 0.8% d

140

Medical Research Funding, $, in Billions a

The distribution of investments across the types of medical research changed from 2004 to 2011. Pharmaceutical companies

shifted funding to late-phase clinical trials and away from discovery activity such as target identification and validation. The share

of pharmaceutical industry funding (including that by US companies outside of the United States) spent on phase 3 trials increased

by 36% (5%/year growth rate) from 2004 to 2011 (Figure 4), and

the share of investment in prehuman/preclinical activities decreased by 4% (2%/year average decline). This shift toward clinical

research and development reflects the increasing costs, complexity, and length of clinical trials but may also reflect a deemphasis of

early discovery efforts by the US pharmaceutical industry. While industry has shifted funding to clinical trials, the share of NIH contributions dedicated to basic science and clinical research was unchanged (eTable 2 in the Supplement), with the majority of funds

still focused on basic research. These data may not accurately reflect the true division of NIH investment for basic science vs diseasefocused research, as a growing proportion of NIH expenditures is

for projects having potential clinical application in many diseases or

organ systems.7

In real terms, venture capital investment in biotechnology companies steadily increased from $1.5 billion in 1995 to a peak of $7.0

billion in 2007 (eFigure 3 in the Supplement). During that period,

investment in biotechnology companies as a share of total venture

capital investment increased from 10% to 18%, and the number of

investments increased from 176 to 538. Investment levels and the

number of transactions of biotechnology decreased following the

financial crisis in 2008-2009, declining to a low of $4.3 billion in

2009. Venture capital investment still has not recovered to its pre2008 levels, with only $4.5 billion invested in 2013. Size of investment per transaction (median, $11 million, inflation adjusted) has remained unchanged for 2 decades.

Public funding of medical research by condition was only marginally associated with disease burden in the United States in 2010

(eFigure 4 in the Supplement). A set of 27 diseases that account

for 84% of US mortality, 52% of years of life lived with disability,

84% of years of life lost, and 70% of disability-adjusted life-years

receive 48% of NIH funding (R2 = 0.26) (eTable 3 in the Supplement). Several factors other than disease burden may influence

funding, including the quality of research, scientific opportunity,

portfolio diversification, or building of infrastructure, and the combination of these factors complicates the relationship of funding to

particular conditions.8,9 Cancer and HIV/AIDS were funded well

above the predicted levels based on US disability alone (eFigure 4

in the Supplement), with cancer accounting for 16% ($5.6 billion)

of total NIH funding and 25% of all medicines currently in clinical

trials (Figure 5).

Rare diseases have emerged for industry as a preferential area

of therapeutic development, with nearly as many compounds in

trials as analgesics and antidiabetic drugs (Figure 5). Industry

favors rare diseases because they are commercially attractive due

120

100

80

60

40

20

0

1994

1996

1998

2000

2002

2004

Year

2006

2008

2010

2012

Includes

ARRA Fundingb

Data were calculated according to methods outlined in eTable 1 in the

Supplement. ARRA indicates American Recovery and Reinvestment Act.

a

Data were adjusted to 2012 dollars using the Biomedical Research and

Development Price Index.4

The National Institutes of Health and other federal sources include stimulus

provided by ARRA in 2009 and 2010.

Data from 1994-2002 and 2011-2012 were estimated based on linear

regression analysis of industry market share.

Compound annual growth rate (CAGR) supposing that year A is x and year B is

y, CAGR = (y/x){1/(BA)}1. The CAGR was calculated separately for 2 different

periods with a single overlapping year: 1994-2004 and 2004-2012. The cut

point was chosen at 2004 given the changes seen in funding from the

National Institutes of Health in that year.

to provisions of the Orphan Drug Act and relative ease of clinical

trials. Investment can be expected to increase as diseases are

defined by biomarkers that allow the development of targeted

therapies.12

Support from private foundations, public charities, and other

entities comes from only a few organizations. In 2011, 42% of total

not-for-profit funding was by the top 10 public medical charities and

top 10 private foundations (eTable 4 in the Supplement). The Howard Hughes Medical Institute (which supports domestic research primarily) and the Bill and Melinda Gates Foundation (which supports

international research primarily) account for 87% of biomedical research funding by private foundations (eTable 4, panel B). United

Statesbased medical charities direct most monies in the United

States, though the amount spent on research (as opposed to education, disease screening, and other activities) cannot be quantified using public data.

Health Services Research Funding

Health services research, which examines access to care, the quality and cost of care, and the health and well-being of individuals,

communities, and populations, accounted for between 0.2% and

(Reprinted) JAMA January 13, 2015 Volume 313, Number 2

Copyright 2014 American Medical Association. All rights reserved.

Downloaded From: http://jama.jamanetwork.com/ on 01/15/2015

177

Clinical Review & Education Special Communication

The Anatomy of Medical Research

Figure 3. Growth in US Funding for Medical Research by Source, 1994-2012

Compound Annual

Growth Rate, % b

Medical Research Funding,

$ (%), in Billions a

Medical Research Funding,

$, in Billionsa

120

1994

2004

2012

1994-2004

2004-2012

Foundations, charities, other private

2.6 (4)

3.9 (4)

4.2 (4)

4.2

1.0

State and local government

3.9 (7)

5.9 (5)

6.3 (5)

4.1

0.9

Other federal

8.0 (13)

4.8 (4)

7.1 (6)

4.9

5.0

17.6 (29)

35.6 (33)

30.9 (27)

7.3

1.8

6.2

Funding Source

100

80

National Institutes of Health

60

40

20

Medical device firms

3.8 (6)

7.1 (6)

11.5 (10)

6.6

Biotechnology firms

3.7 (6)

13.7 (12)

19.6 (17)

14.1

4.6

Pharmaceutical firms

20.0 (34)

38.6 (35)

36.8 (32)

6.8

0.6

Overall

59.5

6.3

0.8

116.5

109.7

0

1994

2004

2012

Year

b

Data were calculated according to methods outlined in eTable 1 in the

Supplement.

a

Compound annual growth rate (CAGR) supposing that year A is x and year B is

y, CAGR = (y/x){1/(BA)}1.

Adjusted to 2012 dollars using the Biomedical Research and Development

Price Index.4

Figure 4. Pharmaceutical Industry Medical Research Funding by Phase of Research, 2004-2011

Industry Medical Research

Funding, $, (%), in Billions a

2004

2011

2004-2011

50

Uncategorizedc

4.2 (9)

1.7 (3)

11.9

40

Phase 4

6.4 (13)

4.8 (10)

3.9

Approval

4.5 (9)

4.1 (8)

1.2

Phase 3

12.6 (26)

17.6 (36)

4.9

20

Phase 2

4.9 (10)

6.2 (13)

3.3

10

Phase 1

3.2 (7)

4.3 (9)

4.1

Prehuman/preclinical

12.5 (26)

10.6 (22)

2.3

Overall

48.3

49.3

Industry Medical Research

Funding, $, in Billionsa

Phase of Research

30

2004

2011

Pharmaceutical industry funding by phase was obtained from Pharmaceutical

Research and Manufacturers of America (PhRMA) annual reports, 2004-2011.6

Data were 2 years old at time of publication and include both domestic and

international research funding from PhRMA members.

0.3% of national health expenditures between 2003 and 2011, an

approximately 20-fold difference in comparison with total medical

research funding (eFigure 1 in the Supplement). Health services

research funding increased 4.6% per year from $3.7 billion in

2004 to $5.0 billion in 2011 (Figure 6 and eTable 5 in the Supplement). Investment from foundations decreased in real terms at 1%

per year over the period, following declines after the recession of

2008. Increases in health services research funding were largely

driven by AHRQ (15.8%/year growth) and the health care services

industry (11.0%/year growth), which includes hospitals, ambulatory health care services, and nursing care facilities. Although

health care industry funding is likely underestimated because

research funds may not account for hidden costs of quality

improvement, research investment was especially low when compared with other industrial sectors (Figure 7). Insurers and health

systems rank among the lowest in research and development

(funding $1.3 billion, or 0.1% of revenue), which was well below

the median for industrial sectors ($5.5-$7.3 billion for total fund178

Compound Annual

Growth Rate, % b

Data were adjusted to 2012 dollars using the Biomedical Research and

Development Price Index.4

Compound annual growth rate (CAGR) supposing that year A is x and year B is

y, CAGR = (y/x){1/(BA)}1.

Uncategorized funding could not be allotted to a single phase of research.

ing, or 1.7%-2.5% of revenue). Health insurers may provide additional health services research funding that cannot be distinguished from the insurance industry as a whole, although these

funds are small and unlikely to change the results for industry

funding (Figure 7).

International Medical Research Funding

Global medical research expenditures by public and industry sources

in the United States, Europe, Asia, Canada, and Australia combined

increased from $208.8 billion in 2004 to $265.0 billion in 2011, growing at 3.5% annually (Figure 8 and eTable 6 in the Supplement). Although there may be medical research funding from other areas of

the world (eg, South America), these data represent the most reliable and current sources of global medical research investment.

Among the regions included in the analysis, the United States demonstrated the slowest annual growth in investment (1.5%/year), followed by Europe (4.1%/year) and Canada (4.5%/year). Asian countries increased from $28.0 billion in 2004 to $52.4 billion in 2011,

JAMA January 13, 2015 Volume 313, Number 2 (Reprinted)

Copyright 2014 American Medical Association. All rights reserved.

Downloaded From: http://jama.jamanetwork.com/ on 01/15/2015

0.3

jama.com

The Anatomy of Medical Research

Special Communication Clinical Review & Education

or 9.4% per year, with especially large increases in China, India, South

Korea, and Singapore.

These trends resulted in the restructuring of the share of total

global investment (eFigure 5 in the Supplement). As a percentage

of global funding, the United States declined by approximately 13%

from 2004 to 2012, and Asian economies increased by approximately the same share (13% in 2004 to 20% in 2011). Although absolute growth of Asian investment from 2004 to 2011 reached $24

billion, the United States remained the leading sponsor of global

medical research in 2011 (44% share), and Europe the next largest

sponsor (33% share).

Overall growth was slightly greater for industry outside the

United States compared with public sources (4.3% vs 2.2%), and industry accounted for two-thirds of funds in 2011. However, US contributions increased slowly from both public (0.1%/year) and industry sources (1.7%/year).

Public funding in the United States decreased to a 49% share

of the worlds public research investment by 2011, down from 57%

in 2004 (Figure 8). United States industry, which accounted for

nearly half of global industry medical research expenditures in 2004,

declined to 41% of global industry funding in 2011 (Figure 8). Japan

demonstrated the greatest increase in the worlds share of industry funding (+3.9%), and European countries gained the most in public investment (+3.5%). Despite decreases in the US share of investment, the United States remained the worlds leading sponsor for

both public and industry medical research funding in 2011.

Science and Technology Workforce

From 1996 to 2011, the US science and technology workforce increased by 2.7% annually to reach 1.25 million workers (Figure 9).

Over the same period, Chinas workforce increased 6% annually to

reach 1.31 million workers, making it the largest national science and

technology workforce in the world. Reliable information about the

proportion of medical researchers could not, however, be obtained.

Although China led the world in the overall size of their science

and technology workforce, it had only 1.9 science and technology

workers per 100 000 full-time equivalents, the lowest among the

countries included in the analysis (Figure 9). The United States employed 8.1 science and technology workers per 100 000 full-time

equivalents in its total workforce, or the median for the 10 largest

workforces in the world.

The investment in capital terms and in labor terms differ widely

across countries and regions. The United States contributes 44.2%

of global medical research funding but comprises only 21.2% of the

Figure 5. Compounds in Development for Top 10 Therapeutic Areas, 2013

Therapeutic areaa

Anticancer, otherb

Anticancer,

immunological

Prophylactic vaccine,

anti-infective

Antidiabetic

Analgesic

Rare diseasec

Anti-inflammatory

Recombinant vaccine

Cognition enhancer

0

200

400

600

800 1000 1200 1400 1600 1800

No. of Compounds in Clinical Trialsa

Data for the number of compounds in development were from the Citeline

Pharma R&D Annual Review 2014.10 Data for rare diseases were from the

Pharmaceutical Research and Manufacturers of America.11

a

Number of compounds in clinical trials or under review by the US Food and

Drug Administration. This includes a total of 10 479 compounds in 2013.

Includes all nonimmunological anticancer compounds.

Rare diseases were defined as those affecting 200 000 or fewer people in the

United States.

Figure 6. US Funding for Health Services Research by Source, 2004-2011

Health Services Research

Funding, $, in Millions (%) a

Health Services Research

Funding, $, in Billions a

Funding source

6

2004

2011

2004-2011

Health services industryc

653 (18)

1352 (27)

11.0

AHRQ

365 (10)

1018 (20)

15.8

1158 (32)

1189 (24)

0.4

Other federald

442 (12)

494 (10)

1.6

Foundationse

1034 (28)

967 (19)

1.0

Overall

3652

NIH

Compound Annual

Growth Rate, % b

5019

4.6

2004

2011

AHRQ indicates Agency for Healthcare Research and Quality; NIH, National

Institutes of Health. Data were calculated according to methods outlined in

eTable 5 in the Supplement.

a

Adjusted to 2012 dollars using the Biomedical Research and Development

Price Index.4

Compound annual growth rate (CAGR) supposing that year A is x and year B is

y, CAGR = (y/x){1/(BA)}1.

Health services industry includes funding from hospitals, ambulatory health

care services, nursing and residential facilities. Health insurance companies

were not included. Data may not fully capture the entirety of funding for

jama.com

health services research and quality improvement initiatives for the US health

care services industry.

d

Other federal funding includes the Centers for Disease Control and Prevention,

Centers for Medicare & Medicaid Services, Veterans Health Administration,

Health Resources and Services Administration, and Patient Centered

Outcomes Research Institute (in 2011 only).

Foundation funding includes total giving from the Robert Wood Johnson

Foundation, California Endowment, Pew Charitable Trusts, W. K. Kellogg

Foundation, and Commonwealth Fund.

(Reprinted) JAMA January 13, 2015 Volume 313, Number 2

Copyright 2014 American Medical Association. All rights reserved.

Downloaded From: http://jama.jamanetwork.com/ on 01/15/2015

179

Clinical Review & Education Special Communication

The Anatomy of Medical Research

Figure 7. Research and Development Investment Ranking of Industrial Sectors Among US-Based Companies, 2011

Total research and development fundinga

Share of revenue spent on research and developmenta

Pharmaceuticals and biotechnology

Pharmaceuticals and biotechnology

Computer and electronics manufacturing

Internet service provider and web search

Software and paper publishing

Software and paper publishing

Automobiles and parts

Physical, engineering, and life sciences

Medical devices

Computer and electronics manufacturing

Machinery

Medical devices

Computer software and systems design

Aerospace and defense

Chemicals

Computer software and systems design

Aerospace and defense

Data processing and hosting

Machinery

Plastics, minerals, and metal products

Internet service provider and web search

Automobiles and parts

Median

Food and beverage

Chemicals

Mining, extraction, and support activities

Plastics, minerals, and metal products

Data processing and hosting

Mining, extraction, and support activities

Banking, credit, and securities

Architectual engineering

Telecommunications

Food and beverage

Physical, engineering, and life sciences

Telecommunications

Architectual engineering

Utilities

Health care servicesc

Banking, credit, and securities

Utilities

Health care servicesc

Domestic

Insurance carriers

Transportation services

Foreign

0.2

Transportation services

0

0.04

Insurance carriers

20

40

60

80

0.04

0

Research and Development

Spending, $, in Billions b

10

15

Research and Development

Spending as % of Revenue

Research and development expenditures for US-based companies performing

research by the industrial sector were obtained from the National Science

Foundation.13 Data include research funds spent both domestically and abroad.

Industry revenues were obtained from the National Science Foundation13 or US

Census Bureau14 based on the availability of data. Revenues and research and

development expenditures were matched by industry using North American

Industry Classification System codes.

The pharmaceuticals and biotechnology, medical devices, and health care

services industries are highlighted in red.

Adjusted to 2012 dollars using the Biomedical Research and Development

Price Index.4

Health care services industry includes US-based hospitals, ambulatory health

care services, and nursing and residential facilities.

global science and technology workforce (eFigure 6 in the Supplement). Conversely, China contributes only 1.8% of global funding for

medical research but comprises 22.3% of the global science and technology workforce. This difference in investment represents a natural experiment in productivity management and has broad implications for patents and intellectual property ownership, which will

evolve over the next few years.

eFigure 7 in the Supplement). The proportion of US inventors filing

patents in the United States decreased from 57% to 51% from 1981

to 2011. During the same period, the share of highly valuable patents filed by US inventors decreased between from 73% to 59%

(Figure 12), while all other countries in the analysis increased their

share of highly valuable patents. Similar trends were observed for

highly valuable patents filed through the European Patent Office

(eFigure 8 in the Supplement). Highly valuable patents are defined

by the frequency they are cited by other inventors in subsequent

patent applications (Figure 12, footnote b)

Outputs of Medical Research

Life Science Patent Filings

China filed 30% of global life science patent applications in 2011, increasing from 1% of global applications in 1991 (Figure 10). This includes applications from a number of patenting offices throughout

the world, including offices in China, the United States, and the

European Union. The United States followed with 24% of patent filings globally, increasing from an 11% share in 1991.

United States inventors led in the number of life science patent filings in both the United States and EU, where China accounted for less than 2% of filings in both regions (Figure 11 and

180

Median

Publications

The United States led the world with 33% of published biomedical

research articles in 2009 (Figure 13A). In the United States, the number of biomedical research articles increased at 0.6% per year from

2000 to 2009. During the same period, the number of articles published in China increased by 18.7% annually.

The United States also leads the world in its share of the most

highly cited biomedical research articles, with 63% of the top cited

JAMA January 13, 2015 Volume 313, Number 2 (Reprinted)

Copyright 2014 American Medical Association. All rights reserved.

Downloaded From: http://jama.jamanetwork.com/ on 01/15/2015

jama.com

The Anatomy of Medical Research

Special Communication Clinical Review & Education

Medical Research Funding, in Billionsa

Figure 8. Global Medical Research Funding in Select Countries/Regions, 2011

280

260

240

220

200

180

160

140

120

100

80

60

40

20

0

Publicb

Industryc

Globale

United

States

Europe

Japan

China

Other

Asiaf

Canada

Australia

Medical research funding,

$, in billions (%) a

Overall

265.0 (100) 117.2 (44) 88.6 (33)

37.8 (14)

4.9 (1.2)

9.7 (4)

3.1 (1.2)

3.8 (1.4)

Publicb

102.8 (100) 50.5 (49) 26.9 (26)

17.0 (17)

1.3 (2)

2.4 (2)

1.8 (2)

2.8 (3)

Industryc

162.2 (100) 66.6 (41) 61.6 (38)

20.8 (13)

3.6 (0.8)

7.3 (4)

1.3 (0.8)

1.0 (0.6)

4.5

9.3

Compound annual growth

rate, % (2004-2011)d

3.5

1.0

4.1

The regions/countries/economies in the analysis include the major countries of

North America (United States, Canada), Europe (including the 10 largest

European countries in the Organisation for Economic Co-operation and

Development), and Asia-Oceania (Australia, China, India, Japan, Singapore, and

South Korea). Data for African and South American countries and Russia were

not available. Data were calculated according to methods outlined in eTable 6 in

the Supplement.

a

Data were converted to US currency using an average annual exchange rate

for the respective year15 and adjusted to 2012 dollars using the Biomedical

Research and Development Price Index.4

articles in 2000 and 56% in 2010; however, the growth of highly

cited literature published by the United States trails other major countries, regions, and economies (Figure 13B). After controlling for the

share of the worlds biomedical research articles using a citation index, the United States declined from 2000 to 2010 at 0.2% per

year as the rest of the world increased by approximately 1% per year.

New Drugs and Devices

Since 2003, drug approvals by the US Food and Drug Administration (FDA) have remained unchanged with an average of 26 approvals per year. Although drug approvals increased slightly in 2011 and

2012, they returned closer to average in 2013 with 27 approvals (eFigure 9 in the Supplement). United States device approvals have also

remained relatively constant over the last decade. While the number of approvals steadily increased from 15 approvals in 2009 to 39

approvals in 2012, only 22 new devices were approved in 2013.

During the same period, the European Medicines Agency (EMA)

averaged a higher number of both applications (55/year) and approvals (42/year) than the FDA (eFigure 9). In 2013, the EMA received 22 more applications and approved 16 more drugs than the

FDA.

Life Sciences Market Performance

Equity (stock) markets reflect broad public perception of one industrys value in comparison with others. Since 2003, market return for the entire health care industry (including medical device,

jama.com

6.8

16.9

20.8

Public research and development funding included that from government

agencies, higher educational institutes, and not-for-profit organizations.

Industry research and development funding included pharmaceutical,

biotechnology, and medical device firms.

Compound annual growth rate (CAGR) supposing that year A is x and year B is

y, CAGR = (y/x){1/(BA)}1.

Global total for medical research funding includes research and development

expenditures from 36 major world countries across 4 continents.

Other Asia includes India, Singapore, and South Korea.

pharmaceutical, and biotechnology companies as well as hospitals, nursing homes, and other health service suppliers) as measured by the Dow Jones US Health Care Index increased 8.2% annually, closely trailing the Standard & Poors 500 (8.3%) (Figure 14).

Market returns for biotechnology and health insurance companies

outperformed the market, growing at 18.5% and 13.8% per year, respectively. Medical device companies, pharmaceutical companies,

and hospital chains underperformed compared with the Standard

& Poors 500, increasing annually at 7.3%, 6.8%, and 5.8%, respectively. The financial crisis of 2008 led to a decrease in market performance for all life sciences industries. Generally, all sectors recovered in the years following, and biotechnology companies, hospital

chains, and health insurance companies performed exceptionally well

since their decline in 2008-2009.

Discussion and Implications

Medical research in the United States remains the primary source

of new discoveries, drugs, devices, and clinical procedures for the

world, although the US lead in these categories is declining. For example, whereas the United States funded 57% of medical research

in 2004, in 2011 that had declined to 44%. Basic research and product development are central to the health of countries economies.

However, changes in the pattern of investment, particularly level

funding by US government and foundation sponsors, with a de(Reprinted) JAMA January 13, 2015 Volume 313, Number 2

Copyright 2014 American Medical Association. All rights reserved.

Downloaded From: http://jama.jamanetwork.com/ on 01/15/2015

181

Clinical Review & Education Special Communication

The Anatomy of Medical Research

Figure 9. Top 10 Countries by Size of Science and Technology Workforce, 1996-2011

A Work force sizea

Full-time Equivalents, in Thousands

1400

1996

1200

2011

1000

800

600

400

200

0

Compound annual growth

rate, % (1996-2011)b

B

Chinac

United

States

Japan

Russian

Federation

Germany

United

Kingdom

Korea

France

Canada

Spain

6.0

2.7

0.4

1.5

2.6

3.7

7.4

3.2

3.8

6.4

Work force size per 1000 total employment

No. per 1000 Total Employment

12

1996

10

2011

8

6

4

2

0

Compound annual growth

rate, % (1996-2011)b

Korea

Japan

France

Canada

United

States

Germany

6.2

0.5

2.5

2.2

1.8

2.2

2.9

2.1

Spain

Chinac

4.1

5.2

The sizes of national science and technology workforces were obtained from

the Organisation for Economic Co-operation and Development.16

Compound annual growth rate (CAGR) supposing that year A is x and year B is

y, CAGR = (y/x){1/(BA)}1.

Annual growth in Chinas science and technology workforce may be

underestimated because of a change in reporting methods for China in 2009.

Workforce size was measured in number of full-time equivalents and includes

all science and technology sectors (eg, engineering, physical sciences) in

addition to the medical and health sciences.

cline in real terms, combined with companies focus on late-stage

products (with diminished discovery-level investment) indicate that

difficulties may soon appear in the ability of clinicians to fully realize the value of past investments in basic biology.

In addition, the limited support of ambitious but scientifically

rigorous methods to improve delivery of health services represents a major missed opportunity to improve many aspects of health,

especially as the burden of chronic illness, aging populations, and

the need for more effective ways to deliver care are appreciated.1

Over the past 2 decades, the period of this analysis, medical research has become global. It has been transformed by multiple, complex and subtle transitions, from small laboratories to large, industrial-scale institutes, from hypothesis-driven inquiries to datadriven compilations, from experiments by single individuals to those

requiring large teams, and from finding causes of specific diseases

to learning how entire systems become disordered.21

182

United

Russian

Kingdom Federation

The information assembled demonstrates that 3 factors, wavering financial support for science, underinvestment in service innovation, and globalization, pose the chief challenges of the current era.

Biomedical Research

New knowledge about disease has a 15- to 25-year gestation from

basic discovery to clinical application, an interval that may be

lengthening.22,23 Hence, the cumulative investment in biomedical

research of the past 3 decades will soon mature. Therefore, ensuring sufficient support for its clinical development is a pressing need.

Equally important are stable academic institutions and companies

along with skilled researchers that have the capability to organize

the research process and to sustain the innovation cycle,24 particularly since the size of research teams and scale of activities have

grown. Year to year variability in funding is a threat to that stability.

JAMA January 13, 2015 Volume 313, Number 2 (Reprinted)

Copyright 2014 American Medical Association. All rights reserved.

Downloaded From: http://jama.jamanetwork.com/ on 01/15/2015

jama.com

The Anatomy of Medical Research

Special Communication Clinical Review & Education

Figure 10. Global Life Science Patent Applications by Country of Origin, 1981-2011

No. of patent family applications

in life sciencea

400 000

Percentage distribution by country

100

Other

Other

Germany

Germany

80

Japanb

300 000

Japanb

Russia

Percentage

Russia

No.

Taiwan

India

200 000

Australia

60

Taiwan

India

Australia

40

Canada

100 000

Canada

Korea

Korea

20

United States

United States

China

0

1981

1991

2001

China

2011

1981

1991

Year

2011

Year

biotechnology, pharmaceuticals, macromolecular chemistry and polymers,

and microstructural and nanotechnology.

The number of patent family applications by country filed was calculated based

on data obtained from Thomson Innovation.17 Only the most recent patent

application in a patent family was counted for this analysis. Data are included for

all countries available in the Thomson data set.

a

2001

Life science was defined to include the following categories: analysis of

biological materials, medical technology, organic fine chemistry,

Only patent grants, not all patent applications, are counted for Japan, which

tends toward patent applications with narrower definitions and therefore

much greater numbers relative to the number of patents ultimately granted.

Figure 11. US Life Science Patent Applications by Country of Origin, 1981-2011

No. of patent application families

in life science by country of inventor a

80 000

Percentage distribution

by country of inventor

100

Other

Netherlands

Great Britain

60

Switzerland

40

France

20 000

Germany

France

Germany

20

Japan

United States

0

1981

1991

2001

2011

Taiwan

Percentage

No.

Korea

40 000

Great Britain

China

Taiwan

Switzerland

Korea

Netherlands

80

China

60 000

The number of patent application

families by country was calculated

counting the most recent application

in family of patents based on data

obtained from Thomson Innovation.17

Data are included for all countries

available in the Thomson data set.

Other

Japan

United States

0

1981

Year

1991

2001

2011

Year

Although the biomedical research enterprise is basically healthy,

to fully capture the clinical value of past investment in science and

its promise for the future, 2 areas require particular attention: (1) increased financial support for critical early studies that validate basic biological discoveries and demonstrate their relevance to disease (establishing proof of concept) and (2) greater productivity,

especially acceleration of the application of new findings to disease.

Financing That Can Sustain Long-term Investment

In the United States and Europe, private companies will not likely

have the latitude from their investors, or governments the political

will, to continue to make long-term investments at historical levels.

Todays political and commercial environment leads to this conclusion. Many new basic discoveries that have probable clinical value

are stymied by financial constraints at the critical proof-of-concept

stage, where utility in humans is demonstrated. That number can

be expected to increase once platform technologies (such as highresolution mapping of the central nervous system, analysis of complex biological systems and networks, or insights into developjama.com

Life science was defined to include

the following categories: analysis of

biological materials, medical

technology, organic fine chemistry,

biotechnology, pharmaceuticals,

macromolecular chemistry and

polymers, and microstructural and

nanotechnology.

ment of cell maturation and differentiation) show potential clinical

value. This is an unfortunate paradox because many of the diseases associated with substantial morbidity and mortality may benefit the most from these new discoveries.

Various new sources for long-term investments have been proposed. Most often, public funds have been sought, by expansion of

the NIH budget, appropriations by state legislatures, or earmarked

federal appropriations for threatened epidemics or defenserelated biological risks. Most advocates look to government for support of high-risk, early-stage research, given private companies focus on development of new technologies at their later stage. Private

foundations and public charities, though small, play an essential role

in filling that gap, especially for the most speculative undertakings

or where commercial incentives are insufficient. However, it is unlikely that these conventional sources of research investment will

be sufficient to meet the challenges of an aging population, the aggregate burden of disease, or the promise of emerging science.

The reduced funding of large pharmaceutical and biotechnology companies on early, basic, discovery-stage research (with concomitant growth of late-stage clinical trials) is apparent from our

(Reprinted) JAMA January 13, 2015 Volume 313, Number 2

Copyright 2014 American Medical Association. All rights reserved.

Downloaded From: http://jama.jamanetwork.com/ on 01/15/2015

183

Clinical Review & Education Special Communication

The Anatomy of Medical Research

Figure 12. Highly Valuable US Life Science Patents by Country of Origin, 1981-2011

No. of life science patent applications

in top 10% of patents by inventor countrya,b

8000

Percentage distribution of top 10%

of patents by country of inventor b

100

Other

Other

China

China

80

Netherlands

6000

Netherlands

Korea

Percentage

Korea

No.

Canada

Switzerland

4000

France

60

Canada

Switzerland

France

40

Great Britain

2000

Great Britain

Germany

Germany

20

Japan

Japan

United States

0

1981

1991

2001

United States

2011

1981

1991

Year

2011

Year

The number of patent application families by country was calculated counting

the most recent application in family of patents based on data obtained from

Thomson Innovation.17 Data are included for all countries available in the

Thomson data set.

a

2001

and microstructural and nanotechnology.

b

Life science was defined to include the following categories: analysis of

biological materials, medical technology, organic fine chemistry,

biotechnology, pharmaceuticals, macromolecular chemistry and polymers,

Top 10% of patents ranked by year using BCG Quality Index. The BCG Quality

Index is made up of 3 components; specifically, forward citations of a patent in

newer patents adjusted for the patents age, the number of patent claims, and

the strength of a patents backward citations. The components and

corresponding weights used by the quality index are a product of proprietary

Boston Consultng Group research.

Figure 13. Medical Research Articles and Citations by Selected Countries/Regions, 2000-2010

400 000

300 000

2000

2009

Otherb

49 946

63 483

Other Asiac

10 029

20 790

8.4

3937

18 399

18.7

No.

China

100 000

2.7

26 755

21 477

2.4

114 970

120 421

0.5

United States

116 156

122 659

0.6

Overall

321 795

367 229

1.5

2000

2000-2009

European Uniond

Japan

200 000

Annual

Growth Rate, % a

No. of Medical

Research Articles

A No. of medical research articles

2009

Year

No. of Highly Cited

Medical Research

Articles

No. of highly cited medical research articles

No.

2000

Citation Index

of Highly

Cited Articles

Compound

Annual Growth

Rate (Citation

Index), % a

2000

2010

2000-2009

763

1034

0.57

0.59

0.4

Other Asiac

20

113

0.1

0.22

8.6

8000

China

16

82

0.22

0.22

0.3

6000

Japan

345

294

0.5

0.45

1.0

4000

European Uniond

2079

2936

0.68

0.86

2.5

United States

5402

5729

1.67

1.63

0.2

Overall

8626

10 189

NA

NA

NA

12 000

Otherb

10 000

2000

0

2000

2010

2009

Year

NA indicates not available. Medical research was defined as the life sciences and

psychology, excluding agricultural science. Article counts reported by the

National Science Foundation were from the Thomas Reuters Science Citation

Index and Social Science Citation Index,18 classified by year of publication and

assigned to countries on the basis of institutional addresses listed on each

article. Articles were counted on a fractional basis; ie, for articles with

collaborating institutions from multiple countries, each country received

fractional credit on the basis of proportion of its participating institutions.

Citations were based on a 3-year period with 2-year lag; eg, citations for 2000

are references made in articles in 2000 to articles published in 1996-1998. The

citation index of highly cited articles was defined as the share of the worlds top

184

1% cited biomedical research articles divided by the share of the worlds

biomedical research articles in the cited year window.

a

Compound annual growth rate (CAGR) supposing that year A is x and year B is

y, CAGR = (y/x){1/(BA)}1.

Other includes the remaining 159 nations of the world within the original

database.

Other Asia includes India, Indonesia, Malaysia, Philippines, Singapore, South

Korea, Taiwan, and Thailand.

The European Union includes 27 European nations.

JAMA January 13, 2015 Volume 313, Number 2 (Reprinted)

Copyright 2014 American Medical Association. All rights reserved.

Downloaded From: http://jama.jamanetwork.com/ on 01/15/2015

jama.com

The Anatomy of Medical Research

Special Communication Clinical Review & Education

Figure 14. Market Performance of Publicly Traded Life Sciences and Health Care Companies, 2003-2013

NYSE Arca Biotechnology Index

Health insurance

Standard & Poor 500 index

Dow Jones US health care index

Dow Jones US medical equipment index

NYSE Arca Pharmaceutical Index

Hospital chains

Value of $100 Invested January 2003, $

700

600

500

400

300

200

100

0

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Year

analysis. This trend will likely continue. A combination of the limited recent record of industry research and development and the unpredictability of outcomes and length of time required to observe

results produces uncertain returns on investment, which are not tolerated in an economy that values short-term performance disproportionally.

Therefore, altogether new funding sources are required. As we

and others have proposed previously,25,26 a variety of new financing vehicles are feasible and attractive. These might include

Foreign capital repatriation, with new tax provisions that allow companies to return funds held outside the United States if used for

research.27 Because of the size of these holdings, a yearly increment of 25% to 50% of total research funding is feasible over the

next decade.

Biomedical research bonds, analogous to those used to finance

sports stadiums and airports, could be issued by federal, state, or

local governments, with amortization from patent royalties or converted to equity in new companies created. Historically, bonds have

funded infrastructure investments but are now being adapted for

environmental and green projects, which have economics that

resemble medical research.28

Research innovation trusts could be formed to allow private and

public entities to join forces for innovation in high-priority diseases or those of high public health importance, in return for tax

credits (not deductions), as have been used previously to preserve land, create parks, and build factories. These new trusts can

be structured to permit investments by public and company pension funds or individual retirement programs, which are currently

precluded from most early-stage, speculative investments. Australia, Canada, and the United Kingdom have used such research

and development trusts effectively.

Tax checkoffs, whereby individuals can specify a portion of their

tax payment to be diverted to research, as is currently the practice for public funding of elections. A few states (eg, California,

Maryland, New York, and Oregon) have made science a priority

using tax checkoffs.

Each of these financial innovations could be invoked without direct federal or state funding. They potentially can mobilize new private sources of funds without requiring tax increases or direct public appropriations.

jama.com

NYSE indicates New York Stock

Exchange. Data on market

performance was accessed from

Bloomberg market data. Market

performance was calculated as the

return on investment of US $100 on

January 3, 2003, at various future

time points. More detail regarding the

indexes can be found at Standard &

Poors Dow Jones and New York

Stock Exchange sector

classifications.19,20

Productivity

New science and technology have been slow to address the morbidity and cost of chronic diseases and the growing number of elderly persons. Consequently, some have suggested that changing

patient behavior and education (for adherence and lifestyle modification), not technology, should become the priority.29 Others focus on changing the NIH mission to emphasize prevention and clinical evaluation rather than basic scientific discovery, or altering

incentives of industry to encourage their investment in highprevalence, high-cost conditions rather than lucrative niches such

as cancer and orphan diseases.8,9,12 Some observers have even suggested that expectations for science and technology be reduced,

given the long cycle time from discovery to clinical application.30

Declining productivity is at the root of many of these dissatisfactions. Therefore, greater attention is required to introduce methods that enhance the pace of research with few additional costs.

Improve the scientific process. As our analysis confirms, research

is costly, capital intensive, and, above all, collaborative. Moreover, researchers depend on one another for a source of new ideas,

as well as access to material, reagents, clinical information, samples,

and ultimately patients who are willing to participate in clinical trials.

Therefore, recent efforts have been aimed at facilitating those critical interactions. An example is the Accelerating Medicines

Partnership31 (between companies and the NIH), which identified common diseases for which few effective therapies exist but

science is especially promising. Four conditions meeting those criteria were selected: Alzheimer disease, type 2 diabetes, rheumatoid arthritis, and systemic lupus erythematosus. In each, specific

biological questions were identified that can best be answered using

resources from industry, the NIH, and academic investigators combined, who would otherwise be limited if working on their own.

Enhance benefits of large-scale, industrialized biology and smallscale investigators laboratories. The past 2 decades investment

in large projects, such as sequencing the human genome and its

successors for proteins, the microbiome, or the nervous system

connectome, is unlikely to realize its full value without interpretation and application by skilled individual scientists. Many astute observers suggest that the desirable balance has not yet been struck

between industrial-scale and individual-inspired laboratories.21 Specifically, further experimentation with new organizational models

(Reprinted) JAMA January 13, 2015 Volume 313, Number 2

Copyright 2014 American Medical Association. All rights reserved.

Downloaded From: http://jama.jamanetwork.com/ on 01/15/2015

185

Clinical Review & Education Special Communication

should be aimed at obviating current limitations of the existing balkanized corporate, venture capital, NIH, and university practices.

Examples of new models are the Broad Institute in Cambridge, Massachusetts (genomics), BioDesign Institute at Arizona State University, Tempe (biomedical engineering), and Allen Institute for

Brain Sciences, Seattle, Washington (neurological and psychiatric

disease). Each of these seeks to optimize individual and institutional contributions while ensuring funding. Each orchestrates external relationships.

Underinvestment in Improving Delivery of Health Services

Investment in new ways to deliver better, more effective, and less

expensive medical care has neither economic impetus nor professional recognition compared with technological innovation or basic discovery.

Funding for health services research has increased 37% from

$3.7 billion to $5.0 billion over the last decade (Figure 6). However,

this growth has occurred on a very small base. Total funding for health

services research is 0.3% of total health care funding (eFigure 1 in

the Supplement) compared with 4% toward new drugs and devices. That is, the United States spends $116 billion on research aimed

at 13% of total health care costs but only $5.0 billion aimed at the

remaining 87% of costs.1

Why the disparity in investment? One major difference is that

new drugs and devices command favorable prices, and their value

accrues directly to the firm that invests in them. In contrast, service innovations can reduce morbidity and mortality while also reducing cost, but financial returns to innovators may be negligible or

even negative. For example, as shown by Arriaga et al32 and Pronovost and Wachter,33 procedure checklists and other simple precautions are effective but may result in lower payments to hospitals.34

This mismatch between who invests (the hospital) and who is rewarded (the insurer) is a fundamental barrier, even though clinical

benefit is enormous and total savings may exceed the return on many

categories of blockbuster drugs.35

Three other factors pose barriers:

Behavior change. Disruption of the current patterns of care is threatening to physicians and hospitals, even when shown to produce

comparable or better clinical outcomes, higher patient satisfaction, and lower cost than traditional care.36 Examples include telemedicine, daily monitoring, and intensive in-home services.

Data quality. Claims databases, electronic medical records, and

other sources of clinical information are not yet sufficiently reliable to inform research. Recent initiatives are aimed at linking separate sources of data and introducing standards to support

research34-37 and are a specific goal of international measurement collaborations for chronic illnesses (eg, the International Consortium for Health Outcomes Measurement),38 and alliances

among insurers, hospitals, and clinicians for the most severely ill

patients (eg, Wellpoint/Emory Health).39

Communications. Clinical service innovation is more difficult than

the introduction of a new drug or procedure because it requires

many individuals to adjust the way they interact, communicate, and

use information. Moreover, to have any effect, culture change must

occur throughout large, hierarchical organizations. Cultural barriers are potent reasons why small-scale demonstration projects are

rarely generalized, even when they are initially effective.40 Therefore, research should focus on devising reliable, effective inter186

The Anatomy of Medical Research

ventions that sustain better practices, with lessons adopted from

other complex organizations (eg, military or transportation).

Neither the organizations nor finances exist to innovate on the

scale required. Small, incremental federal or foundation grants are

an ineffective spur of sustained change in clinical practice because

behavioral and cultural issues remain unaddressed. It is unlikely that

recent federal and state risk sharing (accountable care organizations) or other incentives will prove to be adequate for the same reason. Therefore, more fundamental changes are needed. In particular, 3 changes should be considered.

Additional investment by insurers and health systems in delivery

innovation to bring them to the median of other service industries. This increment could produce an annual influx of $8 billion

to $15 billion, potentially quadrupling the level of effort overall, and

can be funded from administrative simplification and savings.

Sharply increasing federal support of service sector innovation,

which can be channeled through the Centers for Disease Control

and Prevention, Public Health Service, AHRQ, Centers for Medicare & Medicaid (CMS), Patient-Centered Outcomes Research Institute, and NIH. Funds might be generated by allocating 50% all

savings generated over the next decade by CMS demonstration

projects and by creating new regional private hospitalphysician

insurer innovation consortia to undertake wholesale change in delivery.

Encouragement of new entrants who are prepared to make basic,

highly disruptive changes in service delivery (via tax credits and

other incentives that are comparable with those now available for

investment in plant and equipment). Examples now on the horizon include provision by pharmacies of chronic disease care (for

hypertension and depression) and use of simple self-monitoring

technologies linked by a ubiquitous internet-of-things to automated artificial intelligence agents for asthma and diabetes control. Such examples are threatening to many physicians and hospitals but have the potential to lower costs and improve quality.41

The Challenge of Globalization

Biomedical science and improved health are tied closely to growth

of a countrys general economy.42 The primacy of the United States

as the source of biomedical technology (and until recently, longevity) has corresponded with a 4-decade-long improvement in real personal incomes. In turn, investment in science and technology has

been a potent force producing higher personal incomes and total

GDP, with the longer life expectancy that was achieved between 1970

and 1990 estimated to have added about 35% to US GDP by 2000.43

Some have suggested that a domestic, US-centric perspective

is antiquated and parochial in an era of globalization because people,

ideas, capital, and information are highly mobile.44 The United States

has been the worlds leader for 6 decades in investment in science

and technology research and development. In 2012, the United

States spent $366 billion on all research and development, or 2.8%

of GDP.45 However, the United States declined from sixth in 2000

to 10th in 2012 in its proportion of research and development investment compared with the 34-country Organisation for Economic Co-operation and Development. In Asia, South Korea and

China now each spend about 2% of GDP, with China expected to surpass the United States in absolute funding within a decade.45 This

trend, along with aggressive patent practices by some countries (notably China) or disregard of intellectual property rights (in Africa, Cen-

JAMA January 13, 2015 Volume 313, Number 2 (Reprinted)

Copyright 2014 American Medical Association. All rights reserved.

Downloaded From: http://jama.jamanetwork.com/ on 01/15/2015

jama.com

The Anatomy of Medical Research

Special Communication Clinical Review & Education

tral Europe, and India), raise barriers to the diffusion of clinical innovations between countries.

Two areas are of particular concern: erosion of the publics support for science in the United States and hesitancy to reform the patent system.

Public Opinion

Recent polls show erosion of public support for biomedical research compared with other priorities. Support has declined steadily

since 2000 and is now well behind concerns about the economy,

domestic security, immigration, crime, and the US role in international affairs.46,47 The trend is not confined to the United States but

is also evident in Europe. Despite the demonstrable successes of earlier decades, the primacy of science as the source of improved health

is today questioned because of the convergence of several forces.

First, despite bold promises, advances visible to the public have

been less frequent because solutions to many conditions like autism, Alzheimer disease, and most cancers remain elusive, with neither effective prevention nor treatment, despite intensive research. Second, drug discovery has proven more difficult and less

predictable than many had expected, with a decline over the past 2

decades in altogether new classes of drugs, new registrations, and

drugs in clinical trials. Third, the economics of medical advances are

being scrutinized as a source of added insurance cost, with growing pressure to justify clinical value using objective criteria, formal

tools of technology assessment, and consideration of quality-oflife measures separately from those that affect mortality. Some technology skeptics have even urged that the United States take a technology holiday for a decade, suggesting that the money saved be

spent on ensuring that everyone receives existing preventive and

therapeutic means, even if this slows scientific discovery.48

Such tensions are perhaps inevitable, given the high cost and

poor performance of US health care as judged by international mortality comparisons. Skepticism of medical research is evident in recent US budget discussions, which have favored the physical sciences as faster, reliable, and more predictable routes to US

competitiveness than the uncertainties of medicine. Also, medical

devices and new manufacturing practices for large-molecule biopharmaceuticals are heavily driven by engineering advances, which