Beruflich Dokumente

Kultur Dokumente

0605 (July 1999)

Hochgeladen von

Yulo Vincent Bucayu Panuncio0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

53 Ansichten1 SeiteA taxpayer shall use this form, in triplicate, to pay taxes and fees which do not require the use of a tax return. One set of form shall be filled-up for each kind of tax and for each taxable period. For payment of deficiency taxes, BIR Form 0605 shall be signed by the taxpayer or his authorized representative.

Originalbeschreibung:

Originaltitel

0605(july 1999)

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenA taxpayer shall use this form, in triplicate, to pay taxes and fees which do not require the use of a tax return. One set of form shall be filled-up for each kind of tax and for each taxable period. For payment of deficiency taxes, BIR Form 0605 shall be signed by the taxpayer or his authorized representative.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

53 Ansichten1 Seite0605 (July 1999)

Hochgeladen von

Yulo Vincent Bucayu PanuncioA taxpayer shall use this form, in triplicate, to pay taxes and fees which do not require the use of a tax return. One set of form shall be filled-up for each kind of tax and for each taxable period. For payment of deficiency taxes, BIR Form 0605 shall be signed by the taxpayer or his authorized representative.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

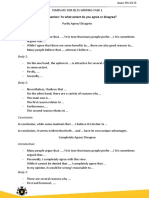

Who Shall File

Every taxpayer shall use this form, in triplicate, to

pay taxes and fees which do not require the use of a tax

return such as second installment payment for income tax,

deficiency tax, delinquency tax, registration fees,

penalties, advance payments, deposits, installment

payments, etc.

When and Where to File and Pay

This form shall be accomplished:

1.

Everytime a tax payment or penalty is due or

an advance payment is to be made;

2.

Upon receipt of a demand letter/assessment

notice and/or collection letter from the BIR; and

3.

Upon payment of annual registration fee for

new business and for renewals on or before

January 31 of every year.

This form shall be filed and the tax shall be paid

with any Authorized Agent Bank (AAB) under the

jurisdiction of the Revenue District Office where the

taxpayer

is

required

to

register/conducting

business/producing articles subject to excise tax/having

taxable transactions. In places where

there

are no

AABs, this form shall be filed and the tax shall be paid

directly with the Revenue Collection Officer or duly

Authorized City or Municipal Treasurer of the Revenue

District Office where the taxpayer is required

to

register/conducting business/producing articles subject to

excise tax/having taxable transactions, who

shall

issue Revenue Official Receipt (BIR Form No. 2524)

therefor.

Where the return is filed with an AAB, the lower

portion of the return must be properly machine-validated

and stamped by the Authorized Agent Bank to serve as the

receipt of payment. The machine validation shall reflect

the date of payment, amount paid and transaction code,

and the stamp mark shall show the name of the bank,

branch code, tellers name and tellers initial. The AAB

shall also issue an official receipt or bank debit advice or

credit document, whichever is applicable, as additional

proof of payment.

One set of form shall be filled-up for each kind

of tax and for each taxable period.

Note:

All background information must be properly

filled-up.

For voluntary payment of taxes, BIR Form 0605

shall be signed by the taxpayer or his authorized

representative.

For payment of deficiency taxes at the Revenue

District Office level and other investigating

offices prior to the issuance of Preliminary

Assessment Notice (PAN)/Final Assessment

Notice (FAN), BIR Form 0605 shall be approved

and signed by the Revenue District Officer

(RDO) or Head of the investigating offices.

For payment of deficiency taxes with issued

Preliminary

Assessment

Notice/Final

Assessment Notice, BIR Form 0605 shall be

signed by the taxpayer or his authorized

representative.

The last 3 digits of the 12-digit TIN refers to the

branch code.

Attachments

For Voluntary Payment:

1.

Duly approved Tax Debit Memo, if

applicable;

2.

Xerox copy of the return (ITR)/

Reminder Letter in case of payment of

second installment on income tax.

For Payment of Deficiency Taxes from

Audit/

Delinquent Accounts

1.

Duly approved Tax Debit Memo, if

applicable;

2.

Preliminary Assessment Notice (PAN)/

Final Assessment Notice (FAN) Letter of

Demand;

3.

Post Reporting Notice, if applicable;

4.

Collection letter of Delinquent/ Accounts

Receivable

ENCS

Das könnte Ihnen auch gefallen

- 1040 Exam Prep: Module II - Basic Tax ConceptsVon Everand1040 Exam Prep: Module II - Basic Tax ConceptsBewertung: 1.5 von 5 Sternen1.5/5 (2)

- Bir 0605Dokument11 SeitenBir 0605Sheelah Sawi0% (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- 1702 Q Guide July 2008Dokument1 Seite1702 Q Guide July 2008fatmaaleahNoch keine Bewertungen

- Bir Form 0605Dokument2 SeitenBir Form 0605alona_245883% (6)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeVon Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeBewertung: 1 von 5 Sternen1/5 (1)

- Quarterly Income Tax Return: Line of Business/OccupationDokument4 SeitenQuarterly Income Tax Return: Line of Business/OccupationMark Christian B. ApordoNoch keine Bewertungen

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCVon EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCBewertung: 4 von 5 Sternen4/5 (5)

- Remittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsDokument5 SeitenRemittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsAngela ArleneNoch keine Bewertungen

- 1040 Exam Prep: Module I: The Form 1040 FormulaVon Everand1040 Exam Prep: Module I: The Form 1040 FormulaBewertung: 1 von 5 Sternen1/5 (3)

- 2551 MDokument2 Seiten2551 MAdrian AyrosoNoch keine Bewertungen

- PenaltiesDokument2 SeitenPenaltiesfatmaaleahNoch keine Bewertungen

- BIR Form 0614-EVAP Payment Form Guidelines and Instructions: Who Shall Use This FormDokument1 SeiteBIR Form 0614-EVAP Payment Form Guidelines and Instructions: Who Shall Use This FormMhel GollenaNoch keine Bewertungen

- BIR Form No. 2551M Percentage Tax Return Guidelines and InstructionsDokument2 SeitenBIR Form No. 2551M Percentage Tax Return Guidelines and InstructionsseanjharodNoch keine Bewertungen

- 1601 C CompensationDokument2 Seiten1601 C Compensationjon_cpaNoch keine Bewertungen

- 1040 Exam Prep Module XI: Circular 230 and AMTVon Everand1040 Exam Prep Module XI: Circular 230 and AMTBewertung: 1 von 5 Sternen1/5 (1)

- BIR Form 1601 c1Dokument2 SeitenBIR Form 1601 c1Ver ArocenaNoch keine Bewertungen

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesVon EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNoch keine Bewertungen

- BIR Form No. 2553Dokument2 SeitenBIR Form No. 2553fatmaaleahNoch keine Bewertungen

- International Taxation In Nepal Tips To Foreign InvestorsVon EverandInternational Taxation In Nepal Tips To Foreign InvestorsNoch keine Bewertungen

- 1601e PDFDokument2 Seiten1601e PDFJanKhyrelFloresNoch keine Bewertungen

- Return of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasDokument2 SeitenReturn of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasAngela ArleneNoch keine Bewertungen

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsVon Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsNoch keine Bewertungen

- Bir Form Percentage TaxDokument3 SeitenBir Form Percentage TaxEc MendozaNoch keine Bewertungen

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!Von EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!Noch keine Bewertungen

- BIR Form 1701QDokument2 SeitenBIR Form 1701QfileksNoch keine Bewertungen

- Wiley Tax Preparer: A Guide to Form 1040Von EverandWiley Tax Preparer: A Guide to Form 1040Noch keine Bewertungen

- Payment Form: Kawanihan NG Rentas InternasDokument2 SeitenPayment Form: Kawanihan NG Rentas InternasJanice BautistaNoch keine Bewertungen

- 0605Dokument6 Seiten0605Ivy TampusNoch keine Bewertungen

- Bir46 PDFDokument2 SeitenBir46 PDFJulia SmithNoch keine Bewertungen

- Form 1600Dokument4 SeitenForm 1600KialicBetito50% (2)

- 2551QDokument3 Seiten2551QJerry Bantilan JrNoch keine Bewertungen

- 1601C GuidelinesDokument1 Seite1601C GuidelinesfatmaaleahNoch keine Bewertungen

- Bir Form 0605Dokument4 SeitenBir Form 0605Manoy BermeoNoch keine Bewertungen

- Bir 1601fDokument3 SeitenBir 1601fJuliet Jayjet Dela CruzNoch keine Bewertungen

- Guidelines and Instructions: BIR Form No. 1702 - Page 4Dokument2 SeitenGuidelines and Instructions: BIR Form No. 1702 - Page 4Vladymir VladymirovnichNoch keine Bewertungen

- BIR Form 0605 UsesDokument4 SeitenBIR Form 0605 UsesCykee Hanna Quizo LumongsodNoch keine Bewertungen

- 2551QDokument3 Seiten2551QnelsonNoch keine Bewertungen

- Monthly Percentage Tax ReturnDokument3 SeitenMonthly Percentage Tax ReturnAu B ReyNoch keine Bewertungen

- 2000 June 2006 (Back)Dokument1 Seite2000 June 2006 (Back)Rica Santos-vallesteroNoch keine Bewertungen

- Guidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsDokument1 SeiteGuidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsAlyssa Hallasgo-Lopez AtabeloNoch keine Bewertungen

- 1601 CDokument2 Seiten1601 CChedrick Fabros SalguetNoch keine Bewertungen

- BIR FormsDokument30 SeitenBIR FormsRoma Sabrina GenoguinNoch keine Bewertungen

- Bir Form 2551qDokument6 SeitenBir Form 2551qmaeshach100% (2)

- Compliance RequirementsDokument27 SeitenCompliance Requirementsedz_1pieceNoch keine Bewertungen

- Executor Estate TaxDokument1 SeiteExecutor Estate TaxJessirie VillanuevaNoch keine Bewertungen

- Bir 53Dokument4 SeitenBir 53toofuuNoch keine Bewertungen

- Guidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldDokument1 SeiteGuidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldMark Joseph BajaNoch keine Bewertungen

- BIR Form 1707Dokument3 SeitenBIR Form 1707catherine joy sangilNoch keine Bewertungen

- 1702-EX June 2013 GuidelinesDokument4 Seiten1702-EX June 2013 GuidelinesAnonymous m6sKy4100% (1)

- Overview of TDS: Who Shall Deduct Tax at Source?Dokument37 SeitenOverview of TDS: Who Shall Deduct Tax at Source?pradeep_ravi_7Noch keine Bewertungen

- O o o o o o O: IndividualsDokument17 SeitenO o o o o o O: IndividualsDustin GonzalezNoch keine Bewertungen

- 1701 GuidelinesDokument4 Seiten1701 GuidelinesJazz techNoch keine Bewertungen

- Efficient Use of Paper Rule A.M. No. 11-9-4-SCDokument3 SeitenEfficient Use of Paper Rule A.M. No. 11-9-4-SCRodney Atibula100% (3)

- Petition For Adoption of A MinorDokument1 SeitePetition For Adoption of A MinorYulo Vincent Bucayu PanuncioNoch keine Bewertungen

- Memorandum For The Plaintiff EMMA CRISOSTOMODokument2 SeitenMemorandum For The Plaintiff EMMA CRISOSTOMOJona AddatuNoch keine Bewertungen

- 001I - Pan Malayan V CADokument8 Seiten001I - Pan Malayan V CALester LeeNoch keine Bewertungen

- Biagtan Vs CADokument19 SeitenBiagtan Vs CAYulo Vincent Bucayu PanuncioNoch keine Bewertungen

- Oposa Vs FactoranDokument16 SeitenOposa Vs FactorananotenoteNoch keine Bewertungen

- Motion To DismissDokument4 SeitenMotion To DismissYulo Vincent Bucayu Panuncio100% (1)

- Conflict 12 DigestDokument12 SeitenConflict 12 DigestYulo Vincent Bucayu PanuncioNoch keine Bewertungen

- Habeas CurousDokument5 SeitenHabeas CurousYulo Vincent Bucayu PanuncioNoch keine Bewertungen

- Thinking Out LoudDokument1 SeiteThinking Out LoudongiesmaNoch keine Bewertungen

- Civil Service Exam Application Form PDFDokument2 SeitenCivil Service Exam Application Form PDFAlbert Quia100% (2)

- Agrarian Reform Law and JurisprudenceDokument169 SeitenAgrarian Reform Law and Jurisprudencejerick16Noch keine Bewertungen

- DILG Resources 201128 4e453a40c3Dokument76 SeitenDILG Resources 201128 4e453a40c3Mary Jane A DelosReyesNoch keine Bewertungen

- Agrarian Law and Social LegislationDokument34 SeitenAgrarian Law and Social LegislationYulo Vincent Bucayu Panuncio100% (1)

- Succession Cases (Midterms)Dokument22 SeitenSuccession Cases (Midterms)Ram BeeNoch keine Bewertungen

- Book 1Dokument61 SeitenBook 1Elinor DashwoodNoch keine Bewertungen

- Under Rule 6 of The 1997 Rules of Civil Procedure: Yulo Vincent B. Panuncio, Jr. Llb-3Dokument1 SeiteUnder Rule 6 of The 1997 Rules of Civil Procedure: Yulo Vincent B. Panuncio, Jr. Llb-3Yulo Vincent Bucayu PanuncioNoch keine Bewertungen

- Succession Reserva+TroncalDokument46 SeitenSuccession Reserva+TroncalLaramie MeñezNoch keine Bewertungen

- Agrarian Law and Social LegislationDokument34 SeitenAgrarian Law and Social LegislationYulo Vincent Bucayu Panuncio100% (1)

- Part 2 Insurance Digested CasesDokument31 SeitenPart 2 Insurance Digested CasesYulo Vincent Bucayu PanuncioNoch keine Bewertungen

- Tax Cases2Dokument38 SeitenTax Cases2Yulo Vincent Bucayu PanuncioNoch keine Bewertungen

- Payment Form: Kawanihan NG Rentas InternasDokument3 SeitenPayment Form: Kawanihan NG Rentas InternasYulo Vincent Bucayu PanuncioNoch keine Bewertungen

- Finman General Assurance Corporation VsDokument4 SeitenFinman General Assurance Corporation VsYulo Vincent Bucayu PanuncioNoch keine Bewertungen

- Conflict of Laws - REVIEWERDokument54 SeitenConflict of Laws - REVIEWERcherylmoralesnavarro81% (16)

- UP SpecPro Reviewer 2008Dokument40 SeitenUP SpecPro Reviewer 2008Ramon Katheryn100% (2)

- LAW Introductory Part - Conflicts of LawDokument54 SeitenLAW Introductory Part - Conflicts of LawYulo Vincent Bucayu PanuncioNoch keine Bewertungen

- Conflict of Laws - REVIEWERDokument54 SeitenConflict of Laws - REVIEWERcherylmoralesnavarro81% (16)

- UST Golden Notes - InsuranceDokument38 SeitenUST Golden Notes - InsuranceAnonymous 5k7iGyNoch keine Bewertungen

- LAW Introductory Part - Conflicts of LawDokument54 SeitenLAW Introductory Part - Conflicts of LawYulo Vincent Bucayu PanuncioNoch keine Bewertungen

- JKR SPJ 1988 Standard Specification of Road Works - Section 1 - GeneralDokument270 SeitenJKR SPJ 1988 Standard Specification of Road Works - Section 1 - GeneralYamie Rozman100% (1)

- Methods of ResearchDokument12 SeitenMethods of ResearchArt Angel GingoNoch keine Bewertungen

- Ababio v. R (1972) 1 GLR 347Dokument4 SeitenAbabio v. R (1972) 1 GLR 347Esinam Adukpo100% (2)

- Hi Smith, Learn About US Sales Tax ExemptionDokument2 SeitenHi Smith, Learn About US Sales Tax Exemptionsmithmvuama5Noch keine Bewertungen

- Juegos PPCDokument8 SeitenJuegos PPCikro995Noch keine Bewertungen

- Question: To What Extent Do You Agree or Disagree?Dokument5 SeitenQuestion: To What Extent Do You Agree or Disagree?tien buiNoch keine Bewertungen

- MTBE - Module - 3Dokument83 SeitenMTBE - Module - 3ABHIJITH V SNoch keine Bewertungen

- Analytical Profiles Drug Substances and Excipien T S: Harry G. BrittainDokument693 SeitenAnalytical Profiles Drug Substances and Excipien T S: Harry G. BrittainNguyen TriNoch keine Bewertungen

- Philips Chassis Lc4.31e Aa Power Dps 181 PDFDokument9 SeitenPhilips Chassis Lc4.31e Aa Power Dps 181 PDFAouadi AbdellazizNoch keine Bewertungen

- ABMOM q2 mod5OrgAndMngmnt Motivation - Leadership and Communication in Organizations-V2Dokument18 SeitenABMOM q2 mod5OrgAndMngmnt Motivation - Leadership and Communication in Organizations-V2Zoren Jovillanos EmbatNoch keine Bewertungen

- VAT (Chapter 8 Compilation of Summary)Dokument36 SeitenVAT (Chapter 8 Compilation of Summary)Dianne LontacNoch keine Bewertungen

- AutoCAD Civil 3D Performance Optimization 2Dokument5 SeitenAutoCAD Civil 3D Performance Optimization 2Renukadevi RptNoch keine Bewertungen

- Art 3 Sec 2Dokument157 SeitenArt 3 Sec 2KELVINNoch keine Bewertungen

- Juniper M5 M10 DatasheetDokument6 SeitenJuniper M5 M10 DatasheetMohammed Ali ZainNoch keine Bewertungen

- Section 12-22, Art. 3, 1987 Philippine ConstitutionDokument3 SeitenSection 12-22, Art. 3, 1987 Philippine ConstitutionKaren LabogNoch keine Bewertungen

- 1 General: Fig. 1.1 Industrial RobotDokument40 Seiten1 General: Fig. 1.1 Industrial RobotArunNoch keine Bewertungen

- ADAMDokument12 SeitenADAMreyNoch keine Bewertungen

- Projek Rekabentuk Walkwaybridge 2014 - 15Dokument6 SeitenProjek Rekabentuk Walkwaybridge 2014 - 15HambaliNoch keine Bewertungen

- Geometric Entities: Basic Gear TerminologyDokument5 SeitenGeometric Entities: Basic Gear TerminologyMatija RepincNoch keine Bewertungen

- Process Plant Layout and Piping DesignDokument4 SeitenProcess Plant Layout and Piping Designktsnl100% (1)

- Motion To DismissDokument24 SeitenMotion To DismisssandyemerNoch keine Bewertungen

- Mss 202 Practice 19-20Dokument2 SeitenMss 202 Practice 19-20fayinminu oluwaniyiNoch keine Bewertungen

- TP913Dokument5 SeitenTP913jmpateiro1985Noch keine Bewertungen

- Procurement Systems and Tools RoundTable Notes (Europe) 13 Oct 2020 - 0Dokument8 SeitenProcurement Systems and Tools RoundTable Notes (Europe) 13 Oct 2020 - 0SathishkumarNoch keine Bewertungen

- Media ReportDokument46 SeitenMedia ReportAndrew AB BurgoonNoch keine Bewertungen

- Mef Cecp TrainingDokument5 SeitenMef Cecp TrainingShambhu KhanalNoch keine Bewertungen

- Technical Specification For Flue Gas Desulfurization of Thermal Power Plant Limestone / Lime - Gypsum MethodDokument17 SeitenTechnical Specification For Flue Gas Desulfurization of Thermal Power Plant Limestone / Lime - Gypsum Methodpramod_tryNoch keine Bewertungen

- Taller Sobre Preposiciones y Vocabulario - Exhibición Comercial SergioDokument5 SeitenTaller Sobre Preposiciones y Vocabulario - Exhibición Comercial SergioYovanny Peña Pinzon100% (2)

- Form DVAT 27A: Intimation of Deposit of Government DuesDokument2 SeitenForm DVAT 27A: Intimation of Deposit of Government DueshhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Genesis and Development of The Network Arch Consept - NYDokument15 SeitenGenesis and Development of The Network Arch Consept - NYVu Phi LongNoch keine Bewertungen

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsVon EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNoch keine Bewertungen

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonVon EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonBewertung: 5 von 5 Sternen5/5 (9)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantVon EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantBewertung: 4 von 5 Sternen4/5 (104)

- How To Budget And Manage Your Money In 7 Simple StepsVon EverandHow To Budget And Manage Your Money In 7 Simple StepsBewertung: 5 von 5 Sternen5/5 (4)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassVon EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNoch keine Bewertungen

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsVon EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNoch keine Bewertungen

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationVon EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationBewertung: 4.5 von 5 Sternen4.5/5 (18)

- The Best Team Wins: The New Science of High PerformanceVon EverandThe Best Team Wins: The New Science of High PerformanceBewertung: 4.5 von 5 Sternen4.5/5 (31)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessVon EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyVon EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyBewertung: 5 von 5 Sternen5/5 (1)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherVon EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherBewertung: 5 von 5 Sternen5/5 (14)

- How to Save Money: 100 Ways to Live a Frugal LifeVon EverandHow to Save Money: 100 Ways to Live a Frugal LifeBewertung: 5 von 5 Sternen5/5 (1)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Von EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Bewertung: 5 von 5 Sternen5/5 (89)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Von EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Bewertung: 3.5 von 5 Sternen3.5/5 (9)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsVon EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsBewertung: 4 von 5 Sternen4/5 (4)

- The Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitVon EverandThe Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitNoch keine Bewertungen

- Rich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouVon EverandRich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouBewertung: 4 von 5 Sternen4/5 (2)

- Smart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestVon EverandSmart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestBewertung: 5 von 5 Sternen5/5 (1)

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayVon EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayBewertung: 3.5 von 5 Sternen3.5/5 (2)

- Sacred Success: A Course in Financial MiraclesVon EverandSacred Success: A Course in Financial MiraclesBewertung: 5 von 5 Sternen5/5 (15)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesVon EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesBewertung: 4.5 von 5 Sternen4.5/5 (30)

- Inflation Hacking: Inflation Investing Techniques to Benefit from High InflationVon EverandInflation Hacking: Inflation Investing Techniques to Benefit from High InflationBewertung: 4.5 von 5 Sternen4.5/5 (5)

- Bitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyVon EverandBitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyBewertung: 4 von 5 Sternen4/5 (4)

- The Ultimate 7 Day Financial Fitness ChallengeVon EverandThe Ultimate 7 Day Financial Fitness ChallengeBewertung: 5 von 5 Sternen5/5 (1)