Beruflich Dokumente

Kultur Dokumente

Aznar Vs Garcia

Hochgeladen von

Leomar Despi LadongaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Aznar Vs Garcia

Hochgeladen von

Leomar Despi LadongaCopyright:

Verfügbare Formate

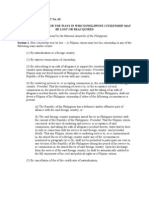

AZNAR VS GARCIA

Facts:

Edward S. Christensen, though born in New York, migrated to California where he resided and consequently

was considered a California Citizen for a period of nine years to 1913. He came to the Philippines where he

became a domiciliary until the time of his death. However, during the entire period of his residence in this

country, he had always considered himself as a citizen of California.

In his will, executed on March 5, 1951, he instituted an acknowledged natural daughter, Maria Lucy

Christensen as his only heir but left a legacy of some money in favor of Helen Christensen Garcia who, in a decision

rendered by the Supreme Court had been declared as an acknowledged natural daughter of his. Counsel of Helen

claims that under Art. 16 (2) of the civil code, California law should be applied, the matter is returned back to the

law of domicile, that Philippine law is ultimately applicable, that the share of Helen must be increased in view of

successional rights of illegitimate children under Philippine laws. On the other hand, counsel for daughter Maria ,

in as much that it is clear under Art, 16 (2) of the New Civil Code, the national of the deceased must apply, our

courts must apply internal law of California on the matter. Under California law, there are no compulsory heirs and

consequently a testator should dispose any property possessed by him in absolute dominion.

--Edward Christensen is a citizen of the State of California and domiciled in the Philippines. He executed in

his will acknowledging his natural daughter Maria Lucy Christensen as sole heir but left a legacy of some money in

favor of Helen Christensen Garcia who is declared by the Supreme Court in its decision as acknowledged natural

daughter of Edward C. Counsel of Helen asserts that her claim must be increased in view of the successional rights

of illegitimate children under Phil. law. Counsel of Maria insists that Art. 16 (2) provides that the NATIONAL LAW OF

THE PERSON applies in intestate and testamentary successions and since Edward C. is a citizen of CA, its law

should be applied. Lower court ruled that CA law should be applied thus this petition for review.

Issue:

What law should be applicable Philippine or California Law?

Ruling:

The court refers to Art. 16 (2) providing that intestate and testamentary successions with respect to order of

succession and amt. of successional right is regulated by the NATIONAL LAW OF THE PERSON.

California Probate Code provides that a testator may dispose of his property in the form and manner he desires.

Art. 946 of the Civil Code of California provides that if no law on the contrary, the place where the personal

property is situated is deemed to follow the person of its owner and is governed by the LAW OF HIS DOMICILE.

These provisions are cases when the Doctrine of Renvoi may be applied where the question of validity of the

testamentary provision in question is referred back to the decedents domicile the Philippines.

S.C. noted the California law provides 2 sets of laws for its citizens: One for residents therein as provided by the

CA Probate Code and another for citizens domiciled in other countries as provided by Art. 946 of the Civil Code

of California.

The conflicts of law rule in CA (Art. 946) authorize the return of question of law to the testators domicile. The

court must apply its own rule in the Philippines as directed in the conflicts of law rule in CA, otherwise the

case/issue will not be resolved if the issue is referred back and forth between 2 states.

The SC reversed the lower courts decision and remanded the case back to it for decision with an instruction that

partition be made applying the Philippine law.

Das könnte Ihnen auch gefallen

- Phil Bank Vs EchiverriDokument1 SeitePhil Bank Vs EchiverriLeomar Despi LadongaNoch keine Bewertungen

- Art. 333 - 346 - Crimes Against ChastityDokument6 SeitenArt. 333 - 346 - Crimes Against ChastityLeomar Despi LadongaNoch keine Bewertungen

- Phil Bank Vs EchiverriDokument1 SeitePhil Bank Vs EchiverriLeomar Despi LadongaNoch keine Bewertungen

- Commonwealth Act No. 63Dokument4 SeitenCommonwealth Act No. 63Sherill Padua GapasinNoch keine Bewertungen

- Aznar Vs GarciaDokument1 SeiteAznar Vs GarciaLeomar Despi LadongaNoch keine Bewertungen

- Crimes Against State LawsDokument4 SeitenCrimes Against State LawsLeomar Despi LadongaNoch keine Bewertungen

- Art. 171 - 184Dokument8 SeitenArt. 171 - 184Leomar Despi LadongaNoch keine Bewertungen

- Conflict CasesDokument28 SeitenConflict CasesLeomar Despi LadongaNoch keine Bewertungen

- Gregorio Araneta Vs RodasDokument2 SeitenGregorio Araneta Vs RodasLeomar Despi LadongaNoch keine Bewertungen

- Bar Exams QuestionsDokument43 SeitenBar Exams QuestionsLeomar Despi LadongaNoch keine Bewertungen

- CRIMES AGAINST CIVIL STATUSDokument4 SeitenCRIMES AGAINST CIVIL STATUSLeomar Despi LadongaNoch keine Bewertungen

- Art. 353 - 364 - Crimes Against HonorDokument13 SeitenArt. 353 - 364 - Crimes Against HonorLeomar Despi Ladonga88% (8)

- NEGLIGENT ACTS UNDER PHILIPPINE LAWDokument3 SeitenNEGLIGENT ACTS UNDER PHILIPPINE LAWLeomar Despi Ladonga100% (3)

- ObligationDokument2 SeitenObligationLeomar Despi LadongaNoch keine Bewertungen

- Mercantile Law 2013 October Bar ExamsDokument17 SeitenMercantile Law 2013 October Bar ExamsNeil RiveraNoch keine Bewertungen

- Full CasesDokument70 SeitenFull CasesLeomar Despi LadongaNoch keine Bewertungen

- Book VDokument19 SeitenBook VLeomar Despi LadongaNoch keine Bewertungen

- Simple Tenses and Perfect Tenses ExplainedDokument3 SeitenSimple Tenses and Perfect Tenses ExplainedLeomar Despi LadongaNoch keine Bewertungen

- January 11-20 2013 Civil CasesDokument1 SeiteJanuary 11-20 2013 Civil CasesLeomar Despi LadongaNoch keine Bewertungen

- MANPOWER SUPPLY AGREEMENTDokument3 SeitenMANPOWER SUPPLY AGREEMENTLeomar Despi LadongaNoch keine Bewertungen

- Spouses Yap vs. International Exchange BankDokument1 SeiteSpouses Yap vs. International Exchange BankLeomar Despi LadongaNoch keine Bewertungen

- Complaint: X IncorporatedDokument6 SeitenComplaint: X IncorporatedLeomar Despi LadongaNoch keine Bewertungen

- Chan Robles Virtual Law LibraryDokument7 SeitenChan Robles Virtual Law LibraryLeomar Despi LadongaNoch keine Bewertungen

- FActsDokument2 SeitenFActsLeomar Despi LadongaNoch keine Bewertungen

- Basco V PagcorDokument1 SeiteBasco V PagcorLeomar Despi LadongaNoch keine Bewertungen

- Monte de Piedad Earthquake Relief Funds DisputeDokument11 SeitenMonte de Piedad Earthquake Relief Funds DisputeLeomar Despi LadongaNoch keine Bewertungen

- Bildner V IlusorioDokument8 SeitenBildner V IlusorioLeomar Despi LadongaNoch keine Bewertungen

- RTC Hilongos Leyte People Philippines vs AB arson informationDokument1 SeiteRTC Hilongos Leyte People Philippines vs AB arson informationLeomar Despi Ladonga100% (1)

- BDO Bank Account Authorization CertificateDokument3 SeitenBDO Bank Account Authorization CertificateLeomar Despi LadongaNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)