Beruflich Dokumente

Kultur Dokumente

JHK

Hochgeladen von

Anant BhargavaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

JHK

Hochgeladen von

Anant BhargavaCopyright:

Verfügbare Formate

To study Reverse Mortgage in SBI Bank

The concept of Reverse Mortgage (RM) is gaining momentum in Indian with Finance Minister P. Chidambaram

giving his nod in the Union Budget for 2007-08. Subsequently, the National Housing Bank (NHB), a subsidiary of

the Reserve Bank of India (RBI), released the guidelines. This had led several banks to announce their intentions to

launch the scheme. Taking the lead, Dewan Housing Finance Limited (DFHL), followed by Punjab National Bank

(PNB) and Bank of Baroda (BOB), State Bank of India (SBI), etc. announced the scheme aimed at senior citizens [1]

Objectives of the research study

I.

II.

To bring out the concept of Reverse Mortgage.

To perform SWOT Analysis of Reverse Mortgage.

III.

To study basic features and process of SBI-Reverse Mortgage.

IV.

To recommend best strategies for making Reverse Mortgage more acceptable in India.

V.

To describe the degree to which reverse mortgages met consumer needs and the degree to which Consumers

are satisfied with their loans

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

CHAPTER 2

INTRODUCTION

2.1 Banking industry overview

History:

Banking in India has its origin as carry as the Vedic period. It is believed that the transition from money lending to

banking must have occurred even before Manu, the great Hindu jurist, who has devoted a section of his work to

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

deposits and advances and laid down rules relating to the interest. During the mogal period, the indigenous bankers

played a very important role in lending money and financing foreign trade and commerce. During the days of East

India Company, it was to turn of the agency houses top carry on the banking business. The general bank of India was

the first joint stock bank to be established in the year 1786.The others which followed were the Bank of Hindustan

and the Bengal Bank. The Bank of Hindustan is reported to have continued till 1906, while the other two failed in the

meantime. In the first half of the 19th Century the East India Company established three banks; The Bank of Bengal

in 1809, The Bank of Bombay in 1840 and The Bank of Madras in 1843.These three banks also known as presidency

banks and were independent units and functioned well. These three banks were amalgamated in 1920 and The

Imperial Bank of India was established on the 27th Jan 1921, with the passing of the SBI Act in 1955, the undertaking

of The Imperial Bank of India was taken over by the newly constituted SBI. The Reserve Bank which is the Central

Bank was created in 1935 by passing of RBI Act 1934, in the wake of swadeshi movement, a number of banks with

Indian Management were established in the country namely Punjab National Bank Ltd, Bank of India Ltd, Canara

Bank Ltd, Indian Bank Ltd, The Bank of Baroda Ltd, The Central Bank of India Ltd .On July 19th 1969, 14 Major

Banks of the country were nationalized and in 15th April 1980 six more commercial private sector banks were also

taken over by the government. The Indian Banking industry, which is governed by the Banking Regulation Act of

India 1949, can be broadly classified into two major categories, non-scheduled banks and scheduled banks.

Scheduled Banks comprise commercial banks and the co-operative banks.

The first phase of financial reforms resulted in the nationalization of 14 major banks in 1969 and resulted in a shift

from class banking to mass banking. This in turn resulted in the significant growth in the geographical coverage of

banks. Every bank had to earmark a min percentage of their loan portfolio to sectors identified as priority sectors

the manufacturing sector also grew during the 1970s in protected environments and the banking sector was a critical

source. The next wave of reforms saw the nationalization of 6 more commercial banks in 1980 since then the number

of scheduled commercial banks increased four- fold and the number of bank branches increased to eight fold. After

the second phase of financial sector reforms and liberalization of the sector in the early nineties. The PSBs found it

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

extremely difficult to complete with the new private sector banks and the foreign banks. The new private sector first

made their appearance after the guidelines permitting them were issued in January 1993. [28]

The Indian Banking System:

Banking in our country is already witnessing the sea changes as the banking sector seeks new technology and its

applications. The best port is that the benefits are beginning to reach the masses. Earlier this domain was the preserve

of very few organizations. Foreign banks with heavy investments in technology started giving some Out of the

world customer services. But, such services were available only to selected few- the very large account holders.

Then came the liberalization and with it a multitude of private banks, a large segment of the urban population now

requires minimal time and space for its banking needs. Automated teller machines or popularly known as ATM are

the three alphabets that have changed the concept of banking like nothing before. Instead of tellers handling your

own cash, today there are efficient machines that dont talk but just dispense cash. Under the Reserve Bank of India

Act 1934, banks are classified

as scheduled banks and nonscheduled banks. The scheduled banks are those, which are entered in the Second

Schedule of RBI Act, 1934. Such banks are those, which have paid- up capital and

reserves of an aggregate value of not less than Rs.5 lacs and which satisfy RBI that their affairs are carried out in the

interest of their depositors. All commercial banks Indian and Foreign, regional rural banks and state co-operative

banks are Scheduled banks. Non Scheduled banks are those, which have not been included in the Second Schedule of

the RBI Act, 1934. The organized banking system in India can be broadly classified into three categories: (i)

Commercial Banks (ii) Regional Rural Banks and (iii) Co-operative banks. The Reserve Bank of India is the

supreme monetary and banking authority in the country and has the responsibility to control the banking system in

the country. It keeps the reserves of all commercial banks and hence is known as the Reserve Bank.

Current scenario:

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

The last decade has seen many positive developments in the Indian banking sector. The policy makers, which

comprise the Reserve Bank of India (RBI), Ministry of Finance and related government and financial sector

regulatory entities, have made several notable efforts to improve regulation in the sector. The sector now compares

favorably with banking sectors in the region on metrics like growth, profitability and non-performing assets (NPAs).

A few banks have established an outstanding track record of innovation, growth and value creation. This is reflected

in their market valuation. However, improved regulations, innovation, growth and value creation in the sector remain

limited to a small part of it. The cost of banking intermediation in India is higher and bank penetration is far lower

than in other markets. Indias banking industry must strengthen itself significantly if it has to support the modern and

vibrant economy which India aspires to be. While the onus for this change lies mainly with bank managements, an

enabling policy and regulatory framework will also be critical to their success. The failure to respond to changing

market realities has stunted the development of the financial sector in many developing countries. A weak banking

structure has been unable to fuel continued growth, which has harmed the long-term health of their economies. In

this white paper, we emphasize the need to act both decisively and quickly to build an enabling, rather than a

limiting, banking sector in India.

Indian banks have compared favorably on growth, asset quality and profitability with other regional banks over the

last few years. The banking index has grown at a compounded annual rate of over 51 per cent since April 2001 as

compared to a 27 per cent growth in the market index

for the same period. Policy makers have made some notable changes in policy and regulation to help strengthen the

sector. These changes include strengthening prudential norms, enhancing the payments system and integrating

regulations between commercial and co-operative banks. However, the cost of intermediation remains high and bank

penetration is limited to only a few customer segments and geographies. While bank lending has been a significant

driver of GDP growth and employment, periodic instances of the failure of some weak banks have often threatened

the stability of the system. Structural weaknesses such as a fragmented industry structure, restrictions on capital

availability and deployment, lack of institutional support infrastructure, restrictive labour laws, weak corporate

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

governance and ineffective regulations beyond Scheduled Commercial Banks (SCBs), unless addressed, could

seriously weaken the health of the sector. Further, the inability of bank managements (with some notable exceptions)

to improve capital allocation, increase the productivity of their service platforms and improve the performance ethic

in their organizations could seriously affect future performance.

Bank is a financial institution that borrows money from the public and lends money to the public for productive

purposes. The Indian Banking Regulation Act of 1949 defines the term Banking Company as "Any company which

transacts banking business in India" and the term banking as "Accepting for the purpose of lending all investment

of deposits, of money from the public, repayable on demand or otherwise and withdrawal by cheque, draft or

otherwise".

Banks play important role in economic development of a country, like:

Banks mobilize the small savings of the people and make them available for productive purposes.

Promotes the habit of savings among the people thereby offering attractive rates of interests on their deposits.

Provides safety and security to the surplus money of the depositors and as well provides a convenient and

economical method of payment.

Banks provide convenient means of transfer of fund from one place to another.

Helps the movement of capital from regions where it is not very useful to regions where it can be more

useful.

Banks advances exposure in trade and commerce, industry and agriculture by knowing their financial

requirements and prospects.

Bank acts as an intermediary between the depositors and the investors. Bank also acts as mediator between

exporter and importer who does foreign trades.

Thus Indian banking has come from a long way from being a sleepy business institution to a highly pro-active and

dynamic entity. This transformation has been largely brought about by the large dose of liberalization and economic

reforms that allowed banks to explore new business opportunities rather than generating revenues from conventional

streams (i.e. borrowing and lending). The banking in India is highly fragmented with 30 banking units contributing

to almost 50% of deposits and 60% of advances.

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

Fig 2.1: Banking structure in India:

S R

C

H

E

S

R

E

D

U

V

E

N

LO

E

K

F

I

D

N

I

A

B

A

N

K

S

The banking institutions in the organized sector, commercial banks are the oldest institutions, some them having their

genesis in the nineteenth century. Initially they were set up in large numbers, mostly as corporate bodies with

shareholding with private individuals. Today 27 banks constitute a strong Public Sector in Indian Commercial

Banking. Commercial Banks operating in India fall under different sub categories on the basis of their ownership and

control over management;

Public Sector Banks

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

Public Sector Banks emerged in India in three stages. First the conversion of the then existing Imperial Bank of India

into State Bank of India in 1955, followed by the taking over of the seven associated banks as its subsidiary. Second

the nationalization of 14 major commercial banks in 1969and last the nationalization of 6 more commercial Bank in

1980. Thus 27 banks constitute the Public Sector Banks.

New Private Sector Banks

After the nationalization of the major banks in the private sector in 1969 and 1980, no new bank could be setup in

India for about two decades, though there was no legal bar to that effect. The Narasimham Committee on financial

sector reforms recommended the establishment of new banks of India. RBI thereafter issued guidelines for setting up

of new private sector banks in India in January 1993. These guidelines aim at ensuring that new banks are

financially viable and technologically up to date from the start. They have to work in a professional manner, so as to

improve the image of commercial banking system and to win the confidence of the public. Eight private sector banks

have been established including banks sector by financially institutions like IDBI, ICICI, and UTI etc.

Local Area Banks

Such Banks can be established as public limited companies in the private sector and can be promoted by individuals,

companies, trusts and societies. The minimum paid up capital of such banks would be 5 crores with promoters

contribution at least Rs. 2 crores. They are to be set up in district towns and the area of their operations would be

limited to a maximum of 3 districts. At present, four local area banks are functional, one each in Punjab, Gujarat,

Maharashtra and Andhra Pradesh.

Foreign Banks

Foreign commercial banks are the branches in India of the joint stock banks incorporated abroad. There number was

38 as on 31.03.2009.

Scheduled Commercial Banks in India

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

The commercial banking structure in India consists of:

Scheduled Commercial Banks in India

Unscheduled Banks in India

Scheduled Banks in India constitute those banks which have been included in the Second Schedule of Reserve Bank

of India (RBI) Act, 1934. RBI in turn includes only those banks in this schedule which satisfy the criteria laid down

vide section42 (6) a) of the Act.

"Scheduled banks in India" means the State Bank of India constituted under the State Bank of India Act, 1955 (23 of

1955), a subsidiary bank as defined in the State Bank of India (Subsidiary Banks) Act, 1959 (38 of 1959), a

corresponding new bank constituted under section 3 of the Banking Companies (Acquisition and Transfer of

Undertakings) Act, 1970 (5 of 1970), or under section 3 of the Banking Companies (Acquisition and Transfer of

Undertakings) Act, 1980 (40 of 1980), or any other bank being a bank included in the Second Schedule to the

Reserve Bank of India Act, 1934 (2 of 1934), but does not include a co-operative bank". "Non-scheduled bank in

India" means a banking company as defined in clause (c) of section 5 of the Banking Regulation Act, 1949 (10 of

1949), which is not a scheduled bank".

Cooperative Banks

Besides the commercial banks, there exists in India another set of banking institutions called cooperative credit

institutions. These have been made in existence in India since long. They undertake the business of banking both in

urban and rural areas on the principle of cooperation. They have served a useful role in spreading the banking habit

throughout the country. Yet, there financial position is not sound and a majority of cooperative banks has yet to

achieve financial viability on a sustainable basis.

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

The cooperative banks have been set up under various Cooperative Societies Acts enacted by State Governments.

Hence the State Governments regulate these banks. In 1966, need was felt to regulate their activities to ensure their

soundness and to protect the interests of depositors

According to the RBI in March 2009, number of all Scheduled Commercial Banks (SCBs) was 171 of which, 86

were Regional Rural Banks and the number of Non-Scheduled Commercial Banks including Local Area Banks stood

at 5. Taking into account all banks in India, there are overall 56,640 branches or offices, 893,356 employees and

27,088 ATMs. Public sector banks made up a large chunk of the infrastructure, with 87.7 per cent of all offices, 82

per cent of staff and 60.3 per cent of all automated teller machines (ATMs).

2.2 INTRODUCTION STATE BANK OF INDIA

Evolution of SBI

The origin of the State Bank of India goes back to the first decade of the nineteenth century with the establishment of

the Bank of Calcutta in Calcutta on 2 June 1806. Three years later the bank received its charter and was re-designed

as the Bank of Bengal (2 January 1809). A unique institution, it was the first joint-stock bank of British India

sponsored by the Government of Bengal. The Bank of Bombay (15 April 1840) and the Bank of Madras (1 July

1843) followed the Bank of Bengal. These three banks remained at the apex of modern banking in India till their

amalgamation as the Imperial Bank of India on 27 January 1921.

Primarily Anglo-Indian creations, the three presidency banks came into existence either as a result of the

compulsions of imperial finance or by the felt needs of local European commerce and were not imposed from outside

in an arbitrary manner to modernize India's economy. Their evolution was, however, shaped by ideas culled from

similar developments in Europe and England, and was influenced by changes occurring in the structure of both the

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

local trading environment and those in the relations of the Indian economy to the economy of Europe and the global

economic framework.

Establishment

The establishment of the Bank of Bengal marked the advent of limited liability, joint-stock banking in India. So was

the associated innovation in banking, viz. the decision to allow the Bank of Bengal to issue notes, which would be

accepted for payment of public revenues within a restricted geographical area. This right of note issue was very

valuable not only for the Bank of Bengal but also its two siblings, the Banks of Bombay and Madras. It meant an

accretion to the capital of the banks, a capital on which the proprietors did not have to pay any interest. The concept

of deposit banking was also an innovation because the practice of accepting money for safekeeping (and in some

cases, even investment on behalf of the clients) by the indigenous bankers had not spread as a general habit in most

parts of India. But, for a long time, and especially up to the time that the three presidency banks had a right of note

issue, bank notes and government balances made up the bulk of the investible resources of the banks.

The three banks were governed by royal charters, which were revised from time to time. Each charter provided for a

share capital, four-fifth of which were privately subscribed and the rest owned by the provincial government. The

members of the board of directors, which managed the affairs of each bank, were mostly proprietary directors

representing the large European managing agency houses in India. The rest were government nominees, invariably

civil servants, one of whom was elected as the president of the board.

Business

The business of the banks was initially confined to discounting of bills of exchange or other negotiable private

securities, keeping cash accounts and receiving deposits and issuing and circulating cash notes. Loans were restricted

to Rs.one lakh and the period of accommodation confined to three months only. The business of the banks was

initially confined to discounting of bills of exchange or other negotiable private securities, keeping cash accounts and

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

receiving deposits and issuing and circulating cash notes. Loans were restricted to Rs.one lakh and the period of

accommodation confined to three months only. The security for such loans was public securities, commonly called

Company's Paper, bullion, treasure, plate, jewels, or goods 'not of a perishable nature' and no interest could be

charged beyond a rate of twelve per cent. Loans against goods like opium, indigo, salt woollens, cotton, cotton piece

goods, mule twist and silk goods were also granted but such finance by way of cash credits gained momentum only

from the third decade of the nineteenth century. All commodities, including tea, sugar and jute, which began to be

financed later, were either pledged or hypothecated to the bank.

Demand promissory notes were signed by the borrower in favor of the guarantor, which was in turn endorsed to the

bank. Lending against shares of the banks or on the mortgage of houses, land or other real property was, however,

forbidden Indians were the principal borrowers against deposit of Company's paper, while the business of discounts

on private as well as salary bills was almost the exclusive monopoly of individuals Europeans and their partnership

firms. But the main function of the three banks, as far as the government was concerned, was to help the latter raise

loans from time to time and also provide a degree of stability to the prices of government securities.

Major change in the conditions

A major change in the conditions of operation of the Banks of Bengal, Bombay and Madras occurred after 1860.

With the passing of the Paper Currency Act of 1861, the right of note issue of the presidency banks was abolished

and the Government of India assumed from 1 March 1862 the sole power of issuing paper currency within British

India. The task of management and circulation of the new currency notes was conferred on the presidency banks and

the Government undertook to transfer the Treasury balances to the banks at places where the banks would open

branches. None of the three banks had till then any branches (except the sole attempt and that too a short-lived one

by the Bank of Bengal at Mirzapore in 1839) although the charters had given them such authority. But as soon as the

three presidency bands were assured of the free use of government Treasury balances at places where they would

open branches, they embarked on branch expansion at a rapid pace. By 1876, the branches, agencies and sub

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

agencies of the three presidency banks covered most of the major parts and many of the inland trade centers in India.

While the Bank of Bengal had eighteen branches including its head office, seasonal branches and sub agencies, the

Banks of Bombay and Madras had fifteen each.

Presidency Banks Act

The presidency Banks Act, which came into operation on 1 May 1876, brought the three presidency banks under a

common statute with similar restrictions on business. The proprietary connection of the Government was, however,

terminated, though the banks continued to hold charge of the public debt offices in the three presidency towns, and

the custody of a part of the government balances. The Act also stipulated the creation of Reserve Treasuries at

Calcutta, Bombay and Madras into which sums above the specified minimum balances promised to the presidency

banks at only their head offices were to be lodged. The Government could lend to the presidency banks from such

Reserve Treasuries but the latter could look upon them more as a favour than as a right.

The decision of the Government to keep the surplus balances in Reserve Treasuries outside the normal control of the

presidency banks and the connected decision not to guarantee minimum government balances at new places where

branches were to be opened effectively checked the growth of new branches after 1876. The pace of expansion

witnessed in the previous decade fell sharply although, in the case of the Bank of Madras, it continued on a modest

scale as the profits of that bank were mainly derived from trade dispersed among a number of port towns and inland

centers of the presidency. India witnessed rapid commercialization in the last quarter of the nineteenth century as its

railway network expanded to cover all the major regions of the country. New irrigation networks in Madras, Punjab

and Sind accelerated the process of conversion of subsistence crops into cash crops, a portion of which found its way

into the foreign markets. Tea and coffee plantations transformed large areas of the eastern Terais, the hills of Assam

and the Nilgiris into regions of estate agriculture par excellence. All these resulted in the expansion of India's

international trade more than six-fold. The three presidency banks were both beneficiaries and promoters of this

commercialization process as they became involved in the financing of practically every trading, manufacturing and

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

mining activity in the sub-continent. While the Banks of Bengal and Bombay were engaged in the financing of large

modern manufacturing industries, the Bank of Madras went into the financing of large modern manufacturing

industries, the Bank of Madras went into the financing of small-scale industries in a way which had no parallel

elsewhere. But the three banks were rigorously excluded from any business involving foreign exchange. Not only

was such business considered risky for these banks, which held government deposits, it was also feared that these

banks enjoying government patronage would offer unfair competition to the exchange banks which had by then

arrived in India. This exclusion continued till the creation of the Reserve Bank of India in 1935.

Presidency Banks of Bengal

The presidency Banks of Bengal, Bombay and Madras with their 70 branches were merged in 1921 to form the

Imperial Bank of India. The triad had been transformed into a monolith and a giant among Indian commercial banks

had emerged. The new bank took on the triple role of a commercial bank, a banker's bank and a banker to the

government, But this creation was preceded by years of deliberations on the need for a 'State Bank of India'. What

eventually emerged was a 'half-way house' combining the functions of a commercial bank and a quasi-central bank.

The establishment of the Reserve Bank of India as the central bank of the country in 1935 ended the quasi-central

banking role of the Imperial Bank. The latter ceased to be bankers to the Government of India and instead became

agent of the Reserve Bank for the transaction of government business at centers at which the central bank was not

established. But it continued to maintain currency chests and small coin depots and operate the remittance facilities

scheme for other banks and the public on terms stipulated by the Reserve Bank. It also acted as a bankers' bank by

holding their surplus cash and granting them advances against authorized securities. The management of the bank

clearing houses also continued with it at many places where the Reserve Bank did not have offices. The bank was

also the biggest tendered at the Treasury bill auctions conducted by the Reserve Bank on behalf of the Government.

The establishment of the Reserve Bank simultaneously saw important amendments being made to the constitution of

the Imperial Bank converting it into a purely commercial bank. The earlier restrictions on its business were removed

and the bank was permitted to undertake foreign exchange business and executor and trustee business for the first

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

time.

Imperial Bank

The Imperial Bank during the three and a half decades of its existence recorded an impressive growth in terms of

offices, reserves, deposits, investments and advances, the increases in some cases amounting to more than six-fold.

The financial status and security inherited from its forerunners no doubt provided a firm and durable platform. But

the lofty traditions of banking which the Imperial Bank consistently maintained and the high standard of integrity it

observed in its operations inspired confidence in its depositors that no other bank in India could perhaps then equal.

All these enabled the Imperial Bank to acquire a pre-eminent position in the Indian banking industry and also secure

a vital place in the country's economic life. When India attained freedom, the Imperial Bank had a capital base

(including reserves) of Rs.11.85 crores, deposits and advances of Rs.275.14 crores and Rs.72.94 crores respectively

and a network of 172 branches and more than 200 sub offices extending all over the country.

First Five Year Plan

In 1951, when the First Five Year Plan was launched, the development of rural India was given the highest priority.

The commercial banks of the country including the Imperial Bank of India had till then confined their operations to

the urban sector and were not equipped to respond to the emergent needs of economic regeneration of the rural areas.

In order, therefore, to serve the economy in general and the rural sector in particular, the All India Rural Credit

Survey Committee recommended the creation of a state-partnered and state-sponsored bank by taking over the

Imperial Bank of India, and integrating with it, the former state-owned or state-associate banks. An act was

accordingly passed in Parliament in May 1955 and the State Bank of India was constituted on 1 July 1955. More

than a quarter of the resources of the Indian banking system thus passed under the direct control of the State. Later,

the State Bank of India (Subsidiary Banks) Act was passed in 1959, enabling the State Bank of India to take over

eight former State-associated banks as its subsidiaries (later named Associates).The State Bank of India was thus

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

born with a new sense of social purpose aided by the 480 offices comprising branches, sub offices and three Local

Head Offices inherited from the Imperial Bank. The concept of banking as mere repositories of the community's

savings and lenders to creditworthy parties was soon to give way to the concept of purposeful banking sub serving

the growing and diversified financial needs of planned economic development. The State Bank of India was destined

to act as the pacesetter in this respect and lead the Indian banking system into the exciting field of national

development. [54]

Fig 4.2 Organization structure of the SBI [55]

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

AGM - Operations

Source-

[55]

2.3 Introduction to Reverse Mortgage

Old age comes with its own share of problems. As a person grows older, and his regular source of income dries up,

his dependency on others can increase significantly. With health care expenses on the rise and little social security,

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

living the golden years respectfully can be quite a challenge for senior citizens. In such a scenario, a regular income

stream that can help them meet their financial needs and maintain their current living standards becomes important.

One typical feature with most senior citizens is that their residential property accounts for a significant portion of

their total asset pie. And, given its illiquid nature, property fails to aid senior citizens on the liquidity front. In the

Union Budget 2007-08, a proposal to introduce 'Reverse Mortgages' was put forth. To understand the concept of

reverse mortgage, first let us understand what a regular mortgage is. In a regular mortgage, a borrower mortgages his

new/existing house with the lender in return for the loan amount (which in turn he uses to finance the property); the

same is charged at a particular interest rate and runs over a predetermined tenure. The borrower then has to repay the

loan amount in the form of EMIs (equated monthly installments), which comprise of both principal and interest

amounts. The property is utilized as a security to cover the risk of default on the borrower's part.

In the reverse mortgage, senior citizens (borrowers), who own a house property, but do not have regular income, can

mortgage the same with the lender (a scheduled bank or a housing finance company-HFC). In return, the lender

makes periodic payment to the borrowers during their lifetime. In spite of mortgaging the house property, the

borrower can continue to stay in it during his entire life span and continue to receive regular flows of income from

the lender as well. Also, since the borrower doesn't have to service the loan, he need not bother about repaying the

'borrowed amount' to the lender.

The concept of Reverse Mortgage (RM) is gaining momentum in Indian with Finance Minister P. Chidambaram

giving his nod in the Union Budget for 2007-08. Subsequently, the National Housing Bank (NHB), a subsidiary of

the Reserve Bank of India (RBI), released the guidelines. This had led several banks to announce their intentions to

launch the scheme. Taking the lead, Dewan Housing Finance Limited (DFHL), followed by Punjab National Bank

(PNB) and Bank of Baroda (BOB), State Bank of India (SBI), etc. announced the scheme aimed at senior citizens.

Senior homeowners of all income levels have taken out reverse mortgages for many different reasons. For some,

reverse mortgages provide the extra money that let them stay securely in their homes throughout retirement. For

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

others, reverse mortgages provide a means to live more comfortably and pursue their dreams. Its a special type of

mortgage which allows the senior homeowner to access their equity which they have built up in the form of the

home and use the money according to their wish, all this while letting owner stay in his home. Its called a reverse

mortgage because the flow of payments is reversed from a traditional mortgage. The lender makes payments to the

owner, or arranges a line of credit that is available for the owners use. This differs from a traditional mortgage used

to purchase or refinance a home in which you must make monthly mortgage payments to the bank.

To qualify for most loans, the lender checks the applicants income to see how much he can afford to pay back each

month. But with a reverse mortgage, he doesnt have to make monthly repayments. So the owner or the applicant

doesnt need a minimum amount of income to qualify for a reverse mortgage. He could have no income, and still be

able to get a reverse mortgage. With most home loans, if a person fails to make his monthly repayments, he could

lose his home. But with a reverse mortgage, he doesnt have any monthly repayments to make. So he cant lose his

home by failing to make them. Reverse mortgages typically require no repayment for as long as the owner or coowner live in the home. So reverse mortgage differ from other home loans in these important ways, the first one is

the applicant dont need an income to qualify for a reverse mortgage and the second one is he dont have to make

monthly repayments on a reverse mortgage.

Reverse mortgages have a different purpose than forward mortgages do. With a forward mortgage, you use your

income to repay debt, and this builds up equity in your home. But with a reverse mortgage, you are taking the equity

out in cash. So with a reverse mortgage your debt increases and your home equity decreases. Its just the opposite, or

reverse of traditional mortgage. During a reverse mortgage, the lender sends you cash, and you make no repayments.

So the amount you owe (your debt) gets larger as you get more cash and more interest is added to your loan balance.

As your debt grows, your equity shrinks, unless your homes value is growing at a high rate. When a reverse

mortgage becomes due and payable, you may owe a lot of money and your equity may be very small. If you have the

loan for a long time, or if your homes value decreases, there may not be any equity left at the end of the loan. In

short, a reverse mortgage is a rising debt, falling equity type of deal. But that is exactly what informed reverse

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

mortgage borrowers want to spend down their home equity while they live in their homes, without having to make

monthly loan repayments. [22]

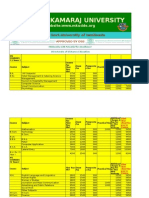

Table 2.1:

mortgage

Difference between traditional mortgage and reverse

[23]

Item

Mortgage

Reverse Mortgage

Purpose of loan

to purchase a home

to generate income

Before closing

borrower has no equity in borrower has a lot of

At closing

the home

equity in the home

borrower owes a lot, and

borrower owes very little,

has little equity

During

the

borrower...

and has lot of equity

loan, - makes monthly payments - receives payments from

to the lender

the lender

- loan balance goes down

- loan balance rises

- equity grows

- equity declines

At end of loan,

- owes nothing

- owes substantial amount

borrower...

- has substantial equity

- has much less, little, or

no equity

Type of

Nikita Jadhav (Finance)

Falling Debt- Rising

Rising Debt- Falling

To study Reverse Mortgage in SBI Bank

Transaction

Equity

Equity

The Benefits of a Reverse Mortgage

Tax-free funds for as long as you live in your home

No loan repayment for as long as you live in your home

No income, medical or credit requirements

Retain ownership of your home for life this is guaranteed as long as you maintain your home, and pay insurance

and real estate taxes

Choose a cash flow plan tailored to your needs

No restrictions on how you may use the funds

A tax-advantaged way to pass on part of your estate today

The following are the guidelines given by RBI for Reverse Mortgage:

Any house owner over 60 years of age is eligible for a reverse mortgage.

The maximum loan is up to 60% of the value of residential property.

The maximum period of property mortgage is 15 years with a bank .

The borrower can opt for a monthly, quarterly, annual or lump sum payments at any point, as per his discretion.

The revaluation of the property has to be undertaken by the Bank once every 5 years.

The amount received through reverse mortgage is considered as loan and not income; hence the same will not

attract any tax liability.

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

Reverse mortgage rates can be fixed or floating and hence will vary according to market conditions depending on

the interest rate regime chosen by the borrower.

Costs which are to be incurred while going for Reverse Mortgage

Processing or origination costs: - These are the costs which covers the banks operating expenses for making the

loan .This cost can be financed as a part of the total loan.

Mortgage Insurance: - This is the insurance charges of the insurer who guarantees that if the lender that is the

banker goes out of business for any reason, the borrower would continue to get his or her payments. The insurer

could also guarantee that the borrower will never owe more than the value of his or her home when the loan is

finally repaid.

Appraisal fee: - This fee is to be paid to an appraiser who fixes a value on the borrowers home which is to be

mortgaged. An appraiser must also make sure there are no major structural defects, such as bad foundation, leaky

roof, or termite damage. If the appraiser uncovers property defects, you must hire a contractor to complete the

repairs. Once the repairs are completed, the same appraiser is paid for a second visit to make sure the repairs

have been completed. The cost of the repair may be financed within the loan.

Other fees which include credit report fee for verifying whether any tax liabilities are there, title search fee,

document preparation fee for loan documents, mortgage recording fee, survey fee, etc. [24]

Risks to RM Lenders

There are some risks faced by a Reverse Mortgage lender. These risks are at the heart of the reluctance of lenders to

get into reverse mortgage lending, in the absence of public policy support. The principal and unique problem facing

the lender is that of predicting accumulated future loan balances under a reverse mortgage, at the time of origination.

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

The uniqueness is because reverse mortgage is a rising debt instrument. Since reverse mortgage is a non-recourse

loan, the lender has no access to other properties, if any, of the borrower. Even if the collateral property appreciates

in value, it might still be lower than the loan balance at the time of disposal of the property. The following are the

basic sources of this risk:1. Mortality Risks:This is the risk that a reverse mortgage borrower lives longer than anticipated. The lender might get hit both ways he

has to make annuity payments for a longer period; and the eventual value realised might decline. However, this risk

is usually diversifiable, if the reverse mortgage lender has a large pool of such borrowers. Possibility of adverse

selection is counterbalanced by the possibility that even borrowers with poor health may be attracted by Reverse

Mortgages credit line or lump sum options. However, there is no literature on one possible source of systematic risk.

Since reverse mortgage is projected to substantially improve the monthly income and/ or liquid funds of the reverse

mortgage borrowers, would it not itself result in a systematically higher life expectancy amongst them than

otherwise, now this is a big question.

2. Interest Rate Risks:Said that the typical reverse mortgage borrower is elderly and is looking for predictable sources of income/ liquidity,

reverse mortgage loans promise a fixed monthly payment / lump sum / credit line entitlement. However, for the

lender, this is a long-term commitment with significant interest rate risks. While fixing the above, the lender has to

account for a risk premium and thus can offer only a conservative deal to the borrower. This interest rate risk is not

fully diversifiable within the reverse mortgage portfolio. Most of the reverse mortgage loans accumulate interest on a

floating rate basis to minimize interest rate risks to the lender, like in SBI the interest rates are revised for every 5

years. However, since there are no actual periodic interest payments from the borrower, these can be realized only at

the time of disposal of the house, if at all.

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

3. Property Market Risk:This risk may be partly diversifiable by geographical diversification of RM loans. However, property values may be

a non-stationary time series. In this three risks may be pointed out they are.

RM can be considered as a package loan with a crossover put option to the borrower to sell his house at the

accumulated value of the reverse mortgage loan at the time of repayment which is uncertain. If this option can be

valued, it can be suitably priced and sold in the market. However, unlike in the case of traditional mortgages,

markets for resale, securitization and derivatives based on reverse mortgages are non-existent or noncompetitive. Small market size and predominance of government backed reverse mortgage insurance may

dissuade potential entrants. This impedes the flow of funds to finance reverse mortgage loans.

For the lender, both the interest and any shared appreciation component added to the loan balance are taxable as

current income even though there is no cash inflow.

Reverse mortgage loans found takers amongst lenders only after the availability of default insurance. Even then,

in most of the reverse mortgage loans, interest accumulates at a floating rate linked to one-year treasury rates. A

fixed interest rate reverse mortgage carries an interest rate risk are higher than a conventional coupon bond or

regular mortgage. It could be especially high at origination and continues to be higher throughout. The small

initial investment under an reverse mortgage is very deceptive. Reverse mortgage creates very large off-balance

sheet liabilities, if market rates rise above the rate assumed under reverse mortgage.

4. Moral Hazard Risk:-

Once an RM loan is taken, the homeowners may have no incentive to maintain the house so as to preserve or

enhance market value. This might be especially true when the loan balance is more or less sure to cross the sale

value. Since the benefit would accrue mainly to the lenders and the cost borne by the homeowner, it is perhaps not

sensible to assume otherwise. They conclude that in a competitive market, the lenders will respond by either

reducing the loan amount or by charging a risk premium in interest or both. The more important point is that some

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

time during the tenure of a reverse mortgage, an elderly borrower may simply be physically incapable of maintaining

the home as per loan requirements. Though the reverse mortgage loan contract provides for foreclosure under such

conditions, this seems to be impractical and sure to result in litigation and bad publicity for the lender.

5. Liquidity Risks:In Reverse mortgage loans where the borrower draws down on his loan through a credit line, there is a risk of sudden

withdrawals.

Risk Mitigation

Risk mitigation is the key for the success of any financial product including reverse mortgage. Some of the risk

mitigation techniques which the providers that is the banker can apply to reduce the risk on their books are as

follow:

Proper eligibility criterions

The first mitigation of risk can be done at the time of providing loans. This can be done through proper verification

of the title of the property, age of the borrower; his/her credit analysis etc. This reduces the risk of default by the

borrower

Variable interest rates loan as compared to fixed interest rate loan

To avoid interest rate risk, the lender can go for variable interest rates based on some market benchmark like

MIBOR. This will also reduce the risk of Pre-payment as the borrower will not have interest arbitrage on prepayment

of the loan.

Proper analysis of mortality trends

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

As the product has significant longevity risk, the lender can do a detailed mortality trend analysis on a macro level

and also in the market where it is operating.

Geographical diversification

The lender can look at spreading the business across the country by promoting the product in secondary and tertiary

cities also so that the law of large numbers may work properly and if the provider has a bad experience in one

market; it can be compensated with good experience in other cities.

Develop the product for lower age groups

The lender can develop home equity conversion mortgages for all households and not just for elderly. This will

significantly reduce loan to value ratio and that will take care of many of the risks inherent in the product.

Securitization

One of the most effective ways of mitigation risk is securitization It involves many other financial players and thus it

spreads the risk of default/prepayment to many other participants.

Repayment schedule

In the Repayment schedule, some default conditions or changes that affect the security of the loan for the lender that

can make reverse mortgages payable should also be added, like Declaration of bankruptcy, Donation or abandonment

of the house, Condemnation/ Sovereign Takeover of the property by a government agency, adding a new owner to

the homes title, taking out new debt against the home etc.

Forces affecting Reverse Mortgage

Any financial product is affected by some forces. The following are forces that affect this innovative financial

product called Reverse Mortgage.

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

1. Borrowers have to bear very high transaction costs. However, with the latest program we can expect a declining

trend in these costs due to growing volumes, increased awareness and learning effects.

2. There is a definite risk of moral hazard in borrowers being responsible for home maintenance and in ultimate

home sale. Given the profile of a typical borrower, there are serious questions on both incentives and ability. It is

impractical to enforce the foreclosure clause. Negative publicity, potential litigation and likely judgments make it

so.

3. Home equity is an important component of precautionary savings. If a homeowner has drawn down on his equity

through a reverse mortgage, his ability to meet unforeseen health care costs or move into alternative housing may

be more limited. Those who become seriously ill but would like to continue to stay at home may face a severe

problem. If they have to be away from home for long for convalescence, they may fail to maintain the home and

pay property taxes. Then, as per the conditions of the reverse mortgage, the lender can foreclose the loan.

4. Many elderly households may be simply reluctant to take on debt, having spent so much of their lifetime saving

for their own house.

5. Real estate laws are state specific whereas regulations governing reverse mortgage loans are national in character.

If there is a conflict, state laws will prevail unless pre-empted by federal law.

6. Laws in some states are not clear on the lien priority to be granted to reverse mortgage over other secured

creditors, in spite of specific provisions in a reverse mortgage contract.

7. What happens if a household declares bankruptcy, having borrowed through a Reverse mortgage is a big

question.

8. Uncertainty exists on taxation of the borrower. If reverse mortgage annuities were considered taxable as income

of the borrower, would accrued interest on the loan be a tax-deductible expense is an issue.

9. The tax authorities may if classify an reverse mortgage as a sale of home rather than a loan, given the high

probability that the entire value may ultimately accrue to the lender. If so, the borrower may suddenly find that he

has lost out on one-time exemptions on capital gains.

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

10. The lender has to account for accrued interest as income, without any corresponding cash flow. [25]

Indian Market Potential

India-specific Characteristics of Relevance to RM

There are no universal old age social security related benefits. Only about 10% of the active working populations

are covered by formal schemes. This would substantially enlarge the potential target market for RM.

A much lower proportion of urban households, and by implication, less scope for reverse mortgage.

A much larger proportion of elders co-living with their family members of subsequent generations and hence less

scope for reverse mortgage.

A possibly stronger hand over motive, reducing the scope for reverse mortgage.

A possibly higher real rate of appreciation of real estate and housing prices, making reverse mortgage more

attractive to the lender.

Widespread under valuation of real estate properties to accommodate transactions involving unaccounted money

and evasion of taxes on property and real estate transactions

Complexity, variety and location specific variations in types of home ownerships like Benami holdings that is

Irrevocable power of attorney, Leasehold, freehold, Land use conversion regulations, Floor space regulations,

rent, tenancy controls, Disposal of ancestral property.

Absence of competitive suppliers for immediate life annuity products. This, in turn, is a consequence of Lack of

data on old age mortality rates, Lack of long-term treasury securities for managing interest rate risks of annuity

providers.

India specific legal and taxation issues like License/ Permission required under insurance/ banking regulation for

offering reverse mortgage ,Income tax treatment for reverse mortgage lender and borrower, Capital gains on

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

property, Reporting and provisioning by the lender as per banking/ insurance regulation, Status of RM loan in

case of insolvency.

Old Age Population

Though the Indian population is still comparatively young, India is also ageing. According to some demographic

survey conducted for India indicated the following outcomes.

The number of elderly (>60 yrs) will increase to 113 million by 2016, 179 million by 2026, and 218 million by

2030. Their share in the total population is projected to be 8.9 % by 2016 and 13.3% by 2026. The dependency

ratio is projected to rise from 15% as of now to about 40% in the next four decades

The percentage of >60 in the population of Tamil Nadu and Kerala will reach about 15% by 2020 itself.

Life expectancy at age 60, which is around 17 yrs now, will increase to around 20 by 2020

Table 2.2: Sources of Income Support for the Elderly in India

As of 1994, the estimated percentage among the elderly, dependent on various sources of income was as follows:

Source

Men

Women

All elderly

Pensions/Rent

9-10%

5%

7-8%

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

Work

65%

15%

40%

Transfers

30%

72%

52%

Of which, from

22%

58%

40%

Children

In addition, as per a survey of the National Sample Survey Organization (NSSO) in 1994, less than 4% of the elderly

lived alone. A 1995-96 National Sample Survey of the elderly reported that about 5% of them lived alone, another

10% lived with their spouses only and another 5% lived with relatives/ non-relatives, other than their own children.

In other words, co-residence with children and other relatives is predominant.

However, the following aspects are worrisome:

The extent and adequacy of support, especially for widows

Vulnerability of such support to shocks to family income

As incomes and life expectancy rose in the now developed countries, simultaneously there was a decline in

co-residence rates and intergenerational support. It may happen in India too

Strains due to demographic trends seem inevitable: fewer children must support parents for longer periods of

time. In a recent survey covering 30 cities, 70% of the respondents did not expect their children to take care

of them after retirement.

Job related migration of youth within the country and emigration.

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

Potential Market Segments

The senior citizen population in India is growing rapidly due to lower fertility rates, improved healthcare, and

better nutrition. The senior population is estimated to become 117 million by 2015, growing from the current

population of 87 million. While this segment of the population is increasing, it continues to be largely neglected

by policymakers.

The Indian government is now employing innovative strategies towards change. It has begun introducing

financial instruments aimed at the senior population. Among several financial products being encouraged is the

reverse mortgage loan (RML), which was introduced by the Finance Minister in his annual budget for 2007-08.

In a new report, Reverse Mortgage Market: Early Days for India, Celent examines the opportunity and

challenges associated with this market opportunity from the lenders perspective. The RML product class is

expected to have a directly addressable market opportunity of around 6 million households with a total of

US$113 billion home equity by 2015 across both urban and rural India.

Fig 3.3: Market size and potential

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

Now let us see specification of the potential target segment for Reverse Mortgage.

Age Group

Above 58 years, assuming 58 is the typical retirement age. Older the individual, more attractive will be reverse

mortgage. Additional considerations will include the minimum age specified for preferential treatment as senior

citizens in matters such as income tax or the recently introduced Varishta Bima Yojana.

High House Equity

The current monthly annuity payout by LIC under its immediate annuity product Jeevan Akshay is 844 Rs for a

single premium payment of Rs 1 lakh, for a person aged 65. The annuity will be lower in case of joint life or annuity

certain options. If we were to use a minimum of Rs 5000 as the monthly annuity that makes reverse mortgage a

worthwhile activity, we need an RM loan of around Rs 6 lakhs. Assuming a loan to home value ratio of 60%, this

implies a current market value of Rs. 10 lakhs.

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

Low Current Incomes Relative to Desired Standard of Living

Amongst such households, we are looking for those whose current levels of income are insufficient to afford their

desired standard of living. The salary replacement rates suggested in the literature, for maintaining the same standard

of living after retirement as before, is around 60%. This implies a pre-retirement take home salary or income (aftertax) of around Rs 9000-10000 a month. A potential reverse mortgage borrower would be one who had such a preretirement income but no substantial pension benefits. Therefore, he would be employed in the private sector or selfemployed.

Long Tenure at Current Home

Reverse Mortgage is attractive to a borrower especially when he values continued stay in his current residence and

plans to do so for a long term into the future. This is likely when he has already stayed in his current home for a

relatively longer period- say a minimum of 10 years. Additional indicators for such a desire could be a person

currently resident in ones home town/ state.

Lack of Other Supports

If such an individual is living alone, as in the case of a widower or widow, reverse mortgage can make a substantial

contribution to his/ her standard of living. Alternatively, the next generation may be living far away, either in India or

abroad.

No Significant Bequeath Motive

It can be said that there is a basic conflict between taking an reverse mortgage loan and a desire to bequeath property

to ones heirs. If an elderly homeowner has no children, this question may not arise. Otherwise, we need to look for

attributes indicating a weak bequeath motive. For example, in the Indian context, it could mean no sons. Or it could

be that the entire next generation of the family has migrated to another metro or abroad with no intention of coming

back. They may be much better off than the older generation and may not value bequests, if any.

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

Independence and Quality of Life

A potential reverse mortgage borrower must be an elderly person who values his financial independence. He must be

interested in maintaining his desired quality of life rather than curtailing consumption for lack of current cash

income. This implies he must be mentally prepared to consider borrowing in old age, let alone through innovative

financial products like reverse mortgage. This implies certain minimum education and exposure to financial savings/

assets/ markets. [26]

Considerations in Product Design

Now lets see what are the aspects which need to be focused for a product design likely to be attractive from the

perspective of a potential reverse mortgage customer and a lender.

Customer Perspective:

Empathetic counseling from professionally competent and independent counselors- NGOs like Help Age,

Dignity Foundation, Indian Association of Retired Persons (IARP) etc., may be interested in providing such

services

Ratio of reverse mortgage Loan limit to current market value of property: This will be a function of

borrowers age, projected long term interest rates and property appreciation rates.

Flexibility in drawdown: The line of credit with interest credit for unutilized portion is the most popular

choice in the U.S context. The same might be true in India too. Cash may be withdrawn as and when needed,

especially large amounts to meet medical and other emergencies, in contrast to a regular monthly amount.

However this is vulnerable to myopic withdrawals or under pressure from relatives.

Minimum possible reverse mortgage closure costs.

Clarity in borrowers responsibility for property maintenance and paying property taxes, insurance etc.

Strong legal protection against foreclosure and/

Nikita Jadhav (Finance)

or forcible eviction based on fine print may be desirable.

To study Reverse Mortgage in SBI Bank

Alternatively, the reverse mortgage lender should be willing to take over such a responsibility against

deduction from reverse mortgage loan limit/ annuity.

Clarity in tax treatment of reverse mortgage receipts, accrued interest, capital gains etc.

Option to refinance in case interest rates decline substantially

Protection against lender defaults- though not very critical.

Lender Perspective:The major concern is with respect to the risks of longevity, interest rates and property appreciation rates. There is no

simple way to explore these except through financial modeling. Some alternatives for limiting risks in the learning

phase can be suggested as below.

Purchasing a life annuity through an insurance tie-up so that a part of the mortality risk is transferred to the

insurer with the necessary core competence. Their expertise may also be used to decide on the lump sum

reverse mortgage loan.

Based on the U.S experience so far, it seems better for the lender to assume responsibility for property

maintenance/ taxes against deduction from reverse mortgage loan limits/ annuity payments.

Though insurance against default risk is unlikely in India, an reverse mortgage lender has to charge an

equivalent additional interest spread of 2-2.5%, if not more, as a default risk premium

It seems worthwhile to explore and lobby for concessional refinance for reverse mortgage loans from

agencies like the National Housing Bank and for lower reverse mortgage related transaction taxes.

Given the requirement of property market related expertise at the micro-level, it might be worthwhile to focus

on only one or two cities in the initial phase.

There might be a need for tie-ups with agencies for various services- property valuation, title search, property

maintenance and so on. [29]

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

Myths about Reverse Mortgages

The following are some of the myths about reverse mortgage in the minds of the people which need to be clearly

addressed in order to make this product more attractive and popular.

1. The lender will own the home

The applicant and his family will continue to retain ownership of the home. The Lender does not take control

of the title. The lender's interest is limited to the outstanding loan balance.

2. Reverse Mortgage lenders just want to sell your house

The lenders are in the business of helping to keep owners home and meet whatever financial needs he may

have in order to help him to maintain financial independence. Reverse Mortgage borrowers may remain in

the home for as long as they wish. However, should they decide to sell the home for any reason, the loan

would then become due and payable.

3. Owners heirs will be saddled with the loan

The Reverse Mortgage is a non-recourse loan. This means that the lender can only derive repayment of the

loan from the proceeds of the sale of the property.

4. Owner need a certain level of income, good credit, or good health to qualify

A Reverse Mortgage has no income, credit, or health requirements.

5. Owner has to make monthly payments on his Reverse Mortgage

There are never any monthly payments. Payment of taxes, insurance and general upkeep of the home are the

only responsibilities of the homeowner.

6. Home must be debt free to qualify for a Reverse Mortgage

Owner may have a mortgage or other debt on his home. The mortgage or debt however, must be paid off first

with the proceeds of the reverse mortgage.

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

7. Only the "cash poor" or desperate senior citizens can benefit from the Reverse Mortgage

Even though some seniors may have a greater need than others for the cash or monthly income, the Reverse

Mortgage can also be an excellent financial or estate planning tool.

SWOT analysis on reverse mortgage loans

Under this scheme, any senior citizen owning unencumbered residential property in India can mortgage such

property for a loan, to tide over expenses in their twilight years. Here's a SWOT analysis of the same.

Strengths

The senior citizens are entitled to regular cash flows at their choice - monthly, quarterly, half yearly and

annually.

The loan is given without any income criteria at an age where normal loans are not available.

No loan servicing or repayment required during the lifetime of borrower and spouse.

If the borrower dies during the period, the spouse will continue to get the loan amount for 15 years.

Tax treatment of a RML will be as loan, not income, so no tax will be payable on the regular cash flows

The borrower and their spouse can continue to stay in the house till both die.

Heirs of the borrower will be entitled to get the surplus of sale value of the property.

Borrower/heir can get mortgage released by paying loan with interest without having to sell property at any

time.

Reassessment

of

Weaknesses

Nikita Jadhav (Finance)

property

value

will

be

done

periodically

say

once

every

years.

To study Reverse Mortgage in SBI Bank

This loan product has a maximum tenure of only 15 years. If the borrower outlives this period, the regular

cash flows will stop.

Basis of property valuation is not clear.

Requirement of clear title to property in the name of the borrower to get the loan.

Various

fees

to

be

added

to

borrowers

liability,

which

can

be

quite

substantial.

Opportunities

Partial substitute for a social security scheme for senior citizens.

Increasing number of nuclear families.

Medical expenses and cost of living going up, increasing the need for additional income in old age.

Most Indians have strong preference for own home. Therefore many eligible citizens may opt for the scheme.

Threats

Property valuations are ambiguous.

There is a non-recourse guarantee, which means that loan plus interest should never exceed realizable value

of property. In case of fall in property value or loan with interest exceeding assessed property value, banks

may resort to strong-arm tactics to force the borrowers to move out, if they live too long after the loan period

is over.

Rate of interest is at the discretion of lender. Any increase in the rate, if floating, will increase the burden of

the borrower.

Lender has discretion to raise loan amount on revaluation. However, if it does not do so, borrower doesn't get

loan according to proper value of property.

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

Lender has right to foreclose loan by forcing sale of property if borrower doesn't pay for insurance, property

taxes or maintain and repair house. [1]

The following factors are considered while determining the amount of loan.

Age of the borrower and any co-applicant.

The current value of the property and expected property appreciation rate.

The current interest rate and interest rate volatility (interest rate risk).

Closure and servicing costs.

Specific features chosen like fixed or floating interest.

Whether the payment is taken as lump sum, or monthly payments or quarterly payment. Lump sum provides

the cash immediately, but the interest fees are the highest.

The location of the property and whether the maximum loan amount is subject to the maximum loan limits.

Steps to followed for getting a Reverse mortgage

The following are the important steps which are to be followed by every person who is going for reverse mortgage.

EDUCATION

The applicant must first educate himself about the reverse mortgage by visiting this website; this will the

beginning of reverse home mortgage learning process. Many banks nowadays send their representatives to

the home of the applicants to explain the benefits of a reverse home mortgage to the homeowner and family

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

or friends. Any doubts regarding reverse mortgage may be cleared at that time. If the homeowner has already

had HUD counseling OR is ready to proceed with the process, an application is to be completed. Government

has developed some websites like HUD or AARP which can be visited for details of reverse mortgage.

HUD COUNSELING

Counseling by a HUD approved counselor is required. This can be taken as a first step or after the application

has been completed. HUD counseling can be done via the telephone or at a fixed location. The HUD

counselor will sign and date a HUD Counseling Certificate at the conclusion of the meeting. The borrower(s)

then sign and date the HUD counseling certificate and give it to their Loan Officer to start the loan process.

APPLICATION

The loan officer takes the application before or after HUD counseling. The loan officer carefully explains the

Reverse home mortgage program features and benefits. Some of the forms are Good Faith Estimate, Tax &

Insurance Disclosure, Loan application, Privacy Policy Disclosure. The loan officer will collect copies of

Drivers License or other form of Picture ID, Social Security Card or Medicare Card, Most recent Property tax

statement, Homeowners Fire Insurance Policy, Most recent mortgage statement.

PROCESSING THE

LOAN

when both the application and HUD counseling have been completed, you are ready to start processing the

loan. The next step is to order a HUD appraisal and a termite inspection. If either report reveals things that

require fixing, according to HUD guidelines the borrower can fix these within six months after the close of

escrow. If there are repairs required, a separate Repair Set Aside account is created. Fire insurance is

required. In some cases the current policy may be less than the lender requires and therefore it is necessary to

increase the insurance policy to the current value.

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

CLOSING

when the loan documents are ready to be signed, the loan officer will schedule a convenient time to come to

the home of the applicant in some case with a notary to go over the documents and sign and date the loan

papers. If you choose to have monthly payment, the funds are wired to your account on the first day of every

month. If you choose a credit line, the funds are wired within five business days of receiving the request in

writing.

AFTER CLOSING

you must continue to pay property taxes and insurance. You must also maintain your home in good repair.

Any repairs that are required must be done within six months of the close date. Proof of required repairs must

be sent to the Lender.

Termination of Reverse Mortgage Contract:The following are the cases where in the reverse mortgage contract may be terminated that is terminating the contract

of giving regular payouts to the borrower by the bank before the tenure gets over:

The borrower has not stayed in the mortgaged property for a continuous period of one year.

The borrower fails to pay property taxes, home insurance or maintain and repair the residential property.

The residential mortgaged property is donated or abandoned by the borrower.

The borrower makes changes in the residential property that affect the security of the loan for the lender. For

example, renting out a part or the entire house, adding a new owner to the house's title, changing the house's

zoning classification, or creating further encumbrance on the property either by way taking out new debt

against the residential property or alienating the interest by way of a gift or will.

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

The government, under legal provisions, seeks to acquire the residential property for public use.

The government condemns the residential property.

Reverse Mortgage Lenders in India

The major reverse mortgage lenders in India or the banks and financial institutions providing reverse mortgage in

India include:

1. National Housing Bank (NHB)

2. Dewan Housing Finance Limited (DHFL)

3. State Bank of India (SBI)

4. Punjab National Bank (PNB)

5. Indian Bank

6.

Central Bank of India

Nikita Jadhav (Finance)

[28]

To study Reverse Mortgage in SBI Bank

CHAPTER 3

REVERSE MORTGAGE IN SBI

Nikita Jadhav (Finance)

To study Reverse Mortgage in SBI Bank

Reverse Mortgage in SBI

The State Bank of India (SBI) has started offering reverse mortgage products for senior citizen on October 12, 2007.

Joint loans will be given if the spouse is alive and is over 58 years of age. The loan is be offered by all branches of

SBI from October 12, 2007. The loan is offered at an interest rate of 10.75% pa and is subject to change at the end of

every five years along with revaluation of security. Every five years, bank may even re-adjust the loan installments,

if it is needed, depending on market conditions and loan status. In an press report The Chief General Manager for

Personal Banking (SBI), Mr. Sangeet Shukla told that there is no upper limit of amount of loan. Also, the maximum

period for availing this benefit is 15 years. Under this loan, borrowers can be avail payment against the security of

their houses on monthly or quarter installments or either he/she can go for as a lump sum payment at the beginning.

During their lifetime, the borrower does not have to pay the loan and will continue to stay in their house. Thereafter,

either the legal heirs can repay the loan and redeem the property but if this option is not exercised, bank will sell the

property and liquidate the loan. Surplus, if any, will be passed on to the legal heirs. DHFL and Punjab National Bank

are the other competitors along with the SBI. Reverse mortgage is very popular product in many countries. The