Beruflich Dokumente

Kultur Dokumente

Franklin Templeton Global Total Return Fund - I (Acc) EUR

Hochgeladen von

giorginoOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Franklin Templeton Global Total Return Fund - I (Acc) EUR

Hochgeladen von

giorginoCopyright:

Verfügbare Formate

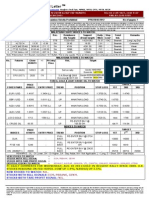

Franklin Templeton Fixed Income Group

Data as of 30 November 2014

Franklin Templeton Investment Funds

Templeton Global Total Return Fund - I(acc) EUR

Source for data and information provided by Franklin Templeton Investments, as of the date of this presentation, unless otherwise noted. Benchmark related data provided by FactSet, as of the date of this presentation, unless otherwise noted.

For professional investor use only. Not for distribution to retail investors.

Templeton Global Total Return Fund

Table of Contents

Topics for Discussion..............................................................................................................4

Case Study: Ireland..............................................................................................................26

Investment Platform Overview.................................................................................................5

Executive Summary.............................................................................................................. 27

Fund Description....................................................................................................................6

Portfolio Characteristics........................................................................................................28

Fund Overview....................................................................................................................... 7

Geographic Allocation...........................................................................................................29

W hy Consider This Fund?...................................................................................................... 8

Currency Allocation...............................................................................................................30

A Record of Strong Performance.............................................................................................9

Sector Allocation...................................................................................................................31

Relatively Low to Moderate Correlations Historically to Other Asset Classes..........................10

Historical Performance..........................................................................................................32

Prolonged Advances vs. Moderate Declines..........................................................................11

Calendar Year Returns......................................................................................................... 33

Distinguishing VolatilityFundamental vs. Market Risks........................................................12

Summary of Advantages.......................................................................................................34

Historically Attractive Risk/Return Profile Compared to Other Asset Classes..........................13

Glossary...............................................................................................................................35

A Different Perspective..........................................................................................................14

Important Disclosures...........................................................................................................36

Expanding Opportunity Set....................................................................................................15

On-the-Ground Research......................................................................................................16

Appendix............................................................................................................38

Insight and Information Sharing Around the Globe................................................................. 17

Management Profiles....................................................................................... 39

A Team of Global Fixed Income Experts................................................................................ 18

Global Bond Group Management Profiles.............................................................................. 40

Investment Philosophy..........................................................................................................19

Investment Process.............................................................................................................. 20

Global ResearchMultiple Perspectives/Lenses................................................................... 21

Country Research Can Help to Identify Potential Alpha Sources............................................ 22

Portfolio ConstructionGlobal Position Sizing....................................................................... 23

Risk Management Integral to the Process............................................................................. 24

Portfolio Positioning.............................................................................................................. 25

For professional investor use only. Not for distribution to retail investors.

Module: Additional Resources........................................................................44

Global Aggregate/EMD Team (New York, London).................................................................45

A Specialised Local Asset Management (LAM) Team............................................................ 46

Fixed Income Policy Committee (FIPC)..................................................................................47

Module: Performance Attribution...................................................................48

Three Sources of Potential Alpha Over Time..........................................................................49

Templeton Global Total Return Fund

Table of Contents (continued)

Module: Process Implementation Examples.................................................50

Navigating Global Divergence............................................................................................... 51

Active Duration Management................................................................................................ 52

For professional investor use only. Not for distribution to retail investors.

2958S

Templeton Global Total Return Fund

Topics for Discussion

Firm and Investment Platform Overview

Tab 1

Description, Overview and Why Consider This Fund?

Tab 2

A Different Perspective

Tab 3

An Unconstrained Worldview

A Truly Global Research Platform

A High-Conviction Process

Portfolio Positioning, Ireland Case Study and Executive Summary

Tab 4

Characteristics and Performance

Tab 5

Summary of Advantages

Tab 6

Appendix

Tab 7

For professional investor use only. Not for distribution to retail investors.

Templeton Global Total Return Fund

Investment Platform Overview

FRANKLIN TEMPLETON INVESTMENTS

Total Combined Assets Under Management (Total AUM) : 711.0 Billion

Franklin Equity

Group

Established

Focus

1947

U.S. Equity

Templeton

Emerging Markets

Group

1987

Emerging Markets Equity

Global Equity

Templeton Global

Equity Group

1940

Franklin Mutual

Series

1949

Franklin Templeton

Fixed Income

Group

Franklin Local

Asset Management

1970

1993

Global Equity

Global Equity

Global Fixed Income

International Equity

International Equity

Regional Fixed Income

U.S. Equity

Emerging Market Debt

International Equity

Distressed Debt & Merger

Arbitrage

Franklin Real Asset Franklin Templeton

Advisors

Solutions

1984

Global Equity & Fixed

Income

Global Private Real

Estate

Regional Equity & Fixed

Income

Global Listed Real Estate

Securities

Single-Country Equity &

Fixed Income

Global Listed

Infrastructure

1994

Multi-Asset Strategy

Global Tactical Asset

Allocation

Custom / Advisory

Solutions - Alternative &

Traditional

Hedge Fund Portfolios

(Multi- & Single Strategy)

& Replication

Style

Growth, Value,

Core/Hybrid

Core Value

Core Value

Deep Value

Single Sector,

Multi-Sector

Multi-Sector, Single- or

Multi-Region

Multi-Sector, Multi-Region Multi-Style, Multi-Region,

Hedged

AUM

160.5 Billion

36.2 Billion

99.5 Billion

59.5 Billion

281.0 Billion

45.4 Billion

3.8 Billion

33.3 Billion

Source: Franklin Templeton Investments (FTI), as of 30 September 2014 unless otherwise noted, based on latest available data. Total combined Assets Under Management (Total AUM) combines the U.S. and non-U.S. AUM of the investment

management subsidiaries of the parent company, Franklin Resources, Inc. (FRI) [NYSE: BEN], a global investment organisation operating as FTI. Total and platform AUM includes discretionary and advisory accounts, including pooled investment

vehicles, separate accounts and other vehicles, as well as some accounts that may not be eligible for inclusion in composites as defined by the firms policies. Total and platform AUM may also include advisory accounts with or without trading authority.

In addition, assets for which certain FTI advisers provide limited asset allocation advisory services, and assets that are not allocated to FTI products are not included in the AUM figures shown.

Franklin Templeton Solutions (FT Solutions) invests in various investment platforms advised by a number of investment advisory entities within FTI. Platform AUM reported for FT Solutions therefore includes certain AUM separately reported under each

utilised investment platform. Total AUM also includes assets managed by certain FTI advisers that do not form part of the selected investment platforms shown. As a result, the combined platform AUMs may not equal Total AUM and may be calculated

and reported separately for regulatory or other purposes under each investment adviser.

Each local asset manager may be considered as an entity affiliated with or associated to FTI by virtue of being a direct or indirect wholly-owned subsidiary of FRI, an entity or joint venture in which FRI owns a partial interest, which may be a minority

interest, or a third party asset management company to which investment advisory services have been delegated by an FTI adviser.

As at 30 June 2014, Mutual Series, Franklin Templeton Local Asset Management and Franklin Templeton Real Asset Advisors were renamed Franklin Mutual Series, Franklin Local Asset Management and Franklin Real Asset

Advisors, respectively. Please refer to the Important Disclosures slide for additional information.

For professional investor use only. Not for distribution to retail investors.

2947S

Templeton Global Total Return Fund

Fund Description

Seeks to:

Maximise, consistent with prudent investment management, total investment return consisting

of a combination of interest income, capital appreciation and currency gains

Capitalise on the large, expanding opportunity set in global bonds

Capture potential alpha opportunities in global fixed income and currencies

Achieve solid, long-term, risk-adjusted returns in diverse market conditions

All investments involve risks, including possible loss of principal. Currency rates may fluctuate significantly over short periods of time, and can reduce

returns. Derivatives, including currency management strategies, involve costs and can create economic leverage in the portfolio which may result in

significant volatility and cause the fund to participate in losses (as well as enable gains) on an amount that exceeds the funds initial investment. The fund

may not achieve the anticipated benefits, and may realise losses when a counterparty fails to perform as promised. Foreign securities involve special risks,

including currency fluctuations and economic and political uncertainties. Investments in emerging markets involve heightened risks related to the same

factors, in addition to those associated with these markets smaller size and lesser liquidity. Investments in lower-rated bonds include higher risk of default

and loss of principal. Changes in interest rates will affect the value of the funds portfolio and its share price and yield. Bond prices generally move in the

opposite direction of interest rates. As the prices of bonds in the fund adjust to a rise in interest rates, the funds share price may decline. The fund is nondiversified, which involves the risk of greater price fluctuation than a more diversified portfolio. Changes in the financial strength of a bond issuer or in

a bonds credit rating may affect its value. These and other risk considerations are discussed in the funds prospectus.

For professional investor use only. Not for distribution to retail investors.

2948S

Templeton Global Total Return Fund

Fund Overview

Investment Objectives1

Seek to maximise, consistent with prudent investment management, total investment return consisting of a combination of interest

income, capital appreciation and currency gains

Take advantage of an unconstrained worldview independent from its benchmarkthe Barclays Multiverse Index

Seek to maintain a portfolio risk profile commensurate with the volatility of the benchmark

Investment Focus

Invest in global debt securities and global currencies across all sectors and utilises active currency management

Limit below-investment grade securities exposure

May include allocations to both developed and emerging markets

Potential Sources of Value Added

May utilise three independent sources of alpha potential:

Yield Curve

Currencies

Credit

1. There is no assurance that the strategy will achieve its investment objectives. As stated above, the strategy is managed in a benchmark unconstrained manner.

For professional investor use only. Not for distribution to retail investors.

Templeton Global Total Return Fund

Why Consider This Fund?

Global financial markets continued to be more broadly influenced by the pickup in growth in the United States and by economic stabilization in

China, in our assessment, rather than escalating geopolitical tensions.

During the third quarter, the funds negative absolute performance was primarily attributable to currency positions followed by overall credit

exposures. Interest-rate strategies contributed to absolute return.

The funds relative performance benefited from currency positions, while overall credit exposures and interest-rate strategies had a neutral effect.

The information is not a complete analysis of every aspect of any market, country, industry, security or portfolio. Statements of fact are from sources considered to be reliable, but no representation or warranty is made as to their completeness or

accuracy. Because market and economic conditions are subject to rapid change, opinions provided are valid only as of the date indicated. The views expressed may not be relied upon as investment advice and are not share class specific. An

investment in the Fund entails risks, which are described in the Funds prospectus and where available, in the relevant Key Investor Information Document. Special risks may be associated with a Funds investment in certain types of securities, asset

classes, sectors, markets, currencies or countries and in the Funds possible use of derivatives. These risks are more fully described in the Funds prospectus and should be read closely before investing.

For professional investor use only. Not for distribution to retail investors.

Templeton Global Total Return Fund

A Record of Strong Performance

Templeton Global Total Return Fund - I(acc) EUR

vs. Barclays Multiverse Index

Annualised Total Returns (%)

As of 30 November 2014

Monthly Rolling 3-Year Annualised Returns

30 September 2009 to 30 November 2014

Templeton Global Total Return Fund - I(acc) EURNet of Fees

24%

Inception

Date

OUTPERFORMED

Templeton Global Total Return Fund - I(acc)

EURNet of Fees

18%

Barclays Multiverse Index

3 Yrs

Since

5 Yrs Incept

1.9.2006 11.86 12.81 11.08

4.11

6.15

4.96

Templeton Global Total Return Fund - I(acc) EUR outperformed the Barclays

Multiverse Index 63 out of the 63 monthly rolling 3-year periods shown above

12%

6%

0%

UNDERPERFORMED

0%

6%

12%

18%

24%

Barclays Multiverse Index

All performance data shown is in the Fund currency stated and net of management fees. Sales charges and other commissions, taxes and other relevant costs paid by the investor are not included in the calculations.

Annualized rolling periods are plotted on a monthly or quarterly basis as indicated. The leading diagonal line links points of return for the index (lower axis). For every point of return along this line there is a corresponding return for the fund represented by

the blue square (left axis). Any point above the line represents outperformance relative to the index for that period. Any point below the line represents underperformance relative to the index for that period.

The value of shares in the Fund and income received from it can go down as well as up, and investors may not get back the full amount invested. Past performance does not guarantee future results. Current performance may differ from figures

shown. Currency fluctuations may affect the value of overseas investments. When investing in a fund denominated in a foreign currency, performance may also be affected by currency fluctuations. Please visit franklintempleton.lu for current

performance.

Performance data may represent blended share class performance, e.g., hybrid created from an A(dis) share class which was converted to A(acc).

The fund offers other share classes subject to different fees and expenses, which will affect their performance. Please see the prospectus for details.

For professional investor use only. Not for distribution to retail investors.

2949S

Templeton Global Total Return Fund

Relatively Low to Moderate Correlations Historically to Other Asset Classes

Templeton Global Total Return Fund - A(Mdis) USD

5-Year Rolling Correlations

Period Ending 30 September 2014

5 Years Ending 30/09/2014

1.00

U.S. Bonds

0.05

High Yield Bonds

0.78

Emerging Markets Sovereign Debt

0.75

U.S. Stocks

0.74

World Stocks1

0.82

FX Carry

0.86

Hedge Funds

0.81

Commodities

0.63

0.75

0.50

0.25

U.S. Bonds

U.S. Stocks

Hedge Funds

High Yield Bonds

World Stocks

Commodities

Correlation: 1 = perfect positive correlation

0 = no correlation

Sep-14

Jun-14

Mar-14

Dec-13

Sep-13

Jun-13

Mar-13

Dec-12

Sep-12

Jun-12

Mar-12

Dec-11

Sep-11

Jun-11

Mar-11

Dec-10

Sep-10

Jun-10

Mar-10

Dec-09

Sep-09

Jun-09

Mar-09

Dec-08

Sep-08

0.00

Emerging Markets Sovereign Debt

FX Carry

-1 = perfect negative correlation

1. Source: Morgan Stanley Capital International (MSCI). All MSCI data is provided as is. In no event shall MSCI, its affiliates or any MSCI data provider have any liability of any kind in connection with the MSCI data or the information described herein.

Copying or redistributing the MSCI data is strictly prohibited.

Sources: Barclays, Citigroup, JP Morgan, Standard & Poors, Deutsche Bank, Hedge Fund Research, Inc. STANDARD & POORS, S&P and S&P 500 are registered trademarks of Standard & Poors Financial Services LLC.

Standard & Poors does not sponsor, endorse, sell or promote any S&P index-based product. The above chart is for illustrative and discussion purposes only. U.S. Bonds are represented by the Barclays U.S. Aggregate Index; U.S. Stocks are

represented by the S&P 500 Index; Hedge Funds are represented by the HFRI Fund Weighted Composite Index; High Yield Bonds are represented by the Citigroup High Yield Market Local Currency Index; World Stocks are represented by the MSCI

World Index; Commodities are represented by the S&P GSCI Official Close Index; Emerging Markets Sovereign Debt are represented by the JP Morgan Emerging Markets Bond Index EMBI Global Composite; FX Carry are represented by the Deutsche

Bank G10 Currency Future Harvest Index. The information is historical over the indicated time period and may vary significantly over other past time periods.

Indexes are unmanaged, and one cannot invest directly in an index.

Past performance is not an indicator or a guarantee of future performance. Charts are for illustrative and discussion purposes only.

For professional investor use only. Not for distribution to retail investors.

10

2950S

Templeton Global Total Return Fund

Prolonged Advances vs. Moderate Declines

The chart below illustrates the performance of Templeton Global Total Return Fund-A(Mdis) USD. The chart below is supplemental

information to be considered in addition to, and not in lieu of, the Templeton Global Total Return Fund-A(Mdis) USD historical

performance information.

Cumulative Daily Returns for Each Period

As of 30 September 2014

60%

Average Advance:

20.52%; 8.9 months

50%

40%

An advance (decline) is any

period of a month or longer when

cumulative daily returns exceed (fall

more than) twice the standard

deviation of rolling monthly returns of

the entire sample period.

30%

20%

10%

0%

-10%

-20%

Dec-03 Aug-04 May-05 Jan-06

Average Decline:

-8.88%; 3.4 months

Oct-06

Jul-07

Mar-08 Dec-08 Sep-09 May-10 Feb-11 Nov-11

Jul-12

Apr-13

Dec-13 Sep-14

Performance for the Templeton Global Total Return Fund-A(Mdis) USD is historical and may not reflect current or future performance. The performance information above is net of management fees and other expenses, assumes reinvestment of any

dividends and is in the fund currency stated. Sales charges and other commissions, taxes and other relevant costs paid by the investor are not included in the calculations. If they were included, the returns would have been lower. The performance

shown relates to the Class A(Mdis) shares and the performance of other share classes may vary depending on their respective commissions and fees. Results may differ over other historical time periods.

Past performance is not an indicator or a guarantee of future performance.?Charts are for illustrative and discussion purposes only.

For professional investor use only. Not for distribution to retail investors.

11

2951S

Templeton Global Total Return Fund

Distinguishing VolatilityFundamental vs. Market Risks

Risk

Annualised Rolling 3-Month Volatility

As of 31 December 2014

80%

70%

60%

50%

40%

30%

20%

10%

Templeton Global Total Return FundNet of Fees (USD)

U.S. Equity

Dec-14

Sep-14

Jun-14

Mar-14

Dec-13

Jun-13

Sep-13

Mar-13

Dec-12

Jun-12

Sep-12

Mar-12

Dec-11

Sep-11

Jun-11

Mar-11

Dec-10

Jun-10

Sep-10

Mar-10

Dec-09

Sep-09

Jun-09

Mar-09

Dec-08

Jun-08

Sep-08

Mar-08

Dec-07

Sep-07

Jun-07

Mar-07

Dec-06

Jun-06

Sep-06

Mar-06

Dec-05

Jun-05

Sep-05

Mar-05

Dec-04

Sep-04

Jun-04

Mar-04

Dec-03

0%

U.S. Government Bonds

Source: Franklin Templeton Investments, Bloomberg, as of 31 December 2014. Indexes represent U.S. Equity (S&P 500 Index), and U.S. Government Bonds (Citigroup 10-Year U.S. Treasury Index). Indexes are unmanaged, and one cannot invest

directly in an index.

Past performance is not an indicator or a guarantee of future performance.?Charts are for illustrative and discussion purposes only.

For professional investor use only. Not for distribution to retail investors.

12

2952S

Templeton Global Total Return Fund

Historically Attractive Risk/Return Profile Compared to Other Asset Classes

Templeton Global Total Return Fund - A(Mdis) USD has provided a relatively strong risk/return profile

compared to other asset classes over the long term

10-Year Period

As of 30 September 2014

14

Templeton Global Total Return Fund

- A(Mdis) USDNet of Fees

12

10

Emerging Market Bonds

Return %

High Yield Bonds

Hedge Funds

U.S. Bonds

U.S. Stocks

World Stocks

REITs

U.S. TIPS

Global Bonds

Cash

Commodities

0

-2

0

10

15

20

25

Standard Deviation %

Source: 2013 Morningstar, as of 30 September 2014. Global Bonds are represented by the Barclays Multiverse Index; U.S. Bonds are represented by the Barclays U.S. Aggregate Bond Index; U.S. TIPS are represented by the Barclays U.S. Treasury

TIPS Index; Emerging Market Bonds are represented by the JP Morgan Emerging Markets Bond Index Global; High Yield Bonds are represented by the Credit Suisse High Yield Index; Commodities are represented by the DJ UBS Commodity Index;

REITs are represented by the FTSE NAREIT All REITs Index; World Stocks are represented by the MSCI World Index; U.S. Stocks are represented by the S&P 500 Index; Hedge Funds are represented by the DJ Credit Suisse Tremont Hedge Fund

Index; Cash is represented by the P&R 90-Day U.S. Treasury Index. Indexes are unmanaged, and one cannot invest directly in an index.

All Morgan Stanley Capital International (MSCI) data is provided as is. In no event shall MSCI, its affiliates or any MSCI data provider have any liability of any kind in connection with the MSCI data described herein. Copying or redistributing the MSCI

data is strictly prohibited.

STANDARD & POORS, S&P and S&P 500 are registered trademarks of Standard & Poors Financial Services LLC. Standard & Poors does not sponsor, endorse, sell or promote any S&P index-based product. Volatility as measured by

annualised standard deviation.

Past performance is not an indicator or a guarantee of future performance. Charts are for illustrative and discussion purposes only.

For professional investor use only. Not for distribution to retail investors.

13

2245M

Templeton Global Total Return Fund

A Different Perspective

An Unconstrained Worldview

Focuses only on potential long-term value without reference to traditional benchmarks

Actively manages three independent potential sources of alpha

A Truly Global Research Platform

One of the largest, most well-established global fixed income teams, drawing on/leveraging

other fixed income teams across the platform

A High-Conviction Process

Alignment among multiple research lensesin-depth country analysis, macroeconomic

modelling and local perspectivecan lead to high-conviction opportunities

Research seeks to identify economic imbalances and isolate only desired risk exposure

For professional investor use only. Not for distribution to retail investors.

14

2241M

Templeton Global Total Return Fund

Expanding Opportunity

Opportunity Set

Set

Total Debt Outstanding of Governments and Corporations: US$98.9 trillion*

140

140

120

120

100

100

80

80

US$70.4 tn

60

60

40

40

US$12.7 tn

US$17.6 tn

20

0

'89

'91

'92

Developing

'93

'94

'95

Developed ex-G3

'96

'97

G3

'99

'00

'01

'02

'03

'04

'06

'07

'08

'09

'10

'11

'12

20

Number of Countries Available for Investment

Debt Outstanding (trillions of U.S. dollars)

As of June 2014

0

'14

Number of Countries

*Note: Excludes international organisations and offshore financial centres. Total is equal to US$100.8 trillion, as of March 2014.

Source: Bank for International Settlements, Securities Statistics and Syndicated Loans, June 2014.

Charts are for illustrative and discussion purposes only.

For professional investor use only. Not for distribution to retail investors.

15

0540M

Templeton Global Total Return Fund

On-the-Ground Research

One of the Worlds Largest Global Fixed Income and Equity Platforms

Edinburgh

Calgary

Warsaw

Toronto

London

San Mateo

Fort Lauderdale

Moscow

Bucharest

Seoul

Vienna

New York

Istanbul

Dubai

Hong Kong

Shanghai1

Bangkok

Nassau

Mumbai

Mexico City

Ho Chi Minh City

Kuala Lumpur

Singapore

170 Global Fixed Income Professionals:

Global Fixed Income Offices

Fixed Income Local Asset

Management (LAM) Offices2

90 Global Equity Professionals:

Rio de Janeiro

Buenos Aires

So Paulo

Cape Town

Melbourne

Global Equity Offices3

1. Includes individuals that are not employees of Franklin Resources, Inc. (FRI) or wholly owned subsidiaries of FRI. However, these individuals are part of our joint venture or strategic partnership relationships worldwide and are an integral component

of our overall fixed income research efforts.

2. This unit is comprised of investment professionals located in affiliates of and joint venture partners with Franklin Templeton Investments. The Local Asset Management Group is not part of, but does share research with, Franklin Templeton Fixed

Income Group.

3. Includes the Templeton Global Equity Group and the Templeton Emerging Markets Equity Group.

As of 30 September 2014.

For professional investor use only. Not for distribution to retail investors.

16

0539M

Templeton Global Total Return Fund

Insight and Information Sharing

Sharing Around

Around the

the Globe

Globe

170 global fixed income and 90 global equity investment professionals.

WEEKLY

Local Asset Management1

AVERAGE EXPERIENCE: 13 YEARS*

WEEKLY

Global

Bond Group

(SAN MATEO, SINGAPORE)

Franklin Templeton

Fixed Income Group

AVERAGE EXPERIENCE: 16 YEARS*

MONTHLY

17 Investment Professionals

Templeton Emerging

Markets Equity

Research Team

AVERAGE EXPERIENCE: 14 YEARS*

AVERAGE EXPERIENCE: 11 YEARS*

MONTHLY

Templeton Global Equity

Research Team

Corporate Credit

Mortgage

AVERAGE EXPERIENCE: 18 YEARS*

Bank Loans

Municipals

Quantitative

Global

Bond Group

1. This unit is comprised of investment professionals located in affiliates of and joint venture partners with Franklin Templeton Investments. The Local Asset Management Group is not a part of, but does share research with, Franklin Templeton Fixed

Income Group.

Investment professionals include portfolio managers, analysts and traders. *Represents number of years of industry experience.

As of 30 September 2014.

For professional investor use only. Not for distribution to retail investors.

17

1808M

Templeton Global Total Return Fund

A Team of Global Fixed Income Experts

Michael Hasenstab, Ph.D.

Global Bond Group

Executive Vice President, Portfolio Manager, Chief Investment Officer, Global Bonds

(SAN MATEO, SINGAPORE)

1 9 YE A R S *

Sonal Desai, Ph.D.

Christine Zhu

Calvin Ho, Ph.D.

Hyung C. Shin, Ph.D.

Kang Tan, Ph.D.

Senior Vice President, Portfolio Manager

Quantitative Research Analyst,

Senior Global Macro & Research Analyst

Senior Global Macro & Research Analyst

Senior Global Macro & Research Analyst

Director of Research, Global Bonds

Portfolio Manager

20 YEARS*

11 YEARS*

9 YEARS*

22 YEARS*

14 YEARS*

Diego Valderrama, Ph.D.

Vivek Ahuja

Laura Burakreis

Attila Korpos, Ph.D.

Charlie Liu

Senior Global Macro & Research Analyst

Portfolio Manager, Research Analyst

Research Analyst, Portfolio Manager

Research Analyst

Research Associate

12 YEARS*

18 YEARS*

27 YEARS*

13 YEARS*

3 YEARS*

Hye Mi Ahn

Paolo Barbone

Michael Messmer

Matthew Henry

Andrew Mesic

Research Associate

Research Associate

Senior Trader

Trader

Trader

1 YEAR*

1 YEAR*

13 YEARS*

7 YEARS*

8 YEARS*

Elsa Goldberg

Brian Henry, CFA

Susan Wong, CFA

Christopher Kennedy

Richard Herbert

Vice President, Director, Product

Institutional Portfolio Manager

Vice President, Product Manager

Senior Associate Product Manager

Product Manager

18 YEARS*

25 YEARS*

9 YEARS*

14 YEARS*

3 YEARS*

Ryan Ferster, CFA

Dennis Lui

Pawel Chodorowski

Senior Risk Analyst

Senior Risk Analyst

Risk Analyst

9 YEARS*

11 YEARS*

6 YEARS*

Christopher Myers

Assistant Trader

10 YEARS*

AD D I T I O N AL R E S O U R C E S

Management

*Represents number of years of industry experience.

As of 30 September 2014.

CFA and Chartered Financial Analyst are trademarks owned by CFA Institute.

For professional investor use only. Not for distribution to retail investors.

18

1810M

Templeton Global Total Return Fund

Investment

Investment Philosophy

Philosophy

Beliefs and Guiding Principles

An unconstrained approach to global fixed income investing can lead to long-term value

potential

Integrating global macroeconomic analysis with in-depth country research can help identify

long-term economic imbalances

Actively allocating risk across three potential independent sources of alpha can deliver

diversification benefits and the potential for more consistent returns in diverse markets

For professional investor use only. Not for distribution to retail investors.

19

2573M

Templeton Global Total Return Fund

Investment

Process

Three Sources

of Potential Alpha Over Time

Multiple Research Lenses Can Lead to High-Conviction

Global Research

Lenses

Three Potential

Sources of Alpha

Portfolio Construction and

Implementation

Yield Curve

Ideas

Risk Modelling

VaR Analysis

Correlation Analysis

Scenario/Stress

Testing

Currency

Ideas

Management Team

Potential Return vs.

Expected Risk

Global Allocations

Macro

Models/Analysis

In-Depth

Country Analysis

Local Asset

Management

Perspective

Credit Ideas

FIPC

Recommendations

Identification

of High-Conviction

Opportunities

PORTFOLIO

Trading

Trade Structuring

Market Flows

Local Execution/

Settlement

Liquidity Analysis

Review/

Performance Attribution

1. This unit is comprised of investment professionals located in affiliates of and joint venture partners with Franklin Templeton Investments. The Local Asset Management Group is not a part of, but does share research with, Franklin Templeton Fixed

Income Group.

2. Fixed Income Policy Committee.

The above chart is for illustration and discussion purposes only.

For professional investor use only. Not for distribution to retail investors.

20

0537M

Templeton Global Total Return Fund

Global ResearchMultiple Perspectives/Lenses

COUNTRY ANALYSIS

MACRO MODELLING

LOCAL PERSPECTIVE1

Currency and interest rate valuation

Currency models

Local/regional perspectives

Fundamentals

Monetary and fiscal policy

Macroeconomic disequilibria

Capacity for change and

policy implementation

Country visits

Meetings with policy-makers

Purchasing Power Parity (PPP),

equilibrium exchange rates,

interest rate differentials

Interest rate models

Econometric analysis, Taylor

Rule, yield curve analysis

Trading

Short-term technicals and flows

Ad hoc thematic research

Australia

Brazil

Canada

China2

India

Korea

Malaysia

Mexico

United Arab Emirates

Scenario, shock and theme/trend

analysis

1. This unit is comprised of investment professionals located in affiliates of and joint venture partners with Franklin Templeton Investments. The Local Asset Management Group is not a part of, but does share research with, Franklin Templeton Fixed

Income Group.

2. Includes individuals that are not employees of Franklin Resources, Inc. (FRI) or wholly owned subsidiaries of FRI. However, these individuals are part of our joint venture or strategic partnership relationships worldwide and are an integral component

of our overall fixed income research efforts.

For professional investor use only. Not for distribution to retail investors.

21

2583M

Templeton Global Total Return Fund

Country Research Can

Can Help

Help to Identify Potential Alpha Sources

Goal of Isolating Desired Risks

Hypothetical Examples

YIELD CURVE

MEXICO

CREDIT

SOUTH KOREA

CURRENCY

AUSTRALIA

Hypothetical Situation and Country Analysis

Hypothetical Situation and Country Analysis

Hypothetical Situation and Country Analysis

If economic activity in Mexico slowed down, that

could eventually force the central bank to cut

interest rates and the Mexican peso to depreciate.

We would see a potential opportunity if Korean

sovereign credit appeared to be priced at

distressed levels while our analysis did not reveal

any solvency issues.

If Australia were to tighten their monetary policy,

we could expect the Australian economy to

recover at a faster pace and the currency to

strengthen.

Proposed Course of Action

Proposed Course of Action

Proposed Course of Action

Take advantage of attractive interest rates in

Mexico but without exposure to the Mexican peso.

Take advantage of attractive yield and spread

compression opportunities in Korean sovereign

credits.

Take advantage of the appreciation of the

Australian dollar.

Hypothetical Portfolio Decision

Hypothetical Portfolio Decision

Hypothetical Portfolio Decision

Purchase peso-denominated 20-year Mexican bond

Hedge out peso risk by purchasing forex forward

Purchase Korean sovereign credit

Purchase short-term government bonds

denominated in Australian dollars

These hypothetical examples are for illustrative purposes only to demonstrate our investment process. They are not intended to reflect any past, current or future holdings of the portfolio and should not be considered as

investment advice or an investment recommendation.

For professional investor use only. Not for distribution to retail investors.

22

2953S

Templeton Global Total Return Fund

Portfolio ConstructionGlobal Position Sizing

Conceptually, the portfolio is continually re-evaluated starting from

a clean slate all-cash portfolio

Position sizes are based on fundamental attractiveness, legal

diversification requirements under the UCITS framework, valuation and

potential expected return weighted against risk and volatility. As you can

see in the illustration on this slide:

Max

(10%+)

Up to about 5 positions

StandardMost positions may be 1% to 5% in size to maximise

diversification

CoreHigher-conviction positions may be scaled up to 5% or more

MaxHighest-conviction view may be scaled up to 10% or more.

Position size will rarely exceed 15%. Typically no more than

a handful of positions reach this level

Core (5%+)

Around 5 to 10 positions

Individual position sizes may be adjusted up or down based on

correlations with other positions and/or portfolio level risk objectives

Standard (15%)

Majority of positions

Note: Duration, currency and sovereign credit views are counted separately in position sizing.

The portfolio composition, characteristics and the number of exposures held by the fund will vary due to a variety of factors, such as, but not limited to, market conditions, asset size, interest rates, currency fluctuations, economic instability and

political developments.

For professional investor use only. Not for distribution to retail investors.

23

1854M

Templeton Global Total Return Fund

Risk Management Integral to the Process

Responsibility Begins and Ends with Our Portfolio Managers

Time-tested strategies and experienced managers and teams

Integrated within our investment process

Performance Analysis and Investment Risk (PAIR) Team

40 dedicated fixed income risk specialists

Scenario analyses, risk modelling, stress-testing, position scaling, risk budgeting and performance attribution

Goal is that risks should be recognised, rational and rewarded

Recognised

Risks should be recognised and

understood at the security,

portfolio and operational level

Rational

Risk decisions should be an

intended and rational part of each

portfolios strategy

As of 30 September 2014.

For professional investor use only. Not for distribution to retail investors.

Rewarded

Every risk should be a potential

opportunity for a commensurate

long-term reward

24

2679M

Templeton Global Total Return Fund

Portfolio Positioning

As of 30 September 2014

Potential Alpha Sources

Current Positioning

Favourable Opportunities in Select Currencies

Continued to position for value in currencies across many developed- and emerging-market economies that we

believe have robust growth fundamentals

Focused on countries that have stayed ahead of the curve regarding fiscal, monetary and financial policy

CURRENCIES

Defensive Stance Due to Concerns about Rising Interest Rates

Continued to position defensively with regard to duration while actively seeking opportunities that can potentially offer

positive real yields without taking undue interest-rate risk

Maintained exposures to a select number of countries that we believe have favourable conditions for yields to remain

even or shift lower

YIELD CURVE

Selectively Finding Credit Opportunities

Continued to selectively invest in credit opportunities across emerging markets, with a particular focus on credit

exposures in economies with strong growth indicators

CREDIT

The foregoing information reflects our analysis, opinions and portfolio information as of 30 September 2014. The views expressed are those of the individual portfolio managers only and may vary from the views expressed by portfolio managers

representing other investment platforms or strategies within Franklin Templeton Investments. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic

conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or portfolio. Statements of fact are from

sources considered to be reliable, but no representation or warranty is made as to their completeness or accuracy. Because market and economic conditions are subject to rapid change, opinions provided are valid only as of the date indicated.

References to particular securities are only for the limited purpose of illustrating general market or economic conditions, and are not recommendations to buy or sell a security or an indication of any actual portfolios holdings.

For professional investor use only. Not for distribution to retail investors.

25

2954S

Templeton Global Total Return Fund

Case Study: Ireland

Investing in Ireland when others feared the worst was a contrarian strategy that required us to have a steady hand.

Irish Government Bond Index Yield to Maturity

CONTRARIAN STRATEGY

16

Entry

Opportunity

IRELAND

Third Quarter 2011

14

Country Analysis

In the second half of 2011, markets around the world began to panic in response to

fears of an Armageddon scenario in Europe.

We believed Irish government bonds were being sold indiscriminately and felt Ireland

did not face the crisis level of risk implied by its borrowing costs at the time.

Yield to Maturity (%)

12

10

8

6

Proposed Course of Action

Based on our fundamental research approach and contrarian views, look to take

advantage of indiscriminate selling of Irish government bonds.

4

2

0

Dec-09

Portfolio Decision

Position in Irish Government Debt

Apr-10

Aug-10

Dec-10

Apr-11

Aug-11

Dec-11

Apr-12

Aug-12

Dec-12

Irish Government Bond Index YTM

Note: this chart shows the yield to maturity of the J.P. Morgan Government Bond Index (GBI) Broad Ireland sub-index starting 31 December 2009. Templeton Global Total Return - A(Mdis) Fund entered the initial position of Irish government bonds

during July 2011. As of 30 September 2014, Templeton Global Total Return Fund had 5.89% of its total net assets invested in Irish sovereign debt. Holdings are subject to change. This information is for general information only as it is based

solely on Templeton Global Total Return Fund. The information is historical and may vary depending on a variety of factors such as portfolio size, market conditions and currency fluctuations just to name a few.

Source: J.P. Morgan Chase & Co., as of 10 January 2013. Franklin Templeton Investments, as of 30 September 2014.

Indexes are unmanaged, and one cannot invest directly in an index.

The chart above is intended solely to show the yield to maturity of the J.P. Morgan Government Bond Index (GBI) Broad Ireland sub-index and general market conditions and does not represent the performance of any holdings of

Templeton Global Total Return Fund.

Templeton Global Total Return Fund is a sub-fund of the Luxembourg-domiciled SICAV, Franklin Templeton Investment Funds.

Past performance is not an indicator or a guarantee of future performance. Charts are for illustrative and discussion purposes only.

For professional investor use only. Not for distribution to retail investors.

26

Templeton Global Total Return Fund

Executive Summary

Templeton Global Total Return Fund - I(acc) EUR

As of 30 November 2014

Portfolio Manager(s)

Morningstar Category

Global Bond

Michael Hasenstab, PhD

United States

Investment Manager

Franklin Advisers, Inc.

Sonal Desai, PhD

United States

Fund Inception Date

29 August 2003

Share Class Inception Date

1 September 2006

Fund Identifiers

Primary Benchmark

Barclays Multiverse Index

ISIN Code

LU0260871040

Base Currency for Fund

USD

SEDOL Code

B19VR87

Base Currency for Share Class

EUR

Bloomberg Code

TGTIAEU LX

Total Net Assets (USD)

35,523,038,650.93

Asset Allocation

Fixed Income: 87.57%

Cash & Cash Equivalents: 12.41%

Equity: 0.02%

Number of Holdings

556

Total Expense Ratio

0.86%

Average Duration

1.22 Yrs

Average Weighted Maturity

3.31 Yrs

Fund Ratings (30 November 2014)

Overall Morningstar Rating

Summary of Investment Objective

The Fund aims to maximise total investment return consisting of a combination of

interest income, capital appreciation, and currency gains by investing principally in a

portfolio of fixed and/or floating rate debt securities and debt obligations issued by

government and government-related issuers or corporate entities worldwide. The fixed

and/or floating-rate debt securities and debt obligations in which the Fund may invest

include investment grade and non-investment grade securities. On an ancillary basis,

the Fund may gain exposure to debt market indexes by investing in index-based

financial derivatives and credit default swaps.

Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar

nor its content providers are responsible for any damages or losses arising from any use of this information.

Information is historical and may not reflect current or future portfolio characteristics. All portfolio holdings are subject to change. Percentage may not equal 100% due to rounding.

Past performance does not guarantee future results.

For professional investor use only. Not for distribution to retail investors.

27

Templeton Global Total Return Fund

Portfolio Characteristics

Templeton Global Total Return Fund

vs. Barclays Multiverse Index

As of 30 November 2014

Portfolio

Index

1.22 Yrs

6.32 Yrs

Yield to Maturity

4.99%

1.93%

Yield to W orst

4.94%

1.91%

Current Yield

5.51%

3.11%

Average Duration

Portfolio Quality Allocation

20%

17.27

12.85

14.63

12.70

10.90

8.16

10%

4.50

0%

0.84

0.26

AAA AA-

A+

2.81

A- BBB+ BBB BBB- BB+

2.97 3.77

1.86 1.40

BB

BB-

B+

1.38

2.77

0.76 0.02 0.01 0.13

B- CCC+ CCC CCC-

N/A

Investment

Grade

Non-Investment

Grade

64.08%

35.92%

NR

Information is historical and may not reflect current or future portfolio characteristics. All portfolio holdings are subject to change.

Yield figures quoted should not be used as an indication of the income that has or will be received. Yield figures are based on the portfolio's underlying holdings and do not represent a payout of the portfolio.

Ratings shown are assigned by one or more Nationally Recognized Statistical Rating Organizations ('NRSRO'), such as Standard & Poor's, Moody's and Fitch. The ratings are an indication of an issuer's creditworthiness and typically range from AAA or

Aaa (highest) to D (lowest). When ratings from all three agencies are available, the middle rating is used; when two are available, the lowest rating is used; and when only one is available, that rating is used. Foreign government bonds without a specific

rating are assigned the country rating provided by an NRSRO, if available. If listed, the NR category consists of rateable securities that have not been rated by an NRSRO; the N/A category consists of nonrateable securities (e.g., equities). Cash and

equivalents (defined as bonds with stated maturities, or that can be redeemed at intervals, of seven days or less) as well as derivatives are excluded from this breakdown. As a result, the chart does not reflect the fund's total net assets.

Weightings as percent of total. Percentage may not equal 100% due to rounding.

For professional investor use only. Not for distribution to retail investors.

28

Templeton Global Total Return Fund

Geographic Allocation

Templeton Global Total Return Fund

As of 30 November 2014

Geographic Allocation

Active Allocations vs. Barclays Multiverse Index

EUROPE/AFRICA

NON-EMU EUROPE/AFRICA

Hungary

Poland

Republic of Serbia

Ukraine

Ghana

Sweden

Russia

United Kingdom

Kenya

South Africa

United Arab Emirates

Croatia

Switzerland

Denmark

Norway

EMU

Ireland

Portugal

Slovenia

Luxembourg

Netherlands

Italy

Germany

France

Spain

Austria

Belgium

Euro Community

AMERICAS

NON-USA AMER.

Mexico

Uruguay

Brazil

Canada

Ecuador

Bermuda

Peru

Chile

USA

United States

ASIA

ASIA, NON-JAPAN

South Korea

Malaysia

India

Philippines

Sri Lanka

Indonesia

Singapore

Australia

Kazakhstan

JAPAN

SUPRANATIONAL

OTHER

ST CASH AND CASH EQUIVALENTS

-1%

2.50

0.75

0.27

0.27

0.17

0.16

0.10

0.10

0.00

0.00

-0.08

1.24

1.23

1.18

0.91

0.45

0.14

0.09

0.08

0.13

9.91

5.69

3.75

1.76

0.66

0.12

0.04

0.03

25.12

7.32

4.35

3.70

2.63

2.41

2.25

1.18

0.45

0.25

0.25

0.14

0.13

0.07

0.00

0.00

6.55

6.55

11.33

5.37

7%

30.39

23.84

9.65

7.79

4.55

35.03

22.04

21.96

7.85

15%

23%

31%

39%

EUROPE/AFRICA

NON-EMU EUROPE/AFRICA

Hungary

Poland

Republic of Serbia

Ukraine

Ghana

Sweden

Russia

United Kingdom

Kenya

South Africa

United Arab Emirates

Croatia

Switzerland

Denmark

Norway

EMU

Ireland

Portugal

Slovenia

Luxembourg

Netherlands

Italy

Germany

France

Spain

Austria

Belgium

Euro Community

AMERICAS

NON-USA AMER.

Mexico

Uruguay

Brazil

Canada

Ecuador

Bermuda

Peru

Chile

USA

United States

ASIA

ASIA, NON-JAPAN

South Korea

Malaysia

India

Philippines

Sri Lanka

Indonesia

Singapore

Australia

Kazakhstan

JAPAN

SUPRANATIONAL

OTHER

ST CASH AND CASH EQUIVALENTS

-31%

-0.78

13.64

7.17

3.98

3.69

2.60

2.41

1.32

0.76

-5.82

0.24

-0.03

-0.02

0.09

-0.81

-0.41

-0.40

-14.41

5.30

2.17

0.68

0.12

-1.67

-4.22

-5.46

-6.01

-2.75

-0.81

-1.10

-0.08

-12.03

8.88

7.77

2.81

-1.62

0.65

0.11

-0.05

-0.07

-30.10

-30.10

2.48

1.13

1.02

1.17

0.61

0.25

-1.45

0.05

-14.52

-2.08

-21%

-11%

-1%

10.04

5.15

4.55

18.07

17.00

7.85

9%

Weightings as percent of total. Percentage may not equal 100% due to rounding. Information is historical and may not reflect current or future portfolio characteristics. All portfolio holdings are subject to change. Percentage may not equal 100% due to

rounding. Information is historical and may not reflect current or future portfolio characteristics. All portfolio holdings are subject to change.

For professional investor use only. Not for distribution to retail investors.

19%

29

Templeton Global Total Return Fund

Currency Allocation

Templeton Global Total Return Fund

As of 30 November 2014

Currency Allocation

Active Allocations vs. Barclays Multiverse Index

AMERICAS

US DOLLAR

NON-USA AMER.

Mexican Peso

Uruguayan Peso

Brazilian Real

Canadian Dollar

Chilean Peso

Peru Nuevo Sol

Colombian Peso

ASIA

ASIA, NON-JAPAN

South Korean Won

Malaysian Ringgit

Singapore Dollar

Indian Rupee

Philippine Peso

Sri Lanka Rupee

Indonesian Rupiah

Australian Dollar

Hong Kong Dollar

New Zealand Dollar

Thailand Baht

JAPANESE YEN

EUROPE/AFRICA

PERIPHERY EUROPE/E. EUROPE

Polish Zloty

Hungarian Forint

Swedish Krona

Serbian Dinar

Ukraine Hryvna

Swiss Franc

Czech Koruna

Danish Krone

Israeli Shekel

Norwegian Krone

Romania Leu

Russian Ruble

Turkish Lira

British Pound

AFRICA

Ghanaian Cedi

Nigerian Naira

South Africa Rand

EURO

-32%

12.07

8.13

4.18

1.23

1.13

0.04

0.00

19.17

5.35

3.31

2.58

1.18

0.91

0.00

0.00

0.00

0.00

-22.40

-10.43

-7%

41.57

14.69

13.55

7.75

5.35

3.29

2.33

0.07

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

-0.01

1.99

1.99

0.00

0.00

-31.20

18%

91.26

64.48

26.78

18.78

43%

68%

93%

AMERICAS

US DOLLAR

NON-USA AMER.

Mexican Peso

Uruguayan Peso

Brazilian Real

Canadian Dollar

Chilean Peso

Peru Nuevo Sol

Colombian Peso

ASIA

ASIA, NON-JAPAN

South Korean Won

Malaysian Ringgit

Singapore Dollar

Indian Rupee

Philippine Peso

Sri Lanka Rupee

Indonesian Rupiah

Australian Dollar

Hong Kong Dollar

New Zealand Dollar

Thailand Baht

JAPANESE YEN

EUROPE/AFRICA

PERIPHERY EUROPE/E. EUROPE

Polish Zloty

Hungarian Forint

Swedish Krona

Serbian Dinar

Ukraine Hryvna

Swiss Franc

Czech Koruna

Danish Krone

Israeli Shekel

Norwegian Krone

Romania Leu

Russian Ruble

Turkish Lira

British Pound

AFRICA

Ghanaian Cedi

Nigerian Naira

South Africa Rand

EURO

-58%

11.68

8.13

3.67

-1.40

1.12

0.00

-0.14

1.40

20.73

23.07

13.59

13.37

43.80

38.16

5.19

3.31

2.45

1.18

0.73

-1.28

-0.02

-0.13

-0.24

-36.76

-45.19

10.28

7.53

5.27

2.80

2.33

0.07

-0.74

-0.10

-0.29

-0.13

-0.13

-0.05

-0.09

-0.19

-6.02

1.71

1.99

-0.05

-0.23

-57.18

-37%

-16%

Weightings as percent of total. Percentage may not equal 100% due to rounding. Information is historical and may not reflect current or future portfolio characteristics. All portfolio holdings are subject to change.

For professional investor use only. Not for distribution to retail investors.

5%

26%

47%

30

Templeton Global Total Return Fund

Sector Allocation

Templeton Global Total Return Fund

As of 30 November 2014

Sector Allocation

Active Allocations vs. Barclays Multiverse Index

Intl Govt/Agency Bonds

65.84

Investment Grade

Non-Investment Grade

Intl Govt/Agency Bonds

Corporate Bonds

11.69

Corporate Bonds

10.98

Non-Investment Grade

Sovereign Bonds

Investment Grade

10.41

-8.81

6.83

Investment Grade

0.71

-15.63

Sovereign Bonds

10.87

Non-Investment Grade

11.64

Non-Investment Grade

10.88

Non-Investment Grade

Investment Grade

22.05

Investment Grade

54.96

6.74

Non-Investment Grade

10.05

9.60

Investment Grade

0.82

-2.86

Convertibles

0.03

Convertibles

0.03

Municipal

0.00

Municipal

-0.28

Securitised

0.00

Securitised

-14.59

CMBS / ABS

0.00

CMBS / ABS

MBS

0.00

MBS

-10.84

N/A

0.00

N/A

-3.04

US Treasuries/Agencies

0.00

US Treasuries/Agencies

Derivatives

-1.00

Derivatives

-1.00

Supranational

0.13

Supranational

-2.08

Others

0.04

Others

0.03

Equity

0.02

Equity

0.02

Others

0.02

Others

0.01

Cash & Cash Equivalents

-2%

-14.51

Cash & Cash Equivalents

12.41

12%

-0.70

26%

40%

54%

68%

-16%

12.41

-8%

0%

Weightings as percent of total. Percentage may not equal 100% due to rounding. Information is historical and may not reflect current or future portfolio characteristics. All portfolio holdings are subject to change.

For professional investor use only. Not for distribution to retail investors.

7%

15%

23%

31

Templeton Global Total Return Fund

Historical Performance

Templeton Global Total Return Fund - I(acc) EUR

As of 30 November 2014

Cumulative Performance (%)

Templeton Global Total Return Fund - I(acc) EURNet of Fees

Inception

Date

3 Mths

YTD

1 Yr

3 Yrs

5 Yrs

7 Yrs

Since

Incept

1.9.2006

5.08

13.40

13.23

39.97

82.68

129.92

137.93

2.30

11.97

10.05

12.86

34.74

52.82

49.03

Inception

Date

1 Yr

3 Yrs

5 Yrs

7 Yrs

Since

Incept

1.9.2006

13.23

11.86

12.81

12.63

11.08

10.05

4.11

6.15

6.25

4.96

Barclays Multiverse Index

Annualised Total Returns (%)

Templeton Global Total Return Fund - I(acc) EURNet of Fees

Barclays Multiverse Index

All performance data shown is in the Fund currency stated and net of management fees. Sales charges and other commissions, taxes and other relevant costs paid by the investor are not included in the calculations.

The value of shares in the Fund and income received from it can go down as well as up, and investors may not get back the full amount invested. Past performance does not guarantee future results. Current performance may differ from figures

shown. Currency fluctuations may affect the value of overseas investments. When investing in a fund denominated in a foreign currency, performance may also be affected by currency fluctuations. Please visit franklintempleton.lu for current

performance.

Performance data may represent blended share class performance, e.g., hybrid created from an A(dis) share class which was converted to A(acc).

The fund offers other share classes subject to different fees and expenses, which will affect their performance. Please see the prospectus for details.

For professional investor use only. Not for distribution to retail investors.

32

Templeton Global Total Return Fund

Calendar Year Returns

Templeton Global Total Return Fund - I(acc) EUR

As of 30 November 2014

31.07

32%

24.16

22%

18.11

13.40

12%

13.20

11.97

3.23

2%

-8%

9.13

9.08

-0.10

YTD 2014

4.67

2.79

2.01

0.20

-6.42

2013

Templeton Global Total Return Fund - I(acc) EURNet of Fees

2012

2011

2010

2009

2008

-1.49

2007

Barclays Multiverse Index

All performance data shown is in the Fund currency stated and net of management fees. Sales charges and other commissions, taxes and other relevant costs paid by the investor are not included in the calculations.

The value of shares in the Fund and income received from it can go down as well as up, and investors may not get back the full amount invested. Past performance does not guarantee future results. Current performance may differ from figures

shown. Currency fluctuations may affect the value of overseas investments. When investing in a fund denominated in a foreign currency, performance may also be affected by currency fluctuations. Please visit franklintempleton.lu for current

performance.

Performance data may represent blended share class performance, e.g., hybrid created from an A(dis) share class which was converted to A(acc).

For professional investor use only. Not for distribution to retail investors.

33

1828M

Templeton Global Total Return Fund

Summary

Summary of

of Advantages

Advantages

The Foundation of Our Long-Term Track Record

An Unconstrained Worldview

A Truly Global Research Platform

A High-Conviction Process

For professional investor use only. Not for distribution to retail investors.

34

Templeton Global Total Return Fund

Glossary

Average Duration: Also known as 'effective' or 'Macaulay' duration it is a measure of the sensitivity of the price (the value of principal) of a fixed-income investment to a change in

interest rates. Duration is expressed as a number of years. It's an indication of an issue's coupon relative to its maturity. Rising interest rates mean falling bond prices; declining interest

rates mean rising bond prices. The bigger the duration number, the greater the interest-rate risk; (or reward for bond prices). The weighted average duration of a fund reflects the

effective duration of the underlying issues, based on the size of each holding. This value differs with 'Modified Duration' which is modified for the market (dirty) price of an issue.

Current Yield: In general, yield is the annual rate of return for any investment and is expressed as a percentage. With bonds, yield is the effective rate of interest paid on a bond,

calculated by the coupon rate divided by the bond's market price. Bonds are typically issued with fixed coupon payments (regular cash payments of a fixed amount). Bonds are typically

valued in terms of the their yield - what dollar amount as coupon payments is received as compared to the bond's current market price. For a bond fund the current yield may be the

disclosed yield paid out to investors.

Yield to Maturity: Yield to Maturity ('YTM') also known as the 'Gross Redemption Yield' or 'Redemption Yield'. The rate of return anticipated on a bond if it is held until the maturity date.

YTM is considered a long-term bond yield expressed as an annual rate. The calculation of YTM takes into account the current market price, par value, coupon interest rate and time to

maturity. It is also assumed that all coupons are reinvested at the same rate.

Yield to Worst: The yield to maturity if the worst possible bond repayment takes place. If market yields are higher than the coupon, the yield to worst would assume no prepayment. If

market yields are below the coupon, the yield to worst would assume prepayment. In other words, yield to worst assumes that market yields are unchanged. Normally this value is not

aggregated since it varies but if a weighted average value is used for a Fund then the figure will reflect the values of the underlying issues, based on the size of each holding.

For professional investor use only. Not for distribution to retail investors.

35

Templeton Global Total Return Fund

Important Disclosures

This document is intended to be of general interest only and does not constitute legal or tax advice nor is it an offer for shares or invitation to apply for shares of the Luxembourg-domiciled SICAV Franklin

Templeton Investment Funds (the Fund). Nothing in this document should be construed as investment advice. Given the rapidly changing market environment, Franklin Templeton Investments disclaims

responsibility for updating this material.

Opinions expressed are the authors at publication date and they are subject to change without prior notice.

Subscriptions to shares of the Fund can only be made on the basis of the current prospectus and, where available, the relevant Key Investor Information Document, accompanied by the latest available

audited annual report and the latest semi-annual report if published thereafter.

The value of shares in the Fund and income received from it can go down as well as up, and investors may not get back the full amount invested. Past performance is not an indicator nor a guarantee

of future performance. Currency fluctuations may affect the value of overseas investments. When investing in a fund denominated in a foreign currency, your performance may also be affected by

currency fluctuations.

An investment in the Fund entails risks which are described in the Funds prospectus and, where available, in the relevant Key Investor Information Document.

In emerging markets, the risks can be greater than in developed markets. Investments in derivative instruments entail specific risks that may increase the risk profile of the fund and are more fully described

in the Funds prospectus and, where available, in the relevant Key Investor Information Document.

No shares of the Fund may be directly or indirectly offered or sold to nationals or residents of the United States of America.

Shares of the Fund are not available for distribution in all jurisdictions and prospective investors should confirm availability with their local Franklin Templeton Investments representative before making any

plans to invest.

Any research and analysis contained in this document has been procured by Franklin Templeton Investments for its own purposes and is provided to you only incidentally.

References to particular industries, sectors or companies are for general information and are not necessarily indicative of a funds holding at any one time.

Please consult your financial advisor before deciding to invest. A copy of the latest prospectus, the relevant Key Investor Information Document, the annual report and semi-annual report, if published

thereafter can be found on our website www.franklintempleton.lu or can be obtained, free of charge, from Franklin Templeton International Services, S. r.l. - Supervised by the Commission de Surveillance

du Secteur Financier 8A, rue Albert Borschette, L-1246 Luxembourg - Tel: +352-46 66 67-1 - Fax: +352-46 66 76.

For professional investor use only. Not for distribution to retail investors.

36

Templeton Global Total Return Fund

Important Disclosures (continued)

Issued by Franklin Templeton International Services, S. r.l.

2014 Franklin Templeton Investments. All rights reserved.

Indexes are unmanaged and one cannot invest directly in an index.

CFA and Chartered Financial Analyst are trademarks owned by CFA Institute.

Additional Information for Investment Platform Overview Slide:

Franklin Equity Group, a unit of Franklin, combines the expertise of the Franklin Advisers, Inc., and Fiduciary Global Advisors equity teams (with origin dating back to 1947 and 1931, respectively). Franklin

Templeton Fixed Income Group, a unit of Franklin, combines the expertise of the Franklin Advisers, Inc., and Fiduciary Trust Company International fixed income teams (originating in 1970 and 1973,

respectively). Franklin Real Asset Advisors originated in 1984 as the global real estate team of Fiduciary Trust Company International. Franklin Templeton Solutions (formerly Franklin Templeton Multi-Asset

Strategies prior to 31 December 2013) is a global investment management group dedicated to multi-strategy solutions and is comprised of individuals representing various registered investment advisory

entity subsidiaries of Franklin Resources, Inc., a global investment organisation operating as Franklin Templeton Investments (FTI). Certain individuals advise Franklin Templeton Solutions (FT Solutions)

mandates through K2 Advisors L.L.C. (K2), an FTI adviser that forms part of an investment group founded in 1994 through existing advisory entities or their predecessors. FT Solutions originated in 2007 to

combine the research and oversight of the multi-strategy investment solutions offered by FTI. Franklin Templeton Investments acquired a majority interest in K2 Advisors Holdings, LLC on 1 November

2012. As at 30 June 2014, Mutual Series, Franklin Templeton Local Asset Management and Franklin Templeton Real Asset Advisors were renamed Franklin Mutual Series, Franklin Local Asset

Management and Franklin Real Asset Advisors, respectively.

For professional investor use only. Not for distribution to retail investors.

37

Templeton Global Total Return Fund

Appendix

38

Templeton Global Total Return Fund

Management Profiles

39

1834M

Templeton Global Total Return Fund

Global Bond Group Management Profiles

MICHAEL HASENSTAB, Ph.D.

Executive Vice President, Portfolio

Manager, Chief Investment Officer,

Global Bonds

Franklin Templeton Fixed Income Group

Dr. Hasenstab is a member of the Fixed Income Policy Committee and is a portfolio manager for a number of Franklin

Templeton fixed income and hybrid funds and strategies.

Dr. Hasenstab holds a Ph.D. in economics from the Asia Pacific School of Economics and Management at Australian National

University, a masters degree in economics of development from the Australian National University and a B.A. in international

relations/political economy from Carleton College in the United States.

Franklin Advisers, Inc.

San Mateo, California, United States

SONAL DESAI, Ph.D.

Senior Vice President, Portfolio Manager

Director of Research, Global Bonds

Franklin Templeton Fixed Income Group

Franklin Advisers, Inc.

San Mateo, California, United States

CHRISTINE ZHU

Quantitative Research Analyst,

Portfolio Manager

Franklin Templeton Fixed Income Group

Franklin Advisers, Inc.

San Mateo, California, United States

CALVIN HO, Ph.D.

Senior Global Macro & Research Analyst

Global Bonds

Franklin Templeton Fixed Income Group

Franklin Advisers, Inc.

San Mateo, California, United States

For professional investor use only. Not for distribution to retail investors.

Dr. Desai is responsible for shaping the research agenda of the global bond group, and providing macroeconomic analysis to the

fixed income team. Dr. Desai acts as a key resource for the firms Fixed Income Policy Committee, which provides policy views

on sectors, markets and currencies.

Dr. Desai holds a Ph.D. in economics from Northwestern University and earned a B.A. with honours from Delhi University in

New Delhi.

Ms. Zhu is a quantitative research analyst and portfolio manager in the global bond group of the Franklin Templeton Fixed

Income Group. She focuses on portfolio construction, derivatives/quantitative strategies in global market, performance attribution

and risk management. Ms. Zhu joined Franklin Templeton in 2007.

Ms. Zhu received an M.B.A. with investment focus from the University of California, Berkeley, and earned her M.S. in computer

science and engineering from the University of Notre Dame. She is fluent in Mandarin.

Dr. Ho joined Franklin Templeton Investments in 2005. Currently, he is a senior global macro & research analyst for the Franklin