Beruflich Dokumente

Kultur Dokumente

Accounting Standard 2 Simplified

Hochgeladen von

R. SinghCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accounting Standard 2 Simplified

Hochgeladen von

R. SinghCopyright:

Verfügbare Formate

Accounting Standard 2 simplified

Login

Register

Member Strength 1370707

and growing..

CCI ONLINE COACHING

HOME

ARTICLES

NEWS

ACCOUNTS

EXPERTS

ARTICLES

FILES

FORUM

JOBS

FEED

ACCOUNTING STANDARD 2 SIMPLIFIED

Please Wait ..

Accounting Standard 2 simplified

Siddharth Kadakia

posted on 12 September 2013

Introduction:

Why is valuation of inventory so important? From a lay mans perspective there can be two

reasons. Firstly since the closing stock of the previous year becomes opening stock of the current

year and it goes because of the going concern concept. Secondly it affects he gross profits. If

youre closing stock is valued high in one year, gross profit for that year will be high. But in the next

year since it becomes the opening stock, gross profit can be comparatively low. Thus it always

becomes an issue as to at what value should the closing stock be valued. This standard comes

into picture at the end of the year when a company holds certain amount of stock which is not sold.

It has to be represented in the Balance Sheet at such a value till the time revenue is recognized

from such stock. In this article we will try to draw a fictitious story to explain the core concepts of

the exceptions to Accounting Standard 2 issued by ICAI, concept of inventory, concepts of cost

and its inclusions and meaning of net-realizable value.

Background:

Suppose that you are a proprietor of a printing press lets name it ABC Printers. A typical business

cycle would be ordering of raw materials like paper, ordering of consumables like ink, converting

raw material into finished goods with the help of printing machines and labour, ordering of packing

boxes, packing of the finished goods with the help of labour and finally transportation of finished

goods to the destination of the customer. Following costs can be assumed. You order paper at a

cost of Rs. 100 per kg. It attracts Octroi at Rs. 2 per kg. The Vat on purchases is 12.5%. Your

labour cost is Rs. 20 per hour for printing department and Rs. 5 per hour in packing department.

Ink costs you Rs. 12 per kg and packing boxes costs you Rs. 10 per box. Transportation is paid by

the customer. It is 31st of March today. You have just received an order today for printing of 1000

leaflets of Rs. 5 each. One of the order of 2000 leaflets is being printing on 31st of March and you

intend to pack it on 1st of April. Since labour is short on 31st of March, a completed order of 500

leaflets will be dispatched by you on 1st April. For simplicity we are ignoring the fixed costs of

department.

Exceptions to Accounting Standard - 2:

Since it is a sole proprietorship printing business, you are not involved into business of

http://www.caclubindia.com/articles/accounting-standard-2-simplified-18356.asp[Thursday-20-11-2014 2:11:06 PM]

EVENTS

STUDENTS

NOTIFICATIONS

MORE

Accounting Standard 2 simplified

construction, you are a manufacturer and not a service provider, and you have not held any shares

or debentures as stock nor are you a producer holding inventories of livestock, agricultural

products and forest products etc. Above all are the exceptions to AS-2. Now since your business is

such that you do not fall into any of the exception categories, you need to understand the AS-2

properly for valuing your inventory.

Concept of Inventory:

For you the inventory is paper, ink and packing boxes which you stock in large quantity so that

once you receive the order you can execute it with minimum time and generate revenue. Paper

would be a part of inventory as it is held for sale and is going to be used in the production process.

Ink and packing boxes are consumables that are going to be consumed in the production process.

You also hold some of the spare parts like bolts that relate to you printing machinery so that your

production is not hampered. Since this spares are not for re-sale and can be used only with your

machinery, it will not be included in you inventory. The order of 2000 leaflets will be your work-inprogress and that of 500 leaflets will be your finished goods.

Concepts of Costs:

With respect to your printing press, raw material will be valued at the purchase price including the

Octroi and Vat of purchases at 12.5%. If on sale, if you a registered dealer and have a VAT

registration number then Vat on purchase (rate) will be reduced by the rate which at which you will

collect the Vat from your customer. Suppose the Vat on sale is 4%. Than in inventory valuation the

Vat would be 8.5%.

With respect to your order of 2000 leaflets, we can term it as work-in progress and it will be valued

at the cost of purchase of raw material paper as above + the amount paid for the ink and the labour

hours involved in the printing department. In this equation the first component is the cost of

purchase and the second is the cost of conversion till date.

With respect to 500 leaflets, which can be referred to as finished goods, it will be cost of purchase

+ cost of conversion + other costs like packing and transportation. The third component of the cost

can be called as the cost in order to bring the goods to their present location and condition.

Fixed overheads are ignored in the case but it will be added to each such cost on the rate

estimated by the management based on normal capacity. If there are some sheets of paper that

have been wasted in the printing process, the cost of storing the paper in a warehouse, cost of

watchman at the warehouse and selling costs, they would not be included in the cost of

inventories.

FIFO:

Obviously there is always a shortage of space in every small firm. Paper will be stack one above

the other. The first that arrives will be below followed by the others above it. You will account the

first stock of paper that you receive and then for others as and when you receive. Thus in your

books of account the first stock of paper will be used for printing first then others. But this actually

does not occur in real life situations because the paper which is on the top is taken first than the

paper at the bottom. You can think of it as when we have to demolish a building, we start from the

top and not from the bottom. But when we want to purchase the building we start reviewing it from

bottom. Thus the accounting for inventory as per FIFO is more theoretical than practical.

Weighted Average:

This method is more appropriate with respect to inventory valuation as the fluctuations are

considered. You can think of it as an investor who invest in a stock at one go and the other who

invests in a stock slowly every month. The other investor is at an advantage as he can average out

in case of fluctuations of the stock prices.

Meaning of Net Realizable Value:

http://www.caclubindia.com/articles/accounting-standard-2-simplified-18356.asp[Thursday-20-11-2014 2:11:06 PM]

Accounting Standard 2 simplified

This is majorly based on estimates. Estimates are made by the management and its their duty to

used the most reliable one and disclose the same in financial statement.

Over here we try to explain the concept of valuation of inventories rule, Inventories are valued at

lower of cost or NRV.

We can think of this rule as the one which is applicable only in case of damaged, obsolete and

goods which we expect to sell at loss. If we expect the inventory to sell at above the cost, naturally

the NRV is going to be high and hence they will be valued at the cost. In case of damaged,

obsolete goods which we are ready to sell it at loss, naturally the NRV is less and hence will be

valued at NRV and not at the cost. Lets understand it with our printing press example as on 31st

March. Paper will always be valued at the cost and it will not be written down below the cost as we

expect to complete the production cycle and sell the printed paper at an amount higher than the

cost. But suppose the warehouse in which the paper was stored had a leakage problem on 31st

March and as a result youre certain stock of paper became wet; this stock cannot be used as a

raw material in the printing process and can only be sold as scrapped. In such a case on 31st of

March you will estimate based on reliable evidence, the scrap value that you can receive from such

wet stock of paper, and you will value your wet paper at that price.

Print this article

Other Articles by - Siddharth Kadakia

Published in Accounts

Source : No Source Specified

Views : 21978

3 Comments for this Article

Related Articles

View other articles from this category

Other Latest Articles

CBEC clarification on availment of Cenvat credit

The Hare Could Win Here !!

How do Internal Controls manifest in an Organization?

Meaning of Debit Note & Credit Note

Advocates alone are entitled to Practice, Plead and Act before the revenue authorities

Service tax on Restaurants and Hotels

You decide importance of Majority and resolutions in your business

http://www.caclubindia.com/articles/accounting-standard-2-simplified-18356.asp[Thursday-20-11-2014 2:11:06 PM]

Accounting Standard 2 simplified

The Row over Constitutional Validity of Service Tax on Restaurant Services

Yahan aisa hi hota hai (Monkey see, monkey do)

Applicability of CST/ K-VAT on E-Commerce Transactions

Quick Links

Submit Articles

Browse by Category

Recent Comments

Popular Articles

Search Articles

GO

Popular

Internal Audit under the new

Companies Act 2013

Fund Flow Statement

Crossroads: What after the CA

degree?

Allotment of Equity Shares as per

Companies Act, 2013

Technologies for new age CAs &

MBAs

http://www.caclubindia.com/articles/accounting-standard-2-simplified-18356.asp[Thursday-20-11-2014 2:11:06 PM]

Accounting Standard 2 simplified

A clear vision - If CA is a regular

course

Service tax on Restaurants and

Hotels

Good Morning GST

Are we are doing good to ourselves

by taking coachings?

Arye wah! Instructions to reduce

hardship of taxpayer in Income Tax

Scrutiny

Subscribe to Articles Feed

Enter your email address

Submit

Browse by Category

Income Tax

Accounts

Audit

Students

Custom

VAT

Career

Service Tax

Corporate Law

Info Technology

Excise

Shares & Stock

Exams

LAW

Professional Resource

Others

Union Budget

Taxpayers

Our Network Sites

Newsletter

Subscribe

We are

About

Hiring

Disclaimer

2014 CAclubindia.com. Let us grow stronger by mutual exchange of knowledge.

http://www.caclubindia.com/articles/accounting-standard-2-simplified-18356.asp[Thursday-20-11-2014 2:11:06 PM]

Advertise

Terms of Use

Privacy Policy

Contact Us

Das könnte Ihnen auch gefallen

- Balaji Viswanathan's Answer To How Is It Possible That Only 3% of Indians Pay Income Tax - QuoraDokument5 SeitenBalaji Viswanathan's Answer To How Is It Possible That Only 3% of Indians Pay Income Tax - QuoraR. SinghNoch keine Bewertungen

- HTTP WWW - Prudenttrader.com PT-TripleSDokument6 SeitenHTTP WWW - Prudenttrader.com PT-TripleSR. SinghNoch keine Bewertungen

- Financials & Key RatiosDokument1 SeiteFinancials & Key RatiosR. SinghNoch keine Bewertungen

- Sbi PDFDokument10 SeitenSbi PDFdisewazoNoch keine Bewertungen

- Safal Niveshak Mastermind BrochureDokument3 SeitenSafal Niveshak Mastermind BrochureR. SinghNoch keine Bewertungen

- Investor CurriculumDokument22 SeitenInvestor CurriculumR. SinghNoch keine Bewertungen

- Analysis of Indian Cement Industry & Financial Performance of ACC LTDDokument1 SeiteAnalysis of Indian Cement Industry & Financial Performance of ACC LTDR. SinghNoch keine Bewertungen

- Duos (Amiduos)Dokument13 SeitenDuos (Amiduos)R. SinghNoch keine Bewertungen

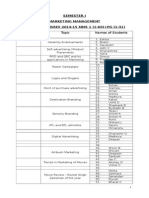

- SL - No Particulars Sessions 1 Session of 3 HoursDokument1 SeiteSL - No Particulars Sessions 1 Session of 3 HoursR. SinghNoch keine Bewertungen

- Funny Full Forms.........Dokument7 SeitenFunny Full Forms.........R. SinghNoch keine Bewertungen

- Rounding Off DecimalsDokument3 SeitenRounding Off DecimalsR. SinghNoch keine Bewertungen

- All Debt Products.Dokument3 SeitenAll Debt Products.R. SinghNoch keine Bewertungen

- Date of Presentation Topic Names of StudentsDokument2 SeitenDate of Presentation Topic Names of StudentsR. SinghNoch keine Bewertungen

- PFC Equity Reportfor Upload-10th July 2012Dokument31 SeitenPFC Equity Reportfor Upload-10th July 2012R. SinghNoch keine Bewertungen

- Born To Serve .Dokument3 SeitenBorn To Serve .R. SinghNoch keine Bewertungen

- Bust A MumbaiDokument28 SeitenBust A MumbaiR. SinghNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Munehisa Homma - The Father of Price Action TradingDokument6 SeitenMunehisa Homma - The Father of Price Action TradingJohan HallatuNoch keine Bewertungen

- Final TFC Round 1 and 2Dokument8 SeitenFinal TFC Round 1 and 2AMRUT PATELNoch keine Bewertungen

- Quiz - Chapter 4 - Provisions, Cont. Liab. & Cont. Assets - 2021Dokument3 SeitenQuiz - Chapter 4 - Provisions, Cont. Liab. & Cont. Assets - 2021Martin ManuelNoch keine Bewertungen

- Project On BankingDokument31 SeitenProject On BankingsarthakNoch keine Bewertungen

- IFRS 15 Revenue From Contracts With CustomersDokument6 SeitenIFRS 15 Revenue From Contracts With CustomersAngelica Sanchez de VeraNoch keine Bewertungen

- Financial StatementDokument33 SeitenFinancial StatementĎêěpãķ Šhăŕmå100% (1)

- 2017 SALES OutlineDokument52 Seiten2017 SALES Outlinerehnegibb100% (1)

- Bain Report India M A Report 2019Dokument40 SeitenBain Report India M A Report 2019Akshay GuptaNoch keine Bewertungen

- Long Term ConstructionDokument6 SeitenLong Term ConstructionJohnAllenMarilla78% (9)

- Contract Payment Schedule: 1 Deposit ($500)Dokument2 SeitenContract Payment Schedule: 1 Deposit ($500)TamerGalhoumNoch keine Bewertungen

- FD03pcl 08Dokument4 SeitenFD03pcl 08Sunilkumar CeNoch keine Bewertungen

- Prelim Assignment 3Dokument3 SeitenPrelim Assignment 3richard jarabeNoch keine Bewertungen

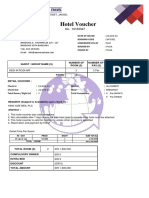

- Hotel Voucher: in - Out Price Night Sub TotalDokument1 SeiteHotel Voucher: in - Out Price Night Sub Totaldedi enggoNoch keine Bewertungen

- Annual Report 2017 English PDFDokument90 SeitenAnnual Report 2017 English PDFanand.srajuNoch keine Bewertungen

- Distribution LorealDokument10 SeitenDistribution LorealNishant Sharma0% (1)

- Shoreline Fire Impact FeesDokument3 SeitenShoreline Fire Impact FeesThe UrbanistNoch keine Bewertungen

- Sales Force Integration at FedEx (A)Dokument9 SeitenSales Force Integration at FedEx (A)Rishabh ShekharNoch keine Bewertungen

- $12,000 Favourable Nil $8,000 Favourable $6,000 UnfavourableDokument72 Seiten$12,000 Favourable Nil $8,000 Favourable $6,000 UnfavourableNavindra JaggernauthNoch keine Bewertungen

- Excel EOQ Wilson AbcSupplyChain enDokument8 SeitenExcel EOQ Wilson AbcSupplyChain enDebasish DeyNoch keine Bewertungen

- MA1 - Progress Test 2 - AnswerDokument14 SeitenMA1 - Progress Test 2 - Answersramnarine1991Noch keine Bewertungen

- Action Plan For ReedDokument5 SeitenAction Plan For ReedNitin Shukla0% (1)

- Group Work - Inventory Cost Flow and LCNRVDokument2 SeitenGroup Work - Inventory Cost Flow and LCNRVKawhileonard LeonardNoch keine Bewertungen

- Coca Cola Marketing AnnalysisDokument79 SeitenCoca Cola Marketing Annalysiskishorekunal50% (2)

- DBSDokument5 SeitenDBSMuhammad ShahbazNoch keine Bewertungen

- Part3D SwapDokument39 SeitenPart3D SwapKaruna SethiNoch keine Bewertungen

- Airo Shot Blasting EquipmentDokument8 SeitenAiro Shot Blasting EquipmentSandipNoch keine Bewertungen

- Summer Training Report ON Acc Cement Pvt. LTD.: SESSION (2017-2018) Career Point University Hamirpur (Himachal Pradesh)Dokument15 SeitenSummer Training Report ON Acc Cement Pvt. LTD.: SESSION (2017-2018) Career Point University Hamirpur (Himachal Pradesh)lucasNoch keine Bewertungen

- Clique Pens The Writing Division of U.S. Home Case Study #1Dokument2 SeitenClique Pens The Writing Division of U.S. Home Case Study #1Jamil Huseynli0% (1)

- Interplanetary Starship Captain Jose Ching Has Been Pondering The InvestmentDokument2 SeitenInterplanetary Starship Captain Jose Ching Has Been Pondering The InvestmentAmit PandeyNoch keine Bewertungen

- Export Costing Sheet For Breakbulk ShipmentsDokument15 SeitenExport Costing Sheet For Breakbulk ShipmentssizwehNoch keine Bewertungen