Beruflich Dokumente

Kultur Dokumente

Learning Objectives: 1. An Overview of Cost Allocation

Hochgeladen von

Lorena TudorascuOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Learning Objectives: 1. An Overview of Cost Allocation

Hochgeladen von

Lorena TudorascuCopyright:

Verfügbare Formate

Support Department Cost Allocation

Learning Objectives

1. Describe the difference between support departments and producing departments.

2. Calculate single and multiple charging rates for a support department.

3. Assign support department costs to producing departments using the direct, sequential,

and reciprocal methods.

4. Calculate departmental overhead rates.

1. AN OVERVIEW OF COST ALLOCATION

In prior chapters, we discussed factory overhead allocation. However, we took the

existence of factory overhead cost in a producing department as a given. This chapter

asks us to step back and trace these factory overhead costs from incurrence through

assignment to units produced.

Use the opening scenario to introduce the concept of the two categories of departments:

support departments and producing departments. Each type of department should be

defined, and it should be indicated that this chapter is primarily concerned with

describing ways of allocating support-department costs to producing departments.

A. Types of Departments

If departments are the cost objects, departments are classified as either producing

departments or support departments.

Definition:

Examples:

responsible for creating the

products

or services sold to customers

assembly department, finishing

department

provide support services for

producing departments

maintenance, personnel, security

Although support departments do not work directly on the products of an organization,

the costs of providing these support services are part of the total product cost.

Three steps in allocating costs are:

1. trace all overhead costs to a support or producing department

2. allocate support-department costs to the producing departments, and

3. allocate overhead costs to units of individual products using a predetermined overhead

rate. The predetermined overhead rate is calculated as follows:

Note that a producing departments overhead consists of two parts:

overhead directly associated with the producing department

overhead allocated to the producing department from the support

departments

In addition, Hansen and Mowen state that some basic guidelines should be followed

when allocating support-department costs. These guidelines are essentially compatible

with the five objectives.

1. As nearly as possible, cost drivers (causal factors) should be used as the basis for cost

allocation.

2. Budgeted or expected costs, not actual costs, should be allocated.

3. Costs should be allocated by behavior; fixed costs and variable costs should be

allocated separately.

B. Types of Drivers

Causal factors are cost drivers within a producing department that cause

or drive the consumption of support service costs.

In general, causal factors should be used as the basis for allocating service

costs.

For example, if power costs were to be allocated, kilowatt hours would be

the cost driver or causal factor that could be used as the allocation base.

C. Objectives of Assigning Support Department Costs

The major objectives associated with the allocation of support-department

costs to producing departments and ultimately to specific products are:

to obtain a mutually agreeable price

to compute product-line profitability

to predict economic effects of planning and control

to value inventory

to motivate managers

2. ASSIGNING DEPARTMENT COSTS TO PRODUCING DEPARTMENTS

A charging rate is used to allocate the costs of a support department to user

departments.

A. A Single Charging Rate

If a single charging rate is used, fixed costs and variable costs are

combined and then divided by estimated activity.

The amount charged to producing departments is calculated as follows:

Single charging rate Producing department usage

Two reasons for allocating support-department costs are:

1. for product costing (to determine the cost of units produced), and

2. for performance evaluation.

For product costing, the allocation is made at the beginning of the year

based on budgeted usage so that a predetermined overhead rate can be

computed to cost products during the year.

For performance evaluation purposes, the allocation is made at the end of

the period based on actual usage.

Usage:

Budgeted usage

Actual usage

Service department

allocation:

Budgeted rate Budgeted usage

Budgeted rate Actual usage

Cornerstone 14-1: How to Calculate and Use a Single Charging Rate

See Mowen and Hansen text for in-class, demo problems.

B. Multiple Charging Rates

Instead of using a single charging rate, a company may break support

department resources and causal factors into multiple charging rates.

For example, two rates may be used to assign support department costs:

o one rate for variable costs (based on actual usage), and

o one rate for fixed costs (based on planned peak usage).

Variable costs of support departments vary with usage so it makes sense to

charge the variable rate for each unit of service consumed by the

producing departments.

Fixed costs are incurred to provide the capacity necessary to deliver the

service units required by the producing departments. Thus, it is reasonable

to assign the fixed costs to producing departments in proportion to their

planned peak usage.

Cornerstone 14-2: How to Calculate and Assign Service Costs Using

Multiple Charging Rates

See Mowen and Hansen text for in-class, demo problems.

C. Assigning Budget versus Actual Service Costs

Budgeted, not actual, costs should be allocated so that support

departments efficiencies or inefficiencies are not passed on to the

producing departments.

A general principle of performance evaluation is that managers should not

be held responsible for costs or activities over which they have no control.

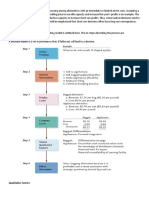

3. CHOOSING A SUPPORT DEPARTMENT COST ALLOCATION

METHOD

There are three methods commonly used to allocate support costs: (1) the direct method;

(2) the sequential (or step) method; and (3) the reciprocal method. Many instructors

choose to defer coverage of the reciprocal method to cost accounting. It is important for

students to realize that no matter which method of support department cost allocation is

used, total factory overhead costs remain unchanged. That is, the different allocation

methods simply split up the costs differently among the producing departments.

Three methods used to allocate support-department costs to producing departments are:

1. direct method

2. sequential method, and

3. reciprocal method.

A. Direct Method of Allocation

The direct method allocates support-department costs directly to the producing

departments based on relative use.

This method ignores reciprocal services (services provided by one support

department to another support department). For example, this method would

ignore service provided by the data processing department to other support

departments, such as personnel or maintenance.

Cornerstone 14-3: How to Assign Support Department Costs Using the

Direct Method

See Mowen and Hansen text for in-class, demo problems.

B. Sequential Method of Allocation

The sequential (or step) method allocates support-department costs to

the producing depart ments an d to some support departments. Thus, the

sequential method partially recognizes reciprocal services.

The sequential method is applied in the following manner:

1. Select a support department and allocate its costs to the producing departments and

support departments to which it provides services. (The support department with the

greatest total costs is allocated first.)

2. Select another support department and allocate its cost to the producing departments

and the remaining support departments.

3. Proceed in this manner until all of the support-department costs have been allocated to

the producing departments.

Notice that once the costs of a support department are allocated, no further

allocations are made to that support department.

Cornerstone 14-4: How to Assign Support

See Mowen and Hansen text for in-class, demo problems.

Department Costs Using the Sequential Method

See Mowen and Hansen text for in-class, demo problems.

C. Reciprocal Method of Allocation

The reciprocal method fully recognizes the reciprocal services provided

by support departments to other support departments.

The reciprocal method requires the use of simultaneous equations.

The total cost of a support department is calculated:

Total cost of support department = Direct costs + Allocated costs of

other support departments

The reciprocal method fully recognizes the reciprocal services provided

by support departments to other support departments.

4. DEPARTMENTAL OVERHEAD RATES AND PRODUCT COSTING

When all costs are allocated from the support departments to the production departments,

overhead rates can be calculated for each production department. These calculations are

similar to overhead calculations discussed in earlier chapters.

Support-department costs are allocated to the producing departments, and then the

support-department costs are included in the producing departments overhead

application rates.

The flow of costs could be diagramed as follows:

Support Department Costs

Producing Department

Overhead Costs

Units of Product

$400,000

$200,000

$200,000

$600,000

The $600,000 of producing department overhead would be allocated to units of product

using a cost driver such as direct labor hours or machine hours.

Cornerstone 14-5: How to Calculate and Use Departmental Overhead

Rates

See Mowen and Hansen text for in-class, demo problems.

SUMMARY

To summarize, the four steps involved in support-department allocation are as follows:

1. Prepare departmental budgets for producing and support departments.

2. Select an allocation base for use in allocating the support-department costs.

3. Allocate the budgeted support-department costs to the producing departments using

either the direct, sequential, or reciprocal method.

4. Calculate a predetermined overhead application rate for each producing department to

apply total overhead costs to units of product produced

Das könnte Ihnen auch gefallen

- CHP 5 Profit CentersDokument16 SeitenCHP 5 Profit CentersDivyang PatelNoch keine Bewertungen

- 7 Lecture Activity Based Costing and Management 1Dokument65 Seiten7 Lecture Activity Based Costing and Management 1Dorothy Enid AguaNoch keine Bewertungen

- Cost and ManagementDokument310 SeitenCost and ManagementWaleed Noman100% (1)

- Cost AccountingDokument316 SeitenCost Accountinghassan100% (1)

- CH 10 Analyzing Financial Performance ReportsDokument21 SeitenCH 10 Analyzing Financial Performance ReportsKentia Pexi100% (1)

- Penerapan Metode Activity Based CostingDokument15 SeitenPenerapan Metode Activity Based CostingAira Oct SaharaNoch keine Bewertungen

- AKMY 6e ch01 - SMDokument20 SeitenAKMY 6e ch01 - SMMuhammad Ahad Habib Ellahi100% (2)

- Chapter 4 Cost Accounting HorngrenDokument23 SeitenChapter 4 Cost Accounting HorngrenNHNoch keine Bewertungen

- Cost AccountingDokument5 SeitenCost AccountingNiño Rey LopezNoch keine Bewertungen

- BudgetingDokument3 SeitenBudgetingSwati RathourNoch keine Bewertungen

- Cost Accounting and Control OutputDokument21 SeitenCost Accounting and Control OutputApril Joy ObedozaNoch keine Bewertungen

- Activity Based Costing SystemDokument6 SeitenActivity Based Costing SystemZoya KhanNoch keine Bewertungen

- Activity Based CostingDokument49 SeitenActivity Based CostingEdson EdwardNoch keine Bewertungen

- Chapter 11 SolutionsDokument3 SeitenChapter 11 Solutionshassan.murad100% (2)

- SDokument59 SeitenSmoniquettnNoch keine Bewertungen

- Tactical Decision MakingDokument2 SeitenTactical Decision MakingMay AugustusNoch keine Bewertungen

- Praktikum Akuntansi-BiayaDokument27 SeitenPraktikum Akuntansi-BiayaK-AnggunYulianaNoch keine Bewertungen

- Cost NotesDokument16 SeitenCost NotesKomal GowdaNoch keine Bewertungen

- 6e ch08Dokument42 Seiten6e ch08Ever PuebloNoch keine Bewertungen

- Financial Ratios - Top 28 Financial Ratios (Formulas, Type)Dokument7 SeitenFinancial Ratios - Top 28 Financial Ratios (Formulas, Type)farhadcse30Noch keine Bewertungen

- Chapter 13 The Flexible-Budget and Standard Costing: Direct Materials and Direct LaborDokument86 SeitenChapter 13 The Flexible-Budget and Standard Costing: Direct Materials and Direct Laborkhaledhereh100% (1)

- Cost Accouting-JOCDokument3 SeitenCost Accouting-JOCAli ImranNoch keine Bewertungen

- Chapter 5 Profit CentersDokument20 SeitenChapter 5 Profit Centers'Osvaldo' Rio75% (4)

- Cost AccountingDokument21 SeitenCost Accountingridon mbayiNoch keine Bewertungen

- Chapter 15Dokument12 SeitenChapter 15Zack ChongNoch keine Bewertungen

- CH - 4 - Responsibility Centers Expense and RevenueDokument117 SeitenCH - 4 - Responsibility Centers Expense and RevenueAj AzisNoch keine Bewertungen

- Hilton 11e Chap001 PPT-STU PDFDokument41 SeitenHilton 11e Chap001 PPT-STU PDFKhánh Linh CaoNoch keine Bewertungen

- Cost AnalysisDokument17 SeitenCost AnalysisBishwajitMazumderNoch keine Bewertungen

- Overhead BudgetDokument16 SeitenOverhead BudgetRonak Singh67% (3)

- Cost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisDokument59 SeitenCost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisHarold Dela Fuente100% (1)

- Accumulating and Assigning Cost To ProductDokument3 SeitenAccumulating and Assigning Cost To ProductAchmad Faizal AzmiNoch keine Bewertungen

- Chapter 5 NotesDokument6 SeitenChapter 5 NotesXenia MusteataNoch keine Bewertungen

- Supplier Payments SampleDokument23 SeitenSupplier Payments SampleAndhika Artha PrayudhaNoch keine Bewertungen

- External Reconstruction DefinitionDokument3 SeitenExternal Reconstruction DefinitionTushar All Rounder67% (3)

- Standard Costs and Balanced Scorecard: Managerial Accounting, Fourth EditionDokument43 SeitenStandard Costs and Balanced Scorecard: Managerial Accounting, Fourth Editionsueern100% (1)

- Activity Based CostingDokument20 SeitenActivity Based CostingImmanuel Sultan Simanjuntak100% (2)

- Management Accouting 1&2 SolutionDokument12 SeitenManagement Accouting 1&2 SolutioniceNoch keine Bewertungen

- Sixty Employees All Cpas of A Local Public Accounting FirmDokument1 SeiteSixty Employees All Cpas of A Local Public Accounting FirmAmit PandeyNoch keine Bewertungen

- Elements of CostDokument17 SeitenElements of CostManikant SAhNoch keine Bewertungen

- Cost Sheet Project - Hindustan Petroleum Corporation LTDDokument20 SeitenCost Sheet Project - Hindustan Petroleum Corporation LTDkuldeep100% (1)

- 10 - Analyzing Financial Performance ReportDokument10 Seiten10 - Analyzing Financial Performance ReportMuhammad Fadli HalimNoch keine Bewertungen

- Chapter 2 - Understanding StrategiesDokument31 SeitenChapter 2 - Understanding StrategiesSarah Laras WitaNoch keine Bewertungen

- CVP AnalysisDokument5 SeitenCVP AnalysisAnne BacolodNoch keine Bewertungen

- UAE Accounting System vs. IFRS Rules.Dokument6 SeitenUAE Accounting System vs. IFRS Rules.Shibam JhaNoch keine Bewertungen

- Activity-Based-CostingDokument37 SeitenActivity-Based-Costingrehanc20Noch keine Bewertungen

- 10-3 GalvorDokument14 Seiten10-3 GalvorAbe RielNoch keine Bewertungen

- Module 1 PDFDokument13 SeitenModule 1 PDFWaridi GroupNoch keine Bewertungen

- Chapter 6 - Using Discounted Cash Flow Analysis To Make Investment DecisionsDokument14 SeitenChapter 6 - Using Discounted Cash Flow Analysis To Make Investment DecisionsSheena Rhei Del RosarioNoch keine Bewertungen

- Applicability of Activity-Based Costing in Services: Case Study in A HotelDokument22 SeitenApplicability of Activity-Based Costing in Services: Case Study in A HotelASIKIN AZIZ100% (9)

- Financial Statement Analysis: K R Subramanyam John J WildDokument40 SeitenFinancial Statement Analysis: K R Subramanyam John J WildManusha ErandiNoch keine Bewertungen

- Cases Chap013Dokument12 SeitenCases Chap013Henry PanNoch keine Bewertungen

- Cost Accounting Unit 1Dokument16 SeitenCost Accounting Unit 1archana_anuragiNoch keine Bewertungen

- Ujian Akhir Semester 2014/2015: Akuntansi InternasionalDokument5 SeitenUjian Akhir Semester 2014/2015: Akuntansi InternasionalRatnaKemalaRitongaNoch keine Bewertungen

- Pilgan Lat UASDokument9 SeitenPilgan Lat UASashilahila04Noch keine Bewertungen

- Managerial or Responsibility Accounting SystemsDokument10 SeitenManagerial or Responsibility Accounting SystemsMuhammad IrshadNoch keine Bewertungen

- Ratio Analysis Synopsis FinalDokument2 SeitenRatio Analysis Synopsis FinaljitenjainNoch keine Bewertungen

- CHAPTER 6 Support Department Cost AllocationDokument22 SeitenCHAPTER 6 Support Department Cost AllocationMudassar Hassan67% (3)

- Latihan Soal AEB Chapter 6Dokument18 SeitenLatihan Soal AEB Chapter 6Arlita RahmaNoch keine Bewertungen

- Ebook Cornerstones of Cost Accounting Canadian 1St Edition Hansen Solutions Manual Full Chapter PDFDokument32 SeitenEbook Cornerstones of Cost Accounting Canadian 1St Edition Hansen Solutions Manual Full Chapter PDFriaozgas3023100% (11)

- Political AspectsDokument4 SeitenPolitical AspectsLorena Tudorascu100% (1)

- European Commission: (Read It From The Book - These Fragments Were Taken From The Chaotic Course Presentations)Dokument2 SeitenEuropean Commission: (Read It From The Book - These Fragments Were Taken From The Chaotic Course Presentations)Lorena TudorascuNoch keine Bewertungen

- Company PresentationDokument2 SeitenCompany PresentationLorena TudorascuNoch keine Bewertungen

- Constitutional Treaty of The European Union AND Related DocumentsDokument56 SeitenConstitutional Treaty of The European Union AND Related DocumentsLorena TudorascuNoch keine Bewertungen

- Draft Eu Constitutional TreatyDokument76 SeitenDraft Eu Constitutional TreatyLorena TudorascuNoch keine Bewertungen

- CHANGE PRESENTATION - Commercial DepartmentDokument3 SeitenCHANGE PRESENTATION - Commercial DepartmentLorena TudorascuNoch keine Bewertungen

- AW OF THE Uropean Nion Utline Rofessor Eiler ALL NIT Uropean Ommunity YstemDokument34 SeitenAW OF THE Uropean Nion Utline Rofessor Eiler ALL NIT Uropean Ommunity YstemLorena TudorascuNoch keine Bewertungen

- Case 41-70Dokument11 SeitenCase 41-70Lorena TudorascuNoch keine Bewertungen

- EU LawDokument2 SeitenEU LawLorena TudorascuNoch keine Bewertungen

- European Parliament V Council of The European CommunitiesDokument3 SeitenEuropean Parliament V Council of The European CommunitiesLorena TudorascuNoch keine Bewertungen

- European Parliament V Council of The European Union. Council Decision 96/664/EC - Promotion of Linguistic Diversity of The Community in The Information Society - Legal BasisDokument4 SeitenEuropean Parliament V Council of The European Union. Council Decision 96/664/EC - Promotion of Linguistic Diversity of The Community in The Information Society - Legal BasisLorena TudorascuNoch keine Bewertungen

- Lorena Cases PT SeminarDokument7 SeitenLorena Cases PT SeminarLorena TudorascuNoch keine Bewertungen

- Council of European UnionDokument5 SeitenCouncil of European UnionLorena TudorascuNoch keine Bewertungen

- X's Cases SeminarDokument7 SeitenX's Cases SeminarLorena TudorascuNoch keine Bewertungen

- History of European Union: The Treaty of Versailles of 1919 Recognised The New Nation-States of Central andDokument5 SeitenHistory of European Union: The Treaty of Versailles of 1919 Recognised The New Nation-States of Central andLorena TudorascuNoch keine Bewertungen

- Legislative Base: WWW - OvidiuioandumitruDokument3 SeitenLegislative Base: WWW - OvidiuioandumitruLorena TudorascuNoch keine Bewertungen

- The European Coal and Steel Community: WWW - OvidiuioandumitruDokument14 SeitenThe European Coal and Steel Community: WWW - OvidiuioandumitruLorena TudorascuNoch keine Bewertungen

- G European ParliamentDokument9 SeitenG European ParliamentLorena TudorascuNoch keine Bewertungen

- The Object of A Juridical RelationDokument2 SeitenThe Object of A Juridical RelationLorena TudorascuNoch keine Bewertungen

- Sources of Law: Rules by Which To Decide Cases?Dokument2 SeitenSources of Law: Rules by Which To Decide Cases?Lorena TudorascuNoch keine Bewertungen

- F EU CouncilDokument3 SeitenF EU CouncilLorena TudorascuNoch keine Bewertungen

- The Juridical Civil Relation: The Civil Relation Always Has A Social Character. It Is A Connection Between Persons. ADokument11 SeitenThe Juridical Civil Relation: The Civil Relation Always Has A Social Character. It Is A Connection Between Persons. ALorena Tudorascu100% (1)

- The Content of The Juridical RelationDokument4 SeitenThe Content of The Juridical RelationLorena TudorascuNoch keine Bewertungen

- The Execution of Civil ObligationsDokument1 SeiteThe Execution of Civil ObligationsLorena TudorascuNoch keine Bewertungen

- Civil Law 3Dokument2 SeitenCivil Law 3Lorena TudorascuNoch keine Bewertungen

- The Main Sources of A Civil Juridical RelationDokument3 SeitenThe Main Sources of A Civil Juridical RelationLorena TudorascuNoch keine Bewertungen

- The Legal PersonDokument5 SeitenThe Legal PersonLorena TudorascuNoch keine Bewertungen

- Civil Law CursuriDokument21 SeitenCivil Law CursuriLorena TudorascuNoch keine Bewertungen

- Proiect Audit - RapoarteDokument28 SeitenProiect Audit - RapoarteLorena TudorascuNoch keine Bewertungen

- Maf151 July 2021Dokument9 SeitenMaf151 July 2021FATIN BATRISYIA MOHD FAZILNoch keine Bewertungen

- ABC Advanced MethodsDokument6 SeitenABC Advanced MethodsMicaiah MasangoNoch keine Bewertungen

- Standard Costing Management Accounting: Fakultas Ekonomi Universitas AndalasDokument8 SeitenStandard Costing Management Accounting: Fakultas Ekonomi Universitas AndalassintaNoch keine Bewertungen

- Chapter 12Dokument9 SeitenChapter 12Gonzales JhayVee100% (2)

- Insem - Qse Ii - Question Bank For StudentsDokument3 SeitenInsem - Qse Ii - Question Bank For StudentsshaolinNoch keine Bewertungen

- Wilkerson Case SolutionDokument4 SeitenWilkerson Case Solutionishan.gandhi1Noch keine Bewertungen

- 2021-10-14 - 10pm - Schedule Optimization Processes - Chris CarsonDokument74 Seiten2021-10-14 - 10pm - Schedule Optimization Processes - Chris CarsonJose Walter MedinaNoch keine Bewertungen

- Unit 3 Overheads - Tutorial SheetDokument4 SeitenUnit 3 Overheads - Tutorial SheetJust for Silly UseNoch keine Bewertungen

- Activity-Based Costing: Sabrina, YY XIE LG508, Tel:28065186 YYXIE@ Hksyu - EduDokument43 SeitenActivity-Based Costing: Sabrina, YY XIE LG508, Tel:28065186 YYXIE@ Hksyu - EduKate CygnetNoch keine Bewertungen

- 06 Standard Costing PDFDokument5 Seiten06 Standard Costing PDFMarielle CastañedaNoch keine Bewertungen

- Flexible Budgets, Standard Costs, and Variance AnalysisDokument90 SeitenFlexible Budgets, Standard Costs, and Variance AnalysisNadia Kartika EkaNoch keine Bewertungen

- Cost Accounting Flashcards - QuizletDokument7 SeitenCost Accounting Flashcards - QuizletWilliam SusetyoNoch keine Bewertungen

- 10 Tips To Job Costing-3Dokument9 Seiten10 Tips To Job Costing-3Sofia Padilla AysanoaNoch keine Bewertungen

- Incremental Analysis Problems 111320Dokument4 SeitenIncremental Analysis Problems 111320KHAkadsbdhsgNoch keine Bewertungen

- CPM - PDF 1Dokument44 SeitenCPM - PDF 1LokeshNoch keine Bewertungen

- Full AssignmentDokument9 SeitenFull AssignmentMumit AhmedNoch keine Bewertungen

- Annual Worth, Capitalized, RorDokument11 SeitenAnnual Worth, Capitalized, RorNaveen KumarNoch keine Bewertungen

- The Vision, Mission, & Values 1.1.VISION: Putoshop-Graham Puto: A Product ConceptDokument23 SeitenThe Vision, Mission, & Values 1.1.VISION: Putoshop-Graham Puto: A Product ConceptMarj Cudal100% (1)

- Business Plan: Simplified Version By: Bryant C. AcarDokument44 SeitenBusiness Plan: Simplified Version By: Bryant C. AcarAbigail DontonNoch keine Bewertungen

- 13 - Relevant Costs For Decision MakingDokument87 Seiten13 - Relevant Costs For Decision MakingrakibNoch keine Bewertungen

- Guideline Answers: Executive ProgrammeDokument94 SeitenGuideline Answers: Executive Programmeblack horseNoch keine Bewertungen

- Mid Term 2ndDokument16 SeitenMid Term 2ndMinh Thư Nguyễn ThịNoch keine Bewertungen

- Property of Asset Pro Training and Development All Right Reserved 2020Dokument10 SeitenProperty of Asset Pro Training and Development All Right Reserved 2020Czar Ysmael RabayaNoch keine Bewertungen

- Analyst GuideDokument825 SeitenAnalyst GuideBearvillaNoch keine Bewertungen

- ExamDokument6 SeitenExamYoDariusNoch keine Bewertungen

- Carola Chemical Inc. Department 2 Cost of Production Report For The Month of December. 19Dokument2 SeitenCarola Chemical Inc. Department 2 Cost of Production Report For The Month of December. 19Melody BautistaNoch keine Bewertungen

- Trial Essay Questions V3 DoneDokument5 SeitenTrial Essay Questions V3 DoneNguyễn Huỳnh ĐứcNoch keine Bewertungen

- Percentage of Sales BudgetsDokument13 SeitenPercentage of Sales BudgetsDavid AwuorNoch keine Bewertungen

- VarianceDokument2 SeitenVarianceKenneth Bryan Tegerero Tegio0% (1)

- Tugas Akuntansi BiayaDokument6 SeitenTugas Akuntansi Biayacathy pisaNoch keine Bewertungen

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindVon EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindBewertung: 5 von 5 Sternen5/5 (231)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassVon EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNoch keine Bewertungen

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (14)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Von EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Bewertung: 4 von 5 Sternen4/5 (33)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantVon EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantBewertung: 4 von 5 Sternen4/5 (104)

- Getting to Yes: How to Negotiate Agreement Without Giving InVon EverandGetting to Yes: How to Negotiate Agreement Without Giving InBewertung: 4 von 5 Sternen4/5 (652)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsVon EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsBewertung: 5 von 5 Sternen5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItVon EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItBewertung: 4.5 von 5 Sternen4.5/5 (14)

- The Best Team Wins: The New Science of High PerformanceVon EverandThe Best Team Wins: The New Science of High PerformanceBewertung: 4.5 von 5 Sternen4.5/5 (31)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineVon EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNoch keine Bewertungen

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Von EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Bewertung: 4.5 von 5 Sternen4.5/5 (14)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsVon EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNoch keine Bewertungen

- How To Budget And Manage Your Money In 7 Simple StepsVon EverandHow To Budget And Manage Your Money In 7 Simple StepsBewertung: 5 von 5 Sternen5/5 (4)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Von EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Bewertung: 5 von 5 Sternen5/5 (89)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsVon EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsBewertung: 4 von 5 Sternen4/5 (7)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetVon EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetBewertung: 4.5 von 5 Sternen4.5/5 (14)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessVon EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessBewertung: 4.5 von 5 Sternen4.5/5 (28)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCVon EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCBewertung: 5 von 5 Sternen5/5 (1)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Von EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeVon EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeBewertung: 4 von 5 Sternen4/5 (21)

- Financial Accounting For Dummies: 2nd EditionVon EverandFinancial Accounting For Dummies: 2nd EditionBewertung: 5 von 5 Sternen5/5 (10)