Beruflich Dokumente

Kultur Dokumente

Steve Bigalow Slides 2

Hochgeladen von

Aaron DrakeCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Steve Bigalow Slides 2

Hochgeladen von

Aaron DrakeCopyright:

Verfügbare Formate

Candlestick Patterns

Advanced Candlestick Patterns

Fry Pan Bottom

Cradle Pattern

Jay-Hook

Scoop Pattern

Belt Hold

Breakout Patterns

Introduction to Advanced

Candlestick Patterns

Fry Pan Bottom

Fry Pan Bottom

The downtrend starts

waning with the

appearance of small

trading bodies

As the trend starts slowly

curling up, a gap up in

price indicates that strong

buying sentiment has

now returned

Fry Pan Bottom minutes, days, months

Long Rounded Curved bottom

Fry Pan Bottom - Past Analysis

Big Percent move at top has a different

meaning when a pattern can be identified

The indecisive rounding bottom is the predominant factor

Candlestick Patterns

Fry Pan Bottom measuring point

Fry Pan Bottom - A Break Out or Failure?

A dimple usually marks

the Halfway point

Easy identification of a failure, which

makes for easy stop loss procedures

Fry Pan Bottom can become a Cup and Handle

CUP

Fry Pan Bottom Exuberant buying

Handle

Want to see break out buying

Or a J-hook pattern

Fry Pan Bottom What is expected?

CLWR Classic FP results

Candlestick Patterns

MICC excellent option trades

VCI Expected results

55% Gain

SQNM Breaking into new highs

INCY What is the entry strategies?

MEOH Option Strategies

SPWRA What does a gap up tell us?

Candlestick Patterns

BAS What do you do with this chart?

MD What pattern?

MGM Next target? Then what?

What do we want to see at the end of a FPB?

What Are we looking for now?

FPB/J-hook classic

Fry Pan Bottom

J-hook

Candlestick Patterns

Cradle Pattern

Cradle pattern

The Cradle Pattern is a symmetric

bottom pattern that is easy to

identify.

A downtrend becomes obvious

with a large black candle at the

bottom.

A series of small or indecisive

trading days trade in a flat area.

A bullish candle, more powerful

with a Bullish Engulfing signal, is

formed of approximately the same

magnitude as a Bearish candle at

the end of the downtrend.

This signifies that the Bulls have

come out of the indecisive trading

area with decisive force.

Cradle Pattern

Cradle Pattern what is the predominant indicators?

Cradle pattern

Cradle Pattern at the MAs

Candlestick Patterns

Cradle pattern

Jay Hook Pattern

The first move of the

uptrend is very strong.

A candlestick sell signal

indicates a pullback about

to occur.

After a few days, small

indecisive candles start to

appear

Doji, small Hammers,

Bullish Engulfing signals

Jay Hook Pattern

The first test becomes the

recent high

Indecision as found in

candlestick sell signals at

the recent high becomes

a quick indicator to get

out of the position

A Bullish candle

breaching the recent high

illustrates that investor

sentiment is taking prices

up

J-hook

Jay Hook Pattern

How to differentiate between profit taking

and a full-scale reversal.

Jay Hook

Candlestick Patterns

J-Hook How to Identify

The pull back is stopped when

Candlestick buy signals appear

J-hook - what is first criteria?

A strong price trend

Stochastics do not get to the

Oversold area

J-Hook with added confirmation

J-Hook Easy Expectations

Indecisive trading at a major moving average

Adds more evidence of a J-hook pattern potential

Scoop Pattern

An extended flat

trading area

Followed by a pullback

Buy signals bring

price back up to flat

trading range

Once price breaks

above flat range, look

for strong uptrend

Scoop Pattern formation

Candlestick Patterns

Scoop Pattern- Completed

Scoop pattern

Scoop pattern off the MAs

Scoop pattern - Do not scan for a Scoop

Scoop pattern Use it to analyze

Scoop Pattern - What should happen upon confirming?

Candlestick Patterns

Scoop Pattern - A strong trend to potential targets

DHI 50 MA resistance?

WY

Mini Scoops

LVS

PCX

Candlestick Patterns

MEE What is the buy criteria?

WYNN

Belthold

Belt Hold Pattern

Strong prevailing trend

The candlestick body

should be the opposite

color of the prevailing

trend

Gap on the open,

continuing the trend

The open is the high or

low of that trend

The length of the body

should be a long body.

Belthold - Adds strength to existing trends

Belthold shows the sellers are flushed out

Candlestick Patterns

Belthold gets rid of the last of the sellers

Belthold

Belthold

Belthold Bearish

Breakouts

Breakout Patterns

Knowing

when to get on

board and when to take

profits.

Candlestick Patterns

Breakouts

Moving

Averages

Support

Breakout where to buy?

Candlestick Patterns

DOW

Analyzing The

Market

MAs support and targets

MAs act as magnets

Candlestick Patterns

MAs and patterns

MAs once breached , will come back and test

MAs Targets

MAs first attempts usually fail

Wave 1-2-3

The T-line

Candlestick Patterns

Trend channels

Trading Gaps

Gaps represent enthusiasm to get into a position

to the point that investors will pay prices away

from any of the previous day's trading range.

Great for identifying panic selling at the bottom

and exuberant buying at the top.

HAR Stop Loss

High Powered Scanning Techniques with Candlesticks

Market trend

Strongest sectors

Strongest signals in those sectors

Additional indicators confirming

Best Target potentials

Easy stop loss points

Analyze best potentials

The Signal

The pattern

Where is it moving from? Mas, trendlines?

Where is the next resistance area?

What is the sector doing?

Money

Management

Eliminate

Emotions

Candlestick Patterns

The Point of investing is to have

the probabilities in your favor!

Candlestick signals provide the

positive probabilities

Candlesticks are merely the

graphic depiction of what

investor sentiment is doing

2008 Downtrend Easy analysis

Trend Analysis

Made easy with

Candlesticks

MAs support to resistance

Sell signals at declining MAs

Double Top at 200 MA

Dumpling Top

Cradle BUY

Double Top at 200 MA

J-hook

Candlestick Patterns

Dumpling Top has expectations

The Bottom Morning Star/Cradle Pattern

J-hook ends with Cradle pattern

What is the market doing Now?

Recent Rec - XTEX

CSIQ

Candlestick Patterns

MIPS buying the BO

CCME buying the J-hook

SOHU buy on BO

Buy when the patterns say to buy - BAS

F signals and MAs

Cradle Pattern indicates very strong uptrend

What was the market doing?

Candlestick Patterns

DOW trend

Signals at the MAs make HP trades

CORN

XIDE buy on BO confirmation

www.candlestickforum.com

WFR signals need confirmation

Das könnte Ihnen auch gefallen

- The Major Candlestick Signals PDFDokument4 SeitenThe Major Candlestick Signals PDFElijahNoch keine Bewertungen

- The Empowered Forex Trader: Strategies to Transform Pains into GainsVon EverandThe Empowered Forex Trader: Strategies to Transform Pains into GainsNoch keine Bewertungen

- LivroDokument163 SeitenLivroLuiz Fernando SilvaNoch keine Bewertungen

- Trading Regime Analysis: The Probability of VolatilityVon EverandTrading Regime Analysis: The Probability of VolatilityBewertung: 3 von 5 Sternen3/5 (1)

- Mastering The Markets (143-184)Dokument42 SeitenMastering The Markets (143-184)Fabi GomesNoch keine Bewertungen

- Simple Profits from Swing Trading: The UndergroundTrader Swing Trading System ExplainedVon EverandSimple Profits from Swing Trading: The UndergroundTrader Swing Trading System ExplainedNoch keine Bewertungen

- Green FlagDokument32 SeitenGreen FlagErezwa100% (1)

- Taming the Bear: The Art of Trading a Choppy MarketVon EverandTaming the Bear: The Art of Trading a Choppy MarketBewertung: 3.5 von 5 Sternen3.5/5 (2)

- Advance Cabdlesticks PatternDokument71 SeitenAdvance Cabdlesticks PatternZULFAKHRIBINZAKARIA100% (1)

- 10-Daytrading Cup BreakoutsDokument5 Seiten10-Daytrading Cup BreakoutsMarvin Zark100% (1)

- Technical Analysis For Short-Term Traders by Martin J. PringDokument104 SeitenTechnical Analysis For Short-Term Traders by Martin J. Pringdag57Noch keine Bewertungen

- Chronicles of a Million Dollar Trader: My Road, Valleys, and Peaks to Final Trading VictoryVon EverandChronicles of a Million Dollar Trader: My Road, Valleys, and Peaks to Final Trading VictoryNoch keine Bewertungen

- Gartman Rules TradingDokument3 SeitenGartman Rules TradingKevin BunyanNoch keine Bewertungen

- Mastery Program Module FiveDokument39 SeitenMastery Program Module FiveJinNoch keine Bewertungen

- Macd PDFDokument15 SeitenMacd PDFsaran21Noch keine Bewertungen

- Darvas Box Explained - Trend Following System For Any Time FrameDokument11 SeitenDarvas Box Explained - Trend Following System For Any Time FrameMae Jumao-asNoch keine Bewertungen

- Bullish J Hook PatternDokument17 SeitenBullish J Hook Patternoguz GUCLUNoch keine Bewertungen

- Hikkake TradingDokument5 SeitenHikkake Tradingnerimarco38Noch keine Bewertungen

- Mastery Program Module ThreeDokument102 SeitenMastery Program Module ThreeJinNoch keine Bewertungen

- The Bottomfishing PatternDokument6 SeitenThe Bottomfishing PatternPiet NijstenNoch keine Bewertungen

- Inside BarDokument5 SeitenInside Barcryslaw100% (2)

- 8 Scientifically Tested Patterns-V1Dokument24 Seiten8 Scientifically Tested Patterns-V1fizzNoch keine Bewertungen

- WWW - Trading-Strategies - Info: Trade When Its Moving and Not A Moment Sooner Break Out TradingDokument57 SeitenWWW - Trading-Strategies - Info: Trade When Its Moving and Not A Moment Sooner Break Out Tradingzitron28Noch keine Bewertungen

- Protect and Grow Capital During Corrections With IvanhoffDokument11 SeitenProtect and Grow Capital During Corrections With IvanhoffaadbosmaNoch keine Bewertungen

- Mastery Program Module TwoDokument149 SeitenMastery Program Module TwoJinNoch keine Bewertungen

- Trendline FlowchartDokument1 SeiteTrendline Flowchartsan RayNoch keine Bewertungen

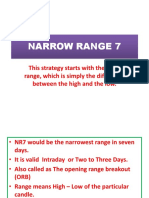

- NR7Dokument18 SeitenNR7RAGHU S100% (1)

- Trade With Least RiskDokument9 SeitenTrade With Least RiskSAM SMITHNoch keine Bewertungen

- Profit BandsDokument12 SeitenProfit BandsAndreea RîşnoveanuNoch keine Bewertungen

- Double-Bottom 102808 PDFDokument16 SeitenDouble-Bottom 102808 PDFanalyst_anil14Noch keine Bewertungen

- Top Technical Patterns For Swing Trading and High-Probability Credit Spreads PDF 181116-1Dokument43 SeitenTop Technical Patterns For Swing Trading and High-Probability Credit Spreads PDF 181116-1analyst_anil14100% (2)

- Keynote Presentation - HandoutsDokument62 SeitenKeynote Presentation - HandoutsRosseyRedNoch keine Bewertungen

- Lesson 7 Bull Call SpreadDokument14 SeitenLesson 7 Bull Call Spreadadms100% (3)

- Triangle Trading MethodDokument14 SeitenTriangle Trading Methodxagus100% (1)

- Quick Fire Lessons in Options TradingDokument101 SeitenQuick Fire Lessons in Options Tradinganalystbank100% (1)

- Turtle Trading MantraDokument1 SeiteTurtle Trading MantraYingyong ChiawchansinNoch keine Bewertungen

- The Power of The ST50 ListDokument13 SeitenThe Power of The ST50 Listivanhoff capitalNoch keine Bewertungen

- STP 1 Foundational Swing Trading Concepts PDFDokument69 SeitenSTP 1 Foundational Swing Trading Concepts PDFDinesh Chaitanya0% (1)

- Trading Flag PatternDokument27 SeitenTrading Flag Patternsudeshjha100% (1)

- The Pristine WayDokument86 SeitenThe Pristine WayLucky Fikile100% (1)

- Hikkake Set UpDokument5 SeitenHikkake Set UpGed WardNoch keine Bewertungen

- Technical Analysis TradingDokument38 SeitenTechnical Analysis Tradingmdajobs100% (1)

- Sanet - ST - 9781949991635 - 9781949991635-Understanding Momentum in Investment Technical AnalysisDokument163 SeitenSanet - ST - 9781949991635 - 9781949991635-Understanding Momentum in Investment Technical AnalysisChan50% (2)

- 2 EditionDokument68 Seiten2 EditionErick Castelo Branco LöweNoch keine Bewertungen

- Price Action MasterclassDokument5 SeitenPrice Action MasterclassBandoler ForexNoch keine Bewertungen

- Pristine Gap TradeDokument1 SeitePristine Gap TradeWuU2345Noch keine Bewertungen

- 01 - The Truth About Support and ResistanceDokument11 Seiten01 - The Truth About Support and ResistanceIv AnNoch keine Bewertungen

- Trading Manual by Tom Hougaard NEW BRANDINGDokument72 SeitenTrading Manual by Tom Hougaard NEW BRANDINGmihaib2007100% (6)

- Tradingstrategyguides All Strategies Forex Strategies Indicator Strategies Indicators 0 CommentsDokument5 SeitenTradingstrategyguides All Strategies Forex Strategies Indicator Strategies Indicators 0 CommentsLucaNoch keine Bewertungen

- Trading Survival 101Dokument44 SeitenTrading Survival 101Ñîwrê ÑwrNoch keine Bewertungen

- Our Top 3 Swing Trading Setups: Deron WagnerDokument36 SeitenOur Top 3 Swing Trading Setups: Deron Wagnerανατολή και πετύχετεNoch keine Bewertungen

- Expert Trader 93 Trading Lessons of Richard Wyckoff by Frank MarshallDokument27 SeitenExpert Trader 93 Trading Lessons of Richard Wyckoff by Frank MarshallrtikNoch keine Bewertungen

- Bull Trap Pattern Strategy PDFDokument6 SeitenBull Trap Pattern Strategy PDFMeechokChokdee100% (1)

- How To Trade With 5 Minute Charts - Learn The SetupsDokument18 SeitenHow To Trade With 5 Minute Charts - Learn The SetupsAnshuman GuptaNoch keine Bewertungen

- Gavin's VSA Trading Plan - Extended Edition (Tom Williams Additional Comments)Dokument10 SeitenGavin's VSA Trading Plan - Extended Edition (Tom Williams Additional Comments)Govind SinghNoch keine Bewertungen

- TraderSimon - 7 Essential Tips To Improve Your TradingDokument39 SeitenTraderSimon - 7 Essential Tips To Improve Your TradingTraderSimon100% (2)

- 1 How To Trade Breakouts Like A ProDokument6 Seiten1 How To Trade Breakouts Like A ProNasruLlaah Abdulkadir JaziirNoch keine Bewertungen

- OV-TALKS-007-Why Do You Always End Up Losing (Text)Dokument9 SeitenOV-TALKS-007-Why Do You Always End Up Losing (Text)Aaron DrakeNoch keine Bewertungen

- 109 Sakamoto Ryuichi Railroad ManDokument4 Seiten109 Sakamoto Ryuichi Railroad ManAaron DrakeNoch keine Bewertungen

- OV-TALKs-002-This Is Exactly How I Became A Profitable TraderDokument6 SeitenOV-TALKs-002-This Is Exactly How I Became A Profitable TraderAaron DrakeNoch keine Bewertungen

- JMHs-002-piano-01-AKB48-Kimi Wa MelodyDokument4 SeitenJMHs-002-piano-01-AKB48-Kimi Wa MelodyAaron DrakeNoch keine Bewertungen

- 070-Haha To (Sakamoto R)Dokument2 Seiten070-Haha To (Sakamoto R)Aaron DrakeNoch keine Bewertungen

- A.W.cohen - Three Point Reversal Method of Point & Figure Stock Market TradingDokument132 SeitenA.W.cohen - Three Point Reversal Method of Point & Figure Stock Market Tradingdilipp_2100% (8)

- A Complete Guide To Volume Price Analysi - A. CoullingDokument242 SeitenA Complete Guide To Volume Price Analysi - A. CoullingGiundat Giun Dat97% (129)

- 018 AKB48 365dayDokument4 Seiten018 AKB48 365dayAaron DrakeNoch keine Bewertungen

- Beginners Guide To Short Selling With Toni TurnerDokument28 SeitenBeginners Guide To Short Selling With Toni Turnermasktusedo785Noch keine Bewertungen

- Happy EndDokument4 SeitenHappy EndAaron DrakeNoch keine Bewertungen

- 004 - Distance Eveyday's Memories (2018 Ed)Dokument4 Seiten004 - Distance Eveyday's Memories (2018 Ed)Aaron DrakeNoch keine Bewertungen

- 001 End ThemeDokument3 Seiten001 End ThemeAaron DrakeNoch keine Bewertungen

- Ott Man Notes BK 1 FinalDokument73 SeitenOtt Man Notes BK 1 FinalAaron DrakeNoch keine Bewertungen

- Alan Farley-Targeting Profitable Entry & Exit Points PDFDokument29 SeitenAlan Farley-Targeting Profitable Entry & Exit Points PDFAaron DrakeNoch keine Bewertungen

- Top 10 Chart PatternsDokument25 SeitenTop 10 Chart Patternsthakkarps50% (2)

- 4 Categories of Brain Wave PatternsDokument1 Seite4 Categories of Brain Wave PatternsAaron DrakeNoch keine Bewertungen

- The Trader Business PlanDokument4 SeitenThe Trader Business Planmitesh100% (4)

- E. Prout-Harmony PDFDokument268 SeitenE. Prout-Harmony PDFAaron DrakeNoch keine Bewertungen

- Clear Emotional ClutterDokument4 SeitenClear Emotional ClutterAaron DrakeNoch keine Bewertungen

- 2014 Ms Gift01!01!01 C Howard SevenkeysDokument2 Seiten2014 Ms Gift01!01!01 C Howard SevenkeysCristina CobzaruNoch keine Bewertungen

- 0301 Diatonic Seventh ChordsDokument1 Seite0301 Diatonic Seventh ChordsAaron DrakeNoch keine Bewertungen

- 0103 Rhythm NotationDokument1 Seite0103 Rhythm NotationAaron DrakeNoch keine Bewertungen

- Why You'Re Losing SalesDokument2 SeitenWhy You'Re Losing SalesAaron DrakeNoch keine Bewertungen

- Magnetic Marketing ChecklistDokument1 SeiteMagnetic Marketing ChecklistAaron Drake100% (1)

- Thomas Bulkowski-Chart Pattern Surpries (6 Pages)Dokument6 SeitenThomas Bulkowski-Chart Pattern Surpries (6 Pages)Aaron Drake100% (6)

- 10 Minute Money MakersDokument75 Seiten10 Minute Money MakersAaron Drake100% (1)

- Deck The Halls Level1 PDF With VideoDokument1 SeiteDeck The Halls Level1 PDF With VideoAaron DrakeNoch keine Bewertungen

- Instruments of The Orchestra 2Dokument24 SeitenInstruments of The Orchestra 2Keron Smith100% (1)

- Risk PoolingDokument3 SeitenRisk PoolingÄyušheë TŸagïNoch keine Bewertungen

- Chapter 8 - Digital MarketingDokument58 SeitenChapter 8 - Digital MarketingReno Soank100% (1)

- Allyah Paula A. Postor MKTG 2216 Bs Entrep 2-2 Case Let #1Dokument2 SeitenAllyah Paula A. Postor MKTG 2216 Bs Entrep 2-2 Case Let #1Allyah Paula PostorNoch keine Bewertungen

- 1st Exam Chapter 11Dokument9 Seiten1st Exam Chapter 11Imma Therese YuNoch keine Bewertungen

- 111Dokument2 Seiten111СергейNoch keine Bewertungen

- QUESTION:-Discuss The Limitations of The Barter System. in Light of These Limitations, Explain How Many Evolve and It's Various FunctionsDokument5 SeitenQUESTION:-Discuss The Limitations of The Barter System. in Light of These Limitations, Explain How Many Evolve and It's Various FunctionstempNoch keine Bewertungen

- ASX Index - Options PDFDokument2 SeitenASX Index - Options PDFZolo ZoloNoch keine Bewertungen

- Reading 30 Central ClearingDokument5 SeitenReading 30 Central ClearingRahul GuptaNoch keine Bewertungen

- CUEGIS AssignmentDokument4 SeitenCUEGIS AssignmentNaheel AyeshNoch keine Bewertungen

- CATC DL Ch06 E Commerce FundamentalsDokument16 SeitenCATC DL Ch06 E Commerce Fundamentals01-11-09 ธีรายุ ฟื้นหัวสระNoch keine Bewertungen

- Finance AssignmentDokument7 SeitenFinance AssignmentMeshack MateNoch keine Bewertungen

- Shapiro CHAPTER 6 SolutionsDokument10 SeitenShapiro CHAPTER 6 SolutionsjzdoogNoch keine Bewertungen

- Environmental Scanning EtopDokument37 SeitenEnvironmental Scanning Etopaksr27Noch keine Bewertungen

- Unit 7 Business StrategyDokument12 SeitenUnit 7 Business StrategyRameza RahmanNoch keine Bewertungen

- Beams11 ppt09Dokument19 SeitenBeams11 ppt09Mario RosaNoch keine Bewertungen

- The Situation - Managerial Economics Chapt 1Dokument7 SeitenThe Situation - Managerial Economics Chapt 1hamna ikramNoch keine Bewertungen

- New Projects Available 2014Dokument14 SeitenNew Projects Available 2014sirfanalizaidiNoch keine Bewertungen

- Accounting: Stern CorporationDokument12 SeitenAccounting: Stern CorporationCamelia Indah Murniwati100% (3)

- Edge Ratio of Nifty For Last 15 Years On Donchian ChannelDokument8 SeitenEdge Ratio of Nifty For Last 15 Years On Donchian ChannelthesijNoch keine Bewertungen

- Debate Bahasa Inggris LMDokument8 SeitenDebate Bahasa Inggris LMJonathanNoch keine Bewertungen

- Pampa Energia S.A.: Price, Consensus & SurpriseDokument1 SeitePampa Energia S.A.: Price, Consensus & SurpriseoaperuchenaNoch keine Bewertungen

- Maurice Levin Resume CV 2017Dokument1 SeiteMaurice Levin Resume CV 2017Maurice LevinNoch keine Bewertungen

- GeraDokument2 SeitenGeraAnonymousNoch keine Bewertungen

- Soal B Inggris Form Andhika Xiii Mipa 6 02Dokument3 SeitenSoal B Inggris Form Andhika Xiii Mipa 6 02Andhika MeyerNoch keine Bewertungen

- Topic 3 Assessment: Liquidation Value Per ShareDokument1 SeiteTopic 3 Assessment: Liquidation Value Per SharePhebe LagutaoNoch keine Bewertungen

- Supermom Indonesia Credential DeckDokument24 SeitenSupermom Indonesia Credential DeckAstri WardhaniNoch keine Bewertungen

- I Title Page Ii Declaration Iiicertificate of The Organisation Ivcertificate of The Institution V Acknowledgement Vi Contents Vii List of Tables and ChartsDokument27 SeitenI Title Page Ii Declaration Iiicertificate of The Organisation Ivcertificate of The Institution V Acknowledgement Vi Contents Vii List of Tables and ChartssandpalanNoch keine Bewertungen

- A Cash Flow Mapping ProcedureDokument2 SeitenA Cash Flow Mapping Procedurethava477cegNoch keine Bewertungen

- Qualitative Methods Quantitativ e Methods: DefinitionDokument11 SeitenQualitative Methods Quantitativ e Methods: Definitionvinay dugarNoch keine Bewertungen

- Distribution Channel PepsiDokument5 SeitenDistribution Channel PepsiNikhil AbhyankarNoch keine Bewertungen