Beruflich Dokumente

Kultur Dokumente

State Bank of India: Unaudited Financial Results For The Period Ended 30Th June 2008

Hochgeladen von

Rajat PaniOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

State Bank of India: Unaudited Financial Results For The Period Ended 30Th June 2008

Hochgeladen von

Rajat PaniCopyright:

Verfügbare Formate

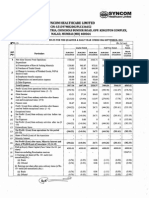

STATE BANK OF INDIA

Central Office, Mumbai - 400 021.

UNAUDITED FINANCIAL RESULTS FOR THE PERIOD ENDED 30TH JUNE 2008

(Rs.in crores)

State Bank of India

Quarter ended

30.06.2008

30.06.2007

(Reviewed)

(Reviewed)

Particulars

Interest Earned (a) + (b) + (c) + (d)

(a) Interest/discount on advances / bills

(b) Income on Investments

State Bank of India (Consolidated)

Year ended

31.03.2008

(Audited)

Quarter ended

30.06.2008

30.06.2007

(Reviewed)

(Reviewed)

Year ended

31.03.2008

(Audited)

13799.20

10013.99

3507.94

11090.50

7988.52

2598.43

48950.31

35228.11

11944.16

20224.08

14819.26

5055.22

16300.04

11851.26

3851.21

71495.82

51920.07

17406.32

207.07

70.20

496.98

6.57

1200.08

577.96

253.56

96.04

577.14

20.43

1442.55

726.88

2403.87

16203.07

1138.59

12229.09

8694.93

57645.24

3523.35

23747.43

2582.53

18882.57

18722.99

90218.81

(c) Interest on balances with Reserve Bank of India

and other inter bank funds

(d) Others

2

Other Income

TOTAL INCOME (1+2)

Interest Expended

8981.54

6889.12

31929.08

13509.96

10447.44

47944.04

Operating Expenses (i) + (ii)

3259.19

2130.95

1128.24

2978.51

2026.37

952.14

12608.61

7785.87

4822.74

5068.51

2873.78

2194.73

5085.46

2773.86

2311.60

23943.23

10457.51

13485.72

12240.73

9867.63

44537.69

18578.47

15532.90

71887.27

3962.34

2361.46

13107.55

5168.96

3349.67

18331.54

1549.47

-247.40

0.00

2412.87

772.08

1640.79

0.00

1640.79

159.37

506.24

0.00

2202.09

776.28

1425.81

0.00

1425.81

2668.65

2000.94

0.00

10438.90

3709.78

6729.12

0.00

6729.12

2640.28

-97.06

0.00

2528.68

848.65

1680.03

0.00

1680.03

39.11

1640.92

387.33

708.19

0.00

2962.34

1038.70

1923.64

0.00

1923.64

61.98

1861.66

4340.97

2804.05

0.00

13990.57

4777.73

9212.84

0.00

9212.84

252.23

8960.61

634.88

526.30

631.47

634.88

526.30

631.47

48401.19

30503.66

48401.19

60604.91

41691.86

60604.91

59.41%

12.99%

59.73%

13.13%

59.73%

13.54%

59.41%

59.73%

59.73%

13.49%

(i)

Employee cost

(ii)

Other Operating Expenses

TOTAL EXPENDITURE (4) + (5)

(excluding Provisions and Contingencies)

OPERATING PROFIT (3 - 6)

(before Provisions and Contingencies)

Provisions (other than tax) and Contingencies (net of write-back)

--- of which provisions for Non-performing assets

Exceptional Items

10

Profit from Ordinary Activities before tax (7-8-9)

11

Tax expenses

12

Net Profit from Ordinary Activities after tax (10-11)

13

Extraordinary items (net of tax expense)

14

Net Profit for the period (12-13)

15

Net Profit after Minority Interest

16

Paid-up equity share capital

Share of Minority

(Face Value of Rs. 10 per share)

17

Reserves excluding Revaluation Reserves

(as per balance sheet of previous accounting year)

18

Analytical Ratios

(i)

Percentage of shares held by Government of India

(ii)

Capital Adequacy Ratio

(iii) Earnings Per Share (EPS) (in Rs.)

(a) Basic and diluted EPS before Extraordinary items (net of tax

expense)

(b) Basic and diluted EPS after Extraordinary items

25.92

27.03

(not annualised)

(not annualised)

25.92

27.03

126.62

(not annualised)

(not annualised)

11408.12

6298.43

2.54%

1.42%

0.85%

11380.43

5504.61

3.30%

1.62%

0.94%

13599.49

7424.34

3.21%

1.78%

1.01%

257673022

40.59%

211959678

40.27%

254263176

40.27%

25.92

(not annualised)

126.62

25.92

(not annualised)

35.29

35.29

(not annualised)

(iv) NPA Ratios

(a) Amount of gross non-performing assets

(b) Amount of net non-performing assets

(c) % of gross NPAs

(d) % of net NPAs

(v)

19

Return on Assets (Annualised)

Public Shareholding

--- No. of shares

--- Percentage of Shareholding

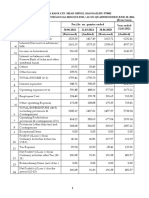

Unaudited Segment-wise Revenue, Results and Capital Employed

(Rs.in crores)

Quarter ended

30.06.2008

30.06.2007

Particulars

1

Year ended

31.03.2008

Segment Revenue (income)

a

Treasury Operations

Corporate / Wholesale Banking Operations

Retail Banking Operations

4328.90

4413.93

7460.24

0.00

16203.07

Less Inter Segmental

Total

2

2319.17

12848.40

2938.48

12229.09

13982.33

15662.77

27654.45

0.00

57299.55

Segment Results (Profit before tax)

a

Treasury Operations

Corporate / Wholesale Banking Operations

Retail Banking Operations

Total

Add / (Less) : Unallocated

Operating Profit

Less : Tax

-816.86

1028.11

2627.93

2839.18

-426.31

-316.71

2885.37

2568.66

-366.57

2412.87

772.08

2202.09

776.28

1640.79

1425.81

13166.77

29478.56

6387.33

49032.66

3399.94

Less : Extraordinary Profit / Loss

Net Profit

3

1230.76

4961.26

5617.52

11809.54

-1370.64

10438.90

3709.78

0.00

6729.12

Capital Employed (Segment Assets - Segment Liabilities)

a

Treasury Operations

Corporate / Wholesale Banking Operations

Retail Banking Operations

Total

27898.62

31298.56

13166.77

29478.56

6387.33

49032.66

1. Capital Employed are as on 31st March of the previous year

2. The segment information is a compiled by the management and relied upon by the auditors.

The above results have been approved by the Central Board of the Bank on the 26th July 2008 and were subjected to Review by the Auditors.

Mumbai

Date : 26.07.2008

S. K. BHATTACHARYYA

Managing Director and Chief Credit & Risk Officer

168.61

(not annualised)

O. P. BHATT

Chairman

page 1 of 3.

168.61

Das könnte Ihnen auch gefallen

- Corporate Centre, Mumbai - 400 021: State Bank of IndiaDokument1 SeiteCorporate Centre, Mumbai - 400 021: State Bank of IndiajoshijaysoftNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Result)Dokument5 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Havells Annual ReportDokument1 SeiteHavells Annual ReportSatyaki DeyNoch keine Bewertungen

- Mothersum Standalone Results Q3 FY2012Dokument4 SeitenMothersum Standalone Results Q3 FY2012kpatil.kp3750Noch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Axis Bank: Regd. Office: Trishul', 3 Floor, Opp. Samartheshwar Temple, Law Garden, Ellisbridge, Ahmedabad - 380 006Dokument3 SeitenAxis Bank: Regd. Office: Trishul', 3 Floor, Opp. Samartheshwar Temple, Law Garden, Ellisbridge, Ahmedabad - 380 006alayprajapatiNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- STATE BANK OF INDIA FINANCIAL RESULTS 2009Dokument1 SeiteSTATE BANK OF INDIA FINANCIAL RESULTS 2009Rekha BaiNoch keine Bewertungen

- Financial Results For June 30, 2015 (Standalone) (Result)Dokument2 SeitenFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- SEBI PAPER PUB 30 06 2021 FINAL (27 07 2021) FDokument20 SeitenSEBI PAPER PUB 30 06 2021 FINAL (27 07 2021) FYathish Us ThodaskarNoch keine Bewertungen

- Updates On Financial Results & Limited Review Report For Sept 30, 2015 (Result)Dokument4 SeitenUpdates On Financial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Fin ResultsDokument2 SeitenFin Resultsparimal2010Noch keine Bewertungen

- Cielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Dokument71 SeitenCielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)b21t3chNoch keine Bewertungen

- Cielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Dokument58 SeitenCielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)b21t3ch0% (1)

- Review Report 311210Dokument1 SeiteReview Report 311210Hriday PandeyNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Dokument2 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNoch keine Bewertungen

- Balance Sheet: Titan Industries LimitedDokument4 SeitenBalance Sheet: Titan Industries LimitedShalini ShreyaNoch keine Bewertungen

- Bodie Industrial SupplyDokument14 SeitenBodie Industrial SupplyHectorZaratePomajulca100% (2)

- Common Size P&LDokument1 SeiteCommon Size P&Lyuvrajsoni17112001Noch keine Bewertungen

- Consolidated Financial HighlightsDokument1 SeiteConsolidated Financial HighlightsMuvin KoshtiNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- q209 - Airtel Published FinancialsDokument7 Seitenq209 - Airtel Published Financialsmixedbag100% (2)

- City Union Bank Audited Results for Q2 FY2011Dokument2 SeitenCity Union Bank Audited Results for Q2 FY2011Ram KumarNoch keine Bewertungen

- Tata Steel Q3 FY13 ResultsDokument6 SeitenTata Steel Q3 FY13 ResultsVaibhav BindrooNoch keine Bewertungen

- Sep 2010-Audited ResultsDokument2 SeitenSep 2010-Audited Resultssalilsingh86Noch keine Bewertungen

- Comparative Income StatementsDokument68 SeitenComparative Income StatementsajjansiNoch keine Bewertungen

- Standalone Q1 Results and Segment DataDokument6 SeitenStandalone Q1 Results and Segment Datamariyathai_1Noch keine Bewertungen

- Rain Calcining Limited: Audited Financial Results For The Quarter Ended June 30, 2004Dokument1 SeiteRain Calcining Limited: Audited Financial Results For The Quarter Ended June 30, 2004nitin2khNoch keine Bewertungen

- Mlabs Systems BerhadDokument4 SeitenMlabs Systems BerhadMary FlmNoch keine Bewertungen

- Financial Results For June 30, 2015 (Standalone) (Result)Dokument2 SeitenFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Dolat: Algoieg-IlimitedDokument14 SeitenDolat: Algoieg-IlimitedPãräs PhútélàNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Business ValuationDokument2 SeitenBusiness Valuationjrcoronel100% (1)

- Central Bank India quarterly resultsDokument1 SeiteCentral Bank India quarterly resultsgtnjlsngh338Noch keine Bewertungen

- SIDBI Financial Result DEC 2010 EnglishDokument2 SeitenSIDBI Financial Result DEC 2010 EnglishSunil GuptaNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Segment Reporting (Rs. in Crore)Dokument8 SeitenSegment Reporting (Rs. in Crore)Tushar PanhaleNoch keine Bewertungen

- 2009-10 Annual ResultsDokument1 Seite2009-10 Annual ResultsAshish KadianNoch keine Bewertungen

- I Practice of Horizontal & Verticle Analysis Activity IDokument3 SeitenI Practice of Horizontal & Verticle Analysis Activity IZarish AzharNoch keine Bewertungen

- I Practice of Horizontal & Verticle Analysis Activity IDokument3 SeitenI Practice of Horizontal & Verticle Analysis Activity IZarish AzharNoch keine Bewertungen

- ITC Annual Report Contents SummaryDokument10 SeitenITC Annual Report Contents SummaryRohit singhNoch keine Bewertungen

- Sintex Industries LimitedDokument14 SeitenSintex Industries Limitednaresh kayadNoch keine Bewertungen

- Indoco Remedies Limited Audited Financial Results for FY 2008-09Dokument1 SeiteIndoco Remedies Limited Audited Financial Results for FY 2008-09Nikhil RanaNoch keine Bewertungen

- JOLLIBEE FOODS CORPORATION AND SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION AND COMPREHENSIVE INCOMEDokument86 SeitenJOLLIBEE FOODS CORPORATION AND SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION AND COMPREHENSIVE INCOMERose Jean Raniel Oropa63% (16)

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument2 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- GAR02 28 02 2024 FY2023 Results ReleaseDokument29 SeitenGAR02 28 02 2024 FY2023 Results Releasedesifatimah87Noch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Persistent Systems - 31st Annual Report 2020-21Dokument2 SeitenPersistent Systems - 31st Annual Report 2020-21Ashwin GophanNoch keine Bewertungen

- Unaudited Financial Results Q2 FY2022 23 Bandhan BankDokument6 SeitenUnaudited Financial Results Q2 FY2022 23 Bandhan BankPradyut RoyNoch keine Bewertungen

- VerticleDokument2 SeitenVerticleWasi AliNoch keine Bewertungen

- Q1 FY09 TablesDokument3 SeitenQ1 FY09 TablesPerminder Singh KhalsaNoch keine Bewertungen

- Karnataka Bank Results Sep12Dokument6 SeitenKarnataka Bank Results Sep12Naveen SkNoch keine Bewertungen

- BSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerDokument9 SeitenBSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerABHIRAJ PARMARNoch keine Bewertungen

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Rbiformat 092009Dokument1 SeiteRbiformat 092009Ketan VermaNoch keine Bewertungen

- Consolidated Financial Results For March 31, 2016 (Result)Dokument3 SeitenConsolidated Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- 6month Audited ResultsDokument2 Seiten6month Audited ResultsJessica HarveyNoch keine Bewertungen

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosVon EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNoch keine Bewertungen

- Nts Exam 2015 PressnoteDokument8 SeitenNts Exam 2015 PressnoteRajat PaniNoch keine Bewertungen

- Invoice Processing ModelDokument4 SeitenInvoice Processing ModelRajat PaniNoch keine Bewertungen

- 14.chemical Effects of CurrentDokument2 Seiten14.chemical Effects of CurrentRajat PaniNoch keine Bewertungen

- Six Sigma Class NotesDokument1 SeiteSix Sigma Class NotesRajat PaniNoch keine Bewertungen

- Mensa AnsDokument1 SeiteMensa AnsqueescorpNoch keine Bewertungen

- A. Choose The Most Appropriate OptionDokument2 SeitenA. Choose The Most Appropriate OptionRajat PaniNoch keine Bewertungen

- A. Choose The Most Appropriate OptionDokument2 SeitenA. Choose The Most Appropriate OptionRajat PaniNoch keine Bewertungen

- Measuring C2C in Shrimp Supply ChainsDokument6 SeitenMeasuring C2C in Shrimp Supply ChainsNancy SherboNoch keine Bewertungen

- Complete air pollution and water pollution quizDokument1 SeiteComplete air pollution and water pollution quizRajat PaniNoch keine Bewertungen

- 1.crop ManagementDokument2 Seiten1.crop ManagementShreyansh DuggarNoch keine Bewertungen

- Solver Version of The Bpo Travel Cost DataDokument4 SeitenSolver Version of The Bpo Travel Cost DataRajat PaniNoch keine Bewertungen

- Feedback FormDokument2 SeitenFeedback FormRajat PaniNoch keine Bewertungen

- How to become an aeronautical engineer - entrance exams, eligibility and collegesDokument1 SeiteHow to become an aeronautical engineer - entrance exams, eligibility and collegesSharique AlamNoch keine Bewertungen

- Kanbay Software .: Kanbay Exam Conducted On 2nd Aug 2003Dokument8 SeitenKanbay Software .: Kanbay Exam Conducted On 2nd Aug 2003Rajat PaniNoch keine Bewertungen

- Daily ReportDokument3 SeitenDaily ReportSuhail100% (1)

- tIER 1 pAPERDokument129 SeitentIER 1 pAPERRajat PaniNoch keine Bewertungen

- Can No One Tell Me Why The Below Arguments Are WrongDokument1 SeiteCan No One Tell Me Why The Below Arguments Are WrongRajat PaniNoch keine Bewertungen

- Analysis of PaperDokument5 SeitenAnalysis of PaperRajat PaniNoch keine Bewertungen

- Technical QuestionDokument3 SeitenTechnical QuestionRajat PaniNoch keine Bewertungen

- Vocabulary 1Dokument1 SeiteVocabulary 1Go GoNoch keine Bewertungen

- Electrical and CommunicationDokument3 SeitenElectrical and CommunicationRajat PaniNoch keine Bewertungen

- ListingsDokument18 SeitenListingsRajat PaniNoch keine Bewertungen

- Computer PapersDokument112 SeitenComputer PapersRajat PaniNoch keine Bewertungen

- Technical LearningDokument6 SeitenTechnical LearningRajat PaniNoch keine Bewertungen

- ProgrammingDokument31 SeitenProgrammingRajat PaniNoch keine Bewertungen

- CSEDokument3 SeitenCSEssand531Noch keine Bewertungen

- Technical Questions 4Dokument5 SeitenTechnical Questions 4Rajat PaniNoch keine Bewertungen

- Brouchure-2012 PG 1-35 OkDokument35 SeitenBrouchure-2012 PG 1-35 Okviratdubey0071989Noch keine Bewertungen

- Sample GRE and technical interview questionsDokument32 SeitenSample GRE and technical interview questionsRajat PaniNoch keine Bewertungen

- Brouchure-2012 PG 1-35 OkDokument35 SeitenBrouchure-2012 PG 1-35 Okviratdubey0071989Noch keine Bewertungen

- Feasibility Report of BakeryDokument43 SeitenFeasibility Report of BakeryEdz Medina0% (1)

- Celebrity EndorsementDokument13 SeitenCelebrity EndorsementMuhammad ZeshanNoch keine Bewertungen

- Wess 2007Dokument212 SeitenWess 2007a10family10Noch keine Bewertungen

- CE533-Chp3-Nominal RateDokument54 SeitenCE533-Chp3-Nominal RateSayamol PetchpraphanNoch keine Bewertungen

- Delink 20150914Dokument1 SeiteDelink 20150914Anonymous BRczTdJTDvNoch keine Bewertungen

- 1 Analysis of Gold Loan Business of K.S.F.EDokument77 Seiten1 Analysis of Gold Loan Business of K.S.F.EArun OusephNoch keine Bewertungen

- Introduction of Philip CapitalDokument4 SeitenIntroduction of Philip CapitalAbhishek SinhaNoch keine Bewertungen

- Intercompany Inventory TransfersDokument31 SeitenIntercompany Inventory TransfersAudrey Louelle100% (2)

- Forex 1Dokument24 SeitenForex 1Ashutosh Singh YadavNoch keine Bewertungen

- A Project Report ON " Quantitative Analysis of Retail InvestorsDokument52 SeitenA Project Report ON " Quantitative Analysis of Retail InvestorsSahil DhimanNoch keine Bewertungen

- Income from Business or Profession GuideDokument24 SeitenIncome from Business or Profession GuideRahulMalikNoch keine Bewertungen

- Strategic ManagementDokument75 SeitenStrategic ManagementIti Sharma100% (1)

- Guide To US AML Requirements 5thedition ProtivitiDokument474 SeitenGuide To US AML Requirements 5thedition ProtiviticheejustinNoch keine Bewertungen

- What Is An Extended TrialDokument19 SeitenWhat Is An Extended TrialocalmaviliNoch keine Bewertungen

- Strategic Business Planning For LGUsDokument108 SeitenStrategic Business Planning For LGUsMark GlennNoch keine Bewertungen

- WEF Alternative Investments 2020 FutureDokument59 SeitenWEF Alternative Investments 2020 FutureOwenNoch keine Bewertungen

- Types of Mutual Funds Based on Asset Class, Structure, Goals and RiskDokument5 SeitenTypes of Mutual Funds Based on Asset Class, Structure, Goals and RiskVishal DudejaNoch keine Bewertungen

- Apr 2013 PDFDokument36 SeitenApr 2013 PDFLuzuko Terence NelaniNoch keine Bewertungen

- ENTRE2 ND GroupDokument66 SeitenENTRE2 ND Groupit is meNoch keine Bewertungen

- Problems On Inventory Control With AnswerDokument5 SeitenProblems On Inventory Control With AnswerPrashant Kanaujia100% (1)

- AnnualReport2010 UKDokument152 SeitenAnnualReport2010 UKsonystdNoch keine Bewertungen

- Written Case Analysis - AmfacDokument3 SeitenWritten Case Analysis - AmfacjobimleeNoch keine Bewertungen

- Chapter 2 Macro SolutionDokument16 SeitenChapter 2 Macro Solutionsaurabhsaurs80% (10)

- Keynesian TheoryDokument98 SeitenKeynesian TheorysamrulezzzNoch keine Bewertungen

- Business Process Reengineering Case Study On K.M. Birla Name-Aman Narula Roll No - 306Dokument2 SeitenBusiness Process Reengineering Case Study On K.M. Birla Name-Aman Narula Roll No - 306amanNoch keine Bewertungen

- Chronocrator XL ManualDokument30 SeitenChronocrator XL ManualDiego Ratti100% (2)

- Business Cycle ProjectDokument7 SeitenBusiness Cycle ProjectUmer KhanNoch keine Bewertungen

- Excercises For Transaction AnalysisDokument4 SeitenExcercises For Transaction AnalysisAhmed Muhamed AkrawiNoch keine Bewertungen

- Arkansas Business Rankings: Wealthiest Arkansas Families.Dokument64 SeitenArkansas Business Rankings: Wealthiest Arkansas Families.gamypoet3380Noch keine Bewertungen

- Lesson7 - The Accounting EquationDokument4 SeitenLesson7 - The Accounting EquationArven Dulay60% (5)