Beruflich Dokumente

Kultur Dokumente

Policy Implications of Backward Linkages in Bangladesh's Readymade Garment Industry

Hochgeladen von

fazlayOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Policy Implications of Backward Linkages in Bangladesh's Readymade Garment Industry

Hochgeladen von

fazlayCopyright:

Verfügbare Formate

Volume 6, Issue 2, Fall2009

Backward Linkages in Readymade Garment Industry of Bangladesh: Appraisal and Policy

Implications

Md. Rakib Ibne Habib, MBA, PhD

Newport University & London Metropolitan University

MBA, PGD in Personnel Management,

PGC in Computer Science & PhD

rakibhabib@yahoo.co.uk

ABSTRACT

In global apparel markets, international buyers place an order with competitive pricing along

with shortest possible lead time. For Bangladesh, lead time is fast emerging as a serious

bottleneck. Backward linkages are playing major part of a garment industry to reduce lead time

and offer competitive price in the international market. It is inevitable that one of the major

issues of success in readymade garment (RMG) industry in Bangladesh must depend on

backward linkage conditions, support, and strategy formulation. This paper briefly discusses the

present condition of backward integration, needs for further development within respect to Post

Multi-fiber Arrangement (MFA) situation in the RMG industry in Bangladesh. This paper will

focus on policy implication on backward Linkage sub-sectors in respect of free trade apparel

market.

Keywords: Readymade garment industry, Bangladesh garment industry, policy formulation,

backward integration.

overall impact of the readymade garment

exports is certainly one of the most

significant

social

and

economic

developments in contemporary Bangladesh.

Because the economy of Bangladesh largely

depends on the RMG sector, in short, this

sector is still considered as the lifeline of the

Bangladesh's economy and plays an

indispensable role for the social stability of

the country.

Introduction

The performance of the readymade garment

(RMG) sector has been one of the most

notable success stories of the Bangladesh

economy over the last two decades. Nearly

two million women workers were directly

and more than ten million habitants were

indirectly associated with this industry. Over

the past twenty years, the number of

manufacturing industries grew from 180 to

over 3600. On the average this sector alone

fetches over 75 % of the total export

earnings of the country (BGMEA, March

2007). Today, the RMG export sector

consists of multibillion dollar manufacturing

and export industries in the country. The

Article Designation: Scholarly

Backward linkage for Bangladesh RMG

Backward linkage means the use by one

firm or industry of produced inputs from

another firm or industry (Alan V Deardorff,

2001). That means the finished garment

1

JTATM

Volume 6, Issue 2, Fall 2009

relies on three steps; first level for

converting fibers/cotton to yarns, second

step for converting yarns to grey fabrics and

the final step for converting gray fabrics to

dyed, printed of other finished fabrics.

These three steps are integrated into each

other as shown in Table 1. It shows that

these three steps are essential for backward

linkage integration (BGMEA, January

2005).

Table 1

Steps from fibers/cotton to finished fabrics

Fibers/

Fabrics

Cotton

Yarns

Spinning

Grey fabrics

Weaving or Knitting

Finished

Dyeing, Printing, Finishing

Bangladesh RMG Sector Need for

Improved Backward Linkages in Post

MFA

Out of three steps, Bangladesh is only

capable of knitting, finishing in knitwear

sectors but far behind in producing yarn,

fabrics which is a major factor for woven

section. Only success came to accessories

where 80% demand of our country was

fulfilled.

After abolition of quota in 2005, RMG

sector in Bangladesh is facing stiff

competition in global apparel export market.

Moreover, increased competitions have been

felt from neighboring countries including

India, Pakistan, China and Thailand from

where Bangladesh imports fabrics to meet

the fabric demands of its RMG sector. These

countries have stronger backward linkage

support as they are able to utilize their

locally produced yarns and fabric internally,

resulting in higher prices in the export

market, putting pressure on the Bangladesh

garment sectors. This observation is

supported by the view of Ahmed Khadker

Habib cited by Hafiz G A Siddiqi,

(November 11, 1999):

The success of the garment industry very

much depends on how effectively RMG

sector linkages may operate backward and

forward. If the manufacturer has effective

control over the supply of raw materials,

components and ancillary services needed to

produce final product, then the production

flow is likely to be interrupted. If the

company develops an effective marketing

service strategies that provide right signal,

and if marketing and distributing systems as

a whole are effective for having the products

reach the target markets, then the sales

revenue for the company is likely to be

maximized. It means that to minimize cost

of production and maximize sales revenues

both backward and forward linkages need to

be integrated. Here the issue of developing

backward linkages is discussed with

reference to the desirability of having

control over the supply of inputs of RMG

industry, mainly, fabric, yarn and processing

status (Siddique, 2004).

Particularly India, Pakistan, China and

Thailand which are at a relatively higher

stage of development and are richer

compared to Bangladesh will in the near

future move to the production of hightechnology higher-value items where return

on investment will be much higher than that

in RGM..

Bangladesh RMG sector, therefore, needs to

develop the backward linkage sub-sectors

further in order to reduce dependency on

imported raw materials and intermediate

goods if she is to meet the export target in

Article Designation: Scholarly

JTATM

Volume 6, Issue 2, Fall 2009

the global market. Again, competitive

pricing is vital with this backward linkage

support. Otherwise, it is not possible to

survive in the world apparel market in the

post MFA era.

composite, spinning, weaving, finishing,

dying and processing, all steps beginning

with raw materials and ending with finished

products must constitute backward linkages

sub-sectors. The RMG sector then will be

faced with more challenges in meeting these

goals. Moreover, Bangladesh RMG sector

has great advantages in terms of the lower in

producing the fabric. The labor cost in

Bangladesh, as shown in Table 2, is one of

the lowest. The table compares average

hourly wages (including fringe benefits) in

the RMG industry (Sattar, 2004).

Faced with the quota-free global apparel

trade, Bangladesh RMG sector must not

only be competitive in product price but also

in the lead time. Development and growth of

backward linkage industries will reduce

price ranges and lead-time in the long run.

As the backward integration is needed for

Table 2. Average Hourly Wages (including Fringe Benefits) in RMG Industry

COUNTRY

HOURLY WAGE(US$)

SINGAPORE

MEXICO

MALAYSIA

THAILAND

PHILLIPINES

INDIA

PAKISTAN

INDONESIA

VIETNAM

SRILANKA

CHINA

BANGLADESH

3.56

2.40

1.20

1.04

0.78

0.56

0.49

0.43

0.40

0.39

0.40

0.23

With cheap labor advantage, Bangladesh

garment industry is still holding competitive

position in the global apparel market.

Overall percentage of RMG sector growth

has been steady although the sector has been

affected by the USA market. This industry

contributed 78% share of total trade of

goods in Bangladesh, compared to the other

South Asian countries like India 14%,

Pakistan 23%, Sri Lanka 50% and Nepal

40% (Garment Association of Nepal, 2001).

cent in 1993-94 to 30% in 1998-99 (CPD,

October

2002).

Another

researcher

(Khadker, January 2002) claimed that of

Garment sector value added is only 25% and

is much lower compare to other exported

items which were contributed 60% to 70%

in some cases. Two-third of garments

export earnings is for the labor fabric

purposes. To add more value it is imperative

necessary to build and develop more

backward linkages industries from yarn to

finishing fabric process in Bangladesh.

In general, backward integration adds value

and at the same time increases employment.

Contribution of RMG sector in Bangladesh

manufacturing can be measured by the

increase in value-added (MVA) from 6.5 per

Article Designation: Scholarly

The Condition of Backward Linkage:

Although the RMG industry in Bangladesh

flourishes in the 80s and 90s, there has

3

JTATM

Volume 6, Issue 2, Fall 2009

been little development in the backward

linkage sector (Habib, 2002). RMG

manufacturers usually import fabric from

different countries as locally produced raw

materials cannot compete with imported

materials in terms of price or in terms of

quality.

situation. This implies that Bangladesh has

to depend on imported cotton which

involving large amount of foreign exchange.

Bangladesh is not even in a position to move

towards synthetic fiber production as it is

capital intensive.

Spinning Mills

At present, only 25%-30% value addition

takes place to the RMG products as

manufacturer import bulk of the raw

materials. On the contrary, almost 70%

value addition takes place to the jute

products exported to different countries. The

garment industry should need to increase at

least 50% value addition through

enhancement of backward integration in the

RMG market.

It is difficult to accurately determine the

percentage of demand for yarn met locally

because of the amount of yarn production

varies with the efficiency of the spindles.

Bangladesh Textile Mills Corporation

(BTMC) and Bangladesh Textile Mills

Association (BTMA) mills have spindles

with different efficiency levels and there is

no numeric data available on the efficiency

levels of the spindles according to A M.

Chowdhury (2002). But According BTMA,

in year 2000 statistics, there are 148

spinning units (private 107 and public 41

units), installed capacity 3.6 million, with

annual production 443 million kg, (BTMEA,

2001). Number of spinning mills increased

to fulfill the gap of shortfall in local and

domestic market.

Backward linkages sub-sector for RMG

industry includes cotton production,

spinning (cotton and synthetic yarn),

weaving and knitting, dyeing and painting,

and accessories and all of the above subsectors reflect the present condition of the

backward integration in the RMG in

Bangladesh.

As per BGMEA, 2005, number of unit of

spinning mills increased to 202 (private

sector 176, public sector 26), Installed

capacity: 4,334,796 Spindles with annual

production capacity of 50 million kgs of

yarn. According to a report submitted by the

Sub-Committee of the Parliamentary

Standing Committee on Textile (May 1999)

to meet the demand (2000) domestically,

Bangladesh will have to established 148

Spinning Mills with 25,000 spindles each

(Hafiz G.A ) and again to attain self

sufficiency in yarn to fulfill the domestic

and export needs in year 2005, Bangladesh

will need to established additional 98

spinning mills. So it shows that capacity of

spinning mills in Bangladesh is not capable

to cover demand of yarn that needed to

produce fabric for RMG sector. The total

demand for yarn by RMG producers and

producers operating in the local market are

more than the existing production capacity

and there is requirement for an enormous

Cotton

Cotton is the main raw material for yarn

production while production of cotton in

Bangladesh has very limited profit margin.

Hence, Bangladeshi spinning mills depends

on imported cotton from international

markets. India, Pakistan, Turkey, China,

Uzbekistan, USA are the main production

sources where Bangladesh largely dependent

on. Bangladesh Cotton Development Board

(BCDB) undertakes cotton promotions

activities but achievement is not satisfactory.

BCDB is striving for higher production of

cotton with a production range of 1,03,620

bales in four cultivating zones in southwestern part of the country. Cotton

production requires vast land areas whereas

in Bangladesh the land is in scarcity at only

144,000 square kilometers. Farmers prefer

agriculture products that are more profitable

than cotton. So in the context of cotton

production, Bangladesh is in a dreadful

Article Designation: Scholarly

JTATM

Volume 6, Issue 2, Fall 2009

increase in capacity if Bangladesh wants to

ensure adequate supply of yarn locally.

and finishing units in Bangladesh are

currently able to process all of the locally

produced grey. According to Bangladesh

Textile Mills Association (BTMA, 2001).

Bangladesh knitting, knit dyeing and

finishing sub-sector had 282 firms (99

merchandized dyeing and finishing, 183

semi-merchandized dyeing and finishing)

with annual fabric production capacity

(fabric) of 680 million meters. On the other

hand, the knitting sector had a total of 155

firms (23 domestically supported existing

units and 132 export oriented units).

Existing knitting, knit dyeing and finishing

sub-sectors cover the local demand and the

major portion of the export RMG sector in

Bangladesh.

Handloom products may be suitable for the

domestic market, but RMG producers

cannot consider handloom as competitive

because of consistent and large quantity

demanded by quality fabric markets. On the

other hand, power looms were originally

targeted to serve the domestic market but to

upgrade them for export quality is very

difficult and costly.

Weaving and Knitting Mills

The next stage is weaving and knitting

where yarn are converted to fabrics. Fabric

is main raw material for making garment

and accounts for 75 percent of the garment

cost. Both hand looms and power looms are

suitable for the domestic market, but a large

demand of quality fabrics cannot be met by

hand loom production. But in case of power

looms, they may increase the production

capacity to satisfy part of the RMG sector

demand with a large investment.

Due to the increased demand in RMG sector

and to attain self-sufficiency in fabric supply,

Bangladesh established 481 additional units

of dyeing, printing and finishing units with

10 million meter fabric production capacity

for each unit (Siddiqi, 2000). Dyeing,

printing and finishing factors had depended

mostly on imported fabrics as Bangladeshs

weaving sector could not fill the export

demand of the RMG. This sector

dramatically improved over the last five

years due to the relatively low level of

investment required. However, only a few

firms could carry out proper dyeing

operations due to deficiencies in dyeing

know-how. Again, as the current dyeing

facilities are mostly dependent on imported

fabrics, their expansion does not depend on

other sectors that impede the growth of

backward linkage sub-sectors.

In the long run, Bangladesh weaving mills

need a high volume of yarn production to

fulfill the demand for domestic and export

markets. In year 2000, fabric demand was

830 million meters, and soon after in year

2005 the demand almost doubled. In about 5

years of time, the demand would increase to

1600 million meters. To fill these huge

demands and the fabric shortfall, the

weaving industry needs to increase the

production capacity by developing number

of new weaving industries. Both new and

reconditioned machines must be added in

this sector. The associated large involvement

required is almost $ 3.9 billon, $ 2.7 billion

for new machines and $ 1.2 billion for

reconditioned looms (CPD in the 12th

EXPO).

To develop dyeing, printing and finishing

sub-sectors, it is imperative to build up

modern units with appropriate technology,

set up bonded warehouses that can meet the

fabric demand until the local grey

production can meet the quality and

quantity, stocks of dyes and chemicals that

can meet the demand of dyeing, printing,

finishing sub-sectors. This sub-sector can

contribute significantly to reduce lead time

and price. It is suggested that dyeing,

printing and finishing sub-sectors be in

Dyeing, Printing and Finishing

This is the final stage where the fabric either

can be used for domestic market or RMG

sector for export purposes. Dyeing, printing

Article Designation: Scholarly

JTATM

Volume 6, Issue 2, Fall 2009

better position than that for other backward

integration sub-sectors when compared with

spinning and weaving sectors. This

statement is supported by Both Drs. Martelli

and Gherzi who identified the finishing

phase as area for improved competitiveness

in Bangladesh and recommended investment

(BGMEA 2004).

Cotton

Cotton considered the first stage of

backward linkage sub-sector which is the

main

source

for

producing

yarn.

Bangladeshi garment industry is fully

dependent on imported cotton to fulfill the

huge shortfall of yarn souring. Though

Bangladesh needs to support cotton

production but due to scarce land in

Bangladesh, to build cotton industry in

Bangladesh may not be recommended. This

view is supported by Ahmed Khander

Habib, who does not recommend it due to

shortage of land as well as the high cost

involved. This situation is similar to

Anatolia Project of Turkey. (Habib, 2002).

But in the another study in Development in

Democracy (DID, 1991) argues that not

having cotton is actually not a disadvantage

due to increased import of high quality

cotton from neighboring countries (mainly

India and Pakistan) where low quality of

cotton are produced.

Accessories

Only for accessories, Bangladeshi garment

industry is in quite good position. About

80% of those known as accessories (zippers,

buttons, threads, stiffeners, inter-linings,

packaging materials, etc.) are available

locally and meet the requirements of the

international buyers. A considerable amount

of backward linkage has already been

established in this export support sector and

it maintains its excellent position.

Policy Implications and Conclusions

This study briefly discussed the present

condition of backward integration and its

prospect as well as the negative impact on

Bangladeshi garment industry in future.

But the question is raised that Bangladesh

garment is not making high quality of

garment nor it ranked as fashion/fancy

garment market in the international apparel

market. Bangladesh garment market is still

categorized as a source of low to medium

quality garment in the international market.

So it may be necessary to sticks with low to

medium range cottons. With the lower-price

cotton

markets,

Bangladeshi

is

disadvantageous compared to Indian textile

mills who buy cotton from Indian growers

25% to 30% cheaper than Bangladesh

import the same cotton from India or

international market. As a matter of Policy,

by allowing this policy, Indian government

provides in effect a subsidy to the Indian

mill owners (Siddique, 2004). Similar

subsidy is given in Pakistan and as a result

their price is 20% lower than Bangladesh

who buys the same cotton from Pakistan

paying more. This creates a disadvantage for

Bangladesh and it could possibly be

overcome by reducing the conversation

costs (labor, energy, depreciation, interest

and other costs) and by improving the

Analyzing the present condition, status and

facts and findings of the above in the RMG

sector, there are number of target actions in

several areas can be considered along with

their policy implications that directly

influence the backward integration. From

cotton to finished products, all steps

involved such as spinning, weaving, dyeing

printing, finishing and accessories form an

integral part of backward linkage procedure.

The alternative support of central bonded

warehouses is essential unless backward

linkage satisfies itself in each sector by its

components, especially in spinning and

weaving sectors. The study tries to come up

with possible suggestions for each sector,

again using different researchers viewpoints.

Article Designation: Scholarly

JTATM

Volume 6, Issue 2, Fall 2009

management efficiency. The government

needs to take some initiatives such as

imposing no tariffs or quota on cotton

import so that importers can get cotton

cheaper and keep the cotton price down in

the local market.

the private and foreign investors to develop

the backward integration.

Weaving

The analysis in the paper spells out number

of points. It is noted that weaving sector is

the largest component of the backward

integration, where the import accounts

almost 75% of the total export garment

value. Bangladesh is only 20% selfsufficient in weaving input supply.

Bangladesh weaving mills constantly fall

short of production owing to chain link

shortage of yarn production in spinning subsector. As a result, the country has to import

3.15 billion meters of grey fabrics per year.

Shortfall 200 weaving mills amounts to 10

million meters of fabric (Siddiqi, 2000) and

it could attain the self sufficiency in yarn to

fulfill the domestic and export needs in year

2005, which cost TK 50 each, amounting to

TK 100 or equivalent to USD $1.43 billion

(US $1 = Taka 70 approx. in 2008). The

knitting segment of Bangladesh is better and

the grey fabric demand is met by the

domestic production. For the export market,

around 85% the total woven fabric demand

and about 35% of the total knit fabric

demand are imported. Due to large demandsupply gap, the weaving and knitted subsectors require expansion at a rapid rate.

Soon after the MFA phase-out, demand for

fabric has risen making it imperative to

increase the investment and modernized the

machinery.

Spinning Sector

Hand loom is the largest support in yarn in

the Bangladeshi clothing industry. This

sector contributes TK 10 billion to national

economy and is capable of fulfilling threefourth of the local requirement in the apparel

sector. Bangladesh is only 10-20% selfsufficient in spinning in input supply or

degree of backward integration. In the

knitting and woven sectors, there are huge

shortfalls in the RMG sector mainly in the

export oriented operation. To overcome the

gap between supply and demand of yarn in

RMG sector, it was necessary to establish 98

spinning mills to have their estimated cost to

be about Taka 73.5 billion, or equivalent to

USD $1.05 billion (approx. US $1 = Taka

70 in 2008). Before making a huge

investment to develop backward linkage

sub-sector in spinning mills, it is imperative

to assess the level of competitiveness and

viability for such project. The conversion

costs and the total manufacturing cost must

be considered and must compare with that in

China, India and Pakistan as Bangladesh

import cotton from these competing

countries.

It was also suggested by the Bangladesh

Ministry of Commerce (2004) that the

handloom sector should be modernized. A

comprehensive training designed for the

RMG sector, Skilled and Quality

Development Programme (SQDP) imparted

training at the grass root level to apply

modern design, dyeing and weaving. The

project tenure was five years at a cost of $4

million.

Government should take some initiatives

such as; to impose no barriers on import

mechanism on back-to-back letter of credits

(LCs); not to import yarns through ports; to

ask recipients of cash subsidy to encourage

Article Designation: Scholarly

It is necessary to have private sector take

positive initiatives to support the weaving

sub-sector. It is considered that the weaving

and spinning sub-sectors would be more

attractive for large capital investment. If

cost-effective investments in the spinning

and weaving enhance the performance in the

sub-sector, then Bangladesh has a possibility

of building a competitive export-oriented

sector in the Post MFA era.

In addition to making the large investments,

the government has to waive import tax and

VAT from spare parts, dyes and chemicals,

7

JTATM

Volume 6, Issue 2, Fall 2009

and support 5% free on board (FOB) value

to deter the currency devaluation in of

neighboring countries, provide loans with

7% flat interest rate on all advances and

loans, provide financial subsidy of at least 67%, waive the peak hour electricity charges,

establish textile development fund of TK 50

billions, build a textile park, reschedule the

container handling charge, and build a

training centre for developing skilled labor

(Habib, 2002). Other issues may be to

reduce the port charges for garment exports,

to increase labor productivity and reduce the

cost of doing business by Bangladesh

Garment Manufacturers and Exporters

Association (BGMEA) and the government.

Unless these bottlenecks are removed, a

simplified backward linkage industry may

not be realized (Siddique, 2004).

infrastructure fees from dyeing, printing and

finishing sub-sector in order to set up new

units with advanced technology.

This dyeing, printing and fabric processing

sub-sectors are doing well in Bangladesh as

these sectors require only small-scale

operations, small investments that are within

reach of many entrepreneurs. All these mean

that a stronger encouragement should be

provided for the development of these

components of the backward integration

(Habib, 2002). This view has also been

supported by a IFC report which suggested

development of dyeing, printing and fabric

production facilities. Bangladesh would do

better if it improves the infrastructural and

the transport facility and its logistics,

streamline the import policy by removing

the cumbersome procedures. In addition,

upgrading the facility at Chittagong port and

substantial upgrading of the national

electricity grid are needed for uninterrupted

supply of power. In addition, improved

telecommunication facilities and improved

seaport management are needed along with

enhanced law and order.

Dyeing, Printing and Finishing

The final linkages in the textile industry,

namely, dyeing, printing and finishing have

improved dramatically over the last five

years although only a few firms can match

colors. The efficiency of the sub-sector

however, depends mostly on the quality of

the imported grey fabrics, which might be

supplemented by domestically produced

grey fabrics if their quality could be

enhanced.

Bangladesh garment industry faces serious

challenges if it wants to maintain and

improve its competitiveness position in the

post-MFA era. The challenge should serve

as a wakeup call for the garment industry for

forming a new strategic position. With large

labor resources, Bangladesh needs initiatives

of private entrepreneurs along with a

sustained government support.

In some cases, facilities for which still

unable to meet the standard of quality

demanded by the export-oriented RMG

industries. To get quality fabrics, some

options can be considered. They include

providing incentives for producing higher

quality grey fabrics domestically and force

the finishing industries to trim down the

costs gradually to compete against the

imported grey fabrics among others.

Another strategy would be to provide

bonded warehouses for fabrics until local

grey production can meet the quality and

quantity demands of the sub-sector. (Habib,

2002).

To maintain the high export position for the

Bangladesh RMG sector, it should not be

supported only by the cheap labor, but also

by factors such as growth of backward

integration. The paper finds that the success

in the finishing, dying, printing, accessories

sub-sector, rapid expansion in the knitting

sector alone even under slow development

in the spinning and weaving sectors, the

Bangladesh RMG sector is still in a viable

position in the global appeal market. As it

says where there is a will there is a way,

the Bangladesh RMG sector will remain in

The government should also withdraw or

reduce duty, advance income tax (AIT),

Article Designation: Scholarly

JTATM

Volume 6, Issue 2, Fall 2009

the same good position by taking all the

steps identified in this paper, and hopefully,

it will enhance its export performance in the

global market as a competitive nation.

Finally, it can be said that this study will be

of significant value if the policy implications

suggested in this research help develop plans

for making Bangladesh RMG industry

viable.

References

Bangladesh Garment manufacturers &

Exporters Association (April 22, 2004)

Central Bonded - A winning formula for

Bangladesh Textile & Clothing, A

presentation to National Coordination

Council on MRG, Bangladesh - Presented at

the meeting of Bangladesh Garment

manufacturers and Exporters Association,

Dhaka, Bangladesh.

a) Books

Ahmed, Khandker Habib (2002) Textile and

clothing: Experience of contemporary

leading countries, Backward Linkage to

Ready Made Garments Bangladesh

Perspective(1st Ed.), (pp. 117). Bangladesh:

Academic Press and Publishers Limited.

Bangladesh Garment and Manufactures

Association (BGMEA). (January 2005).

MFA and Bangladesh Ground rules for

being competitive Organized by BGMEA.

Presented at the meeting of Bangladesh

Garment Manufacturers & Exporters

Association, Dhaka, Bangladesh.

Ahmed, Khandker Habib (2002) Textile and

clothing: Bangladesh perspective, Backward

Linkage to Ready Made Garments

Bangladesh Perspective(1st Ed.), (pp. 146).

Bangladesh: Academic Press and Publishers

Limited.

Ahmed, Khandker Habib (2002) Backward

linkages to clothing export of Bangladesh:

An appraisal, Backward Linkage to Ready

Made Garments Bangladesh Perspective(1st

Ed.), (pp. 206). Bangladesh: Academic Press

and Publishers Limited.

Bangladesh Garment and Manufactures

Association (BMGEA). (May 30, 2004)

Post-MFA & Bangladesh: The Imperatives

of Readiness- Exchange of Views Among

Stakeholders and Concerned Parties,

Presented at the meeting Bangladesh

Garments Manufacturers & Exporters

Association, Dhaka, Bangladesh.

Ahmed, Khandker Habib (2002) Policy

implications: Backward linkages to clothing

export of Bangladesh: Backward Linkage to

Ready Made Garments Bangladesh

Perspective (1st Ed.), (pp. 223). Bangladesh:

Academic Press and Publishers Limited.

Centre for Policy Dialogue (CPD). (October

2002) Contribution of the RMG sector to the

Bangladesh Economy. Presented at the

meeting of Centre for Policy Dialogue,

Dhaka, Bangladesh.

Hafiz G. A. Siddiqi (2004) The development

of backward linkages, The Readymade

garment Industry of Bangladesh (1st Ed.),

,(pp. 102- 121). Bangladesh: The University

Press Limited.

Bangladesh Garment Manufacturers and

Exporters Association (BGMEA) (2005):

RMG sector and Challenges of 2005keynote paper presented at the BATEXPO

2000, sponsored by BGMEA, Dhaka.

b) Conferences

Bangladesh Garments Manufacturers &

Exporters Association (2004, April 22)

Central Bonded Warehouse (CBWs): A

Winning Formula for Bangladesh Textile &

Clothing, Presented at the meeting of

Bangladesh Garment manufacturers &

Exporters Association, Dhaka, Bangladesh.

Article Designation: Scholarly

Bangladesh Garment Manufacturers and

Exporters Association (BGMEA). (April 22,

2004) Central Bonded Warehouse (CBWs).

A winning Formula for Bangladesh Textile

& Clothing: A Presentation to National

Coordination Council on RMG. Dhaka.

JTATM

Volume 6, Issue 2, Fall 2009

Debapriya Bhattacharya (2005)Development

of Backward Linkage Industry in the

Bangladesh Textile Sector: Promise and

Achievements Presented at Center for Policy

Dialogue (CPD) in the 12th EXPO. Dhaka

Garment Association of Nepal (2001)

Global Development Solution. Presented at

Garment Association of Nepal, Nepal.

d) Newspapers

Editorial (October 5, 1999) Garment exports

face global competition, Backward linkage

industries need investment worth TK50b.The

Daily Star, Business & Finance, Volume 1,

Number 318.

Editorial (October 5, 1997) No policy

guidelines yet to face the quota-free regime,

The Daily Star , Volume 1, Number 54.

Hafiz, G. A. Siddiqi (2000) Beyond 2004:

Impact of MFA Phase-out on the Apparel

Industry of Bangladesh Keynote Paper

presented at the BATEXPO 2000, sponsored

by BGMEA, Dhaka.

Editorial (October 5, 1997) Sources of

Export Growth in Bangladesh. The Daily

Star. Volume 1, Number 54.

Regional News. (August 21, 1997). Massive

cotton seeds farming programme in 4 dist.

The Daily Star, Volume 1, Number 9.

c) Journals and Periodicals

Hafiz G. A. Siddiqi (1999, November 11)

Developing Backward Linkage to Face the

Challenges of 2005. The Daily Star

Features, Volume 3 Number 8.

e) Websites

Alan V Deardorff (2001) - Deardorffs

Glossary of International Economics,

February

24,

2008

http://wwwpersonal.umich.edu/~alandear/glossary/b.ht

ml

Mustafizur, Raman, & Asif, Anwar

(September 2006) Bangladesh Appeals

export to the US Market: An examination of

Her Competitive vis--vis China. Central for

Policy Dialogue (CPD), paper 62.

Export Promotion Bureau (EPB), (March

2007) Statement of monthly export by

ministry of commerce Retrieved June 30,

2008.

http://www.epb.gov.bd/bangladesh_epz.html

#

The Ministry Commerce. (2004).Post MFA

Action Programme (PMAP): Government of

the Peoples Republic of Bangladesh.

Dhaka: Bangladesh, The Ministry of

Commerce.

Fashion2Fashion - World of garment

textile-online

(February

12,

2008),

Bangladesh: Government plans two new

EPZs, Retrieved February 12, 2008

http://www.fibre2fashion.com/news/industri

al-textiles-news

/newsdetails.aspx?news_id=50097

The Ministry of Commerce. (August 2002).

Executive Summary of the initial Report on

Post MFA Development Strategy and

Technical Assistance for the RMG Sector,

para 3.0 Dhaka: Bangladesh, The Ministry

of Commerce.

Zaidi, Sattar (2004). Draft concept paper on

World Bank on Post-MFA options for

Bangladesh. Dhaka.

Zaidi, Satter.(September 2004) Challenges

and Opportunities in a Post-MFA World:

Strategies and Options for Bangladesh

Readymade Garment sector: Draft Concept

Note: World Bank Office, Dhaka.

Bangladesh Textile Mills Association

(BTMA) (November 21, 2001) Textiles of

Bangladesh , Dhaka

Article Designation: Scholarly

10

JTATM

Volume 6, Issue 2, Fall 2009

Article Designation: Scholarly

11

JTATM

Volume 6, Issue 2, Fall 2009

Das könnte Ihnen auch gefallen

- Toward New Sources of Competitiveness in Bangladesh: Key Insights of the Diagnostic Trade Integration StudyVon EverandToward New Sources of Competitiveness in Bangladesh: Key Insights of the Diagnostic Trade Integration StudyNoch keine Bewertungen

- Backward Linkages in Readymade Garment Industry of Bangladesh: Appraisal and Policy ImplicationsDokument0 SeitenBackward Linkages in Readymade Garment Industry of Bangladesh: Appraisal and Policy ImplicationsKhan SajalNoch keine Bewertungen

- Transforming Bangladesh’s Participation in Trade and Global Value ChainVon EverandTransforming Bangladesh’s Participation in Trade and Global Value ChainNoch keine Bewertungen

- 380 3936 1 PB PDFDokument11 Seiten380 3936 1 PB PDFMd Khalid Hakim DolonNoch keine Bewertungen

- Economic Indicators for Southeastern Asia and the Pacific: Input–Output TablesVon EverandEconomic Indicators for Southeastern Asia and the Pacific: Input–Output TablesNoch keine Bewertungen

- SWOT Analysis of Bangladesh's RMG IndustryDokument3 SeitenSWOT Analysis of Bangladesh's RMG IndustryMd.Latifull Alam100% (1)

- Economic Indicators for South and Central Asia: Input–Output TablesVon EverandEconomic Indicators for South and Central Asia: Input–Output TablesNoch keine Bewertungen

- A Report On Readymade Garments of BangladeshDokument17 SeitenA Report On Readymade Garments of BangladeshAnonymous Z3FQhwMyiNoch keine Bewertungen

- Unlocking the Potential of Digital Services Trade in Asia and the PacificVon EverandUnlocking the Potential of Digital Services Trade in Asia and the PacificNoch keine Bewertungen

- RMG Industry AnalysisDokument35 SeitenRMG Industry AnalysisSanjana TehjibNoch keine Bewertungen

- Economic Insights from Input–Output Tables for Asia and the PacificVon EverandEconomic Insights from Input–Output Tables for Asia and the PacificNoch keine Bewertungen

- Southeast University: Department of Textile EngineeringDokument16 SeitenSoutheast University: Department of Textile EngineeringHarunur RashidNoch keine Bewertungen

- Facilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeVon EverandFacilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeNoch keine Bewertungen

- The Ready-Made Garment (RMG) Industry of BangladeshDokument17 SeitenThe Ready-Made Garment (RMG) Industry of BangladeshBoier Sesh Pata75% (4)

- University of Dhaka Bba Program Department of A&Is Cource Code:4201 Term Paper On "Backward Linkage Position of Readymade Garments Industries of Bangladesh"Dokument11 SeitenUniversity of Dhaka Bba Program Department of A&Is Cource Code:4201 Term Paper On "Backward Linkage Position of Readymade Garments Industries of Bangladesh"Manjur Hossain ShovonNoch keine Bewertungen

- Overview - Garments Industry in BangladeshDokument24 SeitenOverview - Garments Industry in Bangladeshzubair07077371100% (1)

- Owth and ContributionDokument7 SeitenOwth and ContributionAhmed Akter/SDP/BRACNoch keine Bewertungen

- Bangladesh RMG Industry Past, Present, Future AnalysisDokument19 SeitenBangladesh RMG Industry Past, Present, Future Analysistorsha fahadNoch keine Bewertungen

- Assignment: Bangladesh's RMG On Global Business.: Submitted By: Md. Nasrath Faisal (1210914)Dokument5 SeitenAssignment: Bangladesh's RMG On Global Business.: Submitted By: Md. Nasrath Faisal (1210914)NasrathFaisalNoch keine Bewertungen

- RMG Supply Chain ManagementDokument15 SeitenRMG Supply Chain ManagementMihal As-Samah 070Noch keine Bewertungen

- STUDENT2Dokument17 SeitenSTUDENT2Rahman AsifNoch keine Bewertungen

- SWOT Analysis in RMG Sector in BangladeshDokument3 SeitenSWOT Analysis in RMG Sector in Bangladeshanjonasen978Noch keine Bewertungen

- Assments RMGDokument64 SeitenAssments RMGMd:Mamun UddinNoch keine Bewertungen

- Report On Bangladeshi Readymade Garment IndustryDokument22 SeitenReport On Bangladeshi Readymade Garment IndustryHirok Rahman100% (1)

- The RMG Sector of Bangladesh and Its Revolution: Present SituationDokument4 SeitenThe RMG Sector of Bangladesh and Its Revolution: Present SituationSaif Ahmed ChowdhuryNoch keine Bewertungen

- Subcontracting in Textile and Clothing Sector in Bangladesh1Dokument5 SeitenSubcontracting in Textile and Clothing Sector in Bangladesh1Abrar Ahmed ApuNoch keine Bewertungen

- Bgmea University of Fashion & Technology (Buft) : Assignment OnDokument12 SeitenBgmea University of Fashion & Technology (Buft) : Assignment OnNeFariOus ArYan AraFat AnikNoch keine Bewertungen

- Challenges of Ready-Made Garments Sector in Bangladesh: Ways To OvercomeDokument15 SeitenChallenges of Ready-Made Garments Sector in Bangladesh: Ways To OvercomeMd.Abdur RakibNoch keine Bewertungen

- Chapter - Id 74455Dokument25 SeitenChapter - Id 74455titaskhanNoch keine Bewertungen

- Optimize Profits of Bangladesh Apparel Industry Using Linear ProgrammingDokument8 SeitenOptimize Profits of Bangladesh Apparel Industry Using Linear Programmingsonia josephNoch keine Bewertungen

- Compliance in Garment IndustryDokument11 SeitenCompliance in Garment IndustryNICOLE ARIANA RAMOS DIAZNoch keine Bewertungen

- Assignment On RMG Industry.Dokument6 SeitenAssignment On RMG Industry.Tanvir AhamedNoch keine Bewertungen

- Bangladesh's Textile & Apparel Industry Growth PotentialDokument7 SeitenBangladesh's Textile & Apparel Industry Growth PotentialAl-Imran Bin KhodadadNoch keine Bewertungen

- Z.H Sikder University of Science & Technology: Course TitleDokument22 SeitenZ.H Sikder University of Science & Technology: Course TitleNirban SahaNoch keine Bewertungen

- Research Report On Spinning Sector of Bangladesh-InitiationDokument24 SeitenResearch Report On Spinning Sector of Bangladesh-InitiationjohnsumonNoch keine Bewertungen

- Subcontracting in Textile and Clothing Sector in BangladeshDokument5 SeitenSubcontracting in Textile and Clothing Sector in BangladeshAbrar Ahmed ApuNoch keine Bewertungen

- Prospects and Challanges of RMG Industry in BangladeshDokument4 SeitenProspects and Challanges of RMG Industry in BangladeshRahman AsifNoch keine Bewertungen

- Backward On Linkages in The Textile and Clothing Sector of BangladeshDokument13 SeitenBackward On Linkages in The Textile and Clothing Sector of Bangladeshtdebnath_3Noch keine Bewertungen

- Case Study: Ready Made Garment Sector in BangladeshDokument29 SeitenCase Study: Ready Made Garment Sector in BangladeshMainul Hasan SifatNoch keine Bewertungen

- StudentDokument11 SeitenStudentRahman AsifNoch keine Bewertungen

- Student 2Dokument14 SeitenStudent 2Rahman AsifNoch keine Bewertungen

- Textile Industry of BangladeshDokument10 SeitenTextile Industry of Bangladeshmohammadirfan9889846Noch keine Bewertungen

- Adaptation of Technology in RMG SectorDokument3 SeitenAdaptation of Technology in RMG SectorHasin Jawad Ali 200061107Noch keine Bewertungen

- Bangladesh StudiesDokument10 SeitenBangladesh StudiesMuhammad Rizvy RedwanNoch keine Bewertungen

- MGT 490 AssigmentDokument8 SeitenMGT 490 AssigmentJagannath SahaNoch keine Bewertungen

- Lakshmi Mills Director's Report Highlights Textile Industry ChallengesDokument3 SeitenLakshmi Mills Director's Report Highlights Textile Industry Challengesanusha indrakantiNoch keine Bewertungen

- Challenges of RMG and Textile Sector in BangaldeshDokument14 SeitenChallenges of RMG and Textile Sector in BangaldeshMd. Shazzadi Alam ParvezNoch keine Bewertungen

- A Project Report On Working Capital Management at Gadag Textile Project Report by Babasab Patil (Karisatte)Dokument75 SeitenA Project Report On Working Capital Management at Gadag Textile Project Report by Babasab Patil (Karisatte)Harsh TrivediNoch keine Bewertungen

- Apparel Merchandising and MarketingDokument87 SeitenApparel Merchandising and MarketingBhuva_jana100% (1)

- CottonDokument43 SeitenCottonEkta JoshiNoch keine Bewertungen

- Readymade Garment Industry in Bangladesh Growth CoDokument7 SeitenReadymade Garment Industry in Bangladesh Growth CoShahriar SiddikNoch keine Bewertungen

- Concorde Garments Internship Report on Running an RMG FactoryDokument31 SeitenConcorde Garments Internship Report on Running an RMG Factoryনরকেররাজপুত্রNoch keine Bewertungen

- Bangladesh's Textile Industry: An Overview of Its Structure, Size, and Contribution to the EconomyDokument19 SeitenBangladesh's Textile Industry: An Overview of Its Structure, Size, and Contribution to the EconomyTanzina HaqueNoch keine Bewertungen

- Term Paper On: Business Analysis of Readymade Garments Industry in Context of Complex Strategic Environment of BangladeshDokument42 SeitenTerm Paper On: Business Analysis of Readymade Garments Industry in Context of Complex Strategic Environment of Bangladeshkenn benNoch keine Bewertungen

- Working Capital Management at Gadag Textile Project ReportDokument75 SeitenWorking Capital Management at Gadag Textile Project ReportBabasab Patil (Karrisatte)100% (1)

- Bangladesh RMG Industry AnalysisDokument41 SeitenBangladesh RMG Industry Analysissoul1971Noch keine Bewertungen

- The Present Status, Problem and Challenges of Major Industries of Bangladesh: RMG, Lather and ICTDokument20 SeitenThe Present Status, Problem and Challenges of Major Industries of Bangladesh: RMG, Lather and ICTBabor Ahmad100% (3)

- Term Paper On: "Implications of Information Technology On The Supply Chain of RMG Sector of Bangladesh"Dokument18 SeitenTerm Paper On: "Implications of Information Technology On The Supply Chain of RMG Sector of Bangladesh"Nabeel nayeemNoch keine Bewertungen

- Fully Fashion Knit WearDokument34 SeitenFully Fashion Knit WearsatexNoch keine Bewertungen

- FDI Investment in BangladeshDokument42 SeitenFDI Investment in BangladeshAbdullah Al MamunNoch keine Bewertungen

- Executive SummaryDokument3 SeitenExecutive Summaryfazlay50% (2)

- Analysis Using HHIDokument8 SeitenAnalysis Using HHIfazlayNoch keine Bewertungen

- Government Committed to Liberal Import PolicyDokument22 SeitenGovernment Committed to Liberal Import PolicyfazlayNoch keine Bewertungen

- 11 Steps For GMATDokument4 Seiten11 Steps For GMATfazlayNoch keine Bewertungen

- Brand MGT Draft SlideDokument23 SeitenBrand MGT Draft SlidefazlayNoch keine Bewertungen

- Chap 002Dokument15 SeitenChap 002fazlayNoch keine Bewertungen

- Report of Cse ExportDokument24 SeitenReport of Cse ExportfazlayNoch keine Bewertungen

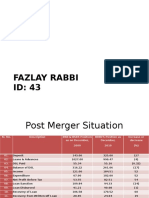

- Merger of BDBLDokument6 SeitenMerger of BDBLfazlayNoch keine Bewertungen

- Category and Brand Management, Product Identification, and New-Product PlanningDokument27 SeitenCategory and Brand Management, Product Identification, and New-Product PlanningfazlayNoch keine Bewertungen

- Bangladesh Import Policy 2009-2012 SummaryDokument3 SeitenBangladesh Import Policy 2009-2012 SummaryfazlayNoch keine Bewertungen

- Stepping Stones or Building BlocsDokument3 SeitenStepping Stones or Building BlocsfazlayNoch keine Bewertungen

- The Magical Number SevenDokument3 SeitenThe Magical Number SevenfazlayNoch keine Bewertungen

- Application Form Teacher 1Dokument3 SeitenApplication Form Teacher 1fazlayNoch keine Bewertungen

- Application Form Teacher 2Dokument3 SeitenApplication Form Teacher 2fazlayNoch keine Bewertungen

- BatnaDokument7 SeitenBatnaSindy KangNoch keine Bewertungen

- Monitoring Regional IntegrationDokument2 SeitenMonitoring Regional IntegrationfazlayNoch keine Bewertungen

- 1 s2.0 S0195666313002171 MainDokument8 Seiten1 s2.0 S0195666313002171 MainfazlayNoch keine Bewertungen

- Rmbœv - Wek We' VJQ, XVKV: WB QVM WeáwßDokument2 SeitenRmbœv - Wek We' VJQ, XVKV: WB QVM WeáwßfazlayNoch keine Bewertungen

- Apparel and FootwearDokument50 SeitenApparel and FootwearfazlayNoch keine Bewertungen

- CLDokument1 SeiteCLfazlayNoch keine Bewertungen

- Leather Goods FinalDokument15 SeitenLeather Goods FinalImran1978Noch keine Bewertungen

- RMG Industry of Bangladesh BY Team DexterDokument21 SeitenRMG Industry of Bangladesh BY Team DexterfazlayNoch keine Bewertungen

- Enron Bank ScandalDokument2 SeitenEnron Bank ScandalfazlayNoch keine Bewertungen

- I. Current/Non-current Method Ii. Monetary/Non-monetary Method Iii. Currency Rate MethodDokument2 SeitenI. Current/Non-current Method Ii. Monetary/Non-monetary Method Iii. Currency Rate MethodfazlayNoch keine Bewertungen

- Lehman Brothers ScandalDokument1 SeiteLehman Brothers ScandalfazlayNoch keine Bewertungen

- A Comparative Study of Financial Performance of Banking Sector in Bangladesh - B. NimalathasanDokument12 SeitenA Comparative Study of Financial Performance of Banking Sector in Bangladesh - B. NimalathasanfarhanNoch keine Bewertungen

- Leather Industry of BangladeshDokument1 SeiteLeather Industry of BangladeshfazlayNoch keine Bewertungen

- Certificate in International Trade and Finance: Michele DonnellyDokument12 SeitenCertificate in International Trade and Finance: Michele DonnellyfazlayNoch keine Bewertungen

- Certificate in International Trade and Finance: Michele DonnellyDokument12 SeitenCertificate in International Trade and Finance: Michele DonnellyfazlayNoch keine Bewertungen

- Cmta ProvisionDokument242 SeitenCmta ProvisionSteffany Casio100% (11)

- Karthikeyan TNPL ProjectDokument102 SeitenKarthikeyan TNPL ProjectSathyaNarayanan100% (1)

- Causes of Imbalance in Balance of Payment AccountsDokument2 SeitenCauses of Imbalance in Balance of Payment AccountsAkashdeep Ghumman0% (1)

- 09 Chapter 1Dokument149 Seiten09 Chapter 1Rahul KawitkeNoch keine Bewertungen

- Appendix 14-I-A Application For Setting Up Eou/Sezs or Units in Special Economic ZoneDokument8 SeitenAppendix 14-I-A Application For Setting Up Eou/Sezs or Units in Special Economic Zoneశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNoch keine Bewertungen

- Custom CleranceDokument15 SeitenCustom CleranceKailash NagdaNoch keine Bewertungen

- International MarketingDokument18 SeitenInternational MarketingHimanshu BansalNoch keine Bewertungen

- The Economic Success Story of MalaysiaDokument5 SeitenThe Economic Success Story of MalaysiahkjarralNoch keine Bewertungen

- C U S T O M S: Boc Single Administrative DocumentDokument2 SeitenC U S T O M S: Boc Single Administrative DocumentRATED KMJS100% (2)

- PRODUCT REPORT Surgical Instruments 2Dokument15 SeitenPRODUCT REPORT Surgical Instruments 2Waqas HashmiNoch keine Bewertungen

- Salient Features of Buyer'S CreditDokument4 SeitenSalient Features of Buyer'S CreditPankit KediaNoch keine Bewertungen

- Orientations of Vietnam Coffee IndustryDokument5 SeitenOrientations of Vietnam Coffee IndustryDung NguyenNoch keine Bewertungen

- Floriculture Today: March 2013Dokument70 SeitenFloriculture Today: March 2013udaykumar300Noch keine Bewertungen

- Global Wheat Crisis & India's Mercator SolutionDokument6 SeitenGlobal Wheat Crisis & India's Mercator SolutionrahulthiNoch keine Bewertungen

- Milk Powder Reference Manual Complete1Dokument120 SeitenMilk Powder Reference Manual Complete1Arifin R Hidayat100% (1)

- PESTLE Analysis of China's Political, Economic, Social and Legal FactorsDokument4 SeitenPESTLE Analysis of China's Political, Economic, Social and Legal FactorsAmit Pathak67% (3)

- Strategic Management in Auto Mobile IndustryDokument10 SeitenStrategic Management in Auto Mobile IndustryVikramaditya ReddyNoch keine Bewertungen

- Quite Possibly The World'S Worst Powerpoint Presentation EverDokument14 SeitenQuite Possibly The World'S Worst Powerpoint Presentation Everapi-198134407Noch keine Bewertungen

- Aftab Garments: Bangladesh Export Oriented Garments Factory ProfileDokument8 SeitenAftab Garments: Bangladesh Export Oriented Garments Factory ProfileMd Sifat KhanNoch keine Bewertungen

- U.S. vs. Vladimir Nevidomy and Dmitrii MakarenkoDokument16 SeitenU.S. vs. Vladimir Nevidomy and Dmitrii MakarenkoDoug StanglinNoch keine Bewertungen

- Bangaluru Commercial: Real Estate Analysis ofDokument16 SeitenBangaluru Commercial: Real Estate Analysis ofmanojkumarmishratNoch keine Bewertungen

- Textile IndustryDokument25 SeitenTextile IndustryArjun VishwakarmaNoch keine Bewertungen

- MYOLA Feedlot WDokument2 SeitenMYOLA Feedlot WNajeeb EMhaNoch keine Bewertungen

- Trafosem 2008Dokument353 SeitenTrafosem 2008tmmsekarNoch keine Bewertungen

- Organization Study ReportDokument25 SeitenOrganization Study Reporttharunarunnaik100% (1)

- KPMG The Indian Services Sector Poised For Global AscendancyDokument282 SeitenKPMG The Indian Services Sector Poised For Global Ascendancyrahulp9999Noch keine Bewertungen

- Legend of Ceylon TeaDokument3 SeitenLegend of Ceylon TeaDilip SirisenaNoch keine Bewertungen

- MITI Report 2010 PDFDokument152 SeitenMITI Report 2010 PDFAdilawi MuhammadNoch keine Bewertungen

- Inland Container Depot (ICD)Dokument10 SeitenInland Container Depot (ICD)piyushk20Noch keine Bewertungen

- Steel ThailandDokument13 SeitenSteel ThailandNadia ArityaNoch keine Bewertungen

- Generative AI: The Insights You Need from Harvard Business ReviewVon EverandGenerative AI: The Insights You Need from Harvard Business ReviewBewertung: 4.5 von 5 Sternen4.5/5 (2)

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Von EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Bewertung: 4.5 von 5 Sternen4.5/5 (11)

- Artificial Intelligence: The Insights You Need from Harvard Business ReviewVon EverandArtificial Intelligence: The Insights You Need from Harvard Business ReviewBewertung: 4.5 von 5 Sternen4.5/5 (104)

- Impact Networks: Create Connection, Spark Collaboration, and Catalyze Systemic ChangeVon EverandImpact Networks: Create Connection, Spark Collaboration, and Catalyze Systemic ChangeBewertung: 5 von 5 Sternen5/5 (8)

- Lean Thinking: Banish Waste and Create Wealth in Your Corporation, 2nd EdVon EverandLean Thinking: Banish Waste and Create Wealth in Your Corporation, 2nd EdBewertung: 4.5 von 5 Sternen4.5/5 (17)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsVon EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsBewertung: 5 von 5 Sternen5/5 (48)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Von EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Noch keine Bewertungen

- Bulletproof Seduction: How to Be the Man That Women Really WantVon EverandBulletproof Seduction: How to Be the Man That Women Really WantBewertung: 4.5 von 5 Sternen4.5/5 (168)

- Systems Thinking: A Guide to Strategic Planning, Problem Solving, and Creating Lasting Results for Your BusinessVon EverandSystems Thinking: A Guide to Strategic Planning, Problem Solving, and Creating Lasting Results for Your BusinessBewertung: 4.5 von 5 Sternen4.5/5 (80)

- The Basics of Corset Building: A Handbook for BeginnersVon EverandThe Basics of Corset Building: A Handbook for BeginnersBewertung: 4.5 von 5 Sternen4.5/5 (17)

- Sales Pitch: How to Craft a Story to Stand Out and WinVon EverandSales Pitch: How to Craft a Story to Stand Out and WinBewertung: 4.5 von 5 Sternen4.5/5 (2)

- Metric Pattern Cutting for Women's WearVon EverandMetric Pattern Cutting for Women's WearBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't (Rockefeller Habits 2.0 Revised Edition)Von EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't (Rockefeller Habits 2.0 Revised Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (13)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerVon EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerBewertung: 4 von 5 Sternen4/5 (121)

- The Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewVon EverandThe Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewBewertung: 4.5 von 5 Sternen4.5/5 (25)

- Knitting for Anarchists: The What, Why and How of KnittingVon EverandKnitting for Anarchists: The What, Why and How of KnittingBewertung: 4 von 5 Sternen4/5 (51)

- Fabric Manipulation: 150 Creative Sewing TechniquesVon EverandFabric Manipulation: 150 Creative Sewing TechniquesBewertung: 4.5 von 5 Sternen4.5/5 (13)

- HBR Guide to Setting Your StrategyVon EverandHBR Guide to Setting Your StrategyBewertung: 4.5 von 5 Sternen4.5/5 (18)

- Famous Frocks: The Little Black Dress: Patterns for 20 Garment Inspired by Fashion IconsVon EverandFamous Frocks: The Little Black Dress: Patterns for 20 Garment Inspired by Fashion IconsBewertung: 4 von 5 Sternen4/5 (4)

- Small Business For Dummies: 5th EditionVon EverandSmall Business For Dummies: 5th EditionBewertung: 4.5 von 5 Sternen4.5/5 (10)

- DIY Updos, Knots, & Twists: Easy, Step-by-Step Styling Instructions for 35 Hairstyles—from Inverted Fishtails to Polished Ponytails!Von EverandDIY Updos, Knots, & Twists: Easy, Step-by-Step Styling Instructions for 35 Hairstyles—from Inverted Fishtails to Polished Ponytails!Bewertung: 3.5 von 5 Sternen3.5/5 (7)

- Playful Petals: Learn Simple, Fusible Appliqué • 18 Quilted Projects Made From PrecutsVon EverandPlayful Petals: Learn Simple, Fusible Appliqué • 18 Quilted Projects Made From PrecutsBewertung: 3.5 von 5 Sternen3.5/5 (3)

- The 10X Rule: The Only Difference Between Success and FailureVon EverandThe 10X Rule: The Only Difference Between Success and FailureBewertung: 4.5 von 5 Sternen4.5/5 (289)

- 250 Japanese Knitting Stitches: The Original Pattern Bible by Hitomi ShidaVon Everand250 Japanese Knitting Stitches: The Original Pattern Bible by Hitomi ShidaBewertung: 5 von 5 Sternen5/5 (7)

- How to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffVon EverandHow to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffBewertung: 5 von 5 Sternen5/5 (61)

- Amp It Up: Leading for Hypergrowth by Raising Expectations, Increasing Urgency, and Elevating IntensityVon EverandAmp It Up: Leading for Hypergrowth by Raising Expectations, Increasing Urgency, and Elevating IntensityBewertung: 5 von 5 Sternen5/5 (50)

- Blue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantVon EverandBlue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantBewertung: 4 von 5 Sternen4/5 (387)