Beruflich Dokumente

Kultur Dokumente

Boeing Company: 14.0 21.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLD

Hochgeladen von

sonystdOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Boeing Company: 14.0 21.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLD

Hochgeladen von

sonystdCopyright:

Verfügbare Formate

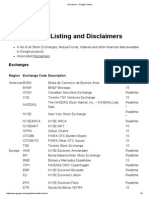

BOEING COMPANY NYSE-BA

TIMELINESS

SAFETY

TECHNICAL

3

2

3

High:

Low:

Raised 5/6/11

70.9

32.0

RECENT

PRICE

69.9

27.6

51.1

28.5

43.4

24.7

14.0 RELATIVE

DIVD

Median: 21.0) P/E RATIO 1.01 YLD 2.4%

70.87 P/ERATIO 14.3(Trailing:

55.5

38.0

72.4

49.5

92.1

65.9

107.8

84.6

88.3

36.2

56.6

29.0

76.0

54.1

80.6

56.0

Target Price Range

2014 2015 2016

LEGENDS

12.0 x Cash Flow p sh

. . . . Relative Price Strength

Options: Yes

Shaded areas indicate recessions

Lowered 3/20/09

Lowered 11/4/11

BETA 1.05 (1.00 = Market)

VALUE

LINE

200

160

2014-16 PROJECTIONS

100

80

60

50

40

30

Annl Total

Price

Gain

Return

High 120 (+70%) 16%

Low

90 (+25%)

8%

Insider Decisions

to Buy

Options

to Sell

J

1

0

0

F

1

3

2

M

0

0

0

A

0

0

0

M

0

5

6

J

0

0

0

J

0

0

0

A

1

0

0

S

0

0

0

20

% TOT. RETURN 11/11

Institutional Decisions

1Q2011

2Q2011

3Q2011

402

422

400

to Buy

to Sell

399

380

421

Hlds(000) 445844 455318 532524

Percent

shares

traded

18

12

6

1 yr.

3 yr.

5 yr.

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Total Debt $12380 mill. Due in 5 Yrs $6550 mill.

LT Debt $10777 mill. LT Interest $500 mill.

(64% of Capl)

Pension Assets-12/10 $49.3 bill. Oblig. $59.1 bill.

Pfd Stock None

Common Stock 743,234,446 shs.G

as of 10/19/11

MARKET CAP: $52.7 billion (Large Cap)

CURRENT POSITION 2009

2010

($MILL.)

Cash Assets

11223 10517

Receivables

5785

5422

Inventory (Avg Cst) 16933 24317

Other

1334

316

Current Assets

35275 40572

Accts Payable

19918 21517

Debt Due

707

948

Other

12258 12930

Current Liab.

32883 35395

ANNUAL RATES Past

of change (per sh)

10 Yrs.

Revenues

3.5%

Cash Flow

3.5%

Earnings

5.0%

Dividends

11.5%

Book Value

NMF

Calendar

2008

2009

2010

2011

2012

Calendar

2008

2009

2010

2011

2012

Calendar

2007

2008

2009

2010

2011

9/30/11

9233

6296

30493

325

46347

19715

1603

16275

37593

Past Estd 08-10

5 Yrs.

to 14-16

6.0%

6.0%

9.0%

9.5%

14.5% 14.0%

14.0%

1.5%

NMF

NMF

QUARTERLY REVENUES ($ mill.)

Mar.31 Jun.30 Sep.30 Dec.31

15990 16962 15293 12664

16502 17154 16688 17937

15216 15573 16967 16550

14910 16543 17727 20420

18750 19100 19950 20200

EARNINGS PER SHARE B

Mar.31 Jun.30 Sep.30 Dec.31

1.65

1.16

.93

d.11

.86

1.41 d2.22

1.82

.70

1.06

1.12

1.56

.78

1.25

1.46

.95

1.25

1.30

1.35

1.40

QUARTERLY DIVIDENDS PAID C

Mar.31 Jun.30 Sep.30 Dec.31

.35

.35

.35

.35

.40

.40

.40

.40

.42

.42

.42

.42

.42

.42

.42

.42

.42

.42

.42

.42

Full

Year

60909

68281

64306

69600

78000

Full

Year

H 3.63

(A) 97 data pro forma incl. McDonnell Doug.

(B) Diluted egs. Excl. nonrecur. gns./losses:

96, 35; 97, d81; 99, 30; 00, d40; 01,

62; 02, d$2.21; 03, d11; 04, 67; 05, 72;

1.87

4.46

4.44

5.30

Full

Year

1.40

1.60

1.68

1.68

VL ARITH.*

INDEX

10.4

75.8

-12.0

1.2

104.4

22.3

VALUE LINE PUB. LLC

14-16

94.01 87.46 93.55 104.55

4.13

6.85

6.75

7.65

1.87

4.46

4.44

5.30

1.68

1.68

1.68

1.68

1.63

1.53

1.85

1.75

2.93

3.76

8.35 10.70

726.29 735.30 744.00 746.00

24.1

14.7 Bold figures are

Value Line

1.61

.93

estimates

3.7%

2.6%

Revenues per sh A

Cash Flow per sh

Earnings per sh B

Divds Decld per sh C

Capl Spending per sh

Book Value per sh D

Common Shs Outstg E

Avg Annl P/E Ratio

Relative P/E Ratio

Avg Annl Divd Yield

120.70

9.60

7.25

1.80

1.75

22.55

754.00

14.5

.97

1.7%

58198 54069 50485 52457 54845 61530 66387 60909

11.7% 10.9%

7.2%

8.3%

7.4%

9.0% 11.1%

8.9%

1750.0 1497.0 1450.0 1509.0 1503.0 1545.0 1486.0 1491.0

2316.0 2275.0 809.0 1321.0 1920.0 2839.0 4058.0 2654.0

30.6% 26.4% 21.2% 24.1% 29.0% 28.6% 33.7% 33.6%

4.0%

4.2%

1.6%

2.5%

3.5%

4.6%

6.1%

4.4%

d4280 d2955 d1190 d5735 d6220 d6718 d4258 d4961

10866 12589 13299 10879 9538.0 8157.0 7455.0 6952.0

10825 7696.0 8139.0 11286 11059 4739.0 9004.0 d1294

12.2% 12.9%

5.6%

7.5% 11.0% 24.3% 26.5% 51.1%

21.4% 29.6%

9.9% 11.7% 17.4% 59.9% 45.1%

-16.0% 22.1%

2.9%

6.0%

9.9% 39.7% 32.9%

-25%

25%

71%

49%

43%

34%

27%

45%

68281

5.4%

1666.0

1335.0

22.9%

2.0%

2392.0

12217

2128.0

11.3%

62.7%

5.4%

91%

Revenues ($mill) A

Operating Margin

Depreciation ($mill) F

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Capl ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Capl

Return on Shr. Equity

Retained to Com Eq

All Divds to Net Prof

91000

11.5%

1750

5500

30.0%

6.0%

13000

10000

17000

21.5%

32.5%

24.5%

25%

BUSINESS: The Boeing Company is a leading manufacturer of

commercial jet aircraft. Manufactures the 737, 747, 767, 777, and

787. Also produces business jets, fighters (F-15, F/A-18), C-17

cargo carrier, V-22 helicopter, E-3 AWACS, E-4 command post, E-6

submarine communicator, ground transportation systems, develops

the space station, and does work on the F-22 (ATF). Foreign sales:

41%; R&D: 6.4%. Has 160,500 employees. Officers & directors

control about 0.8% of stock; State Street Bank and Trust, 13.8%;

Evercore Trust, 12.7%; Capital World Investors, 6.5% (3/11 proxy).

Chrmn., CEO, and Pres.: W. James McNerney, Jr. Incorporated:

Delaware. Address: 100 North Riverside, Chicago, Illinois 606061596. Telephone: 312-544-2000. Internet: www.boeing.com.

Boeings September-period financial

results were impressive. For the interim,

the

aerospace/defense behemoth

achieved share net of $1.46, well ahead of

our estimate, and 30% higher than the

year-earlier figure. Looking ahead,

The fourth quarter ought to be more

challenging. We now expect share net of

$0.95 for the period, $0.13 lower than our

previous estimate, and well below the

year-earlier tally. Management recently

mentioned that it will likely deliver 15 to

20 new 747 and 787 models in 2011, down

from its previous target of 25 to 30. It

looks like a good chunk of these deliveries

will be pushed into 2012, and not contribute to December-period results.

Boeings prospects for 2012 and

beyond appear solid. Although probable

cuts to the United States Defense Budget

loom (discussed below), significant demand

for the companys commercial aircraft

should persist. For instance, just recently,

Lion Air, Indonesias largest private airline, stated that it is planning to purchase

230 Boeing aircraft; the total list price is

$21.7 billion. A number of other carriers

are also interested in purchasing new

planes, and Boeings backlog remains

huge, at more than 3,500 aircraft, valued

at $273 billion. Furthermore, after a number of production and testing delays,

Boeing recently delivered the first 787, as

well as an updated version of its 747.

These planes are in great demand and

should support full production for many

years. All told, we project healthy annual

share-earnings gains to 20142016.

Likely cuts to the Defense Budget are

a concern. Boeing designs and manufactures a wide array of military products

ranging from fighter aircraft to radios.

Due to the failure of Congress Super Committee to come to a debt-reduction agreement, the Defense Budget will likely be

cut by about $1.2 trillion over the next ten

years or so. At this time, it is too early to

tell which programs will be reduced or

eliminated, but Boeing stands to lose some

business over the next decade.

That said, we still like this Dow component as a long-term holding. Its vast

backlog should support sizable annual

profit advances, giving the equity appealing 3- to 5-year total return potential.

Ian Gendler

December 16, 2011

28.37 32.65 47.05 59.87 66.60 61.36 72.94 67.61 63.08 66.13 72.11 81.19 90.12 87.24

2.07

2.83

2.15

2.92

4.22

4.77

5.10

4.72

2.82

3.57

4.50

5.78

7.53

5.94

.58

1.42

.63

1.15

2.19

2.84

2.79

2.82

1.00

1.63

2.39

3.62

5.26

3.63

.50

.55

.56

.56

.56

.59

.68

.68

.68

.85

1.05

1.25

1.45

1.62

.91

1.10

1.43

1.69

1.42

1.11

1.34

1.25

.93

1.23

2.03

2.22

2.35

2.40

14.39 15.75 13.31 13.13 13.16 13.18 13.57

9.62 10.17 14.23 14.54

6.25 12.22 d1.85

687.91 694.73 973.48 937.86 870.82 836.33 797.89 799.66 800.28 793.20 760.58 757.84 736.68 698.14

NMF

31.0

NMF

37.6

18.6

17.1

18.6

14.1

33.4

29.4

26.0

22.2

17.9

18.3

NMF

1.94

NMF

1.96

1.06

1.11

.95

.77

1.90

1.55

1.38

1.20

.95

1.10

1.6%

1.2%

1.1%

1.3%

1.4%

1.2%

1.3%

1.7%

2.0%

1.8%

1.7%

1.6%

1.5%

2.4%

CAPITAL STRUCTURE as of 9/30/11

THIS

STOCK

06, d54; 07, 2; 08, 2; 09, d3; 10, 45.

EPS may not sum to total due to roundg. Next

egs. rpt. due late Jan.(C) Divds paid in early

Mar., Jun., Sept., Dec. Divd rein. plan avail.

64306

10.2%

1727.0

3311.0

26.5%

5.1%

5177.0

11473

2766.0

25.6%

NMF

74.4%

38%

69600

10.0%

1700

3340

30.0%

4.8%

8500

11000

6200

21.0%

54.0%

33.5%

38%

(D) Incl intang. In 2010: $7.9 bill., $10.77/sh.

(E) In millions. (F) Depr. on accelerated basis.

(G) Excl. ShareValue stk. (H) Based on fullyear diluted shares.

2011, Value Line Publishing LLC. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscribers own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

78000

10.5%

1725

4000

30.0%

5.1%

9300

10000

8000

23.5%

50.0%

34.5%

32%

Companys Financial Strength

Stocks Price Stability

Price Growth Persistence

Earnings Predictability

A+

75

70

30

To subscribe call 1-800-833-0046.

Das könnte Ihnen auch gefallen

- Treasury Direct Account TDADokument10 SeitenTreasury Direct Account TDAVincent J. Cataldi91% (81)

- Chapter 7. CH 7-20 Build A Model: Dividend $1.60 1.92 2.304 2.44224Dokument6 SeitenChapter 7. CH 7-20 Build A Model: Dividend $1.60 1.92 2.304 2.44224wincippNoch keine Bewertungen

- Harley DavidsonDokument5 SeitenHarley DavidsonpagalinsanNoch keine Bewertungen

- Arrangement Architecture - BasicDokument26 SeitenArrangement Architecture - Basicsharath.np100% (6)

- Case 2 AuditDokument8 SeitenCase 2 AuditReinhard BosNoch keine Bewertungen

- Ek VLDokument1 SeiteEk VLJohn Aldridge ChewNoch keine Bewertungen

- Credit Suisse (Incl. NPV Build Up)Dokument23 SeitenCredit Suisse (Incl. NPV Build Up)rodskogjNoch keine Bewertungen

- 3M Company: 20.1 15.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDokument1 Seite3M Company: 20.1 15.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDasdzxcv1234Noch keine Bewertungen

- Wet Seal - VLDokument1 SeiteWet Seal - VLJohn Aldridge ChewNoch keine Bewertungen

- Alcoa: 5.7 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDokument1 SeiteAlcoa: 5.7 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDekidenNoch keine Bewertungen

- JPM Guide To The Markets - Q1 2014Dokument71 SeitenJPM Guide To The Markets - Q1 2014adamsro9Noch keine Bewertungen

- B11066 Long Term Financing, EVA & MVA: Dewan Housing Finance LimitedDokument7 SeitenB11066 Long Term Financing, EVA & MVA: Dewan Housing Finance LimitedAmit JindalNoch keine Bewertungen

- Havells Initiating Coverage 27 Apr 2011Dokument23 SeitenHavells Initiating Coverage 27 Apr 2011ananth999Noch keine Bewertungen

- Eclerx Services (Eclser) : Chugging Along..Dokument6 SeitenEclerx Services (Eclser) : Chugging Along..shahavNoch keine Bewertungen

- United Engineers - CIMBDokument7 SeitenUnited Engineers - CIMBTheng RogerNoch keine Bewertungen

- Bosch (Akash Negi-JL19FS006) Assumptions Used in Valuation and Their RationaleDokument4 SeitenBosch (Akash Negi-JL19FS006) Assumptions Used in Valuation and Their Rationaleakash NegiNoch keine Bewertungen

- Subros Result UpdatedDokument10 SeitenSubros Result UpdatedAngel BrokingNoch keine Bewertungen

- First Resources: Singapore Company FocusDokument7 SeitenFirst Resources: Singapore Company FocusphuawlNoch keine Bewertungen

- Atul Auto (ATUAUT) : Market Rewards PerformanceDokument5 SeitenAtul Auto (ATUAUT) : Market Rewards PerformanceGaurav JainNoch keine Bewertungen

- Chapter09 SMDokument14 SeitenChapter09 SMkike-armendarizNoch keine Bewertungen

- Infosys: Performance HighlightsDokument15 SeitenInfosys: Performance HighlightsAtul ShahiNoch keine Bewertungen

- Tide Water OilDokument24 SeitenTide Water OilAditya Kumar KonathalaNoch keine Bewertungen

- Financial Management Report FPT Corporation: Hanoi University Faculty of Management and TourismDokument18 SeitenFinancial Management Report FPT Corporation: Hanoi University Faculty of Management and TourismPham Thuy HuyenNoch keine Bewertungen

- Relaxo Footwear 1QFY2013RU 070812Dokument12 SeitenRelaxo Footwear 1QFY2013RU 070812Angel BrokingNoch keine Bewertungen

- Top Glove 140618Dokument5 SeitenTop Glove 140618Joseph CampbellNoch keine Bewertungen

- Bank of Baroda Result UpdatedDokument12 SeitenBank of Baroda Result UpdatedAngel BrokingNoch keine Bewertungen

- Kajaria Ceramics: Upgrade in Price TargetDokument4 SeitenKajaria Ceramics: Upgrade in Price TargetSudipta BoseNoch keine Bewertungen

- Lbo Case StudyDokument6 SeitenLbo Case StudyRishabh MishraNoch keine Bewertungen

- Bank of India Result UpdatedDokument12 SeitenBank of India Result UpdatedAngel BrokingNoch keine Bewertungen

- Jagran Prakashan: Performance HighlightsDokument10 SeitenJagran Prakashan: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Suggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsDokument16 SeitenSuggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsMdAnjum1991Noch keine Bewertungen

- Bank of Baroda: Q4FY11 - Core Numbers On Track CMPDokument5 SeitenBank of Baroda: Q4FY11 - Core Numbers On Track CMPAnkita GaubaNoch keine Bewertungen

- IDBI Bank: Performance HighlightsDokument13 SeitenIDBI Bank: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Cox & Kings (CNKLIM) : Peak Season of HBR Drives ToplineDokument6 SeitenCox & Kings (CNKLIM) : Peak Season of HBR Drives ToplineDarshan MaldeNoch keine Bewertungen

- Gujarat State Petronet: Performance HighlightsDokument10 SeitenGujarat State Petronet: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Hexaware Result UpdatedDokument13 SeitenHexaware Result UpdatedAngel BrokingNoch keine Bewertungen

- Nestle India: Performance HighlightsDokument9 SeitenNestle India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Asian Paints Result UpdatedDokument10 SeitenAsian Paints Result UpdatedAngel BrokingNoch keine Bewertungen

- Blue Star Q1FY14 Result UpdateDokument5 SeitenBlue Star Q1FY14 Result UpdateaparmarinNoch keine Bewertungen

- SageOne Investor Memo Mar 2024Dokument9 SeitenSageOne Investor Memo Mar 2024bhavan123Noch keine Bewertungen

- DCF Valuation Financial ModelingDokument10 SeitenDCF Valuation Financial ModelingHilal MilmoNoch keine Bewertungen

- IDBI Bank Result UpdatedDokument13 SeitenIDBI Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- Bank of India Result UpdatedDokument12 SeitenBank of India Result UpdatedAngel BrokingNoch keine Bewertungen

- Coach, Inc.: 16.9 21.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDokument1 SeiteCoach, Inc.: 16.9 21.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDiver2340_729926247Noch keine Bewertungen

- Ratio Analysis Mini Case ModelDokument3 SeitenRatio Analysis Mini Case ModelSammir MalhotraNoch keine Bewertungen

- Turning The Corner, But No Material Pick-UpDokument7 SeitenTurning The Corner, But No Material Pick-UpTaek-Geun KwonNoch keine Bewertungen

- Technics Oil & Gas: 3QFY12 Results ReviewDokument4 SeitenTechnics Oil & Gas: 3QFY12 Results ReviewtansillyNoch keine Bewertungen

- GSK Consumer: Performance HighlightsDokument9 SeitenGSK Consumer: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Glaxosmithkline Pharma: Performance HighlightsDokument11 SeitenGlaxosmithkline Pharma: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Financial InvestmentDokument16 SeitenFinancial InvestmentUyên TrangNoch keine Bewertungen

- 1 Valuation Exercise Fall 2020 1Dokument3 Seiten1 Valuation Exercise Fall 2020 1Elizabeth PGNoch keine Bewertungen

- Wing Tai Holdings: 2QFY11 Results ReviewDokument4 SeitenWing Tai Holdings: 2QFY11 Results ReviewRaymond LuiNoch keine Bewertungen

- Relaxo Footwear, 7th February, 2013Dokument12 SeitenRelaxo Footwear, 7th February, 2013Angel BrokingNoch keine Bewertungen

- HCL Technologies: Performance HighlightsDokument15 SeitenHCL Technologies: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Indian Overseas BankDokument11 SeitenIndian Overseas BankAngel BrokingNoch keine Bewertungen

- Rs 490 Hold: Key Take AwayDokument5 SeitenRs 490 Hold: Key Take AwayAnkush SaraffNoch keine Bewertungen

- RMN - 0228 - THCOM (Achieving The Impossible)Dokument4 SeitenRMN - 0228 - THCOM (Achieving The Impossible)bodaiNoch keine Bewertungen

- R&D Expenses: Despite Establishing New Facilities With Updated Technologies, R&D Expenses Have Not Been ExplicitlyDokument1 SeiteR&D Expenses: Despite Establishing New Facilities With Updated Technologies, R&D Expenses Have Not Been ExplicitlyAmarjeet SinghNoch keine Bewertungen

- Hexaware Result UpdatedDokument13 SeitenHexaware Result UpdatedAngel BrokingNoch keine Bewertungen

- Persistent, 29th January 2013Dokument12 SeitenPersistent, 29th January 2013Angel BrokingNoch keine Bewertungen

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioVon EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNoch keine Bewertungen

- Handout 2654 CP2654 Automated TestingDokument14 SeitenHandout 2654 CP2654 Automated TestingsonystdNoch keine Bewertungen

- Handout 2654 CP2654 Automated TestingDokument14 SeitenHandout 2654 CP2654 Automated TestingsonystdNoch keine Bewertungen

- Principal Protected Investments: Structured Investments Solution SeriesDokument8 SeitenPrincipal Protected Investments: Structured Investments Solution SeriessonystdNoch keine Bewertungen

- AutoCAD 2016 - Restoring The Classic WorkspaceDokument8 SeitenAutoCAD 2016 - Restoring The Classic WorkspacesonystdNoch keine Bewertungen

- C# - Algorithm For Simplifying Decimal To Fractions - Stack OverflowDokument12 SeitenC# - Algorithm For Simplifying Decimal To Fractions - Stack OverflowsonystdNoch keine Bewertungen

- ISO 10383 Market Identifier Code (MIC)Dokument27 SeitenISO 10383 Market Identifier Code (MIC)sonystdNoch keine Bewertungen

- Disclaimer - Google FinanceDokument5 SeitenDisclaimer - Google FinancesonystdNoch keine Bewertungen

- The Best of Charlie Munger 1994 2011Dokument349 SeitenThe Best of Charlie Munger 1994 2011VALUEWALK LLC100% (6)

- Tax Reporting 2013Dokument2 SeitenTax Reporting 2013sonystdNoch keine Bewertungen

- RecursiveDokument3 SeitenRecursivevijayakumarvarmaNoch keine Bewertungen

- 5 Ways 6 Themes DiagramsDokument3 Seiten5 Ways 6 Themes DiagramssonystdNoch keine Bewertungen

- TP's "Top 41" Quotes: "Do One Thing Every Day That Scares You."-Eleanor RooseveltDokument6 SeitenTP's "Top 41" Quotes: "Do One Thing Every Day That Scares You."-Eleanor RooseveltFelipe Rodrigues MadeiraNoch keine Bewertungen

- Temple Grandin On A New Approach For Thinking About ThinkingDokument3 SeitenTemple Grandin On A New Approach For Thinking About Thinkingsonystd100% (1)

- How People With Autism ThinkDokument20 SeitenHow People With Autism ThinksonystdNoch keine Bewertungen

- Through The Interface - ExcelDokument19 SeitenThrough The Interface - ExcelsonystdNoch keine Bewertungen

- Visual Thinking - Autism Research InstituteDokument10 SeitenVisual Thinking - Autism Research InstitutesonystdNoch keine Bewertungen

- 649 1444 1 PBDokument12 Seiten649 1444 1 PBsonystdNoch keine Bewertungen

- RamachandranDokument2 SeitenRamachandranmumsthewordfaNoch keine Bewertungen

- AnnualReport2010 UKDokument152 SeitenAnnualReport2010 UKsonystdNoch keine Bewertungen

- 10718Dokument23 Seiten10718sonystdNoch keine Bewertungen

- Page 17Dokument1 SeitePage 17sonystdNoch keine Bewertungen

- The Mutual Fund Scandal: 104 Poor Charlie's AlmanackDokument1 SeiteThe Mutual Fund Scandal: 104 Poor Charlie's AlmanacksonystdNoch keine Bewertungen

- FIN424 - Assignment 1-2nd Term-2021-22Dokument7 SeitenFIN424 - Assignment 1-2nd Term-2021-22Memoona NawazNoch keine Bewertungen

- Apparel Roi CalculatorDokument3 SeitenApparel Roi CalculatorRezza AdityaNoch keine Bewertungen

- BAM 242 Pre Final Exam PointersDokument2 SeitenBAM 242 Pre Final Exam PointersMarielle Dela Torre LubatNoch keine Bewertungen

- CO5123 Assignment - FinalDokument23 SeitenCO5123 Assignment - Finalchenxinyu821Noch keine Bewertungen

- Hitungan Kuis 6 Bethesda Mining CompanyDokument6 SeitenHitungan Kuis 6 Bethesda Mining Companyrica100% (1)

- Real Estate Finance and Investment - Lecture NotesDokument2 SeitenReal Estate Finance and Investment - Lecture NotesCoursePin100% (1)

- Business AccountingDokument1.108 SeitenBusiness AccountingAhmad Haikal100% (1)

- GIA Application Form.2018Dokument9 SeitenGIA Application Form.2018Charles Lim100% (1)

- Pfrs Title Effective DateDokument8 SeitenPfrs Title Effective DateZenedel De JesusNoch keine Bewertungen

- Oracle Fusion TaxDokument43 SeitenOracle Fusion Taxneeraj pandey60% (5)

- A Global Market Rotation Strategy With An Annual Performance of 41.4 PercentDokument6 SeitenA Global Market Rotation Strategy With An Annual Performance of 41.4 PercentLogical Invest100% (1)

- Finance Application Form PDFDokument2 SeitenFinance Application Form PDFKamo WolffNoch keine Bewertungen

- ch08 Financial Accounting, 7th EditionDokument72 Seitench08 Financial Accounting, 7th Editionrobbi ajaNoch keine Bewertungen

- Surveillance in Stock Exchanges ModuleDokument13 SeitenSurveillance in Stock Exchanges ModulebharatNoch keine Bewertungen

- Mergers and AcquisationsDokument33 SeitenMergers and AcquisationsAnku SharmaNoch keine Bewertungen

- Lecture 8 Metrics For Entrepreneurs and Startup Funding PDFDokument28 SeitenLecture 8 Metrics For Entrepreneurs and Startup Funding PDFBhagavan BangaloreNoch keine Bewertungen

- Citi Corporate SolutionsDokument9 SeitenCiti Corporate Solutionsapi-26094277Noch keine Bewertungen

- REFLECTION-PAPER-BA233N-forex MarketDokument6 SeitenREFLECTION-PAPER-BA233N-forex MarketJoya Labao Macario-BalquinNoch keine Bewertungen

- BS50619006056314 PDFDokument3 SeitenBS50619006056314 PDFAldrin Frank ValdezNoch keine Bewertungen

- Chapter 4 - Non-Current Assets Held For Sale & Discontinued OperationsDokument23 SeitenChapter 4 - Non-Current Assets Held For Sale & Discontinued Operationsarlynajero.ckcNoch keine Bewertungen

- Glossary Entrepreneurship Development: V+TeamDokument8 SeitenGlossary Entrepreneurship Development: V+TeamCorey PageNoch keine Bewertungen

- Cir Vs MitsubishiDokument3 SeitenCir Vs MitsubishiPacta Sunct ServandaNoch keine Bewertungen

- Financial Institutions and MarketDokument19 SeitenFinancial Institutions and MarketNilesh MotwaniNoch keine Bewertungen

- (Epelbaum) Vol Risk PremiumDokument25 Seiten(Epelbaum) Vol Risk PremiumrlindseyNoch keine Bewertungen

- Super Regulator in Financial MarketDokument32 SeitenSuper Regulator in Financial Marketrkaran22Noch keine Bewertungen

- CFITS BrochureDokument6 SeitenCFITS BrochureSiddhartha GaikwadNoch keine Bewertungen

- Democracy and The Policy Preferences of Wealthy AmericansDokument53 SeitenDemocracy and The Policy Preferences of Wealthy AmericansUmkc EconomistsNoch keine Bewertungen