Beruflich Dokumente

Kultur Dokumente

Irish Capital Gains Form

Hochgeladen von

Gragory NyauchiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Irish Capital Gains Form

Hochgeladen von

Gragory NyauchiCopyright:

Verfügbare Formate

Form CG1

Capital Gains Tax Return and Self-Assessment 2013

Tax Reference Number

Remember to quote this number in all correspondence or

when calling at your Revenue office (address available from

Contact Locator on www.revenue.ie)

Name and Address

When submitting this return use any envelope

and write Freepost above the Return Address.

NO STAMP REQUIRED

Return Address

RETURN OF CAPITAL GAINS FOR YEAR ENDED 31 DECEMBER 2013

This Tax Return should be completed and returned to your Revenue office on or before 31 October 2014. On that

date you must also pay any balance of tax due for 2013. If you file the return on or before 31 August 2014 Revenue

will complete the self-assessment for you. This will assist you in paying the correct amount by the due date. Where

this return is submitted after 31 October 2014 a surcharge (5% where the return is submitted within two months,

otherwise 10%) will be added to your tax liability. Failure to submit your Local Property Tax return will result in a tax

surcharge - please see note in the Form CG1 Helpsheet.

Please read the Form CG1 Helpsheet before completing this form. The helpsheet is available at www.revenue.ie or

from our Forms & Leaflets Service by phoning LoCall 1890 306 706 (ROI only), +353 1 702 3050.

Legislative references relate to Sections of the Taxes Consolidation Act 1997, unless otherwise stated.

YOU MUST SIGN THIS DECLARATION

I DECLARE that, to the best of my knowledge and belief, this form contains a correct return of all the chargeable gains and allowable

losses that accrued to me in the year ended 31 December 2013 in accordance with the provisions of the Taxes Consolidation Act 1997, and

I DECLARE that, to the best of my knowledge and belief, all the particulars given as regards reliefs claimed are correctly stated.

(DD/MM/YYYY)

Signature

Date

Capacity of Signatory

Main Residence Address

(Registered Office, if a Company)

Business Address if different from

Main Residence Address or

Registered Office Address

Contact Details (in case of query about this return)

Agents TAIN

Contact Name

Clients Reference

Telephone or E-Mail

RPC003707_EN_WB_L_1

PAGE 1

FORM CG1 2013

Tax Reference Number

CAPITAL GAINS - Capital Gains for the year 1 January 2013 - 31 December 2013

1. Description of Assets

No. of

Disposals

Aggregate

Area in Hectares

Aggregate

Consideration

(a) Shares/Securities - Quoted

. 00

(b) Shares/Securities - Unquoted

. 00

(c) Agricultural Land/Buildings

. 00

(d) Development Land

. 00

(e) Foreign Life Policies (S. 594) chargeable at 40%

. 00

(f) Offshore Funds (S. 747A) chargeable at 40%

. 00

(g) Commercial Premises

. 00

(h) Residential Premises

. 00

(i) Shares or Securities exchanged (S. 913(5))

. 00

(j) Venture Fund Gains (S. 541C(2)(a)) chargeable at 15%

. 00

(k) Other Assets

. 00

(l) Total Consideration

. 00

Insert T in the box(es) to indicate

Spouse or

Civil Partner

Self

2. If any disposal was between connected parties or otherwise

not at arms length

3. If any of the original acquisitions were between connected parties

or otherwise not at arms length

4. If the market value has been substituted for the cost of acquisition

of any assets disposed of

5. Claim to Reliefs - Self

(a) Disposal of Principal Private Residence: enter amount of consideration

. 00

(b) Retirement Relief - Within the Family: enter consideration on disposal of qualifying assets

. 00

(c) Retirement Relief - Outside the Family: enter consideration on disposal of qualifying assets

. 00

(d) Disposal of a site to a child: enter amount of consideration

. 00

. 00

(a) Disposal of Principal Private Residence: enter amount of consideration

. 00

(b) Retirement Relief - Within the Family: enter consideration on disposal of qualifying assets

. 00

(c) Retirement Relief - Outside the Family: enter consideration on disposal of qualifying assets

. 00

(d) Disposal of a site to a child: enter amount of consideration

. 00

. 00

(e) Other

(specify)

enter amount of consideration

6. Claim to Reliefs - Spouse or Civil Partner

(e) Other

(specify)

enter amount of consideration

PAGE 2

FORM CG1 2013

Tax Reference Number

Spouse or

Civil Partner

Self

CAPITAL GAINS (contd.)

7.

Chargeable Gain(s) (excluding Foreign Life Policies)

. 00

. 00

8.

Previous Gain(s) Rolled-over (now chargeable)

. 00

. 00

9.

Net Loss(es) in 2013

. 00

. 00

. 00

. 00

10. Amount of unused Loss(es) from prior year(s) available for offset

against chargeable gains above

. 00

11. Personal Exemption (max 1,270 per spouse or civil partner & not transferable)

Note: losses, including losses forward, must be used first

. 00

12. Net Chargeable Gain (excluding Foreign Life Policies)

. 00

. 00

13. Chargeable Gain on Foreign Life Policies

. 00

. 00

14. Unused Loss(es) for carry forward to 2014

. 00

. 00

If you have an overall CGT loss in 2013 there is no need to complete Lines 15 or 16.

15. In respect of net chargeable gains that arose in the period 1 January 2013 - 30 November 2013

(a) Enter amount of net gain to be charged at 33%

(b) Enter amount of net gain to be charged at 40%

(excluding Foreign Life Policies)

(c) Enter amount of net gain on Foreign Life Policies

to be charged at 40%

(d) Enter amount of net gain in respect of Venture Fund Capital

to be charged at 15%

(e) (i) Enter amount of net gain in respect of a disposal of land

under Compulsory Purchase Order (CPO) which has

accrued in 2013 by virtue of S. 542(1)(d)

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

(ii) Date of disposal (DD/MM/YYYY)

(f) Enter the amount of net gain on windfall gains attributable

to rezoning/relevant planning decisions to be charged

at 80% (S. 649B)

/

. 00

. 00

16. In respect of net chargeable gains that arose in the period 1 December 2013 - 31 December 2013

(a) Enter amount of net gain to be charged at 33%

. 00

. 00

(b) Enter amount of net gain to be charged at 40%

(excluding Foreign Life Policies)

. 00

. 00

(c) Enter amount of net gain on Foreign Life Policies

to be charged at 40%

. 00

. 00

(d) Enter amount of net gain in respect of Venture Fund Capital

to be charged at 15%

. 00

. 00

(e) (i) Enter amount of net gain in respect of a disposal of land

under Compulsory Purchase Order (CPO) which has

accrued in 2013 by virtue of S. 542(1)(d)

. 00

. 00

(ii) Date of disposal (DD/MM/YYYY)

(f) Enter the amount of net gain on windfall gains attributable

. 00

to rezoning/relevant planning decisions to be charged

,

,

,

,

at 80% (S. 649B)

17. Double Taxation Relief

If you wish to claim relief for foreign tax in respect of a disposal that gives rise to a liability to capital gains tax shown above,

provide the following information in respect of each such foreign disposal

Amount of foreign tax

Country

Amount of gain

,

PAGE 3

. 00

for which relief

is now claimed

. 00

. 00

.

.

FORM CG1 2013

18. Expression of Doubt

If you have a genuine doubt about the correct application of tax law to any item in the return, insert T

in the box and provide details of the point of issue in the entry fields provided below.

(a) Provide full details of the facts and circumstances of the matter to which the Expression of Doubt relates

(b) Specify the doubt, the basis for the doubt and the tax law giving rise to the doubt

(c) Identify the amount of tax in doubt in respect of the chargeable period to which the Expression

of Doubt relates

(d) List the supporting documents that are being submitted in relation to the matter involved. These documents should accompany

this return

(e) Identify any published Revenue guidelines that you have consulted concerning the application of the law in similar circumstances

Self-Assessment made under Chapter 4 of Part 41A

This return must include a Self-Assessment by the chargeable person to whom the return relates. An individual who fails to make a selfassessment will be liable to a penalty of 250.

19. Self-Assessment Capital Gains Tax 2013

(a) Amount of chargeable gains arising for this period

(b) Amount of tax chargeable for this period

(c) Amount of tax payable for this period

(d) Amount of surcharge due under S. 1084 because of late filing of this return

(e) Amount of surcharge due under S. 1084 because of non-compliance with LPT requirements

(f) Amount of tax paid directly to the Collector-General for this period

(g) (i) Balance of tax payable for this period

(ii) Balance of tax overpaid for this period

I DECLARE the above to be my Self-Assessment to Capital Gains Tax for the year of assessment 2013

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

(DD/MM/YYYY)

Date

Signature

Capacity of Signatory

Page 4

FORM CG1 2013

Das könnte Ihnen auch gefallen

- Instructions For Filling Out FORM ITR-2Dokument8 SeitenInstructions For Filling Out FORM ITR-2Ganesh KumarNoch keine Bewertungen

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDokument6 SeitenCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax Returnapi-252942620Noch keine Bewertungen

- 1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Dokument12 Seiten1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Ganesh ChavanNoch keine Bewertungen

- IT Return IndividualDokument42 SeitenIT Return IndividualAllanNoch keine Bewertungen

- Income Tax - ExercisesDokument2 SeitenIncome Tax - ExercisesEnges FormulaNoch keine Bewertungen

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDokument2 SeitenInterest Charge On DISC-Related Deferred Tax Liability: Sign HereInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Noch keine Bewertungen

- Special Itemized Deductions, NOLCO & OSDDokument13 SeitenSpecial Itemized Deductions, NOLCO & OSDdianne caballero100% (1)

- IRS f982 Goes With The 1099-CDokument5 SeitenIRS f982 Goes With The 1099-Cexousiallc100% (3)

- Form 15ca FormatDokument4 SeitenForm 15ca FormattejashtannaNoch keine Bewertungen

- Finals - II. Deductions & ExemptionsDokument13 SeitenFinals - II. Deductions & ExemptionsJovince Daño DoceNoch keine Bewertungen

- Monthly VAT ReturnDokument34 SeitenMonthly VAT ReturnEdris MatovuNoch keine Bewertungen

- Questionnaire ObjectiveDokument9 SeitenQuestionnaire Objectiveprasadzinjurde100% (3)

- Form No.16: Part ADokument3 SeitenForm No.16: Part AYogesh DhekaleNoch keine Bewertungen

- Application For Exemption of Customs DutyDokument10 SeitenApplication For Exemption of Customs DutyFahad BataviaNoch keine Bewertungen

- Tax Form 2013 (Trinidad)Dokument5 SeitenTax Form 2013 (Trinidad)Natasha ThomasNoch keine Bewertungen

- Instructions For Filling Out FORM ITR-2Dokument7 SeitenInstructions For Filling Out FORM ITR-2Harminder Singh DhamNoch keine Bewertungen

- Belastingaangifte Bill & Melinda Gates FoundationDokument98 SeitenBelastingaangifte Bill & Melinda Gates FoundationDe MorgenNoch keine Bewertungen

- 2012 Building Intl Bridges (03!28!2013)Dokument17 Seiten2012 Building Intl Bridges (03!28!2013)Jk McCreaNoch keine Bewertungen

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Dokument6 SeitenTax Credit Statement (: Instructions For Filling FORM ITR-2ajey_p1270Noch keine Bewertungen

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Dokument7 SeitenTax Credit Statement (: Instructions For Filling FORM ITR-2Manyam JainiNoch keine Bewertungen

- As 22 Accounting For Taxes On IncomeDokument34 SeitenAs 22 Accounting For Taxes On IncomeArun AroraNoch keine Bewertungen

- Tax Audit Clauses PDFDokument13 SeitenTax Audit Clauses PDFSunil KumarNoch keine Bewertungen

- Income Tax Declaration Form - F.Y. 2020-21Dokument8 SeitenIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNoch keine Bewertungen

- Instructions For Filling Out FORM ITR-2: Page 1 of 10Dokument10 SeitenInstructions For Filling Out FORM ITR-2: Page 1 of 10mehtakvijayNoch keine Bewertungen

- Form 11: Tax Return and Self-Assessment For The Year 2014Dokument32 SeitenForm 11: Tax Return and Self-Assessment For The Year 2014garyjenkins82Noch keine Bewertungen

- WWW - Incometaxindia.gov - In: Instructions To Form ITR-7 (A.Y .2018-19)Dokument26 SeitenWWW - Incometaxindia.gov - In: Instructions To Form ITR-7 (A.Y .2018-19)Uttam K SharmaNoch keine Bewertungen

- Form 231Dokument9 SeitenForm 231sanjay jadhav100% (5)

- Income From Business & ProfessionDokument8 SeitenIncome From Business & ProfessionAnitha GirigoudruNoch keine Bewertungen

- Mvat f231Dokument5 SeitenMvat f231pgotaphoeNoch keine Bewertungen

- Bir60 EguideDokument15 SeitenBir60 Eguidekumar.arasu8717Noch keine Bewertungen

- Toaz - Info Reviewers For Deductions Taxation PRDokument30 SeitenToaz - Info Reviewers For Deductions Taxation PRLa JewelNoch keine Bewertungen

- US Internal Revenue Service: f5500sb - 1993Dokument3 SeitenUS Internal Revenue Service: f5500sb - 1993IRSNoch keine Bewertungen

- Mcq-Pgbp-Ito Exam-2020Dokument9 SeitenMcq-Pgbp-Ito Exam-2020Durgadevi BaskaranNoch keine Bewertungen

- Form Jvat 409Dokument2 SeitenForm Jvat 409Suzanne BradyNoch keine Bewertungen

- Return of Private Foundation: Line 16)Dokument13 SeitenReturn of Private Foundation: Line 16)diego76diegoNoch keine Bewertungen

- Income-Tax Rules, 1962Dokument17 SeitenIncome-Tax Rules, 1962mohd aslamNoch keine Bewertungen

- Farm Rental Income and Expenses: Form Department of The Treasury Internal Revenue Service (99) OMB No. 1545-0074Dokument4 SeitenFarm Rental Income and Expenses: Form Department of The Treasury Internal Revenue Service (99) OMB No. 1545-0074AlexNoch keine Bewertungen

- ITR62 Form 15 CADokument5 SeitenITR62 Form 15 CAMohit47Noch keine Bewertungen

- Colegio de San Juan de Letran: The Accountancy ProfessionDokument2 SeitenColegio de San Juan de Letran: The Accountancy ProfessionRed YuNoch keine Bewertungen

- Ca Inter Direct Tax MCQDokument213 SeitenCa Inter Direct Tax MCQVikramNoch keine Bewertungen

- Tax 1 CorpDokument16 SeitenTax 1 CorpRen A Eleponio0% (1)

- Statement For Claiming Exemption From Withholding On Foreign Earned Income Eligible For The Exclusion(s) Provided by Section 911Dokument2 SeitenStatement For Claiming Exemption From Withholding On Foreign Earned Income Eligible For The Exclusion(s) Provided by Section 911douglas jonesNoch keine Bewertungen

- Final Audit - Insurance Audit Notes PDFDokument9 SeitenFinal Audit - Insurance Audit Notes PDFBhavin Nilesh PandyaNoch keine Bewertungen

- 2015 Taxation Law QuestionsDokument15 Seiten2015 Taxation Law QuestionsSab CardNoch keine Bewertungen

- Accounting For Income Taxes - QuizDokument3 SeitenAccounting For Income Taxes - QuizAngelica manaois100% (2)

- Taxation - Deduction - Quizzer - CPA Review - 2017Dokument6 SeitenTaxation - Deduction - Quizzer - CPA Review - 2017Kenneth Bryan Tegerero Tegio100% (1)

- Bir60 EguideDokument12 SeitenBir60 EguideRay Li Shing KitNoch keine Bewertungen

- 2016 Itr4 PR3Dokument165 Seiten2016 Itr4 PR3TejasNoch keine Bewertungen

- Suggested Answers Intermediate Examination - Spring 2013: TaxationDokument7 SeitenSuggested Answers Intermediate Examination - Spring 2013: TaxationMuhammad Usman SaeedNoch keine Bewertungen

- Form No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - ADokument16 SeitenForm No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - ARaj PalNoch keine Bewertungen

- ITR FAQs AY 2223 TaxmannDokument45 SeitenITR FAQs AY 2223 TaxmannManikandanNoch keine Bewertungen

- 2007 Bar ExaminationDokument14 Seiten2007 Bar ExaminationHaRry PeregrinoNoch keine Bewertungen

- Final Tax Audit-JigarDokument20 SeitenFinal Tax Audit-JigarJigar MehtaNoch keine Bewertungen

- RMC 17 2011 Notes To FS Taxes PDFDokument3 SeitenRMC 17 2011 Notes To FS Taxes PDFMarie Vea RamosNoch keine Bewertungen

- 1040 Exam Prep: Module I: The Form 1040 FormulaVon Everand1040 Exam Prep: Module I: The Form 1040 FormulaBewertung: 1 von 5 Sternen1/5 (3)

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsVon Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsNoch keine Bewertungen

- 1040 Exam Prep Module X: Small Business Income and ExpensesVon Everand1040 Exam Prep Module X: Small Business Income and ExpensesNoch keine Bewertungen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Direct Property & Casualty Insurance Carrier Revenues World Summary: Market Values & Financials by CountryVon EverandDirect Property & Casualty Insurance Carrier Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Laguna Lake Development Authority VDokument2 SeitenLaguna Lake Development Authority VErikha AranetaNoch keine Bewertungen

- Dodds v. Law Firm Office of Bryon Barnhill Et Al - Document No. 5Dokument7 SeitenDodds v. Law Firm Office of Bryon Barnhill Et Al - Document No. 5Justia.comNoch keine Bewertungen

- Dispensing Barangay Justice Through Lupong Tagapamayapa: Barangay Bagong Nayon, Antipolo City, RizalDokument5 SeitenDispensing Barangay Justice Through Lupong Tagapamayapa: Barangay Bagong Nayon, Antipolo City, RizalMar GieNoch keine Bewertungen

- Self Supporting Ministry InformationDokument19 SeitenSelf Supporting Ministry Informationknownperson100% (38)

- Garvida Vs Sales G.R. No. 124893Dokument7 SeitenGarvida Vs Sales G.R. No. 124893Taluwt A MaguindanaoNoch keine Bewertungen

- Basic Legal Ethics - CASE DIGESTS Ass. 8-10 (Due April 26)Dokument38 SeitenBasic Legal Ethics - CASE DIGESTS Ass. 8-10 (Due April 26)Kim Muzika Perez100% (2)

- MR Elany MartyDokument16 SeitenMR Elany Martyjomalaw6714Noch keine Bewertungen

- Common Letter of Parliamentary, Extra-Parliamentary Parties, & Social Movements of Mauritius 22-05-23 8.00 P.MDokument2 SeitenCommon Letter of Parliamentary, Extra-Parliamentary Parties, & Social Movements of Mauritius 22-05-23 8.00 P.ML'express Maurice100% (1)

- Reyes vs. VitanDokument2 SeitenReyes vs. VitanMark Catabijan CarriedoNoch keine Bewertungen

- Alagappa Industrial Relations PDFDokument162 SeitenAlagappa Industrial Relations PDFprabu06051984Noch keine Bewertungen

- Government Office Hours DocuDokument6 SeitenGovernment Office Hours DocuChing Romero100% (1)

- Narido v. LinsanganDokument2 SeitenNarido v. LinsanganNikki Rose Laraga AgeroNoch keine Bewertungen

- 6714 16245 1 SMDokument15 Seiten6714 16245 1 SMadrian bima putraNoch keine Bewertungen

- DOPL Contractor Fined 072619Dokument5 SeitenDOPL Contractor Fined 072619Alyssa RobertsNoch keine Bewertungen

- Income Taxation Chapter1Dokument50 SeitenIncome Taxation Chapter1Ja Red100% (1)

- Jews in Nazi Germany 1933Dokument103 SeitenJews in Nazi Germany 1933سید ہارون حیدر گیلانی100% (1)

- PDF 8128 PDFDokument60 SeitenPDF 8128 PDFBatteriefuhrerNoch keine Bewertungen

- Reservation in PromotionsDokument33 SeitenReservation in PromotionsAhad AliNoch keine Bewertungen

- Application For Probation PabloDokument4 SeitenApplication For Probation Pablofrancis deeNoch keine Bewertungen

- Rights of A ConsumerDokument2 SeitenRights of A ConsumerAkilesh ReddyNoch keine Bewertungen

- Chapter 4 - The Global Interstate System E-ModuleDokument17 SeitenChapter 4 - The Global Interstate System E-Modulefilbiano18Noch keine Bewertungen

- Gang Stalking Flyer3Dokument1 SeiteGang Stalking Flyer3Dan Williams100% (1)

- PUBCORP - SALVA Vs MAKALINTALDokument2 SeitenPUBCORP - SALVA Vs MAKALINTALMakjaz VelosoNoch keine Bewertungen

- University of Minnesota Foundation CEO Position DescriptionDokument7 SeitenUniversity of Minnesota Foundation CEO Position DescriptionLars LeafbladNoch keine Bewertungen

- Cynthia Research Report - FinalDokument69 SeitenCynthia Research Report - FinalLukiyo OwuorNoch keine Bewertungen

- Tourism and Local Agenda 21 - The Role of Local Authorities in Sustainable TourismDokument64 SeitenTourism and Local Agenda 21 - The Role of Local Authorities in Sustainable TourismInnovaPeruConsultingNoch keine Bewertungen

- LIWORIZDokument1 SeiteLIWORIZKrizzi Dizon GarciaNoch keine Bewertungen

- What Is The Essence of Hart-Fuller DebateDokument4 SeitenWhat Is The Essence of Hart-Fuller DebateEzzah Radzi0% (1)

- Gramsci Hegemony Separation PowersDokument2 SeitenGramsci Hegemony Separation PowersPrem VijayanNoch keine Bewertungen

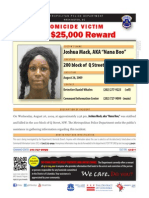

- Mack JoshuaDokument1 SeiteMack JoshuaKimberlyNoch keine Bewertungen