Beruflich Dokumente

Kultur Dokumente

Residential Farm

Hochgeladen von

Paul LeichtCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Residential Farm

Hochgeladen von

Paul LeichtCopyright:

Verfügbare Formate

Clear Form Data

Residential/Farm

Assessment Complaint for 2014

Page 1 of 2

BOARD USE ONLY

Instructions

KANE COUNTY BOARD OF REVIEW

719 South Batavia Avenue, Building C

Geneva, Illinois 60134-3000

(630) 208-3818

www.KaneCountyAssessments.org

Postmark Date

Complaint No.

Use Code

Tax Code

Hearing Date

Hearing Time

1. The assessment complaint process is governed by the Board of Reviews Rules and Procedures, which can be found at

www.KaneCountyAssessments.org/rules.pdf. The taxpayer is responsible for reviewing these rules prior to filing a complaint.

2. One copy of this form and five copies of all supporting documents must be filed no more than 30 days from the date of publication of the assessment notice required under 35 ILCS 200/12-10. To see a list of publication dates and filing deadlines by

township, visit www.KaneCountyAssessments.org/Appeal.htm.

3. All written documentation (except for appraisal reports prepared by appraisers certified to practice by the State of Illinois; see

Rule C.11) must be submitted with this form. The board will not accept additional written documentation after the filing is

made except as provided in the Rules and Procedures.

4. Video instructions for filling out this form are available at www.KaneCountyAssessments.org/Complaint/Complaint.htm.

5. The taxpayer must appear before the Board unless the proper box at the bottom of this page (below the signature) is checked.

6. Questions about this form or the Boards Rules and Procedures may be directed to the Board office at (630) 208-3818.

Section 1: Property Identification (required)

Owner of Record:

Parcel No.

Mailing Address:

Property Address:

Mailing City, State, ZIP:

Property City, State, ZIP:

Daytime Telephone:

Check all that apply:

Property occupied by owner

Property occupied by tenant(s)

Property is vacant ________%

If owner/taxpayer is represented by an attorney licensed to practice law in Illinois, please fill out the following information

(A power of attorney signed by an owner of record or taxpayer is required; otherwise, the complaint will be returned.)

Attorney Name:

IL ARDC Registration No.:

Firm Name:

Address:

Telephone:

City, State, ZIP:

Section 2: Oath (required) I swear or affirm that:

I am the taxpayer of record or owner for the above-captioned property, or the duly authorized attorney for owner/taxpayer; and

The statements made and the facts set forth in the foregoing complaint are true and correct to the best of my knowledge; and

If I am the attorney for the owner/taxpayer, I have attached a properly executed power of attorney; and

If I have submitted any additional evidence aside from this two-page form, I have included five copies of each page; I agree to pay

the Board of Review $1.00 per page for any missing copies; and

Unless indicated otherwise in Section 5, all evidence for my assessment complaint has been submitted with this form; and

Check if applicable: I am seeking a reduction of $100,000 or more of equalized assessed value, and I understand that local

taxing districts will be notified of this complaint and given opportunity to intervene in the proceedings; if this box is not checked,

I hereby waive the right to a reduction of $100,000 or more at the Board of Review or any other jurisdiction for this taxable year.

____________________________________________ _____________________________________

_____________

Taxpayer or attorney signature

Print Name

Date

Check one: I would like the Board of Review to determine the correct assessment based on the evidence submitted

without my appearing before the Board.

I would like to appear before the Board of Review at a hearing; I understand that I cannot submit any additional evidence (except appraisal reports by certified appraisers as provided under Rule C.11) after this filing.

If neither box is checked, the complainant will be required to appear before the Board of Review.

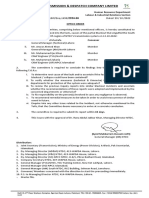

Residential/Farm Assessment Complaint for 2014, Page 2 of 2

Section 3: Reason for Assessment Complaint (required) Check all that apply

1. Overvaluation My propertys Equalized Assessed Valuation (EAV) is greater than 1/3 its Fair Cash Value (must provide at

least three sale comparables in Section 4 and/or attach complete appraisal report; see Rule D of Rules and Procedures).

2. Equity My propertys Equalized Assessed Valuation (EAV) is greater than the 2014 EAVs of other comparable properties in

the neighborhood (must provide at least three EAV comparables in Section 4; see Rule E of Rules and Procedures).

3. Discrepancy in Physical Data My propertys Equalized Assessed Valuation (EAV) was based on a property record card

description that contains a discrepancy from the actual physical data for my property (must attach explanation of discrepancy

and must state the valuation sought; see Rule F of Rules and Procedures).

4. Preferential Assessment My propertys Equalized Assessed Valuation (EAV) qualifies for assessment under one of the

preferential assessment categories under Article 10 of the Illinois Property Tax Code (must attach brief describing

qualifications for special assessment and valuation sought; see Rule G of Rules and Procedures).

Section 4: Sale Comparables/EAV Comparables

INSTRUCTIONS:

1. Sale comparables from 2011, 2012, and/or 2013 are required for all assessment complaints based on Overvaluation.

2. EAV comparables from 2014 are required for all assessment complaints based on Equity.

3. Video instructions for filling out this form are available at www.KaneCountyAssessments.org/Complaint/Complaint.htm.

4. Please use at least three comparables; if you wish to submit more, please use additional pages (must submit 5 copies of all

additional pages).

Subject

Comparable 1

Comparable 2

Comparable 3

Parcel Number

Address

House Style

Exterior Material

Land Area

Living Area (Sq. Ft.)

Year Built

No. of Bedrooms

No. of Bathrooms

Basement/% Finished

Garage/Parking Spaces

Patio/Deck/In-Ground Pool

Fireplace

Sale Comparables from 2011, 2012, and/or 2013 (if complaint based on Overvaluation)

Sale Price

Sale Date

Equalized Assessed Valuation Comparables from 2014 Values (if complaint based on Equity)

Land

Buildings

Farm Land

Farm Buildings

Total EAV

Comments on Comparables (use additional sheets if necessary; be sure to include 5 copies of all additional sheets).

Section 5: Taxpayer Opinion of Correct Assessment (required)

Opinion provided at right

Opinion unknown; complainant will submit an appraisal report (5 copies of

complete appraisal report) that will be delivered to the board office no more

than fourteen (14) calendar days after the filing deadline. Evidence other than

an appraisal report cannot be submitted apart from this form.

Land

Buildings

Farm Land

Farm Buildings

Total Assessment

Level of Assessment

Fair Cash Value

33.33%

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Town of Bridgepuddle 5eDokument36 SeitenThe Town of Bridgepuddle 5ePaul Leicht100% (3)

- Halls of Beoll DurDokument44 SeitenHalls of Beoll DurPaul LeichtNoch keine Bewertungen

- MetraDokument4 SeitenMetraPaul LeichtNoch keine Bewertungen

- Whois BlandlandscapingDokument3 SeitenWhois BlandlandscapingPaul LeichtNoch keine Bewertungen

- 2017 TRP Plan CalendarsDokument12 Seiten2017 TRP Plan CalendarsPaul LeichtNoch keine Bewertungen

- HIS 3537 Syllabus 2009Dokument4 SeitenHIS 3537 Syllabus 2009Paul LeichtNoch keine Bewertungen

- Keegan 6e 10 ImDokument23 SeitenKeegan 6e 10 ImPaul LeichtNoch keine Bewertungen

- Westlaw KeyCite A CaseDokument2 SeitenWestlaw KeyCite A CasePaul LeichtNoch keine Bewertungen

- Full Metal JacketDokument115 SeitenFull Metal JacketPaul LeichtNoch keine Bewertungen

- BUSN603 Syllabus NewDokument7 SeitenBUSN603 Syllabus NewPaul LeichtNoch keine Bewertungen

- CO OWNERSHIP - PropertyDokument3 SeitenCO OWNERSHIP - PropertyShannen Kaye CrespoNoch keine Bewertungen

- CIB14511Dokument10 SeitenCIB14511Dipak ChhetriNoch keine Bewertungen

- Manzano vs. Court of Appeals, 278 SCRA 688, G.R. No. 113388 September 5, 1997Dokument4 SeitenManzano vs. Court of Appeals, 278 SCRA 688, G.R. No. 113388 September 5, 1997Lyka Angelique CisnerosNoch keine Bewertungen

- Resignation of Compelled Social Security Trustee Form InstructionsDokument124 SeitenResignation of Compelled Social Security Trustee Form InstructionsMaryUmbrello-Dressler100% (1)

- Letter To HLURB III Re Cancellation of JV AnnotationDokument5 SeitenLetter To HLURB III Re Cancellation of JV AnnotationPending_nameNoch keine Bewertungen

- Trust Fund DoctrineDokument10 SeitenTrust Fund DoctrineKhimie PadillaNoch keine Bewertungen

- Tan Vs CADokument2 SeitenTan Vs CADarren MansillaNoch keine Bewertungen

- Matt Sridhar Letter To Alameda City CouncilDokument4 SeitenMatt Sridhar Letter To Alameda City CouncilAction Alameda NewsNoch keine Bewertungen

- History/NeedDokument6 SeitenHistory/Needananya pandeNoch keine Bewertungen

- MOA - N and NDokument8 SeitenMOA - N and NJanice PunzalanNoch keine Bewertungen

- KLM v. CADokument1 SeiteKLM v. CAGR100% (1)

- Chapter 01Dokument43 SeitenChapter 01PeiHueiNoch keine Bewertungen

- VICARIOUS LIABILITY D. 5. Salvosa v. Intermediate Appellate Court, G.R. No. 70458, October 5, 1988Dokument3 SeitenVICARIOUS LIABILITY D. 5. Salvosa v. Intermediate Appellate Court, G.R. No. 70458, October 5, 1988Mika AurelioNoch keine Bewertungen

- PP V AgapitoDokument10 SeitenPP V AgapitoJoanne De Guzman SolisNoch keine Bewertungen

- Blackout On 13-10-22Dokument1 SeiteBlackout On 13-10-22Zakir AhmedNoch keine Bewertungen

- Ong vs. PCIBDokument11 SeitenOng vs. PCIBLizzy WayNoch keine Bewertungen

- Icrc Women in WarDokument29 SeitenIcrc Women in WarlealeaaNoch keine Bewertungen

- 14 Panduan Pelaksanaan Pentaksiran Bilik Darjah 2018Dokument1 Seite14 Panduan Pelaksanaan Pentaksiran Bilik Darjah 2018aril eduNoch keine Bewertungen

- Andersons Business Law and The Legal Environment Comprehensive Volume 23rd Edition Twome Test BankDokument13 SeitenAndersons Business Law and The Legal Environment Comprehensive Volume 23rd Edition Twome Test BankDeborah SchmittNoch keine Bewertungen

- Family Law1 PDFDokument394 SeitenFamily Law1 PDFRen BenNoch keine Bewertungen

- 11 - Chua v. de Castro - AngelesDokument2 Seiten11 - Chua v. de Castro - AngelesAustin AngelesNoch keine Bewertungen

- Kando Vs ToyotaDokument12 SeitenKando Vs ToyotaOmar sarmientoNoch keine Bewertungen

- SB 669Dokument45 SeitenSB 669David MarkNoch keine Bewertungen

- Cunanan vs. Jumping Jap Case DigestDokument2 SeitenCunanan vs. Jumping Jap Case DigestShiela Marie GonzalesNoch keine Bewertungen

- Hlavkova EsejDokument3 SeitenHlavkova EsejNadhira Zahrani WidiafinaNoch keine Bewertungen

- Ma Ao Vs CA Case DigestDokument3 SeitenMa Ao Vs CA Case Digestpkdg1995Noch keine Bewertungen

- Official Gazette of The Republic of The PhilippinesDokument15 SeitenOfficial Gazette of The Republic of The Philippinesiricamae ciervoNoch keine Bewertungen

- Audit Working PapersDokument5 SeitenAudit Working PapersDlamini SiceloNoch keine Bewertungen

- ICog ACC Trainer's Agreement (3) 1Dokument5 SeitenICog ACC Trainer's Agreement (3) 1adisNoch keine Bewertungen

- Module 1 (B) - Articles 15, 16, 17Dokument23 SeitenModule 1 (B) - Articles 15, 16, 17J SNoch keine Bewertungen