Beruflich Dokumente

Kultur Dokumente

A Bayesian Approach To Managing Foreign Exchange in International Sourcing - by Vickery, Shawnee Carter, Joseph R. D'Itri, Michael - International Journal of Purchasing and Materials Management, Vol

Hochgeladen von

raj sharmaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

A Bayesian Approach To Managing Foreign Exchange in International Sourcing - by Vickery, Shawnee Carter, Joseph R. D'Itri, Michael - International Journal of Purchasing and Materials Management, Vol

Hochgeladen von

raj sharmaCopyright:

Verfügbare Formate

2/7/2015

"ABayesianApproachtoManagingForeignExchangeinInternationalSourcing"byVickery,ShawneeCarter,JosephR.D'Itri,MichaelInternationalJo

Home (/) Browse (/library) Academic journals (/library/academic-journal-articles) General Business Journals (/library/t3036/general-business-journals) International

Journal of Purchasing and Materials Management (/library/p420587/international-journal-of-purchasing-and-materials) Article details, "A Bayesian Approach to Managing

Foreign..."

A Bayesian Approach to Managing Foreign Exchange in International Sourcing

ACADEMIC JOURNAL ARTICLE

By Vickery, Shawnee; Carter, Joseph R.; D'Itri, Michael

International Journal of Purchasing and Materials Management , Vol. 28, No. 1 , Winter 1992

Read preview (/read/1G1-11866666/a-bayesian-approach-to-managing-foreign-exchange-in)

Read the full text of this article by trying Questia for FREE today (/free-trial)

1 Additional information

Article excerpt

A Bayesian Approach to Managing Foreign Exchange in International Sourcing

The cost of a firm's finished goods is affected by exchange rates whenever a firm purchases imported goods or goods that are in turn

produced with imported materials. As American firms source abroad, changes in currency values can erode the profitability of

established products and markets. This article describes a Bayesian approach to managing foreign exchange which combines the use

of a forward rate forecast and an economic forecast in determining a viable strategy. The approach was specifically designed for firms

whose principal international activity is foreign sourcing.

INTRODUCTION

Over the last decade, the dollar volume of U.S. imports has been steadily increasing. This has occurred in spite of some significant

declines in the exchange rate value of the U.S. dollar. In 1989, for example, the value of U.S. imports was estimated to be 473 billion

dollars, one of the largest import volumes in history.[1] Should this trend continue, not only will the volume of imports increase, but

more and more U.S. firms will become importers of purchased goods from foreign suppliers.

As international sourcing activity increases for many American firms, the effective management of foreign exchange will become

more important to the cost competitiveness of these firms. A recent study has found that firms in North America, Europe, and

especially Japan are placing a strategic emphasis on lowering costs.[2] For many firms, purchased components and materials

represent a substantial portion of their total costs.[3] Changes in currency values can erode the profitability of established products

and markets, if the firms import materials used in those products.[4] Thus, the management of foreign exchange presents a

challenging opportunity for cost reduction for firms engaged in substantial foreign sourcing.[5]

There are three basic approaches to foreign exchange management:

1. Do nothing

2. A passive approach

3. An active approach

For an importer, a do nothing strategy converts all foreign currency cash outflows in the spot market as they occur. A passive strategy

for the importer is one in which either (1) all anticipated outflows of foreign currency are exchanged for domestic currency cash

outflows in the forward market, thereby hedging all foreign exchange positions, or (2) all sourcing contracts are negotiated for

payment in U.S. dollars, forcing the supplier to assume the foreign exchange risk.[6]

In contrast, an active strategy is one in which the importing firm selectively hedges its foreign exchange rate positions based on

exchange rate forecast information. This means that the firm at times may intentionally assume open positions in foreign exchange if

it anticipates a favorable movement in the exchange rate.[7]

Since the practice of maintaining open positions in foreign currencies assumes risk, the question arises as to why a firm should follow

an active strategy. The argument for an active strategy is based on the supposition that it can be more cost effective than a passive

https://www.questia.com/library/journal/1G111866666/abayesianapproachtomanagingforeignexchangein

1/3

2/7/2015

"ABayesianApproachtoManagingForeignExchangeinInternationalSourcing"byVickery,ShawneeCarter,JosephR.D'Itri,MichaelInternationalJo

one. From a purchasing standpoint, this means that an active strategy can result in lower landed costs for the importing firm.

Research suggests there is merit to an active approach if good exchange rate forecast information can be identified and used

correctly.[8] This article describes a Bayesian approach for determining a viable strategy for managing foreign exchange. It combines

the use of a forward rate forecast and an economic forecast provided by an exchange rate forecasting service. The approach was

specifically designed for firms whose principal international activity is foreign sourcing.

A BAYESIAN APPROACH FOR MANAGING FOREIGN EXCHANGE

Bayesian analysis is a probabilistic decision-making tool that can be used in situations where a manager has several alternative

courses of action, but is faced with a risk-filled set of future possibilities.

Read the full-text article, try us out FREE today (/free-trial)

Related books and articles

Books

Academic journals

Magazines

Newspapers

Encyclopedia

The Legal and Economic Basis of International Trade

Grady Miller.

Quorum Books, 1996

Read preview (/read/26227042/the-legal-and-economic-basis-of-international-trade)

Overview (/library/3419877/the-legal-and-economic-basis-of-international-trade)

Labor Costs and International Trade

Stephen S. Golub.

American Enterprise Institute, 1999

Read preview (/read/102106880/labor-costs-and-international-trade)

Overview (/library/102106855/labor-costs-and-international-trade)

Human Rights and World Trade: Hunger in International Society

Ana Gonzalez-Pelaez.

Routledge, 2005

Read preview (/read/109141094/human-rights-and-world-trade-hunger-in-international)

Overview (/library/109141068/human-rights-and-world-trade-hunger-in-international)

The International Politics of Agricultural Trade: Canadian-American Relations in a Global Agricultural Context

Theodore H. Cohn.

University of British Columbia Press, 1990

Read preview (/read/23173704/the-international-politics-of-agricultural-trade)

Overview (/library/3001996/the-international-politics-of-agricultural-trade)

Trade, Aid, or What? A Report Based upon a Conference on International Economic Policy at the Merrill Center for

Economics, Summer, 1953

Willard L. Thorp.

https://www.questia.com/library/journal/1G111866666/abayesianapproachtomanagingforeignexchangein

2/3

2/7/2015

"ABayesianApproachtoManagingForeignExchangeinInternationalSourcing"byVickery,ShawneeCarter,JosephR.D'Itri,MichaelInternationalJo

Johns Hopkins Press, 1954

Read preview (/read/6005996/trade-aid-or-what-a-report-based-upon-a-conference)

Overview (/library/655547/trade-aid-or-what-a-report-based-upon-a-conference)

See all 9,700 related books and articles (/searchglobal#!/?keywords=

(International%20Trade%20Economic%20Aspects)%20OR%20(Economic%20Forecasting%20Methods)%20OR%20(Bayesian%20Analysis%20Usage))

Open the reader tool (/read/1G1-11866666/a-bayesian-approach-to-managing-foreign-exchange-in) to

Bookmark important pages

Highlight and save any text

A

F

Add your own notes to any page

Cite pages and passages instantly

w Search inside this article

Find a periodical in our library

w Enter a periodical name

https://www.questia.com/library/journal/1G111866666/abayesianapproachtomanagingforeignexchangein

3/3

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- 27 Feb 2021 - (Free) ..A3v3uiegdac - Zw11zbd5fwwadgzwhhaadg5yb2h0axwcaxidahmedaubcgehcwr0bqdwaqz2bh0bahoiDokument4 Seiten27 Feb 2021 - (Free) ..A3v3uiegdac - Zw11zbd5fwwadgzwhhaadg5yb2h0axwcaxidahmedaubcgehcwr0bqdwaqz2bh0bahoiSindhu Ramlall100% (1)

- Unrestricted Warfare A Chinese Doctrine For PDFDokument26 SeitenUnrestricted Warfare A Chinese Doctrine For PDFraj sharma75% (4)

- Specification Checklist: Aqa A Level BusinessDokument4 SeitenSpecification Checklist: Aqa A Level BusinessZayna Amelia Khan100% (1)

- Option Chain Analysis in Trading - Dot Net TutorialsDokument19 SeitenOption Chain Analysis in Trading - Dot Net Tutorialsaaditya01100% (1)

- The Crest-Jewel of Wisdom PDFDokument35 SeitenThe Crest-Jewel of Wisdom PDFraj sharmaNoch keine Bewertungen

- Under Irrevocable Confirmation Corporate Pay Order (Iccpo) : Payment Guarantee Letter (PGL) of UndertakingDokument9 SeitenUnder Irrevocable Confirmation Corporate Pay Order (Iccpo) : Payment Guarantee Letter (PGL) of UndertakingEsteban Enrique Posan Balcazar100% (1)

- Critical Appreciation of K N Rao InterviewDokument39 SeitenCritical Appreciation of K N Rao Interviewraj sharma50% (2)

- First National Bank of Portland v. NobleDokument2 SeitenFirst National Bank of Portland v. NoblePat NaffyNoch keine Bewertungen

- Chapter 3 International Financial MarketsDokument93 SeitenChapter 3 International Financial Marketsธชพร พรหมสีดาNoch keine Bewertungen

- Jaimini SutramDokument18 SeitenJaimini Sutramraj sharmaNoch keine Bewertungen

- Recommended Usage XDokument11 SeitenRecommended Usage XHenry LucenaNoch keine Bewertungen

- 10 Buying, Using, DisposingDokument14 Seiten10 Buying, Using, Disposingsofia fiersNoch keine Bewertungen

- Astrology, Science, and Cau..Dokument7 SeitenAstrology, Science, and Cau..raj sharmaNoch keine Bewertungen

- Is It Necessary To Get Afraid of Sade SatiDokument9 SeitenIs It Necessary To Get Afraid of Sade Satiraj sharmaNoch keine Bewertungen

- Military History of India - Camels in Indian WarfareDokument5 SeitenMilitary History of India - Camels in Indian Warfareraj sharmaNoch keine Bewertungen

- Venkatapati Deva Raya - The Great Savior of Southern India - VajrinDokument5 SeitenVenkatapati Deva Raya - The Great Savior of Southern India - Vajrinraj sharmaNoch keine Bewertungen

- Non-random-Thoughts - Is Vedic Astrology Derived From Greek Astrology - (Part 22) (Masonry and Stemmed Cup - From Pandyans To Tiryns)Dokument13 SeitenNon-random-Thoughts - Is Vedic Astrology Derived From Greek Astrology - (Part 22) (Masonry and Stemmed Cup - From Pandyans To Tiryns)raj sharma0% (1)

- Hindu Capitalism-Why Capitalism Is The Only Economic System Compatible With Indian CultureDokument150 SeitenHindu Capitalism-Why Capitalism Is The Only Economic System Compatible With Indian Cultureraj sharmaNoch keine Bewertungen

- Unit of TimeDokument2 SeitenUnit of Timeraj sharmaNoch keine Bewertungen

- Gavi Gangadhareshwara TempleDokument5 SeitenGavi Gangadhareshwara Templeraj sharmaNoch keine Bewertungen

- A Mahabharata Reference To Sidereal SystemDokument8 SeitenA Mahabharata Reference To Sidereal Systemraj sharmaNoch keine Bewertungen

- Saraswati 1Dokument65 SeitenSaraswati 1Naira Puneet BhatiaNoch keine Bewertungen

- Akuntansi Pertanggungjawaban PT TarunginDokument8 SeitenAkuntansi Pertanggungjawaban PT TarunginGiarni Prisma DewiNoch keine Bewertungen

- Ch6 Risk Aversion and Capital Allocation To Risky AssetsDokument28 SeitenCh6 Risk Aversion and Capital Allocation To Risky AssetsAmanda Rizki BagastaNoch keine Bewertungen

- Transportation Freight Trucking and Towing Open MyFlorida BusinessDokument5 SeitenTransportation Freight Trucking and Towing Open MyFlorida BusinessalejandrosantizoNoch keine Bewertungen

- 1.4-2 - Evidence Plan (Template)Dokument2 Seiten1.4-2 - Evidence Plan (Template)J'LvenneRoz AnepolNoch keine Bewertungen

- Cost Estimates For FTTP Network Construction: Prepared For City of Santa Cruz, California May 2015Dokument36 SeitenCost Estimates For FTTP Network Construction: Prepared For City of Santa Cruz, California May 2015Jacob PedroNoch keine Bewertungen

- Shank 2006 Case 1 American Investment Management Services Edition 3rdDokument9 SeitenShank 2006 Case 1 American Investment Management Services Edition 3rdsyeda alinaNoch keine Bewertungen

- Hyundai D4a d4d Engine Service ManualDokument13 SeitenHyundai D4a d4d Engine Service Manualjoemeadows110401kib100% (137)

- Restructuring Notification 09mar2020Dokument19 SeitenRestructuring Notification 09mar2020DAG SS2Noch keine Bewertungen

- Cibil - Report (P - JAYSINGH YADAV - 26 - 05 - 2023 12 - 23 - 04)Dokument5 SeitenCibil - Report (P - JAYSINGH YADAV - 26 - 05 - 2023 12 - 23 - 04)Geeta MallahNoch keine Bewertungen

- Lecture 10Dokument39 SeitenLecture 10Zixin GuNoch keine Bewertungen

- CSCP Sample Questions - PDFDokument4 SeitenCSCP Sample Questions - PDFnitinNoch keine Bewertungen

- CHG002335304 - Pre-Invoice - Transport of Paper Sales - ImplementationDokument4 SeitenCHG002335304 - Pre-Invoice - Transport of Paper Sales - ImplementationcathyNoch keine Bewertungen

- Name: - Date: - Yr. & Sec.: - ScoreDokument4 SeitenName: - Date: - Yr. & Sec.: - Scoreharriette caminoNoch keine Bewertungen

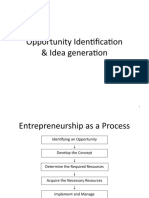

- Opportunity Identification & Idea GenerationDokument51 SeitenOpportunity Identification & Idea GenerationpreyanshitNoch keine Bewertungen

- SSRN Id1709011Dokument30 SeitenSSRN Id1709011Cristiana CarvalhoNoch keine Bewertungen

- Practice Exam - Part 3: Multiple ChoiceDokument4 SeitenPractice Exam - Part 3: Multiple ChoiceAzeem TalibNoch keine Bewertungen

- FM Chapter 3 Devienna Antonetta Sudiarto 201950456Dokument3 SeitenFM Chapter 3 Devienna Antonetta Sudiarto 201950456Devienna AntonettaNoch keine Bewertungen

- Option Pricing TheoryDokument5 SeitenOption Pricing TheoryNadeemNoch keine Bewertungen

- GST State WiseDokument2 SeitenGST State WiseSuraj GadageNoch keine Bewertungen

- The Market Is Calling For Biolage Raw CaseDokument14 SeitenThe Market Is Calling For Biolage Raw CaseRichard DauberNoch keine Bewertungen

- Crux 3.0 - 10Dokument11 SeitenCrux 3.0 - 10Neeraj GargNoch keine Bewertungen