Beruflich Dokumente

Kultur Dokumente

Untitled

Hochgeladen von

api-249785899Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Untitled

Hochgeladen von

api-249785899Copyright:

Verfügbare Formate

February 18, 2015

The Honorable Mary Jo White

Chair

U.S. Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

Re:

Roundtable on Proxy Voting

Dear Chair White:

The U.S. Chamber of Commerce1 (Chamber) created the Center for Capital

Markets Competiveness (CCMC) to promote a modern and effective regulatory

structure for the capital markets to fully function in a 21st century global economy. It

is an important priority of the CCMC to advance an effective and transparent

corporate governance system that encourages shareholder communications and

participation.

We would like to thank the Securities and Exchange Commission (SEC or

Commission) for holding the upcoming roundtable on proxy voting. However, the

CCMC is concerned that a universal ballot is a vehicle to fix the unbroken.

Consequently, the universal ballot will divorce corporate governance from the

fiduciary duties integral to the long-term performance of a public company and its

ability to provide a return to investors. Director elections will turn into annual

political-style campaigns and create dynamics that are not conducive to the effective

management of a public company.

The SEC has also, through benign neglect, ignored the needs of retail

shareholders, which has led to their increasing disenfranchisement in the proxy voting

process. This has created an uneven playing field that distorts and harms the proxy

voting system and fails to ensure reasonable and balanced corporate governance

The Chamber is the worlds largest business federation, representing the interests of more than 3 million businesses

and organizations of every size, sector, and region.

1

The Honorable Mary Jo White

February 18, 2015

Page 2

policies that benefit companies and their investors, and which keep American capital

markets from reaching their competitive potential in a global economy.

Starting in 2009, the CCMC has written to the SEC on numerous occasions

proposing solutions to enfranchise retail shareholders.2 To redress imbalances in the

proxy voting system and provide retail shareholders with the same privileges as large

shareholders, the CCMC respectfully requests that the SEC:

1. Examine possible interpretive guidance to give retail shareholders

access to Client Directed Voting;

2. Encourage greater use of web-based communications and technology;

and

3. Streamline proxy disclosures through the SECs Disclosure Effectiveness

Project.

Each of these policies are interrelated and it is important that all of these steps

be taken together to boost retail shareholder participation in director elections and

consideration of shareholder proposals.

Our concerns and suggestions are discussed in greater detail below.

Discussion

In 2009, the Chamber developed principles, crafted in consultation with

businesses and investors, which should be incorporated into effective corporate

governance and executive compensation policies. These principles, in our view,

should guide appropriate policy making related to corporate governance, investor

responsibility and executive compensation:

Corporate governance policies must promote long-term shareholder

value and profitability but should not constrain reasonable risk-taking

and innovation.

See letters from the CCMC to SEC Chairman Mary Schapiro, September 16, 2009; CCMC Comment Letter on the

Proxy Voting System Concept Release, September 20, 2010; CCMC Comment Letter on the Proxy Voting System

Concept Release, November 1, 2012; and CCMC Comment Letter on Proposed Rule Change to amend New York

Stock Exchange Rule 451 and 465.

2

The Honorable Mary Jo White

February 18, 2015

Page 3

Long-term strategic planning should be the foundation of managerial

decision-making.

Corporate executives compensation should be premised on a balance of

individual accomplishment, corporate performance, adherence to risk

management and compliance with laws and regulations, with a focus on

shareholder value.

Management needs to be robust and transparent in communicating with

shareholders.

These principles provide a template for policies that will allow for reasonable

risk taking, continued innovation, the ability to acquire and retain talent and the

protection of investor rights. We believe that these principles should be the

touchstone for the consideration of the universal ballot, as well as common sense

reforms for retail shareholders.

a. Universal Ballot

For decades, SEC rules have allowed a shareholder who is willing to commit

the necessary resources to conduct a proxy contest to seek a change in board

composition. If such a shareholder is able to nominate credible, qualified candidates

that garner the widespread support of other investors, the shareholder can, in fact,

alter the make-up of the board. With these rules already in place, we do not see a

compelling reason to change what is not broken.

Mandating a universal ballot, also known as a universal proxy card, at all public

companies would inevitably increase the frequency and ease of proxy fights. Such a

development has no clear benefit to public companies, their shareholders, or other

stakeholders. The SEC has historically sought to remain neutral with respect to

interactions between public companies and their investors, and has always taken great

care not to implement any rule that would favor one side over the other. We do not

understand why the SEC would now pursue a policy that would increase the regularity

of contested elections or cause greater turnover in the boardroom.

A board of directors has a fiduciary duty to act in the best interests of a

corporation and its shareholders. A board is also accountable to the companys

The Honorable Mary Jo White

February 18, 2015

Page 4

shareholders through the companys charter, bylaws and corporate governance

policies, as developed within the context of state incorporation statutes and federal

securities laws. Instead of this system of accountability, the universal proxy card

would facilitate proxy fights by individual shareholders (or small groups of

shareholders) who do not have a similar fiduciary duty, are not bound by the

companys corporate governance policies, and who may nominate directors who

advance their own parochial agenda without regard to the broader best interests of the

company or its shareholders. In striking down Rule 14a-11 (the SECs mandatory

proxy access rule), the D.C. Circuit cited the SECs failure to assess the risk of giving

special interest groups new powers to pursue self-interested objectives rather than the

goal of maximizing shareholder value.3

Proxy contests are significantly disruptive to public companies, often to the

ultimate detriment of their investors.4 Promoting proxy contests should not be a goal

of the SEC, as boards of directors would be increasingly forced to focus a companys

resources in support of board-nominated candidates, detracting from managing and

overseeing company business. The constant churning of directors could lead to the

formation of factions on the board of directors, resulting in balkanization of the

board. A politicized board cannot effectively serve the long-term best interests of

investors or other corporate constituencies.

Indeed, the universal ballot may empower a small vocal minority at the expense

of the majority. This clearly was a major concern of the court in striking down the

SECs Proxy Access rule.5

Seeking to avoid the cost and distraction of an SEC-sanctioned proxy fight,

many companies will simply follow the path of least resistance and negotiate to place

dissident directors directly on their boards without the need for a shareholder vote.

This phenomenon will serve to further accelerate the pace at which activists pursue

board representation in what becomes a vicious cycle. Again, the winner here is the

special interest activistnot the rank-and-file investor.

Many advocates for the universal proxy card invariably cite the concept of

advancing corporate democracy. The reality is that the two dominant proxy

advisory firmsfirms that own no stock and owe no duties to American

See Business Roundtable & U.S. Chamber of Commerce v. SEC, 647 F.3rd 1144 (D.C. Cir. 2011).

See Chamber August 14, 2009 comment letter on Facilitating Shareholder Director Nominations, File No. S7-10-09.

5 See Business Roundtable & U.S. Chamber of Commerce v. SEC, n.3, Supra.

3

4

The Honorable Mary Jo White

February 18, 2015

Page 5

shareholders, employees or consumershave come to exert an inordinate influence

on the casting of votes at U.S. public companies. The lack of transparency, the onesize-fits-all policies, and the routine mistakes and the rampant conflicts of interest at

proxy advisory firms are well-documented. We believe the SEC has started to take

the first steps to address these issues through the release of SEC staff guidance on

proxy advisory firms.6 However, as we enter the first proxy season since its release, it

is too early to know if the SEC staff guidance is sufficient to address these issues or if

more needs to be done.

Despite all these flaws in the governance and regulation of proxy advisors,

movement to the universal proxy card would further expand the influence of proxy

advisory firms and thereby cement their grasp on corporate governance of public

companies. A system in which one or two actors control the outcome of an election

is no kind of democracy at all.

We see little reason to reimagine a process that, by and large, has served public

companies and their investors well for decades. The current system of proxy voting

for directors is well-understood by the marketplace and has been the basis for tens of

thousands of orderly director elections (including countless proxy contests) over

many, many years. More fundamentally, the proxy contest should be the last resort in

corporate governance, not the first. Rather, robust communications between

management and shareholders should continue to be the preferred mechanism to

resolve issues.

b. Retail Shareholder Issues

Retail shareholders generally invest in companies with an interest in attaining

long-term growth. Cumbersome voting procedures combined with dense disclosures

have driven retail shareholder participation in corporate elections to historic lows,

sometimes with participation rates below 10%. By contrast, many large institutional

investors are mandated to participate in corporate elections by law or regulation.

These institutional investors can use a variety of tools to help streamline their voting

and due diligence processes, making possible significant levels of participation.

Unfortunately, retail shareholders do not have similar options.

See Proxy Voting: Proxy Voting Responsibilities of Investment Advisors and Availability of Exemptions from the Proxy Rules for Proxy

Advisory Firms, released by the SEC on June 30, 2014.

6

The Honorable Mary Jo White

February 18, 2015

Page 6

This situation has created an imbalance where institutional and activist

investors must vote and have the means necessary to facilitate this process, yet retail

shareholders are not given access to a similar array of tools. Concurrently, some large

activist institutional investors obtain stakes in a company to further short-term

objectives through their shareholder franchise. Other special interest activists may use

the corporate governance system not as a means to ensure reform but rather to push

an agenda unrelated to shareholder interests.7 These objectives frequently have no

relation to securing long-term shareholder returns. This inequity in shareholder rights

erodes confidence in, and the credibility of, the corporate election system,

undermining the SECs mission to protect the rights of all investors.

While some small halting measures, such as the Financial Industry Regulatory

Authority (FINRA) and New York Stock Exchange (NYSE) rule changes

allowing greater use of enhanced broker internet platforms, have sought to address

these issues, the languishing of the proxy voting systems concept release is testament

to the inactivity on retail shareholder issues.

1. Examine Possible Interpretive Guidance to give Retail Shareholders

Access to Client Directed Voting

The Client Directed Voting model (CDV) has emerged as a response to low

retail shareholder participation. While there are many formulations of CDV, all

involve a process by which a retail shareholder can provide some form of advance

voting instructions to an entity authorized to vote his or her shares, subject to the

shareholders ability to change the instructions, or to override them on a case-by-case

basis. Adoption of the CDV model would decrease the time and other costs of retail

participation in the proxy voting process, allowing retail shareholders to establish

standing instructions in accordance with their overall investment philosophy and

strategy and to focus research and analysis on individual companies or proxy

proposals that warrant individual attention. CDV would also be relatively easy to

implement in tandem with enhanced broker internet platforms. .

7Research

conducted by the Manhattan Institute indicates that union pension funds tend to introduce more shareholder

proposals at companies that are the ongoing targets of union-organizing campaigns. In 2012, for example, companies in

lightly-unionized and labor-targeted sectors received significantly more shareholder proposals backed by employee

pension funds than companies in other industries. James R. Copland, Op-Ed, Manhattan Moment: Unions Target

Corporations Through Shareholder Activism, Wash. Examiner (July 19, 2012), available at

http://www.washingtonexaminer.com/manhattan-moment-unions-target-corporations-through-shareholderactivism/article/2502610.

The Honorable Mary Jo White

February 18, 2015

Page 7

Allowing the use of a CDV model would give retail shareholders access to

mechanisms used by other large institutional shareholders. This innovative change

could allow for greater retail shareholder involvement in corporate elections and longterm decision making processes for companies. This will create a level of fairness and

equal representation that is currently lacking in the corporate election process.

2. Encourage Greater Use of Web-Based Communications and

Technology

To further complement the CDV model and enhanced broker internet

platforms, we recommend policies that more generally encourage broader use of

technology to increase retail shareholder participation in the proxy voting process. In

particular, greater use of virtual meetings would permit a greater number of

shareholders to actively participate in the annual meetings of companies, where

participation in physical meetings is impractical, as is often the case for retail

shareholders.

3. Streamline Proxy Disclosures through the Disclosure Effectiveness

Project

Over the years since the securities laws were enacted, public company

disclosures have become increasingly voluminous and complex, making it difficult for

even the most sophisticated of investors to determine the most salient information

about a company.8 Retail investors are particularly vulnerable when our corporate

disclosure regime makes it more difficult for them to make well-informed investment

and voting decisions. This is hardly an environment that promotes retail investor

participation in corporate governance.

The SECs ongoing Disclosure Effectiveness Project provides the Commission

with an opportunity not just to make company filings more intelligible, but to help

retail investors become more involved in the governance of companies they invest

in. The Commission should first take the step of eliminating outdated or duplicative

information in filings, and then focus on more fundamental changes to a system that

A survey of 64 asset managers, conducted in the fall of 2014 and recently released by the Rock Center for Corporate

Governance at Stanford University, Equilar and R.R. Donnelley, found that institutional investors also favor streamlined

and simpler disclosures. Survey can be found here: http://www.gsb.stanford.edu/sites/gsb/files/publication-pdf/cgrisurvyey-2015-deconstructing-proxy-statements_0.pdf

8

The Honorable Mary Jo White

February 18, 2015

Page 8

has been in place since the 1930s.9 All investorsin particular retail investors

would then be able to make better informed investment and voting decisions.

Conclusion

The public company model has fallen out of favor as a preferred mechanism

for capital formation in this century. The SEC is at a crossroad and can engage in

policy making that promotes the public company as an attractive investment vehicle

for investors and incentivize competition in our capital markets, or make policy

choices that continue the disfavor investors have shown through the allocation of

capital in vehicles other than public companies.

As outlined, we have serious concerns in the consideration of the universal

ballota response to a non-issue which fails to promote the interests of a majority

of shareholders. Similarly, we believe that the failure of the SEC to address issues

related to retail shareholders has allowed serious shortcomings in the proxy voting

system to worsen. As outlined in this and other letters, we believe there are common

sense solutions that can be implemented to address these problems.

We look forward to continuing to work with the SEC on these important

issues necessary to ensure that our proxy voting systems are fair, balanced, and help

promote efficient capital markets that support public companies.

Sincerely,

Tom Quaadman

Cc:

The Honorable Luis A. Aguilar

The Honorable Daniel M. Gallagher

The Honorable Kara M. Stein

The Honorable Michael S. Piwowar

Mr. Keith Higgins, Director, Division of Corporation Finance

In July 2014 the Chamber made a number of recommendations for the SECs Disclosure Effectiveness project in a

report entitled Corporate Disclosure Effectiveness: Ensuring a Balanced System that Informs and Protects Investors and Facilitates

Capital Formation. The report can be found at: http://www.centerforcapitalmarkets.com/wpcontent/uploads/2014/07/CCMC_Disclosure_Reform_Final_7-28-20141.pdf

9

Das könnte Ihnen auch gefallen

- The 100 Best Trading and Investing Books of All TimeDokument59 SeitenThe 100 Best Trading and Investing Books of All TimeJoe D100% (2)

- DA4139 Level III CFA Mock Exam 1 AfternoonDokument31 SeitenDA4139 Level III CFA Mock Exam 1 AfternoonIndrama Purba100% (1)

- IBIG 04 02 Accounting 3 StatementsDokument99 SeitenIBIG 04 02 Accounting 3 StatementsCarloNoch keine Bewertungen

- Trading Stocks and Indices - 23 CommandmentsDokument8 SeitenTrading Stocks and Indices - 23 CommandmentsAnil SelarkaNoch keine Bewertungen

- BNY Mellon DR IssueDokument30 SeitenBNY Mellon DR IssueViktor LobanNoch keine Bewertungen

- (Financial Accounting and Auditing Collection) Bettner, Mark S - 2015 PDFDokument152 Seiten(Financial Accounting and Auditing Collection) Bettner, Mark S - 2015 PDFJorge Ysrael Velez Murillo50% (2)

- Corporate Governance CH.1Dokument123 SeitenCorporate Governance CH.1Mubeen WahlaNoch keine Bewertungen

- Chapter 1 Corporation and Corporate GovernanceDokument32 SeitenChapter 1 Corporation and Corporate GovernanceWellaNoch keine Bewertungen

- The Role of SEBI in Investor Protection AssignmentDokument2 SeitenThe Role of SEBI in Investor Protection AssignmentRam babu Bcom HonsNoch keine Bewertungen

- Review Questions Minus AnswersDokument71 SeitenReview Questions Minus AnswersTushar BallabhNoch keine Bewertungen

- KPMG Renewable Energy Ma ReportDokument48 SeitenKPMG Renewable Energy Ma ReportAnand KVNoch keine Bewertungen

- SellingRulesArticleMay16 PDFDokument8 SeitenSellingRulesArticleMay16 PDFGourav SinghalNoch keine Bewertungen

- Infinity and Beyond: Iscussion OpicsDokument2 SeitenInfinity and Beyond: Iscussion Opicsdiana100% (1)

- Financial Aspects IntroductionDokument5 SeitenFinancial Aspects IntroductionSef Getizo Cado67% (3)

- Re: File No. S7-33-10 - Proposed Rules For Implementing The Whistleblower Provisions of Section 21F of The Securities Exchange Act of 1934Dokument9 SeitenRe: File No. S7-33-10 - Proposed Rules For Implementing The Whistleblower Provisions of Section 21F of The Securities Exchange Act of 1934MarketsWikiNoch keine Bewertungen

- Borrowing Powers of Directors of Public Limited CompaniesDokument14 SeitenBorrowing Powers of Directors of Public Limited CompaniesMuhammad Saeed BabarNoch keine Bewertungen

- Corporate Governance Issues in Mergers and AcquisitionsDokument12 SeitenCorporate Governance Issues in Mergers and AcquisitionsSoumya KesharwaniNoch keine Bewertungen

- 6-The Investment Committee: Factors Affecting Stakeholder RelationsDokument6 Seiten6-The Investment Committee: Factors Affecting Stakeholder RelationsfoodNoch keine Bewertungen

- GGSR ch3Dokument29 SeitenGGSR ch3Bryan DialingNoch keine Bewertungen

- Role of Creditors and Institutional Shareholders On Corporate GovernanceDokument15 SeitenRole of Creditors and Institutional Shareholders On Corporate GovernanceRukmani KhadkaNoch keine Bewertungen

- CorporateGovernance (IB)Dokument27 SeitenCorporateGovernance (IB)Arjun AgrawalNoch keine Bewertungen

- What Is Corporate GovernanceDokument4 SeitenWhat Is Corporate GovernanceJinho ParkNoch keine Bewertungen

- (Corporate Governance) : Government Collage University, LahoreDokument6 Seiten(Corporate Governance) : Government Collage University, Lahorehafeez ullahNoch keine Bewertungen

- Corporate FraudDokument11 SeitenCorporate FraudAakanksha MunjhalNoch keine Bewertungen

- Q& A Corpo GovDokument71 SeitenQ& A Corpo GovChris Castle50% (2)

- Ch10 Monitoring and ControlDokument7 SeitenCh10 Monitoring and ControlchristineNoch keine Bewertungen

- Corporate Governance & Business Law: Unit IDokument52 SeitenCorporate Governance & Business Law: Unit Imurarimishra17Noch keine Bewertungen

- ProQuestDocuments 2018-05-15Dokument29 SeitenProQuestDocuments 2018-05-15agathaniken91Noch keine Bewertungen

- Chapter 9 - Corporate GovernanceDokument26 SeitenChapter 9 - Corporate GovernanceAdrienne SmithNoch keine Bewertungen

- Corporate GovernanceDokument8 SeitenCorporate Governanceshaifali pandeyNoch keine Bewertungen

- An Effective Corporate Governance Framework Requires A Sound LegalDokument31 SeitenAn Effective Corporate Governance Framework Requires A Sound LegalNigist WoldeselassieNoch keine Bewertungen

- Failure of Corporate Governance of DHFLDokument4 SeitenFailure of Corporate Governance of DHFLs meena arumugamNoch keine Bewertungen

- MAHUSAYLAW211 REFLECTIVE ESSAY - Module 3Dokument3 SeitenMAHUSAYLAW211 REFLECTIVE ESSAY - Module 3Jeth MahusayNoch keine Bewertungen

- Corporate Governance: Presented byDokument36 SeitenCorporate Governance: Presented bymala singhNoch keine Bewertungen

- ShareholdersDokument3 SeitenShareholdersNicolás GutiérrezNoch keine Bewertungen

- QuestionDokument3 SeitenQuestionThirah TajudinNoch keine Bewertungen

- Glass Lewis ReportDokument39 SeitenGlass Lewis ReportNavendu TripathiNoch keine Bewertungen

- Principles of Corporate Governance - HarvardDokument14 SeitenPrinciples of Corporate Governance - Harvard8D TOONSNoch keine Bewertungen

- ON Corporate Governance IN India": A On "Oecd RecommendationsDokument25 SeitenON Corporate Governance IN India": A On "Oecd RecommendationsUrvesh ParmarNoch keine Bewertungen

- s73610 32Dokument7 Seitens73610 32MarketsWikiNoch keine Bewertungen

- Corporate Governance - Convictions and RealitiesDokument10 SeitenCorporate Governance - Convictions and Realitieskarthik kpNoch keine Bewertungen

- Corporate GovernanceDokument8 SeitenCorporate GovernanceAnkita GhoshNoch keine Bewertungen

- Re: Prompt Corrective Action, Risk Based Capital. 12 CFR Parts 700, 701, 702, 703, 713, 723 and 747, RIN 3133-AD77Dokument8 SeitenRe: Prompt Corrective Action, Risk Based Capital. 12 CFR Parts 700, 701, 702, 703, 713, 723 and 747, RIN 3133-AD77api-249785899Noch keine Bewertungen

- Becg.l-8.Cg - Nature & Evolution of CGDokument19 SeitenBecg.l-8.Cg - Nature & Evolution of CGabhishek fanseNoch keine Bewertungen

- Corporete Governance Final ExamDokument7 SeitenCorporete Governance Final Examcn comNoch keine Bewertungen

- Lecture 1Dokument7 SeitenLecture 1Marielle UyNoch keine Bewertungen

- Jayshree SBL PDFDokument5 SeitenJayshree SBL PDFs meena arumugamNoch keine Bewertungen

- ProxyVotingGuidelines SustainableInvestmentsCommitteeDokument8 SeitenProxyVotingGuidelines SustainableInvestmentsCommitteeNiyanta KhatriNoch keine Bewertungen

- Presentation On Corporate GovernanceDokument29 SeitenPresentation On Corporate Governancesuren471988Noch keine Bewertungen

- Corporate GovernanceDokument22 SeitenCorporate GovernanceAl MahdiNoch keine Bewertungen

- Director 1Dokument64 SeitenDirector 1Manoj Kumar MohanNoch keine Bewertungen

- Ch07 Courts in Corporate GovernanceDokument7 SeitenCh07 Courts in Corporate GovernancechristineNoch keine Bewertungen

- Presentation 1Dokument29 SeitenPresentation 1Ratish ThacoorNoch keine Bewertungen

- Latihan Soal Corporate GovernanceDokument2 SeitenLatihan Soal Corporate Governancebukan kamuNoch keine Bewertungen

- Corporate GovernanceDokument4 SeitenCorporate Governancesahil200768Noch keine Bewertungen

- Article by Hamad020211 - True BnkingDokument4 SeitenArticle by Hamad020211 - True BnkingHamad Rasool BhullarNoch keine Bewertungen

- Corporate Governance - 20180401093Dokument10 SeitenCorporate Governance - 20180401093amar vyasNoch keine Bewertungen

- Via Electronic Mail:: Rule-Comments@sec - GovDokument4 SeitenVia Electronic Mail:: Rule-Comments@sec - GovMarketsWikiNoch keine Bewertungen

- Cited - A DEFENSE OF PROXY ADVISORSDokument44 SeitenCited - A DEFENSE OF PROXY ADVISORSAna RamishviliNoch keine Bewertungen

- Good Corporate Governance - An Idea Whose Time Has Arrived: Project Report OnDokument61 SeitenGood Corporate Governance - An Idea Whose Time Has Arrived: Project Report OnSubramanyam MutyalaNoch keine Bewertungen

- Dev Kumar - Company Law 2 - ChapterDokument8 SeitenDev Kumar - Company Law 2 - ChapterdevNoch keine Bewertungen

- AKM4H - Etika Bisnis - MOSES JOK SAMUEL ATEMDokument3 SeitenAKM4H - Etika Bisnis - MOSES JOK SAMUEL ATEMJok ZemarkoNoch keine Bewertungen

- Principles of Corporate GovernanceDokument16 SeitenPrinciples of Corporate GovernanceMohammed Abdul HadyNoch keine Bewertungen

- Thesis On Good Corporate GovernanceDokument7 SeitenThesis On Good Corporate Governancevictorialeonlittlerock100% (2)

- "G20/Oecd Principles of Corporate Governance": Financial EngineeringDokument6 Seiten"G20/Oecd Principles of Corporate Governance": Financial EngineeringIan Sanchez IrsNoch keine Bewertungen

- Assignment Topic: Legal and Policy Issues in Corporate GovernanceDokument82 SeitenAssignment Topic: Legal and Policy Issues in Corporate GovernanceHarshSuryavanshiNoch keine Bewertungen

- Copy (3) of Copy of Corporate Governance 1Dokument20 SeitenCopy (3) of Copy of Corporate Governance 1bappa85Noch keine Bewertungen

- Stijn Summary Concept+PaperDokument4 SeitenStijn Summary Concept+PaperMukesh Kumar MukulNoch keine Bewertungen

- Lecture 4 Week 4: Shareholder Rights and Theories of Corporate GovernanceDokument37 SeitenLecture 4 Week 4: Shareholder Rights and Theories of Corporate GovernanceDeelan AppaNoch keine Bewertungen

- A Review of Corporate Governance in Uk Banks and Other Financial Industry EntitiesDokument40 SeitenA Review of Corporate Governance in Uk Banks and Other Financial Industry EntitiesImi MaximNoch keine Bewertungen

- How Main Street Businesses Use Financial Services: Key Survey FindingsDokument15 SeitenHow Main Street Businesses Use Financial Services: Key Survey Findingsapi-249785899Noch keine Bewertungen

- Proposed Rules On Pay Versus Performance 17 CFR Parts 229 and 240 Release No. 34-74835 File No. S7-07-15 RIN 3235-AL00Dokument12 SeitenProposed Rules On Pay Versus Performance 17 CFR Parts 229 and 240 Release No. 34-74835 File No. S7-07-15 RIN 3235-AL00api-249785899Noch keine Bewertungen

- UntitledDokument1 SeiteUntitledapi-249785899Noch keine Bewertungen

- UntitledDokument2 SeitenUntitledapi-249785899Noch keine Bewertungen

- UntitledDokument10 SeitenUntitledapi-249785899Noch keine Bewertungen

- UntitledDokument82 SeitenUntitledapi-249785899Noch keine Bewertungen

- Examining The Main Street Benefits of Our Modern Financial MarketsDokument28 SeitenExamining The Main Street Benefits of Our Modern Financial Marketsapi-249785899Noch keine Bewertungen

- Re: Three-Year Review of The Private Company CouncilDokument3 SeitenRe: Three-Year Review of The Private Company Councilapi-249785899Noch keine Bewertungen

- UntitledDokument3 SeitenUntitledapi-249785899Noch keine Bewertungen

- UntitledDokument4 SeitenUntitledapi-249785899Noch keine Bewertungen

- UntitledDokument2 SeitenUntitledapi-249785899Noch keine Bewertungen

- Consultative Document (2nd) : Assessment Methodologies For Identifying Non-Bank Non-Insurer Global Systemically Important Financial InstitutionsDokument16 SeitenConsultative Document (2nd) : Assessment Methodologies For Identifying Non-Bank Non-Insurer Global Systemically Important Financial Institutionsapi-249785899Noch keine Bewertungen

- Re: FINRA Regulatory Notice 14-37: FINRA Requests Comment On A Rule Proposal To Implement The Comprehensive Automated Risk Data SystemDokument7 SeitenRe: FINRA Regulatory Notice 14-37: FINRA Requests Comment On A Rule Proposal To Implement The Comprehensive Automated Risk Data Systemapi-249785899Noch keine Bewertungen

- 1615 H Street NW - Washington, DC - 20062Dokument8 Seiten1615 H Street NW - Washington, DC - 20062api-249785899Noch keine Bewertungen

- UntitledDokument71 SeitenUntitledapi-249785899Noch keine Bewertungen

- In The United States Court of Appeals For The Fourth CircuitDokument30 SeitenIn The United States Court of Appeals For The Fourth Circuitapi-249785899Noch keine Bewertungen

- Re: Announcement Regarding Rule 14a-8 (I)Dokument4 SeitenRe: Announcement Regarding Rule 14a-8 (I)api-249785899Noch keine Bewertungen

- 1615 H Street NW - Washington, DC - 20062Dokument12 Seiten1615 H Street NW - Washington, DC - 20062api-249785899Noch keine Bewertungen

- 1615 H Street NW - Washington, DC - 20062Dokument11 Seiten1615 H Street NW - Washington, DC - 20062api-249785899Noch keine Bewertungen

- UntitledDokument2 SeitenUntitledapi-249785899Noch keine Bewertungen

- 30 January 2015: To The Members of The Committee On Legal Affairs of The European ParliamentDokument2 Seiten30 January 2015: To The Members of The Committee On Legal Affairs of The European Parliamentapi-249785899Noch keine Bewertungen

- Re: Announcement Regarding Application of Rule 14a-8 (I) (9) During The Current Proxy SeasonDokument4 SeitenRe: Announcement Regarding Application of Rule 14a-8 (I) (9) During The Current Proxy Seasonapi-249785899Noch keine Bewertungen

- Global Systemically Important Banks in ResolutionDokument10 SeitenGlobal Systemically Important Banks in Resolutionapi-249785899Noch keine Bewertungen

- Re: Financial Accounting Foundation (Working Draft, December 2014)Dokument3 SeitenRe: Financial Accounting Foundation (Working Draft, December 2014)api-249785899Noch keine Bewertungen

- UntitledDokument12 SeitenUntitledapi-249785899Noch keine Bewertungen

- Financial Crisis Responsibility Fee: Issues For Policy MakersDokument16 SeitenFinancial Crisis Responsibility Fee: Issues For Policy Makersapi-249785899Noch keine Bewertungen

- Relation To, This Bill in Our Annual How They Voted ScorecardDokument1 SeiteRelation To, This Bill in Our Annual How They Voted Scorecardapi-249785899Noch keine Bewertungen

- Re: 2015 Benchmark Policy ConsultationDokument7 SeitenRe: 2015 Benchmark Policy Consultationapi-249785899Noch keine Bewertungen

- WWW - Sec.gov/cgi-Bin/ruling-Comments: Subject: Cybersecurity Roundtable, File No. 4-673Dokument6 SeitenWWW - Sec.gov/cgi-Bin/ruling-Comments: Subject: Cybersecurity Roundtable, File No. 4-673api-249785899Noch keine Bewertungen

- Moon Phase Effect On Investor Psychology and Stock Trading PerformanceDokument21 SeitenMoon Phase Effect On Investor Psychology and Stock Trading PerformanceAnish KrishnanNoch keine Bewertungen

- FM-Sessions 23 - 24 Dividend Policy-CompleteDokument72 SeitenFM-Sessions 23 - 24 Dividend Policy-CompleteSaadat ShaikhNoch keine Bewertungen

- CH 01Dokument126 SeitenCH 01Hassaan ShaikhNoch keine Bewertungen

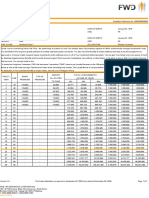

- Set For Life 7pay Sales IllustrationDokument7 SeitenSet For Life 7pay Sales IllustrationRyanNoch keine Bewertungen

- SAML's Mutual Funds DetailsDokument4 SeitenSAML's Mutual Funds DetailsSalman RahmanNoch keine Bewertungen

- IMFI 2019 02 PuspitaningtyasDokument13 SeitenIMFI 2019 02 PuspitaningtyasYulianto ImantakaNoch keine Bewertungen

- Global Islamic Finance MagazineDokument88 SeitenGlobal Islamic Finance MagazineDavid SmithNoch keine Bewertungen

- Issue ManagementDokument194 SeitenIssue ManagementBubune KofiNoch keine Bewertungen

- Dr. Arvind B Telang SR College: - Supriya Arvind Tarde. - M Com Ii, Sem IiiDokument10 SeitenDr. Arvind B Telang SR College: - Supriya Arvind Tarde. - M Com Ii, Sem IiiSun ShineNoch keine Bewertungen

- Class Notes - Financial Institutions and ManagementDokument83 SeitenClass Notes - Financial Institutions and ManagementRutwik PatilNoch keine Bewertungen

- Pyramiding/Ponzi Scheme: Presented By: Mae Joy D. BacantoDokument14 SeitenPyramiding/Ponzi Scheme: Presented By: Mae Joy D. BacantoMae Joy BacantoNoch keine Bewertungen

- Regulatory Framework For Investors ProtectionDokument32 SeitenRegulatory Framework For Investors Protectionharsh sahuNoch keine Bewertungen

- Metrobank Money Market FundDokument3 SeitenMetrobank Money Market FundExequielCamisaCrusperoNoch keine Bewertungen

- Ipo Sharekhan ProjectDokument73 SeitenIpo Sharekhan ProjectSaadullah Khan100% (1)

- Sec ComplaintDokument45 SeitenSec ComplaintDan Primack100% (4)

- Chapter - 4.2: Stock BrokingDokument10 SeitenChapter - 4.2: Stock BrokingNisarg ShahNoch keine Bewertungen

- Designing The Roadmap For Pre IncubationDokument9 SeitenDesigning The Roadmap For Pre IncubationQuốc Phòng An NinhNoch keine Bewertungen

- Mutual Funds in ICICI Bank: Bachelor of Management StudiesDokument19 SeitenMutual Funds in ICICI Bank: Bachelor of Management StudiesGanganiya GauravNoch keine Bewertungen

- A Study of Financial Planning and InvestDokument5 SeitenA Study of Financial Planning and InvestAndrew PottsNoch keine Bewertungen