Beruflich Dokumente

Kultur Dokumente

2015 Qualified Plan Conversion & Tax Strategies

Hochgeladen von

Mark Houston0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

31 Ansichten6 SeitenA Fidelity Financial White Paper

Mark T. Houston

(402) 880-7008

mark@fidfin.co

www.FidFin.co

Schedule An Appointment: http://bit.ly/1DtF3mj

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenA Fidelity Financial White Paper

Mark T. Houston

(402) 880-7008

mark@fidfin.co

www.FidFin.co

Schedule An Appointment: http://bit.ly/1DtF3mj

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

31 Ansichten6 Seiten2015 Qualified Plan Conversion & Tax Strategies

Hochgeladen von

Mark HoustonA Fidelity Financial White Paper

Mark T. Houston

(402) 880-7008

mark@fidfin.co

www.FidFin.co

Schedule An Appointment: http://bit.ly/1DtF3mj

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 6

2015 QUALIFIED

PLAN CONVERSION

& TAX STRATEGIES

BILL GASTL, CLU

2015 QUALIFIED PLAN CONVERSION & TAX STRATEGIES

As we begin to plan and manage our assets for

a new year, this might be the right time to consider a

pragmatic approach to managing certain assets in

our portfolio or our clients portfolio. Many of us or

our clients have qualified plan assets or assets

residing in variable annuities. Most of these assets

are allocated to some type of equity mutual fund,

which over the past five years have increased in

value due to the current bull market. In analyzing

this bull market to others bull markets in the past;

this bull market is already one of the longest since

the Great Depression. Since 1932, there have only

been four bull markets which have had a longer

growth period than the current bull market, which is

the purpose of this article.

Fidelity Financial Co., LLC

White Paper

Since mutual funds do not allow any downside

protection in the event of a down turn in stocks, this

might be the time to considering redirecting all or a

portion of your portfolio to an index type insurance

product. Index products allow assets to be deposited

into a contract that has solid upside growth, while

eliminating the downside risks involved with market

based investments, like a mutual fund or the sub-

accounts of a variable annuity product. Furthermore,

since historically the current top marginal tax rate is

low compared to historical standards, any taxes due

to distributions today or over the next couple of

years might be beneficial since it is very likely taxes

will increased in the future due to current debt of

the federal government and the interest due as a

result of the debt. Late last year, federal debt

reached $18 trillion dollars and according to the

Congressional Budget Office now represents

approximately 78% of our gross domestic product or

Page | 1

2015 QUALIFIED PLAN CONVERSION & TAX STRATEGIES

GDP. Qualified plan distributions or distributions up

to basis from non-qualified annuities are taxed as

ordinary income. Considering this, the question

becomes what are the chances my individual tax

bracket will be lower, stay the same or increase in

the future, as a result of federal debt and the

interest payments associated with this debt. If your

answer is increase, then paying taxes sooner

rather than later on these types of plans is a

pragmatic approach to managing the taxes which

will be due once distributions are distributed from

these type of plans.

Moving forward in 2015, most of us hope the

current bull market will continue, but there is data

which should be considered, which is why protecting

the downside risk of our qualified plans or variable

annuities is important. Many financial experts

agreed financial markets have been inflated due to

the cheap money from our central bank through

their quantitative easing strategies.

If we look at the correlation between market

downward movements to the domestic markets in

recent years to the Federal Reserves unprecedented

bond-buying program from 2008 and forward, stocks

tended to rise when the central bank was in the

market supporting assets prices. Conversely, sell-offs

coincided with periods when the Federal Reserve

was pulling back on its stimulus programs.

Fidelity Financial Co., LLC

White Paper

Since November 2008 through October 2014,

the Federal Reserve had been stimulating the

economy and propping up our stock market by

accumulating massive amount of government bonds.

Before the recession, the Federal Reserve had less

Page | 2

2015 QUALIFIED PLAN CONVERSION & TAX STRATEGIES

than $1.54 trillion of government bonds or mortgage

backed securities on its balance sheet. As of

November, 2014 the Federal had $4.18 trillion as

listed on their quarterly report of November, 2014.

This is an increase of approximately 169%. You might

ask why is this important.

As I mentioned earlier, only one developed

country has tried a stimulus plan similar to the one

the Federal Reserve implemented with its

quantitative easing strategies, and that was Japan.

The Japanese government implemented a similar

stimulus strategy between 2001 and 2006. After this

program ended, Japanese stocks fell by 50% over the

next two years. Is this an indication stocks will follow

a similar course in this country. Nobody knows the

answer to that question, but there are several

financial experts or firms who are concerned. For

example, according to the respected Shiller P/E ratio,

stocks are overvalued by 56%. This market-

measuring tool was popularized by Yales Robert

Shiller, who shared the Nobel Prize in economics in

October 2013 for showing the predictability of stock

prices over long periods of time. The Shiller P/E is at

its highest levels since the dot-com era, even higher

than Black Monday in 1987, which might indicate a

major correction in the market is near. There are

several other financial experts who are also

concerned and can be easily found by searching the

internet and visiting the websites or blogs.

Fidelity Financial Co., LLC

White Paper

Considering

the

information

herein,

implementing

a

financial

strategy

which

protects

the

downside

market

risk

associated

with

mutual

funds

and

variable

annuities

sub-accounts,

paying

the

taxes

at

todays

low

rates

might

be

a

pragmatic

and

Page | 3

2015 QUALIFIED PLAN CONVERSION & TAX STRATEGIES

pro-active approach of locking in some impressive

gains, allowing your portfolio to grow in the future,

while eliminating the downside risks associated with

mutual funds or variable annuity contracts.

Fidelity Financial Co., LLC

White Paper

Page | 4

2015 QUALIFIED PLAN CONVERSION & TAX STRATEGIES

Fidelity Financial

215 S. 88th Street

Omaha, NE 68114

Mark T. Houston

(402) 880-7008

mark@fidfin.co

WWW.FIDFIN.CO

Fidelity Financial Co., LLC

White Paper

Page | 5

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Registry of Public Infrastructures: - Registry of Reforestation Projects - Shall Be Maintained For Each CategoryDokument31 SeitenRegistry of Public Infrastructures: - Registry of Reforestation Projects - Shall Be Maintained For Each CategoryAllen Gonzaga100% (1)

- Estate and Gift Tax OutlineDokument26 SeitenEstate and Gift Tax OutlineDaniela Pretus100% (2)

- Bac03-Chapter 5Dokument25 SeitenBac03-Chapter 5Rea Mariz JordanNoch keine Bewertungen

- 2015 Qualified Plan Conversion & Tax Strategy PlanDokument12 Seiten2015 Qualified Plan Conversion & Tax Strategy PlanMark HoustonNoch keine Bewertungen

- Taxes - The Largest Transfer of Your WealthDokument20 SeitenTaxes - The Largest Transfer of Your WealthMark Houston0% (1)

- 2014 Quantitative Analysis of Investor BehaviorDokument21 Seiten2014 Quantitative Analysis of Investor BehaviorMark HoustonNoch keine Bewertungen

- Can I Really Have A Tax Free Retirement?Dokument5 SeitenCan I Really Have A Tax Free Retirement?Mark HoustonNoch keine Bewertungen

- Politics From The Blue CollarDokument5 SeitenPolitics From The Blue CollarMark HoustonNoch keine Bewertungen

- For LTC Protection Look To AnnuitiesDokument6 SeitenFor LTC Protection Look To AnnuitiesMark HoustonNoch keine Bewertungen

- 16soirepar PDFDokument388 Seiten16soirepar PDFGabriela VladNoch keine Bewertungen

- TB January To December 2022Dokument102 SeitenTB January To December 2022Dhvani PanchalNoch keine Bewertungen

- Ias 41 AgricultureDokument37 SeitenIas 41 AgricultureDiane ClarisseNoch keine Bewertungen

- Tax RemediesDokument15 SeitenTax RemediesChristopher Jan DotimasNoch keine Bewertungen

- U01 Apps SGSunSMART SGSunSMARTFiles OPENILLUSTRATIONPDF 800954O150420211227375178095Dokument11 SeitenU01 Apps SGSunSMART SGSunSMARTFiles OPENILLUSTRATIONPDF 800954O150420211227375178095Marilou AgustinNoch keine Bewertungen

- Bill of Rights ReviewerDokument7 SeitenBill of Rights ReviewerMark SerranoNoch keine Bewertungen

- GST Summary by Cma Tharun RajDokument122 SeitenGST Summary by Cma Tharun Rajrock rollNoch keine Bewertungen

- Income-Tax Rules, 1962Dokument2 SeitenIncome-Tax Rules, 1962Abdul SattarNoch keine Bewertungen

- Law On PropertyDokument25 SeitenLaw On PropertyMildred PagsNoch keine Bewertungen

- Assignment 3 - TAXDokument29 SeitenAssignment 3 - TAXLoNoch keine Bewertungen

- Payslilp: Afcons Infrastructure LTDDokument1 SeitePayslilp: Afcons Infrastructure LTDAnkitNoch keine Bewertungen

- Reinventing Conservation EasementsDokument44 SeitenReinventing Conservation EasementsLincoln Institute of Land PolicyNoch keine Bewertungen

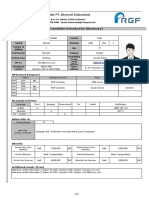

- 【RGF】Application Form RADokument11 Seiten【RGF】Application Form RAReini AndriatiNoch keine Bewertungen

- 10 - Pas 20 - Government GrantsDokument4 Seiten10 - Pas 20 - Government GrantsAbbygail Michelle TalaveraNoch keine Bewertungen

- InvoiceDokument2 SeitenInvoicebhavesh kumarNoch keine Bewertungen

- Pakistan Tobacco CompanyDokument23 SeitenPakistan Tobacco CompanyMohsen SirajNoch keine Bewertungen

- Sunstein, Cass Holmes, Stephen - The Cost of Rights - 1 ParteDokument60 SeitenSunstein, Cass Holmes, Stephen - The Cost of Rights - 1 Parteh3nry0100% (2)

- Tendor of EsiDokument7 SeitenTendor of EsiRaj KumarNoch keine Bewertungen

- Egypt Import ProfileDokument31 SeitenEgypt Import ProfileKarim BakriNoch keine Bewertungen

- 85.RP Vs Central AzucareraDokument5 Seiten85.RP Vs Central AzucareraClyde KitongNoch keine Bewertungen

- Lesson 2 Nature, Classifications and Collection of TaxesDokument25 SeitenLesson 2 Nature, Classifications and Collection of TaxesMegumi ParkNoch keine Bewertungen

- ERPNext DocumentationDokument13 SeitenERPNext DocumentationSree EedupugantiNoch keine Bewertungen

- CL Cup 2018 (AUD, TAX, RFBT)Dokument4 SeitenCL Cup 2018 (AUD, TAX, RFBT)sophiaNoch keine Bewertungen

- Carlos Alonzo and Casimira Alonzo, Petitioners, vs. Intermediate Appellate COURT and TECLA PADUA, RespondentsDokument23 SeitenCarlos Alonzo and Casimira Alonzo, Petitioners, vs. Intermediate Appellate COURT and TECLA PADUA, RespondentsraemmmanlagradaNoch keine Bewertungen

- Article 1 - Taxation and Its Negative Impact On Business Investment ActivitiesDokument6 SeitenArticle 1 - Taxation and Its Negative Impact On Business Investment ActivitiesceistNoch keine Bewertungen

- Income Tax Evasion and Tax Recovery PetitionDokument3 SeitenIncome Tax Evasion and Tax Recovery PetitionArjun GhoseNoch keine Bewertungen

- New FORM 15H Applicable PY 2016-17Dokument2 SeitenNew FORM 15H Applicable PY 2016-17addsingh100% (1)