Beruflich Dokumente

Kultur Dokumente

CRS Memo EITC and ACTC Max Amounts

Hochgeladen von

Laney SommerCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CRS Memo EITC and ACTC Max Amounts

Hochgeladen von

Laney SommerCopyright:

Verfügbare Formate

February 25, 2015

MEMORANDUM

To:

Senate Judiciary Committee

Attention:

, Legislative Counsel

From:

Subject:

Amount of the Child Tax Credit and Earned Income Tax Credit for a Hypothetical

Family, 2011-2014

This memorandum responds to your request for the amount of the earned income tax credit (EITC) and

the child tax credit (CTC) that a hypothetical family could receive in 2011, 2012, 2013, and 2014.

Specifically, you were interested in the value of these credits for a married couple with three and four

children. In addition, you requested that for every year, the familys income be equal to the maximum

amount of earnings a taxpayer could have and still receive the maximum amount of the EITC. This

income level is often referred to as the phase-out threshold amount and is adjusted annually for

inflation. (By definition, once a taxpayers income is greater than the phase-out threshold amount, the

value of the EITC begins to fall, until it reaches zero).

In order to calculate the value of these credits, several assumptions were made. First, the family was

assumed to be eligible for both the EITC and the CTC for every year specified.1 Second, every child was

assumed to be a qualifying child for both credits.2 Third, all of the taxpayers earnings were eligible for

determining the credit.3 Finally, this married couple filed their taxes jointly.

For a detailed overview of the eligibility requirements for each credit see CRS Report R43805, The Earned Income Tax Credit

(EITC): An Overview, by Gene Falk and Margot L. Crandall-Hollick and CRS Report R41873, The Child Tax Credit: Current

Law and Legislative History, by Margot L. Crandall-Hollick.

2

The definition of qualifying child for the EITC and the child tax credit do differ. For example, an eligible child for the child tax

credit must be under 17 years of age, while a qualifying child for the EITC must be under 19 years of age, or under 24 if a fulltime student. In addition, taxpayers must provide the social security numbers (SSNs) of children in order to claim the EITC,

while they can provide either an individual taxpayer identification number (ITIN) or SSN for the child to claim the child tax

credit. For a more detailed overview of the definition of qualifying children for these credits see CRS Report R43805 and CRS

Report R41873.

3

Certain forms of income are not considered earnings for the purpose of the EITC. These include pension and annuity income,

income of nonresident aliens not from a U.S. business, income earned while incarcerated for work in a prison, and TANF benefits

paid in exchange for participation in work experience or community service activities. In addition, tax filers who claim the

foreign earned income exclusion (i.e., they file Form 2555 or Form 2555EZ with their federal income tax return) are ineligible to

claim the EITC.

Congressional Research Service

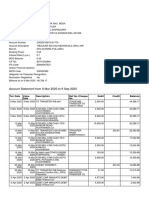

The value of the credits is provided in Table 1. Since it is assumed that the familys income

equaled the phase-out threshold amount, the family would by definition receive the maximum

EITC for a family with three or more children. The maximum amount of the EITC, as well as

other inflation adjusted parameters of the credit (and other provisions of the tax code), are

published in Internal Revenue Service (IRS) revenue procedures.4

The child tax credit is effectively calculated as 15% of earnings above $3,000, not to exceed the

maximum amount of the credit.5 (The maximum amount of the child tax credit is the number of

qualifying children multiplied by $1,000.) For example, in 2013, the value of the child tax credit

would be calculated as 15% of $19,870 ($22,870 minus $3,000), equaling $2,981 as illustrated in

Table 1. In 2014, the child tax credit is calculated using the same formula (15% of $20,260

($23,260 minus $3,000)). Using the formula, the credit would be equal $3,039. However, if the

family has three qualifying children, the credit cannot exceed $3,000, and hence this familys

child tax credit would be $3,000. If the family had four qualifying children, in contrast, the child

tax credit in 2014 would be $3,039 as illustrated in Table 1.Unlike the EITC, the amount of the

child tax credit is not indexed for inflation.

Table 1. Amount of the EITC and Child Tax Credit for a Stylized Taxpayer, 2011-2014

EITC

Child Tax Credit

Total of EITC & Child

Tax Credit

Year

Earned

Income

3 Children

4 Children

3 Children

4 Children

3 Children

4 Children

2011

$21,770

$5,751

$5,751

$2,816

$2,816

$8,567

$8,567

2012

$22,300

$5,891

$5,891

$2,895

$2,895

$8,786

$8,786

2013

$22,870

$6,044

$6,044

$2,981

$2,981

$9,025

$9,025

2014

$23,260

$6,143

$6,143

$3,000

$3,039

$9,143

$9,182

Source: CRS calculations based on Internal Revenue Code section 32 and 24 and Internal Revenue Procedures 11-12, 1152, 13-5 & 13-35

Notes: Earned income is equal to the maximum earned income a married taxpayer can have and still receive the

maximum EITC amount.

Figure 1 provides a graphical representation of the amount of the EITC and child tax credit by earnings

for a married couple with three children in 2014. As this figure shows, the EITC gradually increases to its

maximum value of $6,143, remains constant at this maximum value, and then begins to fall in value when

earnings exceed the phase-out threshold amount of $23,260. In addition, the child tax credit reaches its

4

The maximum EITC amount for 2011 through 2014 can be found in Revenue Procedure 11-2, 11-52,13-5 and 13-35 available

at http://www.irs.gov/pub/irs-drop/rp-11-12.pdf, http://www.irs.gov/pub/irs-drop/rp-11-52.pdf, http://www.irs.gov/pub/irsdrop/rp-13-15.pdf, and http://www.irs.gov/pub/irs-drop/rp-13-35.pdf.

5

Currently, eligible families that claim the child tax credit can subtract up to $1,000 per qualifying child from their federal

income tax liability. If a family's tax liability is less than the value of their child tax credit, they may be eligible for a refundable

credit calculated using the earned income formula, which is 15% of earnings above $3,000. Given the low income of the family

in this example, they will calculate the credit using the earned income formula.

Congressional Research Service

maximum value of $3,000 when earnings equal $23,000. The child tax credit does not begin to fall in

value until income is greater than $110,000 for a married couple filing jointly. Hence, when this familys

income is between $23,000 and $23,260 they will receive the maximum combined credit of $9,143.

Figure 1. Amount of the EITC and Child Tax Credit

for a Married Couple with Three Children in 2014, by Earnings

Source: CRS calculations based on Internal Revenue Code section 32 and 24 and Internal Revenue Procedures 11-12, 1152, 13-5 & 13-35

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Journal Pone 0201193Dokument11 SeitenJournal Pone 0201193Laney SommerNoch keine Bewertungen

- 277155Dokument167 Seiten277155Laney SommerNoch keine Bewertungen

- 2016 Election Final Report 06-14-18Dokument568 Seiten2016 Election Final Report 06-14-18Anonymous FBZLGrNoch keine Bewertungen

- Mortality in The United States, 2015: NCHS Data Brief No. 267 December 2016Dokument8 SeitenMortality in The United States, 2015: NCHS Data Brief No. 267 December 2016Laney SommerNoch keine Bewertungen

- U.S. Market For Giraffe Parts UncoveredDokument2 SeitenU.S. Market For Giraffe Parts UncoveredLaney SommerNoch keine Bewertungen

- New RAISE Act Bill Text1Dokument40 SeitenNew RAISE Act Bill Text1Laney SommerNoch keine Bewertungen

- TP 200Dokument852 SeitenTP 200Laney SommerNoch keine Bewertungen

- Isp I 18 42Dokument33 SeitenIsp I 18 42Laney SommerNoch keine Bewertungen

- CensoredDokument56 SeitenCensoredLaney SommerNoch keine Bewertungen

- NAM Manufacturers Outlook Survey Q2 2018Dokument11 SeitenNAM Manufacturers Outlook Survey Q2 2018Laney SommerNoch keine Bewertungen

- Tax Cuts and Jobs Act - Full TextDokument429 SeitenTax Cuts and Jobs Act - Full TextWJ Editorial Staff0% (1)

- DHS Document Release On Aviation Cybersecurity PDFDokument117 SeitenDHS Document Release On Aviation Cybersecurity PDFLaney SommerNoch keine Bewertungen

- Ef Gast Data Research Report 062717Dokument30 SeitenEf Gast Data Research Report 062717Laney SommerNoch keine Bewertungen

- Cornucopia DIY Farmers Market GuideDokument9 SeitenCornucopia DIY Farmers Market GuideLaney SommerNoch keine Bewertungen

- A Burgeoning Crisis? A Nationwide Assessment of The Geography of Water Affordability in The United StatesDokument19 SeitenA Burgeoning Crisis? A Nationwide Assessment of The Geography of Water Affordability in The United StatesLaney SommerNoch keine Bewertungen

- Visual Perception May Depend On Birthplace and Environment - ScienceDailyDokument3 SeitenVisual Perception May Depend On Birthplace and Environment - ScienceDailyLaney SommerNoch keine Bewertungen

- Retail Automation Stranded Workers Final May 2017Dokument56 SeitenRetail Automation Stranded Workers Final May 2017Laney SommerNoch keine Bewertungen

- BetterCareJuly13 2017Dokument172 SeitenBetterCareJuly13 2017kballuck10% (2)

- Data Point: Individual Market Premium Changes: 2013 - 2017Dokument5 SeitenData Point: Individual Market Premium Changes: 2013 - 2017ZerohedgeNoch keine Bewertungen

- 6379 Exhibit AB 20170307 3Dokument8 Seiten6379 Exhibit AB 20170307 3Laney SommerNoch keine Bewertungen

- Preterm Birth, Vaccination and Neurodevelopmental Disorders: A Cross-Sectional Study of 6-To 12-Year-Old Vaccinated and Unvaccinated ChildrenDokument8 SeitenPreterm Birth, Vaccination and Neurodevelopmental Disorders: A Cross-Sectional Study of 6-To 12-Year-Old Vaccinated and Unvaccinated ChildrenLaney SommerNoch keine Bewertungen

- Use of Force Statistical Analysis 2012-2016Dokument30 SeitenUse of Force Statistical Analysis 2012-2016Laney SommerNoch keine Bewertungen

- Ef Data Research Report Press Release 0418172Dokument1 SeiteEf Data Research Report Press Release 0418172Laney SommerNoch keine Bewertungen

- Monthlywebsitestats04 01 17Dokument9 SeitenMonthlywebsitestats04 01 17Laney SommerNoch keine Bewertungen

- CBO Report On Federal vs. Private Sector Pay 2011-2015Dokument30 SeitenCBO Report On Federal vs. Private Sector Pay 2011-2015FedSmith Inc.Noch keine Bewertungen

- 10th Anniversary Edition EP 3 Damage AssessmentDokument117 Seiten10th Anniversary Edition EP 3 Damage AssessmentLaney SommerNoch keine Bewertungen

- Pilot Comparative Study On The Health of Vaccinated and Unvaccinated 6 - To 12-Year-Old U.S. Children - 2017Dokument12 SeitenPilot Comparative Study On The Health of Vaccinated and Unvaccinated 6 - To 12-Year-Old U.S. Children - 2017breakingthesilence100% (1)

- Ef Data Research Report Second Editionfinal041717 1Dokument73 SeitenEf Data Research Report Second Editionfinal041717 1Laney SommerNoch keine Bewertungen

- Analyzing The Threats Posed by New StyleDokument30 SeitenAnalyzing The Threats Posed by New StyleLaney SommerNoch keine Bewertungen

- HofR Challenge To ACA DCT 5-12-16Dokument38 SeitenHofR Challenge To ACA DCT 5-12-16john7451Noch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- F 706Dokument31 SeitenF 706Bogdan PraščevićNoch keine Bewertungen

- Cir vs. PhilamlifeDokument2 SeitenCir vs. PhilamlifeAnny YanongNoch keine Bewertungen

- Flowcharts in LtomDokument14 SeitenFlowcharts in LtomKristel Faye TandogNoch keine Bewertungen

- 1558063928887q2LhA3o4bMk7ldb6 PDFDokument2 Seiten1558063928887q2LhA3o4bMk7ldb6 PDFsravanNoch keine Bewertungen

- FABM2 Q2 Mod13Dokument29 SeitenFABM2 Q2 Mod13Fretty Mae Abubo100% (3)

- Invoice: Patient Name: Order # 28798120 Insurance: VSP CHOICE PLANDokument2 SeitenInvoice: Patient Name: Order # 28798120 Insurance: VSP CHOICE PLANUniqueEye OptiqueNoch keine Bewertungen

- BCOM HONS 5 Income Tax Law PracticeHDokument36 SeitenBCOM HONS 5 Income Tax Law PracticeHPurushottam RathoreNoch keine Bewertungen

- Inter Past Question Exemption-GSTDokument10 SeitenInter Past Question Exemption-GSTKaylee WrightNoch keine Bewertungen

- Pay Bill GazettedDokument3 SeitenPay Bill Gazettedibrahimshahghotki_20Noch keine Bewertungen

- Invoice Flomih & Vio Bussines SRL: CX Ref: 18911926 Invoice No.: 151140-838 Invoice Date: 29 Nov 2019Dokument1 SeiteInvoice Flomih & Vio Bussines SRL: CX Ref: 18911926 Invoice No.: 151140-838 Invoice Date: 29 Nov 2019calinmusceleanuNoch keine Bewertungen

- REVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherDokument15 SeitenREVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherGoogleNoch keine Bewertungen

- International Investment AppraisalDokument6 SeitenInternational Investment AppraisalZeeshan Jafri100% (1)

- Understanding MT 940 bank statement formatDokument7 SeitenUnderstanding MT 940 bank statement formatpandu MNoch keine Bewertungen

- Bank Statement09-2020Dokument6 SeitenBank Statement09-2020Tnt SolutionsNoch keine Bewertungen

- Dr. OEN KANDANG SAPI SOLO INVOICE SummaryDokument2 SeitenDr. OEN KANDANG SAPI SOLO INVOICE Summaryyulius agus lingga pratomoNoch keine Bewertungen

- Universidad ECCI Sales ProFormaDokument1 SeiteUniversidad ECCI Sales ProFormaManuel LopezNoch keine Bewertungen

- CVS Health Earnings Statement: SSN: Taxable Marital Status: Exemptions/Allowances: Yasmine Bastien 12818 Early Run LaneDokument2 SeitenCVS Health Earnings Statement: SSN: Taxable Marital Status: Exemptions/Allowances: Yasmine Bastien 12818 Early Run LaneJeremy WhiteNoch keine Bewertungen

- TMT Quote 08.05.2023Dokument1 SeiteTMT Quote 08.05.2023sathya narayanaNoch keine Bewertungen

- Account Activity: Transaction Date Value Date Reference No. Description Debit Amount Credit Amount Running BalanceDokument4 SeitenAccount Activity: Transaction Date Value Date Reference No. Description Debit Amount Credit Amount Running BalanceDILIP VELHALNoch keine Bewertungen

- Municipal Salary ListDokument50 SeitenMunicipal Salary ListMercy LazaragaNoch keine Bewertungen

- GST/CST & VAT: Karnataka HC rules input tax credit cannot be denied based on tax period or timing of claimDokument16 SeitenGST/CST & VAT: Karnataka HC rules input tax credit cannot be denied based on tax period or timing of claimShashwat JoshiNoch keine Bewertungen

- Medicare Part B Premium Fact SheetDokument2 SeitenMedicare Part B Premium Fact SheetTerry PetersonNoch keine Bewertungen

- Catholic Relief Services-USCCB Proposed Chart of Accounts For PartnersDokument59 SeitenCatholic Relief Services-USCCB Proposed Chart of Accounts For PartnersRic VinceNoch keine Bewertungen

- Individual Customer Relation Form: ApplicationDokument7 SeitenIndividual Customer Relation Form: ApplicationJay JaniNoch keine Bewertungen

- Medicard Philippines V Cir (Vat - Hmo)Dokument1 SeiteMedicard Philippines V Cir (Vat - Hmo)Jerome MagpantayNoch keine Bewertungen

- Class AssignmentDokument3 SeitenClass AssignmentZen JoaquinNoch keine Bewertungen

- Employee Pay Slip DetailsDokument1 SeiteEmployee Pay Slip Detailsk8shoebNoch keine Bewertungen

- Vat PDFDokument28 SeitenVat PDFJovelyn Villasenor33% (3)

- Interpretation of Statute - ResearchDokument7 SeitenInterpretation of Statute - ResearchBlood MoneyNoch keine Bewertungen

- Case 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTDokument4 SeitenCase 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTkunalNoch keine Bewertungen