Beruflich Dokumente

Kultur Dokumente

Enterprising Rural Families: Chat This Month

Hochgeladen von

Bill TaylorOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Enterprising Rural Families: Chat This Month

Hochgeladen von

Bill TaylorCopyright:

Verfügbare Formate

TM

Enterprising Rural Families

Chat This Month An Online Newsletter June, 2005 Volume 1, Issue 6

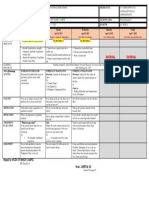

Reminder: The chat this month is

scheduled for North America: THE IMPACT OF PERSONALITY ON

Pacific Time- 6 p.m., Mountain RISK MANAGEMENT DECISIONS

Time- 7 p.m.; Queensland, Aus-

tralia: Eastern Time-12 Noon. Is maximizing profits the most important goal in the family business?

The topic is “The Impact of Per- Do owners or managers approach risk management the same? How do

personality characteristics affect decision-making?

sonality on Risk Management

Certainly economic decision making is key to operating a family

Decisions.”

business, but it is the individual decision-maker who often guides the

Suggested Progress by Group: business and is responsible for whether the operation succeeds. How

In order to stay current, by the end of the decision-maker reacts in a given situation, and how he/she thinks

this month you should be completed is at the core of economic decision-making (3). Other factors such as

to: goals and management style, attitude and personality impact one’s ap-

Antarctic – End of Module 7 proach to risk management decisions. (More detailed material on per-

sonality and risk management is presented in modules 2 & 3 of the En-

terprising Rural Families: Making it Worktm online course).

Arctic – 2nd Week of “Project”

in Module 6

Goals and Management Style

A principal assumption behind much family business research

Atlantic – End of Module 5 and education is that the owner’s primary goal is to maximize the dif-

ference between costs and returns—in essence, maximize profits. But

Baltic – 2nd Week of Module 4 studies have shown that profits may not always be the prime goal for

the operation. For example, a study of 29 farm family business owners

Bering – End of Module 2 asked them to assign value to a list of benefits they received from

farming. They reported that “doing something worthwhile,” and “being

Black – End of Module 1 my own boss” was viewed as more important than “producing a good

income” (4).

Caribbean - Management goals are also important to consider in an assess-

ment of family business management. Since family businesses com-

Coral – bine business and way of life goals in complex and personal ways, un-

derstanding management styles helps explain different approaches to

Indian – farm management. To understand the goals of farm family business

owners for example, a study of New Zealand farmers asked them to

Mediterranean - rank farm management goal statements. This produced a description

of three distinctive management styles—dedicated producer, flexible

Pacific - strategist, and resource steward.

Dedicated Producer—has a strong desire to achieve the best

Red - quality product. This producer thrives on farm work and wants to be

Contact e-mail for further course

the best producer possible. The dedicated producer realizes that finan-

cial sacrifices are necessary but the possibility of financial gain is tem-

information: pered by the fear of losing the ranch or farm.

information@eRuralFamilies.org

PAGE 2 E NTERP R IS I NG R UR A L F AMI LI ES TM V OLU ME 1 , I SSUE 6

Continued from page one – The Impact of Personality on Risk Management Decisions

he or she operates. Working close to nature is rewarding and the preferred lifestyle. Money is a means

to an end—having a good quality of life. The resource steward accepts moderate risk.

Although producers desire to achieve all valued goals, when this is not possible the management

style of the producer will influence the importance of the goal and decision making related to that goal.

For example, dedicated producers value producing a high-quality product and use financial and business

management practices to achieve production goals and success. This is not to say that the flexible

strategist and resource steward do not value high quality and success. But the definition of success may

be different. For the flexible strategist, success is marketing the product well. For the resource steward,

success is a quality lifestyle and preservation of natural resources (1).

Attitude Toward Business Debt

Some business owners can maintain an objective view in the face of

debt; but for others, debt (especially when excessive) becomes a very per-

sonal experience. A focus group study investigated the relationship be-

tween debt and viability of Australian agriculture producers and busi-

nesses. The researchers determined that debt impacts farm families in a

personal manner, “business consultants see debt conditions as a business

issue, while families see it as a personal issue” (6). Excessive debt placed a

great deal of mental strain on individual farmers; contributed to family

conflict, and had a negative impact on entire communities.

In addition to a personal view of debt, the attitude of the business family will impact decisions

related to debt. McCubbin and McCubbin (5) developed a family adaptation model that describes the

family’s capacity to meet obstacles. A factor in the model is the family’s definition of, or attitude toward

a problem. If the family views the situation as a challenge or opportunity for growth instead of a threat

or crisis, they are more likely to cope and adapt. A business family, therefore, that perceives debt as nec-

essary for sustainability is more likely to take a positive view of debt management.

Business-Owning Families’ Risk Tolerance

An examination of risk tolerance of family business owners using data from the 1995 Survey of

Consumer Finances revealed the following: family business owners are more willing to take financial

risks and have a larger share of financial assets in risky assets compared to people who do not own a

family business; among family business owners, age, race, net worth, and number of employees affect

both risk-taking attitudes and behaviors; the number of years owning the business, gross sales, having

started the business, and sole proprietorship affect risk-taking behaviors, while education affects risk-

taking attitudes (7).

Psychological characteristics of operators influence business decisions and the ability of the busi-

ness to respond effectively to changes in the operating environment. There are various models that de-

scribe these psychological characteristics and predict human behavior. The Myers-Briggs typology

(MBTI) is one of the most widely used models. The essence of the theoretical model is that we all have

certain fundamental options regarding our functioning. These are:

Whether we prefer the outer world of things and people (Extrovert) or the inner world of thoughts and

ideas (Introvert);

Whether we typically perceive our environment in a literal, factual way (Sensing) or typically using in-

tuition, creativity and imagination (INtuitive);

Whether we reach our decisions mostly in a logical, rational, objective way (Thinker) or in a value based,

subjective way (Feeler);

Whether we take action in an orderly and planned manner with deadlines and schedules (Judging) or in

a spontaneous, changing and adaptable manner with options and possibilities (Perceiving).

V OLU ME 1 , I SSUE 6 E NTERP R IS I NG R UR A L F AMI LI ES TM PAGE 3

The MBTI has been used to enhance the un-

derstanding of business owner personality and deci-

sion making. In one study of 500 Nebraska farm cou-

ples, the largest percentage of farm men (25.3%) had

an ISTJ personality type while the largest percent-

age of farm women (17.8%) were ISFJ personality

type. An additional 20.5% of the farm men were

categorized as ESTJ and 14.2% of the farm women

were ISTJ. Based on psychological type theory, it

may be predicted that ISTJ/ISFJ producer couples’

strength lies in being hard working, realistic, conser-

vative, and traditionally oriented. Their weaknesses

lie in their resistance to change, dislike of risk, pessi-

mism, and strong ties to tradition (2).

Today’s business climate is undergoing tre-

mendous change in production, global competition,

business structure, technology, and risk management

strategies. These changing events and conditions

present a real challenge to ISTJ and ISFJ family

business operators because their most effective way

of operating comes from their careful accumulation of solid experience. Situations in which they have no

experience (as in new or non-traditional risk management strategies) can seem confusing and out of con-

trol to them. They need time and the opportunity to use their carefully developed expertise to understand

the changes.

Conclusion

This article was not intended to assume that economic decision-making and profits are not impor-

tant in family businesses. Rather, it points out the complexity of owner/manager decision making. People

are different in how they approach and analyze situations, as well as how they act on information.

(For more information on this topic and the management of rural family enterprises, check the Enterpris-

ing Rural Families website at http://eRuralFamilies.org.)

Author: Randy R. Weigel, UW Extension Human Development Specialist

References

1. Fairweather, J.R., & Keating, N.C. (1994). Goals and management styles of New Zealand farmers. Agricultural

Systems, 44, 181-200.

2. Horner, J.T., & Barrett, L.A. (1987). Personality types of farm couples—Implications for intervention strategies.

In H.G. Lingren et al., Family Strengths 8-9: Pathways To Well-Being (pp. 131-142). Lincoln, NE: Center for Family

Strengths, University of Nebraska.

3. Howard, W.H., Brinkman, G.L., & Lambert, R. (1997). Thinking styles and financial characteristics of selected

Canadian farm managers. Canadian Journal of Agricultural Economics, 45, 39-49.

4. Kliebenstein, J.B., Heffernan, W.D., Barrett, D.A., & Kirtley, C.L. (1981). Economic and sociologic motivational

factors in farming. Journal of American Society of Farm Managers & Rural Appraisers, 45(1), 10-14.

5. McCubbin, M.A., & McCubbin, H.I (1987). Family stress theory and assessment: The T-double ABCX model of

family adjustment and adaptation. In H.I. McCubbin & A. Thompson (Eds.), Family assessment inventories for re-

search and practice. Madison: University of Wisconsin-Madison.

6. Reeve, J., & Curthoys, C. (1999, June). Adapting DPI services for rural debt and farm viability. Rockhampton,

QLD, AU: Rural Industry Business Services, Department of Primary Industries.

7. Xiao, J.J., Alhabeeb, M.J., Hong, G-S., & Haynes, G.W. (2001, Winter). Attitude toward risk and risk-taking be-

havior of business-owning families. Journal of Consumer Affairs, 35(2), 307-326.

Enterprising Rural FamiliesTM

June. 2005 Volume 1, Issue 6

Das könnte Ihnen auch gefallen

- Introduction To Entrepreneurship: Bruce R. Barringer R. Duane IrelandDokument26 SeitenIntroduction To Entrepreneurship: Bruce R. Barringer R. Duane IrelandYasir AlamNoch keine Bewertungen

- Erf Newsletter 2.08Dokument2 SeitenErf Newsletter 2.08Bill TaylorNoch keine Bewertungen

- Local Media6678742499800428630Dokument25 SeitenLocal Media6678742499800428630sean gladimirNoch keine Bewertungen

- Keys To A Successful Family Business: Laura BechardDokument3 SeitenKeys To A Successful Family Business: Laura BechardBusiness Expert PressNoch keine Bewertungen

- Management Skills: Paradigms of Management 10 Traits of Top ManagersDokument4 SeitenManagement Skills: Paradigms of Management 10 Traits of Top ManagersAderaw GashayieNoch keine Bewertungen

- Distinctive Features of The Existence of Activity of SMEsDokument4 SeitenDistinctive Features of The Existence of Activity of SMEsNyegran LauraNoch keine Bewertungen

- Enterprising Rural Families: Characteristics of The Family BusinessDokument4 SeitenEnterprising Rural Families: Characteristics of The Family BusinessBill TaylorNoch keine Bewertungen

- The Basics of Starting a Child-Care Business: The Business of Child CareVon EverandThe Basics of Starting a Child-Care Business: The Business of Child CareNoch keine Bewertungen

- Managing for the Long Run (Review and Analysis of Miller and Le-Breton-Miller's Book)Von EverandManaging for the Long Run (Review and Analysis of Miller and Le-Breton-Miller's Book)Noch keine Bewertungen

- EntrepreneurshipDokument19 SeitenEntrepreneurshipLoraine CastilloNoch keine Bewertungen

- Barringer 01 Intro To EntrepreneurshipDokument27 SeitenBarringer 01 Intro To EntrepreneurshipPutera FirdausNoch keine Bewertungen

- The Business Logic in DebiasingDokument8 SeitenThe Business Logic in DebiasingCarolina ReyesNoch keine Bewertungen

- Finance for Strategic Decision-Making: What Non-Financial Managers Need to KnowVon EverandFinance for Strategic Decision-Making: What Non-Financial Managers Need to KnowNoch keine Bewertungen

- Achieving Class A Business Excellence: An Executive's PerspectiveVon EverandAchieving Class A Business Excellence: An Executive's PerspectiveNoch keine Bewertungen

- Studiu Afaceri Familie 2019Dokument36 SeitenStudiu Afaceri Familie 2019ClaudiuNoch keine Bewertungen

- Ubs Global Family Office Report 2020Dokument21 SeitenUbs Global Family Office Report 2020Peter ErnstNoch keine Bewertungen

- Modern Finance For Ordinary Folks: You Do Not Need A Ph.D Or Nobel Prize To Understand The JargonVon EverandModern Finance For Ordinary Folks: You Do Not Need A Ph.D Or Nobel Prize To Understand The JargonNoch keine Bewertungen

- Future Farm Blueprint: Plan Your Sustainability Journey with Clarity and ConfidenceVon EverandFuture Farm Blueprint: Plan Your Sustainability Journey with Clarity and ConfidenceNoch keine Bewertungen

- CG LAC Guide Chapter5Dokument26 SeitenCG LAC Guide Chapter5lobna qassemNoch keine Bewertungen

- Capital Structure Decisions: Evaluating Risk and UncertaintyVon EverandCapital Structure Decisions: Evaluating Risk and UncertaintyNoch keine Bewertungen

- SAGONOSDokument5 SeitenSAGONOSEthan SagonosNoch keine Bewertungen

- Enterprising Rural Families: Chat This MonthDokument3 SeitenEnterprising Rural Families: Chat This MonthBill TaylorNoch keine Bewertungen

- Barclays Report EntrepreneurshipDokument32 SeitenBarclays Report EntrepreneurshipFede LBNoch keine Bewertungen

- Employees' Financial Literacy, Behavior, Stress and WellnessDokument12 SeitenEmployees' Financial Literacy, Behavior, Stress and WellnessYong Leigh LocusamNoch keine Bewertungen

- Companies on a Mission: Entrepreneurial Strategies for Growing Sustainably, Responsibly, and ProfitablyVon EverandCompanies on a Mission: Entrepreneurial Strategies for Growing Sustainably, Responsibly, and ProfitablyNoch keine Bewertungen

- Smarter Finance For A Sustainable Future: Report Based On Proceedings at IBM StartDokument24 SeitenSmarter Finance For A Sustainable Future: Report Based On Proceedings at IBM Startkate_mcelweeNoch keine Bewertungen

- Baaaarrrr NicaDokument39 SeitenBaaaarrrr NicaSharmine TejanoNoch keine Bewertungen

- Semana 1. An Introductory Note On General ManagementDokument24 SeitenSemana 1. An Introductory Note On General ManagementMelvin100% (3)

- Sustainability and the Small and Medium Enterprise (Sme): Becoming More ProfessionalVon EverandSustainability and the Small and Medium Enterprise (Sme): Becoming More ProfessionalNoch keine Bewertungen

- Investment Management Perspective of Micro EnterprisesDokument6 SeitenInvestment Management Perspective of Micro EnterprisesCHAMSON CHANG-GOYNoch keine Bewertungen

- Enterprising Rural Families: Setting Strategic Goals: Where Do I Start?Dokument4 SeitenEnterprising Rural Families: Setting Strategic Goals: Where Do I Start?Bill TaylorNoch keine Bewertungen

- Barringer Ent6 01Dokument30 SeitenBarringer Ent6 01karlaNoch keine Bewertungen

- Beyond The 9-5: Single Parents' Journey To Financial IndependenceVon EverandBeyond The 9-5: Single Parents' Journey To Financial IndependenceNoch keine Bewertungen

- Strategic Risk Management: A Practical Guide to Portfolio Risk ManagementVon EverandStrategic Risk Management: A Practical Guide to Portfolio Risk ManagementBewertung: 5 von 5 Sternen5/5 (1)

- Familly BusinessDokument13 SeitenFamilly BusinessAman rautNoch keine Bewertungen

- A Critical Analysis of Succession Planning in Selected Family Based Enterprises in IndiaDokument30 SeitenA Critical Analysis of Succession Planning in Selected Family Based Enterprises in IndiaKavan HkNoch keine Bewertungen

- Risk Management AgricultureDokument20 SeitenRisk Management Agriculturemeetwithsanjay100% (2)

- The Integrative Leader: How Leaders Use Both Sides Of Their Brain To Build Resilient CompaniesVon EverandThe Integrative Leader: How Leaders Use Both Sides Of Their Brain To Build Resilient CompaniesNoch keine Bewertungen

- When Family Businesses Are Best - INSEADDokument25 SeitenWhen Family Businesses Are Best - INSEADBe DawsonNoch keine Bewertungen

- Etrp TRCK 2 - Etrp 8 Part 1Dokument35 SeitenEtrp TRCK 2 - Etrp 8 Part 1Kaitlinn Jamila AltatisNoch keine Bewertungen

- Topic Defense 2Dokument11 SeitenTopic Defense 2Sami JankinsNoch keine Bewertungen

- Entrepreneurship - Lecture 1Dokument66 SeitenEntrepreneurship - Lecture 1nesma fawzyNoch keine Bewertungen

- Erf Newsletter 6.09Dokument3 SeitenErf Newsletter 6.09Bill TaylorNoch keine Bewertungen

- Erf Newsletter 10.06Dokument3 SeitenErf Newsletter 10.06Bill TaylorNoch keine Bewertungen

- Maple Lodge FarmsDokument9 SeitenMaple Lodge FarmsHannaNoch keine Bewertungen

- Entrepreneurship Module - Week 1Dokument4 SeitenEntrepreneurship Module - Week 1Drama LlamaNoch keine Bewertungen

- Hugging A Cloud: Profits + Meaning From the Human Side of BusinessVon EverandHugging A Cloud: Profits + Meaning From the Human Side of BusinessNoch keine Bewertungen

- Cultural Calamity: Culture Driven Risk Management Disasters and How to Avoid ThemVon EverandCultural Calamity: Culture Driven Risk Management Disasters and How to Avoid ThemNoch keine Bewertungen

- Detreminants of Financial Risk Attitide Among SmesDokument7 SeitenDetreminants of Financial Risk Attitide Among SmesCHARLES HORMEKUNoch keine Bewertungen

- Business Dynasty Factors Affecting The Success of Leading Family Owned Businesses As Perceived by SHSDokument22 SeitenBusiness Dynasty Factors Affecting The Success of Leading Family Owned Businesses As Perceived by SHSMa.jilliana MamauagNoch keine Bewertungen

- WholeFarmPlanningModel OSUExtensionDokument4 SeitenWholeFarmPlanningModel OSUExtensionOswaldoNoch keine Bewertungen

- Group 4 Reference Notes - FBMDokument60 SeitenGroup 4 Reference Notes - FBMlowi shooNoch keine Bewertungen

- An Era of Pandemic - Business Survival During Pandemic and Its AftermathVon EverandAn Era of Pandemic - Business Survival During Pandemic and Its AftermathNoch keine Bewertungen

- Agribusiness Management: Agribusiness: "The Collective Businesses and Operations That Engage inDokument6 SeitenAgribusiness Management: Agribusiness: "The Collective Businesses and Operations That Engage inMary Irish Cayanan JardelezaNoch keine Bewertungen

- Pamphlets Cookery 9: Clotchie Gail Canar 9-NeonDokument6 SeitenPamphlets Cookery 9: Clotchie Gail Canar 9-NeonCJ StylesNoch keine Bewertungen

- The Entrepreneurial MindDokument8 SeitenThe Entrepreneurial MindAsma ChNoch keine Bewertungen

- Sixth Edition, Global Edition: Dr. Badrul Mohamed Jan Associate ProfessorDokument31 SeitenSixth Edition, Global Edition: Dr. Badrul Mohamed Jan Associate ProfessorsehunNoch keine Bewertungen

- Better BylawsDokument58 SeitenBetter BylawsBill TaylorNoch keine Bewertungen

- Disinheritance PDFDokument4 SeitenDisinheritance PDFBill TaylorNoch keine Bewertungen

- After A Death: What Steps Are Needed?Dokument12 SeitenAfter A Death: What Steps Are Needed?Bill TaylorNoch keine Bewertungen

- A Walk Through Wyoming ProbateDokument12 SeitenA Walk Through Wyoming ProbateBill TaylorNoch keine Bewertungen

- Personal Property MemorandumDokument6 SeitenPersonal Property MemorandumBill TaylorNoch keine Bewertungen

- Copreneurs: Mixing Business and LoveDokument3 SeitenCopreneurs: Mixing Business and LoveBill TaylorNoch keine Bewertungen

- Death CertificatesDokument4 SeitenDeath CertificatesBill TaylorNoch keine Bewertungen

- Personal Property TransferDokument4 SeitenPersonal Property TransferBill TaylorNoch keine Bewertungen

- Chairing A Difficult MeetingDokument3 SeitenChairing A Difficult MeetingBill TaylorNoch keine Bewertungen

- Creating An Ethical Culture in Your Small BusinessDokument3 SeitenCreating An Ethical Culture in Your Small BusinessBill TaylorNoch keine Bewertungen

- Is A Will Enough?Dokument4 SeitenIs A Will Enough?Bill TaylorNoch keine Bewertungen

- Kasl Weston County Extension Report Bill Taylor 5/7/13 Plant CombinationsDokument3 SeitenKasl Weston County Extension Report Bill Taylor 5/7/13 Plant CombinationsBill TaylorNoch keine Bewertungen

- Enterprising Rural Families: Renewable Energy: Is It Right For Your Family Business?Dokument4 SeitenEnterprising Rural Families: Renewable Energy: Is It Right For Your Family Business?Bill TaylorNoch keine Bewertungen

- Basic Financial StatementsDokument4 SeitenBasic Financial StatementsBill TaylorNoch keine Bewertungen

- Agreeing and Disagreeing WorksheetDokument3 SeitenAgreeing and Disagreeing WorksheetkknunsilmangkubumiNoch keine Bewertungen

- Chapter 8Dokument49 SeitenChapter 8RosmarinusNoch keine Bewertungen

- Moral Minds - How Nature Designed Our Universal Sense of Right and WrongDokument4 SeitenMoral Minds - How Nature Designed Our Universal Sense of Right and WrongDalila VicenteNoch keine Bewertungen

- Essay 15 - Symbolic AnthropologyDokument7 SeitenEssay 15 - Symbolic AnthropologyarchaeofreakNoch keine Bewertungen

- Advantages and Disadvantages of English As A Second Language in The PhilippinesDokument12 SeitenAdvantages and Disadvantages of English As A Second Language in The Philippineskitakattt22% (9)

- Class Program: Kindergarten - DaisyDokument2 SeitenClass Program: Kindergarten - DaisyKLeb VillalozNoch keine Bewertungen

- A Survey On Multiclass Image Classification Based On Inception-V3 Transfer Learning ModelDokument6 SeitenA Survey On Multiclass Image Classification Based On Inception-V3 Transfer Learning ModelIJRASETPublicationsNoch keine Bewertungen

- Life Stress and BurnoutDokument14 SeitenLife Stress and BurnoutCammille AlampayNoch keine Bewertungen

- A Formal Report The Decreasing Habit of Book Reading Among StudentsDokument18 SeitenA Formal Report The Decreasing Habit of Book Reading Among StudentsAsh QueenNoch keine Bewertungen

- Scope and Sequence 2014 Journeys gr4Dokument15 SeitenScope and Sequence 2014 Journeys gr4api-347346936Noch keine Bewertungen

- La 7 - Unit 1 - Lesson 9 - Lesson PlanDokument3 SeitenLa 7 - Unit 1 - Lesson 9 - Lesson Planapi-584557540Noch keine Bewertungen

- Mid-Semester Regular Data Mining QP v1 PDFDokument2 SeitenMid-Semester Regular Data Mining QP v1 PDFsangeetha kNoch keine Bewertungen

- Inbound Marketing Certification Study GuideDokument9 SeitenInbound Marketing Certification Study GuideYash TiwariNoch keine Bewertungen

- (G11-Hera, Athena & Aphrodite) (G11-Hera, Athena & Aphrodite) (G11 Hera & Athena) (G11 Athena Only) (G11 Hera & Aphrodite Only)Dokument1 Seite(G11-Hera, Athena & Aphrodite) (G11-Hera, Athena & Aphrodite) (G11 Hera & Athena) (G11 Athena Only) (G11 Hera & Aphrodite Only)Argie Joy Marie AmpolNoch keine Bewertungen

- The Learning Environment PPT GrethelleDokument16 SeitenThe Learning Environment PPT GrethelleGrethelle Bayani100% (3)

- James S. Cutsinger-My Last LectureDokument16 SeitenJames S. Cutsinger-My Last LectureTomaszUchańskiNoch keine Bewertungen

- True Colors OutlineDokument2 SeitenTrue Colors Outlineapi-305242503Noch keine Bewertungen

- Apa Itu CEFRDokument9 SeitenApa Itu CEFRAminah AdnanNoch keine Bewertungen

- Academic LiteraciesDokument11 SeitenAcademic LiteraciesbecobonNoch keine Bewertungen

- Technology IntegrationDokument12 SeitenTechnology Integrationvishalmate10Noch keine Bewertungen

- Lesson 6 OutliningDokument17 SeitenLesson 6 OutliningICT 11 Lemi, Arvie Paulo D.Noch keine Bewertungen

- Chapter 1 - PerceptionsDokument94 SeitenChapter 1 - Perceptionsjaime ballesterosNoch keine Bewertungen

- E1 - The Passive Voice - CDokument13 SeitenE1 - The Passive Voice - CDarcy DeeaNoch keine Bewertungen

- Find Someone Who Present Simple Vs Present Continuous PDFDokument2 SeitenFind Someone Who Present Simple Vs Present Continuous PDFmaria nicolaeNoch keine Bewertungen

- EGRA Presentation - For TOTDokument75 SeitenEGRA Presentation - For TOTimranNoch keine Bewertungen

- Material 5Dokument3 SeitenMaterial 5LauraNoch keine Bewertungen

- 5133 Detailed Lesson PlanDokument6 Seiten5133 Detailed Lesson Planapi-310546938Noch keine Bewertungen

- The Six LokasDokument3 SeitenThe Six Lokasunsuiboddhi100% (2)

- DisciplineDokument4 SeitenDisciplineHans WeirlNoch keine Bewertungen

- Hartog, D. N., Boselie, P. & Paauwe, J. (2004) - Performance Management - A Model and Research AgendaDokument14 SeitenHartog, D. N., Boselie, P. & Paauwe, J. (2004) - Performance Management - A Model and Research AgendaCarlindo Xavier100% (1)