Beruflich Dokumente

Kultur Dokumente

HRM Assignment

Hochgeladen von

NabeelOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

HRM Assignment

Hochgeladen von

NabeelCopyright:

Verfügbare Formate

Antecedent Verification Services

With the scale of expansion and influx of people from all section and backgrounds

in the corporate world it has become pertinent to ve a valid and reliable antecedent

verification of the employees, customers & clients alike.

Employee Antecedent Verification tool is used to confirm information and details

provided by the applicant regarding prior employment

Often overlooked in the selection process, diligent verification of an individuals

employment history often reveals unreported employment exaggerations and

falsifications about previous titles or duties and gaps in empIoyment

Our team of professionals personally obtains the employee antecedents

verification from the applicants supervisor at the previous company or from the

previous employers human resource department.

To meet client needs across the organization we are offering a veriety of important

and necessary verification services. Each is designed to thoroughly assess the

background of your new employee according to the level of their appointment and

provide you with a comprehensive report outlining the key findings

Antecedents Verification includes:

o Dates of employment

o Position held

o Ending pay

o General information concerning performance and

o Reason for departure

Process Involved

a. Documentation: Review completed personal data forms,

check for completeness, accuracy, inconsistencies, errors,

omissions, and falsifications.

b. Police Verification: Obtain and review records from Police

Station, criminal & civil courts and State and Municipal law

enforcement agencies to determine if the candidate was a

witness, victim, suspect or perpetrator of any crime.

c. Other Verification: Obtain and review arrest reports,

witness statements, and other documents to determine if the

candidate has affiliation with any trade union, ultra or

militant organization.

d. Authenticity of Educational Certificates & attainment

verification.

e. Credit reports and financial position verification.

f. Interview previous employers, co-workers & superiors to

verify the particulars of employment, strengths/ weaknesses/

reputation for honesty/ integrity reasons for leaving, rehire

eligibility etc.

g. Develop second and third level references and make

additional inquiries to assist.

h. Prepare a detailed summary of adverse information based

upon objective analysis and evaluation of candidate's

background in determining credibility of statements. Gather

any and all information concerning the subject in such a

fashion as to allow management the opportunity to enforce

its policies and effect appropriate corrective decision.

Conduct the fact-finding process so that it is least disruptive

to the organization and its operations

Induction is the process whereby employees adjust or acclimatise

to their jobs and their working environment.

Every organisation that values its staff will have an induction

programme which aims to provide all the information that new

staff need, and are able to assimilate, without being

overwhelming or diverting them from the essential process of

integration into their new team.

Well-planned induction enables new employees to become fully

operational quickly and should be integrated with the recruitment

process.

The benefits of providing a good induction programme is to reinforce the

positive first impressions employees have of your organisation, making

new employees feel welcome.

Induction is designed to achieve following objectives: * To help the new comer to overcome his shyness and overcome

his shyness nervousness in meeting new people in a new

environment.

* To give new comer necessary information such as location of a

caf, rest period etc.

* To build new employee confidence in the organization.

* It helps in reducing labor turnover and absenteeism.

* It reduces confusion and develops healthy relations in the

organization.

* To ensure that the new comer do not form false impression and

negative attitude towards the organization.

* To develop among the new comer a sense of belonging and

loyalty to the organization.

PLACEMENTS

After the employee is hired and oriented, he/she must be placed

in his/her right job. Placement is understood as the allocation of

people to the job. It is assignment or re-assignment of an

employee to a new or different job. Placement is a process of

assigning a specific job to each of the selected candidates. It

involves assigning a specific rank and responsibility to an

individual. It implies matching the requirements of a job with the

qualifications of the candidate.

Placement is highly significant in the HR process because it

improves employee morale, helps in reducing employee turnover,

reduces absenteeism, and reduces accident rates, as well in

avoiding a misfit between the candidate and the job. It helps the

candidate to work as per the predetermined objectives of the

organization. Usually the placement process starts after an

applicant is selected, the offer is made to him and it is accepted.

Once an employee is selected and placed on an appropriate job,

the process of familiarizing him with the job and the organization

is known as Induction.

Compensation Administration

The Compensation Administration Department is charged with the

task of developing and maintaining a comprehensive

compensation and classification system in order to support the

mission of the Division of Human Resources.

The Compensation Administration Departments

responsibilities include:

Developing compensation programs, policies, and

procedures to meet the needs of the University

administrators as they attract, retain, motivate, develop,

and organize their diverse workforce.

Ensuring compliance with federal and state compensation

laws, statutes, and regulations,

Balancing the need for internal equity while recognizing the

desire to be market competitive.

Evaluating positions consistently and classifying them into

appropriate job titles ensuring that they are internally

equitable, while recognizing the need to be market

competitive.

Developing and maintaining the classification and

compensation structures.

Some of the services provided by the Compensation

Administration Department include:

Providing compensation related information, tools and

training to HR Liaisons .

Conducting salary surveys and gathering market data in

making informed salary decisions.

Advising HR Liaisons in compensation matters; including

establishment of new positions, promotions, transfers,

demotions, reorganizations and salary increases.

Providing current position descriptions to administrative and

staff employees.

Providing departments with Organizational Charts.

Assisting in departmental re-organizations.

Minimum WagesThe minimum wage may be defined as the

lowest wage necessary to maintain a worker and his family

at the minimum level of subsistence, which includes food,

clothing and shelter. A minimum wage is the lowest hourly, daily or

monthly remuneration that employers may legally pay to workers.

Equivalently, it is the lowest wage at which workers may sell their

labor. When the government fixes minimum wage in a

particular trade, the main objective is not to control or

determine wages in general but to prevent the employment

of workers at a wage below an amount necessary to

maintain the worker at the minimum level of subsistence.

Minimum wage in a country is fixed by the government in

consultation with business organisations and trade unions.

The law relating to the minimum wage either states

definitely the wage considered to the minimum or the

determination of the wage left to an administrative

commission which from time to time determines the

minimum wage according to the varying economic

conditions, e.g., variation in the price level should be

compensated with the variation in the wage rates because

the prime aim of the minimum wage low is just to cover

"minimum living cost." The authority entrusted with the task

of fixing of minimum wage should consider such factors as

local economic conditions, transportation cost and the size of

the units in the industry in fixing minimum wages.

Fair WagesA fair wage is something more than the minimum

wages. Fair wage is a mean between the living wage and the

minimum wage. While the lower limit of the fair wage must

obviously be the minimum wage, the upper limit is the capacity of

the industry to pay fair wage compares reasonably with the

average payment of similar task in other trades or occupations

requiring the same amount of ability. Fair wage depends on the

present economic position as well as on its future prospects. Thus

the fair wages depends upon the following factors :

(1) Minimum Wages

(2) Capacity of the industry to pay

(3) Prevailing rates of wages in the same or similar occupations in

the same or neighbouring localities

(4) Productivity of labour

(5) Level of national income and its distribution.

(6) The place of the industry in the economy of the country.

Living Wages-Living wages has been defined differently by

different people in different countries. The best definition is given

by Justice Higgins which reads "Living wage is a wage sufficient

to ensure the workman food, shelter, clothing, frugal comfort,

provision for evil days etc. as regard for the skill of an artisan, if

he is one". According to Fair Wages Committee Report: "The

living wage should enable the male earner to provide himself and

his family not merely the basic essentials of food, clothing and

shelter but a measure of frugal comfort including education for

the children, protection against ill-health, requirement of

essential social needs and measures of insurance against old

age." Thus living wages means the provision for the bare

necessities plus certain amenities considered necessary for the

wellbeing of the workers in terms of his social status.

Article 43 of the Constitution of India states that the state shall

endeavour to secure by suitable legislation or economic

organisation or in any other way to all workers a living wage,

conditions of work ensuring a decent standard of life and full

enjoyment of pleasure and social and cultural opportunities. Thus,

Government of India has adopted as one of the directives of the

principle of slate policy to ensure living wages.

Wage differential refers to differences in wage rates due to the

location of company, hours of work, working conditions, type of

product manufactured, or other factors. It may be the difference

in wages between workers with different skills working in the

same industry or workers with similar skills working in different

industries or regions.

For example, wage differentials may also be used to compare

wages between genders, union and non-union jobs, or wages of

employees with and without college degrees.

The nature and extent of wage differentials are conditioned by a

set of factors such as: The condition prevailing in the market

The extent of unionization Relative bargaining power of

employer and employee The rate of growth of productivity The

extent of authoritarian regulations and the centralization of

decision making The customs and traditions The general

economic, industrial and economic conditions in the country.

Prevailing rates of wages Capacity of an industry to pay.

The system of wage payment is the method adopted by

manufacturing concerns to remunerate workers. It is the way of

giving financial compensation to the workers for the time and

effort invested by them in converting materials into finished

products. It indicates the basis of making payment to the workers,

which may be either on time basis or output basis. The selection

of the system depends on the type and nature of the concern and

its products. The wage payment systems can be divided into two

main systems as follows.

1. Piece rate system

2. Time rate system

1. Time Wage System or Time Rate System :

Under this system, laborers get wage on the basis of time which is

utilized in organisation. This wages may be charged on per hour,

per day, per month or per year basis. There is no relation or

quantity of output and wages in this method. In India's industry,

this method is most popular. Its other name is day wages system

or time wok system.

We can calculate wages with following formula

Total Wages = Time taken X Rate

For Example

A worker produced 10000 articles in 7600 hours. His hourly wage

rate is Rs. 2 /- . Calculate the wage of the worker when he is paid

on the basis of time.

Solution :

Applying the formula, we get :

Wage = T.T. X R

= 7600 X 2 = Rs. 15200

2. Piece Wage System or Work Rate System :

Under this method or system, laborers can get the wages on the

basis of their work done. No time element will be used for

calculation of wages. Rate is also on the basis of quantity or unit

produced. Under this, method, laborer tries to best for producing

the products fastly for getting more wages. This method is also

called payment by result.

formula

Total Wages = Unit Produced X Rate per unit

For Example :

2500 units were produced by a worker in 1200 hrs. Rate of

production is Rs. 3 /- per unit. Calculate the wage of the worker if

he is paid according piece rate method.

Solution :

By applying formula, we get :

Wages = units produced X rate per unit

= 2500 X 3 = Rs. 7500

The importance of wage payment system can be summarized as

follows:

* Wage payment system facilitates the preparation of wage plan

for future.

* Wage payment system helps to determine the cost of production

and the profitability of the organization.

* Wage payment system determines the amount of earning of the

workers and their living standards.

* Wage payment system affects the interest and attitude of the

workers.

* Wage payment system determines the level of satisfaction of

the workers and affects the rate of labor turnover.

* Wage payment system helps in recruiting skilled, experienced

and trained workers.

* Wage payment system helps to increase the productivity and

goodwill of the organization.

Das könnte Ihnen auch gefallen

- Job Satisfaction: Bharath Sanchar Nigam LimitedDokument41 SeitenJob Satisfaction: Bharath Sanchar Nigam Limitedomkar jokeNoch keine Bewertungen

- Job Satisfaction: Bharath Sanchar Nigam LimitedDokument41 SeitenJob Satisfaction: Bharath Sanchar Nigam Limitedomkar jokeNoch keine Bewertungen

- Job Satisfaction: Bharath Sanchar Nigam LimitedDokument41 SeitenJob Satisfaction: Bharath Sanchar Nigam Limitedomkar jokeNoch keine Bewertungen

- Mba Recruitment and Selection ProcessDokument1 SeiteMba Recruitment and Selection ProcessNabeelNoch keine Bewertungen

- Human Capital and Knowledge Management in The New Economy 2.1Dokument15 SeitenHuman Capital and Knowledge Management in The New Economy 2.1NabeelNoch keine Bewertungen

- Human Capital and Knowledge Management in The New Economy 2.1Dokument15 SeitenHuman Capital and Knowledge Management in The New Economy 2.1NabeelNoch keine Bewertungen

- Job Satisfaction: Bharath Sanchar Nigam LimitedDokument41 SeitenJob Satisfaction: Bharath Sanchar Nigam Limitedomkar jokeNoch keine Bewertungen

- OD Intervention PDFDokument9 SeitenOD Intervention PDFNabeelNoch keine Bewertungen

- Operations Research: by Dr. S.M. IsrarDokument18 SeitenOperations Research: by Dr. S.M. IsrarManohar SimhaNoch keine Bewertungen

- HRDDokument28 SeitenHRDAlahari Manoj KumarNoch keine Bewertungen

- Process, Assumptions, Values N Beliefs of ODDokument21 SeitenProcess, Assumptions, Values N Beliefs of ODPankaj Azad100% (2)

- Key Principles For The Development of Effective Training ProgramsDokument3 SeitenKey Principles For The Development of Effective Training ProgramsNabeelNoch keine Bewertungen

- HRDDokument28 SeitenHRDAlahari Manoj KumarNoch keine Bewertungen

- Model Answer: Course: MBA Semester: I Subject: International Business Environment and ManagementDokument7 SeitenModel Answer: Course: MBA Semester: I Subject: International Business Environment and ManagementNabeelNoch keine Bewertungen

- SCM NotesDokument46 SeitenSCM NotesKaran Umralkar50% (6)

- Operations Research: by Dr. S.M. IsrarDokument18 SeitenOperations Research: by Dr. S.M. IsrarManohar SimhaNoch keine Bewertungen

- Extended Warrenty XperiaDokument1 SeiteExtended Warrenty XperiaNabeelNoch keine Bewertungen

- Guru Krupa Computer NotesDokument37 SeitenGuru Krupa Computer NotesSameer SawantNoch keine Bewertungen

- SCM Dist Edu NotesDokument156 SeitenSCM Dist Edu NotesNabeelNoch keine Bewertungen

- OD Intervention PDFDokument9 SeitenOD Intervention PDFNabeelNoch keine Bewertungen

- Bal DR CR Finance C: (RS.) (RS.) (DD-MM-YYYY)Dokument2 SeitenBal DR CR Finance C: (RS.) (RS.) (DD-MM-YYYY)NabeelNoch keine Bewertungen

- HRM AssignmentDokument11 SeitenHRM AssignmentNabeelNoch keine Bewertungen

- EEM2046 - 1314 - T2 - OR - Lecture - Notes Operation Research NotesDokument59 SeitenEEM2046 - 1314 - T2 - OR - Lecture - Notes Operation Research NotesNazmi AzizNoch keine Bewertungen

- 25 Jan TKTDokument2 Seiten25 Jan TKTNabeelNoch keine Bewertungen

- E Commerce PresentationDokument20 SeitenE Commerce PresentationNabeel33% (3)

- Siraj AhmadDokument2 SeitenSiraj AhmadNabeelNoch keine Bewertungen

- Sap Fico Interview Question Logistic Invoice VerificationDokument2 SeitenSap Fico Interview Question Logistic Invoice VerificationNabeelNoch keine Bewertungen

- Accounts Receivable and Accounts PayableDokument4 SeitenAccounts Receivable and Accounts PayableNabeelNoch keine Bewertungen

- Bal DR CR Finance C: (RS.) (RS.) (DD-MM-YYYY)Dokument2 SeitenBal DR CR Finance C: (RS.) (RS.) (DD-MM-YYYY)NabeelNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Timo 2019 Heat Round Invitation Invitation To Parents4257063345853157948Dokument2 SeitenTimo 2019 Heat Round Invitation Invitation To Parents4257063345853157948Eric GoNoch keine Bewertungen

- Ageing PopulationDokument3 SeitenAgeing PopulationBoglar BernadettNoch keine Bewertungen

- Theory of Cost and ProfitDokument11 SeitenTheory of Cost and ProfitCenniel Bautista100% (4)

- Daily Renewables WatchDokument2 SeitenDaily Renewables WatchunitedmanticoreNoch keine Bewertungen

- Types of SlabsDokument5 SeitenTypes of SlabsOlga KosuoweiNoch keine Bewertungen

- No-BS Trading SystemDokument6 SeitenNo-BS Trading SystemIvan Sanader100% (1)

- Study Id95787 Wealth Management in IndiaDokument40 SeitenStudy Id95787 Wealth Management in IndiaAbhinandhNairNoch keine Bewertungen

- Margaret Thatcher 19252013Dokument2 SeitenMargaret Thatcher 19252013selvamuthukumarNoch keine Bewertungen

- Types of Raw MaterialsDokument27 SeitenTypes of Raw MaterialsAppleCorpuzDelaRosaNoch keine Bewertungen

- Company Details 2.8Dokument3 SeitenCompany Details 2.8Prakash KumarNoch keine Bewertungen

- Romona Taylor Williams & Anne-Sophie Gintzburger - Examining The Impact of Economic Exclusion On Low Wealth and Communities of Color in ST - Louis, MO: A Simulation of Pay LendingDokument15 SeitenRomona Taylor Williams & Anne-Sophie Gintzburger - Examining The Impact of Economic Exclusion On Low Wealth and Communities of Color in ST - Louis, MO: A Simulation of Pay LendingFondation Singer-PolignacNoch keine Bewertungen

- Book by Sadiku Link For ItDokument6 SeitenBook by Sadiku Link For ItShubhamNoch keine Bewertungen

- Unit 1.1 India's Stalled RiseDokument3 SeitenUnit 1.1 India's Stalled RiseKushagra AroraNoch keine Bewertungen

- BRS Sample Card FormatDokument50 SeitenBRS Sample Card FormatJezreel FlotildeNoch keine Bewertungen

- Reimbursement Expense Receipt Reimbursement Expense ReceiptDokument2 SeitenReimbursement Expense Receipt Reimbursement Expense Receiptsplef lguNoch keine Bewertungen

- Urban Renewal DelhiDokument18 SeitenUrban Renewal DelhiaanchalNoch keine Bewertungen

- Beston Global AssignmentDokument13 SeitenBeston Global AssignmentTayyaba TariqNoch keine Bewertungen

- Michael Porter - What Is StrategyDokument19 SeitenMichael Porter - What Is Strategysidharth.bediNoch keine Bewertungen

- Eia On Galachipa Bridge Project Bangladesheia On Galachipa Bridge Project BangladeshDokument3 SeitenEia On Galachipa Bridge Project Bangladesheia On Galachipa Bridge Project BangladeshropovevNoch keine Bewertungen

- 1.1 Introduction To Financial CrisisDokument13 Seiten1.1 Introduction To Financial CrisisvarshikaNoch keine Bewertungen

- New Microsoft Word DocumentDokument2 SeitenNew Microsoft Word DocumentAnonymous e9EIwbUY9Noch keine Bewertungen

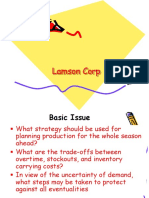

- Day 2 - Lamson CorpDokument21 SeitenDay 2 - Lamson CorpFrans AdamNoch keine Bewertungen

- Mercantil Financiero Precios Titulos ValoresDokument3 SeitenMercantil Financiero Precios Titulos ValoresEvelyn MantillaNoch keine Bewertungen

- Corporate FinanceDokument69 SeitenCorporate FinancePriyanka RaipancholiaNoch keine Bewertungen

- Roland Berger - Think-Act - Growth - # 14 2009Dokument59 SeitenRoland Berger - Think-Act - Growth - # 14 2009apritul3539Noch keine Bewertungen

- GD TopicDokument2 SeitenGD TopicrohitNoch keine Bewertungen

- Advantages and Problems of PrivatisationDokument4 SeitenAdvantages and Problems of PrivatisationShahriar HasanNoch keine Bewertungen

- Tax Reviewer: Law of Basic Taxation in The Philippines Chapter 1: General PrinciplesDokument93 SeitenTax Reviewer: Law of Basic Taxation in The Philippines Chapter 1: General PrinciplesAnonymous oTRzcSSGunNoch keine Bewertungen

- Characteristics of The Industrial RevolutionDokument5 SeitenCharacteristics of The Industrial RevolutionShyamsunder SharmaNoch keine Bewertungen

- Infopack Circular Economy For Youth Malta 2023 RevisedDokument12 SeitenInfopack Circular Economy For Youth Malta 2023 RevisedProutist Universal MaltaNoch keine Bewertungen