Beruflich Dokumente

Kultur Dokumente

FINN 400-Applied Corporate Finance-Atif Saeed Chaudhry-Fazal Jawad Seyyed

Hochgeladen von

You VeeCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FINN 400-Applied Corporate Finance-Atif Saeed Chaudhry-Fazal Jawad Seyyed

Hochgeladen von

You VeeCopyright:

Verfügbare Formate

Lahore University of Management Sciences

FINN 400 Applied Corporate Finance

Spring Semester 2015

Instructor

Room No.

Office Hours

Telephone

Secretary/TA

TA Office Hours

Course URL (if any)

Dr. Atif Saeed Chaudry / Fazal Jawad Seyyed

SDSB 4-28

TBA

atif.saeed@lums.edu.pk ; fazal.jawad@lums.edu.pk

042-3560-8428; 8030

Malik Imran Abbass, Saleem Ahmad Khan

TBA

Suraj.lums.edu.pk

COURSE BASICS

Credit Hours

Lecture(s)

Recitation/Lab (per week)

Tutorial (per week)

3

Nbr of Lec(s) Per Week

Nbr of Lec(s) Per Week

Nbr of Lec(s) Per Week

Duration

Duration

Duration

COURSE DISTRIBUTION

Core

Elective

Open for Student Category

Close for Student Category

ACF - Core

COURSE DESCRIPTION

Course Description: Applied Corporate Finance is a case-based course in intermediate level finance. It provides insights into the

role of the financial manager, whose primary responsibility consists of acquiring funds needed by the firm and directing these funds

into projects that will maximize the value of the firm for its shareholders. In reaching this objective, financial managers perform a

variety of tasks such as financial analysis and forecasting of cash flows; analysis of working capital; project evaluation and risk

analysis; evaluating financing choices available to the firm; valuation of financial and real assets including valuation of M&A

candidates, and cross-border transactions involving foreign currencies and global financial markets.

Course Focus and Modules: As an applied course, the focus is on: (a) application of financial concepts, models, and tools to address

typical problems faced by financial managers, (b) examining financial theories and concepts in light of corporate practices and

empirical evidence for better understanding of the critical success factors and processes related to financing, investment, and

payout decisions of firms, and (c) interaction of financing and investment decisions and how they interface with capital markets

and impact firm value.

The course is divided into following four modules:

Module 1: Overview of Financial Analysis and Financial Forecasting

Module 2: Cost of Capital, Capital Budgeting, and Resource Allocation

Module 3: Financing, Capital Structure, and Dividend Policy Decisions

Module 4: Firm Valuation, M&A, and Special Topics in Finance

COURSE PREREQUISITE(S)

FINN 200

Intermediate Finance

Lahore University of Management Sciences

COURSE LEARNING OUTCOMES (CLO)

Upon successful completion of the course, students should be able to:

1. Demonstrate understanding of the fundamental concepts, mainstream theories, and practices in corporate

finance;

2. Analyze financing and investment choices faced by financial managers based on financial theories and empirical

evidence;

3. Apply relevant financial concepts, tools, and theories to critically analyze and evaluate business

problems/financial decisions and recommend action consistent with the objective of creating value for

shareholders;

4. Evaluate the interaction of firm specific variables with wider economic and financial factors in the securities

markets and its impact on firms choices;

5. Discuss and debate a variety of topics in finance relevant to financial managers including the ethical and global

perspectives in making financial decisions;

6. Present and defend their analysis and recommendations effectively, both in oral and written forms. (General

Learning Goal)

UNDERGRADUATE PROGRAM LEARNING GOALS & OBJECTIVES

General Learning Goals & Objectives

Goal 1 Effective Written and Oral Communication

Objective: Students will demonstrate effective writing and oral communication skills

Goal 2 Ethical Understanding and Reasoning

Objective: Students will demonstrate that they are able to identify and address ethical issues in an organizational

context.

Goal 3 Analytical Thinking and Problem Solving Skills

Objective: Students will demonstrate that they are able to identify key problems and generate viable solutions.

Goal 4 Application of Information Technology

Objective: Students will demonstrate that they are able to use current technologies in business and management

context.

Goal 5 Teamwork in Diverse and Multicultural Environments

Objective: Students will demonstrate that they are able to work effectively in diverse environments.

Goal 6 Understanding Organizational Ecosystems

Objective: Students will demonstrate that they have an understanding of Economic, Political, Regulatory, Legal,

Technological, and Social environment of organizations.

Major Specific Learning Goals & Objectives

Goal 7 (a) Discipline Specific Knowledge and Understanding

Objective: Students will demonstrate knowledge of key business disciplines and how they interact including

application to real world situations. (including subject knowledge)

Goal 7 (b) Understanding the science behind the decision-making process (for MGS Majors)

Objective: Students will demonstrate ability to analyze a business problem, design and apply appropriate

decision-support tools, interpret results and make meaningful recommendations to support the decision-maker

Lahore University of Management Sciences

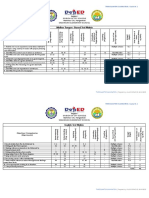

Indicate below how the course learning objectives/outcomes specifically relate to any program learning goals and objectives.

PROGRAM LEARNING GOALS AND

OBJECTIVES

COURSE LEARNING OBJECTIVES

COURSE ASSESSMENT ITEM

Goal 1 Effective Written and Oral

Communication

Students get a number of opportunities to

demonstrate their ability to communicate

effectively (CLO #6)

Ethical perspectives in some of the case

studies are highlighted (CLO #5)

Major Goal: Analytical thinking and

problem solving skills are essential for

success in this course (CLO #1-4)

Application of information technology in

preparing cases analyses and assignments

Students work in groups of 4-5 persons

each to prepare case briefs and analyses.

Most case settings are global and

multicultural.

Develop students understanding of the

interaction of firm specific variables with

the securities markets, industry, and the

economy (CLO #4)

Major Goal: Comprehensive coverage of

topics in Applied Corporate Finance (CLO

#1-5)

NA

CP, Cases, and Exam

Goal 2 Ethical Understanding and

Reasoning

Goal 3 Analytical Thinking and Problem

Solving Skills

Goal 4 Application of Information

Technology

Goal 5 Teamwork in Diverse and

Multicultural Environments

Goal 6 Understanding Organizational

Ecosystems

Goal 7 (a) Program Specific Knowledge

and Understanding (Subject Knowledge)

Goal 7 (b) Understanding the science

behind the decision-making process

Cases and Exam (minor component)

CP, Quizzes, Assignments, Cases, and

Exam

Assignments, Cases

Cases

CP, Quizzes, Assignments, Cases, and

Exam

CP, Quizzes, Assignments, Cases, and

Exam

NA

GRADING BREAKUP AND POLICY

The course grade is based on the following criteria:

Source

Class Participation

Quizzes/Assignments

Midterm

Final Examination (comprehensive)

Total

% of Total

20

25

25

30

100

Class Participation and Attendance: Students are expected to attend all classes. If you are not present at the beginning of a class or

leave class during the session without instructors prior permission, you will be considered absent for the day. You must review the

assigned materials in advance of the class in order to contribute meaningfully to class discussions.

Quizzes: Several unannounced quizzes will be given on the assigned material (readings, cases, assignments, etc) during the term.

No make-up quizzes will be given. However, the lowest quiz grade including a zero for a missed quiz will be disregarded.

Assignments: Students are expected to form groups of 2-3 people and write a case brief of every case that we will study in class.

This brief is should be 2 pages long and should address the following:

1. What is the primary problem(s) in the case?

2. What is your analysis of the problem

3. What is your suggestion to the management?

In addition to the brief, each group also needs to submit an excel sheet containing the financial model.

Lahore University of Management Sciences

Midterm Examination: Midterm examination will cover all the concepts covered in the class until the midterm session. It may

include MCQs, caselets or an integrative case, or a combination of all of these.

Examination: The final examination will comprise a blend of MCQs and open-ended questions, caselets, or an integrative case for

analysis.

Calculator Requirement: You will need a financial calculator capable of performing present value/future value functions. For

example, Texas Instrument BA II meets these criteria. Many other brands are equally suitable for this course.

EXAMINATION DETAIL

Midterm

Exam

Yes/No: Yes

Combine Separate: Combined

Duration: 3 Hours

Preferred Date: Exam Specifications:

Final Exam

Yes/No: Yes

Combine Separate: Combined

Duration: 3 Hours

Exam Specifications:

COURSE SCHEDULE

MODULE/

SESSION

Session 1

Session 2

Session 3

Session 4

SESSION TOPIC AND CASE

READING MATERIAL

SESSION OUTCOME(S)

(STUDENTS WILL BE ABLE TO

)

Module 1: Overview of Financial Analysis and Financial forecasting

Appreciate the scope of

RWJ Ch 1: Introduction to

1

Topic: Overview of Corporate Finance

corporate finance and how

Corporate Finance (Optional)

finance can be a source of value

Case: The Battle for Value, 2004: Fed Ex

for the firm. (CLO # 1)

Corp vs. United Parcel Service Inc.

Topic: Financial Analysis & Performance

Examine linkages between

Z-Factor Rescue by the

Assessment

corporate strategy and firms

Numbers

performance. (CLO # 1)

Case: Krispy Kreme Doghnts, Inc.; BES #8

Topic: Free Cash Flows and Building

Estimate and forecast free cash

BES: The Thoughtful

Financial Models

flows and its applications in

Forecaster

building financial models for

Case: The Body Shop International PLC

valuation. (CLO # 1)

2001: An Introduction to Financial

Modeling; BES #9

Topic: Corporate Financial Strategy and

Understand linkages between

Market Efficiency

Financial Markets

corporate financial strategy and

financial markets. (CLO # 5)

Case: Bill Miller and Value Trust; BES #2

Lahore University of Management Sciences

Topic: Financial Analysis & Forecasting

Session 5

Session 6

Session 7

Session 8

Session 9

Session 10

Session 11

Session 12

Session 13

Session 14

Evaluate firms health and

forecast performance. (CL) # 1)

BES: Structuring Corporate

Financial Policy (#32)

Analyze change in capital

structure and its impact on firms

value. (CLO # 2,3,4,6)

Understand the value of financial

flexibility and its impact. (CLO #

3,4)

*Case: Value Line Publishing: Oct. 2002;

BES #10

Module 2: Cost of Capital, Capital Budgeting, and Resource Allocation

Topic: Cost of Capital Theory and

Examine various approaches and

Survey: Best Practices in

Practice

Estimating the Cost of Capital: issues in estimating cost of

capital of a firm. (CLO # 1)

An Update, 2013.

Case: Nike, Inc.: Cost of Capital; BES # 15

Topic: Estimating Cost of Capital of the

Apply theory and insights from

RWJ Ch 13: Risk and Cost of

Firm

practice to estimate a firms cost

Capital (Optional)

*Case: Teletech Corporation, 2005; BES #

of capital. (CLO # 3,6)

16

Topic: Multifaceted Capital Investment

BES: The Investment Detective Plan and evaluate multifaceted

Decisions

capital investment projects. (CLO

# 2,3)

Case: Target Corp.; BES # 20

Topic: Capital Budgeting Analysis RWJ Ch 6-7: Making Capital

Apply analysis of an investment

Application

Investment Decisions and Risk in a declining industry. (CLO #

in Capital Budgeting (Optional) 2,3)

*Case: Aurora Textile Company; BES # 21

Topic: Risk in Capital Budgeting

Apply scenario analysis in capital

RWJ Ch 18: Valuation and

project decision. (CLO # 2,3)

Capital Budgeting for the

Case: The Procter and Gamble Company Levered Firm (Optional)

BES # 23

Topic: Capital Budgeting Relevant Cash

RWJ Ch 6-7: Making Capital

Estimate relevant cash flows to

Flows

Investment Decisions and Risk evaluate capital project(s) of a

in Capital Budgeting (Optional) firm. (CLO # 2,3,6)

*Case: Victoria Chemicals plc (A): The

Merseyside Project; BES # 24

Topic: Working Capital Management

Appraise a firms working capital

RWJ Ch 26-28: Short-Term

Policies

policies and short-term financing

Financing, Cash, Receivable

requirements. (CLO # 1, 2,3)

and Inventory Management

Case: Dells Working Capital Management

(Optional)

Midterm

Module 3: Financing, Capital Structure, and Dividend Policy Decisions

Topic: Corporate Financing and Capital

Evaluate the optimal leverage for

BES: An Introduction to Debt

Structure

a firm. (CLO # 2,3)

Policy and Value (#31)

BES: Structuring Corporate

Case: California Pizza Kitchen -BES # 33

Financial Policy (#32)

Topic: Analysis of Leverage Restructuring

Session 15

Session 16

RWJ Ch 3: Financial Statement

Analysis and Financial Models

(Optional)

*Case: The Wm Wrigley Jr. Co.; BES # 34

Topic: Financial Flexibility and Alternative

Sources of Financing

Case: Deluxe Corp.; BES # 35

Topic: Introduction to Leasing

Session 17

Case: AMG Lease Versus Buy Decision

BES: Structuring Corporate

Financial Policy (#32)

RWJ Ch 21: Leasing (Optional)

RWJ Ch 21: Leasing (Optional)

Understand leasing as an

alternative to corporate

borrowing. (CLO # 2,3)

Lahore University of Management Sciences

Topic: Lease Financing Analysis

Session 18

Session 19

Session 20

*Case: Primus Automation Division, 2002BES # 40

Topic: Dividends and Alternative Payouts

RWJ Ch 21: Leasing (Optional)

Evaluate lease financing as an

alternative to borrowing. (CLO #

2,3,6)

RWJ Ch 19: Dividend and

other Payouts (Optional)

Evaluate corporate dividend

polices in light of finance theory

and business practices.

(CLO # 2,3)

Case: Gainesboro Machine Tools

Corporation - BES # 29

Module 4: Firm Valuation, M&A, and Special Topics in Finance

Topic: Valuation of the Firm

BES # 42: Methods of

Valuation for Mergers and

Case: American Greetings BES #43

Acquisitions

Topic: Raising Capital Through Public

RWJ Ch 20: Issuing Securities

Offerings: IPO Valuation

to the Public (Optional)

Session 21

*Case: JetBlue Airways IPO Valuation; BES

#45

Topic: Introduction to Adjusted Present

Value (APV)

Session 22

Session 24

Understand adjusted present

value (APV) and its applications

as an alternative to WACC based

valuation. (CLO # 1,5)

*Case: Sun Microsystems; BES # 48

BES # 42: Methods of

Valuation for Mergers and

Acquisitions)

Topic: Financial Distress and Corporate

Restructuring

RWJ Ch 30: Financial Distress

and Restructuring (Optional)

Apply various valuation methods

to appraise merger and

acquisition candidates. (CLO #

3,6)

Appreciate special situations such

as financial distress that typically

require corporate restructuring &

reassessment. (CLO # 5)

Evaluate firms choices under

conditions of financial distress.

(CLO # 3,5,6)

Appreciate issues and

complexities in evaluating cross

border investing and financing

alternatives. (CLO # 5)

(CLO # 5)

Case: Saifs Paper Venture (LUMS Case)

Case: Massey Ferguson, 1980

Topic: Bankruptcy and Restructuring

Session 25

Session 26

Understand the IPO process and

apply valuation techniques in an

initial offering. (CLO # 2,3,6)

Using APV: A Better Tool for

Valuing Operations

RWJ Ch 18: Valuation and

Capital Budgeting for the

Levered Firm (Optional)

Topic: Merger and Acquisition Evaluation

Session 23

Develop free cash flow estimates

to value a firm. (CLO # 3)

*Case: Horizon Lines, Inc. BES # 36

Topic: International Corporate Finance

Currency Risk Management

RWJ Ch 30: Financial Distress

and Restructuring (Optional)

RWJ Ch 31: International

Corporate Finance (Optional)

Case: Carrefour S.A. BES #37

Topic: Strategic Valuation

Session 27

Session 28

Case: Medfield Pharmaceuticals

Topic: : Ethical Perspectives in Finance &

Promoting Ethical Behavior

Financial Measures of Value

Creation

Appreciate the value of ethical

life at personal and professional

level. (CLO # 5)

Final Exam Review

Note: Reading material designated as Optional is not part of the study pack. You may use any standard Corporate Finance

textbook of your choice to review the session topic.

1

Lahore University of Management Sciences

TEXTBOOK(S)/SUPPLEMENTARY READINGS

Casebook:

th

Bruner, Eades, and Schill, Case Studies in Finance: Managing for Corporate Value Creation, 7 Edition, McGraw Hill/Irwin Series in

Finance, 2014. (BES)

Textbook:

No specific textbook is required for this course. You may use any standard corporate finance textbook to review the assigned topic.

A number of corporate finance textbooks are listed below. The course schedule refers to relevant chapters from Corporate Finance

by Ross, Westerfield, and Jaffe (RWJ) for your convenience (indicated as Optional). Material indicated as Optional is not

mandatory reading. You can substitute this material with any textbook of your choice. The study pack does not contain readings

designated as Optional.

Reference Books:

th

Ross, Westerfield and Jaffe, Corporate Finance, 9 Edition, McGraw Hill, 2010. (RWJ)

nd

Benninga, Simon, Principles of Finance with Excel, 2 Edition, Oxford University Press, 2011. (SB)

th

Brigham, Eugene and Daves, P., Intermediate Financial Management, 8 (or a later edition), Thomson, South Western.

th

Brealey, Myers, and Allen, Principles of Corporate Finance, 8 Edition, McGraw-Hill/Irwin, 2006.

Additional Recommended Readings:

Students are encouraged to read financial publications such as The Wall Street Journal, Financial Times; Business Recorder to stay

abreast of developments related to this course.

Das könnte Ihnen auch gefallen

- UFCW 1776 2012 Financials Wendell YoungDokument38 SeitenUFCW 1776 2012 Financials Wendell YoungbobguzzardiNoch keine Bewertungen

- Following Directions TestDokument5 SeitenFollowing Directions TestNick Penaverde100% (1)

- 2018 Contractor Benefit GuideDokument38 Seiten2018 Contractor Benefit GuidepseudoanonNoch keine Bewertungen

- Frequently Asked Tax Questions 2015sdaDokument8 SeitenFrequently Asked Tax Questions 2015sdaVikram VickyNoch keine Bewertungen

- New-Reg-2023 (N)Dokument2 SeitenNew-Reg-2023 (N)saramohamed5137Noch keine Bewertungen

- When To Hire A Tax ProfessionalDokument7 SeitenWhen To Hire A Tax ProfessionalMaimai Durano100% (1)

- Mckinsey Problem Solving TestDokument0 SeitenMckinsey Problem Solving TestAgnes Tan Lay Hong100% (2)

- Bachelor of Science in AccountancyDokument6 SeitenBachelor of Science in AccountancyJayvee FelipeNoch keine Bewertungen

- Employee Photo ID and Access Card Requisition Form PDFDokument2 SeitenEmployee Photo ID and Access Card Requisition Form PDFsuryavikyNoch keine Bewertungen

- Indian DGCA Type Rating Requirements CARDokument14 SeitenIndian DGCA Type Rating Requirements CARCyril Mathew RoyNoch keine Bewertungen

- Accounting Solutions To ExercisesDokument18 SeitenAccounting Solutions To ExercisesJaveria SalmanNoch keine Bewertungen

- English Teacher CV TemplateDokument1 SeiteEnglish Teacher CV TemplateSana UmairNoch keine Bewertungen

- IT NINJA-CPA-Review-BEC-Notes ITDokument24 SeitenIT NINJA-CPA-Review-BEC-Notes ITSāikrushna KāvūriNoch keine Bewertungen

- FINN 100-Principles of Finance-Mohammad Basharullah-Arslan Shahid Butt-Humza GhaffarDokument7 SeitenFINN 100-Principles of Finance-Mohammad Basharullah-Arslan Shahid Butt-Humza GhaffarHaris AliNoch keine Bewertungen

- Important CSS Essays OutlinesDokument19 SeitenImportant CSS Essays OutlinesAgha Zohaib Khan81% (118)

- Competitive Strategy Syllabus YaleDokument11 SeitenCompetitive Strategy Syllabus YaleSulekha Bhattacherjee100% (1)

- ACCT 221-Corporate Financial Reporting-Atifa Dar-Waqar AliDokument6 SeitenACCT 221-Corporate Financial Reporting-Atifa Dar-Waqar AliDanyalSamiNoch keine Bewertungen

- Understanding The Principles and Practice of AssessmentDokument6 SeitenUnderstanding The Principles and Practice of Assessmentapi-265013545Noch keine Bewertungen

- Abap e Hanaaw 12Dokument2 SeitenAbap e Hanaaw 12ivan8925% (4)

- MIS604 Assessment 2 Brief ELINK-converted ElinkDokument8 SeitenMIS604 Assessment 2 Brief ELINK-converted ElinkZouh BharatNoch keine Bewertungen

- MKTG 201-Principles of Marketing - Sarah Suneel SarfrazDokument6 SeitenMKTG 201-Principles of Marketing - Sarah Suneel SarfrazAmmaraArhamNoch keine Bewertungen

- TC Transcontinental Benefits Guide 2020 HourlyDokument31 SeitenTC Transcontinental Benefits Guide 2020 HourlyMike SloopNoch keine Bewertungen

- Benefits Guide Current PDFDokument32 SeitenBenefits Guide Current PDFzachNoch keine Bewertungen

- Global Body for Professional Accountants Review Past F6 P6 ExamsDokument26 SeitenGlobal Body for Professional Accountants Review Past F6 P6 ExamslmuzivaNoch keine Bewertungen

- Lan Yuye Brock OfferDokument4 SeitenLan Yuye Brock Offerapi-384261979100% (1)

- Motivation Letter For A Shop AssistantDokument1 SeiteMotivation Letter For A Shop AssistantKevin KausiyoNoch keine Bewertungen

- JB Hi-FiDokument1 SeiteJB Hi-Fidavinci0317Noch keine Bewertungen

- Senior Tax Accountant in Orlando FL Resume Maria ClaudioDokument3 SeitenSenior Tax Accountant in Orlando FL Resume Maria ClaudioMariaClaudio2Noch keine Bewertungen

- PF CMA NotesDokument19 SeitenPF CMA NotesvigneshanantharajanNoch keine Bewertungen

- Bahria University Midterm ITB Paper Fall 2021 07052021 091547pmDokument1 SeiteBahria University Midterm ITB Paper Fall 2021 07052021 091547pmUmer Abid100% (1)

- Exam and Question Tutorial Operational Case Study 2019 CIMA Professional QualificationDokument61 SeitenExam and Question Tutorial Operational Case Study 2019 CIMA Professional QualificationMyDustbin2010100% (1)

- Certified Compliance Officer-CCODokument4 SeitenCertified Compliance Officer-CCOamyhashemNoch keine Bewertungen

- It Student / Junior Developer: Kasetsart University, 2015 Bangkok, ThailandDokument2 SeitenIt Student / Junior Developer: Kasetsart University, 2015 Bangkok, ThailandNantawan GantongNoch keine Bewertungen

- Understanding Income TaxDokument43 SeitenUnderstanding Income TaxMerediths KrisKringleNoch keine Bewertungen

- Morning Session Q&ADokument50 SeitenMorning Session Q&AGANESH MENONNoch keine Bewertungen

- Payroll: Assessment QuestionsDokument30 SeitenPayroll: Assessment QuestionsdanielNoch keine Bewertungen

- ACCA Paper F5 Mock Exam June 2011Dokument6 SeitenACCA Paper F5 Mock Exam June 2011Tasin Yeva LeoNoch keine Bewertungen

- Source of Control Premium Data and What It Doesn't Tell UsDokument5 SeitenSource of Control Premium Data and What It Doesn't Tell UsNatalia CadavidNoch keine Bewertungen

- Regional Sales Building Materials in Dallas FT Worth TX Resume Gerald BaltzDokument2 SeitenRegional Sales Building Materials in Dallas FT Worth TX Resume Gerald BaltzGeraldBaltzNoch keine Bewertungen

- SwotDokument3 SeitenSwotShahebazNoch keine Bewertungen

- Excel Financial Functions IDokument18 SeitenExcel Financial Functions IElie YabroudiNoch keine Bewertungen

- RPL Application Guide & TemplatesDokument8 SeitenRPL Application Guide & TemplatesMilamarinaNoch keine Bewertungen

- F5 Mapit Workbook Questions PDFDokument88 SeitenF5 Mapit Workbook Questions PDFBeryl Maliakkal0% (1)

- MM Pricing ProcedureDokument21 SeitenMM Pricing ProcedureSandip SarodeNoch keine Bewertungen

- Adjusting Entries and Adjusted Trial BalanceDokument8 SeitenAdjusting Entries and Adjusted Trial Balancetgibson621Noch keine Bewertungen

- Quectel BC65&BC66&BC68&M66 Compatible Design V1.2Dokument37 SeitenQuectel BC65&BC66&BC68&M66 Compatible Design V1.2Marwane TassaNoch keine Bewertungen

- Tally: Chap-1:-Company Creation & Deletation Create CompanyDokument32 SeitenTally: Chap-1:-Company Creation & Deletation Create CompanysananathaniNoch keine Bewertungen

- FREE ACCA F3 Practice KIT - Free Accountancy Resources - Video Lectures - Online Forums - Notes - Past Papers - Mock ExamsDokument6 SeitenFREE ACCA F3 Practice KIT - Free Accountancy Resources - Video Lectures - Online Forums - Notes - Past Papers - Mock Examsmashooqali100% (1)

- Course Outline: School: DepartmentDokument8 SeitenCourse Outline: School: DepartmentRick TanderNoch keine Bewertungen

- Wiley CPAexcel - BEC - Assessment Review - 3Dokument20 SeitenWiley CPAexcel - BEC - Assessment Review - 3ABCNoch keine Bewertungen

- 8524Dokument7 Seiten8524KhurramRiaz100% (1)

- ECO4122Z - 2021 Examination QuestionDokument3 SeitenECO4122Z - 2021 Examination QuestionRico BartmanNoch keine Bewertungen

- Advanced Audit Planning and Risk AssessmentDokument10 SeitenAdvanced Audit Planning and Risk AssessmentAdaamShabbirNoch keine Bewertungen

- ZCAS University Fees ListDokument2 SeitenZCAS University Fees ListVirginbum Fatty downNoch keine Bewertungen

- EY-Point-of-view-auditor-reporting-February-2014 Ernst and Young PDFDokument5 SeitenEY-Point-of-view-auditor-reporting-February-2014 Ernst and Young PDFMai RosaupanNoch keine Bewertungen

- Handouts Week-04Dokument42 SeitenHandouts Week-04MN IrshadNoch keine Bewertungen

- Professional: $245 Academic: $135 Student: $39 Two-Year Student: $78Dokument5 SeitenProfessional: $245 Academic: $135 Student: $39 Two-Year Student: $78anwarNoch keine Bewertungen

- Annual Report ProjectDokument56 SeitenAnnual Report ProjectJoan Frazzetto100% (2)

- Assessment Task 1: Written Questions: Do Not Copy Guideline For BSREL401Dokument10 SeitenAssessment Task 1: Written Questions: Do Not Copy Guideline For BSREL401TiiTle KsNoch keine Bewertungen

- ACCA p4 2007 Dec QuestionDokument13 SeitenACCA p4 2007 Dec QuestiondhaneshwareeNoch keine Bewertungen

- Case 3 - Rugby Football Union Tries Big DataDokument1 SeiteCase 3 - Rugby Football Union Tries Big DataJohnny Abou YounesNoch keine Bewertungen

- Finn 400 Outline Spring 2020 PDFDokument8 SeitenFinn 400 Outline Spring 2020 PDFadam jamesNoch keine Bewertungen

- Applied Corporate FinanceDokument8 SeitenApplied Corporate FinanceSafi Ullah KhanNoch keine Bewertungen

- FINN 400 Outline Fall 2021Dokument8 SeitenFINN 400 Outline Fall 2021Waris AliNoch keine Bewertungen

- FINN 400 Outline Fall 2020Dokument8 SeitenFINN 400 Outline Fall 2020Zahra EjazNoch keine Bewertungen

- Lahore University of Management Sciences ACCT-411 Applied Financial AnalysisDokument7 SeitenLahore University of Management Sciences ACCT-411 Applied Financial AnalysisusamaNoch keine Bewertungen

- West Pakistan General Clauses Act 1956Dokument19 SeitenWest Pakistan General Clauses Act 1956You VeeNoch keine Bewertungen

- The West Pakistan Civil Courts Ordinance, 1962Dokument12 SeitenThe West Pakistan Civil Courts Ordinance, 1962Amee MemonNoch keine Bewertungen

- Court Fee ActDokument45 SeitenCourt Fee ActMajid Masoom KhattakNoch keine Bewertungen

- The Oaths Act, 1873 PDFDokument4 SeitenThe Oaths Act, 1873 PDFrashid001Noch keine Bewertungen

- Final Term ContentsDokument1 SeiteFinal Term ContentsYou VeeNoch keine Bewertungen

- SHR 2017 Highlights PDFDokument6 SeitenSHR 2017 Highlights PDFYou VeeNoch keine Bewertungen

- Report On SA - Day 1Dokument1 SeiteReport On SA - Day 1You VeeNoch keine Bewertungen

- Final Term ContentsDokument1 SeiteFinal Term ContentsYou VeeNoch keine Bewertungen

- The Fata ReformsDokument3 SeitenThe Fata ReformsYou VeeNoch keine Bewertungen

- West Pakistan General Clauses Act 1956Dokument19 SeitenWest Pakistan General Clauses Act 1956You VeeNoch keine Bewertungen

- Manitoba Labour and Immigration, Manitoba Culture, Heritage and Tourism - Population by Mother Tongue PDFDokument1 SeiteManitoba Labour and Immigration, Manitoba Culture, Heritage and Tourism - Population by Mother Tongue PDFmatildameisterNoch keine Bewertungen

- Pakistan StudiesDokument2 SeitenPakistan StudiesYou VeeNoch keine Bewertungen

- Pakistan' S Evolution Relations With China, Central Asia and RussiaDokument19 SeitenPakistan' S Evolution Relations With China, Central Asia and RussiaYou VeeNoch keine Bewertungen

- Annex Foreign Relations PakistanDokument8 SeitenAnnex Foreign Relations PakistanGoogle BuxNoch keine Bewertungen

- Future of Pakistan-US Relations PDFDokument7 SeitenFuture of Pakistan-US Relations PDFYou VeeNoch keine Bewertungen

- AmendmentsDokument2 SeitenAmendmentsYou VeeNoch keine Bewertungen

- Pakistan's Strong Economic GrowthDokument22 SeitenPakistan's Strong Economic GrowthRajesh KumarNoch keine Bewertungen

- The Fata ReformsDokument3 SeitenThe Fata ReformsYou VeeNoch keine Bewertungen

- Pakistan Iran RoundtableDokument17 SeitenPakistan Iran RoundtableMushtaq AnjumNoch keine Bewertungen

- Future of Pakistan-US Relations PDFDokument7 SeitenFuture of Pakistan-US Relations PDFYou VeeNoch keine Bewertungen

- Duaen'Dokument1 SeiteDuaen'You VeeNoch keine Bewertungen

- Student's Name: EnglishDokument15 SeitenStudent's Name: EnglishYou VeeNoch keine Bewertungen

- Pakistan Iran RoundtableDokument17 SeitenPakistan Iran RoundtableMushtaq AnjumNoch keine Bewertungen

- Subjects of Intlaw 2sept2013Dokument25 SeitenSubjects of Intlaw 2sept2013You VeeNoch keine Bewertungen

- Towards Flat Low Rate Broad and Predictable TaxesDokument90 SeitenTowards Flat Low Rate Broad and Predictable TaxesYou VeeNoch keine Bewertungen

- Law8 Final PDFDokument19 SeitenLaw8 Final PDFYou VeeNoch keine Bewertungen

- Sweet Menu RestaurantDokument13 SeitenSweet Menu RestaurantYou VeeNoch keine Bewertungen

- Packages Jun To Dec 15 FaqsDokument10 SeitenPackages Jun To Dec 15 FaqsYou VeeNoch keine Bewertungen

- 7 13septemberDokument16 Seiten7 13septemberpratidinNoch keine Bewertungen

- 7 Things To Do When You're On School BreakDokument5 Seiten7 Things To Do When You're On School BreaksufiehadirahNoch keine Bewertungen

- MIA International Security AssignmentDokument6 SeitenMIA International Security AssignmentZainImranNoch keine Bewertungen

- Eden Ias Ethics Test Series 2021Dokument3 SeitenEden Ias Ethics Test Series 2021Micky GautamNoch keine Bewertungen

- Guide to Developing KPUP-Aligned AssessmentsDokument32 SeitenGuide to Developing KPUP-Aligned AssessmentsDinahrae Vallente50% (2)

- University of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelDokument8 SeitenUniversity of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelHubbak KhanNoch keine Bewertungen

- Cleveland Institute of MusicDokument4 SeitenCleveland Institute of MusicDorian VoineaNoch keine Bewertungen

- Coursebook Evaluation Course ContentDokument18 SeitenCoursebook Evaluation Course ContentNgwaNoch keine Bewertungen

- STAT202 Syllabus W2020Dokument5 SeitenSTAT202 Syllabus W2020Sagar PatelNoch keine Bewertungen

- Third Quarter Test Matrix 1Dokument8 SeitenThird Quarter Test Matrix 1Freddie AnchetaNoch keine Bewertungen

- ECON1101 Microeconomics 1 PartsAandB S12016Dokument17 SeitenECON1101 Microeconomics 1 PartsAandB S12016sachin rolaNoch keine Bewertungen

- PP Assignmrnt 2Dokument11 SeitenPP Assignmrnt 2Ali GoharNoch keine Bewertungen

- AQFI - PHD ProposalDokument424 SeitenAQFI - PHD Proposalsummer123100% (1)

- Elective Subjects All (2nd To 10th Semester)Dokument72 SeitenElective Subjects All (2nd To 10th Semester)Dr Banic BranislavNoch keine Bewertungen

- Mohd Ikhwan Hakim 820904035489001 OUMH 1203Dokument2 SeitenMohd Ikhwan Hakim 820904035489001 OUMH 1203Mohd Ikhwan HakimNoch keine Bewertungen

- Government of Andhra Pradesh, Grama/Ward Sachivalayam Recruitment-2020 Hall TicketDokument3 SeitenGovernment of Andhra Pradesh, Grama/Ward Sachivalayam Recruitment-2020 Hall TicketAkhil TupiliNoch keine Bewertungen

- Assessing critical thinking skills with a faculty-developed testDokument14 SeitenAssessing critical thinking skills with a faculty-developed testSultan MilanoNoch keine Bewertungen

- Kahoot Lesson PlanDokument2 SeitenKahoot Lesson Planapi-497815699Noch keine Bewertungen

- Uk Job Search and Recruitment A Guide For International StudentsDokument5 SeitenUk Job Search and Recruitment A Guide For International StudentsTien Dung TranNoch keine Bewertungen

- 1 Contact Information: San Francisco State University (Sfsu) Fin 350: Business Finance SUMMER 2017Dokument12 Seiten1 Contact Information: San Francisco State University (Sfsu) Fin 350: Business Finance SUMMER 2017Zainab AbidNoch keine Bewertungen

- Sve.. TirupathiDokument317 SeitenSve.. TirupathiSssNoch keine Bewertungen

- 9231 s14 Ms 11Dokument10 Seiten9231 s14 Ms 11Cheah Jun SiangNoch keine Bewertungen

- 2020 Chatham County PD - SGT - Study Material PDFDokument472 Seiten2020 Chatham County PD - SGT - Study Material PDFScottNoch keine Bewertungen

- Final BroucherDokument76 SeitenFinal Broucherhit2011Noch keine Bewertungen

- U Greg AlliedDokument4 SeitenU Greg AlliedgdmanNoch keine Bewertungen