Beruflich Dokumente

Kultur Dokumente

AirAsia - Group 8

Hochgeladen von

AnkitGovilCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

AirAsia - Group 8

Hochgeladen von

AnkitGovilCopyright:

Verfügbare Formate

Page | 1

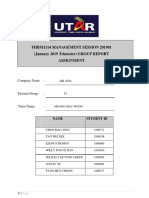

CASE STUDY

THE ASCENDANCE OF AIRASIA: BUILDING A SUCCESSFUL

BUDGET AIRLINE IN ASIA

Group:8

Mr.

Pradeep Kumar Agrawal

13010121336

Ms.

Aloka Reddy

13010121115

Mr.

Ankit Govil

13010121273

Mr.

Sarath P.

13010121199

Mr.

Saurabh Biswal

13010121089

Submitted to:

Dr. Samik Shome

Page | 2

I. PROBLEM STATEMENT:

Air Asia needs to be examined if their strategies can be repeated across the world, and how it

will compete with the influx of new entrants especially in the low budget and no frills

category and also if it can become the world leader competing with the other full service

airlines. It explains how combining an entrepreneur leader with a purposeful strategic process

and an efficient business model can create a winning formula for wealth creation.

II. ISSUE ANALYSIS:

In September 2001, Tony Fernandes left his job as the vice president and head of Warner

Musics Southeast Asian operations, cashed in stock options, took out a mortgage on his

house and took control of a struggling Malaysian Airline with two jets and US$ 37 million in

debt.

Tony Fernandes was inherited with a risk taking ability and an entrepreneurial attitude. But

apart from the unique strategies, the external environmental factors also helped him with his

cause.

FACTS AND OPINIONS OF THE CASE:

Facts:

Japan was the pioneer in the budget airlines sector and started with Air Do in 1998,

followed by Skymark in 2000. Thailand started with PB Air and Air Andaman and

Cambodia started with Siem Reap Air. In late 2001, Air Asia was launched and

Page | 3

Philippines started with Cebu Pacific Airways. India started with Air Deccan (now

Kingfisher Red) in 2003 and finally China entered into the scene in 2005 with Spring

Airlines.

The liberalization of the economy in the 1990s and agreements such as the Open

Skies Agreement with the United States led to the emergence of many carriers, all of

whom by the turn of the century have become major players in their countrys air

service sectors both domestic and international.

First outside investment in China was George Soross US$25 million acquisition of a

25% stake in Hainan Airlines in 1995.

ASEAN (Association of Southeast Nation) leaders announced plans to fully liberalize

air travel by the end of 2008, however, the countries were allowed to opt out and

delay liberalization until 2015.

The strategies followed by Skymark Airlines operating from1998 are as follows:

- Low Fare Price Leadership Model

- Satellite TV Entertainment System

- 12 Business Class Seats out of its total 309 seats Hybrid Budget Airline

Model

In Malaysia, only 6% of the adult population travelled by air in 2001.

Due to policy of highly regulated domestic fares of Malaysian Govt. Malaysian

Airlines had been losing US$79 million annually on its domestic routes.

Air Asia transformed from a money losing airline when a new group of investors,

Tune Air SdnBhd, bought the shares and half of the shares and half the share of

liabilities in the original airline in September, 2001.

According to 2006 data Asian Airlines had fleets comprising of 71% wide-body

aircraft and only 29% narrow-body ones whereas in North America and Europe, 23

% were wide-body and 77% were narrow-body ones. This affected in terms of load

factor and the fuel efficiency.

Air Asia initially launched in 1996 as a full service regional airline offering slightly

cheaper fares as compared to its competitors. But this strategy failed as they were

unable to attract customers.

The investors announced an agreement on September 8, 2001 to buy Air Asia for a

symbolic one ringgit (26 cents) and to assume 50% of the liabilities or around 40

million ringgit.

In January 2002, Air Asia was relaunched as a budget airline with three Boeing 737

aircraft

Government helped in the infrastructure development and provided huge freedom

associated with subsidies and tax expenditure which led to the development of routes

from the urban cities to outlying areas thereby improving the economy.

Air Asia achieved a cost per available-seat-kilometer (ASK) early in its development

of 2.5 cents, half of that MAS and Ryanair and a third of Easyjet. According to UBS,

it was the lowest cost airline in the world by 2007. Its revenue model was driven by

VFR and small business travellers.

Page | 4

By 2007, Air Asia was handling 51,000 passengers a day with a fleet of 54 planes

offering a fare of 50 ringgit which was 40-60% lower than fares of full service airlines

and in some cases the fares were even less than that of bus or rail fares at that time.

Air Asia expanded from 2 aircrafts in 2001 to 54 by 2007, 70 by 2010 and finally 180

by 2014.

Air Asia handled 1.5 million passengers in 2003, 6.3 million in 2005 and almost 14

million passengers by 2007. In early 2010, in spite of fall in global passenger demand,

Air Asias passenger numbers grew by 24% to 22.7 million. Its profit margin was 35%

and it announced a profit of RM 549 million (US$ 162 million) for the year 2009.

Air Asia took over 96 of MASs 118 domestic routes in 2006, only four of which were

profitable.

Air Asia entered into a number of joint ventures including Thai Air Asia, Indonesia

Air Asia and Air Asia X.

Malaysian Govt. built a low cost terminal at Kuala Lumpur International Airport in

2006.

Air Asia X was a legally separate company in which Air Asia had only 16% stake but

a consortium that included Tony Fernandes owned 48%. Virgin Group also had a

stake of 16% in it.

To compete with Air Asia, Singapore Airlines launched Valuair in 2003, Thai Airways

International launched NokAr in 2004, the Sri Lankan government launched Mihin

Lanka in 2007 and Quantas started Jetstar in 2004.

Air Asia prompted increased passenger travel with its 2007- 2008 To Malaysia with

Love campaign. It celebrated 50 years of nationhood of Malaysia and offered cheap

fares owing to the low-cost carrier terminal in the Kuala Lumpur airport with a

throughput of about 10 million passengers.

By 2010, Air Asia X was connecting to three cities in China and Air Asia was

connecting six shorter haul cities from Malaysia and Thailand.

Air Asia improved their brand recognition by sponsoring Manchester United Football

club in England and Oakland Raiders Football team in USA. Oakland was chosen

because of its strategic advantages.

In 2007, Air Asia expanded to cargo transportation and entered into an agreement with

the cargo management company Leisure Cargo. The agreement served 18 destinations

made possible by the Airbus A320s carrying both passengers and cargo.

Air Asiawent public on November 22, 2004. Its IPO was worth US$226 million. It

was one of the largest public offerings in Malaysia and brought RM 717.4 million

(US$ 188.8 million) for its future expansion. Its revenue grew 52 % from 2006-2007

reaching 1603 million ringgits in 2007. Its pre-tax profit grew 223 % from 86 to 278

million ringgits and net profit grew 147 % from 202 to 498 million ringgit. Despite

some challenges and profit drops in 2007 and 2008, it continued its growth when the

core operating profit rose by 591 % and the net profit by 26% in the 2008 and 2009

period.

Opinions:

Page | 5

The prevailing sentiment among some of the Asian majors, expressed by the Asia

Pacific Airlines Association in the early 2003, was that no frill fliers are not a threat

to Asian Airlines.

According to Peter Harbison of the Centre for Asia Pacific Aviation, consultancy in

Sydney, Australia, the key ingredient is liberalization.

Tony Fernandes wanted to start operations on a long haul basis but as per Conor

McCarthys opinion he started on short haul routes.

According to Conor McCarthy, timing and luck had striking importance in the success

of Air Asia, right from cheap aircraft prices owing to 9/11 attacks, establishment of

forward contracts and also to get a foothold in the market and thus become the market

leader

As Air Asia planned to enter Thailand and other neighbouring countries, the

Malaysian Govt. was sceptical about its success in those region and also because they

would need to accommodate the growth of a new budget airline at the cost of

reducing the market value of government-owned Malaysian Airlines.

At the introduction of the Quantass budget airline Jetstar, in which Temasek Holdings

had a stake of 19% and also a 57% stake in Singapore Airlines, were accused of

conflict of interest but they retaliated saying that the introduction of this airline would

increase the pie and their interest were strictly for financial returns and they view both

of them as potentially attractive investments.

Eric Kohn of Deutsche BA argued that established carriers are not set up to succeed in

the low-cost space. He said, People at big airlines dont have accountability or a

focus on costs. It is a lot easier to start an airline from scratch than to take a legacy

airline and make a profit.

As per the interview with Tony Fernandes he expressed that they feel pretty

vindicated as a lot people doubted them and laughed at them and warned him not to

go international but he thought there is no difference between the domestic and

international operations and finally proved them wrong.

Relating to Air Asias expansion to cargo transportation, one of the regional directors

commented that, Cargo plays an integral part of our ancillary income and we foresee

cargo to be one of the key drivers with significant contribution towards the companys

bottom line.

STRATEGIES IMPLEMENTED BY AIR ASIA FOR ITS SUCCESS:

Low Fare and No Frills Strategy - Price Leadership Model

Employment of low cost airline experts to restructure Air Asias business model and

also persuaded McCarthy to join the executive team and become one of the investors.

Hey bought used planes initially to reduce cost. The 9/11 attacks further helped them

in lowering their costs

Followed Ryan airs operational strategy, Southwests people strategy and Easyjets

branding strategy.

Page | 6

Initially focussed on short haul flights to establish themselves and become the market

leader before expanding to long haul international borders.

Entered into maintenance contracts and fuel hedging to further reduce costs.

In distribution, the majority of the bookings were made via the web and in some

places where payment type was an issue, it opened up billing and settlement plan

(BSP) and computer reservation system (CRS) channels.

Achieve ASK early

Its revenue model was driven by VFR and small business travellers.

Rapid expansion in neighbouring countries like Thailand, Indonesia, India and China

both in terms of fleet and number of flights.

Joint Venture with cross border markets. Harmonization of regulations in pilot hours

and maintenance oversight.

Separate low-cost terminal in airports.

Operate through secondary airports as they are able to provide fast Turnaround Time

(TAT) and Taxi Times.

Communication strategy though campaigns like To Malaysia with Love to promote

itself and increase reach.

International route expansion through Thai Air Asia, Indonesia Air Asia and Air Asia

X.

Sponsorship of Manchester United and Oaklands Raiders to improve brand

recognition in those countries

Oakland was further strategically chosen as it was a base for Southwest Airlines

thereby connecting thousands of passengers in their domestic routes at low price.

Air Asia used A320s for short haul routes and A330s to support the projected long

haul operator Air Asia X. Apart from relying on A340s for one stop service to USA

and non-stop service to Europe, it was rapidly increasing its fleet with A350s.

It entered into Cargo Transportation through an agreement with Leisure Cargo.

It went public in 2004 and brought in a lot of capital for expansion.

SWOT Analysis:

STRENGTHS

Strong management Team

Strong Strategy and Execution

plan on fuel hedging, buying low

cost airbuses.

Low cost Model

Single type fleet

Efficient Operations

First to market with ICT

collaboration

Strong Brand Name

WEAKNESSES

Outsourcing

Limited human resources

Heavy reliance on IT

Non-central location of secondary

airports

Page | 7

Multi-skilled Staff seamless

transition within workforce

OPPORTUNITIES

Expansion to new routes based on

low cost philosophy (exploit

growing markets like China, India)

Higher fuel costs means less

profitable competitors may be forced

out of business

Partnerships with Virgin airline to

use existing strengths (brand

recognition, landing rights)

Differentiate from old LCC model

(include customer service and

operation as full service airline)

Long haul flight to approach

undeveloped market (Air Asia X to

Europe)

THREATS

Accident and disaster affect

customer confidence

Aviation regulation and government

policy (barriers in new routes

expansion)

Full service airlines start cut costs to

compete

Entrance of other low cost couriers

(Jetstar, Tiger Airways)

QUESTIONS & ANSWERS:

1. What is the macro and industry environment in the Southeast Asian region for the entrance

of new budget airlines? What opportunities and challenges are associated with this

environment?

In recent years as more carriers have entered the market Competition for the

Southeast Asian budget traveller has increased significantly. These new entrants are

attracted by the large number of potential travellers, and the fact that government

deregulations in this region made easier for companies to operate. However, fuel

prices are a concern as are other costs involved in running airlines such as providing

ground operations and passenger services. Some airlines including Air Asia are

forming alliances to share these additional costs.

2. How might demand for low-fare service differ in the Asia-Pacific region from North

America and Europe?

The relatively low income levels in most Asian countries created Substantial

opportunities for low-fare airlines in Asia by, the availability of alternative modes of

transportation, and the less percentage of the population that utilizes more expensive

Page | 8

airlines, as well as the increased awareness of the U.S. and European trends favouring

low-fare providers. It is to be note that the Asian markets are substantially more

sensitive to fare differentiation than the North American market due to the high

competition from high speed rail. Asian markets are still relatively limited in their

utilization of the full potential of Internet resources, and still depend on travel agents

and other middlemen. In addition Asia low-fare airlines are less likely to compete

with more expensive providers for the same customers, and are more likely to target

individuals who would otherwise not travel by air. Finally, Asian low-fare airlines

have a smaller market share, compared to their dominance in Western markets.

3. Compare AirAsias generic strategy (cost leadership, differentiation, focus) with the

strategies of other incumbent carriers and with Southwest and Ryanair. How is it similar to

and different from the strategies of those carriers?

Air Asia is trying to imitate Southwests successful people-oriented strategies and

Ryanairs efficient operational strategies. However, Southwest and Ryanair

implement those strategies in order to differentiate themselves from a large number of

low-cost providers in highly competitive and relatively saturated American and

European markets. Air Asia is an imitator in the market with limited competition and

growing demand from a previously nonexistent market segment. This gives AirAsia

opportunity to be a leader in its own market, while at the same time imitating and

integrating business models that showed to be successful elsewhere. The success of

such an approaches depend on the similarities between the Asian market and other

markets, as well as the ability of AirAsia to capitalize upon the potential synergies

between these strategies. Today, AirAsia is seen as the worlds most successful

budget airline.

4. Did Fernandes weigh the range of political, economic, and operational uncertainties and

risks when he took over AirAsia? What risks might he have overlooked?

The case indicates that Fernandes was well-aware of most of these risks, especially

having worked in a decision making capacity in the same geographic region. He

seems to have also taken appropriate steps in seeking professional advice in the lowfare airline industry from Conor McCarthy of Ryanair and others. One area that he

might have overlooked is macro political risks - major political decisions likely to

affect all enterprises in a country. For example, Several Asian countries continue to

face political instability, religious turmoil, currency fluctuations, corruption

problems, discrimination issues, and other problems that may have spillover effects

on the airline industry.

Page | 9

5. How would you describe Fernandes entrepreneurial strategy?

Fernandes possesses a strong entrepreneurial spirit. He is also flexible, insightful, and

responsive to change. However, he seems to also take calculated risks, supported by

the appropriate level of research and consultation.

6. How should AirAsia respond to the challenges posed by (a) new low-fare carriers entering

the Asian marketplace and (b) low-fare strategies pursued by incumbent carriers? How would

you characterize the competitive dynamics in this market?

AirAsia has first-mover advantage, which gives it an edge over competition in terms

of brand image, customer loyalty, and government support. Moreover, AirAsia has an

advantage over potential multinational competitors due to its established knowledge

of the Asian culture. AirAsia also seems to have the resources, credibility and

planning capacity necessary for expansion into international markets and/or going

public before many of its competitors. AirAsia does not face the obstacles and

hurdles of bureaucracy, stagnant organizational culture, and lack of a cost-conscious,

efficiency-oriented mentality, prevalent in the incumbent, government-controlled,

expensive carriers. The most effective approach for AirAsia is likely to be

capitalizing on the above mentioned advantages to the maximum, rather than

attempting to create hostile competition, especially with incumbent carriers. In order

to neutralize the threats of government interference to save the survival of its primary

carriers, AirAsia should initiate and maintain positive relations to rally the support of

the government. This can be accomplished through finding mutually motivating goals

so that AirAsia can be perceived as a contributor to the national economy, rather than

a destroyer of the established carriers.

7. How do you think the Asian passenger air transport marketplace will shake out? What

lessons can be drawn from the North American and European experience?

It is likely that the Asian market will eventually be very similar to the North

American and European markets. As low-fare airlines enter this promising market, it

will become more competitive, with price dominating all other criteria in consumer

decisions and choices. Other promotional tools will be necessary to create and

maintain customer loyalty, including mileage accumulation, frequent and timely

schedules, convenience, and availability of routes to a wide range of locations.

However, these tools will not replace the domination of a price-orientation, but rather

supplement it in creating competitive advantage.

P a g e | 10

8.What is your assessment of Air Asia moving beyond its historic strength in Southeast Asia

to Australia, China, India, and Europe?

Air Asia is successful in executing the appropriate budget airline, and should

capitalize on the ability by expanding into similar markets such as China and India.

Expanding into the new markets will not only create a new stream of revenue, it will

also help diminish the companys reliance on its existing markets. It is noted that the

business environment in these other countries may be quite different from that in Air

Asias existing markets. Based on this perspective, Air Asia should avoid diversifying

into too many new markets.

Das könnte Ihnen auch gefallen

- Business Strategy Air AsiaDokument3 SeitenBusiness Strategy Air Asiahelmiwell100% (3)

- Airasia Marketing PlanDokument26 SeitenAirasia Marketing Planfirinaluvina71% (7)

- Air AsiaDokument37 SeitenAir AsiaZulkifli Said100% (1)

- Air AsiaDokument22 SeitenAir AsiaMohd Mazhan Kaya Amin50% (2)

- Air Asia Strategic ManagementDokument2 SeitenAir Asia Strategic ManagementAffizul AzuwarNoch keine Bewertungen

- AIR Asia Assignment MasterDokument58 SeitenAIR Asia Assignment MasterZakuan AeuUniversity100% (5)

- Imr451 - AirasiaDokument58 SeitenImr451 - AirasiaAzz Izumi100% (1)

- Leadership of Tony Fernandes - Air AsiaDokument14 SeitenLeadership of Tony Fernandes - Air AsiaASIKIN AZIZ100% (5)

- Analysis of Leadership From Competency Perspective 1. Motivation For LeadershipDokument6 SeitenAnalysis of Leadership From Competency Perspective 1. Motivation For LeadershipKavitha VallathNoch keine Bewertungen

- Strategic Analysis On AirAsiaDokument31 SeitenStrategic Analysis On AirAsiallyida100% (1)

- The AirAsia Company Strategic ManagementDokument13 SeitenThe AirAsia Company Strategic ManagementNur Zara100% (1)

- Sime Darby Berhad Full AnalysisDokument7 SeitenSime Darby Berhad Full AnalysisHari Dass100% (2)

- DMB AirAsia Core Competencies DistinctiveDokument34 SeitenDMB AirAsia Core Competencies Distinctiveheda kalenia100% (1)

- Airasia Berhad (: Hubs Kuala Lumpur International AirportDokument10 SeitenAirasia Berhad (: Hubs Kuala Lumpur International AirportHananie NanieNoch keine Bewertungen

- Muhammad Izwan Yusof - Sustaining Competitive Edge For Mas and Air AsiaDokument27 SeitenMuhammad Izwan Yusof - Sustaining Competitive Edge For Mas and Air AsiaIzwan Yusof100% (2)

- Air Asia MKTDokument9 SeitenAir Asia MKTnurul hashimaNoch keine Bewertungen

- Air Asia Strategic AnalysisDokument28 SeitenAir Asia Strategic AnalysisR. Iwan Budhiarta80% (20)

- Case 2 Flat Cargo BerhadDokument11 SeitenCase 2 Flat Cargo Berhadyumiko_sebastian20140% (1)

- Air AsiaDokument32 SeitenAir AsiaLittle FaithNoch keine Bewertungen

- Air Asia Marketing MixDokument8 SeitenAir Asia Marketing MixAnonymous B6yEOYI50% (2)

- Air AsiaDokument25 SeitenAir AsiaCeline SuHuiNoch keine Bewertungen

- ReferencesDokument9 SeitenReferencesFarah WahidaNoch keine Bewertungen

- AirAsia SlidesDokument9 SeitenAirAsia SlidesjaysonchammbaNoch keine Bewertungen

- Air AsiaDokument20 SeitenAir AsiaAngela TianNoch keine Bewertungen

- Positioning Malaysia in the International Arena: Perdana Discourse Series 5Von EverandPositioning Malaysia in the International Arena: Perdana Discourse Series 5Noch keine Bewertungen

- Air Asia Marketing PlanDokument18 SeitenAir Asia Marketing PlanDharshviny Sasidharan100% (1)

- Air Asia Mix MarketingDokument29 SeitenAir Asia Mix MarketingHadzme Hajan100% (1)

- Leadership Air Asia FINAL SK PDFDokument15 SeitenLeadership Air Asia FINAL SK PDFMuhamad DanielNoch keine Bewertungen

- Air AsiaDokument15 SeitenAir AsiaSuresh Samarasinhe100% (5)

- Air Asia Cost Leadership StrategyDokument16 SeitenAir Asia Cost Leadership Strategyajiinal100% (1)

- Malaysia Airline ReportDokument24 SeitenMalaysia Airline Reportrussell9285% (13)

- AirAsia Berhad - PESTLE Analysis of The Low Cost Carrier in The AsiaDokument8 SeitenAirAsia Berhad - PESTLE Analysis of The Low Cost Carrier in The Asiahanwei_8650% (2)

- Pest Analysis (Air Asia)Dokument4 SeitenPest Analysis (Air Asia)Viknesh Rajandran100% (4)

- E Commerce - AirAsiaDokument25 SeitenE Commerce - AirAsiakhormm100% (3)

- Assignment 2 - AirAsiaDokument8 SeitenAssignment 2 - AirAsiaRevathi PattuNoch keine Bewertungen

- PEST and SWOT Analysis of AirAsias International Business OperationsDokument21 SeitenPEST and SWOT Analysis of AirAsias International Business OperationsDoremon G Fly100% (1)

- Mydin - Enterpreneurship BackgroundDokument10 SeitenMydin - Enterpreneurship BackgroundMuhammad Fattah FazelNoch keine Bewertungen

- SWOT Analysis MASDokument4 SeitenSWOT Analysis MASwlyip1986100% (6)

- Parkson Holdings BerhadDokument15 SeitenParkson Holdings BerhadKhairul AnwarNoch keine Bewertungen

- Strategic Analysis On AirAsiaDokument31 SeitenStrategic Analysis On AirAsiaWooGimChuan83% (12)

- Food and Beverage Management AssignmentDokument7 SeitenFood and Beverage Management AssignmentKuda L-jay MugairiNoch keine Bewertungen

- Design An Orientation Training Programme For A Group of Employees in An OrganisationDokument11 SeitenDesign An Orientation Training Programme For A Group of Employees in An OrganisationNa'ilah Apandi100% (1)

- Company? What Are The Positive and Negative MIS in Dell?Dokument3 SeitenCompany? What Are The Positive and Negative MIS in Dell?Nelle Renei67% (3)

- Jack MaDokument8 SeitenJack MaLee Zhe HuiNoch keine Bewertungen

- Air Asia Case StudyDokument8 SeitenAir Asia Case StudyLaila Al-Alawi80% (5)

- Tan Sri Syed MokhtarDokument9 SeitenTan Sri Syed MokhtarHelmi NasirNoch keine Bewertungen

- Sime Darby Plantation Is The Plantation and AgriDokument1 SeiteSime Darby Plantation Is The Plantation and AgriNorazila SupianNoch keine Bewertungen

- Analysis SWOT of AirAsiaDokument3 SeitenAnalysis SWOT of AirAsiaemmedh100% (1)

- Air Asia - Brand PersonalityDokument10 SeitenAir Asia - Brand PersonalityNovena Christie HNoch keine Bewertungen

- The Effect of Pandemic Covid-19 To The Company SlideDokument13 SeitenThe Effect of Pandemic Covid-19 To The Company SlideSiti Nur Halinda Binti Haris A21A3450Noch keine Bewertungen

- Case 9 AirasiaDokument10 SeitenCase 9 AirasiaaryaNoch keine Bewertungen

- Air AsiaDokument25 SeitenAir AsiaFaiaze Ikramah50% (4)

- Malaysia AirlineDokument3 SeitenMalaysia AirlineAndy LeeNoch keine Bewertungen

- Management Air AsiaDokument19 SeitenManagement Air AsiaPrisy ChooNoch keine Bewertungen

- Strategic Management Assignment Part B AirAsia - EditedDokument36 SeitenStrategic Management Assignment Part B AirAsia - EditedRaja Deran43% (7)

- Air Asia CS#1Dokument6 SeitenAir Asia CS#1MaryamKhalilahNoch keine Bewertungen

- Airsia Mas Swap Case StudyDokument11 SeitenAirsia Mas Swap Case StudyMasz KamarudinNoch keine Bewertungen

- Alternative Strategies Selection Process: A) Build Strengths-Weaknesses-Opportunities Threats (SWOT) Matrix Swot Analysis Matrix - Air Asia AirlinesDokument7 SeitenAlternative Strategies Selection Process: A) Build Strengths-Weaknesses-Opportunities Threats (SWOT) Matrix Swot Analysis Matrix - Air Asia Airlinesmalikldu50% (2)

- Strategic Management - THE AIR ASIA STORY & CORE COMPETENCIESDokument7 SeitenStrategic Management - THE AIR ASIA STORY & CORE COMPETENCIESNoor Hairulnizam NasirNoch keine Bewertungen

- Air Asia Group Assignment Project Mini OMDokument7 SeitenAir Asia Group Assignment Project Mini OMyanuar triyantoraharjoNoch keine Bewertungen

- Sample Individual AssignmentDokument15 SeitenSample Individual AssignmentZainuddin Abu Nasir100% (1)

- Uj 6 A 6 LDokument33 SeitenUj 6 A 6 LPhilemon SurenNoch keine Bewertungen

- AirAsia The World S Lowest Cost AirlineDokument66 SeitenAirAsia The World S Lowest Cost AirlineEdithiryanto DekaapiNoch keine Bewertungen

- Airasia Comprehensive Case Analysis 2Dokument32 SeitenAirasia Comprehensive Case Analysis 2Shaina Mae C ValenzuelaNoch keine Bewertungen

- Jawapan KeusahawananDokument12 SeitenJawapan KeusahawananjzariziNoch keine Bewertungen

- MGT 3124 QS - V2Dokument11 SeitenMGT 3124 QS - V2marcus liewNoch keine Bewertungen

- Ceo Morning BriefDokument29 SeitenCeo Morning Briefhaziqah zakariaNoch keine Bewertungen

- Case 1 Air Asia Lowest Cost AirlineDokument11 SeitenCase 1 Air Asia Lowest Cost AirlinerazharyNoch keine Bewertungen

- Perbandingan Air Asia Dan Lion AirDokument14 SeitenPerbandingan Air Asia Dan Lion AirAnna AdventaNoch keine Bewertungen

- Question 3Dokument2 SeitenQuestion 3Nur SyahirahNoch keine Bewertungen

- Case 9 AirasiaDokument10 SeitenCase 9 AirasiaaryaNoch keine Bewertungen

- Air AsiaDokument15 SeitenAir AsiaarieanorNoch keine Bewertungen

- Anisah BBIM4103 Jan2019Dokument25 SeitenAnisah BBIM4103 Jan2019Supian Jannatul FirdausNoch keine Bewertungen

- AAX 16th AGM MinutesDokument15 SeitenAAX 16th AGM MinutesDennis AngNoch keine Bewertungen

- Air Asia Marketing StrategiesDokument36 SeitenAir Asia Marketing StrategiesJenNoch keine Bewertungen

- Air Asia Marketing MixDokument8 SeitenAir Asia Marketing MixAnonymous B6yEOYI50% (2)

- AirAsia X Results Presentation For CY2Q22 1661713717Dokument17 SeitenAirAsia X Results Presentation For CY2Q22 1661713717Irvins vietnamNoch keine Bewertungen

- Airasia X BHD V BOC Aviation LTD & OrsDokument96 SeitenAirasia X BHD V BOC Aviation LTD & OrsZhi EnNoch keine Bewertungen

- Air Asia FinalDokument21 SeitenAir Asia FinalIshmail People's33% (3)

- Assignment Air Asia Report ODC FullDokument16 SeitenAssignment Air Asia Report ODC FullThiviyaa DarshiniNoch keine Bewertungen

- Air Asia Final ProjectDokument59 SeitenAir Asia Final Projectmanaswini sharma B.G.Noch keine Bewertungen

- AirAsia - Group 8Dokument10 SeitenAirAsia - Group 8AnkitGovilNoch keine Bewertungen

- 360 Jun13Dokument172 Seiten360 Jun13Abe KobNoch keine Bewertungen

- Ar 2019Dokument226 SeitenAr 2019Tasma Farhah YazidNoch keine Bewertungen

- HBS AirAsia AssignmentDokument1 SeiteHBS AirAsia AssignmentMuslim MaRu0% (1)

- Issue 43 - Volume 2Dokument32 SeitenIssue 43 - Volume 2Indian WeekenderNoch keine Bewertungen

- Leadership of Tony Fernandes - Air AsiaDokument14 SeitenLeadership of Tony Fernandes - Air AsiaASIKIN AZIZ100% (5)

- Final Project On AIR ASIADokument15 SeitenFinal Project On AIR ASIAArpit Pradhan100% (1)

- Economy Group AssignmentDokument8 SeitenEconomy Group AssignmentTio Li JingNoch keine Bewertungen

- R V Airbus Statement of Facts PDFDokument40 SeitenR V Airbus Statement of Facts PDFThavam RatnaNoch keine Bewertungen