Beruflich Dokumente

Kultur Dokumente

Proposed SAIL Pension Scheme

Hochgeladen von

angadpurCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Proposed SAIL Pension Scheme

Hochgeladen von

angadpurCopyright:

Verfügbare Formate

Proposed SAIL Pension Scheme

Coverage :

Non-executives (including Trainees recruited for eventual employment) on

rolls of the Company on or after 01/01/2012.

Contract Appointees & employees on deputation to SAIL not covered.

Eligibility for benefits :

Minimum 15 years of service and superannuate from the Company.

In case of death/PTD/Medical invalidation, minimum service condition shall

be waived off.

Scheme :

Effective date :

Contributions with effect from 1st January, 2012.

Employees retired in the intervening period will also eligible for Pension.

Trust Managed :

Contributions direct deposit to SESBF Trust.

Funds to be self-managed or through a Fund Manager decision of the

Trust.

Annuity Provider(s) to be decided by the Trust.

Contributions to the Fund :

Company contributions (6% of Basic Pay plus D.A. w.e.f. 01/01/2012).

Voluntary contributions by the individual (@2% of Basic Pay plus D.A. to

continue, option of contributing voluntarily available to increase monetary

benefit from the Scheme).

Annuities :

Employees exiting before completing 15 years will be eligible only for own

contribution and interest.

On superannuation / separation individual to purchase annuity from

various annuity options from a prescribed Annuity Provider(s).

Fund Management (through existing SESBF Trust) :

Existing SESBF accumulations in individual accounts to be merged with

Pension Account.

Management of funds in-house or partly / fully through IRDA approved

Fund Manager decision of the Trustees.

Annuity Provider(s) to be decided by the Trust.

No need for acquiring a fresh income tax exemption.

Benefits both Employers & Employee contribution :

Cases of death / PTD / Medical invalidation.

Resignation to other CPSE having similar scheme.

Cases of Voluntary Retirement as per the prevailing scheme at that time.

Deputation from other CPSE (provided employee joins back).

Cases of employees maintaining lien with SAIL.

Contribution for lien period not payable.

Contribution re-starts from date of re-joining.

Service period not accounted for.

Benefits Employee contribution only :

Resignation / Transfer to other CPSE / Organization.

Compulsory retirement, removal or dismissal because of disciplinary

proceedings as per CDA Rules / Standing Orders.

Cases of employees maintaining lien with SAIL but superannuating from the

borrowing Organization.

Nominations :

In absence of Nomination, nomination(s) made by the employee under P.F.

to be considered.

Process Road Map :

Go ahead from Union and SEFI representatives.

Decision of the SESBF Trust.

SAIL Board.

Approval from Administrative Ministry.

Implementation.

Availing Annuity :

On superannuation / separation individual to purchase annuity from

various annuity options from a prescribed Annuity Provider(s).

Commutation not allowed.

Annuity Providers :

Life Insurance Corporation off India.

SBI Life Insurance Co. Ltd.

ICICI Prudential Life Insurance Co. Ltd.

HDFC Standard Life Insurance Co. Ltd.

Bajaj Allianz Life Insurance Co. Ltd.

Reliance Life Insurance Co. Ltd.

Star Union Dai-ichi Life Insurance Co. Ltd.

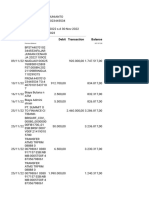

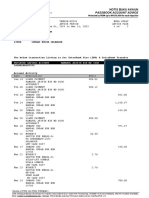

GSCA RATES

(Revised annuity options & rates w.e.f. 01/08/2012)

Type of Annuities

60 years

Purchase Price

Annuity for life

Annuity for life with

return of Capital (ROC)

Annuity for 5 years

certain & life thereafter

Annuity for 10 years

certain & life thereafter

Annuity for 15 years

certain & life thereafter

Annuity for 20 years

certain & life thereafter

Annuity

for

life

increasing at a simple

rate of 3% p.a.

Annuity for life with 50%

to spouse

Annuity for life with

100% to spouse

Annuity for life with

100% to spouse with

ROC

GSCA Monthly Annuity at Age

Basic

Rate

91.2

69.3

90.4

88.6

86.2

83.2

74

84.6

78.8

68.7

2.5

lakhs

1960.4

2

1504.1

7

1943.7

5

1906.2

5

1856.2

5

1793.7

5

1602.0

8

5 lakhs 7.5

lakhs

3945.8 5937.50

3

3033.3 4568.75

3

3912.5 5887.50

0

3837.5 5775.00

0

3737.5 5625.00

0

3612.5 5437.50

0

3229.1 4862.50

7

10

lakhs

7925.0

0

6100.0

0

7858.3

3

7708.3

3

7508.3

3

7258.3

3

6491.6

7

1822.9

2

1702.0

8

1491.6

7

3670.8

3

3429.1

7

3008.3

3

7375.0

0

6891.6

7

6050.0

0

5525.00

5162.50

4531.25

Das könnte Ihnen auch gefallen

- Vrs PresentationDokument24 SeitenVrs PresentationshrutipalkarNoch keine Bewertungen

- Salary Advance PolicyDokument3 SeitenSalary Advance PolicySandeep MazumdarNoch keine Bewertungen

- Superannuation IndiaDokument3 SeitenSuperannuation IndiaSURYAPRATAPREDDY BHUMANoch keine Bewertungen

- Provident Fund Act Summary NotesDokument8 SeitenProvident Fund Act Summary Notesshanky631Noch keine Bewertungen

- 1040 Exam Prep Module IV: Items Excluded from Gross IncomeVon Everand1040 Exam Prep Module IV: Items Excluded from Gross IncomeNoch keine Bewertungen

- Gratuity PolicyDokument2 SeitenGratuity PolicyVishala GudageriNoch keine Bewertungen

- Corporate Finance: A Beginner's Guide: Investment series, #1Von EverandCorporate Finance: A Beginner's Guide: Investment series, #1Noch keine Bewertungen

- SBF Iocl 19.11.12Dokument18 SeitenSBF Iocl 19.11.12ParameshNoch keine Bewertungen

- BMS Financial AccountsDokument38 SeitenBMS Financial AccountsJicksonNoch keine Bewertungen

- Employee Benefits of Jamuna Bank & ACI Ltd.Dokument16 SeitenEmployee Benefits of Jamuna Bank & ACI Ltd.Cholo Bristy NamaiNoch keine Bewertungen

- ABC Co Loan PlicyDokument3 SeitenABC Co Loan Plicyrobinson ronoNoch keine Bewertungen

- Employees Provident Fund (And Miscellaneous Provisions) Act, 1952Dokument30 SeitenEmployees Provident Fund (And Miscellaneous Provisions) Act, 1952Rahul ChintaNoch keine Bewertungen

- Gratuity ActDokument3 SeitenGratuity ActSagarmakodeNoch keine Bewertungen

- Annexure New Pension SchemeDokument3 SeitenAnnexure New Pension SchemeAbhilasha MathurNoch keine Bewertungen

- Defined Contributions Retirement PlanDokument5 SeitenDefined Contributions Retirement PlanguaporicNoch keine Bewertungen

- Benefits 187Dokument2 SeitenBenefits 187Naimi SmithNoch keine Bewertungen

- Voluntary Retirement SchemeDokument32 SeitenVoluntary Retirement SchemeParas FuriaNoch keine Bewertungen

- Base SchemeDokument19 SeitenBase SchemeSandipNanawareNoch keine Bewertungen

- Voluntary Retirement SchemeDokument32 SeitenVoluntary Retirement Schemeudbhav786Noch keine Bewertungen

- Provident FundDokument18 SeitenProvident FundRashmi Ranjan Panigrahi100% (1)

- POWERGRID PresentationDokument31 SeitenPOWERGRID Presentationskaushik21Noch keine Bewertungen

- Labour Laws 10Dokument11 SeitenLabour Laws 10dskrishnaNoch keine Bewertungen

- IPSAS 25 Employees BenefitsDokument38 SeitenIPSAS 25 Employees BenefitsREJAY89Noch keine Bewertungen

- Employee BenefitsDokument18 SeitenEmployee BenefitsSabarish .SNoch keine Bewertungen

- Group Saving Linked Insurance SchemeDokument14 SeitenGroup Saving Linked Insurance SchemeSam DavidNoch keine Bewertungen

- Provident Fund - SynopsisDokument9 SeitenProvident Fund - SynopsisSIDDHANT MOHAPATRANoch keine Bewertungen

- Provident Fund PolicyDokument3 SeitenProvident Fund PolicyHajra AslamNoch keine Bewertungen

- Provident Fund Policy - Retail DirectDokument3 SeitenProvident Fund Policy - Retail DirectHajra AslamNoch keine Bewertungen

- Employee Benefits ServicesDokument16 SeitenEmployee Benefits ServicesDhruv BansalNoch keine Bewertungen

- General Explanatory Notes On MPF - Student HelperDokument4 SeitenGeneral Explanatory Notes On MPF - Student HelperHi ChanNoch keine Bewertungen

- Overview of Retirement and SocialDokument13 SeitenOverview of Retirement and SocialRukeshNoch keine Bewertungen

- GPF (General Provident Fund) Rules, 1960 and Contributory Provident FundDokument9 SeitenGPF (General Provident Fund) Rules, 1960 and Contributory Provident FundFinance AdministrationNoch keine Bewertungen

- Funds Section: Section. The Criteria of Payment For The Final Settlement IncludeDokument5 SeitenFunds Section: Section. The Criteria of Payment For The Final Settlement Includemohsin_111Noch keine Bewertungen

- Income From SalaryDokument19 SeitenIncome From SalaryAnupriya BajpaiNoch keine Bewertungen

- PF & Miscellaneous Provisions ActDokument19 SeitenPF & Miscellaneous Provisions Actpriya_ammuNoch keine Bewertungen

- SheldonAcharekar Vrs CrsDokument16 SeitenSheldonAcharekar Vrs CrsNitin KanojiaNoch keine Bewertungen

- IAS 19 SummaryDokument6 SeitenIAS 19 SummaryMuchaa VlogNoch keine Bewertungen

- Member LoansDokument2 SeitenMember LoansGian Pius ReyesNoch keine Bewertungen

- Business Law - AssignmentDokument7 SeitenBusiness Law - AssignmentShilpi SinghNoch keine Bewertungen

- IAM Pension Fund Red Zone FAQDokument9 SeitenIAM Pension Fund Red Zone FAQLaborUnionNews.comNoch keine Bewertungen

- Employee Benefits PlansDokument9 SeitenEmployee Benefits PlansshrikaapntNoch keine Bewertungen

- VRS 2012 Oo ReintDokument8 SeitenVRS 2012 Oo ReintShrinath GonganiNoch keine Bewertungen

- Overview of Retirement and Social Security Benefits: Presented By: Jehangir DaruvallaDokument13 SeitenOverview of Retirement and Social Security Benefits: Presented By: Jehangir Daruvallafrenz2kiranNoch keine Bewertungen

- Ra 8291 (Gsis)Dokument68 SeitenRa 8291 (Gsis)saihunter100% (4)

- Artifact 7 - Superannuation Pension Calculator-GuidelinesDokument2 SeitenArtifact 7 - Superannuation Pension Calculator-GuidelinesSai RamNoch keine Bewertungen

- Retirement Planning With Group SuperannuationDokument5 SeitenRetirement Planning With Group SuperannuationRutul DaveNoch keine Bewertungen

- Gratuity ActDokument9 SeitenGratuity ActMonil DesaiNoch keine Bewertungen

- Comp Ens ADokument14 SeitenComp Ens AViritha RebcaNoch keine Bewertungen

- EPF ActDokument3 SeitenEPF ActdskrishnaNoch keine Bewertungen

- ESICDokument30 SeitenESICpraveen singh BhimNoch keine Bewertungen

- Offer LetterDokument19 SeitenOffer LetterMukesh YadavNoch keine Bewertungen

- Provident Fund ActDokument14 SeitenProvident Fund ActAkanksha Dubey0% (1)

- VillanuevaJohnLloydA Module4ActivityDokument2 SeitenVillanuevaJohnLloydA Module4ActivityJan JanNoch keine Bewertungen

- Iv. Computation of The Amount of ContributionDokument11 SeitenIv. Computation of The Amount of ContributionYoan Baclig BuenoNoch keine Bewertungen

- Voluntary Retirement SchemeDokument3 SeitenVoluntary Retirement SchemeJinesh ThakkerNoch keine Bewertungen

- Private and Confidential TCSL/1809553 1Dokument19 SeitenPrivate and Confidential TCSL/1809553 1Aditya NarayanNoch keine Bewertungen

- Phone No Change ApplicationDokument1 SeitePhone No Change ApplicationangadpurNoch keine Bewertungen

- Lic Plan 165Dokument1 SeiteLic Plan 165angadpurNoch keine Bewertungen

- Combustion Basics: The Fire Triangle / Fire TetrahedronDokument2 SeitenCombustion Basics: The Fire Triangle / Fire TetrahedronangadpurNoch keine Bewertungen

- Combustion Basics: The Fire Triangle / Fire TetrahedronDokument23 SeitenCombustion Basics: The Fire Triangle / Fire TetrahedronangadpurNoch keine Bewertungen

- AppraisalDokument1 SeiteAppraisalangadpurNoch keine Bewertungen

- Case Study - JaneDokument2 SeitenCase Study - Janenguyenphuonganh07102002Noch keine Bewertungen

- UnknownDokument11 SeitenUnknown瑜惜Noch keine Bewertungen

- Statement 02 Dec 22 AC 40963607 PDFDokument3 SeitenStatement 02 Dec 22 AC 40963607 PDFJarrod GlandtNoch keine Bewertungen

- Bank Statement Template 3 - TemplateLabDokument1 SeiteBank Statement Template 3 - TemplateLabAlex AxfordNoch keine Bewertungen

- Statements 3612 2Dokument4 SeitenStatements 3612 2Aditya Pangestu ArdanaNoch keine Bewertungen

- Xzkeh.K Csad VKWQ VK Kzorz: Lanhkz % - .K at Udn M/KKJ (KKRKDokument2 SeitenXzkeh.K Csad VKWQ VK Kzorz: Lanhkz % - .K at Udn M/KKJ (KKRKd unpredictibleNoch keine Bewertungen

- Account SummaryDokument1 SeiteAccount Summaryvanita kunnoNoch keine Bewertungen

- NovemberstatementDokument2 SeitenNovemberstatementbejoNoch keine Bewertungen

- FMI10eAbr ch09Dokument37 SeitenFMI10eAbr ch09Zefanya VanessaNoch keine Bewertungen

- Bob SsaDokument1 SeiteBob Ssaranbir9drNoch keine Bewertungen

- Retirement Planner TemplateDokument4 SeitenRetirement Planner TemplateAmaliaAvramNoch keine Bewertungen

- 定时福利1126Dokument5 Seiten定时福利1126Ozzy Lina100% (3)

- Proc No. 345-2003 Public Servants PensionsDokument13 SeitenProc No. 345-2003 Public Servants Pensionsይህየይስ ተአምኖ100% (2)

- MCQ8. Government Businees ModuleDokument9 SeitenMCQ8. Government Businees Modulesimranjyot2021Noch keine Bewertungen

- Acct Statement - XX4920 - 02022023Dokument4 SeitenAcct Statement - XX4920 - 02022023Popi BhowmikNoch keine Bewertungen

- Bonus Rates-FY 2017-18 - tcm47-67139Dokument2 SeitenBonus Rates-FY 2017-18 - tcm47-67139KaranNoch keine Bewertungen

- Math For Business and Finance An Algebraic Approach 1st Edition Slater Test BankDokument71 SeitenMath For Business and Finance An Algebraic Approach 1st Edition Slater Test Bankarnoldjasmine4bflc100% (27)

- Banking Law 100marks March April 2023 (Dec 2022)Dokument7 SeitenBanking Law 100marks March April 2023 (Dec 2022)Veena T NNoch keine Bewertungen

- Activity Hidden Cost of CreditDokument5 SeitenActivity Hidden Cost of CreditpccrawdadsNoch keine Bewertungen

- HLB Receipt-2023-03-02 PDFDokument3 SeitenHLB Receipt-2023-03-02 PDFNabilla HudaNoch keine Bewertungen

- Holyoke Property Receivership ListDokument2 SeitenHolyoke Property Receivership ListMike PlaisanceNoch keine Bewertungen

- Sheetal Kaur PNBDokument7 SeitenSheetal Kaur PNBvaibhav tanejaNoch keine Bewertungen

- Statement 20231115Dokument2 SeitenStatement 20231115dbourke735Noch keine Bewertungen

- StatementOfAccount 6136231667 15092023 070122Dokument6 SeitenStatementOfAccount 6136231667 15092023 070122Santosh Kumar RathNoch keine Bewertungen

- Bank Interview QuestionsDokument2 SeitenBank Interview Questionsrithiksuman57Noch keine Bewertungen

- Account STMTDokument5 SeitenAccount STMTBrar ManjotNoch keine Bewertungen

- Compound Interest TableDokument6 SeitenCompound Interest TablespmzNoch keine Bewertungen

- Simple Interest Old Questions PDFDokument4 SeitenSimple Interest Old Questions PDFSanzu SangroulaNoch keine Bewertungen

- 2024 12 31 StatementDokument4 Seiten2024 12 31 StatementAlex NeziNoch keine Bewertungen

- RHB Islamic Bank BerhadDokument2 SeitenRHB Islamic Bank BerhadVape Hut KlangNoch keine Bewertungen

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsVon EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNoch keine Bewertungen

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantVon EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantBewertung: 4 von 5 Sternen4/5 (104)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Von EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Bewertung: 5 von 5 Sternen5/5 (91)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassVon EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNoch keine Bewertungen

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsVon EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsBewertung: 4 von 5 Sternen4/5 (4)

- How To Budget And Manage Your Money In 7 Simple StepsVon EverandHow To Budget And Manage Your Money In 7 Simple StepsBewertung: 5 von 5 Sternen5/5 (4)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationVon EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationBewertung: 4.5 von 5 Sternen4.5/5 (18)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsVon EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNoch keine Bewertungen

- CAPITAL: Vol. 1-3: Complete Edition - Including The Communist Manifesto, Wage-Labour and Capital, & Wages, Price and ProfitVon EverandCAPITAL: Vol. 1-3: Complete Edition - Including The Communist Manifesto, Wage-Labour and Capital, & Wages, Price and ProfitBewertung: 4 von 5 Sternen4/5 (6)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessVon EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessBewertung: 4.5 von 5 Sternen4.5/5 (4)

- The Best Team Wins: The New Science of High PerformanceVon EverandThe Best Team Wins: The New Science of High PerformanceBewertung: 4.5 von 5 Sternen4.5/5 (31)

- The Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomVon EverandThe Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomBewertung: 4.5 von 5 Sternen4.5/5 (2)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Von EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Bewertung: 3.5 von 5 Sternen3.5/5 (9)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonVon EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonBewertung: 5 von 5 Sternen5/5 (9)

- The Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitVon EverandThe Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitNoch keine Bewertungen

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherVon EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherBewertung: 5 von 5 Sternen5/5 (14)

- Rich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouVon EverandRich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouBewertung: 4 von 5 Sternen4/5 (2)

- Debt Freedom: A Realistic Guide On How To Eliminate Debt, Including Credit Card Debt ForeverVon EverandDebt Freedom: A Realistic Guide On How To Eliminate Debt, Including Credit Card Debt ForeverBewertung: 3 von 5 Sternen3/5 (2)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyVon EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyBewertung: 5 von 5 Sternen5/5 (1)

- Radically Simple Accounting: A Way Out of the Dark and Into the ProfitVon EverandRadically Simple Accounting: A Way Out of the Dark and Into the ProfitBewertung: 4.5 von 5 Sternen4.5/5 (9)

- Inflation Hacking: Inflation Investing Techniques to Benefit from High InflationVon EverandInflation Hacking: Inflation Investing Techniques to Benefit from High InflationBewertung: 4.5 von 5 Sternen4.5/5 (5)