Beruflich Dokumente

Kultur Dokumente

Horniman Horticulture

Hochgeladen von

GuptajiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Horniman Horticulture

Hochgeladen von

GuptajiCopyright:

Verfügbare Formate

DardenBusinessPublishing:213653

UVA-F-1512

Rev. Apr. 13, 2011

This document is authorized for use only by Saurabh Gupta at university of Calgary .

Please do not copy or redistribute. Contact permissions@dardenbusinesspublishing.com for questions or additional permissions.

HORNIMAN HORTICULTURE

Bob Brown hummed along to a seasonal carol on the van radio as he made his way over

the dark and icy roads of Amherst County, Virginia. He and his crew had just finished securing

their nursery against some unexpected chilly weather. It was Christmas Eve 2005, and Bob, the

father of four boys ranging in age from 5 to 10, was anxious to be home. Despite the late hour,

he fully anticipated the hoopla that would greet him on his return and knew that it would be some

time before even the youngest would be asleep. He regretted that the boys holiday gifts would

not be substantial; money was again tight this year. Nonetheless, Bob was delighted with what

his company had accomplished. Business was booming. Revenue for 2005 was 15% ahead of

2004, and operating profits were up even more.

Bob had been brought up to value a strong work ethic. His father had worked his way up

through the ranks to become foreman of a lumber mill in Southwest Virginia. At a young age,

Bob began working for his father at the mill. After earning a degree in agricultural economics at

Virginia Tech, he married Maggie Horniman in 1993. Upon his return to the mill, Bob was made

a supervisor. He excelled at his job and was highly respected by everyone at the mill. In 2000,

facing the financial needs of an expanding family, he and Maggie began exploring employment

alternatives. In late 2002, Maggies father offered to sell the couple his wholesale nursery

business, Horniman Horticulture, near Lynchburg, Virginia. The business and the opportunity to

be near Maggies family appealed to both Maggie and Bob. Pooling their savings, the proceeds

from the sale of their house, a minority-business-development grant, and a sizable personal loan

from Maggies father, the Browns purchased the business for $999,000. It was agreed that Bob

would run the nurserys operations and Maggie would oversee its finances.

Bob thoroughly enjoyed running his own business and was proud of its growth over the

previous three years. The nurserys operations filled 52 greenhouses and 40 acres of productive

fields and employed 12 full-time and 15 seasonal employees. Sales were primarily to retail

nurseries throughout the mid-Atlantic region. The company specialized in such woody shrubs as

azaleas, camellias, hydrangeas, and rhododendrons, but also grew and sold a wide variety of

This case was prepared by Michael J. Schill, Robert F. Vandell Research Associate Professor of Business

Administration, as a basis for class discussion rather than to illustrate effective or ineffective handling of an

administrative situation. Horniman Horticulture is a fictional company reflecting the issues facing actual firms.

Copyright 2006 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved.

To order copies, send an e-mail to sales@dardenbusinesspublishing.com. No part of this publication may be

reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means

electronic, mechanical, photocopying, recording, or otherwisewithout the permission of the Darden School

Foundation.

Page 1 of 5

DardenBusinessPublishing:213653

-2-

UVA-F-1512

This document is authorized for use only by Saurabh Gupta at university of Calgary .

Please do not copy or redistribute. Contact permissions@dardenbusinesspublishing.com for questions or additional permissions.

annuals, perennials, and trees.1 Over the previous two years, Bob had increased the number of

plant species grown at the nursery by more than 40%.

Bob was a people person. His warm personality had endeared him to customers and

employees alike. With Maggies help, he had kept a tight rein on costs. The effect on the

businesss profits was obvious, as its profit margin had increased from 3.1% in 2003 to an

expected 5.8% in 2005. Bob was confident that the nurserys overall prospects were robust.

With Bob running the business full time, Maggie primarily focused on attending to the

needs of her active family. With the help of two clerks, she oversaw the companys books. Bob

knew that Maggie was concerned about the recent decline in the firms cash balance to below

$10,000. Such a cash level was well under her operating target of 8% of annual revenue. But

Maggie had shown determination to maintain financial responsibility by avoiding bank

borrowing and by paying suppliers early enough to obtain any trade discounts. 2 Her aversion to

debt financing stemmed from her concern about inventory risk. She believed that interest

payments might be impossible to meet if adverse weather wiped out their inventory.

Maggie was happy with the steady margin improvements the business had experienced.

Some of the gains were due to Bobs response to a growing demand for more-mature plants.

Nurseries were willing to pay premium prices for plants that delivered instant landscape, and

Bob was increasingly shifting the product mix to that line. Maggie had recently prepared what

she expected to be the end-of-year financial summary (Exhibit 1).3 To benchmark the companys

performance, Maggie used available data for the few publicly traded horticultural producers

(Exhibit 2).

Across almost any dimension of profitability and growth, Bob and Maggie agreed that the

business appeared to be strong. They also knew that expectations could change quickly.

Increases in interest rates, for example, could substantially slow market demand. The companys

margins relied heavily on the hourly wage rate of $8.51, currently required for H2A-certified

nonimmigrant foreign agricultural workers. There was some debate within the U.S. Congress

about the merits of raising this rate.

Bob was optimistic about the coming year. Given the ongoing strength of the local

economy, he expected to have plenty of demand to continue to grow the business. Because much

of the inventory took two to five years to mature sufficiently to sell, his top-line expansion

efforts had been in the works for some time. Bob was sure that 2006 would be a banner year,

1

Over the past year, Horniman Horticulture had experienced a noticeable increase in business from small

nurseries. Because the cost of carrying inventory was particularly burdensome for those customers, slight

improvements in the credit terms had been accompanied by substantial increases in sales.

2

Most of Hornimans suppliers provided 30-day payment terms, with a 2% discount for payments received

within 10 days.

3

As compensation for the Browns services to the business, they had drawn an annual salary of $50,000

(itemized as an SG&A expense) for each of the past three years. This amount was effectively the familys entire

income.

Page 2 of 5

DardenBusinessPublishing:213653

This document is authorized for use only by Saurabh Gupta at university of Calgary .

Please do not copy or redistribute. Contact permissions@dardenbusinesspublishing.com for questions or additional permissions.

-3-

UVA-F-1512

with expected revenue hitting a record 30% growth rate. In addition, he looked forward to

ensuring long-term-growth opportunities with the expected closing next month on a neighboring

12-acre parcel of farmland.4 But for now, it was Christmas Eve, and Bob was looking forward to

taking off work for the entire week. He would enjoy spending time with Maggie and the boys.

They had much to celebrate for 2005 and much to look forward to in 2006.

With the acquisition of the additional property, Maggie expected 2006 capital expenditures to be $75,000.

Although she was not planning to finance the purchase, prevailing mortgage rates were running at 6.5%. The

expected depreciation expense for 2006 was $46,000.

Page 3 of 5

DardenBusinessPublishing:213653

-4-

UVA-F-1512

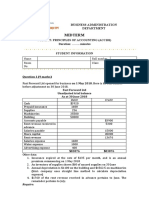

Exhibit 1

HORNIMAN HORTICULTURE

This document is authorized for use only by Saurabh Gupta at university of Calgary .

Please do not copy or redistribute. Contact permissions@dardenbusinesspublishing.com for questions or additional permissions.

Projected Financial Summary for Horniman Horticulture

(in thousands of dollars)

Profit and loss statement

Revenue

Cost of goods sold

Gross profit

SG&A expense

Depreciation

Operating profit

Taxes

Net profit

Balance sheet

Cash

Accounts receivable

Inventory1

Other current assets2

Current assets

Net fixed assets3

Total assets

2002

2003

2004

2005

788.5

402.9

385.6

301.2

34.2

50.2

17.6

32.6

807.6

428.8

378.8

302.0

38.4

38.4

13.1

25.3

908.2

437.7

470.5

356.0

36.3

78.2

26.2

52.0

1048.8

503.4

545.4

404.5

40.9

100.0

39.2

60.8

120.1

105.2

66.8

9.4

90.6

99.5

119.5

146.4

468.3

507.6

523.4

656.9

20.9

19.3

22.6

20.9

699.9

731.6

732.3

833.6

332.1

332.5

384.3

347.9

1,032.0 1,064.1 1,116.6 1,181.5

Accounts payable

Wages payable

Other payables

Current liabilities

Net worth

6.0

5.3

4.5

5.0

19.7

22.0

22.1

24.4

10.2

15.4

16.6

17.9

35.9

42.7

43.2

47.3

996.1 1,021.4 1,073.4 1,134.2

Capital expenditure

Purchases4

22.0

140.8

38.8

145.2

88.1

161.2

4.5

185.1

Inventory investment was valued at the lower of cost or market. The cost of inventory was determined by

accumulating the costs associated with preparing the plants for sale. Costs that were typically capitalized as

inventory included direct labor, materials (soil, water, containers, stakes, labels, chemicals), scrap, and overhead.

2

Other current assets included consigned inventory, prepaid expenses, and assets held for sale.

3

Net fixed assets included land, buildings and improvements, equipment, and software.

4

Purchases represented the annual amount paid to suppliers.

Page 4 of 5

DardenBusinessPublishing:213653

-5-

UVA-F-1512

Exhibit 2

HORNIMAN HORTICULTURE

This document is authorized for use only by Saurabh Gupta at university of Calgary .

Please do not copy or redistribute. Contact permissions@dardenbusinesspublishing.com for questions or additional permissions.

Financial Ratio Analysis and Benchmarking

2002

Revenue growth

Gross margin (gross profit/revenue)

Operating margin (op. profit/revenue)

Net profit margin (net profit/revenue)

2003

2004

2005

2.9% 2.4% 12.5% 15.5%

48.9% 46.9% 51.8% 52.0%

6.4% 4.8% 8.6% 9.5%

4.1% 3.1% 5.7% 5.8%

Benchmark1

(1.8)%

48.9%

7.6%

2.8%

Return on assets (net profit/total assets)

Return on capital (net profit/total capital)

3.2%

3.3%

2.4%

2.5%

4.7%

4.8%

5.1%

5.4%

2.9%

4.0%

Receivable days (AR/revenue 365)

Inventory days (inventory/COGS 365)

Payable days (AP/purchases 365)

NFA turnover (revenue/NFA)

41.9

424.2

15.6

2.4

45.0

432.1

13.3

2.4

48.0

436.5

10.2

2.4

50.9

476.3

9.9

3.0

21.8

386.3

26.9

2.7

Benchmark figures were based on 2004 financial ratios of publicly traded horticultural producers.

Page 5 of 5

Das könnte Ihnen auch gefallen

- Toaz - Info Horniman Horticulture Case PR DikonversiDokument2 SeitenToaz - Info Horniman Horticulture Case PR DikonversiDinda ArdiyaniNoch keine Bewertungen

- Horniman Horticulture CaseDokument2 SeitenHorniman Horticulture CaseVinny Tuteja0% (1)

- Horniman HorticultureDokument11 SeitenHorniman Horticultureangela4620100% (2)

- CaseDokument1 SeiteCaseNurMunirahBustamamNoch keine Bewertungen

- Caso American Greetings PDFDokument14 SeitenCaso American Greetings PDFcesar umanzorNoch keine Bewertungen

- Case 11 Horniman Horticulture 20170504Dokument16 SeitenCase 11 Horniman Horticulture 20170504Chittisa Charoenpanich100% (4)

- Horniman Horticulture CaseDokument6 SeitenHorniman Horticulture Case3happy3100% (1)

- 06 Horniman Student F-1512xDokument5 Seiten06 Horniman Student F-1512xjohn galt0% (2)

- Case 11 Horniman HorticultureDokument4 SeitenCase 11 Horniman HorticultureFaza FadhilahNoch keine Bewertungen

- Horniman Horticulture Case Study SolutionDokument7 SeitenHorniman Horticulture Case Study SolutionshaniaNoch keine Bewertungen

- FY07FY Financial Management and PoliciesDokument5 SeitenFY07FY Financial Management and Policiesjablay29030% (1)

- CASE6Dokument7 SeitenCASE6Yến NhiNoch keine Bewertungen

- BCTC Case 2Dokument10 SeitenBCTC Case 2Trâm Nguyễn QuỳnhNoch keine Bewertungen

- Case 33 California Pizza Kitchen ExhibitsDokument10 SeitenCase 33 California Pizza Kitchen ExhibitsmhogomanNoch keine Bewertungen

- Kota Fibres IncDokument20 SeitenKota Fibres IncMuhamad FudolahNoch keine Bewertungen

- Brown FormanCaseStudyDokument16 SeitenBrown FormanCaseStudyNicholas Reyner TjoegitoNoch keine Bewertungen

- Target Corporation: Ackman Versus The Board: FM2 Case Study AnalysisDokument6 SeitenTarget Corporation: Ackman Versus The Board: FM2 Case Study AnalysisSuman MandalNoch keine Bewertungen

- Butler Lumber Case DiscussionDokument3 SeitenButler Lumber Case DiscussionJayzie Li100% (1)

- Caso American GreetingsDokument11 SeitenCaso American GreetingsPaulo4255Noch keine Bewertungen

- Acova Radiateurs (v7)Dokument4 SeitenAcova Radiateurs (v7)Sarvagya JhaNoch keine Bewertungen

- Analysis On Tiga Pilar SejahteraDokument3 SeitenAnalysis On Tiga Pilar SejahteraridaNoch keine Bewertungen

- Aol Vs Times WarnerDokument5 SeitenAol Vs Times WarnerJyoti GoyalNoch keine Bewertungen

- Kasus 1 - Flinder Valves and Controls IncDokument6 SeitenKasus 1 - Flinder Valves and Controls IncChitaraniKartikadewiNoch keine Bewertungen

- Southland Case StudyDokument7 SeitenSouthland Case StudyRama Renspandy100% (2)

- This Study Resource Was: Group 9 - M&M Pizza Case StudyDokument2 SeitenThis Study Resource Was: Group 9 - M&M Pizza Case StudyAsma AyedNoch keine Bewertungen

- Gso Lenders of Last Resort 2013Dokument12 SeitenGso Lenders of Last Resort 2013Stanley WangNoch keine Bewertungen

- DressenDokument22 SeitenDressenGonz�lez Alonzo Juan ManuelNoch keine Bewertungen

- YPF Repsol CaseDokument30 SeitenYPF Repsol CaseVijoyShankarRoyNoch keine Bewertungen

- Allen Lane Case Write UpDokument2 SeitenAllen Lane Case Write UpAndrew Choi100% (1)

- Case 45 Jetblue ValuationDokument12 SeitenCase 45 Jetblue Valuationshawnybiha100% (1)

- California Pizza Kitchen v3Dokument12 SeitenCalifornia Pizza Kitchen v3xinz1313Noch keine Bewertungen

- Gainesboro Case AnalysisDokument8 SeitenGainesboro Case AnalysisJhimcee Ghlenn Corvera100% (1)

- MGT431 - AppleDokument13 SeitenMGT431 - AppleMokshNoch keine Bewertungen

- Jacobs Division PDFDokument5 SeitenJacobs Division PDFAbdul wahabNoch keine Bewertungen

- Organizational Restructuring and Economic Performance in Leveraged Buyouts: An Ex Post StudyDokument37 SeitenOrganizational Restructuring and Economic Performance in Leveraged Buyouts: An Ex Post StudyPriyanka SinghNoch keine Bewertungen

- 20 How Kimberly-Clark Uses Real OptionsDokument10 Seiten20 How Kimberly-Clark Uses Real OptionsrohanNoch keine Bewertungen

- Jazz Pharmaceuticals Investment Banking Pitch BookDokument20 SeitenJazz Pharmaceuticals Investment Banking Pitch BookdaniellimzyNoch keine Bewertungen

- Linear Technology Payout Policy Case 3Dokument4 SeitenLinear Technology Payout Policy Case 3Amrinder SinghNoch keine Bewertungen

- 7.scotts Turning A Lemon Into LemonadeDokument24 Seiten7.scotts Turning A Lemon Into LemonadeEkaNoch keine Bewertungen

- Bed Bath Beyond (BBBY) Stock ReportDokument14 SeitenBed Bath Beyond (BBBY) Stock Reportcollegeanalysts100% (2)

- Tyco Scandal (2002) : (Acc C607-302A Auditing and Good Governance)Dokument20 SeitenTyco Scandal (2002) : (Acc C607-302A Auditing and Good Governance)Jericho Dupaya100% (2)

- 24 RJR Nabisco - A Case Study of Complex Leveraged Buyout - Financial Analyst's JournalDokument14 Seiten24 RJR Nabisco - A Case Study of Complex Leveraged Buyout - Financial Analyst's JournalJoel DiasNoch keine Bewertungen

- Marketing Report GilletteDokument17 SeitenMarketing Report GilletteQueenie Marie Obial AlasNoch keine Bewertungen

- 300 - PEI - Jun 2019 - DigiDokument24 Seiten300 - PEI - Jun 2019 - Digimick ryanNoch keine Bewertungen

- KKR Annual Review 2006Dokument53 SeitenKKR Annual Review 2006AsiaBuyoutsNoch keine Bewertungen

- Case #7 Butler LumberDokument2 SeitenCase #7 Butler LumberBianca UcheNoch keine Bewertungen

- CORNING Case ExampleDokument13 SeitenCORNING Case ExampleAmanda Thurston0% (1)

- COVID-19 R M&A TransactionsDokument3 SeitenCOVID-19 R M&A TransactionsrdiazeplaNoch keine Bewertungen

- Sabya BhaiDokument6 SeitenSabya BhaiamanNoch keine Bewertungen

- Liquor ProductsDokument33 SeitenLiquor ProductsAdrienne Leigh BasilanNoch keine Bewertungen

- Berkshire - IntroDokument2 SeitenBerkshire - IntroRohith ThatchanNoch keine Bewertungen

- Horniman HorticultureDokument5 SeitenHorniman HorticultureLutfi HakimNoch keine Bewertungen

- Case 11 AaaaaDokument3 SeitenCase 11 Aaaaatrâm quếNoch keine Bewertungen

- Horniman Horticulture: - CasiDokument7 SeitenHorniman Horticulture: - CasiDwi Putro Erianto WicaksonoNoch keine Bewertungen

- Session 7 Case StudyDokument4 SeitenSession 7 Case StudyDiajal HooblalNoch keine Bewertungen

- Case Study On Horniman HorticultureDokument2 SeitenCase Study On Horniman Horticulturesanthosh rameshNoch keine Bewertungen

- Little Bits Marketing and Business PlanDokument14 SeitenLittle Bits Marketing and Business Planlittlebitsinc100% (9)

- THE GAP, INC. - Financial and Strategic Analysis Review: Company Snapshot Company OverviewDokument4 SeitenTHE GAP, INC. - Financial and Strategic Analysis Review: Company Snapshot Company OverviewslidesputnikNoch keine Bewertungen

- Strategic-Case StudyDokument44 SeitenStrategic-Case Studysushma.thapa404Noch keine Bewertungen

- Cargill Annual Report 2013Dokument16 SeitenCargill Annual Report 2013ChawkiTrabelsiNoch keine Bewertungen

- Act.4-8 Ae23Dokument6 SeitenAct.4-8 Ae23Damian Sheila MaeNoch keine Bewertungen

- Module For ACC 206 Understanding ExpensesDokument12 SeitenModule For ACC 206 Understanding ExpensesMerecci Angela De ChavezNoch keine Bewertungen

- Answer A Name Probability: Company/State 0.3 0.5 0.2Dokument53 SeitenAnswer A Name Probability: Company/State 0.3 0.5 0.2nilufar nourinNoch keine Bewertungen

- Basic Concepts and Job Order Cost CycleDokument15 SeitenBasic Concepts and Job Order Cost CycleGlaiza Lipana Pingol100% (2)

- Stuvia 2038540 Fac3762 Exam Pack 2023Dokument223 SeitenStuvia 2038540 Fac3762 Exam Pack 2023Thulani NdlovuNoch keine Bewertungen

- Quiz On Stock ValuationDokument2 SeitenQuiz On Stock ValuationJesse John A. Corpuz0% (1)

- AUDPROBDokument36 SeitenAUDPROBRizza Nicole MacanangNoch keine Bewertungen

- CHAPTER 2 Statement of Comprehensive IncomeDokument13 SeitenCHAPTER 2 Statement of Comprehensive IncomeJM MarquezNoch keine Bewertungen

- Midterm: Hoa Lac Subject: Principles of Accounting (Acc101) Duration: .. Minutes Student InformationDokument2 SeitenMidterm: Hoa Lac Subject: Principles of Accounting (Acc101) Duration: .. Minutes Student InformationNguyen Ngoc Minh Chau (K15 HL)Noch keine Bewertungen

- FM Chapter 3.new-1Dokument11 SeitenFM Chapter 3.new-1Terefe DubeNoch keine Bewertungen

- PT MBSS TBK - 31 Desember 2022 (FINAL)Dokument98 SeitenPT MBSS TBK - 31 Desember 2022 (FINAL)Reza RizaldiNoch keine Bewertungen

- Tugas Cost of Capital QuestionsDokument7 SeitenTugas Cost of Capital Questionssmoky 22Noch keine Bewertungen

- Department of Accounting University of Jaffna-Sri Lanka Programme TitleDokument8 SeitenDepartment of Accounting University of Jaffna-Sri Lanka Programme TitleajanthahnNoch keine Bewertungen

- FIM Exel 1 1Dokument46 SeitenFIM Exel 1 1Bao Khanh HaNoch keine Bewertungen

- Business Strat Analysis - Costs Concepts and ClassificationsDokument37 SeitenBusiness Strat Analysis - Costs Concepts and Classificationskristelle0marisseNoch keine Bewertungen

- 1차 문제은행 국제재무기초 이상휘Dokument50 Seiten1차 문제은행 국제재무기초 이상휘JunNoch keine Bewertungen

- Audited Financial StatementDokument17 SeitenAudited Financial StatementVictor BiacoloNoch keine Bewertungen

- Final SLP Accounting For ReceivablesDokument26 SeitenFinal SLP Accounting For ReceivablesLovely Joy SantiagoNoch keine Bewertungen

- Module 7Dokument5 SeitenModule 7trixie maeNoch keine Bewertungen

- Swiss Cottage 2023 Prelim P1 AnswersDokument5 SeitenSwiss Cottage 2023 Prelim P1 Answersvikalp.singh.sengarNoch keine Bewertungen

- Seatwork 01 Audit of Intangible Assets - ReviewDokument4 SeitenSeatwork 01 Audit of Intangible Assets - ReviewDan Andrei BongoNoch keine Bewertungen

- Group Assignment 1Dokument2 SeitenGroup Assignment 1Adis TsegayNoch keine Bewertungen

- Book 2Dokument2 SeitenBook 2Piyush JainNoch keine Bewertungen

- (ACYFAR2) Toribio Critique Paper K36.editedDokument12 Seiten(ACYFAR2) Toribio Critique Paper K36.editedHannah Jane ToribioNoch keine Bewertungen

- Cash Flow Part 2 To 7 Term 2 Sunil PandaDokument35 SeitenCash Flow Part 2 To 7 Term 2 Sunil PandaAnupama SinghNoch keine Bewertungen

- Capital Structure Analysis of Hero HondaDokument7 SeitenCapital Structure Analysis of Hero HondaNiklesh ChandakNoch keine Bewertungen

- Guiding PrinciplesDokument39 SeitenGuiding PrinciplestiwariajaykNoch keine Bewertungen

- Transcom Annual Report 2022Dokument56 SeitenTranscom Annual Report 2022John ProticNoch keine Bewertungen

- Capital Budgeting AssignmentDokument3 SeitenCapital Budgeting AssignmentRobert JohnsonNoch keine Bewertungen

- Ch12 Segment Reporting and DecentralizationDokument84 SeitenCh12 Segment Reporting and DecentralizationMaricar CachilaNoch keine Bewertungen

- Summary of Zero to One: Notes on Startups, or How to Build the FutureVon EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureBewertung: 4.5 von 5 Sternen4.5/5 (100)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsVon EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsBewertung: 5 von 5 Sternen5/5 (48)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeVon EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeBewertung: 4.5 von 5 Sternen4.5/5 (90)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurVon Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurBewertung: 4.5 von 5 Sternen4.5/5 (3)

- The Master Key System: 28 Parts, Questions and AnswersVon EverandThe Master Key System: 28 Parts, Questions and AnswersBewertung: 5 von 5 Sternen5/5 (62)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthVon EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthBewertung: 4.5 von 5 Sternen4.5/5 (1027)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldVon Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldBewertung: 5 von 5 Sternen5/5 (20)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizVon EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizBewertung: 4.5 von 5 Sternen4.5/5 (112)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryVon EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryBewertung: 4 von 5 Sternen4/5 (26)

- Having It All: Achieving Your Life's Goals and DreamsVon EverandHaving It All: Achieving Your Life's Goals and DreamsBewertung: 4.5 von 5 Sternen4.5/5 (65)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedVon EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedBewertung: 4.5 von 5 Sternen4.5/5 (38)

- Transformed: Moving to the Product Operating ModelVon EverandTransformed: Moving to the Product Operating ModelBewertung: 4 von 5 Sternen4/5 (1)

- Entrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveVon EverandEntrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveBewertung: 4.5 von 5 Sternen4.5/5 (89)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveVon EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNoch keine Bewertungen

- Every Tool's a Hammer: Life Is What You Make ItVon EverandEvery Tool's a Hammer: Life Is What You Make ItBewertung: 4.5 von 5 Sternen4.5/5 (249)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelVon EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelBewertung: 5 von 5 Sternen5/5 (51)

- Your Next Five Moves: Master the Art of Business StrategyVon EverandYour Next Five Moves: Master the Art of Business StrategyBewertung: 5 von 5 Sternen5/5 (802)

- Summary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberVon EverandSummary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberBewertung: 5 von 5 Sternen5/5 (39)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleVon EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleBewertung: 4.5 von 5 Sternen4.5/5 (48)

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyVon EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyBewertung: 5 von 5 Sternen5/5 (22)

- Think Like Amazon: 50 1/2 Ideas to Become a Digital LeaderVon EverandThink Like Amazon: 50 1/2 Ideas to Become a Digital LeaderBewertung: 4.5 von 5 Sternen4.5/5 (60)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessVon EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessBewertung: 4.5 von 5 Sternen4.5/5 (25)

- Anything You Want: 40 lessons for a new kind of entrepreneurVon EverandAnything You Want: 40 lessons for a new kind of entrepreneurBewertung: 5 von 5 Sternen5/5 (46)

- Summary of $100M Offers: How To Make Offers So Good People Feel Stupid Saying NoVon EverandSummary of $100M Offers: How To Make Offers So Good People Feel Stupid Saying NoBewertung: 4 von 5 Sternen4/5 (1)

- Built to Serve: Find Your Purpose and Become the Leader You Were Born to BeVon EverandBuilt to Serve: Find Your Purpose and Become the Leader You Were Born to BeBewertung: 5 von 5 Sternen5/5 (25)

- 7 Secrets to Investing Like Warren BuffettVon Everand7 Secrets to Investing Like Warren BuffettBewertung: 4.5 von 5 Sternen4.5/5 (121)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessVon EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessBewertung: 4.5 von 5 Sternen4.5/5 (407)

- Cryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyVon EverandCryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyBewertung: 4.5 von 5 Sternen4.5/5 (300)