Beruflich Dokumente

Kultur Dokumente

Análisis Técnico Soriana

Hochgeladen von

Gustavo Jiménez RuánOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Análisis Técnico Soriana

Hochgeladen von

Gustavo Jiménez RuánCopyright:

Verfügbare Formate

PDF Report issued on the 11/03/2015

ORGANIZACION SORIANA SAB DE CV

Company Profile

BOLSA MEXICANA DE VALORES (MEXICAN STOCK EXCHANGE) / SORIANA B / MXP8728U1671

Business Summary

Sector

Organizacin Soriana SAB de CV operates a chain of supermarkets.

>> Supermarkets & Convenience Stores

The company's business divisions are made up of Groceries, Perishables, Clothing, General Merchandise and Others.

Income Statement Evolution

It retails and wholesales fresh produce, prepared foods, household electronics and apparel.

Organizacion Soriana SAB de CV :

The company was founded by Francisco Martin Borque and Armando Martin Borque in 1968 and is headquartered in

Monterrey, Mexico.

EPS - Rate of surprise

Organizacion Soriana SAB de CV :

Number of employees : 80 900 persons.

Managers

Sales per Businesses

Name

2012

MXN (in Million)

Supermarket

102,605

2013

%

100%

MXN (in Million)

102,853

97.9%

MXN (in Million)

Mexico

102,605

2013

%

100%

Upcoming events on ORGANIZACION SORIANA SAB DE CV

04/24/15

07/24/15

Q1 2015 Earnings Release (Projected)

Interim 2015 Earnings Release (Projected)

10/23/15

Q3 2015 Earnings Release (Projected)

MXN (in Million)

102,853

97.9%

Since

Ricardo Martn

Bringas

54

1991

Chief Executive Officer &

Director

+0.24%

Francisco Javier

Martn Bringas

62

1986

Chairman

Aurelio Oscar

Adn Hernndez

62

Chief Financial Officer & HeadInvestor Relations

Sergio Fernando

Martnez San

Germn

58

CTO, Director-Systems &

Administration

Ana Mara Martn

Bringas

64

1994

Delta

+0.24%

Director

Shareholders

Name

Shares

1,031,741,928

57.3%

518,745,099

28.8%

Aberdeen Asset Managers Ltd.

60,161,281

3.34%

23,357,662

1.30%

6,631,974

0.37%

Martin Bringas Family

Martin Soberon Family

Past events on ORGANIZACION SORIANA SAB DE CV

Title

Delta

Sales per Regions

2012

Age

10/24/14

Q3 2014 Earnings Release

Dimensional Fund Advisors LP

08/15/14

ex-dividend day for annual dividend

The Vanguard Group, Inc.

07/25/14

04/29/14 | 12:00pm

Interim 2014 Earnings Release

Annual General Meeting

Company contact info

Alejandro de Rodas 3102-A

Colonia Cumbres

8 Sector

Monterrey, Nuevo Leon 64610

Phone : +52.81.8329.9000

Fax : +52.81.8329.9122

Web : www.soriana.com.mx

Disclaimer : Marketscreener.com is a website published by SURPERFORMANCE SAS. Surperformance or Marketscreener.com is not a registered broker-dealer nor

a registered investment adviser. You understand that this web site and its content is furnished for your personal, noncommercial, informational purposes only, and that

no mention of a particular security in this website constitutes a recommendation to buy, sell, or hold any other security, nor that any particular security, portfolio of

securities, transaction or investment strategy is suitable for any specific person. Surperformance and Marketscreener.com services...

http://www.4-traders.com

Page 1 of 6

PDF Report issued on the 11/03/2015

ORGANIZACION SORIANA SAB DE CV

Financials and Forecast

BOLSA MEXICANA DE VALORES (MEXICAN STOCK EXCHANGE) / SORIANA B / MXP8728U1671

Income Statement Evolution : Past and Forecast

Financial Ratios

Organizacion Soriana SAB de CV :

Size

Annual Income Statement Data : Past and Forecast

Actuals in M MXN

Fiscal Period December

Sales

Operating income (EBITDA)

2012

2013

Estimates in M MXN

2014

2015

2016

2017

104 611

105 028

101 829

108 222

113 154

116 835

7 407

7 534

7 700

8 115

8 573

2015e

2016e

Capitalization

59 724 M MXN

Entreprise Value (EV)

57 284 M MXN

55 246 M MXN

Valuation

2015e

2016e

PER (Price / EPS)

15,2x

14,4x

Capitalization / Revenue

0,55x

0,53x

EV / Revenue

0,53x

0,49x

EV / EBITDA

7,44x

6,81x

0,66%

1,19%

1,20x

1,12x

Operating profit (EBIT)

5 430

5 558

4 977

5 455

5 817

6 192

Pre-Tax Profit (EBT)

5 225

5 326

4 578

5 607

6 168

5 594

Net income

3 613

3 117

3 704

3 887

4 282

3 915

EPS ( MXN)

2,00

1,73

2,06

2,18

2,30

2,37

Operating Margin (EBIT / Sales)

operating Leverage (Delta EBIT / Delta Sales)

Yield (DPS / Price)

Price to book (Price / BVPS)

Profitability

Dividend per Share ( MXN)

Yield

Announcement Date

0,28

0,22

0,39

0,14

0,84%

0,66%

1,19%

0,42%

02/25/2013

04:41pm

Finances - Leverage : Past and Forecast

Organizacion Soriana SAB de CV :

02/28/2014

12:11am

02/25/2015

04:10pm

2015e

2016e

5,04% 5,14%

1,53x

1,46x

Net Margin (Net Profit / Revenue)

3,59% 3,78%

ROA (Net Profit / Asset)

4,73% 5,06%

ROE (Net Profit / Equities)

8,04% 8,23%

Rate of Dividend

10,0% 17,2%

Balance Sheet Analysis

2015e

2016e

CAPEX / Sales

3,08%

3,47%

Cash Flow / Sales (Taux d'autofinancement)

5,18%

5,13%

0,76x

0,75x

-0,32x

-0,55x

Capital Intensity (Assets / Sales)

Financial Leverage (Net Debt / EBITDA)

Revenue Revisions

Organizacion Soriana SAB de CV :

EPS Revisions

Organizacion Soriana SAB de CV :

Disclaimer : 4-traders.com is a website published by SURPERFORMANCE SAS. Surperformance or 4-traders.com is not a registered broker-dealer nor a registered

investment adviser. You understand that this web site and its content is furnished for your personal, noncommercial, informational purposes only, and that no mention

of a particular security in this website constitutes a recommendation to buy, sell, or hold any other security, nor that any particular security, portfolio of securities,

transaction or investment strategy is suitable for any specific person.

http://www.4-traders.com

Page 2 of 6

PDF Report issued on the 11/03/2015

ORGANIZACION SORIANA SAB DE CV

Analysts' Consensus

BOLSA MEXICANA DE VALORES (MEXICAN STOCK EXCHANGE) / SORIANA B / MXP8728U1671

Evolution of the average consensus target price

Organizacion Soriana SAB de CV :

Target Price consensus revisions : last 18 months

Organizacion Soriana SAB de CV :

Consensus

Sell

Mean consensus

Buy

HOLD

Number of Analysts

16

Average target price

39,3 MXN

Last Close Price

33,2 MXN

Spread / Highest target

39%

Spread / Average Target

18%

-4,0%

Spread / Lowest Target

Consensus detail

Organizacion Soriana SAB de CV :

Consensus revision (last 18 months)

Organizacion Soriana SAB de CV :

Disclaimer : 4-traders.com is a website published by SURPERFORMANCE SAS. Surperformance or 4-traders.com is not a registered broker-dealer nor a registered

investment adviser. You understand that this web site and its content is furnished for your personal, noncommercial, informational purposes only, and that no mention

of a particular security in this website constitutes a recommendation to buy, sell, or hold any other security, nor that any particular security, portfolio of securities,

transaction or investment strategy is suitable for any specific person.

http://www.4-traders.com

Page 3 of 6

PDF Report issued on the 11/03/2015

ORGANIZACION SORIANA SAB DE CV

Sector and Competitors

BOLSA MEXICANA DE VALORES (MEXICAN STOCK EXCHANGE) / SORIANA B / MXP8728U1671

Chart Sector

Organizacion Soriana SAB de CV :

Subsector Supermarkets & Convenience Stores

1st jan.

Capitalisation (M$)

-19.43%

3 822

CARREFOUR

20.81%

24 020

ALIMENTATION COUCHE-TARD IN..

-4.65%

20 973

WHOLE FOODS MARKET, INC.

8.07%

19 658

DAIRY FARM INTERNATIONAL HO..

5.97%

13 102

EMAAR MALLS GROUP PJSC

5.22%

9 992

J SAINSBURY PLC

7.78%

7 676

METRO, INC.

11.56%

6 911

LAWSON INC

9.20%

6 597

CENCOSUD SA

--.--%

6 295

E MART CO LTD

--.--%

5 384

YONGHUI SUPERSTORES CO., LT..

7.00%

4 844

SHANGHAI BAILIAN GROUP INC ..

2.68%

4 839

FAMILYMART CO LTD

9.29%

4 267

GS HOLDINGS CORP.

--.--%

3 624

KESKO OYJ

14.91%

3 611

CASEY'S GENERAL STORES INC

-3.07%

3 401

GRUPO COMERCIAL CHEDRAUI SA..

12.29%

2 930

0.00%

2 826

26.95%

2 780

--.--%

2 693

ORGANIZACION SORIANA SAB DE..

AXFOOD AB

SONAE

ROBINSONS RETAIL HOLDINGS I..

Best Growth (Revenue) : Yonghui Superstores Co.

Best Profitability : Emaar Malls Group PJSC

Best Situation Fi. : FamilyMart Co Ltd

Best EPS revision 4m. : Casey's General Stores

Best Valuation : J Sainsbury plc

Best Investor Rating : Whole Foods Market, Inc

Growth (Revenue)

Profitability

Finances

Valuation

PER

EPS revision 4m.

Worst Growth (Revenue) : SONAE

Worst Profitability : Alimentation Couche-Tar

Worst Situation Fi. : Shanghai Bailian Group

Worst EPS revision 4m. : J Sainsbury plc

Worst Valuation : Shanghai Bailian Group

Worst Investor Rating : Shanghai Bailian Group

Disclaimer : 4-traders.com is a website published by SURPERFORMANCE SAS. Surperformance or 4-traders.com is not a registered broker-dealer nor a registered

investment adviser. You understand that this web site and its content is furnished for your personal, noncommercial, informational purposes only, and that no mention

of a particular security in this website constitutes a recommendation to buy, sell, or hold any other security, nor that any particular security, portfolio of securities,

transaction or investment strategy is suitable for any specific person.

http://www.4-traders.com

Page 4 of 6

PDF Report issued on the 11/03/2015

ORGANIZACION SORIANA SAB DE CV

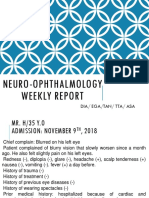

Technical Analysis

BOLSA MEXICANA DE VALORES (MEXICAN STOCK EXCHANGE) / SORIANA B / MXP8728U1671

Daily chart

Technical analysis trends

Short Term

Mid-Term

Long Term

Bearish

Bearish

Bearish

35,3

39,5

41,3

Spread/Res.

-5,9%

-16%

-20%

Spread/Supp.

2,2%

2,2%

0,67%

Support

32,5

32,5

33,0

Trend

Resistance

Indicators

STIM

RSI 14 days

MA20

MA50

MA100

MA20 / Price

MA50 / Price

MA100 / Price

22.56

34.79

36.33

38.77

-4.85%

-9.49%

-16.85%

Volumes

Session volume

Avg. Volume 20 sessions

Volume ratio

Session exchange

Avg. Exchange 20 sessions

Number of securities

Swapped fund session

537 210

390 026

1.38

17 824 628MXN

12 941 063MXN

1 800 000 000

0.03%

Changes at 03/10 market close

Weekly chart

5-day price change

Change as of January 1

1-year price change

10-year price change

-2.41%

-17.67%

-14.40%

-21.95%

Extremes

10-year High (05/13/2013)

10-year Low (10/24/2008)

Disclaimer : 4-traders.com is a website published by SURPERFORMANCE SAS. Surperformance or 4-traders.com is not a registered broker-dealer nor a registered

investment adviser. You understand that this web site and its content is furnished for your personal, noncommercial, informational purposes only, and that no mention

of a particular security in this website constitutes a recommendation to buy, sell, or hold any other security, nor that any particular security, portfolio of securities,

transaction or investment strategy is suitable for any specific person.

50.94

17.9

http://www.4-traders.com

Page 5 of 6

PDF Report issued on the 11/03/2015

ORGANIZACION SORIANA SAB DE CV

Summary

BOLSA MEXICANA DE VALORES (MEXICAN STOCK EXCHANGE) / SORIANA B / MXP8728U1671

Strengths

Surperformance ratings of Organizacion Soriana

SAB de CV

Overall rating

The company is one of the most undervalued, with an "enterprise value to sales" ratio at 0.53 for

the 2015 fiscal year.

The difference between current prices and the average target price is rather important and implies

a significant appreciation potential for the stock.

Trading Rating

Investor Rating

Growth (Revenue)

Share prices are approaching a strong support area in daily data, which offers good timing for

investors.

Valuation

The current area is a good opportunity for investors interested in buying the stock in a mid or longterm perspective. Indeed, the share is moving closer to its lower bound at MXN 32.96 MXN in

weekly data.

Profitability

The company has solid fundamentals for a short-term investment strategy.

Finances

Earnings quality

Business Predictability

PER

Potential

Weaknesses

Yield

The group usually releases earnings worse than estimated.

The company is not the most generous with respect to shareholders' compensation.

For the last twelve months, sales expectations have been significantly downgraded, which means

that less important sales volumes are expected for the current fiscal year over the previous period.

For the past seven days, analysts have been lowering their EPS expectations for the company.

Most analysts recommend that the stock should be sold or reduced.

Consensus

7 days EPS revision

4 months EPS revision

1 year EPS revision

4 months Revenue revision

1 year Revenue revision

Surperformance rating of Organizacion Soriana

SAB de CV

Overall rating

Short Term Timing

Middle Term Timing

Long Term Timing

RSI

Bollinger Spread

Unusual Volumes

STIM

Disclaimer : 4-traders.com is a website published by SURPERFORMANCE SAS. Surperformance or 4-traders.com is not a registered broker-dealer nor a registered

investment adviser. You understand that this web site and its content is furnished for your personal, noncommercial, informational purposes only, and that no mention

of a particular security in this website constitutes a recommendation to buy, sell, or hold any other security, nor that any particular security, portfolio of securities,

transaction or investment strategy is suitable for any specific person.

http://www.4-traders.com

Page 6 of 6

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Management of Preterm LaborDokument2 SeitenManagement of Preterm LaborpolygoneNoch keine Bewertungen

- Exercises - Fluid MechanicsDokument3 SeitenExercises - Fluid MechanicsgemnikkicNoch keine Bewertungen

- Nta855 C400 D6 PDFDokument110 SeitenNta855 C400 D6 PDFIsmael Grünhäuser100% (4)

- Home Composting SystemsDokument8 SeitenHome Composting Systemssumanenthiran123Noch keine Bewertungen

- BV Lesson Plan 4Dokument3 SeitenBV Lesson Plan 4api-252119803Noch keine Bewertungen

- Ventricular Septal DefectDokument8 SeitenVentricular Septal DefectWidelmark FarrelNoch keine Bewertungen

- Riber 6-s1 SP s17-097 336-344Dokument9 SeitenRiber 6-s1 SP s17-097 336-344ᎷᏒ'ᏴᎬᎪᏚᎢ ᎷᏒ'ᏴᎬᎪᏚᎢNoch keine Bewertungen

- OPSS1213 Mar98Dokument3 SeitenOPSS1213 Mar98Tony ParkNoch keine Bewertungen

- How McDonald'sDokument2 SeitenHow McDonald'spratik khandualNoch keine Bewertungen

- Electri RelifDokument18 SeitenElectri Relifsuleman247Noch keine Bewertungen

- 2 Dawn150Dokument109 Seiten2 Dawn150kirubelNoch keine Bewertungen

- A Project Report On A Study On Amul Taste of India: Vikash Degree College Sambalpur University, OdishaDokument32 SeitenA Project Report On A Study On Amul Taste of India: Vikash Degree College Sambalpur University, OdishaSonu PradhanNoch keine Bewertungen

- High Speed DoorsDokument64 SeitenHigh Speed DoorsVadimMedooffNoch keine Bewertungen

- PPR Soft Copy Ayurvedic OkDokument168 SeitenPPR Soft Copy Ayurvedic OkKetan KathaneNoch keine Bewertungen

- Case Report CMV RetinitisDokument27 SeitenCase Report CMV RetinitistaniamaulaniNoch keine Bewertungen

- Arsenal Strength Catalog 6.2-1Dokument41 SeitenArsenal Strength Catalog 6.2-1Mohammed NavedNoch keine Bewertungen

- ResumeDokument3 SeitenResumejohn DaqueNoch keine Bewertungen

- Feeder BrochureDokument12 SeitenFeeder BrochureThupten Gedun Kelvin OngNoch keine Bewertungen

- DPA Fact Sheet Women Prison and Drug War Jan2015 PDFDokument2 SeitenDPA Fact Sheet Women Prison and Drug War Jan2015 PDFwebmaster@drugpolicy.orgNoch keine Bewertungen

- Service Manual: Multifunction Electrical Tester CalibratorDokument106 SeitenService Manual: Multifunction Electrical Tester CalibratorJuan Carlos Ferrer OrtizNoch keine Bewertungen

- Finite Element Analysis Project ReportDokument22 SeitenFinite Element Analysis Project ReportsaurabhNoch keine Bewertungen

- Parche CRP 65 - Ficha Técnica - en InglesDokument2 SeitenParche CRP 65 - Ficha Técnica - en IngleserwinvillarNoch keine Bewertungen

- Food and Beverage Control Systems Can Help You Introduce The Same Financial Rigour To Your Dining Establishment or Catering Company That YouDokument11 SeitenFood and Beverage Control Systems Can Help You Introduce The Same Financial Rigour To Your Dining Establishment or Catering Company That Younarinder singh saini100% (4)

- Xi 3 1Dokument1 SeiteXi 3 1Krishnan KozhumamNoch keine Bewertungen

- Brief RESUME EmailDokument4 SeitenBrief RESUME Emailranjit_kadalg2011Noch keine Bewertungen

- Science and TechnologyDokument21 SeitenScience and TechnologyPat MillerNoch keine Bewertungen

- Principles of Health Management: Mokhlis Al Adham Pharmacist, MPHDokument26 SeitenPrinciples of Health Management: Mokhlis Al Adham Pharmacist, MPHYantoNoch keine Bewertungen

- Food Processing NC II - SAGDokument4 SeitenFood Processing NC II - SAGNylmazdahr Sañeud DammahomNoch keine Bewertungen

- Standards Spec Brochure ME WEBDokument44 SeitenStandards Spec Brochure ME WEBReza TambaNoch keine Bewertungen

- Revision Ror The First TermDokument29 SeitenRevision Ror The First TermNguyễn MinhNoch keine Bewertungen