Beruflich Dokumente

Kultur Dokumente

Scheduled Commercial Banks - Business in India: Reserve Bank of India Bulletin Weekly Statistical Supplement

Hochgeladen von

Priyanka JainOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Scheduled Commercial Banks - Business in India: Reserve Bank of India Bulletin Weekly Statistical Supplement

Hochgeladen von

Priyanka JainCopyright:

Verfügbare Formate

RESERVE BANK OF INDIA BULLETIN WEEKLY STATISTICAL SUPPLEMENT

4. Scheduled Commercial Banks - Business in India

(` Billion)

Outstanding

as on Feb. 6,

2015

1

Item

1 Liabilities to the Banking System

1.1 Demand and Time Deposits from Banks

1.2 Borrowings from Banks

1.3 Other Demand and Time Liabilities

2 Liabilities to Others

2.1 Aggregate Deposits

2.1a Growth (Per cent)

2.1.1 Demand

2.1.2 Time

2.2 Borrowings

2.3 Other Demand and Time Liabilities

3. Borrowings from Reserve Bank

4 Cash in Hand and Balances with Reserve Bank

4.1 Cash in hand

4.2 Balances with Reserve Bank

5 Assets with the Banking System

5.1 Balances with Other Banks

5.2 Money at Call and Short Notice

5.3 Advances to Banks

5.4 Other Assets

6 Investments

6.1a Growth (Per cent)

6.1 Government Securities

6.2 Other Approved Securities

7 Bank Credit

7.1a Growth (Per cent)

7a.1 Food Credit

7a.2 Non-food credit

7b.1 Loans, Cash credit and Overdrafts

7b.2 Inland Bills Purchased

7b.3 Discounted

7b.4 Foreign Bills Purchased

7b.5 Discounted

Fortnight

2

Variation over

Financial year so far

2013-14

2014-15

3

4

Year-on-Year

2014

2015

5

6

1,069.7

402.4

51.1

15.8

27.4

32.5

145.2

174.3

23.5

292.6

52.7

83.9

69.8

83.9

8.6

368.3

183.1

16.3

84,629.2

622.5

0.7

117.7

504.7

29.9

295.4

278.2

138.2

7.4

145.6

8,208.9

12.2

169.1

8,039.8

99.1

111.7

190.5

359.5

30.3

329.2

7,573.6

9.8

441.9

7,131.7

30.4

224.2

403.5

526.7

57.8

468.8

9,965.7

15.2

680.2

9,285.5

182.2

304.4

229.3

342.2

30.8

311.4

8,915.8

11.8

789.1

8,126.7

135.8

379.5

413.3

561.7

81.4

480.4

15.6

10.6

9.9

2.1

65.7

0.3

67.1

1.4

477.0

0.7

0.2

477.2

482.8

1.6

13.3

4.6

12.9

10.3

122.4

6.3

408.2

2,247.8

11.2

2,255.6

7.8

5,750.9

10.9

142.9

5,608.0

5,600.6

138.7

45.0

40.3

16.3

311.6

61.5

27.1

140.1

3,142.2

14.2

3,138.6

3.6

4,474.2

7.5

45.1

4,429.1

4,549.8

39.4

59.6

23.0

72.7

159.7

11.1

44.4

270.2

2,326.0

11.6

2,329.9

3.9

7,360.1

14.4

19.8

7,340.3

7,062.4

158.5

44.9

49.1

45.1

423.4

42.9

7.1

104.9

2,961.6

13.3

2,958.4

3.2

6,059.7

10.4

77.3

6,136.9

6,048.2

42.4

115.8

15.3

46.6

7,581.1

77,048.1

2,179.9

4,607.5

819.7

4,148.8

516.5

3,632.3

1,373.8

216.5

140.3

302.6

25,270.4

25,250.6

19.9

64,415.2

1,029.8

63,385.3

62,240.6

345.0

1,165.4

239.9

424.4

5. Ratios and Rates

(Per cent)

Item/Week Ended

Ratios

Cash Reserve Ratio

Statutory Liquidity Ratio

Cash-Deposit Ratio

Credit-Deposit Ratio

Incremental Credit-Deposit Ratio

Investment-Deposit Ratio

Incremental Investment-Deposit Ratio

Rates

Policy Repo Rate

Reverse Repo Rate

Marginal Standing Facility (MSF) Rate

Bank Rate

Base Rate

Term Deposit Rate >1 Year

Savings Deposit Rate

Call Money Rate (Weighted Average)

91-Day Treasury Bill (Primary) Yield

182-Day Treasury Bill (Primary) Yield

364-Day Treasury Bill (Primary) Yield

10-Year Government Securities Yield

RBI Reference Rate and Forward Premia

INR-US$ Spot Rate ( ` Per Foreign Currency)

INR-Euro Spot Rate ( ` Per Foreign Currency)

Forward Premia of US$ 1-month

3-month

6-month

2014

Feb. 14

1

Jan. 16

2

Jan. 23

3

2015

Jan. 30

4

Feb. 6

5

Feb. 13

6

4.00

23.00

..

..

..

..

..

4.00

22.00

..

..

..

..

..

4.00

22.00

4.77

76.11

57.50

30.00

44.26

4.00

22.00

..

..

..

..

..

4.00

22.00

4.90

76.11

59.08

29.86

41.49

4.00

21.50

..

..

..

..

..

8.00

7.00

9.00

9.00

10.00/10.25

8.00/9.10

4.00

8.90

9.11

9.08

..

8.83

7.75

6.75

8.75

8.75

10.00/10.25

8.00/8.75

4.00

7.94

8.39

8.25

..

7.75

7.75

6.75

8.75

8.75

10.00/10.25

8.00/8.75

4.00

7.85

8.19

..

7.91

7.74

7.75

6.75

8.75

8.75

10.00/10.25

8.00/8.75

4.00

7.79

8.23

8.14

..

7.69

7.75

6.75

8.75

8.75

10.00/10.25

8.00/8.75

4.00

7.64

8.27

..

8.04

7.72

7.75

6.75

8.75

8.75

10.00/10.25

8.00/8.75

4.00

7.78

8.27

8.25

..

7.71

62.28

85.18

8.29

8.86

8.54

61.89

72.01

7.95

7.63

7.21

61.50

69.62

7.61

7.74

7.32

61.76

70.03

7.09

7.84

7.35

61.74

70.79

7.09

7.81

7.52

62.14

71.05

7.34

7.79

7.60

February 20, 2015

Das könnte Ihnen auch gefallen

- Bank Balance Sheet Components and ALM OverviewDokument41 SeitenBank Balance Sheet Components and ALM Overviewgaurav112011Noch keine Bewertungen

- Alternative Investment Strategies and Risk Management: Improve Your Investment Portfolio’S Risk–Reward RatioVon EverandAlternative Investment Strategies and Risk Management: Improve Your Investment Portfolio’S Risk–Reward RatioBewertung: 5 von 5 Sternen5/5 (2)

- Leadership Theories and StylesDokument13 SeitenLeadership Theories and Stylessalim1321Noch keine Bewertungen

- Assets and Liability ManagementDokument42 SeitenAssets and Liability Managementssubha123100% (4)

- Major Bank Fraud Cases: A Critical ReviewVon EverandMajor Bank Fraud Cases: A Critical ReviewBewertung: 4.5 von 5 Sternen4.5/5 (6)

- Asset Liability ManagementDokument84 SeitenAsset Liability ManagementAmrita Jha100% (1)

- Regional Rural Banks of India: Evolution, Performance and ManagementVon EverandRegional Rural Banks of India: Evolution, Performance and ManagementNoch keine Bewertungen

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsVon EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNoch keine Bewertungen

- Scheduled Commercial Banks - Business in India: Reserve Bank of India Bulletin Weekly Statistical SupplementDokument1 SeiteScheduled Commercial Banks - Business in India: Reserve Bank of India Bulletin Weekly Statistical Supplementb_nagarjuna5814Noch keine Bewertungen

- Scheduled Commercial Banks - Business in India: (' Billion)Dokument1 SeiteScheduled Commercial Banks - Business in India: (' Billion)AkashNoch keine Bewertungen

- Scheduled Commercial Banks - Business in India: Reserve Bank of India Bulletin Weekly Statistical SupplementDokument1 SeiteScheduled Commercial Banks - Business in India: Reserve Bank of India Bulletin Weekly Statistical SupplementmkmanojdevilNoch keine Bewertungen

- Scheduled Commercial Banks - Business in India: (? Billion)Dokument1 SeiteScheduled Commercial Banks - Business in India: (? Billion)sasirekaarumugamNoch keine Bewertungen

- Scheduled Commercial Banks - Business in India: Reserve Bank of India Bulletin Weekly Statistical SupplementDokument1 SeiteScheduled Commercial Banks - Business in India: Reserve Bank of India Bulletin Weekly Statistical SupplementMukul BabbarNoch keine Bewertungen

- Mod 5 Topic 1 PDFDokument1 SeiteMod 5 Topic 1 PDFManipalGlobalNoch keine Bewertungen

- Annex - I: Sources of DataDokument4 SeitenAnnex - I: Sources of Dataankit71420Noch keine Bewertungen

- Reserve Bank of India - Liabilities and AssetsDokument1 SeiteReserve Bank of India - Liabilities and Assetsbookie101Noch keine Bewertungen

- RBI's 2005-06 Annual ReportDokument10 SeitenRBI's 2005-06 Annual ReportporuterNoch keine Bewertungen

- Constituents of Balance Sheet: Team-3Dokument45 SeitenConstituents of Balance Sheet: Team-3AnilKumarNoch keine Bewertungen

- Introduction To Asset Liability and Risk MGMTDokument147 SeitenIntroduction To Asset Liability and Risk MGMTMani ManandharNoch keine Bewertungen

- RBI Weekly Statistical Supplement GuideDokument38 SeitenRBI Weekly Statistical Supplement Guidemohitvishal34Noch keine Bewertungen

- Financial Data Highlights of Scheduled Commercial Banks in IndiaDokument2 SeitenFinancial Data Highlights of Scheduled Commercial Banks in Indiansgowrish007Noch keine Bewertungen

- Master Circular - CRR and SLR - 2010Dokument24 SeitenMaster Circular - CRR and SLR - 2010prathi05Noch keine Bewertungen

- Monthly Test - February 2020Dokument7 SeitenMonthly Test - February 2020Keigan ChatterjeeNoch keine Bewertungen

- ALM in BanksDokument65 SeitenALM in BanksrockpdNoch keine Bewertungen

- RBI Policy Weak Policy Given The Economy & Frozen Credit MarketsDokument10 SeitenRBI Policy Weak Policy Given The Economy & Frozen Credit MarketsKeigan ChatterjeeNoch keine Bewertungen

- CRR, SLR: Dr.S.C.BihariDokument16 SeitenCRR, SLR: Dr.S.C.BihariAbhi2636100% (1)

- Banking Statistics GuideDokument63 SeitenBanking Statistics GuideKirubaker PrabuNoch keine Bewertungen

- CRR and SLR MCDokument26 SeitenCRR and SLR MCNagaratnam ChandrasekaranNoch keine Bewertungen

- RBI Monthly Roundup: On-tap bank licence rejections, outward remittances hit record highDokument122 SeitenRBI Monthly Roundup: On-tap bank licence rejections, outward remittances hit record highAtul sharmaNoch keine Bewertungen

- TOI - How RBI - Bring Dollars - Arrest Rupee's SlideDokument5 SeitenTOI - How RBI - Bring Dollars - Arrest Rupee's Slidekarthik sNoch keine Bewertungen

- CRR and SLR Requirements for BanksDokument25 SeitenCRR and SLR Requirements for BanksSamhitha KandlakuntaNoch keine Bewertungen

- GK Power Capsule NICL AO Assistant 2015Dokument45 SeitenGK Power Capsule NICL AO Assistant 2015Abbie HudsonNoch keine Bewertungen

- CRR-SLR in BanksDokument25 SeitenCRR-SLR in BanksPrashant GargNoch keine Bewertungen

- Banking Awareness Model Question Paper For IBPS PO and Clerks ExamsDokument19 SeitenBanking Awareness Model Question Paper For IBPS PO and Clerks Examshackna100% (1)

- Cash Reserve Ratio (CRR) & Statutory Liquidity Ratio (SLR) Cash Reserve Ratio (CRR)Dokument4 SeitenCash Reserve Ratio (CRR) & Statutory Liquidity Ratio (SLR) Cash Reserve Ratio (CRR)Sushil KumarNoch keine Bewertungen

- DJ WorkDokument49 SeitenDJ WorkPratik GhadeNoch keine Bewertungen

- QuizDokument51 SeitenQuizIndu GuptaNoch keine Bewertungen

- Understanding Bank Financial StatementsDokument49 SeitenUnderstanding Bank Financial StatementsRajat MehtaNoch keine Bewertungen

- Current Affairs: List of Important DaysDokument26 SeitenCurrent Affairs: List of Important Daysவெங்கடேஷ் ராமசாமிNoch keine Bewertungen

- NPA History of IDBI Bank MainDokument7 SeitenNPA History of IDBI Bank MainMonish SelvanayagamNoch keine Bewertungen

- RBI Master Circular on Wilful DefaultersDokument13 SeitenRBI Master Circular on Wilful DefaultersMahfuj KhanNoch keine Bewertungen

- Annual Report 2014-15 (English) - 20160613042736Dokument220 SeitenAnnual Report 2014-15 (English) - 20160613042736anupa bhattaraiNoch keine Bewertungen

- Vol. 28 SEPTEMBER 27, 2013 No. 39: 1. Reserve Bank of India - Liabilities and AssetsDokument2 SeitenVol. 28 SEPTEMBER 27, 2013 No. 39: 1. Reserve Bank of India - Liabilities and AssetsKaran ShoorNoch keine Bewertungen

- GK Bullet - SBI PO (Mains) II PDFDokument33 SeitenGK Bullet - SBI PO (Mains) II PDFgaurav singhNoch keine Bewertungen

- Handbook To WSS FinalDokument38 SeitenHandbook To WSS Finalrs0728Noch keine Bewertungen

- Long Form Audit Report ChecklistDokument47 SeitenLong Form Audit Report ChecklistGanesh PhadatareNoch keine Bewertungen

- 1.bankers Adda Banking CapsuleDokument17 Seiten1.bankers Adda Banking CapsulePavan TejaNoch keine Bewertungen

- 'CC (CCC" CCC CCCCCCDokument14 Seiten'CC (CCC" CCC CCCCCCGopi KrishnaNoch keine Bewertungen

- RBI Master Circular on Reporting Wilful DefaultersDokument21 SeitenRBI Master Circular on Reporting Wilful DefaultersShaeqNoch keine Bewertungen

- Asset Liability ManagementDokument21 SeitenAsset Liability ManagementVishnu thankachanNoch keine Bewertungen

- RBI Master Circular On RestructuringDokument120 SeitenRBI Master Circular On RestructuringHarish PuriNoch keine Bewertungen

- Mid Quarter Monetary Policy Review March 2012Dokument2 SeitenMid Quarter Monetary Policy Review March 2012Prashant KumarNoch keine Bewertungen

- Assignment-Ii: ON How Do Rbi Manages Currency Note IN INDIADokument3 SeitenAssignment-Ii: ON How Do Rbi Manages Currency Note IN INDIAJasmin AtwalNoch keine Bewertungen

- CRR, SLR Requirements ExplainedDokument4 SeitenCRR, SLR Requirements ExplainedBabul YumkhamNoch keine Bewertungen

- PAS 1 Financial Statement AnalysisDokument1 SeitePAS 1 Financial Statement AnalysisMartin JenniferNoch keine Bewertungen

- Bank of BarodaDokument19 SeitenBank of BarodaAmit VataliyaNoch keine Bewertungen

- 08 Chapter 01Dokument44 Seiten08 Chapter 01anwari risalathNoch keine Bewertungen

- Essar Steel Creditors ListDokument57 SeitenEssar Steel Creditors Listvarinder kumar0% (1)

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaVon EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaNoch keine Bewertungen

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsVon EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNoch keine Bewertungen

- Financial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteVon EverandFinancial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteNoch keine Bewertungen

- Indian Surgeons Removed WorldDokument104 SeitenIndian Surgeons Removed WorldnisteelroyNoch keine Bewertungen

- Net Owned FundsDokument24 SeitenNet Owned FundsnisteelroyNoch keine Bewertungen

- 1 Pmsby Rules - 1Dokument5 Seiten1 Pmsby Rules - 1Surender Kumar JakanalliNoch keine Bewertungen

- DepressionDokument24 SeitenDepressionnisteelroyNoch keine Bewertungen

- State Bank of Hyderabad Has Entered An Agreement With National Insurance Company LimitedDokument7 SeitenState Bank of Hyderabad Has Entered An Agreement With National Insurance Company LimitednisteelroyNoch keine Bewertungen

- EngDokument8 SeitenEngnisteelroyNoch keine Bewertungen

- Narendra Modi's Overseas Visits to Central Asian NationsDokument12 SeitenNarendra Modi's Overseas Visits to Central Asian NationsnisteelroyNoch keine Bewertungen

- Digital India Huge Opportunity For Health, Education: Anil AgarwalDokument125 SeitenDigital India Huge Opportunity For Health, Education: Anil AgarwalnisteelroyNoch keine Bewertungen

- 2015 Portal, App Jan-July by AffairsCloudDokument3 Seiten2015 Portal, App Jan-July by AffairsCloudnisteelroyNoch keine Bewertungen

- SBIPO 2015 Full English AdvertisementDokument3 SeitenSBIPO 2015 Full English AdvertisementMohitNoch keine Bewertungen

- EngDokument8 SeitenEngnisteelroyNoch keine Bewertungen

- 2015 Awards - Jan-July - by AffairsCloudDokument15 Seiten2015 Awards - Jan-July - by AffairsCloudnisteelroyNoch keine Bewertungen

- Best Choice For North IndiaDokument1 SeiteBest Choice For North IndianisteelroyNoch keine Bewertungen

- 26th May 2015Dokument130 Seiten26th May 2015nisteelroyNoch keine Bewertungen

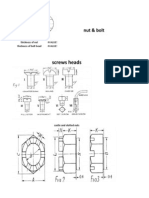

- Nut & Bolt: Screws HeadsDokument5 SeitenNut & Bolt: Screws HeadsnisteelroyNoch keine Bewertungen

- Soft DrinksDokument1 SeiteSoft DrinkssyamyyyNoch keine Bewertungen

- 1Dokument30 Seiten1nisteelroyNoch keine Bewertungen

- Marginal Standing FacilityDokument2 SeitenMarginal Standing FacilitynisteelroyNoch keine Bewertungen

- Money Market and Money Market InstrumentsDokument4 SeitenMoney Market and Money Market InstrumentsLeon MushiNoch keine Bewertungen

- Data ValidationDokument5 SeitenData ValidationnisteelroyNoch keine Bewertungen

- Job Predictor: Psycho-Therapist Maggie SmithDokument1 SeiteJob Predictor: Psycho-Therapist Maggie SmithnisteelroyNoch keine Bewertungen

- BPSCLDokument2 SeitenBPSCLnisteelroyNoch keine Bewertungen

- MMDokument1 SeiteMMnisteelroyNoch keine Bewertungen

- 151 EndDokument16 Seiten151 EndnisteelroyNoch keine Bewertungen

- Calvin N Hobbes Calender 2003Dokument1 SeiteCalvin N Hobbes Calender 2003nisteelroyNoch keine Bewertungen

- De CSP 12122013Dokument12 SeitenDe CSP 12122013nisteelroyNoch keine Bewertungen

- And 4 Sem Mark Sheet Along With Passing Certificate To My CousinDokument1 SeiteAnd 4 Sem Mark Sheet Along With Passing Certificate To My CousinnisteelroyNoch keine Bewertungen

- Check Hall Ticket Results OnlineDokument1 SeiteCheck Hall Ticket Results OnlinenisteelroyNoch keine Bewertungen