Beruflich Dokumente

Kultur Dokumente

Top 10 Strategic IT Initiatives

Hochgeladen von

Flaviub23Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Top 10 Strategic IT Initiatives

Hochgeladen von

Flaviub23Copyright:

Verfügbare Formate

Top 10 Strategic IT Initiatives

in e-Payment Services for the New Millennium

February, 2000 Special Research Brief - e-Payments Service

Dave Potterton, +1.617.796.2822

dpotterton@meridien-research.com

Sarah Ablett, +1.617.796.2832

sablett@meridien-research.com

Overview

Upon hearing the words e-payments, FSI business and IT professionals typically pause to ask, How do we

facilitate the e-payment process while providing adequate security around it?. The answer is by no means

clear and often leads to conflicts between security and usability. Complicating matters further for FSIs are

the seemingly incompatible demands made by customers, internal business lines and the institutions own

information security department. While striking a balance in this environment is not an easy task, successful and secure payment processes are being implemented. One need only look at the universe of escalating

e-commerce numbers to recognize the fact that although e-payments are still in their infancy, there is more

than enough momentum and money on hand to drive them to maturity.

Against this backdrop, we provide our list of the top ten strategic e-payment initiatives. Some of these

efforts reflect the front-end evolution underway, while others are infrastructure changes necessary for continued e-commerce growth. As a group, however, they reflect both the promise and challenge of e-payments as we begin the new millennium.

Table 1: Top 10 Strategic IT Initiatives for e-Payment Services

Rank

Business Issue/Application

Electronic purchasing for business-to-business procurement through electronic catalogs,

storefronts and auctions will accelerate. XML appears poised to be the technology driver in

this space.

Technology enablers for fraud prevention and detection will become even more important as the volume of e-business accelerates.

FSIs will increasingly need to deal with issues concerning authentication and privacy

from their wholesale and retail customer base.

Secure integration with back-office payment systems, whether in-house or outsourced to ASPs, will need to be defined, refined and implemented.

Electronic bill presentment and payment (EBPP) will realize continued acceptance

among consumers and corporations as FSIs step forward to facilitate the process.

Multi-application chip cards will make inroads as convenience and security become

linked.

Electronic wallets will gain momentum from both merchants and card issuers.

Retail/Wholesale Convergence will continue as e-payment solutions are shared across the

organization. This will become increasingly important as the use of on-line banking solutions increases within the consumer and corporate market segments.

Non-credit card payment mechanisms will increase in order to support e-commerce

growth beyond the United States.

10

While still in its infancy, wireless payments have a future which cannot be denied.

Source: Meridien Research

2000 Meridien Research, Inc. All rights reserved, worldwide

Special Brief

February, 2000

Page 2

We project that spending on strategic technology initiatives by wholesale and retail FSIs will expand from the

normal 20% of IT spending to 27% to 30% during 2000 with total spending on e-payments initiatives approximating US$5.60 billion in development activity. EBPP investment will continue to be a major area of concentration in addition to business-to-business e-procurement and security infrastructure. As with other

investments, time to market becomes a critical differentiator for FSIs. This environment will, therefore, benefit ASPs that can provide integrated solutions in very aggressive timeframes along with the expertise to integrate to the FSIs middle and back-office systems. Increased levels of activity will also be found among

middleware and integration providers who can provide the EAI to legacy payment systems in a secure manner.

Other beneficiaries will include network security, infrastructure and legacy back-office payments vendors who

understand the rapidly changing e-commerce landscape and issues surrounding e-payment activities.

Figure A summarizes our strategic spending estimates for e-payments by industry segments and geographic

regions.

Figure A: Strategic IT Spending for e-Payments (2000)

Total = US$5.60 billion

Total = US$5.60 billion

Other FSIs

Other

1%

3%

Asia Pacific

12%

Non-FSIs

40%

Banks

North

59%

America

46%

Europe

39%

Source: Meridien Research Estimates

Looking Ahead - The Why Behind These Payment Initiatives

Two factors place e-payment evolution squarely on the shoulders of FSIs. The first involves issues of trust and

security. FSIs are viewed as trusted third parties today and should look to extend that trust relationship within

the new e-commerce marketplace. The second significant factor is that payments processing is a core competency of FSIs (particularly banks) which should be fully exploited. As the Internet continues to blur the lines of

delineation between competitors (whether inside or outside of the industry), FSI management needs to recognize the significant impact and opportunity for their respective business strategies. Management also needs to

ensure that internal organizational and line of business issues are resolved in order to extend any new solutions

to the entire range of customer segments. Secure payment processes, which are necessary to sustain the continued expansion of e-commerce activities among corporations and consumers, present the perfect opportunity for

FSIs to leverage their competitive advantage. It is from this perspective that wholesale and retail financial

institutions should review the why of their current strategic initiatives to ensure they are assuming a leadership role in e-payment development. The winners will be those financial institutions who invest in strategic epayment technologies over the next 12-24 months to support the continuing growth of e-commerce. In addition to FSIs, beneficiaries of these efforts will include consulting and integration firms who possess a knowledge of security and payments implementations across increasingly complex internal environments of multiple

customer segments, business lines and channels.

2000 Meridien Research, Inc. All rights reserved, worldwide

Special Brief

February, 2000

Das könnte Ihnen auch gefallen

- PCI DSS: A practical guide to implementing and maintaining complianceVon EverandPCI DSS: A practical guide to implementing and maintaining complianceBewertung: 5 von 5 Sternen5/5 (1)

- ContinueDokument2 SeitenContinueNaimur Rahman JoyNoch keine Bewertungen

- Limitations of E-CommerceDokument4 SeitenLimitations of E-CommerceabhayNoch keine Bewertungen

- Virgo ProposalDokument8 SeitenVirgo ProposalWalterNoch keine Bewertungen

- Dissertation On Mobile PaymentDokument8 SeitenDissertation On Mobile PaymentPayToWriteAPaperAnchorage100% (1)

- Fintech ReportDokument24 SeitenFintech ReportAnvesha TyagiNoch keine Bewertungen

- Scope Needs and Importance of E-CommerceDokument4 SeitenScope Needs and Importance of E-CommercehariiNoch keine Bewertungen

- Cashflow, Operation, Investing, Financing, RRLDokument6 SeitenCashflow, Operation, Investing, Financing, RRLSuzune HorikitaNoch keine Bewertungen

- ITG MA-2022 Suggested AnswersDokument9 SeitenITG MA-2022 Suggested AnswersnurulaminNoch keine Bewertungen

- Simplify and Layer Your Security Approach To Protect Card DataDokument5 SeitenSimplify and Layer Your Security Approach To Protect Card DataJerome B. AgliamNoch keine Bewertungen

- AI Impacting Financial Services IndustryDokument3 SeitenAI Impacting Financial Services IndustrysmritiNoch keine Bewertungen

- E CommerceDokument7 SeitenE CommerceAbhay PrakashNoch keine Bewertungen

- Big Data Group AssingmentDokument41 SeitenBig Data Group AssingmentJatin NandaNoch keine Bewertungen

- Fintech ReportDokument24 SeitenFintech ReportAnvesha TyagiNoch keine Bewertungen

- Implementation of a Central Electronic Mail & Filing StructureVon EverandImplementation of a Central Electronic Mail & Filing StructureNoch keine Bewertungen

- Challenges in The Financial Services Sector in India..Dokument4 SeitenChallenges in The Financial Services Sector in India..anna merlin sunnyNoch keine Bewertungen

- IDRBT Banking Technology Excellence AwardsDokument5 SeitenIDRBT Banking Technology Excellence AwardskshitijsaxenaNoch keine Bewertungen

- B2B Fintech - Payments, Supply Chain Finance & E-Invoicing Guide 2016Dokument99 SeitenB2B Fintech - Payments, Supply Chain Finance & E-Invoicing Guide 2016bathongvoNoch keine Bewertungen

- Bhavya Wani: Ai in FinanceDokument5 SeitenBhavya Wani: Ai in FinanceScrappy CocoNoch keine Bewertungen

- RESEARCH - Ch. 1 To 3Dokument32 SeitenRESEARCH - Ch. 1 To 3Rena sigoNoch keine Bewertungen

- АІDokument7 SeitenАІsavenkosofia685Noch keine Bewertungen

- AI and ML in BankingDokument2 SeitenAI and ML in BankingHazem MuhamadNoch keine Bewertungen

- BIS - Bigtechs, QR Code Payments and Financial Inclusion (May 2022)Dokument47 SeitenBIS - Bigtechs, QR Code Payments and Financial Inclusion (May 2022)Fernando HernandezNoch keine Bewertungen

- Emerging FinTech: Understanding and Maximizing Their BenefitsVon EverandEmerging FinTech: Understanding and Maximizing Their BenefitsNoch keine Bewertungen

- Banking SectorDokument8 SeitenBanking Sectorvishal thomkeNoch keine Bewertungen

- Where Security FitsDokument15 SeitenWhere Security FitsmcharyorkutNoch keine Bewertungen

- Accenture Cloud Computing Retail POVDokument28 SeitenAccenture Cloud Computing Retail POVAparna Adithya VarmaNoch keine Bewertungen

- Challenges in Financial Market IndustriesDokument5 SeitenChallenges in Financial Market IndustriesKUNAL KISHOR SINGHNoch keine Bewertungen

- Artificial Intelligence and Its Impacts On The Financial Services Sector.Dokument5 SeitenArtificial Intelligence and Its Impacts On The Financial Services Sector.Dilesh VeeramahNoch keine Bewertungen

- Financial Services AssignmentDokument18 SeitenFinancial Services Assignmentshiv mehraNoch keine Bewertungen

- Fintech Report (RSB2101030)Dokument5 SeitenFintech Report (RSB2101030)Manoj JesurajNoch keine Bewertungen

- Research Paper On e Cash Payment SystemDokument5 SeitenResearch Paper On e Cash Payment Systemcarkdfp5100% (1)

- Banking 2020: Transform yourself in the new era of financial servicesVon EverandBanking 2020: Transform yourself in the new era of financial servicesNoch keine Bewertungen

- IntroductionDokument3 SeitenIntroduction3037 Vishva RNoch keine Bewertungen

- Case Study On The Rational of Multi-Channel Platform As A Management Information System in The Banking SectorDokument11 SeitenCase Study On The Rational of Multi-Channel Platform As A Management Information System in The Banking SectorHurul AinNoch keine Bewertungen

- Mastering Next Generation IT: Executive Guide to Enterprise Technology Transformation & the Business of Cloud ServicesVon EverandMastering Next Generation IT: Executive Guide to Enterprise Technology Transformation & the Business of Cloud ServicesNoch keine Bewertungen

- Next Gen InsuranceDokument1 SeiteNext Gen Insurancemegha_kshatriyaNoch keine Bewertungen

- The Analyst's Atlas: Navigating the Financial Data SphereVon EverandThe Analyst's Atlas: Navigating the Financial Data SphereNoch keine Bewertungen

- Digital Methods For Small and Large Businesses That Are Popular and In-DemandDokument6 SeitenDigital Methods For Small and Large Businesses That Are Popular and In-DemandShreya dubeyNoch keine Bewertungen

- E CommerceDokument10 SeitenE CommerceKhushi RajgarriaNoch keine Bewertungen

- MerceDokument53 SeitenMercedeepakraj0192Noch keine Bewertungen

- Artificial Intelligence in The Banking Sector With Special Reference To Pros and Cons, Need, Significance and RecommendationsDokument4 SeitenArtificial Intelligence in The Banking Sector With Special Reference To Pros and Cons, Need, Significance and RecommendationsVikram Singh MeenaNoch keine Bewertungen

- A Note On Cyber Crime and Economic Offence in Online BankingDokument14 SeitenA Note On Cyber Crime and Economic Offence in Online BankingBasu DuttaNoch keine Bewertungen

- Role of Information Technology in An OrganizationDokument4 SeitenRole of Information Technology in An OrganizationSayed ShahbazNoch keine Bewertungen

- Powering The Digital Economy PDFDokument16 SeitenPowering The Digital Economy PDFYoussef EchNoch keine Bewertungen

- Report & Analysis About The Market of Payment Gateway Industry in Indonesia and A Strategic Plan On How To Survive The Market.Dokument15 SeitenReport & Analysis About The Market of Payment Gateway Industry in Indonesia and A Strategic Plan On How To Survive The Market.Ario Wibisono100% (1)

- Agent-Mediated Trading: Intelligent Agents and E-Business: Matthias KluschDokument14 SeitenAgent-Mediated Trading: Intelligent Agents and E-Business: Matthias Kluschoptimistic_harishNoch keine Bewertungen

- Role of It in Knowledge ManagementDokument11 SeitenRole of It in Knowledge ManagementShaik Mohamed ThafreezNoch keine Bewertungen

- Mobile Commerce ThesisDokument7 SeitenMobile Commerce ThesisHelpWritingCollegePapersSingapore100% (2)

- Digital Transformation: ShoppingDokument16 SeitenDigital Transformation: ShoppingCrystel Joyce UltuNoch keine Bewertungen

- Emerging TrendsDokument8 SeitenEmerging TrendsNandeeta JainNoch keine Bewertungen

- Digital BankingDokument16 SeitenDigital BankingMJ Zayad100% (1)

- Impact of IT On Banking: Management Information SystemsDokument12 SeitenImpact of IT On Banking: Management Information SystemssairamskNoch keine Bewertungen

- Lecture #6: Developing Sector StrategiesDokument32 SeitenLecture #6: Developing Sector StrategiesraobilalNoch keine Bewertungen

- MoP19Innovation and Disruption in US Merchant PaymentsDokument9 SeitenMoP19Innovation and Disruption in US Merchant PaymentsKantiKiranNoch keine Bewertungen

- Case Online Round Synergy'24Dokument2 SeitenCase Online Round Synergy'2415G.V.Pranav12-DNoch keine Bewertungen

- Fachwirt Videos YOUTUBE IHKSchwabenDokument5 SeitenFachwirt Videos YOUTUBE IHKSchwabenFlaviub23Noch keine Bewertungen

- Resurse Online de MatematicaDokument3 SeitenResurse Online de MatematicaFlaviub23Noch keine Bewertungen

- Game of LifeDokument51 SeitenGame of LifeFlaviub23Noch keine Bewertungen

- As A Man Thinketh: by James AllenDokument22 SeitenAs A Man Thinketh: by James AllenFlaviub23Noch keine Bewertungen

- WTGH SampleChapterDokument12 SeitenWTGH SampleChapterFlaviub23Noch keine Bewertungen

- A Special GiftDokument106 SeitenA Special GiftFlaviub23Noch keine Bewertungen

- Road Signs 1Dokument11 SeitenRoad Signs 1Flaviub23Noch keine Bewertungen

- Sae EbookDokument264 SeitenSae EbookFlaviub23Noch keine Bewertungen

- A Big Picture E-BookDokument35 SeitenA Big Picture E-BookFlaviub23Noch keine Bewertungen

- Remembrance Karen WrightDokument52 SeitenRemembrance Karen WrightFlaviub23Noch keine Bewertungen

- MFSCDokument28 SeitenMFSCFlaviub23Noch keine Bewertungen

- Creating The Value of LifeDokument155 SeitenCreating The Value of LifeFlaviub23Noch keine Bewertungen

- Elephant Bar Mezzanine Finance Case Write UpDokument5 SeitenElephant Bar Mezzanine Finance Case Write UpPouya YousefNoch keine Bewertungen

- Toa 4 Cash FlowsDokument3 SeitenToa 4 Cash Flowsmae tuazonNoch keine Bewertungen

- NYSEDokument184 SeitenNYSEZaher HossainNoch keine Bewertungen

- BiographyDokument48 SeitenBiographyGade Sirish ReddyNoch keine Bewertungen

- Satnam Overseas LimitedDokument12 SeitenSatnam Overseas LimitedRavishankar ManthaNoch keine Bewertungen

- Finlatics Investment Banking Experience Program: Arjun's Driving ForceDokument2 SeitenFinlatics Investment Banking Experience Program: Arjun's Driving ForceSakshi BakliwalNoch keine Bewertungen

- Property NotesDokument87 SeitenProperty NotesBecky Smith0% (1)

- Principles of Ed Seykota (Trend Follower)Dokument7 SeitenPrinciples of Ed Seykota (Trend Follower)Deng Qiang100% (4)

- Mergers and Aquisition: University of Economics - Ho Chi Minh CityDokument7 SeitenMergers and Aquisition: University of Economics - Ho Chi Minh CityNhân TrịnhNoch keine Bewertungen

- Feature Importance: Mutual Fund Performance PredictionDokument1 SeiteFeature Importance: Mutual Fund Performance PredictionadityanagodraNoch keine Bewertungen

- Project PeeDokument38 SeitenProject PeeHatta AimanNoch keine Bewertungen

- Christine Guthrie Was Recently Hired by S S Air Inc ToDokument2 SeitenChristine Guthrie Was Recently Hired by S S Air Inc ToAmit PandeyNoch keine Bewertungen

- Alkem Lab: Ratio Analysis and InterpretationsDokument3 SeitenAlkem Lab: Ratio Analysis and InterpretationsAlbin BijuNoch keine Bewertungen

- Resource Markets Connect AnswersDokument10 SeitenResource Markets Connect AnswersMargarita ArnoldNoch keine Bewertungen

- Markus - Oligarchs and Corruption in Putins Russia of Sand Castles and Geopolitical Volunteering"Dokument8 SeitenMarkus - Oligarchs and Corruption in Putins Russia of Sand Castles and Geopolitical Volunteering"Sophia VaskovskaNoch keine Bewertungen

- JollibeeDokument8 SeitenJollibeeDavid DoanhNoch keine Bewertungen

- Prospectus of KDS Accessories LTD - 23.07.2015Dokument172 SeitenProspectus of KDS Accessories LTD - 23.07.2015Murshed Arif Mahin100% (1)

- Case Study GroupDokument9 SeitenCase Study GroupPrabhujot SinghNoch keine Bewertungen

- Using The PESTEL Framework Carry Out An Analysis of The Target Country From The OrganisationDokument21 SeitenUsing The PESTEL Framework Carry Out An Analysis of The Target Country From The OrganisationpracashNoch keine Bewertungen

- Who Are The Shareholders?Dokument24 SeitenWho Are The Shareholders?Roosevelt InstituteNoch keine Bewertungen

- Digest HSBC Vs CirDokument2 SeitenDigest HSBC Vs CirJoan Atup100% (1)

- HDFCDokument78 SeitenHDFCsam04050Noch keine Bewertungen

- Acct 602-Discussion 4Dokument2 SeitenAcct 602-Discussion 4Michael LipphardtNoch keine Bewertungen

- 'Docslide - Us - Case Pricing Options AtlanticDokument6 Seiten'Docslide - Us - Case Pricing Options AtlanticAbhishek VermaNoch keine Bewertungen

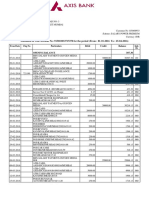

- Bank StatementDokument3 SeitenBank StatementNeha Pradeep SainiNoch keine Bewertungen

- Assignment: External Environment of The IT Industry of BangladeshDokument19 SeitenAssignment: External Environment of The IT Industry of Bangladeshkazi saadNoch keine Bewertungen

- Make in IndiaDokument15 SeitenMake in IndiaKuldipNoch keine Bewertungen

- IA3 Chapter 1Dokument4 SeitenIA3 Chapter 1Juliana ChengNoch keine Bewertungen

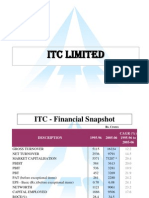

- ITCDokument47 SeitenITCHarshit KatwalaNoch keine Bewertungen

- Case #2 NIKE INCDokument6 SeitenCase #2 NIKE INCSamantha LunaNoch keine Bewertungen