Beruflich Dokumente

Kultur Dokumente

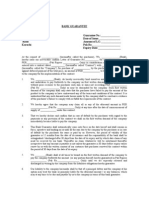

Bank Guarantee

Hochgeladen von

hhhhhhhuuuuuyyuyyyyy0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

185 Ansichten2 SeitenBank guarantee for DVAT Registration

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenBank guarantee for DVAT Registration

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

185 Ansichten2 SeitenBank Guarantee

Hochgeladen von

hhhhhhhuuuuuyyuyyyyyBank guarantee for DVAT Registration

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

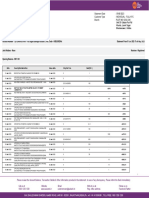

Bank Guarantee for Delhi VAT Purpose

Guarantee No. .. dated .

Amount of Guarantee Rs. .

Guarantee cover from . to ..

Last date for lodgment of claim

This deed of guarantee executed by the (Bank) having the Regd Office at

, (Address) and amongst other places, a Branch at ., (Address of the Branch)

(hereinafter referred to as the Bank) in favour of the President of India, through Commissioner DVAT,

New Delhi (hereinafter referred to as the Beneficiary) for an amount not exceeding Rs. 85,,000/(Rupees Eighty Five Thousand only) at the request of M/s . (hereinafter referred to as the

Dealer).

This Guarantee is issued subject to the condition that the liability of the Bank under this Guarantee is

limited to a maximum of Rs. 85,000/- (Rupees Eighty Five Thousand only) and the Guarantee shall

remain in full force upto and cannot be invoked otherwise than by a written demand or

claim under this Guarantee served on the Bank on or before the .. .

We, .. (Name & Branch of the Bank) hereby undertake to indemnify against

Delhi Value Added Tax and keep indemnified the President of India to the extent of Rs. 85,000/(Rupees Eighty Five Thousand only) against any loss caused to or suffered in respect of Delhi Value

Added Tax and that in the event of any default on the part of the dealer in such payment, we shall pay

to the President of India, on demand of such taxes or penalty which the VAT Officer may certify to be

due from the dealer under the Delhi Value Added Tax Act, 2004, subject to the maximum limit as

aforesaid.

We, the Bank further agree that the guarantee herein contained shall be valid upto a period of .

(Period of Guarantee) and shall remain in full force till all dues of the sales tax/VAT under the Delhi

Value Added Tax Act, 2004 have fully paid.

We, the Bank undertake not to revoke this Guarantee during the contingency except with the previous

consent of the VAT officer in writing.

We, the Bank further agree that we shall not be discharged or relieved from the Guarantee herein

contained by the agreement made between the President of India or the Sales Tax/VAT Officer and the

said dealer with or without our consent or any forbearance whether as to pay time or otherwise and that

for the purpose of its enforcement our liability hereunder shall be joint and severally liable alongwith

that of the dealer.

NOT WITHSTANDING anything contained herein before our liability under this Guarantee shall be

restricted to a sum of Rs. 85,000/- (Rupees Eighty Five Thousand only) and unless a demand or a

claim is made on us in writing on or before We shall be released or discharged from our

liability there under and no claim shall be entertained by the bank after this date.

PLACE : NEW DELHI

DATED

* Delete whichever is not applicable

Signature of the Bank Manager under its seal

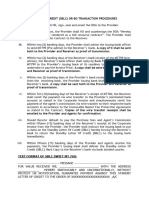

Bank Guarantee for Central Sales Tax Purpose

Guarantee No. .. dated .

Amount of Guarantee Rs. .

Guarantee cover from . to ..

Last date for lodgment of claim

This deed of guarantee executed by the (Bank) having the Head Office at

, (Address) and amongst other places, a Branch at ., (Address of the Branch)

(hereinafter referred to as the Bank) in favour of the President of India, New Delhi (hereinafter referred

to as the Beneficiary) for an amount not exceeding Rs. . (Rupees ) at

the request of (Name & Address of the dealer) (hereinafter referred to as the Dealer).

This Guarantee is issued subject to the condition that the liability of the Bank under this Guarantee is

limited to a maximum of Rs. (Rupees .. ) and the Guarantee shall remain in full

force upto and cannot be invoked otherwise than by a written demand or claim under

this Guarantee served on the Bank on or before the .. .

We, .. (Name & Branch of the Bank) hereby undertake to indemnify against the

central sales tax and keep indemnified the President of India to the extent of Rs. .

against any loss caused to or suffered in respect of central sales tax and that in the event of any default

on the part of the dealer in such payment, we shall pay to the President of India, on demand of such

taxes or penalty which the Sales Tax/VAT Officer may certify to be due from the dealer under the

Central Sales Tax Act, 1956, subject to the maximum limit as aforesaid.

We, the Bank further agree that the guarantee herein contained shall be valid up to a period of .

(Period of Guarantee) and shall remain in full force till all dues of the sales tax/VAT under the Central

Sales Tax Act, 1956 have fully paid.

We, the Bank undertake not to revoke this Guarantee during the contingency except with the previous

consent of the sales tax/VAT officer in writing.

We, the Bank further agree that we shall not be discharged or relieved from the Guarantee herein

contained by the agreement made between the President of India or the Sales Tax/VAT Officer and the

said dealer with or without our consent or any forbearance whether as to pay time or otherwise and that

for the purpose of its enforcement our liability hereunder shall be joint and severally liable along with

that of the dealer.

NOT WITHSTANDING anything contained herein before our liability under this Guarantee shall be

restricted to a sum of Rs. (Rupees . ) and shall not exceed

beyond Rs. and unless a demand or a claim is made on us in writing on or before

We shall be released or discharged from our liability there under and no claim shall be

entertained by the bank after this date.

PLACE : NEW DELHI

DATED

* Delete whichever is not applicable

Signature of the Bank Manager under its seal

Das könnte Ihnen auch gefallen

- Bank GuaranteeDokument3 SeitenBank GuaranteeNitesh Kotian100% (1)

- Bank GuaranteeDokument2 SeitenBank GuaranteeAdnan AminNoch keine Bewertungen

- Transaction Procedure and Terms.Dokument2 SeitenTransaction Procedure and Terms.karthicfincon100% (1)

- Swift Stand by Letter of CreditDokument2 SeitenSwift Stand by Letter of CreditJr Qomarruzzaman100% (1)

- Bank Guarantee (FormatDokument2 SeitenBank Guarantee (Formatmsadhanani3922Noch keine Bewertungen

- Modelo BCLDokument1 SeiteModelo BCLRailesUsados100% (1)

- 14 SBLC Format - UnsDokument2 Seiten14 SBLC Format - UnsJohannes Marcus StillenbachNoch keine Bewertungen

- Relay 760 Fortress IssuedDokument2 SeitenRelay 760 Fortress Issuedcodeblack100% (3)

- Rwa PDFDokument1 SeiteRwa PDFIndustria Concretera Noguera IconnoNoch keine Bewertungen

- Sales & Purchase Contract Agrement: As The SellerDokument8 SeitenSales & Purchase Contract Agrement: As The SellerNote BuriNoch keine Bewertungen

- SwissGold Exchange Company FCO2Dokument2 SeitenSwissGold Exchange Company FCO2LilianNoch keine Bewertungen

- SBLC Verbiage Jva Ghana 28 May 2021Dokument2 SeitenSBLC Verbiage Jva Ghana 28 May 2021Manuel Satorra PujolarNoch keine Bewertungen

- Agreement For HSBC Time Draft 30mDokument13 SeitenAgreement For HSBC Time Draft 30msathyaji100% (2)

- IcpoDokument4 SeitenIcpoRonnie AdnalcamaNoch keine Bewertungen

- Buyer'S Letterhead: Letter of Intent /deed of AgreementDokument21 SeitenBuyer'S Letterhead: Letter of Intent /deed of Agreementchachou100% (1)

- Bank Confirmation Letter: On Buyer's Bank LetterheadDokument2 SeitenBank Confirmation Letter: On Buyer's Bank LetterheadToni MadaraNoch keine Bewertungen

- 3 Sample SBLCDokument2 Seiten3 Sample SBLCDat Tran100% (2)

- SBLC MT760 VerbiageDokument2 SeitenSBLC MT760 VerbiageRalph AjahNoch keine Bewertungen

- SBLC Terms & ProcedureDokument2 SeitenSBLC Terms & ProcedureDima RajaNoch keine Bewertungen

- Transaction Procedures En590 Fob DramsDokument1 SeiteTransaction Procedures En590 Fob DramsIchal Chelsea KasminNoch keine Bewertungen

- Sample Standby LCDokument2 SeitenSample Standby LCAmbarish DasNoch keine Bewertungen

- Exclusive Letter of Request Valid For 45 Days Only or As Agreed by Both PartiesDokument27 SeitenExclusive Letter of Request Valid For 45 Days Only or As Agreed by Both PartiesRian HidayatNoch keine Bewertungen

- HSBC London - Bank Comfort LetterDokument3 SeitenHSBC London - Bank Comfort Lettersumantri100% (1)

- Ledger-To-Ledger (L2L) Transfer: of Cash Funds and Certificate of DepositsDokument9 SeitenLedger-To-Ledger (L2L) Transfer: of Cash Funds and Certificate of DepositsMamny100% (1)

- Irrevocable Documentary Credit - Appl (EN) v1.1Dokument2 SeitenIrrevocable Documentary Credit - Appl (EN) v1.1Firaol BelayNoch keine Bewertungen

- ECS101 080416 USD 700,000.00 BANK WINTER SBLC - Draft - 08041601Dokument2 SeitenECS101 080416 USD 700,000.00 BANK WINTER SBLC - Draft - 08041601codeblack33% (3)

- Deed of Agreement: DateDokument27 SeitenDeed of Agreement: DateJose Manuel Quiroz MarinNoch keine Bewertungen

- Swift CodesDokument1 SeiteSwift Codesapi-3802032100% (2)

- DOA Template LCDokument10 SeitenDOA Template LCYash Mit100% (1)

- Sender: Verbiage Mt799 Acceptable Draft of Mt799 Block FundsDokument1 SeiteSender: Verbiage Mt799 Acceptable Draft of Mt799 Block FundsAdi HamdaniNoch keine Bewertungen

- Blanjk Ncncda IfmpaDokument12 SeitenBlanjk Ncncda Ifmpaalvaro4356100% (1)

- Bank GuaranteeDokument30 SeitenBank GuaranteeKaruna ThatsitNoch keine Bewertungen

- Imfpa Diesel Pdvsa2Dokument15 SeitenImfpa Diesel Pdvsa2Sergio PeyrotNoch keine Bewertungen

- PGL INTSA GLOBAL PAY Aug 09-2021Dokument4 SeitenPGL INTSA GLOBAL PAY Aug 09-2021Cammissa Khoi Services and TradingNoch keine Bewertungen

- Bank Winter BG MT760 - GuaranteeDokument2 SeitenBank Winter BG MT760 - GuaranteeLaz Cozetat100% (2)

- Information RequestDokument3 SeitenInformation Requestapi-26156627Noch keine Bewertungen

- Bank Guarantee Verbiage (Icc 758)Dokument1 SeiteBank Guarantee Verbiage (Icc 758)David100% (1)

- Signed Copy Atlantis Bitcoin Sales and Purchase AgreementDokument10 SeitenSigned Copy Atlantis Bitcoin Sales and Purchase AgreementKiki SajaNoch keine Bewertungen

- Societe Chinoise LTD: Irrevocable Corporate Purchase OrderDokument4 SeitenSociete Chinoise LTD: Irrevocable Corporate Purchase OrderPatrick NoelNoch keine Bewertungen

- Deutsche Bank's MotionDokument15 SeitenDeutsche Bank's MotionDealBookNoch keine Bewertungen

- Swift Car SampleDokument3 SeitenSwift Car SampleAjish KumarNoch keine Bewertungen

- GAF Loan Funding ProceduresDokument3 SeitenGAF Loan Funding ProceduresNamita SardaNoch keine Bewertungen

- Standard Format SBLC Incoming (Final) - CorrectionDokument1 SeiteStandard Format SBLC Incoming (Final) - Correctionfugga50% (2)

- 1 Draft of Ncnda ImfpaDokument10 Seiten1 Draft of Ncnda ImfpaAnonymous XZnkpMecNoch keine Bewertungen

- Verbiage MT799 MT760Dokument3 SeitenVerbiage MT799 MT760ocazeta100% (2)

- Loi - 44+2 - BG - Uk V.2 DPDokument17 SeitenLoi - 44+2 - BG - Uk V.2 DPAtthippattu Srinivasan MuralitharanNoch keine Bewertungen

- Standard Wording For Bank Guarantee in Favor of CS CREDITDokument1 SeiteStandard Wording For Bank Guarantee in Favor of CS CREDITapi-26156627Noch keine Bewertungen

- Federal Deposit Insurance Corporation: Certificate of AssuranceDokument1 SeiteFederal Deposit Insurance Corporation: Certificate of AssurancebravokNoch keine Bewertungen

- Fresh Cut Bank Draft Doa - 2022Dokument15 SeitenFresh Cut Bank Draft Doa - 2022MANOJ VIJAYANNoch keine Bewertungen

- USD Agency L2L Transaction Procedures 20-15Dokument3 SeitenUSD Agency L2L Transaction Procedures 20-15alehillarNoch keine Bewertungen

- New مستند Microsoft WordDokument4 SeitenNew مستند Microsoft WordMohammed Abuhyder100% (1)

- Soft Corporate Offer (SCO) : End BuyerDokument9 SeitenSoft Corporate Offer (SCO) : End BuyeranandavedaNoch keine Bewertungen

- Modele Lettre enDokument8 SeitenModele Lettre entamer abdelhady100% (1)

- FCSBLCDokument19 SeitenFCSBLCSumantriNoch keine Bewertungen

- DOA Zedra JKTDokument23 SeitenDOA Zedra JKTdjasman0% (1)

- Imfpa ArvindDokument7 SeitenImfpa Arvindabelardo osechesNoch keine Bewertungen

- Gas Extra Inc LTD.-MT103 MD-PGL Draft-WbDokument10 SeitenGas Extra Inc LTD.-MT103 MD-PGL Draft-WbwayneNoch keine Bewertungen

- Imfpa - SampleDokument4 SeitenImfpa - SamplePike Winchurkar100% (1)

- 1 Huang Xingren 79m Signed CpuDokument4 Seiten1 Huang Xingren 79m Signed CpuМухаммед АлиNoch keine Bewertungen

- Bank Guarantee Format For Security DepositDokument3 SeitenBank Guarantee Format For Security DepositRajesh KumarNoch keine Bewertungen

- Form Vat - 26: Certificate of Chartered AccountantDokument1 SeiteForm Vat - 26: Certificate of Chartered AccountanthhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- PublicNotice 1WREH4SMDokument12 SeitenPublicNotice 1WREH4SMhhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Form DVAT 27A: Intimation of Deposit of Government DuesDokument2 SeitenForm DVAT 27A: Intimation of Deposit of Government DueshhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Form DVAT 24: Notice of Default Assessment of Tax and Interest Under Section 32Dokument2 SeitenForm DVAT 24: Notice of Default Assessment of Tax and Interest Under Section 32hhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Form DVAT 09 Cover Page: Application For Cancellation of Registration Under Delhi Value Added Tax Act, 2004Dokument4 SeitenForm DVAT 09 Cover Page: Application For Cancellation of Registration Under Delhi Value Added Tax Act, 2004hhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Form DVAT 38: (Please Tick)Dokument2 SeitenForm DVAT 38: (Please Tick)hhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Laws Relating To LeaveDokument7 SeitenLaws Relating To LeavehhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Share-Purchase-Agreement Final DraftDokument50 SeitenShare-Purchase-Agreement Final DrafthhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- E-Way Bill System 47Dokument1 SeiteE-Way Bill System 47hhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- E-Way Bill System7787Dokument1 SeiteE-Way Bill System7787hhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- E-Way Bill: Government of IndiaDokument1 SeiteE-Way Bill: Government of IndiahhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Janardhanam Prasad Vs Ramdas On 2 February, 2007Dokument5 SeitenJanardhanam Prasad Vs Ramdas On 2 February, 2007hhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

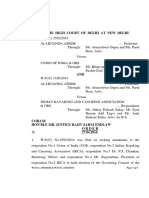

- In The High Court of Delhi at New Delhi W.P. (C) 3424/2017Dokument18 SeitenIn The High Court of Delhi at New Delhi W.P. (C) 3424/2017hhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- CA Certificate Trade Junction - MSME ClassificationDokument1 SeiteCA Certificate Trade Junction - MSME ClassificationhhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Sanjay Samaksh Seth Marketing & OperationsDokument3 SeitenSanjay Samaksh Seth Marketing & OperationshhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- VAT ApppealDokument7 SeitenVAT ApppealhhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Laws Relating To LeaveDokument7 SeitenLaws Relating To LeavehhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- About UsbibiDokument1 SeiteAbout UsbibihhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Emergency ContactDokument1 SeiteEmergency ContacthhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Alaknanda V Union of IndiaDokument5 SeitenAlaknanda V Union of IndiahhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- The Union of India (Uoi) Through ... Vs The State of Bihar and Ors. On 22 June, 2004Dokument6 SeitenThe Union of India (Uoi) Through ... Vs The State of Bihar and Ors. On 22 June, 2004hhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Karyapalak Engineer and Ors. Vs Rajasthan Tax Board and Ors. On 8 May, 2001Dokument23 SeitenKaryapalak Engineer and Ors. Vs Rajasthan Tax Board and Ors. On 8 May, 2001hhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Arun Jaitley Vs State of U.P. On 5 November, 2015Dokument11 SeitenArun Jaitley Vs State of U.P. On 5 November, 2015hhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- A) TM QuestionnaireDokument2 SeitenA) TM QuestionnairehhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- About Us IIIDokument1 SeiteAbout Us IIIhhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Amity Business School: Dissertation NTCC DiaryDokument2 SeitenAmity Business School: Dissertation NTCC DiaryhhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Gunwantbhai Mulchand Shah & Ors Vs Anton Elis Farel & Ors On 6 March, 2006Dokument6 SeitenGunwantbhai Mulchand Shah & Ors Vs Anton Elis Farel & Ors On 6 March, 2006hhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- FAS, DELHI/2016-17/MATHS/PERIOD 1/ : Learning ObjectiveDokument6 SeitenFAS, DELHI/2016-17/MATHS/PERIOD 1/ : Learning ObjectivehhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Amity Business School: Dissertation NTCC DiaryDokument2 SeitenAmity Business School: Dissertation NTCC DiaryhhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Amity Business School: Dissertation NTCC DiaryDokument2 SeitenAmity Business School: Dissertation NTCC DiaryhhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- Reaction Paper Estate Tax Valencia, Reginald GDokument2 SeitenReaction Paper Estate Tax Valencia, Reginald GReginald ValenciaNoch keine Bewertungen

- Fiber Monthly Statement: This Month's SummaryDokument4 SeitenFiber Monthly Statement: This Month's SummaryShivang SethNoch keine Bewertungen

- Phil Guaranty Co Vs Commissioner, G.R. No. L-22074 April 30, 1965Dokument3 SeitenPhil Guaranty Co Vs Commissioner, G.R. No. L-22074 April 30, 1965Antonio Palpal-latocNoch keine Bewertungen

- Engineering Economic Analysis 11thDokument2 SeitenEngineering Economic Analysis 11thJesus DunnNoch keine Bewertungen

- Exempt: BMBE, Enterrises Enjoying Tax Holiday Incentives Under CREATE LawDokument5 SeitenExempt: BMBE, Enterrises Enjoying Tax Holiday Incentives Under CREATE LawPaula Mae DacanayNoch keine Bewertungen

- 2023 01 20 23 09 42 PDFDokument13 Seiten2023 01 20 23 09 42 PDFSantosh Kumar GuptaNoch keine Bewertungen

- Vendor Opening Form - Format REVISEDDokument1 SeiteVendor Opening Form - Format REVISEDFarhan SaghirNoch keine Bewertungen

- LT E-BillDokument3 SeitenLT E-Billsandeep khairnarNoch keine Bewertungen

- Sizing Tank Blanketing Regulators Using Latest API 2000 7th Edition GuidelinesDokument1 SeiteSizing Tank Blanketing Regulators Using Latest API 2000 7th Edition GuidelinesSanju ChauhanNoch keine Bewertungen

- Important Notice To All Candidates For Admissions To Degree Courses 2017Dokument165 SeitenImportant Notice To All Candidates For Admissions To Degree Courses 2017TamuNoch keine Bewertungen

- 21 870 Campbelltown To Liverpool Via Glenfield 20230925 20231007 1Dokument6 Seiten21 870 Campbelltown To Liverpool Via Glenfield 20230925 20231007 1Neng RegsNoch keine Bewertungen

- MR - Ajith & Suganthan Invoice 1Dokument2 SeitenMR - Ajith & Suganthan Invoice 1Araa E learningNoch keine Bewertungen

- Use of Tally Software in AccountingDokument36 SeitenUse of Tally Software in AccountingHarsh KumarNoch keine Bewertungen

- Caso Compaq (Resumen) - United States - Docket No. 24238-96 Compaq Computer Corporation and Subsidiaries v. Commissioner of Internal Revenue - IBFDDokument2 SeitenCaso Compaq (Resumen) - United States - Docket No. 24238-96 Compaq Computer Corporation and Subsidiaries v. Commissioner of Internal Revenue - IBFDRaquel Lopez0% (1)

- Bank ReconciliationDokument3 SeitenBank Reconciliationp12400Noch keine Bewertungen

- Keafer Mfg. Cash BudgetDokument2 SeitenKeafer Mfg. Cash BudgetElcah Myrrh LaridaNoch keine Bewertungen

- 1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationDokument1 Seite1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationNards SVNoch keine Bewertungen

- Alpha Group Company Profile 12.8.21Dokument28 SeitenAlpha Group Company Profile 12.8.21Laeth HarebNoch keine Bewertungen

- Bulletin: The Institute of Cost Accountants of IndiaDokument68 SeitenBulletin: The Institute of Cost Accountants of IndiaSrinivasa RaoNoch keine Bewertungen

- A Calculate The Hernandezes Income Tax Liability For This YearDokument1 SeiteA Calculate The Hernandezes Income Tax Liability For This YearAmit PandeyNoch keine Bewertungen

- Dealings in PropertiesDokument2 SeitenDealings in PropertiesJamaica DavidNoch keine Bewertungen

- Annex1 - Journal of Cash Transaction 2023 (HALAYHAYIN)Dokument32 SeitenAnnex1 - Journal of Cash Transaction 2023 (HALAYHAYIN)Nazzer Balmores NacuspagNoch keine Bewertungen

- 2.form of Appeal ACIR - MDokument4 Seiten2.form of Appeal ACIR - Mwasim nisarNoch keine Bewertungen

- Week 10 - Leasing (Part 1)Dokument1 SeiteWeek 10 - Leasing (Part 1)Vidya IntaniNoch keine Bewertungen

- Form No. 16A: From ToDokument2 SeitenForm No. 16A: From ToMurthy KarumuriNoch keine Bewertungen

- Stripe's Guide To Payment MethodsDokument33 SeitenStripe's Guide To Payment MethodsYogesh Gutta100% (1)

- Gas BillDokument1 SeiteGas BillJitesh SharmaNoch keine Bewertungen

- SMR For ITR 2022Dokument1 SeiteSMR For ITR 2022Micaela VillanuevaNoch keine Bewertungen

- Statement of Account: Penyata AkaunDokument5 SeitenStatement of Account: Penyata AkaunyogsivaNoch keine Bewertungen

- Sample Debit NoteDokument1 SeiteSample Debit Notekokocute71% (7)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorVon EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorBewertung: 4.5 von 5 Sternen4.5/5 (63)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingVon EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingBewertung: 4.5 von 5 Sternen4.5/5 (97)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementVon EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementBewertung: 4.5 von 5 Sternen4.5/5 (20)

- Introduction to Negotiable Instruments: As per Indian LawsVon EverandIntroduction to Negotiable Instruments: As per Indian LawsBewertung: 5 von 5 Sternen5/5 (1)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorVon EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorBewertung: 4.5 von 5 Sternen4.5/5 (132)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersVon EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNoch keine Bewertungen

- The Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysVon EverandThe Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysNoch keine Bewertungen

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseVon EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNoch keine Bewertungen

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpVon EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpBewertung: 4 von 5 Sternen4/5 (214)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASVon EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASBewertung: 3 von 5 Sternen3/5 (5)

- Competition and Antitrust Law: A Very Short IntroductionVon EverandCompetition and Antitrust Law: A Very Short IntroductionBewertung: 5 von 5 Sternen5/5 (3)

- Learn the Essentials of Business Law in 15 DaysVon EverandLearn the Essentials of Business Law in 15 DaysBewertung: 4 von 5 Sternen4/5 (13)

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessVon EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessBewertung: 5 von 5 Sternen5/5 (1)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsVon EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNoch keine Bewertungen

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesVon EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesBewertung: 5 von 5 Sternen5/5 (1)

- California Employment Law: An Employer's Guide: Revised and Updated for 2024Von EverandCalifornia Employment Law: An Employer's Guide: Revised and Updated for 2024Noch keine Bewertungen

- Public Finance: Legal Aspects: Collective monographVon EverandPublic Finance: Legal Aspects: Collective monographNoch keine Bewertungen