Beruflich Dokumente

Kultur Dokumente

Sample Risk Register - For Reference

Hochgeladen von

Omkar LoganOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Sample Risk Register - For Reference

Hochgeladen von

Omkar LoganCopyright:

Verfügbare Formate

1

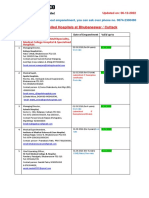

Detailed Risk Listing

Risk

Category

Risk

Event

Risk Description

Strategic

Investment

Risk

The project may not generate revenue as anticipated

resulting in negative Net Present Value (NPV) / delayed

payback/ suboptimal growth rate

1. Gaps in validation of the traffic volume assumptions on a

periodic basis and revising the revenue projection (revenue

drivers)

Rating

The Organization needs to develop a structured report to monitor

all the assumptions

Risk remains.

2. Inadequacies in assessment of competition activities (XYZ,

other ports)

We have learnt that XYZ has initiated the export of Bauxite from

the Port.

It was also learnt that the competitor has plans to go ahead with

container exports and it form part of its master plan

From the physical review, we have observed that the reclamation

activity near the port is being carried out at a rapid pace. The port

may become a major challenge going forward.

Risk is scaled upwards

3. Change in economic relations with other countries (dry bulk,

duties, bans etc)

Certain commodities driving the food inflation are being banned

for exports. The risk is subject to target segment of commodity

and any applicable restriction.

To be evaluated with the Marketing Team

4. Reliance on the existing road infrastructure connecting rail and

other parts of hinterland

The Project continues to depend on the existing level of

infrastructure.

The risk remains

ABC Limited

Detailed Risk Listing

Risk

Category

Risk

Event

Risk Description

Strategic

Investment

Risk

The project may not generate revenue as anticipated

resulting in negative Net Present Value (NPV) / delayed

payback/ suboptimal growth rate

Rating

5. Sandbar at the channel entry may pose challenges after

dredging

The mitigation is subject to final dredge design at present.

Risk remains

6. High cost of initial capital (2 monsoons) and recurring

maintenance dredging (pre-dredged survey, dredging, disposal

through barges, post dredge survey)

Dredging activities carried out prior to <Date>(pre-monsoon) may

result into additional cost in absence of adequate protection. The

dredge design is under process.

Risk remains.

7. Selection of incompetent contractor (expertise, scalability and

proven experience)

This may need to be scaled down for Port as the contractors for

critical project activities have been evaluated and brought onboard.

However, risk remains in relation to fabrication of platform for ship

lift, road construction, and other ancillary contracts

Risk scaled upwards

8. Unacquired land within the project area (14 acres of land

pending to be acquired)

We have learnt that the matter is pending for final decision at the

Collector's office.

Risk remains

9. Inability to make changes in the Master Layout / Plan of the

project plan without the approval of the regulator

We have learnt that there are no major changes anticipated to the

Project except for Bunkering Facility, Change in technology for the

ship lift.

The approval requirements need to be evaluated

ABC Limited

Detailed Risk Listing

Risk

Category

Risk

Event

Risk Description

Strategic

Investment

Risk

The project may not generate revenue as anticipated resulting

in negative Net Present Value (NPV) / delayed payback/

suboptimal growth rate

Rating

ABC Port Specific

1. Change in cost ratio between road transport and coastal

transport to JNPT

The crude is trading at peak and on account of external situations

(Middle East, Japan) the prices are expected to remain at high

level. The fall out of the inflation, the domestic prices of fuel are

also likely remain at high levels. This may work favourably for

transhipment cargo. However, the benefit is subject to situation at

the time of port heading towards operational stage

Risk scaled downwards

2. Significant dependency on single commodity (bauxite) with

limited reserves and handful of miners coupled with regulatory

decisions which may impact their mining licenses

We have learnt that XYZ has initiated the export of Bauxite from

the Port. This poses a potential threat to the Port.

Risk scaled upwards

3. Dependency of exports by chemical companies in the

hinterland which are operating at low capacity utilization levels

and also subject to regulatory action by CPCB

The CPCB regulations and actions are becoming more stringent.

The risk is also subject to segment of cargo being evaluated by

the Port.

Risk remains

4. Commercial terms of the concession agreement are on the

basis of fixed rate pricing

To be evaluated at HO for developments

5. Proposed move by government to bring non-major ports under

the Tariff Authority for Major Ports (TAMP). This may restrict

independence in pricing and may lead to conflict between the

Central and State Government over the concessions granted

To be evaluated at HO for developments

ABC Limited

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Book Speos 2023 R2 Users GuideDokument843 SeitenBook Speos 2023 R2 Users GuideCarlos RodriguesNoch keine Bewertungen

- BA 4722 Marketing Strategy SyllabusDokument6 SeitenBA 4722 Marketing Strategy SyllabusSri GunawanNoch keine Bewertungen

- T688 Series Instructions ManualDokument14 SeitenT688 Series Instructions ManualKittiwat WongsuwanNoch keine Bewertungen

- Icici PrudentialDokument52 SeitenIcici PrudentialDeepak DevaniNoch keine Bewertungen

- C++ Program To Create A Student Database - My Computer ScienceDokument10 SeitenC++ Program To Create A Student Database - My Computer ScienceSareeya ShreNoch keine Bewertungen

- Assignment RoadDokument14 SeitenAssignment RoadEsya ImanNoch keine Bewertungen

- Saif Powertec Limited Project "Standard Operating Process" As-Is DocumentDokument7 SeitenSaif Powertec Limited Project "Standard Operating Process" As-Is DocumentAbhishekChowdhuryNoch keine Bewertungen

- Current Surgical Therapy 13th EditionDokument61 SeitenCurrent Surgical Therapy 13th Editiongreg.vasquez490100% (41)

- Functions PW DPPDokument4 SeitenFunctions PW DPPDebmalyaNoch keine Bewertungen

- Empanelled Hospitals List Updated - 06-12-2022 - 1670482933145Dokument19 SeitenEmpanelled Hospitals List Updated - 06-12-2022 - 1670482933145mechmaster4uNoch keine Bewertungen

- Taxation Law 1Dokument7 SeitenTaxation Law 1jalefaye abapoNoch keine Bewertungen

- Astm D2000 PDFDokument38 SeitenAstm D2000 PDFMariano Emir Garcia OdriozolaNoch keine Bewertungen

- O'Dell v. Medallia, Inc. Et Al, 1 - 21-cv-07475, No. 1 (S.D.N.Y. Sep. 7, 2021)Dokument15 SeitenO'Dell v. Medallia, Inc. Et Al, 1 - 21-cv-07475, No. 1 (S.D.N.Y. Sep. 7, 2021)yehuditgoldbergNoch keine Bewertungen

- Effect of Plant Growth RegulatorsDokument17 SeitenEffect of Plant Growth RegulatorsSharmilla AshokhanNoch keine Bewertungen

- HPCL CSR Social Audit ReportDokument56 SeitenHPCL CSR Social Audit Reportllr_ka_happaNoch keine Bewertungen

- PNGRB - Electrical Safety Audit ChecklistDokument4 SeitenPNGRB - Electrical Safety Audit ChecklistKritarth SrivastavNoch keine Bewertungen

- SAP HR - Legacy System Migration Workbench (LSMW)Dokument5 SeitenSAP HR - Legacy System Migration Workbench (LSMW)Bharathk KldNoch keine Bewertungen

- Sodexo GermanyDokument13 SeitenSodexo GermanySandeep Kumar AgrawalNoch keine Bewertungen

- Profibus Adapter Npba-02 Option/Sp Profibus Adapter Npba-02 Option/SpDokument3 SeitenProfibus Adapter Npba-02 Option/Sp Profibus Adapter Npba-02 Option/Spmelad yousefNoch keine Bewertungen

- Level Swiches Data SheetDokument4 SeitenLevel Swiches Data SheetROGELIO QUIJANONoch keine Bewertungen

- Thesis On Retail Management of The Brand 'Sleepwell'Dokument62 SeitenThesis On Retail Management of The Brand 'Sleepwell'Sajid Lodha100% (1)

- FHHR 013 Red Tag Procedure PDFDokument5 SeitenFHHR 013 Red Tag Procedure PDFN3N5YNoch keine Bewertungen

- XU-CSG Cabinet Minutes of Meeting - April 4Dokument5 SeitenXU-CSG Cabinet Minutes of Meeting - April 4Harold John LaborteNoch keine Bewertungen

- Forces L2 Measuring Forces WSDokument4 SeitenForces L2 Measuring Forces WSAarav KapoorNoch keine Bewertungen

- 2011-11-09 Diana and AtenaDokument8 Seiten2011-11-09 Diana and AtenareluNoch keine Bewertungen

- Chapter 13Dokument15 SeitenChapter 13anormal08Noch keine Bewertungen

- SXV RXV ChassisDokument239 SeitenSXV RXV Chassischili_s16Noch keine Bewertungen

- Atlascopco XAHS 175 DD ASL Parts ListDokument141 SeitenAtlascopco XAHS 175 DD ASL Parts ListMoataz SamiNoch keine Bewertungen

- LSL Education Center Final Exam 30 Minutes Full Name - Phone NumberDokument2 SeitenLSL Education Center Final Exam 30 Minutes Full Name - Phone NumberDilzoda Boytumanova.Noch keine Bewertungen

- Friday 25 Mar 12:15 AM Friday 25 Mar 5:30 AM: Emirates CGK DXBDokument3 SeitenFriday 25 Mar 12:15 AM Friday 25 Mar 5:30 AM: Emirates CGK DXBDONI ARTANoch keine Bewertungen