Beruflich Dokumente

Kultur Dokumente

Bruce Babcock Interviews Steve Briese

Hochgeladen von

fredtag4393Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bruce Babcock Interviews Steve Briese

Hochgeladen von

fredtag4393Copyright:

Verfügbare Formate

3/6/2015

BruceBabcockInterviewsSteveBriese

RealityBasedTrading

Company

presents

BruceBabcock

Interviews

SteveBriese

on

Tradingwiththe

Commitmentsof

Traders

Report

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

1/55

3/6/2015

BruceBabcockInterviewsSteveBriese

SteveBrieseistheworld'sforemostauthorityon

interpretingtheCFTC'sCommitmentsofTraders

Report.Alongwithhisownsuccessfultrading,hehas

hadadistinguishedcommoditycareerasanewsletter

publisherandsoftwaredeveloper.Hehassomevery

uniqueandeffectiveapproachestotrading.

Now47yearsold,BriesewasborninMinneapolis,

wherehegrewup.AftertwoyearsatSt.John'sCollege,

in1968,helefttoflyhelicoptersintheArmy.Thiswas

attheheightoftheVietnamWar.Asheexplainedit,

"MyfatherhadbeenaprisonerofwarinWorldWarII.

MygrandfatherhadservedinWorldWarI.Ijust

thoughtIoughttogoandfindoutwhatitwasallabout.

Therewasn'tanythingIfoundouttherewhichmademe

feelweshouldn'thavebeenthere."

WhenheleftVietnam,Briesewasthehighestdecorated

officerinthehistoryofhisunit.Ittookhimalongtime

togethisfeetbackontheground.Hesaid,"ittook

threeyearstoreturntosomesortofnormalcy.WhenI

gotbackIcouldn'tstayputinoneplace.Iwas

constantlytraveling.Lookingbackatitafewyears

later,IcouldseethatforthreeyearsIreallydidn'thave

mywitsaboutme."

Stevebelieveshisexperienceasacombathelicopter

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

2/55

3/6/2015

BruceBabcockInterviewsSteveBriese

pilothadaverypositiveeffectontherestofhislife."I

operatedunderextremestressandunderthose

conditionsbecamethebestthatthereeverwasat

something.Soitdidbuildselfconfidence.Ihavelived

therestofmylifefeelingifIwasgoingtogetit,that

waswhenIwasgoingtogetit.Idon'thaveanyfearof

death.Idon'thaveanyfearofanythingelse.WhenI

tookaround,Iseethatasabigadvantageovera

tremendousnumberofpeoplewhofearallkindsof

things."

Hereenrolledincollege,butagainleft,thistimeto

helpathisfather'sstructuralsteelfabricationplant.

Togethertheybuiltthebusinesstothepointwhereit

becameatouristattractionforJapanesewhowantedto

comeandcopythemostadvancedsteelfabricating

plantintheworld.Ashedescribedit,"Adozenpeople

showedupwithnotebooksandtapemeasures.Before

weknewwhatwasgoingon,theyphotographedand

measuredourentireplantindetail,everypieceof

equipment.That'showtheJapanesebecamesuchan

industrialpower."

In1976,heleftthatbusinessandforawhileflew

helicoptersinAlaska.Thenhemanagedanemployment

agencyforayear.Throughthat,hefoundaperfectjob

andplacedhimselfasnationalsalesmanagerfora

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

3/55

3/6/2015

BruceBabcockInterviewsSteveBriese

specialtycontractingcompany.Heworkedthereuntil

1982,whenhestartedhisowncommercialroofing

business.Overthenextsevenyearshebuiltthat

operationto60employees.

Onhis40thbirthday,hedecidedtogoontosomething

else.Hefoundotherjobsforhiskeyemployeesandjust

closedthebusinessdowntoconcentrateonpublishing

thecommoditynewsletterhehadpurchasedthe

previousyearandtradingforhisownaccount.

Atthattime,Stevewasnotanewcomertothe

commoditymarkets.Hehadstartedtradingin1973

afterreadingAnyoneCanMakeaMillionDollarsby

MortonSchulman."Thebestandmostexplosive

investmentintheentirebookappearedtobe

commodities,"heexplained."Iwenttoalocalfirmto

seeifanyofthebrokerswastradingcommodities.Sure

enoughtherewasaguytherewhotookLarryWilliam's

hotlineandhadcommoditiesonhisscreenallday.I

openeda$3,000accountandboughtthreesilver

contractsat$2.97.Itwentstraightup.

"Irodeitallthewayto$3.60.Ithoughtithadgonefar

enoughforawhile.IgotoutandthendecidedImight

aswellmakesomemoneyonthecorrection.Iwent

shortandwasaheadforaboutadaybeforethemarket

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

4/55

3/6/2015

BruceBabcockInterviewsSteveBriese

lockedlimitupforthreedaysinarow.Bythetimeit

wasover,Ihadlostmy$3,000,andIowedthebroker

another$3,000."

Stevedidn'tgiveup,however."AfterIpaidthebroker

back,Iwentaboutcreatinganotheraccount.Atthat

time(1974),IdiscoveredtheCommitmentsofTraders

Report.Isubscribedtothatandlookedfor

opportunities.Iwassearchingforextremestogo

againstthesmalltraders.

"ThenicethingabouttheCommitmentsreportwasit

onlycameoutonceamonth.Itmightbeseveralmonths

beforeyou'dseeasituationwheretherewasabig

spreadbetweenthetradingpositions.WhenIfound

somethingthatlookedcheaponthechartsandsmall

traderswereintheoppositepositionorhadnoposition,

thenI'dbuy.Ididn'thaveanyrealsystem,butIbegan

keepingmyownpricechartswithopeninterest,

Williams%RandtheCommitmentsdata.

"Typically,Iwouldmakesomemoneyandthenloseit

back.Iwasmakingenoughthoughtostayinterested.I

soonrealizedthatevenifIlostmoney,ifI'ddonejust

theopposite,Iwouldhavemadealotofmoney.SoI

keptworkingondevelopingsomekindofmethodology

totradeby.

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

5/55

3/6/2015

BruceBabcockInterviewsSteveBriese

"By1983youcouldbuyapersonalcomputer.You

couldn'tdomuchwithityet,butitwasn'ttoolong

beforetherewassoftwareavailabletodosomethings.I

startedprogramingin1983withthefirstportablethat

cameout.ItwasaCP/Mmachine.

"In1987,afterthestockmarketcrashIdecidedthatthe

commercialconstructionbusinesswasnotgoingtobe

booming.Istartedlookingaround.I'dbeeninterestedin

commoditiesallthistimeanddecidedmaybeIcould

makealivingatitanddowhatIreallywantedtodo."I

resolvedtodevelopamethodologytotrade.Ididsome

researchintowhohadorganizedaCommitmentsof

TradersdatabaseandwhereIcouldgetit.Icame

acrossCurtisArnoldwhohadbeenpublishingthe

CommodityInsidernewsletterbuthadjustquit.He

couldn'tmakeagoofit.

"Inegotiatedtobuyhisresearchwhichconsistedofhis

databaseandhisformulafortheCOTindex.His

formulawasastochastictypeoscillatorbasedonthe

commercialpositions.Itmadealotofsense.Istarted

myownnewsletterinMarch,1988,publishingnet

positionchartsandCOTindexes.Infact,Italkedtoyou

atthattimeandusedyourmailinglisttogetstarted.

"Idecidedthenewslettershouldpayallmyliving

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

6/55

3/6/2015

BruceBabcockInterviewsSteveBriese

expensesandoverhead.ThenIwouldn'tbeunderany

particularpressuretoliveoffmytrading.That'stheway

Iorganizedit.Evenwithfivekids,withinsixmonthsI

wasabletoliveoffthenewsletterandtradeonthe

side."

Steveusedhisprogrammingskillstocreateanumberof

commerciallysuccessfulcommodityprograms."Ihad

peoplesendingmesystemsallthetime,wantingmeas

apartnertoselltheirsystem.

"Oneguykeptfaxingmehissignalseverydayforsix

months.Hefinallyconvincedmehehadsomething.I

madeadealwithhim,anddevelopedasoftware

productcalledSystemTracker.Thetheorywastotake

manypubliclyavailablesystemsandmethods,keep

trackoftheirtrading,andthengetintoandoutofthe

marketsalittlebeforetheydid.Werentedtheprogram

for$300amonthto50people,withthecustomerbeing

abletoapplyuptothreemonth'srenttothe$10,000

purchaseprice.49boughtit.Westillhaveoneperson

whocontinuestoleasetheprogramfor$300amonth.

"Thatsamesystemdeveloperlaterinventedan

algorithmfortradingcurrencycrossratespreads.Steve

turneditintoasoftwareproducttheysoldcalledCross

Current.IttradedtheJapaneseYenagainstthethree

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

7/55

3/6/2015

BruceBabcockInterviewsSteveBriese

Europeancurrencies.ItcameoutinAugust,1992,and

purchasersmade"tonsofmoney"thefirstyear.

Althoughthecurrenciesdieddownsomewhatsince,the

systemisstillahighlyratedperformer.Itiscurrently

availablefrom,coincidentally,CurtisArnold.

StevealsomarketedastockindexsystembyRoger

AltmancalledPrivate$tock.Hehasn'trunatrack

recordonitrecentlybutsays,"Wehavepeoplewho

continuetotradeit."Healsocreatedauniquecharting

programprimarilyforhisownusecalled,AutoPilot.

HehasrecentlyreprogrammeditforWindows.It

containssomeindicatorsavailablenowhereelsesuchas

lglehartPercentNewandHurstEnvelopes.

MyinterviewonApril25,1996,continued:

Canyousummarizeyourtradingapproachwith

respecttoentries,exitsandstops?

Ithinkthebottomlinetomyapproachisthatifyouare

tradingamethodology,atechnicalsystem,thetechnical

systemshoulddictatewherestopsandentriesgo.The

typicaltrader,however,probablycan'taffordtotrade

withtheriskthatmostsystemscreatebyhavingalarge

distancebetweentheentryandtheexit.

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

8/55

3/6/2015

BruceBabcockInterviewsSteveBriese

Theroutemostsystemdevelopershavetakenaround

thisistoadjustthestoploss.Itbecomesamoneystop.

"Ican'tafford$1,000riskonthis,soI'mjustgoingto

putamoneystopinat$500."Ithinkthat'sentirely

wrong.Ifyou'regoingtotakeaposition,youshouldbe

abletostaywiththepositionuntilthemarkettellsyou

throughyourtechnicalanalysisthatyouarewrong.If

yougetoutaheadofthat,you'renotreallyfollowing

anykindoftechnicalsystem.Icontinuetobelievethat

usingstandardchartpatternsisaverylucrativewayto

trade.

You'retalkingaboutclassicalchartpatterns.

Triangles,headandshoulders,thatkindofthing?

Yes.EdwardsandMagee.Ialsohaveamanuscriptof

thechartingcoursewhichprecededthatbook.Itwas

neverpublishedinbookform.Itwasatradingcourse

publishedbyanuncleofMagee.I'vegonebacktolook

atwhathasworkedandtriedtoreducethechart

patternsdowntoamanageablefew.IhavetwothatI

lookfor.

Whichare?

Thefirstisafailureswingtoporbottom,whichyoucan

considertobeadoublebottomorslightlyhigher

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

9/55

3/6/2015

BruceBabcockInterviewsSteveBriese

secondbottom.

BruceGould's123.

Orthelasthalfofaheadandshoulderstoporbottom.

Orthelasttwopeaksofatripletoportriplebottom.

Thesearereversaltypepatterns.

Theotheroneisacoil.Thatwouldincludeanytypeof

trianglewhichisaconsolidation.Itistypicallya

continuationpattern,butitcanalsobeareversal

pattern.

Theproblemwiththesepatternsisthattotradea

breakoutandputyourstopontheothersideofthe

patternusuallycreatesmoreriskthanIwanttotakeand

thatmosttradersshouldtakebasedontheiraccount

size.Thetypicalapproachtothiswouldbetotradethe

breakoutwhenitcomes,buttoputyourstopatamoney

riskdistancefromtheentry.

Itaketheoppositeapproach.First,Ideterminewhere

mystoplossshouldbebasedonthepattern.Iwantto

putmystopatthepointwherethepatternfails.ThenI

determinehowmuchI'mwillingtoriskonthetrade.In

mycaseIneverriskmorethen$500percontractonany

trade.Idon'ttradetheS&P,wherethatwouldbe

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

10/55

3/6/2015

BruceBabcockInterviewsSteveBriese

difficult.

Isitamatterofpersonalcomfort?

Yes.

Ona123orfailureswing,wouldyourstopgo

belowthefirstlow?

Yes.

Goon.

I'veestablishedmystop,andIknowwhattheexitpoint

willbe.NowIhavetofindtheentrypointthatwill

keepmyriskwithintherequiredamount.Thiswill

usuallybeatapointbeforeabreakoutverifiesthe

pattern,stillwithinthepattern,Iuseotherfactorsto

forecastwhichwayapatternisgoingtocomplete.

Youdon'twaitforabreakoutandthentrytobuya

reaction.Youtrytoanticipatethecompletionofthe

pattern.

That'sright.IusetheCommitmentsofTradersdatato

predictthedirectionapatternwillcomplete.I'llgive

youanexampleintheBondmarket.[Seethechart.]In

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

11/55

3/6/2015

BruceBabcockInterviewsSteveBriese

theChristmas,1995issueofmynewsletter,Idescribed

aSpecialSituationontheshortsideofinterestrate

futures.BasedontheweeklychartIwaslookingfora

doubletopinTBonds.Itwasahugepattern.Idon't

carehowrichyouare,youcouldn'taffordtowaitfora

breakdownbelowthe1994lowandputastopabovethe

1993high.

That'saworsecasesituation.Mostpeoplearen'tgoing

tobetradingpatternsonaweeklychart.Iwaslooking

foradoubletopontheweeklychartbecausethe

commercialsweresellingveryheavilyintotherally.I

electedtoputonapositionbasedontheweeklychart

patternwithastopabovetheprevioushigh.Ofcourse,

thatoneworkedtoperfection.

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

12/55

3/6/2015

BruceBabcockInterviewsSteveBriese

Youhadtobeprettyluckytoenterwithin$500of

thehigh.

Whenyouknowwhereyourstopisandyouknowwhat

yourriskis,youareforcedtowaitforanopportune

entry.Themarketmustcometoyou.Inthiscaseit

workedoutbecauseItradedoptionsonthistrade.It

waspossibletodoevenwithfuturesifyouwere

preparedaheadoftimeandhadanorderintosellifthe

pricegothighenough.

Thehighontheweeklychartwas12204.Doyou

rememberwherethefutureswerewhenyoudid

youroptions?

Yes,theywereabove121.

Thattypeofsituationdoesn'tcomealongeveryday.

I'mgivinganextremeexample.We'restillnotevenhalf

waydowntothe1994low,whichisthepointwhere

thispatternwillbeconfirmedontheweeklychart.

Peopleshortfromthetophavemadeatremendous

amountofmoneyalready.

Ifindthattheonethingevenpeoplenewtothemarkets

areabletodoisdeterminewheretheywanttobeout

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

13/55

3/6/2015

BruceBabcockInterviewsSteveBriese

thespotwheretheyknowthey'regoingtobewrong

theirstoplosspoint.Typically,Iaskthemtofindthat

point.Itellthemthat'swheretheirentryshouldbe.If

youaregettinginwheneverybodyelseisexiting,the

majorityofthetimeyouwillprobablyhaveanoptional

entry.

That'saveryintriguingidea.Wherewouldyouput

yourstopthan?Thatbecomesamatterofrisk.

Ibasethatonapercentageoftheaccountsize,whichI

thinkshouldbeoneortwopercentonanyonetrade.

Forsmallertradersit'sgoingtobeabiggernumber,but

certainlynomorethanfivepercent.

Thissoundscontradictory.Youstartedoutby

sayingyoudon'twanttouseanonchartbasedstop.

Youuseapatternorsomemethodtosaywhereyou

shouldexit.That'swhereyouputyourstop.Then

youenteratapointwhichwillkeepyourrisktothe

amountyouwant.Nowyou'resayingforgetallthat

andenteratyourexitpointwithamoney

managementstop.

I'musinganoutsideindicator,inthiscasethe

CommitmentsofTradersReport,topredictthe

directionofthenextmove.Typicallytheentrypointis

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

14/55

3/6/2015

BruceBabcockInterviewsSteveBriese

muchclosertothestoplosspointthanpeoplerealize.

Quiteoftencommercialsareabletomoveamarketto

collectallthesereadystopsandhaveamaximum

positionbeforethemarketgoestheirway.SoIthinkthe

stopisthemostimportantthing,andthebestentryis

closetothat.

Yoursecondstrategyrequirespatiencebecause

you'regoingtomisssometradeswhenthemarket

nevermakesittoyourentry.Italsorequires

couragebecausethemarketisprobablylooking

prettybadwhereyourstoppointisandyou'vegotto

besteppinguptotheplate.Thekeytoyour

methodologyisthatnomatterhowbadthemarket

looks,it'sdeceptive.

Themarketalwayslookstheworstbeforeitturnsnear

yourstop.Ofcourse,IusetheCommitmentsdatato

predictthatamajorturnishappening.Underthis

procedureyou'regoingtofindtheoptimumentry.

Soyouwouldn'trecommendthattypeofprocedure

unlessyouwereusingtheCommitmentsofTraders

Reporttoestablishdirection.Wouldthatbeafair

statement?

Yes.

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

15/55

3/6/2015

BruceBabcockInterviewsSteveBriese

Wouldtryingtouseitinotherwaysbedangerous?

Ithinkso.I'malsosayingthisentryissuperiortoa

breakoutentrybecausethebreakoutentryisgoingtobe

toofarawayfromwheretheprescribedstoplossshould

be.

Idon'twantpeopletobedeceived.You'redefinitely

sayingtousethisonlyinconjunctionwith

CommitmentsofTradersdirectionalsuggestions.

That'sright.

Iagreewithyouinthesensethatbuyingweakness

andsellingstrengthisordinarilynotagoodwayto

trade.Butyou'regoingtomakeanexceptionhere

foryourCommitmentsmethodology.

Yes.

BeforewegettoyourCommitmentsstrategy,we

stillhavetocoverexiting.Ithinkyou'vedonea

prettygoodjobofdescribingtwodifferentwaysto

enter.Now,onceyouareinawinningposition,how

doyouexit?

Theexitistherealartoftrading.Therearealotof

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

16/55

3/6/2015

BruceBabcockInterviewsSteveBriese

peoplewhocanenterright,buttheexitisvery,very

difficult.Iprefertouseatrailingstoploss.WhatIlook

foristhepointwhenspeculatorsbecomeheavily

involvedinthemarket.YougetwhatIrefertoasa

speculativebubble.YoucanseeitintheCommitments

Report.Atthattime,Iliketomovemystopupbehind

thelatestcorrectionloworhigh.Ialsohaveasystem

thatlooksatvolatility.Whenthevolatilitydoublesfrom

entry,Iwilltakeoffhalftheposition.

Volatilitydefinedaswhat?

Astheaveragedailyrange.Iusethesametimeframeas

Iuseforgettingintothetrade.

Whatwouldthatbe?

Iusevarioustimeframesdependingonthemarket.For

instance,let'ssayI'mtradingabreakoutsysteminboth

theDeutschemarkandSwissFranc.Sincetheyareso

correlated,Iusetwodifferenttimeframes.Idon'twant

totradethesamemarketcycleinbothmarkets.For

instance,ifyou'retradingabreakoutaboveasomany

dayshigh,Imightlookforabreakouttoanew25day

highinonemarketandabreakouttoanew100day

highintheother.Iwouldtradeeachmarketdifferently.

Thetypicalsystemdeveloperlookstooptimizea

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

17/55

3/6/2015

BruceBabcockInterviewsSteveBriese

systemtoonlyonetimeframe.Doingthat,therewould

onlybeafewcomplexesinwhichyou'rereally

diversified.Youmighthaveachoiceofaslittleassix

marketstotradebeforestartingtodoubleuponthe

samemarketforces.

Whataboutthedangerofcurvefittingwhenyou

optimizeeachmarketdifferently?

ThesystemsIusetypicallyaresorobustthatinterms

ofabreakouttheymightworkfrom20daysto120

days.

Whyaretheysorobust?Becausetheyhaveveryfew

parameters?

Sure.Numberone,theyhaveveryfewparameters.And

numbertwo,therangeofvaluesforthoseparametersis

sobroadthatitreallydoesn'tmatterwhichoneyou

pick.Youcanpickwithadartwhatparametervalue

youwanttotrade.Thekeytoincreasingthesmoothness

ofyourequitycurveisthatwithinaparticularmarket

sectoryoushouldbetradingmorethanonecycle.That

meansusinggrosslydifferenttimeframes.AsI

previouslydescribed,youcouldtradea25daybreakout

inonemarketandinarelatedmarketthattendstomove

thesame,tradea100daytimeframe.Ofcourse,you

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

18/55

3/6/2015

BruceBabcockInterviewsSteveBriese

musthaveasystemthatisrobustenoughtotradethose

noncorrelatedtimeframesprofitably.

Thatsoundsliketryingtocombinelongtermand

shorttermsystemsinthesameportfolio.Thereare

peoplewhowilltradeoneshorttermsystemandin

thesomeaccounttradelongtermaswell.That

wouldamounttothesamething.Isthattheidea

you'retalkingabout?

Yes.Togetbacktomyexitplanwhenvolatility

doubles,inordernottohaveanadditionalparameter,I

usethesametimeframetodeterminetheaveragedaily

rangeasIusedforentry.Youlosedegreesoffreedom

everytimeyouaddanewparametertoasystem.(That's

astatisticalmeasureofreliability.)

Theincreaseinvolatilitytellsmethismarkethas

probablygoneasfarasit'sgoingtogoonthisparticular

legofthemove.Forinstance,recentlyIhadasystem

thatwentlongCrudeOilonabreakout.Volatility

doubledrightatthetop.Itookoffonecontractatthat

point.

Thenyoutrytogetbackinsometimelater?

Yes.Itrytogetbackinwhenthemarketreactsvery

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

19/55

3/6/2015

BruceBabcockInterviewsSteveBriese

closetomycurrentstoploss,soIhavemoreorlessthe

originalriskbackinthetrade.OnalongtradeIlookfor

abigdowndayfollowedbyasmallinsidedaynearthe

bottomofthefirstday'srange.Ifthatbringstherisk

down,Iputthetradebackon.

Fortherestofyourposition,you'retrailingyour

stopbelowthelatestreactionlow?

That'sright.

Youhavesomeimportantideasaboutmoney

management.Canyoutellusaboutthose?

IdeterminedwithCrossCurrent[hiscurrencyspread

tradingsystem]thatbyusingapyramidingscheme

whichaddstowinningtrades,youcoulddrastically

improvethereward/riskratio.Withthatsystemyou

couldaboutdoubleit.Mostsystemtestingsoftware

packagesdon'tallowyoutopyramid.Ortogetoutofa

tradeinstageseither.Thatwascriticaltoturningaso

sosystemintoaverysuccessfulsystem.

Anotherbreakthroughcameinmeasuringsystem

performance.Theavailableoptimizationroutinesuse

standardperformanceyardstickssuchasreturnon

maximumdrawdownortotalprofitsdividedbytotal

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

20/55

3/6/2015

BruceBabcockInterviewsSteveBriese

losses.Whenyouoptimizeasystem'sparameters,you

areoptimizingbasedonthosebenchmarks.Those

standardonesareabouttheonlychoices.Ifoundthey

werenotverygood.

Insystemtradingwhatyoushouldbetryingtodoisto

findasystematicmethodofbuildinganequitycurve

thatisasclosetoastraightlinewithassteepanangle

aspossible.Thebiggestdrawbackwithmostsystemsis

thelackofsmoothnessofthatline.Youwantto

minimizethemovementaroundastraightlineequity

curve.Idevelopedastatisticalmeasurewhichdidthat.

Itdoesn'tdoanygood,however,unlessyoucan

actuallyoptimizeforit,whichiswhyIcreatedsoftware

todoit.

Canyoutellusmorespecifics?

No.It'sproprietary.

Howdoyouchoosethebestmarketstotrade?

Ionceanalyzedahighlyratedsystemforitsauthor.He

foundhissystemwasprofitableinthreedozenmarkets

andfromthosehehadvariousportfoliosforvarious

sizeaccounts.Hebasedhisportfoliodecisionsonthe

totalprofitsgeneratedovera5or20yearperiod.Using

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

21/55

3/6/2015

BruceBabcockInterviewsSteveBriese

thestandardsystemperformancemeasures,whichare

theoneshehadavailabletohim,suchasreturnontotal

drawdownortotalprofitstototallosses,it

seemed/perfectlynatural.Butifyoulookedatmy

proprietaryperformancemeasure,youcouldseeright

awaythatmanyofthesemarketsshouldhavebeen

poorlyratedeventhoughtheywerehighlyratedusing

thestandardmeasures.Ilookedalittlecloseratthe

results.Sureenoughthereweresomegrainmarketsthat

wereveryprofitableforoneyeareveryf'iveorsix

years.Buttheymademoneysoinfrequentlyandhad

suchdrawdownsinbetween,thattheysubtractedfrom

thesmoothnessoftheequitycurve.Theirequitycurves

weresofarfromastraightlinethattheywerenotgood

marketstotradewiththatsystem.

Whataboutspecializinginjustafewmarketsorone

market?

Ioncetalkedtoafellowwhoeveryspringinvested

$75,000inSoybeanoptions.Itoldhimhisstrategywas

goingtohititbigeventually,butitwouldprobablybe

theyearhedidn'thave$75,000lefttoinvest.Oneofthe

bestthingsyoucandoisincludeasmanymarketsas

possibleinyourtradingthathaveshownconsistent

profitmakingpotentialyearafteryear.

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

22/55

3/6/2015

BruceBabcockInterviewsSteveBriese

Whatmarketswouldyourecommend?Whatarethe

bestmarkets?

We'retalkinghereintermsofatrendfollowingsystem.

Thecurrencieshistoricallyhavebeentremendousyear

afteryear.Someoftheinternationalfoodsaregood.

Cocoaisabigexception.Mostofthegrainsarenot

good.Eventhoughtheylooklikeitonachart,when

youtrytotradethemwithatrendfollowingsystem,

youfindtheyjustdon'tperformverywell.Theirbig

trendsaretooerraticandfarbetween.Theymayhave

trendedwellovertime,buttheydon'tperform

consistentlywellyearafteryear.CornandSoybeanOil

arethetwobestmarketswithinthegrains.

Canyoutellmehowmanymarketsisagoodcore

numbertotradewithoutspecifyingwhattheyare

necessarily.Yoursystemauthorhad36markets,

whichwastoomany.Whenyouweededthosedown,

howmanydidyouendupwith?

Eighteen.

AreyoufamiliarwithmybookTrendinessInthe

FuturesMarkets?

Yes.

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

23/55

3/6/2015

BruceBabcockInterviewsSteveBriese

Ifirstpublisheditin1988,andIupdateitevery

year.Itisanobjectiveexaminationofhow

historicallytrendythevariousmarketshavebeen.

Iwouldputthecurrenciesfirstandinterestrates

second.

Exactly.Coffee'supthere,andOrangeJuice.Iagree

withyou100percentthatCocoaisnotagood

trendingmarket.Idon'ttradeCocoawithsystems.I

trade21marketswithmyvarioustrendfollowing

systems.

IlovetheCocoamarket,butithasparticular

characteristicsthatdon'tallowyoutotradeitwitha

trendfollowingsystem.

I'vesuggestedovertheyearsthatpickingtheproper

portfolioofmarketsisequallyimportantwith

pickingagoodsystem.Itsoundslikeyouagreewith

meonthat.

Yes.It'scritical.Theproblemisthatthesystem

performancemeasuresavailabletotheindividualtrader

arenotsatisfactory.

LetmerunanotherideabyyouIfeelstrongly

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

24/55

3/6/2015

BruceBabcockInterviewsSteveBriese

about.Partoftheproblemwithalmostalltesting

softwareIsthatitonlyallowsyoutotestonemarket

atatime.Youcan'tjudgewhathappenswhen

you'retradingaportfolioofmarketstogether.This

appliestodrawdownespecially.Mysystemsoftware

allowsyoutotestawholeportfolioatonceandsee

whatthejointdrawdownis.Doyouagreethat

portfoliotestingiscrucial?

Yes,andIdothataswell.Yoursoftwarehasalways

donethat,andIagreethatitiscritical.Butitstill

doesn'tgiveyoutherightanswerifyoudon'thavethe

rightperformancemeasure.

Thatiscertainlyfoodforthoughtevenifyouwon't

telluswhatitis.Let'sturntoyourCommitmentsof

Tradersmethodology.Whydon'tyoustartwiththe

theoryofwhyItworks?

InmuchthesamewaysomepeopleusetheElliott

WaveTheoryorvarioustechnicalmeasuresto

determinehowfarthemarketwillmoveandwhenit

willreverse,IviewtheCommitmentsdataasameasure

ofcrowdpsychology.Intermsofcrowds,Icanbreak

commoditytradersintothreefairlyhomogeneous

groups.Thesethreecrowdshappentolineupwiththe

breakdownoftheCommitmentsofTradersReport.By

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

25/55

3/6/2015

BruceBabcockInterviewsSteveBriese

measuringtheirrelativebullishnessorbearishness,I

candeterminethelikelydirectionofamarket.WhatI'm

lookingforisextremesinsentiment.Assoonasyou

takeaposition,youhavejoinedacrowd.Youstartto

losepersonalinitiativeandadoptthecrowdmentality.

Let'ssayyou'rewatchingCNBC.Ifananalystagrees

withyou,he'saverysmartguy.Ifhedoesn'tagreewith

you,hedoesn'tknowwhathe'stalkingabout.He'sall

wet.Youtendtofollowyourcrowd'sleaders.

Forthosenotfamiliarwiththis,wouldyoudescribe

thethreedifferentcrowdswe'retalkingabouthere?

Thefirstcrowdiscommercialhedgers.Theyare

membersofoneoftwosubcrowdsinthattheyare

eitherproducersorconsumers.Producerswouldinclude

suchentitiesasminingcompanies,mutualfundsand

grainelevators.Theseentitiesholdcashpositionsina

commodityandselltheircommodityforwardinthe

futuresmarketatcurrentpricesifthey'reexpectinga

pricedecline.

Ontheothersideareconsumercommercialslike

manufacturersandfoodprocessorswhohavea

continuingneedforaparticularcommodity.Ifthey

believethepriceofthecommodityisgoingtorise,they

buyforwardinthefuturesmarkettocovertheirfuture

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

26/55

3/6/2015

BruceBabcockInterviewsSteveBriese

needs.

Whatthesesubgroupshaveincommonisthatthey

tradeoninsideinformationandtheygenerallytradein

onlyonedirection.Miningcompaniesarealwayslong

thephysicalmetals,sotheyalwaysshortinthefutures

market.Dogfoodcompaniesalwayshaveaninventory

ofmeatbyproductsorsoybeanmeal,andtherefore,they

alwaysbuyinthefuturesmarket.

They'reahomogeneousgroup.Theyareinthemarket

toreducetheirriskfromfuturepricemovements.They

haveanoffsettingcashposition.Iftheyarelosingin

futures,theyarewinningincash.Thisgivesthemmuch

morestayingpowerthantheothergroups.Theyhave

deeppocketstobeginwith.Inordertobelonginthe

largecommercialcategory,theyhavehugecash

inventoriesandhugefuturespositions.Thatmakes

commercialsahomogeneouscrowd.

Thesecondcrowdislargespeculators.Somebooks

backinthe1970s,includingLarryWilliams'book,How

IMadeOneMillionDollarsLastYearTrading

Commodities,recommendedthatyoufollowthisgroup

oflargetraders.Atthattimelargespeculatorsusually

gotthatwaythroughtradingprofits.Todaythelarge

tradersareprimarilythecommodityfunds.They're

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

27/55

3/6/2015

BruceBabcockInterviewsSteveBriese

willingtoassumetheriskfromcommercialsin

exchangeforanopportunitytoprofit.Theyare

typicallymotivatedtoshowaprofiteverymonth,and

they'redominatedbycomputerdriven,trendfollowing

approaches.Thus,theyalsotendtobeavery

homogeneousgroup.Theybecamelargebyhavinga

greatsalesdepartment,notbytradingprowess.SoI

don'tfollowthem,buttheyareaverycloseknitgroup.

Theremaininglargegroupissmalltraders.That

includesbothspeculatorsandsmallcommercialhedgers

suchasfarmersandotherswhodon'thavelarge

positions.Whattheyhaveincommonisthattheyhave

smallerpocketbooksthaneitheroftheothertwo

crowds.Theylackinsideinformationand,therefore,

they'remoresusceptibletonews.Thiscrowdtendsto

bebullishiftheyarelongratherthanlongiftheyare

bullish.

Theselittleguysareprobablythemostsusceptibleto

crowdpsychology.Oncethey'reinaposition,they

makeundisciplineddecisionsthatafterthefactthey

wouldfindillogical.Whilethey'reunderpressurefrom

theircrowd'smentality,theygoalongfortheride.They

arethelastonesinandthelastonesout.

IlookattheCommitmentsdataasaveryaccurateway

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

28/55

3/6/2015

BruceBabcockInterviewsSteveBriese

tomeasurecrowdpsychology.FromtheworkIhave

done,Ihavedeterminedthatinmostmarkets,ofthe

three,commercialsarebyfarthebestgrouptouseasan

indicatorformostmarketconditions.Thereasonisthey

takepositionsforthelonghaulandtypicallydefend

pricelevelsforlongperiodsoftime.Ididalittle

researchstudyacoupleofyearsagothatlookedat

extremereadingsforeachofthethreegroupsto

determinewhetherpricehadmovedinagreementwith

theirpositionthreemonthslaterorwhetherithad

movedopposite.Therearemanywaystodetermine

whetheragroupisrightorwrong.Thisisjustone,but

itconfirmedmysuspicions.Commercialswereright

abouttwothirdsofthetime.Smalltraders,whomany

peoplethinkareagoodcontraindicator,wereright45

percentofthetime.That'swaytoocloseto50percent

tobeusefulasacontraindicator.Largespeculators

wereveryclosetosmalltraders.Theywereright46

percentofthetime.Basedonthis,inmostsituationsI

lookattheCommercialposition.

Watchingthecommercialsdoesonemorethingforus.

Nobodycanbeanexpertinfundamentalsinmorethan

afewmarkets.Evenbeinganexpertinfundamentals

doesn'tmeanyou'regoingtomakemoneytradingthat

market.Peoplewhotradewithfundamentalsare

typicallycommercialswhodon'tneedtobeasaccurate

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

29/55

3/6/2015

BruceBabcockInterviewsSteveBriese

astherestofus.Theyhaveanoffsettingcashposition

whichgivesthemmorestayingpower.Ilookatthe

commercialpositionasameasureoftheunanimityof

opinionamongcommercialhedgers.Whencommercial

hedgersgetveryonesidedinamarketbasedon

historicalpatterns,youhaveaconsensusformedthat

candeterminemajorturningpointsinthemarket.

Whatabouttheargumentthathedgershaveto

hedge,andtheyjustgoinanddoit.Theyarenot

thatconcernedaboutpredictingmarketdirection.

They'rejusttryingtohedgetheircashneeds.

Thatmakessenseuntilyoutalktothepeoplewhoare

actuallydoingthetradingfortheselargefirms.Itturns

outthetradingoperationinmanyofthesefirmsisnow

aprofitcenter.Theirlivelihooddependsuponmakinga

profitontheirhedges.Whiletheycanaffordtobe

wrong,theydon'twanttobewrong.Theirtraderswho

areputtingonthesepositions,likeanyothertrader,

wanttoberight.

Theyhaveseveraladvantages.Thebiggestisan

informationaledge.Ifyoulookatthefundamental

informationavailabletotradersthatdoesn'tcomefrom

thegovernment,mostofitoriginatesfromthevery

commercialhousesthatwe'retradingagainst.Inthe

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

30/55

3/6/2015

BruceBabcockInterviewsSteveBriese

bestcasescenario,youassumethecommercialhouses

havealreadyactedbeforetheyreleasetheirreportsand

prognostications.Intheworsecase,youmightimagine

thatwhattheyactuallyreleaseisnotcompleteor

accurate.Theyarealsobetterfinanced.Commercials

haveahugeinformationalandfinancialadvantage.All

myresearchhasshowntheydomakemoneyontheir

hedging.

Mostofthetimetheyaren'tonesidedenoughto

giveasignal.Whatpercentageofthetimedoestheir

tradinggetonesidedenoughtosaysomething?

Ihaven'tworkedoutthepercentage.Butthetimesthey

areonesidedtendtobekeyreversalpoints.Thevery

bestsignalsweget,themostreliable,arewhenamarket

consolidatesandreactsfromanongoingtrend.

Typicallywhenweseecommercialbuyingcomeinon

acorrectiontoanextreme,itisahighlyreliablesignal

thatthemajortrendisgoingtoreassertitself.

Wedon'twanttomakethissoundliketoomuchofa

surething.Itdoesn'talwayswork.Doyouwantto

talkaboutthatalittlebit?

Sure.CommercialsunderthestudyIdidwereonlyright

twothirdsofthetime.Whatyoufindisthatwhenthey

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

31/55

3/6/2015

BruceBabcockInterviewsSteveBriese

arewrong,theycanbevery,verywrong.Inhisnew

bookontechnicalanalysis,JackSchwagertalksabout

signalfailuresbeingthemostreliableofallchart

signals.Whenwehaveasignalfailureonacommercial

signal(suchaswhereCommercialsareasbullishas

theyhaveeverbeeninamarketanditstartsheading

south),Iviewthatasasignalfailure.Thosecanbethe

mostexplosivemoves.

Youanticipatedmynextquestion.Whataboutusing

areversalstopwhenyou'retradingoneofthese

commercialsignals?

That'sthelastpartofSchwager'sdiscussion.He

referredtonovicetraderswhoridetheirpositionsintoa

bigloss.Amoreexperiencedtraderwillhaveaprudent

stoplosstoexithisposition.Butthereallyskilled

traderwilldoa180andreversehispositiontogowith

themove.

WhatItrytodoinmyworkisnotonlypinpointwhere

commercialsareaggressivelyonesidedinthemarket,

butalsokeypointswhereIanticipatetheyaregoingto

bewrong,I'velearnedtoidentifycertainpatternsinthe

Commitmentsdatathatoccuratmajormarketturns.

TaketheTBondmarketasanexample.[Seethe

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

32/55

3/6/2015

BruceBabcockInterviewsSteveBriese

accompanyingchart.]in1993,Ihadspotted

commercialsasverybullish.Theyheldanextremely

bullishpositiongoingintothespringof'94.Their

buyinghadbeenconcentratedataboutthe113level,

whichIthenhighlighted."Ifthemarketbreaksthrough

thisextremecommercialsupportat113,"Isaid,"that

willbeoursignalfailurepointthepointtogoshort."It

didbreakthrough,andthatwastheworstyearon

recordforbondprices.

Interestinglyenough,commercialscameinheavilyas

buyersinOctober,1994,triggeringaminorbuysignal.

Theiractivitycalledbothendsofthemoveina

differentway.Theywerewrongatthetopbutrightat

thebottomofthatmove.

Iwaslookingforthisreboundtobecomeasecondary

sellingopportunity.Aspricescamecloserandcloserto

thepreviouspeakjustover122,1startedtobetona

doubletop.Commercialswerethemostbearishat

Christmastime,justaspricesthreatenedtheprevious

1993top.Inthiscasethecommercialswereexactly

right.Thisiswhereyougetaveryhighconfidence

signal:acorrectiontoanongoingmajortrend.Iviewed

themajortrendashavingturneddownin1994.

Commercialscameinassellersonthetestofthe

previoushighandwereexactlyright.Itisinterestingto

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

33/55

3/6/2015

BruceBabcockInterviewsSteveBriese

notewhathappenedacrosstheinterestratespectrum

afterthemarketbrokefromthesecondtopbutbefore

that3pointdowndaycausedbytheunemployment

report.Commercialswerebuyingwithavengeance

acrosstheinterestratespectrum.Theybought

enormousnumbersofcontracts.

Iviewedthisasanotherindicatorofamajortop

becausewhattypicallyhappensatthesemajorhighsis

commercialsputinthetopthroughtheirsellingbutthen

trytoholdthemarketwithinanarrowrangebybuying

afteraslightdecline.Whentheybuyinhugeamounts,

that'sanindicationofpanic.Whatitmeansistheyhave

suchhugepositionsinthecashmarketthattheytryto

usethefuturesmarket,wheretheycanleverage,tohold

upthecashmarket.Whatyoufindinthesecasesis

firmsputtingonwhatarecalledTexashedges.They're

longcashandlongfutures,too.InthiscaseIwasable,

asIhavebeentimeandagain,tospotthispanicbuying

asaredflagandaredherring.Itwasanindicationthat

weweregoingtohaveasubstantialmoveagainstthe

commercials.

Itsoundssomewhatcontradictory.Yousaythatthe

commercialsaremostlyrightandsoyoudowhat

theydo.Butthenyoualsogooppositetowhatthey

do.Youreallyhavetoknowthespecificsofwhento

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

34/55

3/6/2015

BruceBabcockInterviewsSteveBriese

followthemandwhennotto.

That'swhymynewsletter'srenewalrateissohigh.The

Commitmentsdataisreadilyavailablefromavarietyof

sources.TheCFTChasevenmadeitavailableonthe

Internet.Anybodycancollectitforfreeandtookatit.

Allthechartservicespublishnetpositionchartsthat

showwhatthepositionsofthesetradergroupsare.But

analyzingthesechartsisnotastraightforward,

straightlineprocedure.It'snotricktodeterminewhena

particulartradinggroupisbullish.Therealtrickis

beingabletodeterminewhenthey'regoingtobewrong.

I'mnotsuggestingyoucanbat1,000,butIam

suggestingthatwhencommercialsarewrong,theytend

tobewronginsuchabigwaythatthosearethemoves

wedon'twanttomiss.That'swhyyoushouldtrytospot

thekeycommercialsupportandresistancezones.If

theyarepenetrated,youwanttogowiththatmove.

Let'sgoontotheprocedure.Tellushowyou

producewhatyouprintinyournewsletter.

IstartedwithadatabaseIboughtfromCurtisArnold.

HepublishedanewsletterbeforeIdid.Hehadmanyof

themarketsgoingbackto1983.Ittookmeayearanda

halftofillinthisdatabaseforallthemarketsthathave

enoughopeninteresttofollow.Thedataismonthly

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

35/55

3/6/2015

BruceBabcockInterviewsSteveBriese

from1983toNovember,1990.In1990,Istartedaletter

campaigntopetitiontheCFTCtoreleasethedatamore

promptlyandmorefrequently.Thatactuallybrought

results.StartinginOctober,1990,wegotreportsonthe

firstandfifteenthofthemonththatwerereleased

withinthreedays.Thedatabecamebimonthlyfrom

October,1990untilOctober,1992.Thentheywentto

reportingweeklyfigureseveryotherweek.They

calculatethenetpositionseveryTuesdayandrelease

twoweekswortheveryotherFriday.

Muchofthehistoricaldataoutthereisdefective.

There'sadatasourcecalledPinnacleDatawhichclaims

tobethesolesourceofSteveBriese'sCOTIndex,as

wellasprovidingtheCommitmentsofTradersReports.

WhattheyhaveareCurtisArnold'sCOTindexes.He

usedafixedtimeframeanddidnotadjustforchanges

inopeninterest,whichhavebeenextremeinsome

markets.SoPinnacledoesnothaveSteveBriese'sCOT

Indexes.

ThegovernmentreleasedthehistoricaldataPinnacle

usesintapeformin1990.Itgoesbackto1986and

appearsastwiceamonthdata,whichwasnotwhatwas

reportedatthetime.Itwasnotaudited,anditisfullof

errors.Thegovernmentknewthiswhentheyreleasedit.

Mostoftheavailablehistoricaldata,including

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

36/55

3/6/2015

BruceBabcockInterviewsSteveBriese

Pinnacle's,includethesefaultynumbers.

Mydataisallfromtheoriginalreports.Formanyyears

thegovernmentcouldn'talwaysaddcorrectly,soI

providederrorcheckingtothem.Tomakesuretheyadd

up,IhaveerrorcheckingbuiltintotheprogramIuseto

readthenumbers.Ialsohaveallthecorrectionsthe

governmentissuedsubsequenttothereports.

Doyousellyourdataindependently?

Ido.

Howmuchisit?

$95ayear.

Soifyouwanttogobacktenyears,it's$950?

No.Igiveawaytheentirehistoricaldatabasegoing

backto1983withaoneyearupdateorder.Yougeta

year'sworthoffutureupdatesplusallthehistoryfor

$95.

Theupdatesarewhatyouyourselfdownloadevery

twoweeksusingamodern?Couldn'tapersonjust

getthedatathemselvesontheInternet?

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

37/55

3/6/2015

BruceBabcockInterviewsSteveBriese

Unfortunately,theInternetfilesarestructuredlikea

printedreport.They'renotusefulunlessyouareableto

readthenumbersintoachartablefile.WhatIdoistake

theelectronicallyprintedreport,pulloutthekey

numbersandputthemintocommadelimitedASCII

filesinastandardpricefileformat.Youcanthengraph

theminmostcommoditychartingpackages.They'rein

open,high,low,close,volume,openinterestfields.

Youcanimportthemandcreatechartsonyourown

computer.

Wheredoyougetthedata?

FromMartinMarietta,whichsomebodyelsejust

boughtout.Ipayahundredandsomedollarsamonth

tocollectthedata.

Whydoyoupaysomuchwhenit'sfreeonthe

InternetorfromtheCFTC?

Iamprogrammedtoprocessthefileformatthatcomes

fromMartinMarietta.Ididrevisemyprogramto

conformtothegovernment'snewformatwhenthey

wenttotheInternet,butthentheychangedtheformat

again.Iwasn'tabouttokeepreprogrammingeverytime

theychange.SoIstayedwithMartinMarietta.Also,the

Internetcanbequiteslow.Collectingthatfilehastaken

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

38/55

3/6/2015

BruceBabcockInterviewsSteveBriese

meupto45minutesforsomethingthatshouldtakea

minute.Ineedthedatarightaway,soIpayforit.

Ifsomebodysubscribesto,say,CommodityTrend

Service'schartservicewiththedatainthere,isthere

anythingwrongwithlookingattheircharts?

No,that'stheeasiestwaytodoit.Thenit'saquestionof

interpretingthecharts.Butyouofferquiteabitmore

thanjustcreatingchartsoftherawdata.WhatIdoin

processingthedataiscreatewhatIcalltheBriese

PercentCOT(CommitmentsofTraders)Indexwhich

takesthecommercialpositionandcomparesittoan

historicalbenchmark.Thelargecommercialpositionis

reportedassomanylongsandsomanyshorts.I

subtracttheshortsfromthelongstoarriveatanet

position.Ithencomparethatcurrentnettothe

"maximum"and"minimum"netpositionhistorically.

Thosemaximumsandminimumsarethemostbullish

andtheleastbullishpositionsoveraspecifiedlook

backperiod.Commercialsmovefromnetlongtonet

shortinmostmarkets.AllI'mdoingiscreatinganindex

whichshowsthecurrentposition'srelationshiptoan

historicalperiod.Howrelativelybullishorbearishare

thecommercialscurrently?

Theperiodyouuseisdifferentforeachmarket,and

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

39/55

3/6/2015

BruceBabcockInterviewsSteveBriese

it'sproprietary.

That'sright.

Thedifferencebetweenwhatyoudoandwhat

CurtisArnoldusedtodoisthatheusedthesame

periodforallmarkets.

Correct.Ihavemadeoneothermodificationwhichhas

becomenecessaryovertheyears.Therehavebeenhuge

changesintheopeninterestinmanyofthesemarkets.I

haveaproprietaryopeninterestadjustmentIuse.

Idon'tunderstand.

Becausewe'remeasuringchangesinthedifference

betweenlongsandshorts,iftheopeninterestincreases

substantiallyinamarketbecausethereismoreactive

hedgingfromaparticulargroupofsuppliersor

producers,thenthenetpositionsmightnotbefromthe

samegroupyou'vebeenfollowinghistorically.Asthe

openinterestrises,thenetpositionsyouseecharted

todaymaynotbethesametradermixascomprisedthe

previousdatapointsonyourchart.Forinstance,Futures

Chartsprintsfouryearsofdata.Asyouseetheopen

interestrisequitedramaticallyinsomeofthemarkets,

themixoftraderschanges.Ifoundawaytoadjustfor

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

40/55

3/6/2015

BruceBabcockInterviewsSteveBriese

that,soIgetamoreaccurateongoingreadingof

relativebullishnessandbearishnesscomparedto

historicallevels.

Thepercentagenumbersyouprintinyour

newsletterarepercentagebullish.Thehigherthe

percentage,themorebullishthecommercialsarein

aparticularmarket.

That'sright.WhenIshowa100percentCOTIndex

reading,thatmeansthecommercialnetposition,the

longsminustheshorts,isequaltoorgreaterthanthe

highestithasbeenoverthelookbackperiod.Azero

percentreadingmeanstheopposite.Thatwouldbetheir

mostbearishposition.ThereasonIusethisindexisthat

themixoftradersvariesfrommarkettomarket.You

havetobeabletoreadthenetpositionpatternyousee

byplottingthenetpositionofCommercials,small

tradersandlargespeculatorsforeachparticularmarket.

Patternsinonemarketwillnotworkinanothermarket.

Forinstance,insomemarketsCommercialsarealmost

nevernetshort.YetinSilver,commercialshavenever

beennetlong.Thereasontheyhaveneverbeennetlong

istherearemoreproducers(miningcompanies)inthe

futuresmarketthantherearemanufacturerswhorequire

silver.SothenethedgeinSilverfutureshasalways

favoredtheshortside.Ifyou'relookingataSilverchart

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

41/55

3/6/2015

BruceBabcockInterviewsSteveBriese

versusaGoldchart,inGoldyou'llseethatcommercials

readilymovefromnetlongtonetshort,whereasin

Silvertheynevergetnetlong.It'sacompletelydifferent

pattern.Byusingmyoscillator,theCOTIndex,wecan

comeupwithauniformscaleforallmarkets.

Sothetableyouhaveonthebackofyournewsletter

isquitedifferentfromthenumbersthatyouwould

seecomingfromtheCFTCorchartedinthe

CommodityTrendServicechartbook?

Yes.

Andinyouropinionyournumbersarealotbetterto

use.

Ifyou'refollowingtwoorthreedozenmarketsandyou

havetoassimilatethenetpositionpatternsineachone

differently,that'sadifficultchore.Bysimplychanging

ittoauniformoscillatorsothatzeroandonehundred

meanthesamethingforeverymarket,it'smuchsimpler

toemploy.

Whensomeonegetsyourdataupdatesfor$95a

year,doesItincludetheCOTIndexnumbersas

well?

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

42/55

3/6/2015

BruceBabcockInterviewsSteveBriese

Yes,itdoes.Itincludesthemforeachofthethreetrader

groups.

Thatseemslikeprettyvaluableinformationforonly

$95ayear.Asubscriberwouldreceiveonabiweekly

basisthesamenumbersyoupublishonthelastpage

inyourletter,butnotthethreepagesofanalysis.

That'sright.Itcreatesamarketinterestinthe

Commitmentsdata.WhatIhavefoundthrough

watchingotheranalysts'workisthatasthisdatahas

becomemorereadilyavailableandmorewidely

reviewed,thequalityofothers'analysisissopoorthatit

increasesourreadership.

Otherpeoplearesobadatthisthatyou'relooking

greatbycomparison.isthatwhatyou'resaying?

Yes.Andmisinterpretingthisdatacausesmany

Mondaymovesthatgothewrongway.Mysubscribers

areabletotakeadvantageofthisonTuesdaymorning

aftertheyreadmyletter.

Thishappensbecausethedataisreleasedon

Friday?

Yes,It'sreleasedonFridayaftertheclose.You'llquite

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

43/55

3/6/2015

BruceBabcockInterviewsSteveBriese

oftenseeareactionthen.Whenyoureadonthenews

wirewhathappened,itwasthattheCommitments

numberscameout.

Ifsomebodyhasforinstance,OmegaResearch's

Superchartsprogram,theycoulddownloadyour

dataandthenfigureouthowtodisplayitunder

theircommoditycharts?

Asamatteroffact,Iprovidespecificdirectionsfor

displayingnetCOTIndexpositionsinSuperCharts.

There'sanothernumberinyournewsletterwe

haven'ttalkedaboutyet.It'scalled"move."What's

thatallabout?

Ilookattwothingsinthecommercialnumbers.

Numberone,wewanttolookattheactualnetposition

inrelationshiptothehistoricalperiodtoseehow

extremethecurrentpositionis.Ifit'sextremeenoughto

movetheindextoabout90percent,Icallthat,for

simplicity,amajorbuysignal,althoughsubscribers

shouldnotinterpretitasadvicetobuy.It'ssimplyan

indicationthatcommercialsarebuyinginamajorway.

Ifit'sextremeenoughontheotherendtogetbelow5

percentonourindex,Icallthatamajorsellsignal,

whichagainisnotnecessarilyanindicationfor

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

44/55

3/6/2015

BruceBabcockInterviewsSteveBriese

subscriberstosell.ThereisanotherwayIliketolookat

thedata.Thatistofindouthowmuchthecommercials'

netpositionhaschangedoverarelativelyshortperiod

oftime.Ifit'senoughtomovetheindex40pointsin

eitherdirectionwithinasixweekperiod,thatshowsan

unusualamountofcommercialactivity.Icallthese

minorbuyandsellsignalstodistinguishthemfrom

majorsignalswhich,asIpreviouslyindicated,meanthe

commercialshavereachedanhistoricalextreme.

Typically,theminorsignalsprovidekeyareastobuy

bullmarketsaftercorrectionswherethecorrection

nevergetsdeepenoughtoreach90percentonthe

index.IlookathowmuchtheCoTindexhaschanged

inthelastsixweeks.Ifaminorbuyorselloccurs

becauseofasubstantialchange,Iwillidentifythat

marketwitheitheraplusorminussign.

Lookingatyourmostrecentletter,whichisdated

April15th.Thisisjustpriortosometrulyhuge

movesinthegrains.Lookingatyournumbersfor

commercials,thecommercialsarelonginSoybeans

only10percent,inWheat33percent,Corn26

percent,SoybeanOil17percent,SoybeanMeal23

percent,Oats32percent.Ifonewerelookingat

thesenumbersinyourCOTIndex,itlookslikethe

commercialsarenotverybullish.Yetthemarkets

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

45/55

3/6/2015

BruceBabcockInterviewsSteveBriese

aregoingbananas.Whyisn'tthisgoingtofakeyou

out?

Thecommercialsarevaluebuyers.Theywerethemost

bullishwhenpriceswereclosertotheirvaluepricing

levels.IhadabuysignalinWheatinMarch,1995,at

345,acorrectionlow.InSoybeans,Ihadamajorbuy

signalinFebruary,1995,at550.Beansarenowabove

800.Commercialsarenotbuyingaggressivelyatthis

pricebecausethemarkethasmovedwellabovethe

valuelevelwheretheypreviouslybought.

Butthey'renotsellingaggressivelyeither.Isthatthe

point?

Thishasbeenaninterestingmarket.We'vehadnewall

timehighsrecentlyinCornandWheatalongwith

historicallyhighSoybeanprices,yetcommercialsare

notdowntozero.That'swhyinthatissue,eventhough

thereweren'tanybuyingopportunitys,Itoldsubscribers

thatthisthingmayhavealongwaytogofromhere

becausethecommercialswerenotaggressivelyselling

theseralliesevenatrecordprices.Theycangive

importantindicationsevenwhentheyarenotatextreme

levelsofbuyingorselling.

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

46/55

3/6/2015

BruceBabcockInterviewsSteveBriese

AclearcutexampleofthisoccurredintheCoffee

marketin199394.Thatwasabullmarketmanypeople

thoughtcameoutofnowhere.Everybodyassumedit

wasnothingbutaspeculativebubble.Backin

December,1993,wehadputinabottomafteralong

bearmarket.Therewasasmalldoublebottomin

September,1992,andthenalargerfailureswingbottom

inApril,1993.Thecommercialswereaggressive

buyersonthatfailureswingbottom.Infact,itwasjust

acoupleofpointsshortofamajorbuysignalonmy

index.Thentherewasalongtriangularconsolidation

thatlastedaboutsixmonths.Webrokedownoutofthat

consolidationinJanuary,1994.

WhatIsawwasthis.Onthatbreakdown,commercials

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

47/55

3/6/2015

BruceBabcockInterviewsSteveBriese

cameintothemarket.Theirnetpositionsmovedtothe

highestlevelinovertwoyears.Itwasanindicationto

methatthiswasabeartrap.Theinternationalfoodsare

quitefamousforthesebecausecommercialsdominate

thesemarkets.Theytypicallyholdtwothirdstothree

quartersoftheopeninterestintheinternationalfoods.

InCocoa,CoffeeandSugartheyaremastersatgetting

amaximumpositionatthemostfavorableprice.That's

whattheydidthere.Theymovedthepricedown

throughobviouschartsupportatthebottomofthelong

consolidationandthentookitrightbackup.Everybody

assumedtheinitialmovewasaspeculativerally,thatit

wasthecommodityfundscominginandbuyingoodles

ofcontracts.Themajorportionofthemovewas

actuallycommercialbuying.Thelargespeculatorswere

sellingintothemovebeforeitevergotgoing.They

weresellingatwellbelow$1.Theystartedsellingat85

cents.Asthemarketwentup,volatilityincreasedand

theopeninterestdroppedsubstantially.Thatwaslarge

speculatorsgettingout.Theycouldn'tstandtherisk.

Themarketcontinuedtomoveoncommercialshort

covering,andthat'swhatpropelledtheenormousmove

in1994commercialshortcovering.

Whenyouseethatsituation,itiscommercial

capitulation,whichresultsinhugemoves.Forasimilar

currentsituation,lookataCocoachart.Werecently

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

48/55

3/6/2015

BruceBabcockInterviewsSteveBriese

sawalongconsolidationandthenanapparentdownside

breakoutwithalargecontingentofcommercialbuyers

aheadofthat.Youcouldhaveanticipatedthatifthere

wereadownsidebreakout,itwasgoingtobeabear

trap.That'sexactlywhatoccurred.Thenallofasudden

itwaspushing1400.

Wouldyousummarizehowyouinterpretthe

Commitmentsnumbers?

OnceIgetthenumbersandconvertthemtotheCOT

Indexes,Ilookfortwothings.Ilookforthelarge

movementindexnumberstoseewheretherehasbeena

majorchangeinthelastfewweeks.Secondarily,Ilook

toseewhichonesareatextremes:above90percentand

below5percent.

WoulditmakesensetoanalyzetheCommitments

dataonaseasonalbasis?

CommodityResearchBureaumadethatassumptionin

1985,anditwaslaterrepeatedinacoupleofmarket

books.Theysaidthecorrectwaytoanalyzethe

CommitmentsofTradersdatawastocomparecurrent

commercialpositionswiththeirseasonalaverage

positions.It'sanaturalassumptiontomake.Farmersare

plantinggraininthespringandharvestinginthefallso

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

49/55

3/6/2015

BruceBabcockInterviewsSteveBriese

thereshouldbeaseasonalitytotheirhedging.Isentthe

datatoaPh.D.economistandaskedhimtocheckitfor

seasonality.Heconcludedtherewasnone.That'swhyI

decidednottoprintseasonalchartsoftheCommitments

data.

IthoughtIshouldshowademonstrationofthissoI

drewupthenetpositionsofthecommercialsfor

Soybeansfortenyears.Peopleareamazedwhenthey

seethechart.It'salloverthemap.There'splainlyno

seasonalpatterntoit.Youcancreateseasonalchartsby

makingaverages,butifyoucheckthemstatistically,

you'llfindthere'snostatisticalreliability.

Ifsomebodyreadyourletterforawhile,howlongdo

youthinkitwouldtakebeforetheycoulddotheir

ownanalysiswithoutyou?

I'vebeenanalyzingthisdatafor22years.Itypically

spend12hoursoneachreport,whichincludeswriting

theanalysis.SinceIdon'tmakespecifictrading

recommendations,allIamdoingisanalyzingthe

report.Ican'tbelievetherearemanytraderswhohave

thatamountoftimetospend,andIknowtherearen't

anywhohavethatkindofexperience.Ican'tseewhere

it'sprofitableforanybodytodotheirownanalysisof

theCommitmentsdatawhenmyresearchissocheap

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

50/55

3/6/2015

BruceBabcockInterviewsSteveBriese

andreadilyavailable.

Yes,Iseeyourpoint.Idon'twanttosound

impertinent,butyoumakethissoundsoeasyand

attractive.Naturally,ourreaderswouldwantto

knowifthisissoeffective,howcomeyou'renotrich

fromtradingit?

IthinkIamrich.Ihavefivekidswithjustoneleftin

highschool.ForthelastdozenyearsIhavecoached

basketball,softballandbaseball.Ihavemadeenough

moneyinthemarketsthatmyfamilyhasbeen

comfortableandsecure.I'mputtingallmykidsthrough

college.I'vetakenoutofthemarketswhatI'veneeded

tomeetmyprimarygoalwhichwasgettingthesefive

kidsofftoagoodstart.Iwillhavemoretimefromnow

ontoconcentrateonthefinancialaspectofmywork.

Sowithinyourownfinancialparametersyouhave

beensuccessfulasatraderusingthis?

Sure.

Isthereanythingwe'veleftout?

WhenyouthinkabouttheCommitmentsdata,people

oftenthinkofitasaseparatespecialtyareaofanalysis.

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

51/55

3/6/2015

BruceBabcockInterviewsSteveBriese

Thisisbasicallyopeninterestthatwe'relookingat.

Therewasawholebookwrittenonvolumeandopen

interest.Hereisaquicksummaryofthestandardopen

interestandvolumeanalysisrules.(1)Whenprice,

volumeandopeninterestareallrising,that'sastrong

market.(2)Ifthepriceisrisingbutvolumeandopen

interestaredeclining,you'llhaveaweakrally.(3)If

priceisdecliningwithvolumeandopeninterestrising,

youhaveastrongdowntrend.(4)Decliningpriceswith

decliningvolumeandopeninterestmeansaweak

downtrend.Thosearethefourrulesofvolumeandopen

interestinterpretationyoucanreadinbooks.

Hereisthereality.Inthefirstplace,volumeisnota

predictiveindicatorincommoditymarkets.Idon'tknow

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

52/55

3/6/2015

BruceBabcockInterviewsSteveBriese

whetheritisinstocksornot,butI'veprovenitisno

morethanacoincidentindicatorinthecommodity

markets.It'scoincidentwithvolatility.Whenyouchart

thefivedayaveragevolumeversusthefivedayaverage

pricerangeandinvertone,you'llseeaperfect

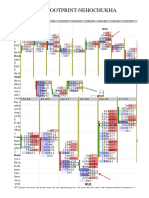

Rorschach.[Seechart.]Yougetamirrorimage.Asthe

pricerangeincreases,moretradersbecomeactive,more

stopsarehit,andvolumeincreases.Volumeisdirectly

proportionaltovolatility.Therefore,itisnota

predictiveindicator.

IfyoulookatthefourrulesIspelledout,theywork

abouthalfthetime.Theyworkoftenenoughso

somebodycanshowexamplesoftheirsupposed

effectiveness.Icouldshowjustasmanyexamples

wheretheydon'twork.Forexample,therewas

decliningopeninterestovertheentire1994rallyin

Coffee.Idon'tthinkanyonewilldenythatwasavery

strongrally,andyetitoccurredwithdecliningvolume

anddecliningopeninterest,whichisexactlyoppositeto

theclassicrules.

Openinterestisofparamountimportanceinmarket

analysis,butyouhavetothrowoutalltheoldrulesand

lookatthemakeupoftheopeninterestinarivingat

yourconclusions.Bylookingatthemakeupofthe

varioustradinggroups,whosebreakdownthe

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

53/55

3/6/2015

BruceBabcockInterviewsSteveBriese

Commitmentsdataprovides,youcantellwhenthose

rulesaregoingtoworkandwhenthey'renot.

What'sthepriceofayearlysubscriptiontoyour

letterandwhatdoesitinclude?

$295.00.Thatincludes26issues,a16pagesubscriber's

guidewithlongtermchartsofthevariousmarkets,plus

avideo.IgaveanalldayseminarinNewYorka

coupleofyearsagoandputthebestofthatintoa3

hourvideo,whichgoestonewsubscribers.

Isthereanyshortertrialsubscription?

Yes,a3monthtrialis$95.

Thatsoundslikeoneofthebestbargainsaround.

MythankstoSteveforthisenlighteninginterview.If

Iwerelimitedtoreadingjustonecommodity

newsletter,IthinkI'dhavetomakeithisBullish

Review.Youmaysubscribetohisnewsletteror

modemupdateservicebywritingtoBullishReview,

14600BlaineAvenueEast,Rosemount,MN55068.

Orcall(612)4234900.Fax(612)4234949.

RealityBasedTradingCompany

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

54/55

3/6/2015

BruceBabcockInterviewsSteveBriese

1731HoweAvenue,Suite149

SacramentoCA958252210(800)9992827

or(916)6777562

Copyright1996byBruceBabcock,Jr.All

rightsreserved.

http://commitmentsoftraders.org/wpcontent/uploads/Static/Perm/babcock.htm

55/55

Das könnte Ihnen auch gefallen

- Gregory Morris - Dancing With The Trend 2015Dokument110 SeitenGregory Morris - Dancing With The Trend 2015John SmithNoch keine Bewertungen

- Anderson - Janus FactorDokument7 SeitenAnderson - Janus FactorutammarryNoch keine Bewertungen

- Dynamic TradersDokument7 SeitenDynamic Traders郑登宇Noch keine Bewertungen

- Lundgren - Stochastics Indicators and Trading PDFDokument5 SeitenLundgren - Stochastics Indicators and Trading PDFLuis Alberto PinedaNoch keine Bewertungen

- Peter Brandt - Interview With A Trading LegendDokument38 SeitenPeter Brandt - Interview With A Trading LegendghafarkhaniNoch keine Bewertungen

- Multiple Time Frame Analysis for Beginner TradersVon EverandMultiple Time Frame Analysis for Beginner TradersBewertung: 1 von 5 Sternen1/5 (1)

- Donchian Trading GuidelinesDokument12 SeitenDonchian Trading GuidelinesCEOR73100% (1)

- Factor Update, April 19, 2015Dokument20 SeitenFactor Update, April 19, 2015Peter L. BrandtNoch keine Bewertungen

- Greg Morris - 2017 Economic & Investment Summit Presentation - Questionable PracticesDokument53 SeitenGreg Morris - 2017 Economic & Investment Summit Presentation - Questionable Practicesstreettalk700Noch keine Bewertungen

- Donchian 4 W PDFDokument33 SeitenDonchian 4 W PDFTheodoros Maragakis100% (2)

- Price Headley's Acceleration BandsDokument9 SeitenPrice Headley's Acceleration Bandsjackjensen2852100% (1)

- William Eckhardt - APM InterviewDokument4 SeitenWilliam Eckhardt - APM InterviewJohn HankNoch keine Bewertungen

- Trading Trends: A Simple Approach To Capture Both Short-Term and Longer-Term GainsDokument64 SeitenTrading Trends: A Simple Approach To Capture Both Short-Term and Longer-Term Gainspappu6600100% (1)

- Buy High and Sell Higher - Momentum - TradingDokument34 SeitenBuy High and Sell Higher - Momentum - TradingkosurugNoch keine Bewertungen

- Eckhardt TradingDokument30 SeitenEckhardt Tradingfredtag4393Noch keine Bewertungen

- Hurst Exponent and Trading Signals Derived From Market Time SeriesDokument8 SeitenHurst Exponent and Trading Signals Derived From Market Time SeriesJuan SchmidtNoch keine Bewertungen

- Bruce Babcock - The Four Cardinal Principles of Trading PDFDokument119 SeitenBruce Babcock - The Four Cardinal Principles of Trading PDFMas Thulan100% (1)

- Market Technician No 55Dokument12 SeitenMarket Technician No 55ppfahd100% (2)

- Donchian Trading GuidelinesDokument9 SeitenDonchian Trading GuidelinesIzzadAfif1990Noch keine Bewertungen

- Interview Tom DemarkDokument4 SeitenInterview Tom Demarkthiroshann0% (1)

- Timothy Ord - Picking Tops and Bottoms With The Tick IndexDokument4 SeitenTimothy Ord - Picking Tops and Bottoms With The Tick IndexAlberto Pedroni100% (1)

- Full Text of " ": Jim-Sloman-Ocean-TheoryDokument106 SeitenFull Text of " ": Jim-Sloman-Ocean-TheoryRavinder50% (2)

- Appel Master Class 4 DaysDokument89 SeitenAppel Master Class 4 DaysAnonymous YI6bCGEoDNoch keine Bewertungen

- Traders Mag Aug2010 Dan ZangerDokument1 SeiteTraders Mag Aug2010 Dan Zangergadgetguy2020100% (2)

- D Ifta Journal 09Dokument64 SeitenD Ifta Journal 09seyed ali nateghiNoch keine Bewertungen

- MAMIS Interview1 PDFDokument12 SeitenMAMIS Interview1 PDFMarco A SuqorNoch keine Bewertungen

- Tim Bourquin InterviewDokument8 SeitenTim Bourquin Interviewartus14Noch keine Bewertungen

- Mark Boucher - 2001 Watching Macro Indicators. The DollarDokument4 SeitenMark Boucher - 2001 Watching Macro Indicators. The Dollardavin_zi100% (1)

- Time Series MomentumDokument23 SeitenTime Series MomentumpercysearchNoch keine Bewertungen

- Paul Tudor Jones Louis Bacon ADokument7 SeitenPaul Tudor Jones Louis Bacon AukxgerardNoch keine Bewertungen

- Market Technician No39 PDFDokument16 SeitenMarket Technician No39 PDFrosehawkfireNoch keine Bewertungen

- Stendhal, David - Winning With Value Charts - The Key To Consistent Trading ProfitsDokument59 SeitenStendhal, David - Winning With Value Charts - The Key To Consistent Trading Profitscbratton27Noch keine Bewertungen

- 00f GML System Naaim Final Humphrey LloydDokument34 Seiten00f GML System Naaim Final Humphrey Lloydtempor1240Noch keine Bewertungen

- Art Collins - Beating The Financial MarketsDokument15 SeitenArt Collins - Beating The Financial Marketsjonofs0% (1)

- Spotting Price Swings & Seasonal Patterns - Techniques For Precisely Timing Major Market MovesDokument14 SeitenSpotting Price Swings & Seasonal Patterns - Techniques For Precisely Timing Major Market Movesshruti100% (1)

- DMI LectureDokument24 SeitenDMI Lecture_karr99Noch keine Bewertungen

- A Practical Guide To Indicators 12 PgsDokument12 SeitenA Practical Guide To Indicators 12 PgsAntonio C S LeitaoNoch keine Bewertungen

- Schwager SMW PDFDokument16 SeitenSchwager SMW PDFForex Trading100% (1)

- Gilmo Report Feb 2 2011Dokument9 SeitenGilmo Report Feb 2 2011Alessandro Ortiz FormoloNoch keine Bewertungen

- Stocks Commodities Dan Zanger - Interview PDFDokument5 SeitenStocks Commodities Dan Zanger - Interview PDFukxgerardNoch keine Bewertungen

- TurtleTrader Interview QuestionsDokument2 SeitenTurtleTrader Interview QuestionsMichael Covel100% (1)

- Short Term Trading - Getting Started in Momentum-Based Swing TradingDokument8 SeitenShort Term Trading - Getting Started in Momentum-Based Swing Tradingdiglemar100% (1)

- Market Technicians AssociationDokument50 SeitenMarket Technicians Associationabdallahnoor100% (1)

- 60-The Volatility (Regime) Switch IndicatorDokument4 Seiten60-The Volatility (Regime) Switch IndicatorBenjaminRavaruNoch keine Bewertungen

- Jason Perl Interview ExpertDokument2 SeitenJason Perl Interview ExpertmoongraberNoch keine Bewertungen

- Stock Selection: A Test of Relative Stock Values Reported Over 17 YearsDokument19 SeitenStock Selection: A Test of Relative Stock Values Reported Over 17 YearsalexmorenoasuarNoch keine Bewertungen

- Trend Following Commodity Trading AdvisorDokument14 SeitenTrend Following Commodity Trading AdvisorTempest SpinNoch keine Bewertungen

- Businessinsider - Relative Strength. How Does Momentum Investing WorkDokument4 SeitenBusinessinsider - Relative Strength. How Does Momentum Investing WorkRemmy TaasNoch keine Bewertungen

- Winning the Day Trading Game: Lessons and Techniques from a Lifetime of TradingVon EverandWinning the Day Trading Game: Lessons and Techniques from a Lifetime of TradingBewertung: 3.5 von 5 Sternen3.5/5 (2)

- Daniel Gramza - Building Your E-Mini Trading StrategyDokument121 SeitenDaniel Gramza - Building Your E-Mini Trading StrategyBig Tex100% (4)

- Donchian Channel BreakoutDokument11 SeitenDonchian Channel BreakoutShahzad Dalal100% (2)

- Surface Quality After Broaching With Variable Cutting ThicknessDokument6 SeitenSurface Quality After Broaching With Variable Cutting ThicknessThequang HongocNoch keine Bewertungen

- Tribe of TradersDokument6 SeitenTribe of TradersdatsnoNoch keine Bewertungen

- Interview With A Trading Legend Pts 1-8Dokument44 SeitenInterview With A Trading Legend Pts 1-8Peter L. Brandt100% (1)

- Coppock Indicator - How To Catch A BullDokument4 SeitenCoppock Indicator - How To Catch A BullBogdan TudoseNoch keine Bewertungen

- The Hunt Volatility FunnelDokument5 SeitenThe Hunt Volatility FunnelOctavian Pufulete100% (2)

- Traders at Work: How the World's Most Successful Traders Make Their Living in the MarketsVon EverandTraders at Work: How the World's Most Successful Traders Make Their Living in the MarketsNoch keine Bewertungen

- Arthur MerrillDokument20 SeitenArthur Merrillfredtag4393Noch keine Bewertungen

- Arcadia Agri 01032021Dokument7 SeitenArcadia Agri 01032021fredtag4393Noch keine Bewertungen

- AQR-Introducing The New AQR SMOOTH FundDokument2 SeitenAQR-Introducing The New AQR SMOOTH Fundfredtag4393Noch keine Bewertungen

- Arthur MerrillDokument20 SeitenArthur Merrillfredtag4393Noch keine Bewertungen

- Active TRader-Marco Dion Interview Sep 2009Dokument5 SeitenActive TRader-Marco Dion Interview Sep 2009fredtag4393Noch keine Bewertungen

- Mulitime Frame TrendDokument7 SeitenMulitime Frame Trendfredtag4393Noch keine Bewertungen

- Active TRader-Marco Dion Interview Sep 2009Dokument5 SeitenActive TRader-Marco Dion Interview Sep 2009fredtag4393Noch keine Bewertungen

- Average Volume&Current Volume Tim Phila TSFDokument3 SeitenAverage Volume&Current Volume Tim Phila TSFfredtag4393Noch keine Bewertungen

- Arcadia Agri 15032021Dokument7 SeitenArcadia Agri 15032021fredtag4393Noch keine Bewertungen

- How To Pick StocksDokument6 SeitenHow To Pick Stocksfredtag4393Noch keine Bewertungen

- Arcadia Agri 29032021Dokument8 SeitenArcadia Agri 29032021fredtag4393Noch keine Bewertungen

- GannSquare FrontEndDocDokument3 SeitenGannSquare FrontEndDocfredtag4393Noch keine Bewertungen

- BRSI Howard WangDokument8 SeitenBRSI Howard Wangfredtag4393100% (1)

- BRSI Howard WangDokument8 SeitenBRSI Howard Wangfredtag4393100% (1)

- Corn Jay Kaeppel 28022019Dokument4 SeitenCorn Jay Kaeppel 28022019fredtag4393Noch keine Bewertungen

- BRSI Howard WangDokument8 SeitenBRSI Howard Wangfredtag4393100% (1)

- Futures Magazine Archives 02Dokument23 SeitenFutures Magazine Archives 02fredtag4393Noch keine Bewertungen

- Eckhardt TradingDokument30 SeitenEckhardt Tradingfredtag4393Noch keine Bewertungen

- Larry Williams (Seminar Notes)Dokument6 SeitenLarry Williams (Seminar Notes)fredtag4393100% (2)

- Nicole Elliott Interview Series - Anne Whitby FSTA - Society of Technical AnalystsDokument1 SeiteNicole Elliott Interview Series - Anne Whitby FSTA - Society of Technical Analystsfredtag4393Noch keine Bewertungen

- Bill Eckhardt The Man Who Launched 1000 SystemsDokument17 SeitenBill Eckhardt The Man Who Launched 1000 Systemsfredtag4393Noch keine Bewertungen

- Vertical Line TSFDokument2 SeitenVertical Line TSFfredtag4393Noch keine Bewertungen

- Heikin Ashi Newsletter 03032019Dokument34 SeitenHeikin Ashi Newsletter 03032019fredtag4393Noch keine Bewertungen

- COT Commercials IndicatorDokument4 SeitenCOT Commercials Indicatorfredtag4393Noch keine Bewertungen

- Fibonacci Time LinesDokument3 SeitenFibonacci Time Linesfredtag4393Noch keine Bewertungen

- Greg Morris Pair Analysis 1&2Dokument7 SeitenGreg Morris Pair Analysis 1&2fredtag4393Noch keine Bewertungen

- Greg Morris Core Rotation StrategyDokument7 SeitenGreg Morris Core Rotation Strategyfredtag4393Noch keine Bewertungen

- Open High Low Close Cart in ExcelDokument6 SeitenOpen High Low Close Cart in Excelfredtag4393Noch keine Bewertungen

- Balance of Power Igor LivshinDokument11 SeitenBalance of Power Igor Livshinfredtag4393100% (1)

- Our Technical Analysis: A Brief IntroductionDokument8 SeitenOur Technical Analysis: A Brief Introductionfredtag4393Noch keine Bewertungen

- Technical Analysis of Indian Stock MarketDokument62 SeitenTechnical Analysis of Indian Stock MarketPritesh PuntambekarNoch keine Bewertungen

- How to Trade Using EMA StrategyDokument13 SeitenHow to Trade Using EMA Strategyznhtogex100% (9)

- Price Action SoftwareDokument6 SeitenPrice Action SoftwaremjmariaantonyrajNoch keine Bewertungen

- STEVE NISON - Japanese Candlestick Charting Techniques PDFDokument330 SeitenSTEVE NISON - Japanese Candlestick Charting Techniques PDFpaladinno_hrgNoch keine Bewertungen

- Cleopatra CaseDokument12 SeitenCleopatra CaseDivya TiwariNoch keine Bewertungen

- Order Block Theory Private Study Notes Extracted From Various EntitiesDokument12 SeitenOrder Block Theory Private Study Notes Extracted From Various EntitiesJoe100% (2)

- Charting SecretsDokument2 SeitenCharting Secretsvaldyrheim100% (2)

- The Power of Stars: Understanding Key Candlestick PatternsDokument25 SeitenThe Power of Stars: Understanding Key Candlestick PatternspaoloNoch keine Bewertungen

- Ichimoku Charting SystemDokument8 SeitenIchimoku Charting SystemIonel Leordeanu100% (3)

- Metals Economics Group Database and Services CatalogueDokument13 SeitenMetals Economics Group Database and Services CatalogueNadine Baker TannerNoch keine Bewertungen

- Mahendra Sharma NewletterDokument12 SeitenMahendra Sharma NewletterNiraj KotharNoch keine Bewertungen

- Corrective WaveDokument1 SeiteCorrective WaveMoses ArgNoch keine Bewertungen

- Elliott Wave Cheat Sheet FINAL PDFDokument6 SeitenElliott Wave Cheat Sheet FINAL PDFmdajobsNoch keine Bewertungen

- Fundamental & Technical Analysis of Portfolio ManagementDokument28 SeitenFundamental & Technical Analysis of Portfolio ManagementSaili SarmalkarNoch keine Bewertungen

- Complete Guide to Volume Price Analysis NotesDokument9 SeitenComplete Guide to Volume Price Analysis NotesUma Maheshwaran100% (1)

- 03 KM Candle SticksDokument10 Seiten03 KM Candle SticksKumarenNoch keine Bewertungen

- Creating An Automated Stock Trading System in ExcelDokument19 SeitenCreating An Automated Stock Trading System in Excelgeorgez111100% (2)

- Using The Arms Index in Intraday Applications: by Richard W. Arms JRDokument6 SeitenUsing The Arms Index in Intraday Applications: by Richard W. Arms JRsatish s100% (1)

- Important Footprint-Nehochukha PatternsDokument2 SeitenImportant Footprint-Nehochukha PatternskishoreNoch keine Bewertungen

- Inside Bar Pattern - 6 Characteristics of A Profitable SetupDokument12 SeitenInside Bar Pattern - 6 Characteristics of A Profitable SetupDexter primeNoch keine Bewertungen

- Technical Analysis Workshop Series Session One Trend IndicatorsDokument61 SeitenTechnical Analysis Workshop Series Session One Trend IndicatorsSriranga G H100% (1)

- The Art of The Candlestick Chart - The Intrepid Investor Series (Part 2)Dokument3 SeitenThe Art of The Candlestick Chart - The Intrepid Investor Series (Part 2)Matt BrennanNoch keine Bewertungen

- Candlestick Pattern Full PDFDokument25 SeitenCandlestick Pattern Full PDFM Try Trader Kaltim80% (5)

- Elliott Wave PrincipleDokument14 SeitenElliott Wave Principleritesh_singh00Noch keine Bewertungen