Beruflich Dokumente

Kultur Dokumente

Final of Service Tax

Hochgeladen von

Anil ChauhanCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Final of Service Tax

Hochgeladen von

Anil ChauhanCopyright:

Verfügbare Formate

1

SERVICE TAX.

CH - 1. DUTYIES OF SERVICE TAX.

Service Tax is a tax imposed by Government of India on services provided in

India. The service provider collects the tax and pays the same to the

government. It is charged on all services except the services covered in the

negative list (Section 66d of Finance Act'1994) of services & services covered

under Mega Exemption Notification (Notification NO. 25/2012 ST dated

20.06.2012). The current rate is 12.% on gross value of the service.

Dr.Raja chelliah committee on tax reforms recommend the introduction of

service tax. Service tax had been first levied at a rate of five per cent flat from

15 July 1994 till 13 May 2003, at the rate of eight percent flat w.e.f 1 plus an

education cess of 2% thereon w.e.f 10 September 2004 services provided by

service providers. The rate of service tax was enhanced to 12% by Finance

Act, 2006 w.e.f 18.4.2006. Finance Act, 2007 has imposed a new secondary

and higher education cess of one percent on the service tax w.e.f 11.5.2007,

increasing the total education cess to three percent and a total levy of 12.36

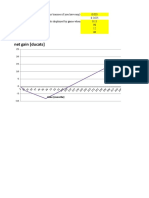

percent. The revenue form the service tax to the Government of India have

shown a steady rise since its inception in 1994. The tax collections have grown

substantially since 1994-95 i.e. from Rs. 410 crores in 1994-95 to Rs.132518

crores in 2012-13. The total number of Taxable services also increased from 3

in 1994 to 119 in 2012. However, from 1 July 2012 the concept of taxation on

services was changed from a 'Selected service approach' to a 'Negative List

regime'. This changed the taxation system of services from tax on some

Selected services to tax being levied on the every service other than services

mentioned in Negative list.

WHAT IS SERVICE ?

Service has been defined in clause (44) of the new section 65B and means

any activity

for consideration

carried out by a person for another

and includes a declared service.

The said definition further provides that Service does not include

any activity that constitutes only a transfer in title of (i) goods or (ii)

immovable property by way of sale, gift or in any other manner

(iii) a transfer, delivery or supply of goods which is deemed to be a sale of

goods within the meaning of clause (29A) of article 366 of the Constitution

a transaction only in (iv) money or (v) actionable claim

a service provided by an employee to an employer in the course of the

employment.

fees payable to a court or a tribunal set up under a law for the time being in

force.

There are four explanations appended to the definition of service which are

dealt with in later part of this Guidance Note. Each of the ingredients bulleted

above have been explained in the points below.

WHAT IS NOT SERVICE ?

The definition of service u/s 65B(44) further provides that service does not include 1. Any activity that constitutes only a transfer is in goods or immovable property by way

of sale, gift or in any manner.

2. A transfer, deliver or supply of goods which is deemed to be a sales of goods within

the meaning of clause (29A) of articles 366 of the constitution.

3. A transaction only in money or in actionable claim.

4. A service provided by an employee to an employer in the course of the employment.

5. Fees payable to a court or a tribunal set up a law for the time begin in force.

CH - 2. REGISTRAION [S.69 & RULE 4].

1). Application : The following should apply for registration under the

Service Tax Act- (1) Every person who has provided a taxable service of value

exceeding Rs.9 lakhs, in the preceding financial year, is required to register

with the service Tax office having jurisdiction over the premises or office of

such service provider.

(2) A recipient who is liable to pay service tax.

(3) The Input Service Distributors.

2). Need : Registration is identification of an assessee. Identification is

necessary to deposit service tax, file returns and undertake various processes

ordained by law relating to service tax. A person liable to pay service tax must

apply for registration before he starts playing service tax and filings of return.

Service provider should apply well in advance to obtain registration, which is

normally granted within 7days of filing of application. If registration is not

granted within seven days, it is deemed to have been granted. Failure to obtain

registration would attract penalty upto Rs 20,000 or Rs 200 for every day

during which such failure continues, whichever is higher. It should be noted

that assessee means a person liable to pay service tax and include his agent.

3). Period :(a) When a person commences business of providing a taxable service, he is

required to register himself within 30 days of such commencement of

business.

(b) In case service tax is extended to a new service, an existing service

provider must register himself, unless he is eligible for exemption under any

notification, within a period of 30days from the date of new levy.It should be

noted that the word person shall include any company or association or body

of individuals, whether incorporated or not. Thus, this expression includes any

individual, HUF, proprietary firm or partnership firm, company, trust,

institution, society etc.

4). Procedure :- A prospective service tax assessee (service provider or

service receiver) or Input Service Distributor seeking registration should file

an application in FORM ST-1 (in duplicate) before the jurisdictional service

tax officer. To verify the correctness of declaration in the above form, certain

documents such as copy of PAN card, proof of address of business premise(s),

constitution of the business [proprietorship, firm, company, trust, institute etc.]

etc. May be required by the registering authority. The copies may self-certified

by the applicant. In case of doubts in select cases, original documents may

have to be presented for verification.

5). Registration Certificate :- The Registration Certificate in Form ST-2

should be issued within a period of seven days from date of submission of

application ST-1 along with all relevant details/documents. In case the

registration certificate is not issued within seven days, the registration applied

for is deemed to have been granted.

6). Multiple Locations :- Service provider having centralized accounting or

centralized billing system who are located in one or more premises, at their

option, may register such premises or office from where centralized billing or

centralized accounting system are located and thus have centralized

registration.

7). Multiple Services :- Only one Registration Certificate is to be taken even

if the person provides more than one service from the same premises for

which registration is sought. However, while making application for

registration all taxable service provided by the person should be mentioned.

8). Multiple Location & Services :- If there is centralize registration, only

one registration certificate is required for service provided from different

premises, declared in the application for centralized registration.

CH - 3. EXEMPTION UNDER MEGA NOTIFICATION.

The following taxable services have been exempt from the whole of the

service tax leviable thereon under section 66B of the said Act vide mega

exemption notification no. 25/2012 ST dated 20/6/12 namely:1. Services provided to the United Nations or a specified international

organization;

2. Health care services by a clinical establishment, an authorised medical

practitioner or para-medics;

3. Services by a veterinary clinic in relation to health care of animals or birds;

4. Services by an entity registered under section 12AA of the Income tax Act,

1961 (43 of 1961) by way of charitable activities;

5. Services by a person by way of-(a) renting of precincts of a religious place

meant for general public; or

(b) conduct of any religious ceremony;

6. Services provided by-(a) an arbitral tribunal to -(i) any person other than a

business entity; or

(ii) a business entity with a turnover up to rupees ten lakh in the preceding

financial year;

(b) an individual as an advocate or a partnership firm of advocates by way of

legal services to,-(i) an advocate or partnership firm of advocates providing

legal services ;

(ii) any person other than a business entity; or

(iii) a business entity with a turnover up to rupees ten lakh in the preceding

financial year; or

(c) a person represented on an arbitral tribunal to an arbitral tribunal;

7. Services by way of technical testing or analysis of newly developed drugs,

including vaccines and herbal remedies, on human participants by a clinical

research organisation approved to conduct clinical trials by the Drug

Controller General of India;

8. Services by way of training or coaching in recreational activities relating

to arts, culture or sports;

9. Services provided to or by an educational institution in respect of

education exempted from service tax, by way of,-(b) auxiliary educational

services; or

(b) renting of immovable property.

10. Services provided to a recognised sports body by-(a) an individual as a

player, referee, umpire, coach or team manager for participation in a sporting

event organized by a recognized sports body;

(b) another recognised sports body.

11. Services by way of sponsorship of sporting events organised,-(a) by a

national sports federation, or its affiliated federations, where the participating

teams or individuals represent any district, state or zone;

(b) by Association of Indian Universities, Inter-University Sports Board,

School Games Federation of India, All India Sports Council for the Deaf,

Paralympic Committee of India or Special Olympics Bharat ;

(c) by Central Civil Services Cultural and Sports Board;

(d) as part of national games, by Indian Olympic Association; or

(e) under Panchayat Yuva Kreeda Aur Khel Abhiyaan (PYKKA) Scheme;

12. Services provided to the Government, a local authority or a

governmental authority by way of construction, erection, commissioning,

installation, completion, fitting out, repair, maintenance, renovation, or

alteration of -(a) a civil structure or any other original works meant

predominantly for use other than for commerce, industry, or any other

business or profession;

(b) a historical monument, archaeological site or remains of national

importance, archaeological excavation, or antiquity specified under the

Ancient Monuments and Archaeological Sites and Remains Act, 1958 (24 of

1958);

(c) a structure meant predominantly for use as (i) an educational, (ii) a clinical,

or (iii) an art or cultural establishment;

(d) canal, dam or other irrigation works;

(e) pipeline, conduit or plant for (i) water supply (ii) water treatment, or (iii)

sewerage treatment or disposal; or

(f) a residential complex predominantly meant for self-use or the use of their

employees or other persons specified in the Explanation1 to clause 44 of

section 65 B of the said Act;

13. Services provided by way of construction, erection, commissioning,

installation, completion, fitting out, repair, maintenance, renovation, or

alteration of,-(a) a road, bridge, tunnel, or terminal for road transportation for

use by general public;

(b) a civil structure or any other original works pertaining to a scheme under

Jawaharlal Nehru National Urban Renewal Mission or Rajiv Awaas Yojana;

(c) a building owned by an entity registered under section 12 AA of the

Income tax Act, 1961(43 of 1961) and meant predominantly for religious use

by general public;

(d) a pollution control or effluent treatment plant, except located as a part of a

factory; or

(e) a structure meant for funeral, burial or cremation of deceased;

14. Services by way of construction, erection, commissioning, or installation

of original works pertaining to,-(a) an airport, port or railways, including

monorail or metro;

(b) a single residential unit otherwise than as a part of a residential complex;

10

(c) low- cost houses up to a carpet area of 60 square metres per house in a

housing project approved by competent authority empowered under the

Scheme of Affordable Housing in Partnership framed by the Ministry of

Housing and Urban Poverty Alleviation, Government of India;

(d) post- harvest storage infrastructure for agricultural produce including a

cold storages for such purposes; or

(e) mechanised food grain handling system, machinery or equipment for units

processing agricultural produce as food stuff excluding alcoholic beverages;

15. Temporary transfer or permitting the use or enjoyment of a copyright

covered under clauses (a) or (b) of sub-section (1) of section 13 of the Indian

Copyright Act, 1957 (14 of 1957), relating to original literary, dramatic,

musical, artistic works or cinematograph films;

16. Services by a performing artist in folk or classical art forms of (i) music,

or (ii) dance, or (iii) theatre, excluding services provided by such artist as a

brand ambassador;

17. Services by way of collecting or providing news by an independent

journalist, Press Trust of India or United News of India;

18. Services by way of renting of a hotel, inn, guest house, club, campsite or

other commercial places meant for residential or lodging purposes, having

declared tariff of a unit of accommodation below rupees one thousand per day

or equivalent;

19. Services provided in relation to serving of food or beverages by a

restaurant, eating joint or a mess, other than those having (i) the facility of airconditioning or central air-heating in any part of the establishment, at any time

during the year, and (ii) a licence to serve alcoholic beverages;

11

20. Services by way of transportation by rail or a vessel from one place in

India to another of the following goods -(a) petroleum and petroleum products

falling under Chapter heading 2710 and 2711 of the First Schedule to the

Central Excise Tariff Act, 1985 (5 of 1986);

(b) relief materials meant for victims of natural or man-made disasters,

calamities, accidents or mishap;

(c) defence or military equipments;

(d) postal mail or mail bags;

(e) household effects;

(f) newspaper or magazines registered with the Registrar of Newspapers;

(g) railway equipments or materials;

(h) agricultural produce;

(i) foodstuff including flours, tea, coffee, jaggery, sugar, milk products, salt

and edible oil, excluding alcoholic beverages; or

(j) chemical fertilizer and oil cakes;

21. Services provided by a goods transport agency by way of transportation of

-(a) fruits, vegetables, eggs, milk, food grains or pulses in a goods carriage;

(b) goods where gross amount charged for the transportation of goods on a

consignment transported in a single goods carriage does not exceed one

thousand five hundred rupees; or

(c) goods, where gross amount charged for transportation of all such goods for

a single consignee in the goods carriage does not exceed rupees seven hundred

fifty;

22. Services by way of giving on hire -(a) to a state transport undertaking, a

motor vehicle meant to carry more than twelve passengers; or

(b) to a goods transport agency, a means of transportation of goods;

12

23. Transport of passengers, with or without accompanied belongings, by (a) air, embarking from or terminating in an airport located in the state of

Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland,

Sikkim, or Tripura or at Bagdogra located in West Bengal;

(b) a contract carriage for the transportation of passengers, excluding tourism,

conducted tour, charter or hire; or (c) ropeway, cable car or aerial tramway;

24. Services by way of vehicle parking to general public excluding leasing of

space to an entity for providing such parking facility;

25. Services provided to Government, a local authority or a governmental

authority by way of -(a) carrying out any activity in relation to any function

ordinarily entrusted to a municipality in relation to water supply, public

health, sanitation conservancy, solid waste management or slum improvement

and upgradation; or (b) repair or maintenance of a vessel or an aircraft;

26. Services of general insurance business provided under following schemes (a) Hut Insurance Scheme; (b) Cattle Insurance under Swarnajaynti Gram

Swarozgar Yojna (earlier known as Integrated Rural Development

Programme); (c) Scheme for Insurance of Tribals;

(d) Janata Personal Accident Policy and Gramin Accident Policy;

(e) Group Personal Accident Policy for Self-Employed Women;

(f) Agricultural Pumpset and Failed Well Insurance;

(g) premia collected on export credit insurance;

(h) Weather Based Crop Insurance Scheme or the Modified National

Agricultural Insurance Scheme, approved by the Government of India and

implemented by the Ministry of Agriculture;

(i) Jan Arogya Bima Policy;

(j) National Agricultural Insurance Scheme (Rashtriya Krishi Bima Yojana);

13

(k) Pilot Scheme on Seed Crop Insurance;

(l) Central Sector Scheme on Cattle Insurance;

(m) Universal Health Insurance Scheme;

(n) Rashtriya Swasthya Bima Yojana; or

(o) Coconut Palm Insurance Scheme;

27. Services provided by an incubatee up to a total turnover of fifty lakh

rupees in a financial year subject to the following conditions, namely:-(a) the

total turnover had not exceeded fifty lakh rupees during the preceding

financial year; and

(b) a period of three years has not been elapsed from the date of entering into

an agreement as an incubatee;

28. Service by an unincorporated body or a non- profit entity registered under

any law for the time being in force, to its own members by way of

reimbursement of charges or share of contribution -(a) as a trade union;

(b) for the provision of carrying out any activity which is exempt from the

levy of service tax; or

(c) up to an amount of five thousand rupees per month per member for

sourcing of goods or services from a third person for the common use of its

members in a housing society or a residential complex;

29. Services by the following persons in respective capacities -(a) sub-broker

or an authorised person to a stock broker;

(b) authorised person to a member of a commodity exchange;

(c) mutual fund agent to a mutual fund or asset management company;

(d) distributor to a mutual fund or asset management company;

(e) selling or marketing agent of lottery tickets to a distributer or a selling

agent;

14

(f) selling agent or a distributer of SIM cards or recharge coupon vouchers;

(g) business facilitator or a business correspondent to a banking company or

an insurance company, in a rural area; or

(h) sub-contractor providing services by way of works contract to another

contractor providing works contract services which are exempt;

30. Carrying out an intermediate production process as job work in relation to

-(a) agriculture, printing or textile processing;

(b) cut and polished diamonds and gemstones; or plain and studded jewellery

of gold and other precious metals, falling under Chapter 71 of the Central

Excise Tariff Act ,1985 (5 of 1986);

(c) any goods on which appropriate duty is payable by the principal

manufacturer; or

(d) processes of electroplating, zinc plating, anodizing, heat treatment, powder

coating, painting including spray painting or auto black, during the course of

manufacture of parts of cycles or sewing machines upto an aggregate value

of taxable service of the specified processes of one hundred and fifty lakh

rupees in a financial year subject to the condition that such aggregate value

had not exceeded one hundred and fifty lakh rupees during the preceding

financial year;

31. Services by an organiser to any person in respect of a business exhibition

held outside India;

32. Services by way of making telephone calls from -(a) departmentally run

public telephone;

(b) guaranteed public telephone operating only for local calls; or

(c) free telephone at airport and hospital where no bills are being issued;

33. Services by way of slaughtering of bovine animals;

15

34. Services received from a provider of service located in a non- taxable

territory by-(a) Government, a local authority, a governmental authority or an

individual in relation to any purpose other than commerce, industry or any

other business or profession;

(b) an entity registered under section 12AA of the Income tax Act, 1961 (43 of

1961) for the purposes of providing charitable activities; or

(c) a person located in a non-taxable territory;

35. Services of public libraries by way of lending of books, publications or

any other knowledge- enhancing content or material;

36. Services by Employees State Insurance Corporation to persons

governed under the Employees Insurance Act, 1948 (34 of 1948);

37. Services by way of transfer of a going concern, as a whole or an

independent part thereof;

38. Services by way of public conveniences such as provision of facilities of

bathroom, washrooms, lavatories, urinal or toilets;

39. Services by a governmental authority by way of any activity in relation to

any function entrusted to a municipality under article 243 W of the

Constitution.

40. Services by way of loading, unloading, packing, storage or warehousing of

rice.

16

CH - 4. THRESHOLD EXEMPTION [33/2012].

Rs.10 Lakhs: Taxable services provided by service provider are exempted

from whole of service tax leviable there-on upto the aggregate taxable

value Rs. 10Lakhs. [Notification No. 33/2012 - S. T. Dt. 20-06-12]

Not Applicable: Above exemption is not applicable to :(a) taxable service provide by a person under a brand name or trade name,

whether registered or not, of another person or;

(b) Such value of taxable service in respect of which service tax shall be

paid by recipient of service under S. 68(2) read with service tax rules,

1994 (Goods Transport Agency, Insurance Agent, MF Agent, etc.

Conditions: Above exemption is admissible subject of following

conditions :(a) Option: Taxable service provider has the option not to avail the said

exemption and pay service tax on the taxable service and such option once

exercised in a financial year shall not be withdrawn during the remaining

part of such financial year.

17

(b) No CENVAT Credit On Inputs: The provider of service shall not avail

cenvat credit of service tax paid on any input used for providing taxable

service on which exemption of small scale is availed.

(c) No CENVAT Credit on Capital Goods: The provider of taxable

service shall not avail cenvat credit under rule 3 of the cenvat credit rules

2004, on capitals goods during the period in which the service provider

avails small scale exemption.

(d) CENVAT Credit after paying Taxes: The provider of taxable service

shall avail CENVAT Credit only on such input or input service received

on or the date on which the service provider starts paying service tax and

used for provision taxable service on which service tax is payable.

(e) All Premises/Services: This notification shall apply to the aggregate

value of one or more taxable services provided form one or more premises

and not separately for each premises or each service.

(f) Preceding P.Y: The aggregate value of taxable services rendered by a

provider of such service from one or more premises should not exceed

exemption limit fixed (i.e. Ten Lakhs) in the preceding financial year.

GTA: For the purposes of determining aggregate value not exceeding Ten

Lakhs rupees, to avail exemption under this notification, in relation to

taxable service provided by a goods transport agency, the payment

received towards the gross amount charged by such goods transport

agency under section 67 of the said finance Act for which the person

liable for paying service tax is the consignor / consignee [as specified

under section 68(2) of the said Financial Act read with Service Tax Rules,

1994], shall not be taken in to account.

Definitions: For the purpose of the notification -

18

(a) brand name or trade name means a brand name or a trade name,

whether registered or not, that is to say, a name or a mark, such as a

symbol, monogram, logo, label, signature, or invented word or writing

which is used in relation to such specified services for the purpose of

indicating, or so to indicate a connection in the course of trade between

such specified services and some person using such name or mark with or

without any indication of the identity of that person;

(b) aggregate value means the sum total of value of taxable service

charged in the first consecutive invoices issued during a financial year but

does not include value charged in invoices issued towards such section

66B of the said Financial Act or under any other notification.

1-7-2012: This notification shall come into force on the 1 st day of July,

2012.

Special Points: The following special points should be kept in mind (a) Brand Name : If a person provides two services - a taxable service

under a brand name of another person and another taxable service,

threshold exemption will not apply to the service under brand name:

however, he can avail threshold exemption for the other service.

Threshold exemption is not available if the brand name is of a service

provider. Exemption is available if the brand name is in respect for

goods .

(b) Tax by Recipient: The threshold exemption does not apply where tax

is payable by service recipient on behalf of insurance agents will have to

pay tax on insurance commission earned by an insurance agent, even if

the amount is lees than the threshold exemption i.e. Rs. 10Lakhs.

19

(c) Invoices: The threshold exemption is computed on the basis of

invoices raised and not the payments receives. Once the invoices issued

cross the limit of Rs. 10Lakh, the subsequent services became taxable.

The exemption is not affected even if payment is not receives

subsequently.

(d) GTA: For Goods Transport Agency (GTA), the aggregate value is

to be determined after excluding the amount charged by the GTA for

which the consignor / consignee is liable to pay the tax.

(e) Option: The decision not to claim the exemption and pay the tax must

be taken by the service provider of tax became due (5 th May or 5th July, as

the case may be).

20

CH - 5. Service Tax Return.

Records

According to Rule 5 of Service Tax Rules, 1994, records include computerized

data and means the record as maintained by an assessee in accordance with the

various laws in force from time to time. Records maintained as such shall be

acceptable to Central Excise Officer. Every assessee is required to furnish to

the Central Excise Officer at the time of filing his return for the first time a list

of all accounts maintained by the assessee in relation to Service Tax including

memoranda received from his branch offices. This intimation may be sent

along with a covering letter while filing the service tax return for the first time.

Invoice

Rule 4A prescribes that taxable services shall be provided and input credit

shall be distributed only on the basis of a bill, invoice or challan. Such bill,

invoice or challan will also include documents used by service providers of

banking services (such as pay-in-slip, debit credit advice etc.) and

consignment note issued by goods transport agencies. Rule 4B provides for

issuance of a consignment note to a customer by the service provider in

respect of goods transport booking services.

21

CH - 6. PENALTY & INTEREST.

PENALTY :- If a person who is liable to pay service tax fails to pay service

tax, he shall pay in addition to such tax and interest in accordance with the

provisions of section 75 of the Act, a penalty which shall not be less than Rs.

100/- for every day during which such failure continues or @1% of such tax

per month, whichever is higher. However, the penalty amount payable shall

not exceed 50% of the amount of Service Tax payable.

ILLUSTRATION:X,an assessee, this fails to pay service tax of ten lakh rupees payable by 5 th

March 2014. X pays the amount on 15th March 2014. The default has

continued for ten days. Compute the amount of penalty.

Solution :- The penalty payable by X is computed as follows :

1. 1% of the amount of default for 10 days = 1/100 x 10,00,000 x 10/31 =

Rs.3,225.80

2. Penalty calculated @ Rs. 100 per day for 10days = Rs. 1,000

3. Penalty liable to be paid is Rs. 3,226.00.

INTEREST :- Every person, liable to pay the service tax in accordance with

the provisions of section 68 of the Act or rules made there under, who fails to

credit the tax or any part thereof to the account of the central government

within the period prescribed, shall pay simple interest @ 18% per annum

w.e.f. 1-4-2011 [Notification No. 15/2011- ST]. The rate will be 15% for tax

22

payers with turnover below Rs. 60Lakhs in the preceding financial year.

Interest is payable for the period from the first day after the due date till the

date of payment of any defaulted service tax amount.

CH - 7. PAYMENT OF SERVICE TAX.

Who is liable to pay Service Tax.

The following persons are liable to pay service tax.

1]. Service Provider [S. 68(1)]: Every person providing taxable service to any

person shall pay service at the rate specified in section 66B in such manner

within such period as may be prescribed. Manner and period are prescribed

vide Rule 6 of the Service Tax Rules, 1994.

2]. Services Receiver (Reverse charge mechanism) [S.68(2)]: In respect of

certain taxable services notified by the central government, the service tax

thereon shall be paid by the service receiver and in such manner as any be

prescribed and all the provisions of the act shall apply to such person as if he

is the person liable for paying the service tax in the relation such service.

The service notified under this category and the person liable to pay service

tax thereon are shown in the exhibit below : [Rule 2(1)(d) of service tax

rules,1994].

3]. Service tax to be paid partly by service provider and partly by service

receiver (partial reverse charge mechanism) : The Central Government may

notify the service and the extent of service tax which shall be payable by the

service receiver and the provisions of this chapter shall apply to him to the

extent so specified and the remaining part of the service tax shall be paid by

the service provider.

23

The service provider notified under this category and the extent of service tax

payable thereon by the person who provides the service and the person who

receives for the taxable services shall be as specified in the following table.

EXHIBIT 1. Partial Reverse Charge.

Service Provider : Service provider located in the taxable territory must

fall under any one of the following categories :

(i) Individual;

(ii)Hindu Undivided Family;

(iii)Partnership firm, whether registered or not; or

(iv)Association Of Persons

Service Recipient : Service Recipient located in the taxable territory must

be a Business Entity registered as a Body Corporate.

Service Tax Payable In The Prescribed Manner

1]. Due Dates [Rules 6(1)] :

(A) Payment through Bank :

Category

Frequency

In case of Individuals,

Quarterly

Proprietary Firms &

below :-

Partnership Firms

(i) For Q.E. 30th June

- by 5th July

(ii)For Q.E. 30th Sept

- by 5th Oct.

Others (e.g. Companies,

Societies, Trusts etc.)

as

Due Dates

mentioned

(iii)For Q.E. 30th Dec

- by 5th Jan.

(iv)For Q.E. 31st March

- by 31st March

Monthly

By

5th

of

the

month

immediately following the

month in which service is

deemed to be provided.

However, in case of March,

the

payment

should

made before 31 March.

st

be

24

From G.A.R.7 (previously known as TR6 challan) should be used to make service tax

payments at the Bank. Payment service tax may be made at the specified branches of the

designated banks.

(B) Electronic Payments through Internet :

Category

Frequency

In case of Individuals,

Quarterly

Proprietary Firms &

below :-

Partnership Firms

(i) For Q.E. 30th June

- by 6th July

(ii)For Q.E. 30th Sept

- by 6th Oct.

Others (e.g. Companies,

Societies, Trusts etc.)

as

Due Dates

mentioned

(iii)For Q.E. 31th Dec

- by 6th Jan.

(iv)For Q.E. 31st March

- by 31st March

Monthly

By

6th

of

the

month

immediately following the

month in which service is

deemed to be provided.

However, in case of March,

the

payment

should

be

made before 31 March.

st

2]. Individual / Firms [Rules 6(1) - Prov.] : In case of individuals and

partnership firms whose aggregate value of taxable services provided from one

or more premises is fifty lakh rupees or less in the previous financial year, the

service provider shall have the option to pay tax on taxable services provided

or to be provided by him upto a total of rupees fifty lakh in the current

financial year, by the dates specified in this sub-rule with respect to the month

or quarter, as the case may be, in which payment is received.

3]. Advance Payment of Service Tax [RULE 6(1A)] : The assessee has been

provided a facility to make advance payment of service tax on his own and

adjust the amount so paid against the service tax which he is liable to pay for

the subsequent period. Such facility shall be a available when the assessee :

25

(i) intimates the detail of the amount of the service tax paid in advance, to the

jurisdictional superintendent of central excise within a period of 15 days from

the date of such payment, and

(ii) indicates the details of advance payments made, and its adjustment, if any

in the subsequent return to be field under section 70.

4]. E-Payment [Rule 6(2)] ; E-Payment is a payment made through which a

taxpayer can remit his tax dues to govt. (CBEC) using internet banking

service. It is an additional facility being offered by the banks besides

conventional procedure. The e-payment is mandatory for the assessee who has

paid service tax of Rs. 1Lakh or above in the preceding financial year or has

already paid service tax of Rs. 1Lakh in the current financial year.

5].Self adjustment of service tax where service are partly or wholly not

rendered [Rule 6(3)] : Where an assessee has issued an invoice, or received

any payment, against a service to be provided which is not so provided by him

wholly or partially for any reason or where the amount of invoice is

renegotiated due to deficient provision of service, or any terms contained in a

contract, the assessee may take the credit of such excess service tax paid by

him, if the assessee :

(a) has refunded the payment or part thereof, so received for the service

provided to the person from whom it was received; or

(b) Has issued a credit note for the value of the service not so provided to the

persons to whom such invoice had been issued.

CH - 8. NEGATIVE LIST OF SERVICES.

26

In terms of Section 66B of the Act, service tax will be leviable on all services

provided in the taxable territory by a person to another for a consideration

other than the services specified in the negative list. The services specified in

the negative list therefore go out of the ambit of chargeability of service tax.

The negative list of service is specified in the Act itself in Section 66 D. For

ease of reference the negative list of services is given in Exhibit A1. In all,

there are seventeen heads of services that have been specified in the negative

list. The scope and ambit of these is explained in paras below.

Services provided by Government or local authority

No. Most services provided by the Central or State Government or local

authorities are in the negative list except the following:

a) services provided by the Department of Posts by way of speed post, express

parcel post, life insurance, and agency services carried out on payment of

commission on non government business;

b) services in relation to a vessel or an aircraft inside or outside the precincts

of a port or an airport;

c) transport of goods and/or passengers;

d) support services, other than those covered by clauses (a) to (c) above, to

business Entities.

No. If the services provided by the government or local authorities that have

been excluded from the negative list entry are otherwise specified in the

negative list then such services would also not be taxable.

27

Government would include various departments and offices of the Central or

State Government or the U.T. Administrations which carry out their functions

in the name and by order of the President of India or the Governor of a State.

For the support services provided by the Government, other than where such

support services are by way of renting of immovable property, to business

entities government departments will not have to get registered because

service tax will be payable on such services by the service receiver i.e. the

business entities receiving the service under reverse charge mechanism in

terms of the provisions of section 68 of the Act and the notification issued

under the said section as well Service Tax Rules, 1994. For services mentioned

at (a) to (c) of the list (point 4.1.1 above refers) and renting of immovable

properties the tax will be payable by the concerned department.

Support services have been defined in section 65B of the Act as

infrastructural, operational, administrative, logistic marketing or any other

support of any kind comprising functions that entities carry out in ordinary

course of operations themselves but may obtain as services by outsourcing

from others for any reason whatsoever and shall include advertisement and

promotion, construction or works contract, renting of movable or immovable

property, security, testing and analysis. Thus services which are provided by

government in terms of their sovereign right to business entities, and which

are not substitutable in any manner by any private entity, are not support

services e.g. grant of mining or licensing rights or audit of government entities

established by a special law, which are required to be audited by CAG under

section 18 of the Comptroller and Auditor-Generals (Duties, Powers and

28

Conditions of Service) Act, 1971 (such services are performed by CAG under

the statue and cannot be performed by the business entity themselves and thus

do not constitute support services.)

CH - 9. EXCLUDED SERVICES.

SERVICES SPECIFICALLY EXCLUDED

The definition of service u/s 65B(44) provides that services does not include

29

Title :- Any activity that constitutes only a transfer in title of goods or

immovable property by way of sale, gift or in any other manner.

Immovable property include land,, benefit arising out of land, and things

attached to the earth, or permanently fastened to anything attached to the

earth.

Goods :- A transfer, delivery or supply of goods which is deemed to be

sale of goods within the meaning of clauses (29A) of article 366 of the

constitution.

Goods Define in section 65B(25) of the Act means every kind of

movable

property other than actionable claims and money; and

includes securities, growing

crops, grass and things attached to or

forming part of the land which are agreed to be severed before sale or

under contract of sale .

Money :- A transaction only in money or actionable claim. Transaction

only in money do not constitute service, for example:The principal amount of deposit in or withdrawals from a bank account.

Advancing or repayment of principal sum on loan to someone.

Conversion of currency note into coins.

Employee :- A service provided by an employee to an employer in the

course of employment.Only services that are provided by the employee to

the employer in the course of employment are outside the scope of

services. Services provided beyond employment for a consideration would

be a service. Service provided on contract basis i.e. Principal-to-principal

basis are not services provided in the course of employment.

30

Fees :- Fees payable to a court or a tribunal set up under a law for time

being in force.

MP/MLA :- Duties of an M.P/M.L.A. Service does not cover function

or duties performed by members of parliament, State Legislatures,

Panchayat, Municipalities or any other local authority. [Explanation 1(A)

to s.65B(44).

Constitutional Post :- Duties of a person holding constitutional posts.

Service does not cover function or duties performed by any person who

holds any post in pursuance of the provisions of the constitution

[Explanation 1(B) to s. 65B(44)] e.g. Central Vigilance Commission,

Competition Commission of India, Khadi and Village Industries

Commission (KVIC), Commission of India, Planning Commission, Staff

Selection Commission, Union Public Service Commission (UPSC), etc.

Govt. Body :- Duties of a Govt. Body. Service does not cover function

or duties performed by any person as a chairperson or a member or a

director in a body established by the Central or state government or local

authority and who is not deemed as an employee. [Exemption 1(C) to s.

65B(44)]. Some of the bodies set up by the Maharashtra Govt. Are MIDC,

MSEB, MSRDC, MTDC, MMRDA, etc.

These exclusion are explained in detail below.

CH - 10 Place Of Provision Of Services.

1) POP Rules: In terms of section 66B, a service is taxable only when, inter

alia, it is provided (or agreed to be provided) in the taxable territory. Thus,

the taxability of service will be determined based on the place of its

31

provision (POP). The place of provision of service rules, 2012 specify the

manner to determine the taxing jurisdiction for a service.

2) Place where a service is deemed to be provided : Place of provision of

service rules specifies the manner to determine the taxing jurisdiction for a

service. These rules would determine the place where a service shall be

deemed to be provided, in term of section 66C read with section 94(hhh) of

chapter V of the finance Act, 1994. Thus, if a service is provided in taxable

territory as per the said rules, it shall be chargeable to service tax, otherwise

not. These rules have been notified vide notification No. 28/2012-S.T. Dated

20.06.2012. The rules apply even if either the service provider or the service

recipient or both are located at a place outside the taxable territory [s. 66C(2)].

3) Persons for whom the rules are relevant: Place of provision of service

rules are useful for - (i) the person who deal in cross border services.

(ii) those who have operation with suppliers or customers in the state of

Jammu and Kashmir.

(iii) service provider operating within in India from multiple locations, without

having centralized registration, for determining the prices taxable jurisdiction

applicable to there operations.

(iv) determining services that are wholly consumed within a SEZ, to avail the

outright exemptions.

4) Power of the Central Government to frame the rules : Section 66C

empowers the central government to frame rules having regard to the nature

and description of various services, to determine the place where such services

32

are provided or deemed to have been provided or agreed to be provided or

deemed to have been agreed to be provided. Any rule made here under shall

not be invalid merely on the ground that either the service provider or the

service receiver or both are located at a place being outside the taxable

territory.

CH - 11. ILLUSTRATIONS.

Compute taxable value tax thereon (assume that all sums received are

exclusive of service tax) (Ignore small service providers exemption and abatements)

1) Development of customised software : Rs. 120 Lakh.

2) Supply of pre-packaged software on CD : Rs.25 Lakh

3) Onsite development of software : Rs. 6Lakh

4) Advice, consultancy, etc. Relating to software :Rs 9Lakh

5) Licensing of software delivered online : Rs. 9Lakh

6) Repair of software :Rs. 2Lakh

7) Implementation related services of software :Rs. 5Lakh

Solution :-Computation of Taxable Value

Particulars

Rs.

1]. Development of customised software:-Rs.120Lakh Taxable u/s 66(E) - Not a sale of goods

2]. Supply of pre-packaged software on CD:-Rs.25Lakh Since pre-packaged software was put on a media, it

1,20,00,000

33

Became goods and, therefore, it is Not liable to service

Tax u/s 66D.[Trading of goods - Negative List Entry-5]

NIL

3]. Onsite development of software:- Rs.5Lakh - Taxable

U/s. 66E.

5,00,000

4]. Advice, consultancy, etc. Relating to software:- Rs.6Lakh

Taxable as it constitutes service.

6,00,000

5]. Licensing of software delivered online:- Rs.9Lakh Delivery of software online is not goods and hence,

It is a service liable to service tax.

9,00,000

6]. Repair of software :- Rs.2Lakh - Taxable

2,00,000

7]. Implementation related services of software :-Rs.5Lakh Taxable u/s 66E(d)

5,00,000

Taxable Value

Tax at 12.36%

1,47,00,00

18,16,920

ABC Ltd. Received the following sums (exclusive of taxes). Compute

service tax liability (Ignore small service providers exemption and

abatement) 1) Manufacture of exempted excisable goods :- Rs. 13Lakh.

2) Manufacture of dutiable excisable goods :- Rs. 4.3Lakh.

3) Job-work on goods on which duty is paid by principal manufacture :Rs.8Lakh.

4) Job-work on goods on which no duty is payable by principal

manufacture due to exemption :- Rs. 17Lakh.

34

5) Manufacture of alcohol /wine :- Rs. 5Lakh.

6) Job-work of printing :- Rs. 3Lakh.

7) Job-work of textile processing :- Rs. 1Lakh.

Solution :Computation of Service Tax Liability

Computation of Taxable Value

Particulars

Rs.

1]. Manufacture of exempted excisable goods :Rs. 13Lakh - Covered within Negative List u/s.66D(f)

NIL

2]. Manufacture of dutiable excisable goods :- Rs.4.3Lakh

- Covered within Negative List u/s.66D(f)

NIL

3]. Job-work on goods on which duty is paid by principal

Manufacture :- Rs.8Lakh - Exempt Wide NN25/2012

NIL

4]. Job-work on goods on which no duty is payable by Principal manufacture due to exemption :-Rs.17Lakh

Taxable, as no appropriate duty paid by principal

Manufacture.

17,00,000

5]. Manufacture of alcohol/wine :- Rs.5Lakh -Covered

Within Negative List u/s.66D(f).

NIL

6]. Job-work of printing :-Rs.3Lakh -Exempt vide

NN 25/2012 -Entry 30(a)

NIL

7]. Job-work of textile processing :-Rs.1Lakh Exempt vide NN 25/2012 -Entry 30(a)

Taxable Value

Tax at 12.36%

NIL

17,00,000

2,10,120

35

CH - 12. BIBLIOGRAPHY

Refers from Direct & Indirect Taxes Books of M.Com Part-II

Sem - III & IV.

WWW.SLIDESHARE.COM

Refers from Education Guide

Service Tax Notes.

36

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A A1471e PDFDokument108 SeitenA A1471e PDFAnil ChauhanNoch keine Bewertungen

- Business Plan On Food Vending in Finland PDFDokument65 SeitenBusiness Plan On Food Vending in Finland PDFAnil ChauhanNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument1 SeiteNew Microsoft Office Word DocumentAnil ChauhanNoch keine Bewertungen

- Advantages of Joint Family System Include Equitable Economy, Care for All MembersDokument2 SeitenAdvantages of Joint Family System Include Equitable Economy, Care for All MembersAnil ChauhanNoch keine Bewertungen

- M/S. Sunil Tour and Travels Mr. Sunil Nebulal Chauhan: Statement of Total IncomeDokument8 SeitenM/S. Sunil Tour and Travels Mr. Sunil Nebulal Chauhan: Statement of Total IncomeAnil ChauhanNoch keine Bewertungen

- Experiment No 3 DWTTDokument10 SeitenExperiment No 3 DWTTAnil ChauhanNoch keine Bewertungen

- Bank statement request letter templateDokument1 SeiteBank statement request letter templateAnil ChauhanNoch keine Bewertungen

- Urban Farm Business PlanDokument77 SeitenUrban Farm Business PlanZartosht Matthijs100% (11)

- ReambbmbdmeDokument1 SeiteReambbmbdmeNibedanPalNoch keine Bewertungen

- Book 1Dokument10 SeitenBook 1Anil ChauhanNoch keine Bewertungen

- Advantages of Joint Family System Include Equitable Economy, Care for All MembersDokument2 SeitenAdvantages of Joint Family System Include Equitable Economy, Care for All MembersAnil ChauhanNoch keine Bewertungen

- Flow ChatDokument1 SeiteFlow ChatAnil ChauhanNoch keine Bewertungen

- Goa TourismDokument11 SeitenGoa TourismAnil ChauhanNoch keine Bewertungen

- Goa TourismDokument11 SeitenGoa TourismAnil ChauhanNoch keine Bewertungen

- The Recycling of Paper Has Become Increasingly Important Over The Past DecadeDokument2 SeitenThe Recycling of Paper Has Become Increasingly Important Over The Past DecadeAnil ChauhanNoch keine Bewertungen

- What Is The Role of The SecretaryDokument3 SeitenWhat Is The Role of The SecretaryAnil ChauhanNoch keine Bewertungen

- The Recycling of Paper Has Become Increasingly Important Over The Past DecadeDokument2 SeitenThe Recycling of Paper Has Become Increasingly Important Over The Past DecadeAnil ChauhanNoch keine Bewertungen

- AbhishekDokument1 SeiteAbhishekAnil ChauhanNoch keine Bewertungen

- The Importance of Recycling PaperDokument1 SeiteThe Importance of Recycling PaperAnil ChauhanNoch keine Bewertungen

- Municipal Solutions for Eco-Efficient Recyclables ManagementDokument1 SeiteMunicipal Solutions for Eco-Efficient Recyclables ManagementAnil ChauhanNoch keine Bewertungen

- Preparation of Balance Sheet and Profit and Loss Account: TotalDokument7 SeitenPreparation of Balance Sheet and Profit and Loss Account: TotalAnil ChauhanNoch keine Bewertungen

- Paper RecyclingDokument1 SeitePaper RecyclingAnil ChauhanNoch keine Bewertungen

- Index & First 4 Pages of AfmDokument4 SeitenIndex & First 4 Pages of AfmAnil ChauhanNoch keine Bewertungen

- Born: January 23, 1897 Died: August 18, 1945 Achievements: Passed Indian Civil Services Exam Elected CongressDokument1 SeiteBorn: January 23, 1897 Died: August 18, 1945 Achievements: Passed Indian Civil Services Exam Elected CongressAnil ChauhanNoch keine Bewertungen

- Books of Account To Be Kept by A CompanyDokument8 SeitenBooks of Account To Be Kept by A CompanyAnil ChauhanNoch keine Bewertungen

- Form 12 Print PDFDokument4 SeitenForm 12 Print PDFKrishna YeldiNoch keine Bewertungen

- A Good Argument To Halt Human Advancement in Technology Is That If We Continue Creating Technologies and Researching Sciences To ReDokument1 SeiteA Good Argument To Halt Human Advancement in Technology Is That If We Continue Creating Technologies and Researching Sciences To ReAnil ChauhanNoch keine Bewertungen

- Index & First 4 Pages of AfmDokument4 SeitenIndex & First 4 Pages of AfmAnil ChauhanNoch keine Bewertungen

- Final of AFMDokument34 SeitenFinal of AFMAnil ChauhanNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Feasibility Study PresentationDokument22 SeitenFeasibility Study PresentationCarryl MañoscaNoch keine Bewertungen

- CH 5Dokument10 SeitenCH 5Miftahudin MiftahudinNoch keine Bewertungen

- Indian RailWay E Ticket ExampleDokument1 SeiteIndian RailWay E Ticket ExamplegouthamlalNoch keine Bewertungen

- Budgeting and Cost ControlDokument7 SeitenBudgeting and Cost Controlnags18888Noch keine Bewertungen

- Market StructureDokument42 SeitenMarket StructureSurya PanwarNoch keine Bewertungen

- Theoretical Framework on Cash Management and Business ValueDokument2 SeitenTheoretical Framework on Cash Management and Business ValuePaula ReyesNoch keine Bewertungen

- 3 - Zahtjev Za EORI Broj Primjer Kako Se PopunjavaDokument4 Seiten3 - Zahtjev Za EORI Broj Primjer Kako Se PopunjavaiŠunjić_1Noch keine Bewertungen

- Case Questions Spring 2012Dokument2 SeitenCase Questions Spring 2012Refika TetikNoch keine Bewertungen

- Swot Analysis of Indian Road NetworkDokument2 SeitenSwot Analysis of Indian Road NetworkArpit Vaidya100% (1)

- Indian All Colleges Cources List For BcomDokument56 SeitenIndian All Colleges Cources List For BcomAkshayKawaleNoch keine Bewertungen

- Problems in Estimating Production Function Empirically For A Ceramic Tile Manufacture in Sri LankaDokument15 SeitenProblems in Estimating Production Function Empirically For A Ceramic Tile Manufacture in Sri LankaRavinath NiroshanaNoch keine Bewertungen

- Pe Irr 06 30 15Dokument4 SeitenPe Irr 06 30 15Fortune100% (1)

- IRCTC E-ticket from Kota Jn to BhagalpurDokument2 SeitenIRCTC E-ticket from Kota Jn to BhagalpurAditya JhaNoch keine Bewertungen

- Bkf4143-Process Engineering Economics 11213 PDFDokument11 SeitenBkf4143-Process Engineering Economics 11213 PDFJeevanNairNoch keine Bewertungen

- Case StudyDokument6 SeitenCase Studyjuanp12560% (1)

- Solutions For Economics Review QuestionsDokument28 SeitenSolutions For Economics Review QuestionsDoris Acheng67% (3)

- EconomicDokument6 SeitenEconomicDaniloCardenasNoch keine Bewertungen

- CH 01Dokument28 SeitenCH 01aliNoch keine Bewertungen

- Executive SummaryDokument1 SeiteExecutive SummaryGuen ParkNoch keine Bewertungen

- Engineering Steel - SBQ - Supply and Demand in EuropeDokument1 SeiteEngineering Steel - SBQ - Supply and Demand in EuropeAndrzej M KotasNoch keine Bewertungen

- Reaction PaperDokument2 SeitenReaction PaperPerry Ellorin QuejadaNoch keine Bewertungen

- Eu4 Loan-To-Build Profits CalculatorDokument8 SeitenEu4 Loan-To-Build Profits CalculatorAnonymous pw0ajGNoch keine Bewertungen

- OPOSing Telugu Curries PDFDokument2 SeitenOPOSing Telugu Curries PDFpaadam68100% (2)

- End Beginning of Year of Year: Liquidity of Short-Term Assets Related Debt-Paying AbilityDokument4 SeitenEnd Beginning of Year of Year: Liquidity of Short-Term Assets Related Debt-Paying Abilityawaischeema100% (1)

- CIN - TAXINN Procedure - An Overview: Transaction Code: OBYZDokument8 SeitenCIN - TAXINN Procedure - An Overview: Transaction Code: OBYZNeelesh KumarNoch keine Bewertungen

- Food/restaurant Tenants List With Contact Details of The Company For Easy Access in The PhilippinesDokument6 SeitenFood/restaurant Tenants List With Contact Details of The Company For Easy Access in The Philippinesbey_dbNoch keine Bewertungen

- PRC Room Assignment For December 2013 Nursing Board Exam (Cebu)Dokument150 SeitenPRC Room Assignment For December 2013 Nursing Board Exam (Cebu)PhilippineNursingDirectory.comNoch keine Bewertungen

- Personal Financial StatementDokument1 SeitePersonal Financial StatementKiran KumarNoch keine Bewertungen

- Hotel ReportDokument6 SeitenHotel ReportRamji SimhadriNoch keine Bewertungen