Beruflich Dokumente

Kultur Dokumente

Bir Form 1903 - Registration Corp (Blank)

Hochgeladen von

Dennis TolentinoOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bir Form 1903 - Registration Corp (Blank)

Hochgeladen von

Dennis TolentinoCopyright:

Verfügbare Formate

(To be filled up by BIR)

DLN:

BIR Form No.

1903

Application for

Registration

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

For Corporations / Partnerships (Taxable / Non-Taxable),

Including GAIs and LGUs

January 2000 (ENCS)

New TIN to be issued, if applicabl e

(To be filled up by BIR)

Fill in applicable spaces. Mark all appropriate boxes with an "X".

1

REGISTERING OFFICE

Head Office

DATE OF REGISTRATION

(To be filled up by BIR)

Branch Office

(MM

DD

YYYY)

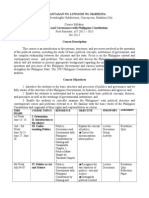

TAXPAYER TYPE

Partnership in General

Government Corporation

International Carrier

General Professional Partnership

Government Agency and Instrumentality (GAI)Offshore Banking Unit/ Foreign

Joint Venture

Insurance - mutual life

Currency Deposit Unit (OBU/ FCDU)

Domestic Corporation in General

Non-profit Hospital

Non-stock Non-profit Organization

Resident Foreign Corporation in General

Proprietary Educational Institutions

Local Government Unit (LGU)

TAXPAYER IDENTIFICATION NUMBER (TIN)

(For Non-Individual Taxpayer with existing TIN

RDO CODE

(To be filled up by BIR)

or applying for a branch)

TAXPAYER'S NAME

DATE OF INCORPORATION OR

ORGANIZATION

NATIONALITY

SEC Registered Name/ Agency/ LGU Charter Name

8 DESCRIPTION OF MAIN ACTIVITY

(MM

DD

Domestic

Engaged in Business

YYYY)

Not Engaged in Business

Resident Foreign

10 PRIMARY/ SECONDARY INDUSTRIES (Attach additional sheets, if necessary)

Facility Type

PSIC

Industry

Primary

Primary

Trade/Business Name

with no independent tax types Number of

(To be filled up by BIR)

Line of Business

PP

SP

WH

Facilities

Secondary

Facility Types : PP - Place of Production; SP - Storage Place; WH - Warehouse

11 TAXABLE YEAR/ ACCOUNTING PERIOD

Calendar Year

Fiscal Year

Starting Date of Fiscal Year

12 LOCAL ADDRESS

No. (Include Building Name)

Street

District/Municipality

13 ZIP CODE

Barangay/Subdivision

City/Province

14 MUNICIPALITY CODE

15 TELEPHONE

(To be filled up by the BIR)

NUMBER

16 FOREIGN BUSINESS ADDRESS

No. (Include Building Name)

Street

State

17 FOREIGN BUSINESS

PHONE NUMBER

City

Country

Zip Code

17A

17B

Country Code

Area Code

Telephone Number

18 CONTACT PERSON / ACCREDITED TAX AGENTS (if different from taxpayer)

Last Name, First Name, Middle Initial (if individual) / Registered Name (if non-individual)

FAX Number

19TELEPHONE NUMBER

BIR FORM NO. 1903 (ENCS) - PAGE 2

19

Tax Types (choose only the tax types that are applicable to you)

FORM TYPE

ATC

(To be filled up by BIR)

(To be filled up by BIR)

Income Tax

Value-added Tax

Percentage Tax - Stocks

Percentage Tax - Stocks (IPO)

Other Percentage Taxes Under the National Internal Revenue Code

(Specify)

Percentage Tax Payable Under Special Laws

Withholding Tax - Compensation

Withholding Tax - Expanded

Withholding Tax - Final

Withholding Tax - Fringe Benefits

Withholding Tax - Banks and Other Financial Institutions

Withholding Tax - Others (One-time Transaction not

subject to Capital Gains Tax)

Withholding Tax - VAT and Other Percentage Taxes

Withholding Tax - Percentage Tax on Winnings and Prizes Paid by

Racetrack Operators

Excise Tax - Ad Valorem

Excise Tax - Specific

Tobacco Inspection and Monitoring Fees

Documentary Stamps Tax

Capital Gains Tax - Real Property

Capital Gains Tax - Stocks

Donor's Tax

Registration Fees

Miscellaneous Tax

(Specify)

Others (Specify)

20 Registration of Books of Accounts

PSIC

TYPE OF BOOKS TO BE REGISTERED

(To be filled up by BIR)

VOLUME

QNTY.

FROM

21 DECLARATION

I declare, under the penalties of perjury, that this application has been made in good faith, verified by

me, and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the

National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

NO. OF PAGES

TO

Stamp of BIR Receiving Office

and Date of Receipt

Attachments complete?

TAXPAYER/AUTHORIZED AGENT

(Signature over printed name)

TITLE/POSITION OF SIGNATORY

(To be filled up by BIR)

Yes

No

ATTACHMENTS: (Photocopy only)

I. For Corporations / Partnerships

1. SEC Certificate of Registration (Certificate of Incorporation/ Certificate of Co-partnership)

2. Mayor's Permit - to be submitted prior to the issuance of Certificate of Registration.

II. For GAIs and LGUs - Unit or Agency's Charter

NOTE:

Taxpayer should attend the required taxpayer briefing before the release of the BIR Certificate of Registration.

POSSESSION OF MORE THAN ONE TAXPAYER IDENTIFICATION NUMBER (TIN) IS CRIMINALLY PUNISHABLE PURSUANT

TO THE PROVISIONS OF THE NATIONAL INTERNAL REVENUE CODE OF 1997, AS AMENDED.

Das könnte Ihnen auch gefallen

- rev-mat-2-IA Print PDFDokument31 Seitenrev-mat-2-IA Print PDFAyaka FujiharaNoch keine Bewertungen

- Picpa 2019 September 6 7 Seminar Invitation LetterDokument1 SeitePicpa 2019 September 6 7 Seminar Invitation Lettersanglay99Noch keine Bewertungen

- 868 Sample Clerical Skills Grammar TestDokument2 Seiten868 Sample Clerical Skills Grammar TestTrixia Mae RamosNoch keine Bewertungen

- Edited Guidelines in The Filling Out of SALNDokument42 SeitenEdited Guidelines in The Filling Out of SALNHael LeighNoch keine Bewertungen

- Donor's Tax A) Basic Principles, Concept and DefinitionDokument4 SeitenDonor's Tax A) Basic Principles, Concept and DefinitionAnonymous YNTVcDNoch keine Bewertungen

- OG-07-016 USB Amended Guidelines On 2nd-End. Chks 10.31.06Dokument6 SeitenOG-07-016 USB Amended Guidelines On 2nd-End. Chks 10.31.06romeldevera100% (2)

- Deed of Sale of Utility VehicleDokument1 SeiteDeed of Sale of Utility VehicleSky SoronoiNoch keine Bewertungen

- Philippine Institute of Certified Public Accountants (PICPA)Dokument2 SeitenPhilippine Institute of Certified Public Accountants (PICPA)Jeaneth Dela Pena Carnicer100% (1)

- Industry Analysis: Positioning The Firm Within The Specific EnvironmentDokument12 SeitenIndustry Analysis: Positioning The Firm Within The Specific EnvironmentJann Aldrin Pula100% (1)

- CMO 7-2012 Supplemental Guidelines Automated Export Documentation System Implementation Under E2mDokument9 SeitenCMO 7-2012 Supplemental Guidelines Automated Export Documentation System Implementation Under E2mMichael Joseph IgnacioNoch keine Bewertungen

- Cielo Mae D. Parungo: ObjectiveDokument2 SeitenCielo Mae D. Parungo: ObjectiveCielo Mae ParungoNoch keine Bewertungen

- FS Defense Rating SheetDokument1 SeiteFS Defense Rating SheetWilliam DC RiveraNoch keine Bewertungen

- Job Description of Branch StaffDokument3 SeitenJob Description of Branch StaffEleanor JamcoNoch keine Bewertungen

- Filipinos Buying BehaviorDokument4 SeitenFilipinos Buying BehaviorMaria Regina EspejoNoch keine Bewertungen

- Rice Loan AgreementDokument2 SeitenRice Loan AgreementJoanna Bernabe AcostaNoch keine Bewertungen

- Furniture and Fixtures DetailaDokument4 SeitenFurniture and Fixtures DetailaCristine Jane Moreno CambaNoch keine Bewertungen

- Annex D 2 BTR Form 1 Request For Authority To Open Bank AccountDokument1 SeiteAnnex D 2 BTR Form 1 Request For Authority To Open Bank AccountRey MocaNoch keine Bewertungen

- Investment in Equity Securities - SeatworkDokument2 SeitenInvestment in Equity Securities - SeatworkLester ColladosNoch keine Bewertungen

- Credit Investigation or Background Investigation PDFDokument4 SeitenCredit Investigation or Background Investigation PDFjoan100% (3)

- Transfer and Business Taxation SyllabusDokument5 SeitenTransfer and Business Taxation SyllabusamqqndeahdgeNoch keine Bewertungen

- Ipon ChallengeDokument1 SeiteIpon ChallengeMichaela Bell ConcepcionNoch keine Bewertungen

- Annex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Dokument4 SeitenAnnex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Kristel Anne LiwagNoch keine Bewertungen

- Letter of IntentDokument2 SeitenLetter of IntentRicMartinNoch keine Bewertungen

- BSC - PNBDokument7 SeitenBSC - PNBHanz SoNoch keine Bewertungen

- Sale of A Parcel of Land Offered by The Two Persons As Co-Owners To The Government For Public UseDokument2 SeitenSale of A Parcel of Land Offered by The Two Persons As Co-Owners To The Government For Public UseCyrus ArmamentoNoch keine Bewertungen

- D. Financial AspectDokument3 SeitenD. Financial AspectJohn Kenneth BoholNoch keine Bewertungen

- 3rd Party Certification Sample (With Letterhead)Dokument1 Seite3rd Party Certification Sample (With Letterhead)billyNoch keine Bewertungen

- Stakeholder Theory Reflection 4-22-14Dokument3 SeitenStakeholder Theory Reflection 4-22-14api-2497206310% (1)

- Letter Permit To TeachDokument2 SeitenLetter Permit To TeachLyn JuvyNoch keine Bewertungen

- FAR Vol 2 Chapter 16 18Dokument14 SeitenFAR Vol 2 Chapter 16 18Allen Fey De Jesus100% (1)

- Tax Compliance Reminders For Political Candidates EnlargedDokument37 SeitenTax Compliance Reminders For Political Candidates EnlargedNiña PacoNoch keine Bewertungen

- BIR Tax Filing and Deadlines For IndividualsDokument2 SeitenBIR Tax Filing and Deadlines For IndividualsDRVBautistaNoch keine Bewertungen

- Lopez Fiesta MartDokument2 SeitenLopez Fiesta Martceli wrightsNoch keine Bewertungen

- ART. 86. Order of Distribution. - The Net Surplus of Every Cooperative ShallDokument3 SeitenART. 86. Order of Distribution. - The Net Surplus of Every Cooperative Shallkat perez100% (1)

- Sales, Agency, Labor and Other Commercial LawsDokument6 SeitenSales, Agency, Labor and Other Commercial LawsREYNOLD BABORNoch keine Bewertungen

- Niat 2018Dokument1 SeiteNiat 2018Akira Marantal ValdezNoch keine Bewertungen

- Assignment Rookie Onboarding Program Part One 11Dokument6 SeitenAssignment Rookie Onboarding Program Part One 11shofa oneoneone0% (1)

- 5th PAPBE Accreditation Invitation LetterDokument5 Seiten5th PAPBE Accreditation Invitation LetterfeasprerNoch keine Bewertungen

- Minutes of MeetingDokument2 SeitenMinutes of MeetingCedric NavalNoch keine Bewertungen

- RR 6-08Dokument19 SeitenRR 6-08matinikkiNoch keine Bewertungen

- 4.registry of Semi-Expendable Property IssuedDokument1 Seite4.registry of Semi-Expendable Property IssuedAlgie ReñonNoch keine Bewertungen

- Business Partner Master Data - Its Objective Is To Record and Retrieve BusinessDokument2 SeitenBusiness Partner Master Data - Its Objective Is To Record and Retrieve BusinessAnjelainePinedaNoch keine Bewertungen

- AC315 Auditing & Assurance Principles-RPT-OBE-sem17 Theory HalfDokument15 SeitenAC315 Auditing & Assurance Principles-RPT-OBE-sem17 Theory HalfLalaine De JesusNoch keine Bewertungen

- Waiver OJTDokument1 SeiteWaiver OJTpingpong1234560% (1)

- PAS 1 With Notes - Pres of FS PDFDokument75 SeitenPAS 1 With Notes - Pres of FS PDFFatima Ann GuevarraNoch keine Bewertungen

- Flavo Lechon Survey FormDokument1 SeiteFlavo Lechon Survey FormEmman Nepacena100% (1)

- Performance Standards For Credit and Other Types of Cooperatives With Credit ServicesDokument56 SeitenPerformance Standards For Credit and Other Types of Cooperatives With Credit ServicesIpiphaniaeFernandezItalio100% (3)

- Reaction Paper NegotiationDokument1 SeiteReaction Paper NegotiationDanielle Elesterio100% (1)

- Value Added TaxDokument3 SeitenValue Added TaxChristine Igna100% (1)

- Abstract of CanvassDokument1 SeiteAbstract of CanvassIzel E. VargasNoch keine Bewertungen

- Rules For Poster Making CompetitionDokument1 SeiteRules For Poster Making CompetitionBaburao ApteNoch keine Bewertungen

- PDF Pup Sample ThesisDokument98 SeitenPDF Pup Sample ThesisaNoch keine Bewertungen

- Accomplishment Report 1Dokument12 SeitenAccomplishment Report 1Kate PotinganNoch keine Bewertungen

- BP Blg. 22Dokument30 SeitenBP Blg. 22Dee LMNoch keine Bewertungen

- RFBT Case Study - MidtermDokument1 SeiteRFBT Case Study - MidtermShenn Rose CarpenteroNoch keine Bewertungen

- Comfort Room Monitoring SheetDokument1 SeiteComfort Room Monitoring SheetJaime SorianoNoch keine Bewertungen

- Feasibility Study On Bachelor of Science in Accountancy and Bachelor of Science in Business Administration Major inDokument7 SeitenFeasibility Study On Bachelor of Science in Accountancy and Bachelor of Science in Business Administration Major inBongbong GalloNoch keine Bewertungen

- Format of Integration PaperDokument31 SeitenFormat of Integration PaperGwen BrossardNoch keine Bewertungen

- BIR Ruling No. 095-95 - Consignment Sales - Issuance of Sales InvoiceDokument2 SeitenBIR Ruling No. 095-95 - Consignment Sales - Issuance of Sales InvoiceCkey ArNoch keine Bewertungen

- Bir - Form 1903Dokument2 SeitenBir - Form 1903Jennifer Deleon86% (7)

- Accion Publiciana Converted To EjectmentDokument19 SeitenAccion Publiciana Converted To EjectmentDennis TolentinoNoch keine Bewertungen

- Form No. 1 - Affidavit One and The Same PersonDokument1 SeiteForm No. 1 - Affidavit One and The Same PersonDennis TolentinoNoch keine Bewertungen

- Public Policy & Program Administration: By: Engr. Rogelio D. Mercado DPA 204Dokument42 SeitenPublic Policy & Program Administration: By: Engr. Rogelio D. Mercado DPA 204Dennis TolentinoNoch keine Bewertungen

- Department of Sociology: Sociology, Culture, and Family Planning (So100/Soci1013)Dokument5 SeitenDepartment of Sociology: Sociology, Culture, and Family Planning (So100/Soci1013)Dennis TolentinoNoch keine Bewertungen

- Department of Sociology: Sociology, Culture, and Family Planning (So100/Soci1013)Dokument5 SeitenDepartment of Sociology: Sociology, Culture, and Family Planning (So100/Soci1013)Dennis TolentinoNoch keine Bewertungen

- Sample UCPB - Biz Secretary's CertificateDokument2 SeitenSample UCPB - Biz Secretary's CertificateBrikkzNoch keine Bewertungen

- Form No 03122014 CARF Check Alteration ReplacementDokument1 SeiteForm No 03122014 CARF Check Alteration ReplacementDennis TolentinoNoch keine Bewertungen

- Francisco vs. DeacDokument22 SeitenFrancisco vs. DeacDennis Tolentino0% (1)

- Implementing Rules RegulationsDokument125 SeitenImplementing Rules RegulationsDennis TolentinoNoch keine Bewertungen

- Politics Governance With Phil ConstitutionDokument9 SeitenPolitics Governance With Phil ConstitutionDennis Tolentino0% (1)

- About The Philippines Bodies of WaterDokument58 SeitenAbout The Philippines Bodies of WaterDennis TolentinoNoch keine Bewertungen

- Check PointDokument31 SeitenCheck PointDennis TolentinoNoch keine Bewertungen

- Obligations and ContractsDokument27 SeitenObligations and ContractsMiGay Tan-Pelaez93% (80)

- BA 211 Midterm 2Dokument6 SeitenBA 211 Midterm 2Gene'sNoch keine Bewertungen

- Chapter 7 9eDokument37 SeitenChapter 7 9eRahil VermaNoch keine Bewertungen

- A Study On Fundamental Analysis of Top IT Companies in IndiaDokument14 SeitenA Study On Fundamental Analysis of Top IT Companies in IndiaMuttavva mudenagudiNoch keine Bewertungen

- 104 2022 218 BdoDokument29 Seiten104 2022 218 BdoJason BramwellNoch keine Bewertungen

- Investment Office ANRS: Project Profile On The Establishment of Absorbent Cotton Making PlantDokument29 SeitenInvestment Office ANRS: Project Profile On The Establishment of Absorbent Cotton Making Plantabel_kayelNoch keine Bewertungen

- Price Return and Total Return of An Index CFA Level 1 - AnalystPrepDokument1 SeitePrice Return and Total Return of An Index CFA Level 1 - AnalystPreprex031162Noch keine Bewertungen

- Amendment For Law-Nov 21 by AoDokument12 SeitenAmendment For Law-Nov 21 by AoConsultant NNoch keine Bewertungen

- Charterhouse 1Dokument57 SeitenCharterhouse 1arbet100% (1)

- Gannon Dunkerley & Co., LTD.: Civil Engineering Division, HyderabadDokument1 SeiteGannon Dunkerley & Co., LTD.: Civil Engineering Division, HyderabadNaga GeeNoch keine Bewertungen

- Mariel Princess TabilangonDokument2 SeitenMariel Princess TabilangonMariel PrincessNoch keine Bewertungen

- NG Cho Cio V NG Diong-Case DigestDokument2 SeitenNG Cho Cio V NG Diong-Case DigestAngelette BulacanNoch keine Bewertungen

- SMU MBA Assignments 3rd Sem Finance ManagementDokument1 SeiteSMU MBA Assignments 3rd Sem Finance ManagementTenzin KunchokNoch keine Bewertungen

- Daftar Akun Rumah Cantik HanaDokument4 SeitenDaftar Akun Rumah Cantik HanaLSP SMKN 1 BanjarmasinNoch keine Bewertungen

- The Currency Trader's Handbook: by Rob Booker, ©2002-2006Dokument23 SeitenThe Currency Trader's Handbook: by Rob Booker, ©2002-2006Pandelis NikolopoulosNoch keine Bewertungen

- CIMA F2 Notes 2018 PDFDokument154 SeitenCIMA F2 Notes 2018 PDFsolstice567567Noch keine Bewertungen

- Chapter 14Dokument18 SeitenChapter 14RenNoch keine Bewertungen

- List Bibliography PDFDokument5 SeitenList Bibliography PDFInes SantosNoch keine Bewertungen

- System of Financial Control & Budgeting 2006 (Updated October 2018)Dokument51 SeitenSystem of Financial Control & Budgeting 2006 (Updated October 2018)usman ziaNoch keine Bewertungen

- FIN2012 Ovigele 10effectivetips ExcerptDokument19 SeitenFIN2012 Ovigele 10effectivetips ExcerptOng OngNoch keine Bewertungen

- AEV Balance Sheet: Total Current AssetsDokument5 SeitenAEV Balance Sheet: Total Current AssetsJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Strategic Management Chapter-4Dokument29 SeitenStrategic Management Chapter-4Towhidul HoqueNoch keine Bewertungen

- 9e1621df KM BUCKET DraftSummaryDokument4 Seiten9e1621df KM BUCKET DraftSummaryAmarnath PNoch keine Bewertungen

- 5Dokument2 Seiten5ABDUL WAHABNoch keine Bewertungen

- Chapter 2Dokument22 SeitenChapter 2Tiến ĐứcNoch keine Bewertungen

- CFA Preparation COURSE 2021: Organized by Cfa Society PolandDokument4 SeitenCFA Preparation COURSE 2021: Organized by Cfa Society PolandJua perezNoch keine Bewertungen

- Bs CSV 22444161Dokument10 SeitenBs CSV 22444161Raghav Sharma0% (1)

- ADB - Masato MiyachiDokument40 SeitenADB - Masato MiyachiAsian Development BankNoch keine Bewertungen

- Informal Economy of Pakistans Land MarketDokument24 SeitenInformal Economy of Pakistans Land MarketJehangir IftikharNoch keine Bewertungen

- Annual Report: FPSB IndiaDokument68 SeitenAnnual Report: FPSB IndiaAnil AnveshNoch keine Bewertungen

- Under The Supervision of MR .Pradeep Singh Kala Isd Head Sbi Mutual Fund (J & K)Dokument57 SeitenUnder The Supervision of MR .Pradeep Singh Kala Isd Head Sbi Mutual Fund (J & K)Faizan NazirNoch keine Bewertungen