Beruflich Dokumente

Kultur Dokumente

Gati LTD.: Initiating Coverage at Dalal & Broacha

Hochgeladen von

yuviOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Gati LTD.: Initiating Coverage at Dalal & Broacha

Hochgeladen von

yuviCopyright:

Verfügbare Formate

Dalal & Broacha

Stock Broking Pvt. Ltd.

..

..

..

..

..

Initiating Coverage @ Dalal & Broacha

Gati Ltd.

Ankit Panchmatia (Research Analyst)

(022) 6714 1449

Milind Karmarkar (Head Research)

(022) 6630 8667

Sandeep Shah/Nilay Dalal (Equity Sales)

(022) 6714 1443

January 20, 2015

ACCUMLATE

Curre nt Pri ce

Ta rge t Pri ce

Upside

52 We e k Ra nge

KEY SHARE DATA

Ma rket Ca p

EV / Sa l es

EV / EBIDTA

Vol ume (BSE + NSE)

No of o/s s ha res

Fa ce Va l ue

Book Va lue

BSE / NSE

Reuters

Bl oomberg

SHAREHOLDING (%)

Period

Promote rs

MF / Ba nks / FI

FII

Publ i c & Othe rs

Total

900

Rs 277

Rs 332

20%

Rs 32 / Rs 342

India, with 16% of the global population, prospective strong GDP growth and

increasing E-commerce penetration is likely to present huge business opportunity

for the logistics sector. This is also apparent from the fact that international

giants like UPS & DHL see significant growth in their business being driven by

India and China.

Well-geared to capitalize on emerging economy

In India, nearly 40% of the logistics market is unorganized. We expect

Rs 24.0 BN/$399.7MN consolidation in the sector and the share of unorganized sector to reduce further.

With a market share of ~16% in surface segment, Gati is all set to emerge as one

2.2

of the key beneficiaries of the overall GDP and trade growth.

34.4

423764

86.6

2

90.9

532345 / GATI

GATI.BO

GTIC IN Equi ty

Sep-14

38.1

8.1

0.2

53.6

100.0

Gati

Jun-14

34.9

0.3

6.5

58.3

100.0

Sensex

800

700

600

Positive synergies from Kintetsu World Express

KWE caters to supply chain requirements of a wide base of global customers.

Indian operations of these customers will be served by Indian JV (Gati-KWE), due

to which it has recently signed couple of large Japanese customers like Sharp,

Idemitsu, Sony, Pioneer etc. One of the key strategies for KWE is to expand its

presence in emerging countries and India is most preferred.

Vast domestic reach to capitalize on E-Commerce Logistics

Gati is one of the largest players in road segment with a pan India network

present in 667 districts out of 675 districts. Additionally, it offers Cash on Delivery

which is essential for E-commerce service and is offered in more than 10000 pin

codes. Moreover, additional services like Gati e-Pack, Gati e-Pick, Gati Reverse

Pick-up and warehousing will take its scale of operations to a higher level going

ahead.

Broad-based growth to perk up revenues

Opportunities in Gati Kausar & e-Tailing and synergies from KWE will provide a

broad based growth across business segments. We expect the E commerce

business to lead the earnings growth with ~70% CAGR over FY14-FY17E, followed

by Gati Kausar and Gati KWE growing 28% and 27% respectively. Furthermore,

growth in high margin business and winding down losses from Gati Ship will

propel profitability. The consequent revenue growth is estimated at ~31% CAGR

over FY14-FY17E, and likely to be broad-based with all businesses contributing.

Growth in high margin business, buoy return ratios

In Q2FY15 the company has sold its ~30% stake in Gati Kausar for Rs.150 crore.

These funds will primarily be utilized to construct 10 cold chain warehouses.

Going ahead the company intends to increase the package delivery capacity.

Capitalizing on the economies of scale, we expect the company to improve its

ROE from 3% to 10% over CY14-17E.

500

400

300

200

100

Valuation:

At CMP the stock trades at 26x FY16E earnings of Rs. 10.7 and 19x FY17E earnings

of Rs. 15. We recommend a "BUY" with a target price of Rs. 332.

Year

FY 13

FY 14 (9-m th s )

FY 15E

FY 16E

FY 17E

Net Sales

12,729.5

11,165.7

17,432.8

20,997.1

25,226.6

% G rowth

7.2

-12.3

56.1

20.4

20.1

EBID TA

821.7

841.1

1,904.0

2,488.0

3,109.5

OPM %

6.5

7.5

10.9

11.8

12.3

PAT

96.3

234.2

620.4

935.9

1,248.2

Dalal & Broacha Research is available on Bloomberg DBVS<GO>

% G rowth

-76.8

143.3

164.9

50.9

33.4

EPS

1.1

2.7

7.1

10.7

14.8

P/E (x)

46.0

103.2

39.0

25.8

19.4

ROE %

1.6

3.0

7.8

11.1

13.4

RoCE %

7.1

6.1

13.6

17.0

20.1

Dalal & Broacha

Stock Broking Pvt. Ltd.

..

..

..

..

..

Gati Ltd.

Company Overview

Gati Limited founded in 1989 as a cargo management company, pioneered Express Distribution

Services in India. It provides Express Distribution services, Supply Chain Solutions, Cold Chain

Transportation Solutions, Warehousing, International Freight Forwarding, Custom Clearance and

e-Commerce Solutions. Gati has a strong market presence in the Asia Pacific region and SAARC

countries, with offices in China, Singapore, Hong Kong, Thailand and Nepal.

In order to strengthen the leadership position in India and establish its global foot print, the

company signed a strategic Joint venture agreement with Kintetsu World Express-Japan (KWE), a

Japanese logistics player. Financial year 2012-13 was the first full year of the operations of Gati

Limited after the company restructured its business by transferring substantial part of its Express

Distribution and Supply Chain division to its subsidiary Gati-Kintetsu Express Pvt. Ltd. (JV Company).

The division was transferred to JV company under a Business Transfer Agreement (BTA) on a going

concern basis, along with associated assets, liabilities, employees and debts amounting to ` 3300

Mn. with effect from March 31, 2012. Below is the organisation structure post transfer.

Source: Company Presentation, Dalal & Broacha Research

Having successfully completed business restructuring and capital infusion, Gati Ltd. continues to

focus on the growth of e-Commerce, Cold Chain and International Freight Forwarding business.

Dalal & Broacha

Stock Broking Pvt. Ltd.

..

..

..

..

..

Gati Ltd.

Gati Ltd. business is aligned to key business verticals; Gati KWE which contributes ~80% of the

total revenue followed by Gati Standalone (23%), Gati Kausar (3%) and Gati Import Export trading

(3%) and Gati ship (2%). Business wise revenue breakup and EBITDA contribution is shown in

following chart for FY14 (9-months).

Source: Company Annual Report, Dalal & Broacha Research

Brief profile of different verticals is as follows:

1. Partly Owned Subsidiaries

A) Gati-Kintetsu Express Pvt Ltd. (GATI-KWE)

Gati-Kintetsu Express Private Limited (GATI-KWE) is a joint venture company between Gati and

Kintetsu World Express - Japans leading logistics provider. It operates as a business vertical and

offers solutions in Express Distribution transport solutions. It is the main subsidiary of the company

and contributes ~75% of its total revenues and ~95 of its operating profits. It provides integrated

multimodal logistics services by road, rail and air network that covers 99.3% of India with a reach

to 667 districts out of 675 districts. Gatis large fleet of 4000 vehicle and an assured space across 28

airline sector positions it as a most preferred express distribution and supply chain solutions

provider. The company retains its market leadership position in the Road Express with ~19%

market share in non-docs Express segment. Below is the revenue break up of its express distribution

segment:-

Source: Company Presentation, Dalal & Broacha Research

Dalal & Broacha

Stock Broking Pvt. Ltd.

..

..

..

..

..

Gati Ltd.

With the strong involvement of the Japanese partner, the company has embarked on a Quality

Improvement program The GATI-KWE Way aimed at minimizing defects through implementation

of KAISEN, LEAN and 5S Principles. Automation processes like introduction of CCTV, Tablets and

Scanners has been introduced to reduce defects and improve the efficiency of service levels.

For FY14 (9-mths) revenue from the segment grew 20% yoy to Rs.7,823 mn. Road continues to

remain the largest portion which grew by 21% yoy, following which air Cargo grew 10% yoy for the

same period. Auto, Electronics/Computer peripherals and Pharma industry continues to be strong

contributor in overall revenue.

2. Gati Standalone:

A) E-Commerce

Gati is one of the top 5 E-Commerce logistic provider in the country. Its e-Commerce Division

provides services like Forward delivery (last mile), Cash on delivery (COD) facility, Reverse logistics

through its integrated supply chain solutions. The parcel size may vary from less than 500 gms (pen

drive) to 500 kg (furniture). The clientele includes Snapdeal, Jabong, Next & their alikes. The

company is well placed in Metros, Capitals, Tier 2 and Tier 3 cities.

Leveraging the extensive reach of KWE segment it covers 667 districts in India. Additionally it also

offers services like Cash on Delivery and Prepaid facility to 6700 direct pincodes and reach to

14,000 remote pin codes in tier II & III cities. The company has been able to increase its number of

packages delivered month on month, however the size of majority of these packages are less than

500 gms. The company has current capacity to deliver 23000 shipments per day, for which it is

equipped with 525 last mile delivery bikers, 6 e-pick centers & 3 e-pack centers.

500

473

Number of packages delivered (in '000)

431

450

455

402

400

359

350

295

300

246

250

264

269

Nov-13

Dec-13

315

315

Mar-14

Apr-14

257

218

200

150

100

50

0

Sep-13

Oct-13

Jan-14

Feb-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Source: Company Presentation, Dalal & Broacha Research

The revenue more than doubled to Rs.407 mn in the nine month period registering a growth of

over 100% as compared to previous period, complementing the same, number of packages delivered

more than double in a year. The company targets to increase the packages to 30000 shipments per

day as compared to current 23000 shipments. Further, it is also targeting traffic from bigger size

packages (>500 gms) which are usually high revenue and high margin.

4

Dalal & Broacha

Stock Broking Pvt. Ltd.

..

..

..

..

..

Gati Ltd.

B) International Freight Forwarding

Gati International, the international business of Gati Ltd. provides end to end Freight Forwarding

services, specializing in Air, Ocean & Land Freight to SAARC countries. The services offered includes

freight forwarding (both inbound and outbound), CHA for customs clearence, International couriers,

Road movement in SAARC nations, Bonded trucking and Custom bonded warehousing. The revenues

from freight forwarding remained flat at Rs.522 mn, however as the India cargo movement from

Asia Pacific countries has come down, the company has shifted its focus across SAARC countries

and other parts of the world.

C) Fuel Stations

Gati deals in petrol and diesel business along with other motor parts and lubricants through its

fuel stations. Presently Gati is operating four fuel stations at Bangalore, Belgaum, Indore and

Shadnagar (near Hyderabad). This segment continues to generate steady revenue & profitability.

It generates run rate revenue of about Rs. 500 mn per quarter. For FY14, the revenue stood at Rs.

1493 million for a period of 9 months. The company does not consider this segment as strategic,

however it plans to continue with the same due to its nature of steady growth with assured return.

3. Wholly Owned Subsidaries:

A) Gati Kausar

Gati Kausar is one of the bigger players in cold chain industry. Gati Kausar provides temperaturecontrolled storage and distribution to a wide variety of industries that include healthcare, meat

and poultry, bio-pharma, frozen and fresh produce, dairy products, organised retails and quick

service restaurants. The company in Q2FY15 has received funding of Rs. 150 crore to expand its

business in the area of cold warehousing and its associated activities like processing the

temperature controlled product. Additionally, the company intends to offer value added services

like primary processing (sourcing, procurement, collection, cleaning, sorting, grading, IQF,

packaging, stickering, ripening, etc. For nine months FY14, the segment posted revenue of Rs. 350

mn, with a loss Rs. 39 mn at the PAT level.

B) Gati Import Export and Trading Ltd.

This is one of the new growing business in Gati portfolio. The company in FY13 entered into a

integrated supply chain contract with Taj group of hotels to manage its entire inventory requirement.

It buys, stores & supplies inventory on behalf of hotels. The company wants to extend this offering

B2B and B2C by providing an end-to-end solution including international freight forwarding,

customs handling, import of goods, warehousing and last-mile delivery to the end-customer. This

will help clients to improve supply chain framework which in turn will improve efficiency in the

domestic hospitality industry procurement process. The revenues for FY14 nine month period

stood at Rs. 306 million, with a minor loss at PAT level. However, we expect it to turnaround this

year.

C) Gati Ship Ltd.

From FY15 the company has divested its Gati Ship limited division which was a loss making

division. The recepits from the same will be used to lower the obligations Gati Ship Ltd. has on its

book. Further, we believe that the overall all profitability will improve as the share of losses of

division would come down.

5

Dalal & Broacha

Stock Broking Pvt. Ltd.

..

..

..

..

..

Investment Argument

Outlook for trade growth in India: better times ahead

WTO ranked India as the 19th largest merchandise exporter in the world, with a share of 1.6%

of the global trade and the 10th largest importer with a share of 2.6% of global imports in 2012.

Further, the Emerging Market Survey, 2013, conducted by Transport Intelligence (TI) ranks India

as the second most attractive logistics market in the future after China. The growth of logistics

sector is directly proportional to overall economic growth of India. The GDP projection for India

was upgraded by 20 bps to 5.6% for 2015 and 6.4% for FY16. With ~40% unorganized market

share, the company will is well positioned to gain the same.

With stable government at the centre , with focus on manufacturing and infrastructure, trade

and GDP is bound to grow at a significantly higher rate in the coming years. This augers well for

the logistics sector. A move from the current state tax regime to GST would also promote trade.

Strong parentage with KWE to improve business metrics

In FY12 Gati transferred 30% of its Express Distribution and Supply Chain business to GatiKintetsu Express Pvt. Ltd. (GKEPL), a subsidiary of the company to form a joint venture with

Kintetsu World Express, Japan (KWE).

Kintetsu World Express-Japan (KWE), a global logistic leader listed at Tokyo offers freight

forwarding, customs clearance, warehousing, packing, temporary staffing, property management,

and insurance agency services. They have developed long-term relationships with major global

corporate clients.

According the latest annual report of KWE, this JV has attracted plenty of client interest due to

the appeal of a logistics network that covers 99% of Indias territory and a cargo tracking service

based on an advanced IT infrastructure. Going forward, they aim to increase the amount of

freight moving to and from India by fostering joint sales activities between Gati-Kintetsu Express

Pvt. Ltd. and the KWE Group, and further increase KWEs presence in India. This is visible as in

previous few quarters Gati has signed a couple of large Japanese customers due to the synergy

benefit. Large Japanese companies like Sharp, Sony, Emerson, NTN, Pioneer etc which have India

operations have become a part of Gati clientele.

Apart from the pipeline of customers, we believe that the qualititative synergy benefits will also

start flowing in from the Japanese JV. The company has embarked on a Quality Improvement

program to further enhance its commitment to high quality, with guidance from its JV partner

KWE. Automation processes like introduction of CCTV, Tablets and Scanners has been introduced

to reduce defects and improve the efficiency of service levels. Further, implementation of

KAIZEN, LEAN and 5S principles will help the company to achieve next level of quality excellence.

We believe that this exercise will help company to achieve next level of quality excellence &

thus will help it penetrate the unorganized sector.

Dalal & Broacha

Stock Broking Pvt. Ltd.

..

..

..

..

..

E-commerce logistics: the growth driver

According to Gartner, in 2014 India eCommerce market is estimated at $3.5 billion, which is

expected to grow annually by ~60-70 percent. It is estimated that the e-Commerce industry

would contribute around 4 percent to the GDP by 2020. In recent years, the growth of the global

e-Commerce market has made cross-border transactions an intensifying force in Indias foreign

trade, offering millions of enterprises, most of which are SMEs/MSMEs, to expand beyond the

domestic market. Over 15,000 sellers export a variety of Indian handcrafted products to 112

million customers in over 190 countries.

Online shopping accounts for less than one percent of the total shopping in the country. Total

global online sales reached $1.22 trillion in 2013. In China alone it was around $200 billion. We

believe that this growth is likely to be triggered by two significant developments. One, mobile

devices such as smartphones and tablets make it easier for shoppers to access the web on the

go. Secondly, traditional retailers too are investing heavily in bolstering their web divisions,

fearing loss of sales to e-enabled competitors.

The ongoing boom in the e-tailing industry whose size is expected to grow at about 52% CAGR till

2020 augurs well for the logistics industry.

Gati is well geared to capitalize the huge opportunity of E-Commerce Logistics, owing to its

coverage throughout India and an established brand name. The company's focus will be to

develop more capabilities in E-com logistics. It is uniquely placed to provide services in Metros,

Capitals, Tier 2 and 3 cities, which is the current need of E-Commerce industry due to surge in

demand from smaller towns. One of the main focus areas of the business has been to strengthen

its last mile delivery.

Dalal & Broacha

Stock Broking Pvt. Ltd.

..

..

..

..

..

Further it is increasing its business through setting up of e-Fulfilment centres, Packaging Centres,

small offices and delivery partners. To strengthen the offering, it has launched value added

services like Gati ePack (packing solutions), Gati ePick model and Gati Reverse Pick-up. The

company is ramping up the delivery capacity so as to meet the growing requirements of the etailing clients which is complementing the revenues.

Delivery capacity in last 7 quarters increased 25% CQGR, complementing the same the revenue

increased 23% CQGR for the same period. This was higher than the company revenue growth of

4% CQCR for the same period.

In E-Commerce solutions the company is integrating supply chain solutions and distribution

through e-fulfillment centers. E-fulfilment centers are basically warehouses where vendors

store their inventory and this primarily allows the vendor to outsource the warehousing

function. The company offers current available 150000 sq.ft as a warehouse to its clients to

store goods. In Q2FY15, the company has started to offer this service to their e-commerce

clients. This service has an additional delivery capacity of 25000 packages/day which is

currently utilized to 5000 packages/day. The company plans to increase this offering with

higher leasing of the space to 300000 sq.ft. Growing traffic from e-commerce will pent up

the remaining available capacity and thus will generate higher revenues going forward.

With the burgeoning growth in the e-tailing and improvement in retail sales e-commerce

logistics revenues for Gati are set to grow at a CAGR of 72~% over FY14-17E. We believe that

Tier II and Tier III cities are likely to lead this growth, because of unavailability of certain

products in those areas. However, the value added service will improve the margins and

thus the overall profitability.

Dalal & Broacha

Stock Broking Pvt. Ltd.

..

..

..

..

..

Gati Kausar - Augmenting the opportunities

Gati Kausar aims to be one of the bigger players in cold chain industry which at present

stands at $5 billion. The current players can can handle only 12-14% of the total agriculture

produce, leaving a huge gap or opportunity to tap the market. Large unorganized market

(~85%), inefficiencient infrastructure and increasing demand for perishable items, creates a

huge opportunity for an integrated cold chain service provider.

GatiKausar currently transports refrigerated goods across verticals such as healthcare, meat

& poultry, bio-pharma, frozen & fresh produce, dairy products, organised retail and quick

service restaurants with a fleet size of close to 200 vehicles. It wants to change its positioning

from a refrigerated trucking company to an integrated cold chain solutions provider.

Additionally it wants to offer value added services like primary processing (sourcing,

procurement, collection, cleaning, sorting, grading, IQF, packaging, stickering, ripening, waxing,

polishing, weighing), tracking, express services, inventory management, bulk breaking and

order picking.

In Q2FY15, the company has done a much awaited private placement of ~30% in Gati Kausar

for a value of Rs. 150 crore. Of the 150 crore, Rs. 30 crore has been infused in the form of

equity and Rs. 6 crore debt (compulsorily convertible preferential shares & non-convertible

bonds). The funding will be used to set up 10 cold chain warehouse across the country over

the next three years which will completely modify its revenue and profitability mix in next

two years.

We believe that the growth in the cold chain logistics is likely to be maintained ~18-20% on

account of accelerated growth in quick service restaurants, meat, poultry sector, government

initiatives and subsidies. Given the small base, Gati Kausar can deliver ~27% CAGR for next

five years by expanding and penetrating more into unorganized sector.

Growth in high margin business & improved utilization to drive up return ratios

Gati currently has a fleet size of 500 & 520 2-wheelers and 4-wheelers, respectively which the

company intends to increase to 800 2-wheelers & 620 4-wheelers. Further, it plans to double it

e-fulfilment centre by leasing another 150000 sq.ft which will more than double the package

handling capacity. The company plans to increase its e-commerce delivery capacity to 30000

packages/day coupled with value added services. The expansion will be done on a asset light

model which will improve the margins. Gati ship, which was loss making will stop denting the

profits, due to divestment. Further, ramping up investments in Gati Kausar will lead to a broad

based profitable growth. Additionally, Gati Import Export Trading Ltd. (GIETL) is creating another

business model for the company, which can be incrementally scaled up.

Summing up the business opportuinities, we estimate the consequent revenue growth at ~20%

CAGR over FY14-FY17E, likely to be broad-based, however the profitability growth will be much

higher at ~58% CAGR for the same period. In the short term we expect margins to be subdued

due to higher investments made in business, however subsequently higher contribution from

better margin segments will bolster the profitability.

9

Dalal & Broacha

Stock Broking Pvt. Ltd.

..

..

..

..

..

Redemption of FCCBs continues to be a concern

On December 12, 2011 the company has allotted 22,182 zero coupon unsecured Foreign

Currency Convertible Bonds (FCCB) of $1,000 each, thereby raising $22.18 million which

are listed with Singapore Stock Exchange Limited. These are convertible any time from

December 12, 2012 upto the close of business on November 13, 2016 by holders of the

Bonds into fully paid equity shares of the company. The conversion price on the face of

the bond is Rs. 38.51.

The company has applied to Reserve Bank of India (RBI) seeking permission for repay

part of these FCCBs from the disposal of land. Following the same, RBI stated that the

company was not eligible to raise such funds and thus levied a compounding fee of

Rs.29.6 million. This was challenged by the company in AP high court which has directed

RBI to take the appropriate decision.

We believe that this will continue to be a major concern as the conversion will lead to

a significant dilution in equity which inturn will adversly affect the EPS. We would

further re-rate the stock once the issue is resolved.

Financials Overview

Consolidated revenue has increased by 12% CAGR for FY12-FY14(annualized) period

while PAT grew by 20% CAGR for the same period. Revenue from E-commerce increased

by 53% for FY13-FY14 period with a 16% annualized (12-mths) growth in KWE and 4%

growth in Kausar. GIETL grew more than 100% for the same period.

16,000.00

1200

Net Sales

EBITDA

PAT

14,000.00

1000

12,000.00

800

10,000.00

600

8,000.00

6,000.00

400

4,000.00

200

2,000.00

2012

2013

2014 (9-mths)

2014 (annualized-adjusted)

2012

2013

2014 (9-mths)

2014 (annualized-adjusted)

Source: Company Annual Report, Dalal & Broacha Research

Outlook & Valuation

We believe that trade recovery, coupled with traction across business segments with

an asset light model will bolster the operating profitability margins from 7.5% in FY14

to ~12.3% in FY17E.

At CMP of Rs. 277 stock trades at 26x FY16E earnings of Rs. 10.7 and 19x FY16E earnings

of Rs. 15. We recommend a "ACCUMLATE" with a target price of Rs. 332.

10

Dalal & Broacha

Stock Broking Pvt. Ltd.

..

..

..

..

..

Valuation:

Weighted average target price

Methodologies

Target price using DCF approach

Target price using EV/EBITDA approach

Target price using P/E approach

Weighted average target price

Current price

Upside/(downside) from current levels

EV/EBIDTA method

Figures (Rs mn)

Company

Blue Dart

TCI

Sical Logistics

Gati

Patel Intergrated logistics

Average EV/EBIDTA

Valuation metrics

Target EV/EBITDA multiple

2016E EBITDA

2016E EV

2016E Debt

2016E Cash

2016E Market Cap.

No. of shares

Target Price

CMP

Upside/(Downside)

P/E method

Figures (Rs mn)

Company

Blue Dart

TCI

Sical Logistics

Gati

Patel Intergrated logistics

Average P/E

Valuation metrics

Target P/E multiple

2016E EPS

Target Price

CMP

Upside/(Downside)

Target Weight Weighted

Comments

price assigned Avg price

325.4

40.0%

130.2 Based on DCF for 10 years & 5% terminal growth rate

314.6

30.0%

94.4

Based on 10x EV/EBIDTA FY17E

107.3

Based on 25x P/E FY17E

357.6

30.0%

332.0

277.0

19.9%

Price

Sales

6,171.0 19,761.0

244.0 20,329.0

159.0 6,017.5

252.0 11,165.7

144.0 5,458.0

EBIDTA

2,145.0

1,564.7

852.7

841.1

167.3

FY14

OPM

10.9

7.7

14.2

7.5

3.1

PAT

1,244.0

620.1

110.5

283.2

23.5

PAT %

6.3

3.1

1.8

2.5

0.4

EV/EBIDTA

FY16E FY17E

47.1

39.3

9.2

7.7

13.1

11.0

10.6

8.5

10.3

8.6

18.1

15.0

10.0

3,109.5

31,094.8

4,922.5

1,281.5

27,453.7

87.3

314.6

277.0

13.6

Price

6,171.0

244.0

159.0

252.0

144.0

FY14

42.8

9.5

2.9

2.7

1.5

FY15E

51.4

11.4

3.5

7.0

1.8

EPS

FY16E

61.6

12.6

4.2

10.7

2.1

FY17E

74.0

15.1

5.0

14.3

2.5

P/E

FY16E FY17E

120.2

100.1

21.4

19.4

45.5

37.9

36.1

23.5

82.2

68.5

61.1

49.9

25.0

14.3

357.6

277.0

29.1

11

Dalal & Broacha

Stock Broking Pvt. Ltd.

..

..

..

..

..

DCF Valuation:

Year

Y14 (9-mths)

EBIT

620.5

Effective Tax Rate

(30.0)

EBIT*(1-Tax Rate)

434.3

Depreciation / Amortization

220.7

Change in Working Capital

387.7

Capex

(75.2)

FCFF

FCF Growth

Cost of Capital

967.5

-306.7%

15.5%

Present Value

Sum of PV of FCFF

Terminal Value calculation

Terminal Growth rate

Terminal year Free Cash Flow

Terminal Value

PV of Terminal Value

12,916.5

Enterprise Value

Less: Debt

Add: Cash & Investment

Market Capitalization

No. of Shares

Value per Share

32,341.9

(4,802.2)

855.8

28,395.5

87.3

325.4

5%

5,592.8

62,742.3

19,425.5

FY 15E

1,592.0

(30.0)

1,114.4

312.0

(36.0)

(500.0)

FY 16E

2,135.8

(30.0)

1,256.3

352.2

(323.3)

(800.0)

FY 17E

2732.2

(30.0)

1,626.1

377.3

(388.0)

(500.0)

FY 18E

3545.5

(30.0)

2,138.1

396.2

(465.6)

(526.1)

FY 19E

4511.1

(30.0)

2,745.3

416.0

(558.7)

(402.1)

FY 20E

5670.4

(30.0)

3,474.3

436.8

(659.3)

(422.2)

FY 21E

6870.0

(30.0)

4,215.0

458.6

(777.9)

(443.3)

FY 22E

8302.4

(30.0)

5,098.9

481.5

(894.6)

(465.5)

FY 23E

9596.0

(30.0)

5,861.8

505.6

(1,028.8)

(488.8)

FY 24E

10667.0

(30.0)

6,440.5

530.9

(1,131.7)

(513.2)

890.4

-8.0%

13.5%

0

890.4

485.2

-45.5%

13.5%

1

427.7

1,115.4

129.9%

13.5%

2

866.6

1,542.5

38.3%

13.5%

3

1056.4

2,200.4

42.6%

13.5%

4

1328.3

2,829.6

28.6%

13.5%

5

1505.5

3,452.4

22.0%

13.5%

6

1619.1

4,220.3

22.2%

13.5%

7

1744.6

4,849.8

14.9%

13.5%

8

1767.2

5,326.4

9.8%

13.5%

9

1710.7

11.4%

296.5

316.4

340.7

371.2

410.6

12.4%

288.6

308.5

332.9

363.4

402.8

WACC

13.4%

281.4

301.2

325.6

356.1

395.5

14.4%

274.5

294.4

318.8

349.3

388.7

15.4%

268.2

288.1

312.4

342.9

382.3

325.4

3%

4%

5%

6%

7%

Calculation of WACC

WACC for explicit forecast

Expected Market Return (Rm)

Risk Free Rate (Rf)

Risk Premium

Beta

Cost of Equity

Cost of Debt

Tax rate

Post Tax Cost of Debt

WACC

Debt

Equity

Total

15.0%

7.5%

7.5%

0.97

14.8%

9.7%

30.0%

6.8%

13.5%

4802.2

24172.4

28974.6

WACC for terminal growth

Expected Market Return (Rm)

Risk Free Rate (Rf)

Risk Premium

Beta

Cost of Equity

Cost of Debt

Tax rate

Post Tax Cost of Debt

Long term debt to capital ratio

WACC

15.0%

7.0%

8.0%

0.97

14.8%

9.7%

35.0%

6.3%

10.0%

13.9%

Terminal Growth Rate

Terminal Year Free Cash Flow

Terminal Enterprise Value

Weight Assigned

Terminal Value

5.0%

2971.1

33330.8

6.0

15254.1

12

Dalal & Broacha

Stock Broking Pvt. Ltd.

..

..

..

..

..

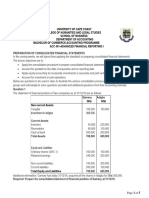

FINANCIALS

Profit & Loss (Rs Mn)

Net Sales

FY 14 (9-mths)

FY 15E

FY 16E

11,165.7 17,432.8 20,997.1

Raw Materials

Employee Cost

Operating Expenses

Other expenses

Cost of Sales

(1,748.1) (2,702.1) (3,254.5)

(1,026.9) (1,654.8) (1,889.7)

(6,627.0) (10,111.0) (12,178.3)

(922.6) (1,060.9) (1,186.5)

(10,324.6) (15,528.8) (18,509.1)

Gati Limited - Financials

FY 17E

Cash Flow Statement (Rs Mn)

25,226.6

Net Profit

Add: Dep. & Amortization

(3,910.1)

Cash Profit

(2,270.4)

(14,631.4)

(Inc) / Dec in

(1,305.2)

Sundry Debtors

(22,117.1)

Inventories

Loans & Advances

3,109.5

Sundry Creditors

(377.3)

Others

2,732.2

Change in Working Capital

122.8

CF from Operating Activities

(477.5)

CF from Investing Activities

2,377.5

(713.3)

CF from Financing Activities

1,664.3

Cash Generated (Utilised)

(416.1)

Cash at the start of year

0.0

Cash at the end of year

1,248.2

Operating Profit

Depreciation

PBIT

Other Income

Interest

841.1

(220.7)

620.5

106.1

(325.0)

1,904.0

(312.0)

1,592.0

111.4

(465.3)

2,488.0

(352.2)

2,135.8

117.0

(470.0)

Profit Before Tax

Provision for Tax

PAT

401.6

(118.4)

283.2

1,238.0

(371.4)

866.6

1,782.7

(534.8)

1,247.9

Minority Interest

Extraordinary Items

Reported PAT

(49.0)

0.0

234.2

(216.7)

(29.6)

620.4

(312.0)

0.0

935.9

FY 14 (9-mths)

174.5

7,553.9

7,728.4

FY 15E

174.5

7,928.8

8,103.3

FY 16E

174.5

8,619.2

8,793.8

FY 17E

174.5

9,622.0

9,796.5

Def. Tax Lib + Minority Int.

Secured Loan

Unsecured Loan

Total Debt

Capital Employed

1,234.0

3,149.1

1,653.1

4,802.2

13,764.6

1,234.0

3,212.1

1,686.2

4,898.2

14,235.5

1,234.0

3,244.2

1,703.1

4,947.2

14,975.0

1,234.0

3,228.0

1,694.5

4,922.5

15,953.0

Gross Block

Accumulated Depreciation

Net Block

Capital WIP

Total Fixed Assets

5,716.3

(1,922.4)

3,794.0

387.1

4,181.0

6,216.3

(2,234.4)

3,981.9

50.0

4,031.9

7,016.3

(2,586.6)

4,429.7

50.0

4,479.7

7,516.3

(2,963.9)

4,552.4

50.0

4,602.4

Goodwill

Investments

Inventories

Sundry debtors

Cash & bank

Loans & advances and Other CA

Sundry creditors

Other Liabi.

Provisions

Working Capital

Deffered Tax

Misc. Expense

Capital Deployed

4,468.9

4,468.9

4,468.9

4,468.9

547.8

520.4

494.4

469.7

119.1

167.2

115.1

138.2

2,414.2

2,770.1

3,336.5

4,008.6

308.0

913.9

908.3

1,281.5

3,734.5

3,921.2

4,117.3

4,323.2

(732.3) (1,110.4) (1,337.5) (1,606.9)

(431.3)

(439.9)

(448.7)

(457.7)

(839.8) (1,007.8) (1,158.9) (1,274.8)

4,572.4

5,214.3

5,532.0

6,412.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

13,764.6 14,235.5 14,975.0 15,953.0

Balance Sheet (Rs Mn)

Equity Capital

Reserves

Net Worth

FY 14 (9-mths)

234.2

220.7

454.9

FY 15E

620.4

312.0

932.4

FY 16E

935.9

352.2

1,288.1

FY 17E

1,248.2

377.3

1,625.5

(211.4)

(0.7)

295.0

69.4

235.5

387.7

842.6

(355.9)

(48.1)

(186.7)

378.1

176.6

(36.0)

896.4

(566.4)

52.1

(196.1)

227.0

160.0

(323.3)

964.8

(672.1)

(23.2)

(205.9)

269.4

124.9

(506.8)

1,118.6

(633.5)

(135.5)

(774.0)

(475.3)

(370.5)

(149.4)

(196.5)

(270.2)

(161.4)

467.9

306.5

611.4

308.0

919.4

(5.6)

913.9

908.3

373.2

908.3

1,281.5

FY 14 (9-mths)

7.5

2.1

(29.5)

FY 15E

10.9

3.6

(30.0)

FY 16E

11.8

4.5

(30.0)

FY 17E

12.3

4.9

(30.0)

(12.3)

2.4

143.3

56.1

126.4

164.9

20.4

30.7

50.9

20.1

25.0

33.4

Per Share

Earning Per Share (EPS)

Cash Earnings (CPS)

Dividend

Book Value

Free Cash flow

2.7

5.2

1.8

88.6

2.4

7.1

10.7

2.4

92.9

8.7

10.7

14.8

2.4

100.8

2.2

14.3

18.6

2.4

112.3

7.4

Valuation Ratios

P/E (x)

P/B (x)

EV / Sales

EV / EBIDTA

Div. Yield (%)

FCF Yield (%)

103.2

3.1

2.6

34.1

0.7

0.9

39.0

3.0

1.6

14.8

0.9

3.1

25.8

2.7

1.3

11.3

0.9

0.8

19.4

2.5

1.1

8.9

0.9

2.7

3.0

6.1

7.8

13.6

11.1

17.0

13.4

20.1

Ratios

OPM

NPM

Tax Rate

Growth Ratio

Net Sales

Operating Profit

PAT

Return Ratios (%)

ROE

ROCE

13

Dalal & Broacha

Stock Broking Pvt. Ltd.

..

..

..

..

..

Disclaimer

This document has been prepared and compiled from reliable sources. While utmost care has been taken to ensure that

the facts stated are accurate and opinions given are fair and reasonable, neither the Company nor any of its Directors,

Officers or Employees shall in any way be responsible for the contents. The Company, its Directors, Officers or Employees

may have a position or may otherwise be interested in the investment referred in this document. This is not an offer or

solicitation to buy, sell or dispose off any securities mentioned in this document.

For Further details

Contact

Mr. Milind Karmarkar

Email ID

milind.karmarkar@dalal-broacha.com

Contact No.

022 67141445

Sector

Head Research

Mr. Sandeep Shah

Mr. Nilay Dalal

sandeep.shah@dalal-broacha.com

nilay.dalal@dalal-broacha.com

022 67141420

022 67141443

Mr. Kunal Bhatia

Mr. Lalitabh Shrivastawa

kunal.bhatia@dalal-broacha.com

lalitabh.s@dalal-broacha.com

022 67141442

022 67141450

Auto, Auto Ancillary, FMCG

Banking & NBFCs

Ms. Purvi Shah

Mr. Chinmay Gandre

purvi.shah@dalal-broacha.com

chinmay.gandre@dalal-broacha.com

022 67141446

022 67141448

Pharma

Capital Goods

Mr. Ankit Panchmatia

ankit.panchmatia@dalal-broacha.com

022 67141449

IT, Logistics

Head Institution Sales

Institution Sales

Address :- 508, Maker Chambers V, 221 Nariman Point, Mumbai 400 021 Tel: 91-22- 2282 2992, 2287 6173, (D) 6630 8667

91-22-2287 0092, E-mail: equity.research@dalal-broacha.com.

Fax:

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 2Q 2018 ICBP Indofood+CBP+Sukses+Makmur+TbkDokument131 Seiten2Q 2018 ICBP Indofood+CBP+Sukses+Makmur+TbkARJUNA RAMADHANNoch keine Bewertungen

- CH 5 - Intermediate Accounting Test BankDokument38 SeitenCH 5 - Intermediate Accounting Test BankCorliss Ko100% (5)

- P1 - Corporate Reporting April 09Dokument21 SeitenP1 - Corporate Reporting April 09IrfanNoch keine Bewertungen

- Management Accounting: Sandeep Gokhale Jamnalal Bajaj Institute University of MumbaiDokument102 SeitenManagement Accounting: Sandeep Gokhale Jamnalal Bajaj Institute University of MumbaiDipen Ashokkumar KadamNoch keine Bewertungen

- North American Iron Ore DEC11 Cs 11Dokument185 SeitenNorth American Iron Ore DEC11 Cs 11TheRealWNoch keine Bewertungen

- Double Accounts - Electricity CompaniesDokument18 SeitenDouble Accounts - Electricity CompaniesbijubodheswarNoch keine Bewertungen

- Capital Budgeting Discounted Cash FlowDokument15 SeitenCapital Budgeting Discounted Cash FlowRanu AgrawalNoch keine Bewertungen

- IND AS 7 Cash Flow Statement by Rahul MalkanDokument13 SeitenIND AS 7 Cash Flow Statement by Rahul Malkanvishwas jagrawalNoch keine Bewertungen

- Chapter1-Focusondecisionmaking Man. Acc.Dokument188 SeitenChapter1-Focusondecisionmaking Man. Acc.eltonNoch keine Bewertungen

- Financial Analysis of Telenor Part 6Dokument3 SeitenFinancial Analysis of Telenor Part 6Muhammad Ehtasham ul HassanNoch keine Bewertungen

- Emba55a s9 Problem1&15Dokument5 SeitenEmba55a s9 Problem1&15Senna El50% (2)

- Company Analysis of GBPDokument10 SeitenCompany Analysis of GBPSatya swaroop ReddyNoch keine Bewertungen

- Exercise#1 Earlmathew VisarraDokument2 SeitenExercise#1 Earlmathew VisarraMathew VisarraNoch keine Bewertungen

- Cleaning Service Business PlanDokument43 SeitenCleaning Service Business PlanSoni Shrivastav0% (1)

- ACC401-Basic Conso-Basic QuestionsDokument5 SeitenACC401-Basic Conso-Basic Questionsisaacbediako82Noch keine Bewertungen

- Module 3. Part 2 - Current LiabilitiesDokument19 SeitenModule 3. Part 2 - Current LiabilitiesJohn RamasNoch keine Bewertungen

- 14Dokument7 Seiten14gfhhfdgdghfgNoch keine Bewertungen

- CHAPTERDokument20 SeitenCHAPTERAditi KhannaNoch keine Bewertungen

- Learning Outcome Statements: Effective: January 1, 2020 Revised: April 1, 2019Dokument14 SeitenLearning Outcome Statements: Effective: January 1, 2020 Revised: April 1, 2019Hasmitha GowdaNoch keine Bewertungen

- 01Dokument14 Seiten01NarinderNoch keine Bewertungen

- Cbleacpu 01Dokument10 SeitenCbleacpu 01Udaya RakavanNoch keine Bewertungen

- Jindal Steel Ratio AnalysisDokument1 SeiteJindal Steel Ratio Analysismir danish anwarNoch keine Bewertungen

- Fabm2: Quarter 1 Module 2 New Normal ABM For Grade 12Dokument16 SeitenFabm2: Quarter 1 Module 2 New Normal ABM For Grade 12Krisha Joy Mercado100% (3)

- Assignment 2.2 Notes ReceivableDokument9 SeitenAssignment 2.2 Notes ReceivableHannah NolongNoch keine Bewertungen

- Chapter 12Dokument17 SeitenChapter 12khae123Noch keine Bewertungen

- Albrecht 4e Student CH 13 Pertemuan 5Dokument10 SeitenAlbrecht 4e Student CH 13 Pertemuan 5eugeniaNoch keine Bewertungen

- Z-Score TestDokument2 SeitenZ-Score TestPrashant MishraNoch keine Bewertungen

- Solution 1.1: Solutions To Gripping IFRS: Graded Questions Financial Reporting FrameworkDokument893 SeitenSolution 1.1: Solutions To Gripping IFRS: Graded Questions Financial Reporting Frameworksarvesh guness100% (1)

- Financial Statement AnalysisDokument34 SeitenFinancial Statement AnalysisanshumanNoch keine Bewertungen

- Analisis Studi Kelayakan Usaha Pendirian (Studi Kasus Pada Home Industry Cokelat "Cozy" Kademangan Blitar)Dokument12 SeitenAnalisis Studi Kelayakan Usaha Pendirian (Studi Kasus Pada Home Industry Cokelat "Cozy" Kademangan Blitar)Zarina IINoch keine Bewertungen