Beruflich Dokumente

Kultur Dokumente

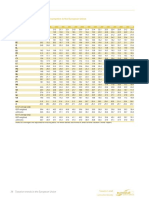

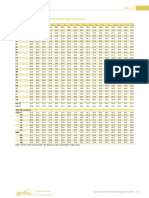

01 IMF - Taxing Immovable Property - 2013 27

Hochgeladen von

Dimitris ArgyriouCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

01 IMF - Taxing Immovable Property - 2013 27

Hochgeladen von

Dimitris ArgyriouCopyright:

Verfügbare Formate

26

purposes, civil servants (police, military), unemployed persons, peasants, and people living in

poverty unable to earn the minimum income are also exempt.39 And many countries provide

tax preferences to pensioners (including tax deferrals as previously mentioned). Agriculture

is another example of a segment that generally receives a very favorable property tax

treatment, either by outright exemption (partly or fully, such as in Nicaragua, Guinea, and

Tunisia40) or by special treatment leading to a negligible liability (such as in Serbia). Perhaps

an exception as regards taxation of agricultural land is Namibia where the newly introduced

central government land tax is designed mainly to encourage better land use. And few

countries, if any, undertake systematic tax expenditure budgeting pertaining to the property

tax, to ascertain the true budgetary costs of the tax reliefs offered. The bottom line is that

taxes frequently are paid on a base that bears little resemblance to the true level of property

values, and yields could be substantially enhanced by scaling-back excessive exemptions and

reliefs.41

Similarly, there are different ways of structuring the tax rate (t). If capital value is the base, a

flat or progressive rate is normally applied (although as noted above progressivity in some

countries is secured through a basic property deduction). A flat rate is typically applied if the

base is rental value, while under area-based taxes the norm is a specific flat rate with given

amount per unit of area (square meter or ha, of either land and/or buildings, such as in

Vietnam). Tax rate levels and structures (including for different types of properties) also vary

substantially across countries (and within countries across jurisdictions). Namibia applies a

central government tax on agricultural land at a basic rate of 0.75 percent while urban

municipalities apply very modest rates to local property.42 Serbia uses a progressive rate

structure set by local governments starting at 0.4 percent up to a maximum of 3 percent,

while Cambodia is considering a uniform 0.1 percent tax. In Kyrgyzstan, a dual rate system

(0.35 and 1.0 percent) is applied depending on type of property. The authority to set rates is

in many countries assigned to local governments, often within a fairly narrow band or below

a ceiling set by law. In Uganda, for example, rates are determined by municipalities but with

a maximum of 2 percent of rateable value prescribed by law. In other countries the rate is set

by a higher level government.

39

ECORYS, Taxation in Africa, Rotterdam, May 2010.

40

Bird and Slack (2008).

41

One study estimates the revenue costs of exempting government property as equivalent to about 12 percent of

collections in Indias 36 largest cities. Many countries, such as Kenya and Canada, charge a payment in lieu for

property tax on government property and non-profit uses of property (Bahl, 2009, p. 15).

42

In the case of Windhoek, for example, the rates are 0.0734 percent of the site value, and 0.0379 percent of the

house (improvement) value.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Republic Vs CA, 236 Scra 257Dokument2 SeitenRepublic Vs CA, 236 Scra 257Jef Comendador100% (1)

- Wedding ScriptDokument11 SeitenWedding ScriptJevon Lorenzo Advincula100% (1)

- Internship BS in Criminology in The PhilippinesDokument8 SeitenInternship BS in Criminology in The PhilippinesJohn Vladimir A. Bulagsay0% (1)

- Taxation Trends in The European Union - 2012 40Dokument1 SeiteTaxation Trends in The European Union - 2012 40Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 39Dokument1 SeiteTaxation Trends in The European Union - 2012 39Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 42Dokument1 SeiteTaxation Trends in The European Union - 2012 42Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 44Dokument1 SeiteTaxation Trends in The European Union - 2012 44Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 41Dokument1 SeiteTaxation Trends in The European Union - 2012 41Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 38Dokument1 SeiteTaxation Trends in The European Union - 2012 38Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 35Dokument1 SeiteTaxation Trends in The European Union - 2012 35Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 30Dokument1 SeiteTaxation Trends in The European Union - 2012 30Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 34Dokument1 SeiteTaxation Trends in The European Union - 2012 34Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 37Dokument1 SeiteTaxation Trends in The European Union - 2012 37Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 33Dokument1 SeiteTaxation Trends in The European Union - 2012 33Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 29Dokument1 SeiteTaxation Trends in The European Union - 2012 29Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 31Dokument1 SeiteTaxation Trends in The European Union - 2012 31Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 8Dokument1 SeiteTaxation Trends in The European Union - 2012 8Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 28Dokument1 SeiteTaxation Trends in The European Union - 2012 28Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 25Dokument1 SeiteTaxation Trends in The European Union - 2012 25Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2011 - Booklet 37Dokument1 SeiteTaxation Trends in The European Union - 2011 - Booklet 37Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 26Dokument1 SeiteTaxation Trends in The European Union - 2012 26Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 27Dokument1 SeiteTaxation Trends in The European Union - 2012 27Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 24Dokument1 SeiteTaxation Trends in The European Union - 2012 24Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 3Dokument1 SeiteTaxation Trends in The European Union - 2012 3Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2011 - Booklet 36Dokument1 SeiteTaxation Trends in The European Union - 2011 - Booklet 36Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 5Dokument1 SeiteTaxation Trends in The European Union - 2012 5Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2011 - Booklet 35Dokument1 SeiteTaxation Trends in The European Union - 2011 - Booklet 35Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 10Dokument1 SeiteTaxation Trends in The European Union - 2012 10Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2011 - Booklet 29Dokument1 SeiteTaxation Trends in The European Union - 2011 - Booklet 29Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2011 - Booklet 33Dokument1 SeiteTaxation Trends in The European Union - 2011 - Booklet 33Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2011 - Booklet 31Dokument1 SeiteTaxation Trends in The European Union - 2011 - Booklet 31Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2011 - Booklet 34Dokument1 SeiteTaxation Trends in The European Union - 2011 - Booklet 34Dimitris ArgyriouNoch keine Bewertungen

- Lecture 7 Political SysremDokument19 SeitenLecture 7 Political SysremDr-Najmunnisa Khan100% (1)

- AVP Compliance Director in New York City NY Resume Thomas SomelofskeDokument2 SeitenAVP Compliance Director in New York City NY Resume Thomas SomelofskeThomas SomelofskeNoch keine Bewertungen

- Tenant Construction Guide Rev1docxDokument12 SeitenTenant Construction Guide Rev1docxBer Salazar JrNoch keine Bewertungen

- Civil Service 2015Dokument44 SeitenCivil Service 2015Mesmerizing NiksNoch keine Bewertungen

- Form 26 Duplicate RCDokument1 SeiteForm 26 Duplicate RCyctgfjyNoch keine Bewertungen

- Clinical Lab FormDokument10 SeitenClinical Lab FormFlor Camille Mallari SumangNoch keine Bewertungen

- Mga Ibat Ibang Tawag Sa Mga RapistDokument7 SeitenMga Ibat Ibang Tawag Sa Mga RapistkikayNoch keine Bewertungen

- Evidence s1 PDFDokument106 SeitenEvidence s1 PDFchey_anneNoch keine Bewertungen

- 07 Government Vs Cabangis G.R. No. L 28379 Mar. 27 1929Dokument4 Seiten07 Government Vs Cabangis G.R. No. L 28379 Mar. 27 1929Awe SomontinaNoch keine Bewertungen

- State Versus Path FunctionsDokument10 SeitenState Versus Path FunctionsRohan RanaNoch keine Bewertungen

- Exam IusDokument10 SeitenExam Iusfatlum1Noch keine Bewertungen

- Ex Post FactoDokument7 SeitenEx Post FactoErica NolanNoch keine Bewertungen

- Upload A Document ScribdDokument11 SeitenUpload A Document ScribdsoumaneroprakctNoch keine Bewertungen

- Affidavit Motion For Summons by Thomas Latanowich's AttorneyDokument5 SeitenAffidavit Motion For Summons by Thomas Latanowich's AttorneyCape Cod TimesNoch keine Bewertungen

- National Highway System (United States)Dokument1 SeiteNational Highway System (United States)BMikeNoch keine Bewertungen

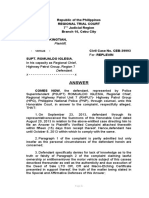

- Answer (Yek-146)Dokument8 SeitenAnswer (Yek-146)Ilmioamore InfermiereNoch keine Bewertungen

- Family/Community As A Site of ViolenceDokument17 SeitenFamily/Community As A Site of ViolenceHarish KumarNoch keine Bewertungen

- cwft1qb3 dmv9442135Dokument16 Seitencwft1qb3 dmv9442135Muhammad NomanNoch keine Bewertungen

- As ISO IEC 15424-2006 Information Technology - Automatic Identification and Data Capture Techniques - Data CADokument8 SeitenAs ISO IEC 15424-2006 Information Technology - Automatic Identification and Data Capture Techniques - Data CASAI Global - APACNoch keine Bewertungen

- The Danger of Joining A Gang GroupDokument22 SeitenThe Danger of Joining A Gang GroupMona Duterte LegitimasNoch keine Bewertungen

- Justification From SB 1317 and HB64Dokument4 SeitenJustification From SB 1317 and HB64robinrubinaNoch keine Bewertungen

- Self Employed Women Association (Sewa)Dokument29 SeitenSelf Employed Women Association (Sewa)man007mba3747100% (1)

- Gravity Finance White PaperDokument14 SeitenGravity Finance White PaperMichael WongNoch keine Bewertungen

- Accounting Equation: Chapter TwoDokument8 SeitenAccounting Equation: Chapter Twojohn adamNoch keine Bewertungen

- Legal Writing - Reply RejoinderDokument3 SeitenLegal Writing - Reply RejoinderdNoch keine Bewertungen

- 10 - Urbano Vs IAC - GR 72964Dokument1 Seite10 - Urbano Vs IAC - GR 72964Bae IreneNoch keine Bewertungen

- Magna Carta of WomenDokument4 SeitenMagna Carta of WomenNevej ThomasNoch keine Bewertungen