Beruflich Dokumente

Kultur Dokumente

Question 31

Hochgeladen von

Noopur GandhiCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Question 31

Hochgeladen von

Noopur GandhiCopyright:

Verfügbare Formate

QUESTION 31

1. Income statements and balance sheets follow for

Snap-On Incorporated. Refer to these financial

statements to answer the requirements.

Snap-On Incorporated

Consolidated Statements of Earnings

(Amounts in millions)

Net sales

Cost of goods sold

Gross profit

Operating expenses

Operating earnings before financial services

Financial services revenue

Financial services expenses

Operating income from financial services before

arbitration settlement

Arbitration settlement

Operating income from financial services

Operating earnings

Interest expense

Other income (expense) -- net

Earnings before income taxes and equity earnings

Income tax expense

Earnings before equity earnings

Equity earnings, net of tax

Net earnings

Net earnings attributable to noncontrolling

interests

Net earnings attributable to Snap-on Incorporated

For the fiscal year ended

2011

2010

$ 2,854.2

$ 2,619.2

(1,516.3)

(1,408.1)

1,337.9

1,211.1

(953.7)

(894.1)

384.2

317.0

124.3

62.3

(51.4)

(47.9)

72.9

18.0

90.9

475.1

(61.2)

(1.0)

412.9

(133.7)

279.2

4.6

283.8

14.4

-14.4

331.4

(54.8)

0.8

277.4

(87.6)

189.8

3.2

193.0

(7.5)

$ 276.3

(6.5)

$ 186.5

2.

Snap-On Incorporated

Consolidated Balance Sheets

(Amounts in millions

Cash and cash equivalents

Trade and other accounts receivable - net

Finance receivables - net

Contract receivables - net

Inventories - net

Deferred income tax assets

Prepaid expenses and other assets

Total current assets

Property and equipment - net

Deferred income tax assets

Fiscal year end

2011

2010

$ 185.6

$572.2

463.5

443.3

277.2

215.3

49.7

45.6

386.4

329.4

92.6

87.0

75.7

72.7

1,530.7

1,765.5

352.9

344.0

125.2

91.5

Long-term finance receivables - net

Long-term contract receivables - net

Goodwill

Other intangibles - net

Other assets

Total assets

Notes payable and current maturities of long-term

debt

Accounts payable

Accrued benefits

Accrued compensation

Franchisee deposits

Other accrued liabilities

Total current liabilities

Long-term debt

Deferred income tax liabilities

Retiree health care benefits

Pension liabilities

Other long-term liabilities

Total liabilities

Preferred stock

Common stock

Additional paid-in capital

Retained earnings

Accumulated other comprehensive income (loss)

Treasury stock at cost

Total shareholders equity attributable to Snap-on

Inc.

Noncontrolling interests

Total shareholders equity

Total liabilities and shareholders equity

431.8

165.1

795.8

188.3

83.1

$ 3,672.9

345.7

119.3

798.4

192.8

72.2

$ 3,729.4

$ 16.2

124.6

48.8

91.0

47.3

255.9

583.8

967.9

108.1

52.8

317.7

95.3

2,125.6

67.3

181.4

1,843.7

(174.6)

(386.9)

$ 216.0

146.1

45.0

86.7

40.4

346.9

881.1

954.8

94.4

59.6

246.1

89.0

2,325.0

67.3

169.2

1,644.1

(104.8)

(387.3)

1,530.9

16.4

1,547.3

$ 3,672.9

1,388.5

15.9

1,404.4

$ 3,729.4

3.

Required

4. a. Compute net operating profit after tax (NOPAT) for 2011

and 2010. Assume that combined federal and state statutory

tax rates are 37.7% for fiscal 2011 and 37.5% for fiscal 2010.

5. b. Compute net operating assets (NOA) for 2011 and 2010.

6. c. Compute return on net operating assets (RNOA) for 2011

and 2010. Comment on the year-over-year change. Net

operating assets are $1,673.0 million in 2009.

7. d. Disaggregate RNOA into profitability and asset turnover

components (NOPM and NOAT, respectively). Remember to

include both net sales and financial services revenue in total

revenue. What explains the year-over-year change in RNOA?

Das könnte Ihnen auch gefallen

- Actavis, Inc. Consolidated Statements of Operations: (In Millions, Except Per Share Amounts)Dokument3 SeitenActavis, Inc. Consolidated Statements of Operations: (In Millions, Except Per Share Amounts)macocha1Noch keine Bewertungen

- Westfield WDC 2011 FY RESULTS Presentation&Appendix 4EDokument78 SeitenWestfield WDC 2011 FY RESULTS Presentation&Appendix 4EAbhimanyu PuriNoch keine Bewertungen

- Net Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonDokument9 SeitenNet Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonvenkeeeeeNoch keine Bewertungen

- Coca Cola Financial Statements 2008Dokument75 SeitenCoca Cola Financial Statements 2008James KentNoch keine Bewertungen

- Macys 2011 10kDokument39 SeitenMacys 2011 10kapb5223Noch keine Bewertungen

- Boeing: I. Market InformationDokument20 SeitenBoeing: I. Market InformationJames ParkNoch keine Bewertungen

- TCS Ifrs Q3 13 Usd PDFDokument23 SeitenTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNoch keine Bewertungen

- 494.Hk 2011 AnnReportDokument29 Seiten494.Hk 2011 AnnReportHenry KwongNoch keine Bewertungen

- USD $ in MillionsDokument8 SeitenUSD $ in MillionsAnkita ShettyNoch keine Bewertungen

- CAT ValuationDokument231 SeitenCAT ValuationMichael CheungNoch keine Bewertungen

- BALANCE SHEET AS AT JUNE 2006,2007,2008.: Liabilities & EquityDokument20 SeitenBALANCE SHEET AS AT JUNE 2006,2007,2008.: Liabilities & EquityAitzaz AliNoch keine Bewertungen

- Condensed Consolidated Statements of IncomeDokument7 SeitenCondensed Consolidated Statements of IncomevenkeeeeeNoch keine Bewertungen

- Accounting Clinic IDokument40 SeitenAccounting Clinic IRitesh Batra100% (1)

- Different: ... and Better Than EverDokument4 SeitenDifferent: ... and Better Than EverViral PatelNoch keine Bewertungen

- (5414) Specialized Design Services Sales Class: $500,000 - $999,999Dokument15 Seiten(5414) Specialized Design Services Sales Class: $500,000 - $999,999Christyne841Noch keine Bewertungen

- Balance Sheet of RaymondDokument5 SeitenBalance Sheet of RaymondRachana Yashwant PatneNoch keine Bewertungen

- 2010 Ibm StatementsDokument6 Seiten2010 Ibm StatementsElsa MersiniNoch keine Bewertungen

- Case SolutionsDokument106 SeitenCase SolutionsRichard Henry100% (5)

- Financial Statement AnalysisDokument18 SeitenFinancial Statement AnalysisSaema JessyNoch keine Bewertungen

- Competition: Name Last Price Market Cap. Sales Net Profit Total Assets (Rs. CR.) TurnoverDokument13 SeitenCompetition: Name Last Price Market Cap. Sales Net Profit Total Assets (Rs. CR.) Turnoverchintan61@gmail.comNoch keine Bewertungen

- 2013-5-14 FirstResources 1Q2013 Financial AnnouncementDokument17 Seiten2013-5-14 FirstResources 1Q2013 Financial AnnouncementphuawlNoch keine Bewertungen

- ITC Cash Flow StatementDokument1 SeiteITC Cash Flow StatementIna PawarNoch keine Bewertungen

- Net Sales: January 28, 2012 January 29, 2011Dokument9 SeitenNet Sales: January 28, 2012 January 29, 2011장대헌Noch keine Bewertungen

- Campbell Soup FInancialsDokument39 SeitenCampbell Soup FInancialsmirunmanishNoch keine Bewertungen

- Nu WareDokument22 SeitenNu WaresslbsNoch keine Bewertungen

- Non Current AssetsDokument40 SeitenNon Current AssetsAbdul Ahad JamilNoch keine Bewertungen

- Ual Jun2011Dokument10 SeitenUal Jun2011asankajNoch keine Bewertungen

- Financial Statement Fy 14 Q 3Dokument46 SeitenFinancial Statement Fy 14 Q 3crtc2688Noch keine Bewertungen

- Interim Condensed Consolidated Financial Statements: OJSC "Magnit"Dokument41 SeitenInterim Condensed Consolidated Financial Statements: OJSC "Magnit"takatukkaNoch keine Bewertungen

- Finnews Q5Dokument48 SeitenFinnews Q5lifeeeNoch keine Bewertungen

- Office MaxDokument21 SeitenOffice MaxBlerta GjergjiNoch keine Bewertungen

- Metro Holdings Limited: N.M. - Not MeaningfulDokument17 SeitenMetro Holdings Limited: N.M. - Not MeaningfulEric OngNoch keine Bewertungen

- Basic Financial Statement Analysis of KodakDokument16 SeitenBasic Financial Statement Analysis of KodakVinodh Kumar LNoch keine Bewertungen

- Asics CorporationDokument6 SeitenAsics Corporationasadguy2000Noch keine Bewertungen

- Problems 1-30: Input Boxes in TanDokument24 SeitenProblems 1-30: Input Boxes in TanSultan_Alali_9279Noch keine Bewertungen

- Consolidated First Page To 11.2 Property and EquipmentDokument18 SeitenConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564Noch keine Bewertungen

- Financial+Data+Excel of UBMDokument100 SeitenFinancial+Data+Excel of UBMmohammedakbar88Noch keine Bewertungen

- Banking System of Japan Financial DataDokument44 SeitenBanking System of Japan Financial Datapsu0168Noch keine Bewertungen

- Accounts AssignmentDokument7 SeitenAccounts AssignmentHari PrasaadhNoch keine Bewertungen

- CFA Lecture 4 Examples Suggested SolutionsDokument22 SeitenCFA Lecture 4 Examples Suggested SolutionsSharul Islam100% (1)

- Operating Model Build v33Dokument22 SeitenOperating Model Build v33chandan.hegdeNoch keine Bewertungen

- Alphabet 2014 Financial ReportDokument6 SeitenAlphabet 2014 Financial ReportsharatjuturNoch keine Bewertungen

- ST Aerospace Financial ReportDokument4 SeitenST Aerospace Financial ReportMuhammad FirdausNoch keine Bewertungen

- Income Statement (In Inr MN) Income: Asian PaintsDokument11 SeitenIncome Statement (In Inr MN) Income: Asian Paintsavinashtiwari201745Noch keine Bewertungen

- Microsoft Corporation: United States Securities and Exchange CommissionDokument75 SeitenMicrosoft Corporation: United States Securities and Exchange Commissionavinashtiwari201745Noch keine Bewertungen

- Qfs 1q 2012 - FinalDokument40 SeitenQfs 1q 2012 - Finalyandhie57Noch keine Bewertungen

- Vertical and Horizontal Analysis of PidiliteDokument12 SeitenVertical and Horizontal Analysis of PidiliteAnuj AgarwalNoch keine Bewertungen

- Airthread Connections NidaDokument15 SeitenAirthread Connections NidaNidaParveen100% (1)

- M&A project-IIMK - TESTDokument34 SeitenM&A project-IIMK - TESTSohom KarmakarNoch keine Bewertungen

- Key Financial RatiosDokument140 SeitenKey Financial RatiosBharat565Noch keine Bewertungen

- 70 XTO Financial StatementsDokument5 Seiten70 XTO Financial Statementsredraider4404Noch keine Bewertungen

- Revenue: Revenue & Net Profit/ (Loss) - 9 Months Ended 31st DecemberDokument2 SeitenRevenue: Revenue & Net Profit/ (Loss) - 9 Months Ended 31st DecemberMihiri de SilvaNoch keine Bewertungen

- Myer AR10 Financial ReportDokument50 SeitenMyer AR10 Financial ReportMitchell HughesNoch keine Bewertungen

- Cash Flow Statement: For The Year Ended March 31, 2013Dokument2 SeitenCash Flow Statement: For The Year Ended March 31, 2013malynellaNoch keine Bewertungen

- Assign 1 - Sem II 12-13Dokument8 SeitenAssign 1 - Sem II 12-13Anisha ShafikhaNoch keine Bewertungen

- MCB Consolidated For Year Ended Dec 2011Dokument87 SeitenMCB Consolidated For Year Ended Dec 2011shoaibjeeNoch keine Bewertungen

- International Financial Statement Analysis WorkbookVon EverandInternational Financial Statement Analysis WorkbookNoch keine Bewertungen

- Goals-Based Wealth Management: An Integrated and Practical Approach to Changing the Structure of Wealth Advisory PracticesVon EverandGoals-Based Wealth Management: An Integrated and Practical Approach to Changing the Structure of Wealth Advisory PracticesNoch keine Bewertungen

- Hjkweek 7 ResearchDokument1 SeiteHjkweek 7 ResearchNoopur GandhiNoch keine Bewertungen

- Dot Net MVC Course ContentDokument6 SeitenDot Net MVC Course ContentNoopur GandhiNoch keine Bewertungen

- The New Warner Village Apartments 1378 Nottingham Way, Hamilton, New Jersey 08609Dokument2 SeitenThe New Warner Village Apartments 1378 Nottingham Way, Hamilton, New Jersey 08609Noopur GandhiNoch keine Bewertungen

- Problem No - 1.2 (Page 21) : Valves Per HourDokument6 SeitenProblem No - 1.2 (Page 21) : Valves Per HourNoopur GandhiNoch keine Bewertungen

- Fin 500 Q&aDokument4 SeitenFin 500 Q&aNoopur GandhiNoch keine Bewertungen

- Toyota Presentation 2Dokument5 SeitenToyota Presentation 2Noopur GandhiNoch keine Bewertungen

- PP Chap 5 FX MarketsDokument59 SeitenPP Chap 5 FX MarketsNoopur GandhiNoch keine Bewertungen

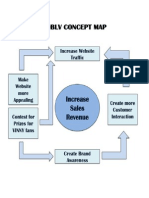

- Concept MapDokument1 SeiteConcept MapNoopur GandhiNoch keine Bewertungen

- Azim PremjiDokument1 SeiteAzim PremjiNoopur GandhiNoch keine Bewertungen

- Transaction Exposure - A Detailed Example PDFDokument16 SeitenTransaction Exposure - A Detailed Example PDFNoopur GandhiNoch keine Bewertungen

- Concept MapDokument1 SeiteConcept MapNoopur GandhiNoch keine Bewertungen

- Metabical CaseDokument3 SeitenMetabical CaseNoopur GandhiNoch keine Bewertungen

- AnalysisDokument2 SeitenAnalysisNoopur GandhiNoch keine Bewertungen

- Assistant Auditor Brown UniversityDokument1 SeiteAssistant Auditor Brown UniversityNoopur GandhiNoch keine Bewertungen

- 1Dokument14 Seiten1Noopur GandhiNoch keine Bewertungen

- Fairchild Water TechDokument2 SeitenFairchild Water TechNoopur Gandhi0% (1)

- Application LetterDokument1 SeiteApplication LetterNoopur GandhiNoch keine Bewertungen

- HondaDokument127 SeitenHondaNoopur GandhiNoch keine Bewertungen

- Howard Mba AddmiDokument2 SeitenHoward Mba AddmiDhairya BajariaNoch keine Bewertungen

- Inbound LogisticsDokument4 SeitenInbound LogisticsNoopur Gandhi100% (2)

- Seven Key MessagesDokument16 SeitenSeven Key MessagesMartijn Planken100% (1)

- Definitions of Occupational DiseasesDokument2 SeitenDefinitions of Occupational DiseasesNoopur GandhiNoch keine Bewertungen

- CCCCCCCDokument1 SeiteCCCCCCCNoopur GandhiNoch keine Bewertungen

- University of Mumbai Bachelor of Management Studies (B.M.S)Dokument18 SeitenUniversity of Mumbai Bachelor of Management Studies (B.M.S)Noopur GandhiNoch keine Bewertungen

- ArticleDokument2 SeitenArticleNoopur GandhiNoch keine Bewertungen

- A Project Report On Comparison Between HDFC Bank & ICICI BankDokument75 SeitenA Project Report On Comparison Between HDFC Bank & ICICI Bankvarun_bawa25191592% (12)

- 07 Progress Chart Jeremy OrtegaDokument2 Seiten07 Progress Chart Jeremy OrtegaJeremy OrtegaNoch keine Bewertungen

- MILJANE PERDIZO - Assignment 2Dokument5 SeitenMILJANE PERDIZO - Assignment 2Miljane PerdizoNoch keine Bewertungen

- Problem 1 4Dokument1 SeiteProblem 1 4Olaysa BacusNoch keine Bewertungen

- Problems Long Term Const ContractsDokument17 SeitenProblems Long Term Const ContractsJane DizonNoch keine Bewertungen

- 5.7 AA Asset Fiscal Year Closing - AJABDokument9 Seiten5.7 AA Asset Fiscal Year Closing - AJABvaishaliak2008Noch keine Bewertungen

- Cambridge Igcse and o Level Accounting Course BookDokument8 SeitenCambridge Igcse and o Level Accounting Course BookJaime0% (1)

- Project RAR IntegerationDokument25 SeitenProject RAR IntegerationAl-Mahad International School100% (1)

- PDF 20230412 193534 0000Dokument41 SeitenPDF 20230412 193534 0000Razalo, Kimberly AnnNoch keine Bewertungen

- Jobzella's 4th Career Fair Booklet 2019Dokument138 SeitenJobzella's 4th Career Fair Booklet 2019Karim HassanNoch keine Bewertungen

- Sarana Meditama Metropolitan (Q4 - 2017)Dokument93 SeitenSarana Meditama Metropolitan (Q4 - 2017)Wihelmina DeaNoch keine Bewertungen

- ASE20104 Examiner Report - March 2018Dokument20 SeitenASE20104 Examiner Report - March 2018Aung Zaw HtweNoch keine Bewertungen

- 11 AmalgmationDokument38 Seiten11 AmalgmationPranaya Agrawal100% (1)

- Tally Syllabus: 1. Basics of AccountingDokument4 SeitenTally Syllabus: 1. Basics of AccountingijrailNoch keine Bewertungen

- Marginal Costing & Absorption Costing - SolvedDokument12 SeitenMarginal Costing & Absorption Costing - SolvedfizzaNoch keine Bewertungen

- Director CFO Controller in San Francisco Bay CA Resume Herbert GottliebDokument2 SeitenDirector CFO Controller in San Francisco Bay CA Resume Herbert GottliebHerbertGottliebNoch keine Bewertungen

- Jurnal Manajemen: Jurnal Manajemen Volume 6 Nomor 1 (2020) P - Issn: 2301-6256 Januari - Juni 2020 E - Issn: 2615-1928Dokument10 SeitenJurnal Manajemen: Jurnal Manajemen Volume 6 Nomor 1 (2020) P - Issn: 2301-6256 Januari - Juni 2020 E - Issn: 2615-1928EvaaNoch keine Bewertungen

- Ias 2 InventoriesDokument10 SeitenIas 2 InventoriesHaniyaAngel100% (1)

- (Module 3) ProblemsDokument17 Seiten(Module 3) ProblemsArriane Dela CruzNoch keine Bewertungen

- Principles of AccountsDokument149 SeitenPrinciples of AccountsMutinta A. Mweemba100% (2)

- Annex 3 (Finrep)Dokument50 SeitenAnnex 3 (Finrep)Cynical GuyNoch keine Bewertungen

- Session 3Dokument90 SeitenSession 3Phuc Ho Nguyen MinhNoch keine Bewertungen

- Challenges of Implementing Computerized Accounting System in Small and Medium Enterprises in Ampara DistrictDokument10 SeitenChallenges of Implementing Computerized Accounting System in Small and Medium Enterprises in Ampara DistrictMohamed Sajir100% (4)

- Acn 201Dokument3 SeitenAcn 201Yasir AlamNoch keine Bewertungen

- Aacctg For Bus CombDokument8 SeitenAacctg For Bus CombMaurice AgbayaniNoch keine Bewertungen

- Cambridge International AS and A Level Accounting Coursebook Answer Section PDFDokument223 SeitenCambridge International AS and A Level Accounting Coursebook Answer Section PDFKasparov T Mhangami80% (5)

- Fair Value and Impairment PDFDokument39 SeitenFair Value and Impairment PDFTanvir AhmedNoch keine Bewertungen

- Solution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsDokument7 SeitenSolution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsIsyraf Hatim Mohd TamizamNoch keine Bewertungen

- Cambridge International Examinations Cambridge International General Certificate of Secondary EducationDokument20 SeitenCambridge International Examinations Cambridge International General Certificate of Secondary Educationcharmainemakumbe60Noch keine Bewertungen

- Understanding Income Statements: Presenter's Name Presenter's Title DD Month YyyyDokument58 SeitenUnderstanding Income Statements: Presenter's Name Presenter's Title DD Month YyyyAbdulelah AlhamayaniNoch keine Bewertungen

- Bio GenixDokument1 SeiteBio GenixVidhyadhar SudaNoch keine Bewertungen