Beruflich Dokumente

Kultur Dokumente

Consignment

Hochgeladen von

FarrukhsgOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Consignment

Hochgeladen von

FarrukhsgCopyright:

Verfügbare Formate

AL WADI INTERNATIONAL SCHOOL

ACCOUNTING

A LEVEL

NOTES

CONSIGNMENT ACCOUNTS

Consignment occurs when goods are sent by their owner (the consignor) to an agent (the

consignee), who undertakes to sell the goods. Consignment deals are made on a variety of

products - from artwork, to clothing, to books. In recent years, consignment shops have become

rather trendy, especially those offering specialty products, infant wear and high-end fashion

items. Therefore,

Consignor is a business or person who makes a consignment to consignee.

Consignee is a business or person that holds consignors goods for sale and acts as

consignors agent in selling the goods.

Consigned inventory includes goods shipped by a consignor to the consignee, who acts as an

agent in selling the goods.

The consignor continues to own the goods until they are sold, so the goods appear

as inventory in the accounting records of the consignor, not the consignee. In other words,

goods on consignment are included in the inventory of the consignor (i.e., seller) while they are

excluded from the consignees (i.e., buyers) inventory. Consignee does not own the inventory

but agrees to exercise due diligence in holding and selling consigned inventory.

Differences between sale of goods and consignment

The major differences between a sale and consignment are listed in the table below:

Sale

Ownership

Consignment

Transferred to the buyer along with Property of the consignor (seller) until

the transfer of goods.

consigned inventory is sold by the

consignee (reseller).

Goods sold on Buyer is a debtor of the seller. Trade Consignee is a debtor of the

credit

receivables and trade payables consignor. Agent

and

principal

relationship.

relationship.

Return of goods Buyer cannot return goods unless Can be returned to seller (consignor)

they are defective or seller agrees to because consigned inventory is

take them back.

property of the consignor until it is sold

by the consignee.

Goods lost after Buyers loss.

delivery

CONSIGNMENT & JOINT VENTURES

Sellers (consignors) loss.

Page 1

AL WADI INTERNATIONAL SCHOOL

ACCOUNTING

A LEVEL

NOTES

Worked example:

Friends Company, a manufacturer of valves, ships a consignment of gas valves to a retail store

BestHome. In this case, Friends Company is a consignor while BestHome is a consignee.

Friends Company pays freight costs while BestHome pays local advertising costs and credit

card processing fees that are reimbursable from Friends Company. By the end of the period,

BestHome sells half of the consigned goods , notifies Friends Company of the sales, retains a

15% commission, and remits cash due to Friends Company.

1. Shipment of consigned inventory:

Friends Company ships gas valves costing $7,000 on consignment to BestHome. To record

the shipment of consigned inventory, Friends Company makes the following journal entry:

Account Titles

Inventory (Consignments)

Debit

$7,000

Finished Goods Inventory

Credit

$7,000

BestHome does not make any journal entry. Mere receipt of the consigned goods does

not make the consignee a debtor of the consignor. In addition, the consignee does not

record the goods as an asset in its books as such goods is the property of the consignor

until it is sold.

2.2. Accounting for payment of freight costs by consignor

2. Payment of freight costs by consignor:

Friends Company shipped the gas valves to BestHome through a third-party shipping

company, which charged Friends Company $600 for shipping goods from the factory to the

consignee (i.e., BestHome). To record the shipping expense, Friends Company makes the

following journal entry:

Account Titles

Inventory (Consignments)

Trade Payable (or Cash)

Debit

Credit

$600

$600

Again, BestHome does not make any journal entry.

2.3. Accounting of payment of advertising by consignee

3. Expenses incurred in connection with consignment:

CONSIGNMENT & JOINT VENTURES

Page 2

AL WADI INTERNATIONAL SCHOOL

ACCOUNTING

A LEVEL

NOTES

Friends Company does not make any journal entry until it is notified by the consignee (e.g.,

receives an Account Sales Report). Usually a consignee is entitled to be reimbursed for

expenses incurred in connection with the consignment (i.e., it depends on the consignment

agreement). Such expenses may include credit card processing fees, storage and insurance

costs, unloading charges, local advertising costs, etc.

BestHome paid $1,000 cash for local advertising costs. The consignee would make the

following journal entry:

Account Titles

Debit

Trade receivable (from Friends Company) $1,000

Cash

Credit

$1,000

2.4ccounting for sale of consigned merchandise

4. Sale of consignment:

By the end of the period, BestHome sells 50% of the consigned gas valves for $8,000.

According to the consignment agreement, BestHom must receive a 15% commission on the

sales (i.e., $1,200 = $8,000 x 0.15) and must be reimbursed for the 2% credit card

processing fee (i.e., $160 = $8,000 x 0.02).

Friends Company does not make any journal entry until it is notified by the consignee (e.g.,

receives an Account Sales Report). BestHome would make the following journal entry to

record the sale of the consigned goods:

Account Titles

Cash

Debit

Credit

$8,000

Trade payables (Friends Company)

$8,000

Expenses incurred in connection with consignment

Account Titles

Trade

Receivable

Company)

Cash

Debit

(from

Friends

Credit

$160

$160

5. Notification of sales and expenses and receipt of cash from consignee:

CONSIGNMENT & JOINT VENTURES

Page 3

AL WADI INTERNATIONAL SCHOOL

ACCOUNTING

A LEVEL

NOTES

BestHome notifies Friends Company of the sales and expenses by sending an Account

Sales Report, retains a 15% commission, and remits cash due to Friends Company.

Friends Company makes the following journal entry:

Account Titles

Cash

Debit

Advertising Expense

$1,000

Commission Expense

$1,200

Credit card fee

$160

Credit

$5,640

Revenue from Consignment Sales

$8,000

BestHome makes the following journal entry:

Account Titles

Trade Payable (Friends Company)

Trade

Debit

Credit

$8,000

receivable

(from Friends

Company)

Commission Revenue

Cash

$1,160

$1,200

$5,640

6. Adjustment of inventory on consignment:

Inventory on consignment should be adjusted for the cost of sales. To record the transfer of

the inventory cost to the cost of goods sold, Friends Company makes the following journal

entry:

Account Titles

Debit

Cost of Goods Sold [50% x ($7,000 +

$3,800

600)]

Consignment Inventory

Credit

$3,800

The cost of goods sold in this example includes not only 50% of the original inventory cost

(i.e., $3,500 = $7,000 x 0.50) but also 50% of the shipping expense (i.e., $300 = $600 x

0.50). BestHome does not make any journal entry.

CONSIGNMENT & JOINT VENTURES

Page 4

AL WADI INTERNATIONAL SCHOOL

ACCOUNTING

A LEVEL

NOTES

Consignment benefit and risks:

Depending on the nature of a consignment arrangement, the following benefits and risks may

arise for consignor and consignee, respectively:

Consignor (Seller)

Benefits

Risks

Consignee (Buyer)

Business expansion with reduced

initial and on-going costs

Reduced inventory holding costs

Better understanding of user demand

and timing of production and supply

chain activities

Operational savings

No inventory sales

Inventory lost after delivery

Reduced investment in inventory

Operational savings

Access to a wider range of inventory

Commission on sale

Risk to retain unsalable or obsolete

inventory

Extra

inventory warehousing and

handling costs not paid by consignor

4. Consig

Points to remember:

Consignor remains the owner of goods even after sending to consignee.

Consignor does not send any Invoice rather a Performa invoice.

The Amount of Sales belongs to Consignor.

All the exp. are to be borne by Consignor. If borne by consignee, recoverable

from consignor.

Consignee entitled to Commission.

Consignee entitled to de-credere commission if he is responsible for bad debts.

Consignee sends a statement called Account Sales, periodically.

Accounting Treatment Of Consignment Or

Accounts Maintained BY The Consignor

A consignment account is a combined form of trading and profit and loss account solely to

the concerned consignment. It can be treated as nominal account. An independent

consignment account for each and consignment to the name of place or consignee is to be

prepared in order to ascertain the profit or loss from that consignment.

CONSIGNMENT & JOINT VENTURES

Page 5

AL WADI INTERNATIONAL SCHOOL

ACCOUNTING

A LEVEL

NOTES

In order to keep complete record of consignment transactions, the consignor maintains the

following accounts:

* Consignment Account

* Consignee's Account

* Goods sent on consignment Account

The following entries are made in the books of the consignor for goods sent at proforma

invoice price or cost price:

1. For the goods sent on consignment

Consignment to .........A/C......................Dr.

To Goods sent on consignment A/c

2. For the expenses incurred by consignor

Consignment to.........A/C..............Dr.

To Bank A/C

3. For the advance received from consignee

Bank/Cash/Bills receivable A/C............Dr.

To Consignee's A/C

4. For the bills discounted

CONSIGNMENT & JOINT VENTURES

Page 6

AL WADI INTERNATIONAL SCHOOL

ACCOUNTING

A LEVEL

NOTES

Bank A/C...................Dr.

To Bills receivable

5. For discount on bills transferred to profit and loss account

Profit and loss A/C...................Dr.

To Discount A/c

6. For expenses paid by consignee

Consignment to..............A/c.................Dr.

To Consignee's A/c

7. For the goods sold by consignee

Consignee's A/c.................Dr.

To consignment to.................A/c

8. For the commission due to consignee

Consignment to .................A/C

To consignee's A/C

9. For closing stock with consignee

Consignment stock A/C...........Dr.

To consignment to.......A/c

CONSIGNMENT & JOINT VENTURES

Page 7

AL WADI INTERNATIONAL SCHOOL

ACCOUNTING

A LEVEL

NOTES

10. For profit or loss on consignment

For profit earned on consignment

Consignment to........A/C..................Dr.

To Profit and loss A/C

For loss on consignment

Profit and loss A/C.....................Dr.

To consignment to.............A/C

11. For final settlement of account with consignee

Bank A/c...............Dr.

To Consignee's A/c

12.For

goods

sent

on

consignment

transferred

to

trading

account(by

manufacturing company) or purchase account(by a trader)

Goods sent to consignment A/C..............Dr.

To trading/ purchase A/C

Difference Between Joint Venture And

Consignment

The main differences between joint venture and consignment are as under:

1. Nature

Joint venture: It is a temporary partnership business without a firm name.

CONSIGNMENT & JOINT VENTURES

Page 8

AL WADI INTERNATIONAL SCHOOL

ACCOUNTING

A LEVEL

NOTES

Consignment: It is an extension of business by principal through agent.

2. Parties

Joint venture: The parties involving in joint venture are known as co-ventures.

Consignment: Consignor and consignee are involving parties in the consignment.

3. Relation

Joint venture: The relation between co-ventures is just like the partners in partnership firm.

Consignment: The relation between the consignor and consignee is 'principal and agent'.

4. Sharing Profit

Joint venture: The profits ans losses of joint venture are shared among the co-ventures in

their agreed proportion.

Consignment: The profits and losses are not shared between the consignor and consignee.

Consignee gets only the commission.

5. Rights

Joint venture: The co-ventures in a joint venture have equal rights.

Consignment: In consignment, the consignor enjoys principal's right whereas consignee

enjoys the right of agent.

6. Exchange Of Information

Joint venture: The co-ventures exchange the required information among them regularly.

CONSIGNMENT & JOINT VENTURES

Page 9

AL WADI INTERNATIONAL SCHOOL

ACCOUNTING

A LEVEL

NOTES

Consignment: The consignee prepares an account sale which contains a details of business

activities carried on and is being sent to the consignor.

7. Ownership

Joint Venture: All the co-ventures are the owners of the joint venture.

Consignment: The consignor is the owner of the business.

8. Method Of Maintaining Accounts

Joint venture: There are different methods of maintaining accounts in joint venture.As per

agreement the co-ventures maintain their account.

Consignment: In consignment, there is only one method of maintaining account.

9. Basis Of Account

Joint venture: Cash basis of accounting is applicable in joint venture.

Consignment: Actual basis is adopted in consignment.

10. Continuity

Joint venture: As soon as the particular venture is completed, the joint venture is

terminated.

Consignment: The continuity of business exists according to the willingness of both

consignor and consignee.

A joint venture occurs when two or more businesses join together to pursue

acommon project

Basics on joint ventures

CONSIGNMENT & JOINT VENTURES

Page 10

AL WADI INTERNATIONAL SCHOOL

ACCOUNTING

A LEVEL

NOTES

With a joint venture, businesses remain separate in legal terms

Joint ventures are common, as firms want to benefit from collaborative

work in reaching a mutually agreed strategic target.

Many joint ventures seek to share the fixed costs of major business research /

infrastructure projects

Examples of joint ventures include:

Vodafone & Telefnica agreed in 2012 to share more of their mobile network

(with more than 18,500 mobile mast sites). This was a response to Everything

Everywhere a JV between T-Mobile and Orange

Vodafone has a joint venture with Verizon Wireless in the United States

BMW and Toyota agreed a partnership in 2011 to co-operate on hydrogen

fuel cells, vehicle electrification, lightweight materials and a future sports car.

Partnership agreements between competing automakers are common in as

manufacturers seek to pool efforts on costly technologies

West Coast between Virgin Rail /Stagecoach

Google and NASA developing Google Earth

Hollywood studios combining to fight internet piracy

Renault-Nissan's joint venture with Indian firm Bajaj to produce a 1,276 car

Intertrust Technologies - between Sony and Philips

Alliances in the airline industry e.g. Star Alliance and One World

Starbucks' expansion in India through a joint venture with the giant Tata

industrial group

Nokia Siemens Joint Networks

Joint Ventures between universities to deliver Massive Open Online

Courses(MOOCs) a fast-expanding sector of the higher education industry

CONSIGNMENT & JOINT VENTURES

Page 11

AL WADI INTERNATIONAL SCHOOL

ACCOUNTING

A LEVEL

NOTES

Govia, a joint venture between Go-Ahead Group and Keolis of France which

will operate the Thameslink rail franchise in London

Talk Talk agreeing in 2014 a joint venture with Sky to provide a fibre network

in York

Every one of the world's 24 biggest carmakers by sales now operates some

form of alliance or joint venture with another large carmaker.

Joint ventures

Two businesses agree to start a new project together, sharing capital, risks and profits.

Pros:

Cons:

Shared costs are good for tackling expensive projects. (e.g aircraft)

Pooled knowledge. (e.g foreign and local business)

Risks are shared.

Profits have to be shared.

Disagreements might occur.

The two partners might run the joint venture differently.

nees accounting controls for consigned inventory

CONSIGNMENT & JOINT VENTURES

Page 12

AL WADI INTERNATIONAL SCHOOL

CONSIGNMENT & JOINT VENTURES

ACCOUNTING

A LEVEL

NOTES

Page 13

AL WADI INTERNATIONAL SCHOOL

CONSIGNMENT & JOINT VENTURES

ACCOUNTING

A LEVEL

NOTES

Page 14

AL WADI INTERNATIONAL SCHOOL

ACCOUNTING

A LEVEL

NOTES

Candidates should be able to distinguish between consignments and joint ventures and the

environment in which they operate. Candidates should be able to:

Prepare ledger accounts for consignment transactions, including the calculation of

closing inventory valuation

Prepare ledger accounts for joint ventures and calculate the profit for joint ventures.

CONSIGNMENT & JOINT VENTURES

Page 15

Das könnte Ihnen auch gefallen

- Electronic funds transfer A Clear and Concise ReferenceVon EverandElectronic funds transfer A Clear and Concise ReferenceNoch keine Bewertungen

- Notes Cases On Credit TransDokument16 SeitenNotes Cases On Credit TransJay Nielsen PagulayanNoch keine Bewertungen

- Understanding The Ucp600Dokument8 SeitenUnderstanding The Ucp600mhussein2006100% (1)

- 1215-24 LA - Audit Assurance and Related Services Guidance - F2Dokument12 Seiten1215-24 LA - Audit Assurance and Related Services Guidance - F2Leila RamirezNoch keine Bewertungen

- Determining Negotiability of Instruments Based on Sum, Time and Additional ProvisionsDokument9 SeitenDetermining Negotiability of Instruments Based on Sum, Time and Additional ProvisionsMikaerika AlcantaraNoch keine Bewertungen

- Beginner's Guide To Bonds 1.1-1.4 PDFDokument16 SeitenBeginner's Guide To Bonds 1.1-1.4 PDFAnonymous UserNoch keine Bewertungen

- Export Credit Insurance Policy PDFDokument2 SeitenExport Credit Insurance Policy PDFBrianNoch keine Bewertungen

- LC Docs ChecklistDokument1 SeiteLC Docs ChecklistkevindsizaNoch keine Bewertungen

- Law On Negotiable Instruments Section 1-10Dokument4 SeitenLaw On Negotiable Instruments Section 1-10Miguel GrayNoch keine Bewertungen

- TB Raiborn - Responsibility Accounting and Transfer Pricing in Decentralized OrganizationDokument44 SeitenTB Raiborn - Responsibility Accounting and Transfer Pricing in Decentralized OrganizationMayla Lei Pablo100% (1)

- CBP Form 7501 instructions summaryDokument32 SeitenCBP Form 7501 instructions summaryAlfred MartinNoch keine Bewertungen

- Evidence 8Dokument258 SeitenEvidence 8Kim Boyles FuentesNoch keine Bewertungen

- Letter of CreditDokument5 SeitenLetter of CreditSujith PSNoch keine Bewertungen

- Payment Methods ExplainedDokument5 SeitenPayment Methods ExplainedJoeina MathewNoch keine Bewertungen

- Assignment of Receivables ManagementDokument6 SeitenAssignment of Receivables ManagementHarsh ChauhanNoch keine Bewertungen

- Bond ValuationDokument50 SeitenBond Valuationrenu3rdjanNoch keine Bewertungen

- Accounting For LeasesDokument8 SeitenAccounting For LeasesAdhiyanto PL100% (1)

- Equity Release: Summary of Learning Outcomes Number of Questions in The ExaminationDokument3 SeitenEquity Release: Summary of Learning Outcomes Number of Questions in The ExaminationClerry SamuelNoch keine Bewertungen

- Share Based Payments - FARDokument87 SeitenShare Based Payments - FARChloe ChiongNoch keine Bewertungen

- Commercial PaperDokument26 SeitenCommercial PaperAnuj KhadriaNoch keine Bewertungen

- Chapter 21 Financial InstrumentsDokument21 SeitenChapter 21 Financial InstrumentsHammad Ahmad67% (3)

- Accounting Principles & Practices An Overview DefinitionDokument23 SeitenAccounting Principles & Practices An Overview DefinitionAmanuel TesfayeNoch keine Bewertungen

- Secrecy of Bank Deposits and Unclaimed Balances LawDokument14 SeitenSecrecy of Bank Deposits and Unclaimed Balances LawAllaiza Mhel Arcenal EusebioNoch keine Bewertungen

- Transfer Tax GuideDokument35 SeitenTransfer Tax GuideRaine DeLeonNoch keine Bewertungen

- ADV FIN ACCOUNTING DERIVATIVES HEDGINGDokument3 SeitenADV FIN ACCOUNTING DERIVATIVES HEDGINGPrankyJellyNoch keine Bewertungen

- 07 - Banking and FinancingDokument16 Seiten07 - Banking and Financingnur farhana shahiraNoch keine Bewertungen

- Assignment of Non-Negotiable Documents of Title ExplainedDokument9 SeitenAssignment of Non-Negotiable Documents of Title ExplainedJae MontoyaNoch keine Bewertungen

- Chapter 4 SolutionsDokument85 SeitenChapter 4 SolutionssevtenNoch keine Bewertungen

- Wiley Chapter 11 Depreciation Impairments and DepletionDokument43 SeitenWiley Chapter 11 Depreciation Impairments and Depletion靳雪娇Noch keine Bewertungen

- Jeter Advanced Accounting 4eDokument14 SeitenJeter Advanced Accounting 4eMinh NguyễnNoch keine Bewertungen

- Chapter 5 SolutionsDokument21 SeitenChapter 5 SolutionsIzu EvansNoch keine Bewertungen

- Documentary Stamp TaxDokument8 SeitenDocumentary Stamp TaxRam DerickNoch keine Bewertungen

- Contract Is A Meeting of Minds Between Two Persons Whereby One Binds HimselfDokument1 SeiteContract Is A Meeting of Minds Between Two Persons Whereby One Binds HimselfIan Ag-aDoctorNoch keine Bewertungen

- 09-MWSS2013 Part2-Observations and RecommendationsDokument128 Seiten09-MWSS2013 Part2-Observations and RecommendationsEppie SeverinoNoch keine Bewertungen

- Financial Market and InstitutionDokument5 SeitenFinancial Market and InstitutionMd MohimanNoch keine Bewertungen

- Assignment of An Agreement For Sale: Form No. 7Dokument2 SeitenAssignment of An Agreement For Sale: Form No. 7Sudeep Sharma100% (1)

- Shipping GuaranteeDokument22 SeitenShipping GuaranteeHazim HafizNoch keine Bewertungen

- Prelims Ms1Dokument6 SeitenPrelims Ms1ALMA MORENANoch keine Bewertungen

- C8 Recievable Financing Pledge Assignment FactoringDokument32 SeitenC8 Recievable Financing Pledge Assignment FactoringAngelie LaxaNoch keine Bewertungen

- Chap 005Dokument97 SeitenChap 005Ahmed El KhateebNoch keine Bewertungen

- BP Blg. 22 Bouncing Checks Law: Specific Acts in Violation of This ActDokument9 SeitenBP Blg. 22 Bouncing Checks Law: Specific Acts in Violation of This Actangela pajelNoch keine Bewertungen

- Acc Business Combination NotesDokument118 SeitenAcc Business Combination NotesTheresaNoch keine Bewertungen

- RFBT Handout Bank Secrecy and Unclaimed Balances - Batch 2019Dokument3 SeitenRFBT Handout Bank Secrecy and Unclaimed Balances - Batch 2019E.D.JNoch keine Bewertungen

- Accomodation Parties: Liability of The PrincipalDokument2 SeitenAccomodation Parties: Liability of The PrincipalLucía MartínezNoch keine Bewertungen

- Cash FlowsDokument142 SeitenCash FlowsDraganNoch keine Bewertungen

- Nocon-NEGOLAW (FINAL EXAM)Dokument3 SeitenNocon-NEGOLAW (FINAL EXAM)M LeylaNoch keine Bewertungen

- Financial Market Problems and FormulasDokument3 SeitenFinancial Market Problems and FormulasNufayl KatoNoch keine Bewertungen

- LC FinalDokument42 SeitenLC FinalPraveen NairNoch keine Bewertungen

- BL AnswerKeyDokument4 SeitenBL AnswerKeyRosalie E. BalhagNoch keine Bewertungen

- FinmanDokument3 SeitenFinmanKaren LaccayNoch keine Bewertungen

- Confidential Disclosure AgreementDokument4 SeitenConfidential Disclosure Agreementstephen roloffNoch keine Bewertungen

- TLAW 401 Class 7 (Consumer Law Part 1) (AH) 63: Review Question Week 7Dokument9 SeitenTLAW 401 Class 7 (Consumer Law Part 1) (AH) 63: Review Question Week 7Thapa SonaNoch keine Bewertungen

- Shipping GuaranteesDokument3 SeitenShipping GuaranteesPadmanabhan RangarajanNoch keine Bewertungen

- Anti Money Laundering LawDokument49 SeitenAnti Money Laundering LawAsru RojamNoch keine Bewertungen

- Accounting For Consigned GoodsDokument6 SeitenAccounting For Consigned GoodsHumphrey OdchigueNoch keine Bewertungen

- Consignment Accounting Journal EntriesDokument22 SeitenConsignment Accounting Journal EntriesRashid HussainNoch keine Bewertungen

- 1.-Accounting For ConsignmentsDokument40 Seiten1.-Accounting For ConsignmentsEligius Nyika50% (6)

- Module 1 - Credit Bad DebtsDokument21 SeitenModule 1 - Credit Bad Debtsiacpa.aialmeNoch keine Bewertungen

- Consignment Accounting Journal EntriesDokument2 SeitenConsignment Accounting Journal EntriesVenn Bacus RabadonNoch keine Bewertungen

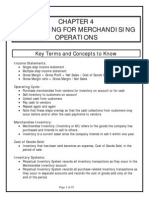

- Accounting For Merchandising Operations: Key Terms and Concepts To KnowDokument25 SeitenAccounting For Merchandising Operations: Key Terms and Concepts To KnowMinji LeeNoch keine Bewertungen

- Assessment Planning Cycle Webinar SlidesDokument31 SeitenAssessment Planning Cycle Webinar SlidesFarrukhsgNoch keine Bewertungen

- Unit Plan TemplateDokument8 SeitenUnit Plan TemplateFarrukhsgNoch keine Bewertungen

- Planning Cycle Infographic v2 - EDITDokument1 SeitePlanning Cycle Infographic v2 - EDITFarrukhsgNoch keine Bewertungen

- MARKETINGDokument14 SeitenMARKETINGFarrukhsgNoch keine Bewertungen

- Teacher S Individual Plan For Professional Development IppdDokument26 SeitenTeacher S Individual Plan For Professional Development IppdFarrukhsgNoch keine Bewertungen

- BUSINESSDokument41 SeitenBUSINESSFarrukhsgNoch keine Bewertungen

- UNIT TITLE: Understanding The Principles and Practices of Assessment LEVEL 3 (3 Credits)Dokument2 SeitenUNIT TITLE: Understanding The Principles and Practices of Assessment LEVEL 3 (3 Credits)FarrukhsgNoch keine Bewertungen

- Lesson Planning CycleDokument21 SeitenLesson Planning CycleK-ril Fiq83% (6)

- Individual Performance Commitment and Review Form (Ipcrf) For TeachersDokument6 SeitenIndividual Performance Commitment and Review Form (Ipcrf) For TeachersNoel Grey50% (4)

- 5 Minute Chats With StudentsDokument2 Seiten5 Minute Chats With StudentsFarrukhsgNoch keine Bewertungen

- June 2021 Examiner ReportDokument35 SeitenJune 2021 Examiner ReportFarrukhsgNoch keine Bewertungen

- November 2021 Examiner ReportDokument30 SeitenNovember 2021 Examiner ReportFarrukhsgNoch keine Bewertungen

- Business Studies Igcse OrientationDokument14 SeitenBusiness Studies Igcse OrientationFarrukhsgNoch keine Bewertungen

- Marketing Mix - Place NotesDokument10 SeitenMarketing Mix - Place NotesFarrukhsgNoch keine Bewertungen

- MARKETINGDokument16 SeitenMARKETINGFarrukhsgNoch keine Bewertungen

- Business Studies SyllabusDokument30 SeitenBusiness Studies SyllabusNafis AyanNoch keine Bewertungen

- NOTESDokument4 SeitenNOTESFarrukhsgNoch keine Bewertungen

- BUSINESSDokument22 SeitenBUSINESSFarrukhsg0% (1)

- IGCSE (9-1) (2017) Economics Student BookDokument84 SeitenIGCSE (9-1) (2017) Economics Student BookMaisha Islam67% (3)

- International GCSE Commerce Student Book AnswersDokument137 SeitenInternational GCSE Commerce Student Book AnswersSyeda Malika Anjum50% (2)

- AccountingDokument8 SeitenAccountingFarrukhsgNoch keine Bewertungen

- Z01 Ans 001-079 PDFDokument80 SeitenZ01 Ans 001-079 PDFHira AsrarNoch keine Bewertungen

- Grade Thresholds - March 2023: Cambridge International AS & A Level Accounting (9706)Dokument1 SeiteGrade Thresholds - March 2023: Cambridge International AS & A Level Accounting (9706)FarrukhsgNoch keine Bewertungen

- Z01 Ans 001-079 PDFDokument80 SeitenZ01 Ans 001-079 PDFHira AsrarNoch keine Bewertungen

- Cambridge International AS & A Level: ACCOUNTING 9706/32Dokument20 SeitenCambridge International AS & A Level: ACCOUNTING 9706/32Ruchira Sanket KaleNoch keine Bewertungen

- Cambridge International AS & A Level: AccountingDokument16 SeitenCambridge International AS & A Level: AccountingFarrukhsgNoch keine Bewertungen

- Cambridge International AS & A Level: ACCOUNTING 9706/32Dokument8 SeitenCambridge International AS & A Level: ACCOUNTING 9706/32Saram Shykh PRODUCTIONSNoch keine Bewertungen

- Cambridge International AS & A Level: AccountingDokument3 SeitenCambridge International AS & A Level: AccountingFarrukhsgNoch keine Bewertungen

- Cambridge International AS & A Level: ACCOUNTING 9706/42Dokument4 SeitenCambridge International AS & A Level: ACCOUNTING 9706/42Saram Shykh PRODUCTIONSNoch keine Bewertungen

- Cambridge International AS & A Level: AccountingDokument16 SeitenCambridge International AS & A Level: AccountingFarrukhsgNoch keine Bewertungen

- Arvind MillsDokument4 SeitenArvind MillsYardenKalinto0% (1)

- Paete Science and Business College, Inc.: J.P. Rizal St. Paete, LagunaDokument9 SeitenPaete Science and Business College, Inc.: J.P. Rizal St. Paete, LagunaCindy LlaneraNoch keine Bewertungen

- SELL 5th Edition Ingram LaForge Avila Schwepker Williams Solution ManualDokument33 SeitenSELL 5th Edition Ingram LaForge Avila Schwepker Williams Solution Manualjoyce100% (25)

- CV Mitali SahaDokument2 SeitenCV Mitali SahaMitali SahaNoch keine Bewertungen

- Courtney Rae Ricks ResumeDokument3 SeitenCourtney Rae Ricks Resumeapi-647371301Noch keine Bewertungen

- Citi Trade May14Dokument23 SeitenCiti Trade May14Marlon RelatadoNoch keine Bewertungen

- Genti CELA - The Impact of Online Buying To Customer Behavior ChangesDokument12 SeitenGenti CELA - The Impact of Online Buying To Customer Behavior ChangesGentiNoch keine Bewertungen

- Understanding Company Systems When SellingDokument2 SeitenUnderstanding Company Systems When SellingRajesh RamaswamyNoch keine Bewertungen

- Pnadz936 PDFDokument122 SeitenPnadz936 PDFHoward EnglishNoch keine Bewertungen

- Product Life-Cycle: Product Design and DevelopmentDokument17 SeitenProduct Life-Cycle: Product Design and DevelopmentVimal GuptaNoch keine Bewertungen

- How multichannel retailing benefits customersDokument18 SeitenHow multichannel retailing benefits customersHarman Gill100% (3)

- Soren Chemical Case Analysis Increases Coracle Water Clarifier SalesDokument4 SeitenSoren Chemical Case Analysis Increases Coracle Water Clarifier SalesDeep Dey75% (4)

- Sample Question From Chapter 8-9 - 11!12!14Dokument24 SeitenSample Question From Chapter 8-9 - 11!12!14huyenb2103459100% (1)

- Flora Logistics Limited EN590 SCODokument2 SeitenFlora Logistics Limited EN590 SCOPadilaNoch keine Bewertungen

- Assignment BFI305Dokument3 SeitenAssignment BFI305Leevya GeethanjaliNoch keine Bewertungen

- SAP Sales Blitz Call Script Industry: Consumer Products/Food & BeverageDokument3 SeitenSAP Sales Blitz Call Script Industry: Consumer Products/Food & BeverageNusrat Azim BorshaNoch keine Bewertungen

- ERP Test BankDokument29 SeitenERP Test BankDiajordan 1Noch keine Bewertungen

- Selection of The Optimum Promotion MixDokument12 SeitenSelection of The Optimum Promotion MixDora MorhanNoch keine Bewertungen

- Managing Relationships and LoyaltyDokument42 SeitenManaging Relationships and Loyaltynurina listya dewiNoch keine Bewertungen

- Marketing Management Essentials You Always Wanted To Know (Second Edition)Dokument23 SeitenMarketing Management Essentials You Always Wanted To Know (Second Edition)Vibrant Publishers100% (1)

- CAT Isrc Guidebook Engine 031709 Rev FDokument372 SeitenCAT Isrc Guidebook Engine 031709 Rev FenjoythedocsNoch keine Bewertungen

- Chapter 1: The Case For ProspectingDokument13 SeitenChapter 1: The Case For ProspectingChuckNoch keine Bewertungen

- Select Solutions Zimm 2009 1-5Dokument40 SeitenSelect Solutions Zimm 2009 1-5AdamNoch keine Bewertungen

- Microfridge ExecutionDokument2 SeitenMicrofridge ExecutionasniNoch keine Bewertungen

- Tudor-Mihai Mititelu CVDokument4 SeitenTudor-Mihai Mititelu CVTudor MititeluNoch keine Bewertungen

- Become Cisco Select PartnerDokument2 SeitenBecome Cisco Select PartnermorzkaNoch keine Bewertungen

- Sales and DistributionDokument3 SeitenSales and DistributionSourabh BhattacharyaNoch keine Bewertungen

- BDC Training MaterialDokument8 SeitenBDC Training MaterialCarlos Parra RavenNoch keine Bewertungen

- Retail BakingDokument29 SeitenRetail BakingdarshpujNoch keine Bewertungen