Beruflich Dokumente

Kultur Dokumente

Chip Amendment

Hochgeladen von

themorningconsultCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chip Amendment

Hochgeladen von

themorningconsultCopyright:

Verfügbare Formate

ERN15177

S.L.C.

AMENDMENT NO.llll

Calendar No.lll

Purpose: To protect and retain our Childrens Health Insurance Program for 4 years (PRO-CHIP).

IN THE SENATE OF THE UNITED STATES114th Cong., 1st Sess.

H. R. 2

To amend title XVIII of the Social Security Act to repeal

the Medicare sustainable growth rate and strengthen

Medicare access by improving physician payments and

making other improvements, to reauthorize the Childrens Health Insurance Program, and for other purposes.

Referred to the Committee on llllllllll and

ordered to be printed

Ordered to lie on the table and to be printed

AMENDMENT intended to be proposed by lllllll

Viz:

1

Strike sections 301 through 304, and insert the fol-

2 lowing:

3

SEC. 301. 4-YEAR EXTENSION OF THE CHILDRENS HEALTH

INSURANCE PROGRAM.

(a) FUNDING.

(1) IN

GENERAL.Section

2104(a) of the So-

cial Security Act (42 U.S.C. 1397dd(a)) is amend-

ed

9

10

(A) in paragraph (17), by striking and

at the end; and

ERN15177

S.L.C.

2

1

(B) by striking paragraph (18) and insert-

ing the following new paragraphs:

(18) for fiscal year 2015, $21,061,000,000;

(19) for fiscal year 2016, $19,300,000,000;

(20) for fiscal year 2017, $20,300,000,000;

(21) for fiscal year 2018, $21,300,000,000;

7

8

9

and

(22) for fiscal year 2019, for purposes of making 2 semi-annual allotments

10

(A) $2,850,000,000 for the period begin-

11

ning on October 1, 2018, and ending on March

12

31, 2019; and

13

(B) $2,850,000,000 for the period begin-

14

ning on April 1, 2019, and ending on Sep-

15

tember 30, 2019..

16

(2) PREVENTION

17

TIONS FOR FISCAL YEAR

18

any other provision of law, insofar as funds have

19

been appropriated under subsection (a)(18) or (m)

20

of section 2104 of the Social Security Act (42

21

U.S.C. 1397dd), or under section 108 of the Chil-

22

drens Health Insurance Program Reauthorization

23

Act of 2009 (Public Law 1113), as such sub-

24

sections and section are in effect on the day before

25

the date of the enactment of this Act, to provide al-

OF DUPLICATE APPROPRIA-

2015.Notwithstanding

ERN15177

S.L.C.

3

1

lotments to States under the State Childrens Health

Insurance Program established under title XXI of

the Social Security Act (42 U.S.C. 1397aa et seq.)

(whether implemented under title XIX, XXI, or

both, of the Social Security Act) for fiscal year

2015

(A) any amounts that are so appropriated

that are not so allotted and obligated before the

date of the enactment of this Act, are re-

10

scinded; and

11

(B) any amount provided for CHIP allot-

12

ments to a State under this section (and the

13

amendments made by this section) for such fis-

14

cal year shall be reduced by the amount of such

15

appropriations so allotted and obligated before

16

such date.

17

(b) ALLOTMENTS.

18

(1) IN

GENERAL.Section

2104(m) of the So-

19

cial Security Act (42 U.S.C. 1397dd(m)) is amend-

20

ed

21

(A) in the subsection heading, by striking

22

THROUGH 2015 and inserting AND THERE-

23

AFTER;

24

(B) in paragraph (2)

ERN15177

S.L.C.

4

1

2

(i) in the paragraph heading, by striking 2014 and inserting 2018; and

(ii) by striking subparagraph (B) and

inserting the following new subparagraph:

(B) FISCAL

YEAR 2013 THROUGH 2018.

Subject to paragraphs (4) and (6), from the

amount made available under paragraphs (16)

through (21) of subsection (a) for each of fiscal

years 2013 through 2018, respectively, the Sec-

10

retary shall compute a State allotment for each

11

State (including the District of Columbia and

12

each commonwealth and territory) for each

13

such fiscal year as follows:

14

(i) REBASING

IN FISCAL YEAR 2013

15

AND EACH SUCCEEDING ODD-NUMBERED

16

FISCAL YEAR.For

17

each succeeding odd-numbered fiscal year,

18

the allotment of the State is equal to the

19

Federal payments to the State that are at-

20

tributable to (and countable toward) the

21

total amount of allotments available under

22

this section to the State in the preceding

23

fiscal year (including payments made to

24

the State under subsection (n) for such

25

preceding fiscal year as well as amounts

fiscal year 2013 and

ERN15177

S.L.C.

5

1

redistributed to the State in such pre-

ceding fiscal year), multiplied by the allot-

ment increase factor under paragraph (5)

for such odd-numbered fiscal year.

(ii) GROWTH

FACTOR UPDATE FOR

FISCAL YEAR 2014 AND EACH SUCCEEDING

EVEN-NUMBERED

as provided in clause (iii), for fiscal year

2014 and each succeeding even-numbered

10

fiscal year, the allotment of the State is

11

equal to the sum of

FISCAL

YEAR.Except

12

(I) the amount of the State al-

13

lotment under clause (i) for the pre-

14

ceding fiscal year; and

15

(II) the amount of any pay-

16

ments made to the State under sub-

17

section (n) for such preceding fiscal

18

year,

19

multiplied by the allotment increase factor

20

under paragraph (5) for such even-num-

21

bered fiscal year.

22

(iii) SPECIAL

RULE

FOR

FISCAL

23

YEAR 2016.For

24

lotment of the State is equal to the Fed-

25

eral payments to the State that are attrib-

fiscal year 2016, the al-

ERN15177

S.L.C.

6

1

utable to (and countable toward) the total

amount of allotments available under this

section to the State in the preceding fiscal

year (including payments made to the

State under subsection (n) for such pre-

ceding fiscal year as well as amounts redis-

tributed to the State in such preceding fis-

cal year), but determined as if the last two

sentences of section 2105(b) were in effect

10

in such preceding fiscal year and then mul-

11

tiplying the result by the allotment in-

12

crease factor under paragraph (5) for fis-

13

cal year 2016.;

14

(C) in paragraph (3)

15

16

17

18

19

(i)

in

the

heading,

by

striking

2015and inserting 2019;

(ii) in subparagraph (A)

(I) by striking paragraph (18)

and inserting paragraph (22); and

20

(II) by striking section 108 of

21

the Childrens Health Insurance Pro-

22

gram Reauthorization Act of 2009

23

and inserting section 301(b)(2) of

24

the Medicare Access and CHIP Reau-

25

thorization Act of 2015;

ERN15177

S.L.C.

7

1

(iii) in subparagraph (B), by striking

paragraph (18) and inserting para-

graph (22);

(iv) in subparagraph (C)

(I) by striking 2014 each place

it appears and inserting 2018; and

(II) by striking 2015 and in-

serting 2019; and

(v) in subparagraph (D)

10

(I) in clause (i)

11

(aa) in subclause (I), by

12

striking subsection (a)(18)(A)

13

and

14

(a)(22)(A); and

inserting

subsection

15

(bb) in subclause (II), by

16

striking section 108 of the Chil-

17

drens Health Insurance Program

18

Reauthorization Act of 2009

19

and inserting section 301(b)(2)

20

of

21

CHIP Reauthorization Act of

22

2015; and

23

(II) in clause (ii)(II), by striking

24

subsection (a)(18)(B) and inserting

25

subsection (a)(22)(B);

the

Medicare

Access

and

ERN15177

S.L.C.

8

1

(D) in paragraph (4), by striking 2015

and inserting 2019;

(E) in paragraph (6)

(i) in subparagraph (A), by striking

2015 and inserting 2019; and

(ii) in the second sentence, by striking

or fiscal year 2014 and inserting fiscal

year 2014, fiscal year 2016, or fiscal year

2018; and

10

(F) in paragraph (8)

11

(i) in the paragraph heading, by strik-

12

ing 2015 and inserting 2019; and

13

(ii) by striking for a period in fiscal

14

year 2015 and inserting for a period in

15

fiscal year 2019.

16

(2) ONE-TIME

APPROPRIATION

FOR

FISCAL

17

YEAR 2019.There

18

of Health and Human Services, out of any money in

19

the

20

$16,700,000,000 to accompany the allotment made

21

for the period beginning on October 1, 2018, and

22

ending

23

2104(a)(22)(A) of the Social Security Act (42

24

U.S.C. 1397dd(a)(22)(A)) (as added by subsection

25

(a)(1)), to remain available until expended. Such

Treasury

on

is appropriated to the Secretary

not

March

otherwise

31,

2019,

appropriated,

under

section

ERN15177

S.L.C.

9

1

amount shall be used to provide allotments to States

under paragraph (3) of section 2104(m) of such Act

(42 U.S.C. 1397dd(m)) (as amended by paragraph

(1)(C)) for the first 6 months of fiscal year 2019 in

the same manner as allotments are provided under

subsection (a)(22)(A) of such section 2104 and sub-

ject to the same terms and conditions as apply to

the allotments provided from such subsection

(a)(22)(A).

10

(c) CHILD ENROLLMENT CONTINGENCY FUND.

11

(1) IN

GENERAL.Section

2104(n) of the So-

12

cial Security Act (42 U.S.C. 1397dd(n)) is amend-

13

ed

14

15

(A) in paragraph (2)

(i) in subparagraph (A)

16

(I) in the matter preceding clause

17

(i), by striking and (D) and insert-

18

ing , (D), and (E); and

19

(II) by striking clause (ii) and in-

20

serting the following:

21

(ii) for each of

22

(I) fiscal years 2010 through

23

2014, such sums as are necessary for

24

making payments to eligible States for

25

such fiscal year, but not in excess of

ERN15177

S.L.C.

10

1

the aggregate cap described in sub-

paragraph (B); and

(II) fiscal years 2015 through

2018 (and for each of the semi-annual

allotment

2019), such sums as are necessary for

making payments to eligible States for

such fiscal year or period.; and

(ii) by striking subparagraph (B) and

periods

10

inserting the following:

11

(B) AGGREGATE

for

CAP.The

fiscal

year

total amount

12

available for payment from the Fund for each

13

of fiscal years 2010 through 2014, taking into

14

account deposits made under subparagraph (C),

15

shall not exceed 20 percent of the amount made

16

available under subsection (a) for the fiscal

17

year. In the case of fiscal years 2015 through

18

2018 (and for each of the semi-annual allot-

19

ment periods for fiscal year 2019), there shall

20

be no limit on the amount available for pay-

21

ment from the Fund.;

22

(iii) in subparagraph (D)

23

(I) by inserting before fiscal

24

year 2015 after fiscal year or pe-

25

riod; and

ERN15177

S.L.C.

11

1

(II) by striking for any suc-

ceeding fiscal year; and

(iv) by adding at the end the following

subparagraph:

(E) TRANSFERS.Notwithstanding any

other provision of this title, the following

amounts shall also be available, without fiscal

year limitation, for making payments from the

Fund:

10

(i) UNOBLIGATED

NATIONAL ALLOT-

11

MENT FOR FISCAL YEARS BEGINNING WITH

12

FISCAL YEAR 2014.

13

(I) FISCAL

YEAR 2014 ALLOT-

14

MENT.As

15

year 2015, the portion, if any, of the

16

amount appropriated under subsection

17

(a) for fiscal year 2014 that is unobli-

18

gated for allotment to a State under

19

subsection (m) for such fiscal year.

20

of December 31 of fiscal

(II) SUCCEEDING

FISCAL YEAR

21

ALLOTMENTS.As

22

fiscal year 2016, and each succeeding

23

fiscal year, the portion, if any, of the

24

amount appropriated under subsection

25

(a) for the preceding fiscal year that

of December 31 of

ERN15177

S.L.C.

12

1

is unobligated for allotment to a State

under subsection (m) for such pre-

ceding fiscal year.

(ii) UNEXPENDED

ALLOTMENTS NOT

USED FOR REDISTRIBUTION.As

cember 31 of fiscal year 2015, and as of

November 15 of each succeeding fiscal

year, the total amount of allotments made

to States under subsection (a) for the sec-

10

ond preceding fiscal year that is not ex-

11

pended or redistributed under subsection

12

(f) during the period in which such allot-

13

ments are available for obligation.

14

(iii) UNEXPENDED

of De-

PERFORMANCE

15

INCENTIVE

16

2016, and as of January 1 of each suc-

17

ceeding calendar year, the portion, if any,

18

of the amount appropriated under section

19

2105(a)(3)(E)(iii) for the preceding fiscal

20

year that is not expended or obligated

21

under such section.; and

22

(B) in paragraph (3)

23

FUNDS.As

of January 1,

(i) in subparagraph (A)

24

(I) by redesignating clauses (i)

25

and (ii) as subclauses (I) and (II), re-

ERN15177

S.L.C.

13

1

spectively, and realigning the left mar-

gins accordingly;

(II) by striking If a States

and all that follows through 2015,

and inserting the following:

(i)

FOR

FISCAL

YEARS

2009

THROUGH 2014.If

under this title in fiscal year 2009, fiscal

year 2010, fiscal year 2011, fiscal year

10

2012, fiscal year 2013, or fiscal year

11

2014;

12

13

a States expenditures

(III) by striking or period each

place it appears;

14

(IV) in subclause (II) (as so re-

15

designated), by striking (or in which

16

the period occurs); and

17

(V) by adding at the end the fol-

18

lowing clause:

19

(ii)

20

21

FOR

FISCAL

YEARS

AFTER

GENERAL.For

each of

2014.

(I) IN

22

fiscal years 2015 through 2018 (and

23

for each of the semi-annual allotment

24

periods for fiscal year 2019), if the

25

Secretary determines that a State is a

ERN15177

S.L.C.

14

1

shortfall State described in subclause

(II) for that fiscal year or period, the

Secretary shall pay to the State from

the Fund, in addition to any other

payments made to the State under

this title for the fiscal year or period,

an amount equal to the amount de-

scribed in subclause (III).

(II) SHORTFALL

STATES

DE-

10

SCRIBED.For

11

clause, with respect to a fiscal year or

12

semi-annual allotment period, a short-

13

fall State is a State for which the Sec-

14

retary estimates, on the basis of the

15

most recent data available to the Sec-

16

retary, that the projected expenditures

17

for the State and fiscal year or period

18

under this title (including in the form

19

of coverage described in paragraph (1)

20

or (2) of section 2101, or both) will

21

exceed the sum of

purposes

of

this

22

(aa) the amount of the

23

States allotments for any pre-

24

ceding fiscal year that remains

25

available for expenditure and

ERN15177

S.L.C.

15

1

that will not be expended by the

end of the immediately preceding

fiscal year;

(bb) the amount (if any)

that will be redistributed to the

State under subsection (f) for the

fiscal year or period;

(cc) the amount (if any) to

be paid to the State in the first

10

quarter of the fiscal year under

11

section 2105(a)(3); and

12

(dd) the amount of the

13

States allotment for the fiscal

14

year or period.

15

(III)

AMOUNT

DESCRIBED.

16

With respect to a State and fiscal

17

year or period, the amount described

18

in this subclause is equal to the

19

amount by which the projected ex-

20

penditures for the State under this

21

title for the fiscal year or period (esti-

22

mated by the Secretary on the basis

23

of the most recent data available to

24

the Secretary) exceed the sum deter-

ERN15177

S.L.C.

16

1

mined under subclause (II) for the

State and fiscal year or period.

(IV) RETROSPECTIVE

ADJUST-

MENT.The

determinations made under this clause

with respect to a State and fiscal year

or period as necessary on the basis of

the amounts reported by States not

later than November 30 of the suc-

10

ceeding fiscal year, as approved by the

11

Secretary.;

12

(ii) in subparagraph (B)(ii), by strik-

13

ing (or semi-annual period occurring in a

14

fiscal year);

15

Secretary may adjust the

(iii) in subparagraph (C)

16

(I) in the matter preceding clause

17

(i), by striking subparagraph (A)(ii)

18

and

19

(A)(i)(II); and

inserting

subparagraph

20

(II) in clause (ii), by striking

21

(or semi-annual period occurring in a

22

fiscal year); and

23

(iv) in subparagraph (G), by inserting

24

the expenditures under the State child

25

health plan and after regarding.

ERN15177

S.L.C.

17

1

(2)

CONFORMING

AMENDMENT.Section

2104(f)(2)(A)(ii) of the Social Security Act (42

U.S.C. 13957dd(f)(2)(A)(ii)) is amended by insert-

ing only in the case of a fiscal year before fiscal

year 2015, before the amount.

(d) EXTENSION

7

8

9

10

11

12

13

CENTIVE

AND

UPDATE

OF

PERFORMANCE IN-

PAYMENTS.

(1)

EXTENSION

THROUGH

FISCAL

YEAR

2019.Section 2105(a)(3) of the Social Security

Act (42 U.S.C. 1397ee(a)(3)) is amended

(A) in subparagraph (A)

(i) by striking 2013 and inserting

2019; and

14

(ii) in the second sentence, by insert-

15

ing , except that payment under this

16

paragraph may be made to a State for fis-

17

cal year 2014 as a single payment not

18

later than December 31, 2015 before the

19

period;

20

(B) in subparagraph (E)

21

(i) in clause (ii)

22

23

24

25

(I) by striking subclause (I) and

inserting the following:

(I)

UNOBLIGATED

NATIONAL

ALLOTMENT FOR FISCAL YEARS 2009

ERN15177

S.L.C.

18

1

THROUGH 2013.As

of fiscal year 2009, and as of Decem-

ber 31 of each succeeding fiscal year

through fiscal year 2013, the portion,

if any, of the amount appropriated

under section 2104(a) for such fiscal

year that is unobligated for allotment

to a State under section 2104(m) for

such fiscal year or set aside under

10

subsection (a)(3) or (b)(2) of section

11

2111 for such fiscal year.;

12

of December 31

(II) in subclause (III), by strik-

13

ing 2013 and inserting 2014;

14

(ii) by redesignating clause (iii) as

15

16

17

18

clause (iv); and

(iii) by inserting after clause (ii) the

following new clause:

(iii) APPROPRIATION

FOR

FISCAL

19

YEARS 2015 THROUGH 2019.Out

20

money in the Treasury not otherwise ap-

21

propriated,

22

$500,000,000 for each of fiscal years 2015

23

through 2019 for making payments under

24

this paragraph. Amounts appropriated for

25

a fiscal year under this clause shall remain

there

are

of any

appropriated

ERN15177

S.L.C.

19

1

available for making payments under this

paragraph until January 1 of the following

fiscal year. Any amounts of such appro-

priations that remain unexpended or unob-

ligated as of such date shall be transferred

and made available for making payments

under section 2104(n).; and

(C) in subparagraph (F)(iii), by striking

9

10

2013 and inserting 2019.

(2) UPDATED

PERFORMANCE INCENTIVE CRI-

11

TERIA FOR FISCAL YEARS 2015 THROUGH 2019.Sec-

12

tion 2105(a) of the Social Security Act (42 U.S.C.

13

1397ee(a)) is amended

14

(A) in paragraph (3)(A), by inserting or

15

(5) after paragraph (4);

16

(B) in paragraph (4)

17

(i) in the heading, by inserting FIS-

18

CAL

YEARS

19

FOR

CHILDREN;

2009

THROUGH

2014

after

and

20

(ii) in the matter preceding subpara-

21

graph (A), by striking for a fiscal year if

22

and inserting for fiscal years 2009

23

through 2014 if; and

24

(C) by adding at the end the following new

25

paragraph:

ERN15177

S.L.C.

20

1

(5) ENROLLMENT

AND

RETENTION

PROVI-

SIONS FOR CHILDREN FOR FISCAL YEAR 2015 AND

SUCCEEDING FISCAL YEARS.

(A) IN

GENERAL.For

purposes of para-

graph (3)(A), a State meets the condition of

this paragraph for fiscal year 2015 and any

succeeding fiscal year if it is implementing at

least 4 of the enrollment and retention provi-

sions specified in subparagraph (B) (treating

10

each clause as a separate enrollment and reten-

11

tion provision) throughout the entire fiscal year.

12

(B) ENROLLMENT

AND RETENTION PRO-

13

VISIONS.The

14

sions specified in this subparagraph are the fol-

15

lowing:

16

enrollment and retention provi-

(i) CONTINUOUS

ELIGIBILITY.The

17

State has elected the option of continuous

18

eligibility for a full 12 months for all chil-

19

dren described in section 1902(e)(12)

20

under title XIX under 19 years of age, as

21

well as applying such policy under its State

22

child health plan under this title.

23

(ii) EXPRESS

LANE ELIGIBILITY.

24

The State is implementing the option de-

25

scribed in section 1902(e)(13) under title

ERN15177

S.L.C.

21

1

XIX as well as, pursuant to section

2107(e)(1), under this title.

(iii) PRESUMPTIVE

ELIGIBILITY.

The State provides medical assistance to

children during a presumptive eligibility

period by implementing section 1920A

under title XIX as well as, pursuant to

section 2107(e)(1), under this title, and

ensures that such period begins with the

10

determination by any qualified entity that

11

the family income of the child does not ex-

12

ceed the applicable level of income eligi-

13

bility under the State plan. A State shall

14

not satisfy this provision if the only type of

15

entity recognized by the State as a quali-

16

fied entity is a hospital that has elected to

17

be

18

1902(a)(47)(B).

qualified

entity

under

section

19

(iv) PREMIUM

20

PLOYER-SPONSORED

21

has opted to offer a premium assistance

22

subsidy for qualified employer-sponsored

23

coverage by implementing section 1906A

24

under title XIX or the option described in

25

section 2105(c)(10) under this title.

ASSISTANCE FOR EMPLANS.The

State

ERN15177

S.L.C.

22

1

(v) ELIMINATION

OF WAITING PERI-

ODS.The

ing period for coverage of any individual

under the State child health plan and en-

sures that no waiting period applies in the

case of coverage provided to any individual

eligible for coverage under the State child

health plan through coverage purchased by

the State under section 2105(c)(3) or em-

10

ployer-sponsored coverage subsidized by

11

the State under section 1906A of title XIX

12

or section 2105(c)(10) of this title.

13

State does not impose a wait-

(vi) AUTOMATED

TRACKING OF COST

14

SHARING OR LOWER CAP ON COST SHAR-

15

ING.In

16

plan that imposes premiums, deductibles,

17

cost sharing, or similar charges that could

18

(as determined by the Secretary) cause

19

families that include an individual receiv-

20

ing assistance under the plan to have out-

21

of-pocket expenses that exceed the limit

22

imposed under section 2103(e)(3)(B), the

23

State has either

the case of a State child health

24

(I) established, or, in the case

25

of a State child health plan that pro-

ERN15177

S.L.C.

23

1

vides child health assistance through

managed care entities or organiza-

tions, required such entities or organi-

zations to coordinate with the State

agency responsible for implementing

the State child health plan under this

title in establishing

(aa) an electronic process

for tracking such expenses that

10

does not rely on documentation

11

provided by the individual or the

12

family; and

13

(bb) a system for notifying

14

each such family of the aggregate

15

monthly or quarterly limits on

16

out-of-pocket expenses applicable

17

to

18

2103(e)(3)(B) and explaining to

19

each such family that no such ex-

20

penses shall be imposed on any

21

individual in the family for the

22

remainder of any month or quar-

23

ter with respect to which the

24

family has reached the applicable

25

aggregate monthly or quarterly

the

family

under

section

ERN15177

S.L.C.

24

1

family limit imposed under such

section; or

(II)

elected

to

eliminate

deductibles, copayments, coinsurance,

or other forms of cost-sharing (other

than premiums) imposed under this

title with respect to any individual re-

ceiving coverage under the State child

health plan.

10

(vii) REAL-TIME

ELIGIBILITY DETER-

11

MINATIONS THROUGH THE USE OF EN-

12

HANCED DATA SOURCES.With

13

applications and renewals for medical as-

14

sistance under title XIX or child health as-

15

sistance under this title for a fiscal year,

16

the State meets the following criteria for

17

all income determinations made using

18

modified adjusted gross income under sec-

19

tion 1902(e)(14)(A):

respect to

20

(I) The State relies on enhanced

21

data sources (which may include, but

22

shall not be limited to, the data

23

sources available under section 1137

24

or the federal Data Services Hub) to

25

make the determinations.

ERN15177

S.L.C.

25

1

(II) In the case of initial appli-

cations, the State makes at least 50

percent of the determinations within

24 hours of receiving the application.

If a State successfully makes the re-

quired minimum percentage of timely

determinations for a fiscal year, such

State shall not receive credit for meet-

ing this provision in any subsequent

10

fiscal year unless the State makes a

11

percentage of timely income deter-

12

minations that is at least 5 percentage

13

points higher (or, if at least 75 per-

14

cent of the States determinations in a

15

previous fiscal year were timely, 1

16

percentage point higher) than the per-

17

centage that the State achieved in the

18

last fiscal year in which the State re-

19

ceived credit for meeting this provi-

20

sion.

21

(III) In the case of renewals,

22

the State makes at least 50 percent of

23

the determinations within 24 hours of

24

receiving the renewal. If a State suc-

25

cessfully makes the required minimum

ERN15177

S.L.C.

26

1

percentage of timely determinations

for a fiscal year, such State shall not

receive credit for meeting this provi-

sion in any subsequent fiscal year un-

less the State makes a percentage of

timely income determinations that is

at least 5 percentage points higher

(or, if at least 75 percent of the

States determinations in a previous

10

fiscal year were timely, 1 percentage

11

point higher) than the percentage that

12

the State achieved in the last fiscal

13

year in which the State received credit

14

for meeting this provision.

15

(viii) ELIMINATION

OF PREMIUMS OR

16

RETROACTIVE REINSTATEMENT UPON PRE-

17

MIUM PAYMENT.The

18

either

State has elected to

19

(I) impose no premiums for cov-

20

erage under the State child health

21

plan; or

22

(II) in the case of an individual

23

whose coverage under the State child

24

health plan has been terminated for

25

failure to make premium payments,

ERN15177

S.L.C.

27

1

provide assistance to such individual

for purposes of immediate reenroll-

ment of the individual upon payment

of outstanding premiums, with cov-

erage retroactive to the beginning of

the most recent month for which an

outstanding premium has been paid,

and shall not impose any waiting pe-

riod or fee as a condition of such re-

10

11

enrollment..

(e) EXTENSION

OF

QUALIFYING STATES OPTION.

12 Section 2105(g)(4) of the Social Security Act (42 U.S.C.

13 1397ee(g)(4)) is amended

14

15

16

(1) in the paragraph heading, by striking

2015 and inserting 2019; and

(2) in subparagraph (A), by striking 2015

17

and inserting 2019.

18

(f) EXTENSION

19

20

ONSTRATION

OF

CERTAIN PROGRAMS

AND

DEM-

PROJECTS.

(1) QUALITY

CARE

FOR

CHILDREN

DEM-

21

ONSTRATION PROJECT.Section

22

Social Security Act (42 U.S.C. 1320b9a(d)(1)) is

23

amended in the matter before subparagraph (A) by

24

inserting , and during the period of fiscal years

1139A(d)(1) of the

ERN15177

S.L.C.

28

1

2016 through 2019, the Secretary shall award not

more than 10 grants, before to States.

(2)

CHILDHOOD

OBESITY

DEMONSTRATION

PROJECT.Section

rity Act (42 U.S.C. 1320b9a(e)(8)) is amended by

inserting , and $25,000,000 for the period of fiscal

years 2015 though 2019 after 2014.

8

9

(3)

1139A(e)(8) of the Social Secu-

PEDIATRIC

GRAM.Section

QUALITY

MEASURES

PRO-

1139A(i) of the Social Security Act

10

(42 U.S.C. 1320b9a(i)) is amended in the first sen-

11

tence by inserting before the period at the end the

12

following: , and there is appropriated for each of

13

fiscal years 2016 through 2019, $45,000,000 for the

14

purpose of carrying out this section (other than sub-

15

sections (e), (f), and (g))..

16

(4) OUTREACH

AND ENROLLMENT GRANTS; NA-

17

TIONAL CAMPAIGN.Section

18

curity Act (42 U.S.C. 1397mm) is amended

19

20

2113 of the Social Se-

(A) in subsection (a)(1), by striking

2015 and inserting 2019; and

21

(B) in subsection (g), by inserting , and

22

$80,000,000 for the period of fiscal years 2016

23

through 2019, to remain available until ex-

24

pended, after 2015.

ERN15177

S.L.C.

29

1

(g)

EXPRESS

LANE

ELIGIBILITY.Section

2 1902(e)(13)(I) of the Social Security Act (42 U.S.C.

3 1396a(e)(13)(I)) is amended by striking September 30,

4 2015 and inserting September 30, 2019.

5

(h) AUTHORITY TO USE INCOME DETERMINATION

6 MADE

UNDER

CERTAIN

PROGRAMS.Section

7 1902(e)(14) of the Social Security Act (42 U.S.C.

8 1396a(e)(14)) is amended

9

(1) in subparagraph (A), in the first sentence,

10

by striking subparagraph (D) and inserting sub-

11

paragraphs (D) and (J); and

12

13

14

15

16

(2) by adding at the end the following new subparagraph:

(J) USE

OF

INCOME

DETERMINATION

MADE UNDER CERTAIN OTHER PROGRAMS.

(i) IN

GENERAL.For

purposes of

17

determining income eligibility for medical

18

assistance under the State plan or under

19

any waiver of such plan, a State may use

20

a determination of income made by

21

22

(I) the State program funded

under part A of title IV; or

23

(II) the supplemental nutrition

24

assistance program established under

25

the Food and Nutrition Act of 2008.

ERN15177

S.L.C.

30

1

2

(ii) SUNSET.Clause (i) shall not

apply after September 30, 2019..

Das könnte Ihnen auch gefallen

- Therapy CapsDokument21 SeitenTherapy CapsthemorningconsultNoch keine Bewertungen

- Women's HealthDokument12 SeitenWomen's HealththemorningconsultNoch keine Bewertungen

- Ryan-Murray II MedicareDokument2 SeitenRyan-Murray II MedicarethemorningconsultNoch keine Bewertungen

- Path Forward On Doc Fix 3-31Dokument2 SeitenPath Forward On Doc Fix 3-31themorningconsultNoch keine Bewertungen

- Lee PAYGODokument1 SeiteLee PAYGOthemorningconsultNoch keine Bewertungen

- Cornyn Individual MandateDokument1 SeiteCornyn Individual MandatethemorningconsultNoch keine Bewertungen

- Oact HR2 04-09-2015Dokument13 SeitenOact HR2 04-09-2015themorningconsultNoch keine Bewertungen

- Morning Consult 2014 GradesDokument204 SeitenMorning Consult 2014 GradesthemorningconsultNoch keine Bewertungen

- MC National Poll - CrosstabsDokument100 SeitenMC National Poll - CrosstabsthemorningconsultNoch keine Bewertungen

- SOTU ReactionsDokument55 SeitenSOTU ReactionsthemorningconsultNoch keine Bewertungen

- MC National Poll - ToplineDokument12 SeitenMC National Poll - ToplinethemorningconsultNoch keine Bewertungen

- Morning Consult Early December CrosstabsDokument91 SeitenMorning Consult Early December CrosstabsthemorningconsultNoch keine Bewertungen

- Morning Consult 2015 SOTU Dial TestDokument55 SeitenMorning Consult 2015 SOTU Dial TestthemorningconsultNoch keine Bewertungen

- Jan. 16-19 Poll ResultsDokument94 SeitenJan. 16-19 Poll ResultsthemorningconsultNoch keine Bewertungen

- Dec. 6 - 9 Poll Topline ResultsDokument10 SeitenDec. 6 - 9 Poll Topline ResultsthemorningconsultNoch keine Bewertungen

- Drilling On Federal Lands SurveyDokument29 SeitenDrilling On Federal Lands SurveythemorningconsultNoch keine Bewertungen

- Net Neutrality Crosstabulation ResultsDokument35 SeitenNet Neutrality Crosstabulation ResultsthemorningconsultNoch keine Bewertungen

- Morning Consult Early December CrosstabsDokument91 SeitenMorning Consult Early December CrosstabsthemorningconsultNoch keine Bewertungen

- GBC Data ReportDokument253 SeitenGBC Data ReportthemorningconsultNoch keine Bewertungen

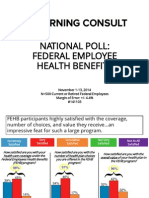

- Crosstabs: Federal Employee Health BenefitDokument14 SeitenCrosstabs: Federal Employee Health BenefitthemorningconsultNoch keine Bewertungen

- GBC Data ReportDokument253 SeitenGBC Data ReportthemorningconsultNoch keine Bewertungen

- GBC ChartsDokument22 SeitenGBC ChartsthemorningconsultNoch keine Bewertungen

- Congress-ACA Voter Trust CrosstabulationsDokument57 SeitenCongress-ACA Voter Trust CrosstabulationsthemorningconsultNoch keine Bewertungen

- GBC Data ReportDokument9 SeitenGBC Data ReportthemorningconsultNoch keine Bewertungen

- November 2014 Health Exchanges Cross TabulationsDokument38 SeitenNovember 2014 Health Exchanges Cross TabulationsthemorningconsultNoch keine Bewertungen

- Memo: Federal Employee Health BenefitsDokument1 SeiteMemo: Federal Employee Health BenefitsthemorningconsultNoch keine Bewertungen

- Charts - Federal Employee Health BenefitsDokument9 SeitenCharts - Federal Employee Health BenefitsthemorningconsultNoch keine Bewertungen

- Data Breaches PollingDokument34 SeitenData Breaches PollingthemorningconsultNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Journal Homepage: - : IntroductionDokument2 SeitenJournal Homepage: - : IntroductionIJAR JOURNALNoch keine Bewertungen

- GGGDGGDokument414 SeitenGGGDGGOtiosse MyosotisNoch keine Bewertungen

- Konsep HaccpDokument86 SeitenKonsep HaccpFauziah Alam AlfharishyNoch keine Bewertungen

- Viral HEPATITIS PPT by ApplemberDokument45 SeitenViral HEPATITIS PPT by ApplemberEmpress ApplemberNoch keine Bewertungen

- Professional Adjustment, Leadership-Management Post-Test Set ADokument7 SeitenProfessional Adjustment, Leadership-Management Post-Test Set AYaj CruzadaNoch keine Bewertungen

- Eucalyptus OilDokument17 SeitenEucalyptus OilSorinGeorgeNoch keine Bewertungen

- Role of IV Meropenem in Current EraDokument38 SeitenRole of IV Meropenem in Current EraImtiyaz Alam SahilNoch keine Bewertungen

- Progressive Balbar Palsy: Dr. Mohamed Ali 3 Year MD IM ResidentDokument15 SeitenProgressive Balbar Palsy: Dr. Mohamed Ali 3 Year MD IM ResidentMohamed AliNoch keine Bewertungen

- Clinico-Pathological Review On Pravahika Vis-A-Vis AmoebiasisDokument3 SeitenClinico-Pathological Review On Pravahika Vis-A-Vis AmoebiasisAdvanced Research PublicationsNoch keine Bewertungen

- Research FinalDokument31 SeitenResearch FinalLiezl mm100% (1)

- Post Offer Employment Health Questionnaire SalariedDokument2 SeitenPost Offer Employment Health Questionnaire Salariedtylers0421Noch keine Bewertungen

- 1101 FullDokument8 Seiten1101 FullAprilia R. PermatasariNoch keine Bewertungen

- Acute Severe Asthma (Status Asthmaticus)Dokument20 SeitenAcute Severe Asthma (Status Asthmaticus)blok etikakedokteranNoch keine Bewertungen

- Miasm IntroductionDokument11 SeitenMiasm IntroductionsurabhiNoch keine Bewertungen

- Artificial RespirationDokument3 SeitenArtificial RespirationRenju JoseNoch keine Bewertungen

- 4th Five Year PlanDokument15 Seiten4th Five Year PlanKrishnaveni MurugeshNoch keine Bewertungen

- Health Vs FitnessDokument5 SeitenHealth Vs FitnessAmy RathoreNoch keine Bewertungen

- (DR Schuster, Nykolyn) Communication For Nurses H (BookFi)Dokument215 Seiten(DR Schuster, Nykolyn) Communication For Nurses H (BookFi)Ariefatun Nisa100% (1)

- Application of Biotechnology in Food, Pharmaceuticals and Agriculture IndustriesDokument22 SeitenApplication of Biotechnology in Food, Pharmaceuticals and Agriculture IndustriesLov SaxenaNoch keine Bewertungen

- Benefits of An Experimental Program of Equestrian Therapy For Children With ADHD PDFDokument10 SeitenBenefits of An Experimental Program of Equestrian Therapy For Children With ADHD PDFJuli DeviaNoch keine Bewertungen

- Nutrition and Students Academic PerformanceDokument10 SeitenNutrition and Students Academic Performanceapi-222239614Noch keine Bewertungen

- Fundamentals of Caregiving Learner’s GuideDokument357 SeitenFundamentals of Caregiving Learner’s GuideBfp SapangdalagaNoch keine Bewertungen

- Are Gadgets and Technology Good or Bad For Students?Dokument2 SeitenAre Gadgets and Technology Good or Bad For Students?Angel C.Noch keine Bewertungen

- Soal Lokasi KIK - 2Dokument2 SeitenSoal Lokasi KIK - 2novida nainggolanNoch keine Bewertungen

- Module 1Dokument52 SeitenModule 1Sarim AliNoch keine Bewertungen

- Danone Integrated Annual Report 2021Dokument40 SeitenDanone Integrated Annual Report 2021mohit gedamNoch keine Bewertungen

- Salicylic Acid and Sulfur (Topical Route) : Commonly Used Brand Name(s)Dokument9 SeitenSalicylic Acid and Sulfur (Topical Route) : Commonly Used Brand Name(s)Gutu DoinaNoch keine Bewertungen

- FAO - Belgium - Annisya Ayu R.Dokument3 SeitenFAO - Belgium - Annisya Ayu R.Annisya RamadhaniNoch keine Bewertungen

- Drug StudyDokument1 SeiteDrug StudyBSN 3-2 RUIZ, Jewel Anne F.Noch keine Bewertungen

- Congenital Adrenal HyperplasiaDokument29 SeitenCongenital Adrenal HyperplasiaMohan RaoNoch keine Bewertungen