Beruflich Dokumente

Kultur Dokumente

Bear Spread - Stock Option Investment Strategy

Hochgeladen von

Sushil MundelOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bear Spread - Stock Option Investment Strategy

Hochgeladen von

Sushil MundelCopyright:

Verfügbare Formate

3/4/2015

"BearSpread"StockOptionInvestmentStrategy

BearSpreadStockOptionInvestmentStrategy

By:InvestorGuideStaff,datedJanuary25th,2013

1

Stockoptionsarecontractsthatgiveholderstheright(butnottheobligation)tobuyorsell100sharesofstockatasetpricebytheexpirationdateofthe

contract.Whentheholderexercisesacalloption,theyareobligatingtheoriginalwriter(seller)tosell100sharesofstockatthestrikeprice.Acall

optionispurchasedbyaninvestorwhobelievesthatthepriceoftheunderlyingstockwillrisebeforetheexpirationdatetoatleastthelistedstrike

price.Aputoption,ontheotherhand,ispurchasedbyaninvestorwhothinksthattheunderlyingpriceofstockwilldropbeforetheexpirationdate.

Therefore,theholderofaputoptioncansellthe100sharesofstockanearlier,higherprice,shouldthepricedropasanticipated.Theparticularstock

optionstrategyyouuse(forbothcallandputoptions)willdependontheoveralltrendofthemarket.

Bearmarketsaremostcommonduringrecessions.But,likeallphasesoftheeconomiccycle,thereisalwaysaperiodoftransition.Forinstance,an

investormaybelievethemarkettostillbeinabearcycle(andexpectoveralldownwardpressureonstockprices),butalsobelievethatthingsare

improvingtothepointthatpriceswilleitherceasefallingoratleastfallatlowerrates.Forinvestorswhothinkthemarketisstillinabearcycle,but

closetoemergingintoaneutral,orevenbullmarket,abearspreadstockoptioninvestmentstrategymaybethebest.

data:text/htmlcharset=utf8,%3Ch1%20style%3D%22outline%3A%20none%3B%20borderbottomstyle%3A%20none%20!important%3B%20color%3A%20rgb(0%2C%2087%2C%20183)%3B%20fontsize%3A%2022px%3B%2

1/3

3/4/2015

"BearSpread"StockOptionInvestmentStrategy

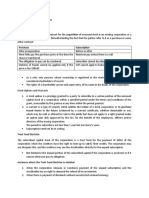

Thebearspreadstrategycanbeusedforbothcallandputoptions.Forthosewithcalloptions,theideaistobuyanoption(withastrikeprice1)while

alsowritinganoptionthathasalowerstrikeprice

(strikeprice2)withtheresultbeinganetcredit.But,forthoseinvestorswithputoptionswhomaywanttobuyaputoptionatahigherstrikepricewhile

alsosellingaputoptionatalowerstrikeprice,theresultisanetdebit.

Bothpotentialprofitsandlossesarelimitedusingthebearspreadstockoptioninvestmentstrategy.Themaximumprofitlevelisattainedinthisstrategy

whenthefinalstockpriceisat,orbelow,strikeprice2fortheoptionthatwassold,beitaputorcalloption.Forthoseinvestorswithcalloptions,this

maximumprofitlevelwillbethenetinitialcredit.Ifyouwereusingputoptions,thistotalprofitislimitedtothedifferencebetweenstrikeprices,minusthe

initialdebit.

Themaximumlossofthebearspreadstrategyisreachedwhenthestockrestsatorabovethestrikeprice1duringthetimeofexpiration.Forthosewith

calloptions,thismaximumlosswillbeequaltothedifferencebetweenstrikeprice1andstrikeprice2,minustheinitialcredit.Forthosewithputoptions,

maximumlossisequaltotheinitialdebit.

data:text/htmlcharset=utf8,%3Ch1%20style%3D%22outline%3A%20none%3B%20borderbottomstyle%3A%20none%20!important%3B%20color%3A%20rgb(0%2C%2087%2C%20183)%3B%20fontsize%3A%2022px%3B%2

2/3

3/4/2015

Wasthishelpful? YES

"BearSpread"StockOptionInvestmentStrategy

NO

Otherr

data:text/htmlcharset=utf8,%3Ch1%20style%3D%22outline%3A%20none%3B%20borderbottomstyle%3A%20none%20!important%3B%20color%3A%20rgb(0%2C%2087%2C%20183)%3B%20fontsize%3A%2022px%3B%2

3/3

Das könnte Ihnen auch gefallen

- Mckinsey DCF Valuation 2000Dokument5 SeitenMckinsey DCF Valuation 2000tiago.ohori03415150% (2)

- Hedging Strategies Using OptionsDokument33 SeitenHedging Strategies Using Optionsaanu1234Noch keine Bewertungen

- Marriott Case FinalDokument17 SeitenMarriott Case FinalFabia BourdaNoch keine Bewertungen

- Neufund Whitepaper Jan 17Dokument37 SeitenNeufund Whitepaper Jan 17xolilevNoch keine Bewertungen

- Team 14 - Boeing 7E7Dokument10 SeitenTeam 14 - Boeing 7E7Niken PramestiNoch keine Bewertungen

- 10 Glossary For OptionsDokument10 Seiten10 Glossary For OptionsTreasure FoundNoch keine Bewertungen

- DerivativesDokument11 SeitenDerivativesPooja AdhikariNoch keine Bewertungen

- Options StrategiesDokument12 SeitenOptions StrategiesVittalDass143 VittalNoch keine Bewertungen

- Handz University: Trading OptionsDokument44 SeitenHandz University: Trading OptionsAman JainNoch keine Bewertungen

- Hedging With OptionsDokument4 SeitenHedging With OptionsboletodonNoch keine Bewertungen

- Stock Option BasicsDokument62 SeitenStock Option BasicsArvind DasNoch keine Bewertungen

- Option Strategies For Novice TradersDokument27 SeitenOption Strategies For Novice Tradersik001Noch keine Bewertungen

- Options Trading Basics The Ins and Outs of Options Trading For Beginners 1368Dokument3 SeitenOptions Trading Basics The Ins and Outs of Options Trading For Beginners 1368IvanaBurićNoch keine Bewertungen

- Education: o o o o oDokument15 SeitenEducation: o o o o oRaj GaikarNoch keine Bewertungen

- Section 1 - Overview and Option Basics: Download This in PDF FormatDokument10 SeitenSection 1 - Overview and Option Basics: Download This in PDF FormatKaraokeNoch keine Bewertungen

- An Introduction To OptionsDokument22 SeitenAn Introduction To OptionsbrijeeshNoch keine Bewertungen

- Option StrategiesDokument9 SeitenOption StrategiesSatya Kumar100% (1)

- Greeks: Type Delta Value Profits When..Dokument6 SeitenGreeks: Type Delta Value Profits When..Anurag SinghNoch keine Bewertungen

- Option Trading GuideDokument17 SeitenOption Trading GuideMariusD100% (1)

- Protective Options StrategiesDokument258 SeitenProtective Options StrategiesdiogonbigNoch keine Bewertungen

- What Are Options?: Here Is How I Define OptionDokument10 SeitenWhat Are Options?: Here Is How I Define OptionAkshay SinghNoch keine Bewertungen

- The Call Option: Short Selling - Not For The Faint HeartedDokument3 SeitenThe Call Option: Short Selling - Not For The Faint HeartedSumit RathiNoch keine Bewertungen

- Butterfly SpreadDokument42 SeitenButterfly Spreadankit_21100% (1)

- Stock Options - Basic Strategies For A Lifetime of Option InvestingDokument19 SeitenStock Options - Basic Strategies For A Lifetime of Option Investingrkumar123Noch keine Bewertungen

- DV TheoryDokument8 SeitenDV Theoryudaya kumarNoch keine Bewertungen

- Derivatives ManagementDokument13 SeitenDerivatives ManagementMaharajascollege KottayamNoch keine Bewertungen

- Basics of Option GreekDokument4 SeitenBasics of Option GreekMrityunjay KumarNoch keine Bewertungen

- Financial Drivatives Assignment 2Dokument6 SeitenFinancial Drivatives Assignment 2striker shakeNoch keine Bewertungen

- Glossory A AccumulationDokument33 SeitenGlossory A AccumulationAmit KumarNoch keine Bewertungen

- Chapter 4 Sent DRMDokument41 SeitenChapter 4 Sent DRMSarvar PathanNoch keine Bewertungen

- Types of OptionsDokument8 SeitenTypes of Optionsching_pongNoch keine Bewertungen

- What Is An Options Contract?Dokument2 SeitenWhat Is An Options Contract?Niño Rey LopezNoch keine Bewertungen

- Financial Engineering & Risk Management: Unit - VDokument16 SeitenFinancial Engineering & Risk Management: Unit - VPrakash ChoudharyNoch keine Bewertungen

- Guide To Expert Options Trading: Advanced Strategies That Will Put You in The Money FastDokument16 SeitenGuide To Expert Options Trading: Advanced Strategies That Will Put You in The Money Fastemma0% (1)

- An Option Is Part of A Class of Securities Called DerivativesDokument9 SeitenAn Option Is Part of A Class of Securities Called DerivativesajnabeeesNoch keine Bewertungen

- Project 5.3 Option MarketDokument22 SeitenProject 5.3 Option MarketKavita KohliNoch keine Bewertungen

- Call Option: Example of A Call Option On A StockDokument4 SeitenCall Option: Example of A Call Option On A StockNiraj KumarNoch keine Bewertungen

- Der Rive TiesDokument30 SeitenDer Rive TiesDEEPAK KUMAR MALLICKNoch keine Bewertungen

- Options NotesDokument7 SeitenOptions Noteshmerin100% (2)

- Put Option: Instrument ModelsDokument4 SeitenPut Option: Instrument ModelsPutta Vinay KumarNoch keine Bewertungen

- Option Pricing (FD)Dokument3 SeitenOption Pricing (FD)Shrestha VarshneyNoch keine Bewertungen

- Optiontradingbook PDFDokument18 SeitenOptiontradingbook PDFdonhankietNoch keine Bewertungen

- Seven Professional Options Strategies Every Trader Needs To KnowDokument6 SeitenSeven Professional Options Strategies Every Trader Needs To KnowrblaisNoch keine Bewertungen

- Naked OptionDokument3 SeitenNaked OptionRayzwanRayzmanNoch keine Bewertungen

- Options Trading Strategies: A Guide For Beginners: Elvin MirzayevDokument4 SeitenOptions Trading Strategies: A Guide For Beginners: Elvin MirzayevJonhmark AniñonNoch keine Bewertungen

- 11 - U102088 - Futops FaqsDokument11 Seiten11 - U102088 - Futops FaqsSanjeev MohapatraNoch keine Bewertungen

- 05.option FaqsDokument15 Seiten05.option FaqsAMAN KUMAR KHOSLANoch keine Bewertungen

- Content:: Option Strategies: 1. Long CallDokument6 SeitenContent:: Option Strategies: 1. Long CallVIHARI DNoch keine Bewertungen

- Unit 3 FDDokument28 SeitenUnit 3 FDsaurabh thakurNoch keine Bewertungen

- What Is Options TradingDokument10 SeitenWhat Is Options TradingRayzwanRayzmanNoch keine Bewertungen

- What Is An Option?: Key TakeawaysDokument7 SeitenWhat Is An Option?: Key Takeawaysramyatan SinghNoch keine Bewertungen

- Financial Engineering (FIBA704) : AssignmentDokument4 SeitenFinancial Engineering (FIBA704) : AssignmentPranesh BhattacharjeeNoch keine Bewertungen

- Summary Derivative Option (04!11!2021)Dokument4 SeitenSummary Derivative Option (04!11!2021)Shafa ENoch keine Bewertungen

- HowToWin FYST EbookDokument12 SeitenHowToWin FYST Ebookmehdi810Noch keine Bewertungen

- Option StrategiesDokument25 SeitenOption Strategiesaditya_singh3036844Noch keine Bewertungen

- Call & PutsDokument4 SeitenCall & PutsInternetian XNoch keine Bewertungen

- Chapter-3 Options: Meaning of Options-Options Are Financial Derivatives That Give Buyers TheDokument15 SeitenChapter-3 Options: Meaning of Options-Options Are Financial Derivatives That Give Buyers TheRaj KumarNoch keine Bewertungen

- Oa 3 Simple Options Strategies PDFDokument38 SeitenOa 3 Simple Options Strategies PDFRoberto Passero100% (1)

- Project topic:-TYPES OF OPTIONDokument17 SeitenProject topic:-TYPES OF OPTIONShreya JoshiNoch keine Bewertungen

- Long PutDokument3 SeitenLong PutpkkothariNoch keine Bewertungen

- 1 Directional Trading Strategies: 1.1 The Strategy MatrixDokument10 Seiten1 Directional Trading Strategies: 1.1 The Strategy MatrixTrần AnhNoch keine Bewertungen

- Dipi DataDokument10 SeitenDipi DataJigisha PatelNoch keine Bewertungen

- Options Market: Introduction ToDokument40 SeitenOptions Market: Introduction ToKurtNoch keine Bewertungen

- 9 How To Improve Maths - Aptitude Calculation Speed - Gr8AmbitionZDokument17 Seiten9 How To Improve Maths - Aptitude Calculation Speed - Gr8AmbitionZSushil MundelNoch keine Bewertungen

- Civil Engineer Interview QuestionsDokument2 SeitenCivil Engineer Interview QuestionsSushil MundelNoch keine Bewertungen

- Top Companies India: Companies List Survey Companies CEO CompaniesDokument14 SeitenTop Companies India: Companies List Survey Companies CEO CompaniesSushil MundelNoch keine Bewertungen

- 7 Mental Maths (Comparison of Fractions) - Part 2 - Gr8AmbitionZDokument10 Seiten7 Mental Maths (Comparison of Fractions) - Part 2 - Gr8AmbitionZSushil MundelNoch keine Bewertungen

- Tata Group - Wikipedia, The Free EncyclopediaDokument17 SeitenTata Group - Wikipedia, The Free EncyclopediaSushil MundelNoch keine Bewertungen

- Multinational Companies in India (MNC)Dokument17 SeitenMultinational Companies in India (MNC)Sushil MundelNoch keine Bewertungen

- Citigroup DCDokument33 SeitenCitigroup DCSushil MundelNoch keine Bewertungen

- Financial EntrepreneurDokument4 SeitenFinancial EntrepreneurSushil MundelNoch keine Bewertungen

- Kotak Mahindra Bank - Wikipedia, The Free EncyclopediaDokument5 SeitenKotak Mahindra Bank - Wikipedia, The Free EncyclopediaSushil MundelNoch keine Bewertungen

- Canal OutletsDokument68 SeitenCanal OutletsSushil MundelNoch keine Bewertungen

- Business Plan For Financial ServicesDokument2 SeitenBusiness Plan For Financial ServicesSushil MundelNoch keine Bewertungen

- Business Plan For ConsultancyDokument2 SeitenBusiness Plan For ConsultancySushil Mundel100% (1)

- Business Plan For BPODokument3 SeitenBusiness Plan For BPOSushil MundelNoch keine Bewertungen

- Academic Calender 2013 2014Dokument5 SeitenAcademic Calender 2013 2014Sushil MundelNoch keine Bewertungen

- Financial Accounting4 PDFDokument10 SeitenFinancial Accounting4 PDFKetanMehtaNoch keine Bewertungen

- Cebu Company Answer KeyDokument4 SeitenCebu Company Answer KeyMarcoNoch keine Bewertungen

- Case Analysis AigDokument3 SeitenCase Analysis AigKathleen Louise Lazaro-BunagNoch keine Bewertungen

- Case Study #9 - Bruner 31 Debt PoliciesDokument6 SeitenCase Study #9 - Bruner 31 Debt PoliciesMarie CuvNoch keine Bewertungen

- BASF Annual Report 1998Dokument68 SeitenBASF Annual Report 1998Nicole Campos CastroNoch keine Bewertungen

- Dividend Policy Theory PDFDokument14 SeitenDividend Policy Theory PDFXael AlvarezNoch keine Bewertungen

- Col Financial - Philippine Equity ResearchDokument5 SeitenCol Financial - Philippine Equity ResearchgwapongkabayoNoch keine Bewertungen

- ApplicationForm ICONdap123Dokument17 SeitenApplicationForm ICONdap123PinkNoch keine Bewertungen

- International Swaps and Derivatives Association (ISDA)Dokument5 SeitenInternational Swaps and Derivatives Association (ISDA)Anonymous f5qGAcZYNoch keine Bewertungen

- On January 1 2015 Talbot Company Acquires 90 of TheDokument1 SeiteOn January 1 2015 Talbot Company Acquires 90 of TheMuhammad ShahidNoch keine Bewertungen

- Accounting Concepts and ConventionsDokument4 SeitenAccounting Concepts and ConventionsSaumitra TripathiNoch keine Bewertungen

- SummaryDokument16 SeitenSummaryapi-529669983Noch keine Bewertungen

- Stocks and StockholdersDokument4 SeitenStocks and StockholdersCleinJonTiuNoch keine Bewertungen

- Bar QuestionsDokument5 SeitenBar QuestionsPatrick RamosNoch keine Bewertungen

- Investing BasicsDokument16 SeitenInvesting BasicsDaniel Liu100% (1)

- Corporate Responsibility, Market Valuation and Measuring The Financial and Non-Financial Performance of The FirmDokument34 SeitenCorporate Responsibility, Market Valuation and Measuring The Financial and Non-Financial Performance of The FirmALBERTO GUAJARDO MENESESNoch keine Bewertungen

- Halal Sarmayakari: Hamari ZimmaydariDokument16 SeitenHalal Sarmayakari: Hamari ZimmaydariAitizaz hassanNoch keine Bewertungen

- Morgan Stanley ChinaDokument3 SeitenMorgan Stanley Chinamahmut123Noch keine Bewertungen

- Cai, Et. Al, 2012Dokument15 SeitenCai, Et. Al, 2012Chantal DeLarentaNoch keine Bewertungen

- Zambia: Doing Business in ZambiaDokument4 SeitenZambia: Doing Business in ZambiaKajal N Jignesh PatelNoch keine Bewertungen

- Chapter 29 AnswersDokument3 SeitenChapter 29 Answersdiscreetmike50Noch keine Bewertungen

- Final Sip Report On Portfolio ManagementDokument18 SeitenFinal Sip Report On Portfolio ManagementavinashsakhareNoch keine Bewertungen

- Chapter 7 - Stock ValuationDokument36 SeitenChapter 7 - Stock ValuationasimNoch keine Bewertungen

- SebiDokument13 SeitenSebiNishat ShaikhNoch keine Bewertungen

- HLCM Top 100 and Beneficial Owner Report As of Dec. 31, 2018Dokument8 SeitenHLCM Top 100 and Beneficial Owner Report As of Dec. 31, 2018Brian SeeNoch keine Bewertungen